|

市场调查报告书

商品编码

1846204

金奈米粒子:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Gold Nanoparticles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

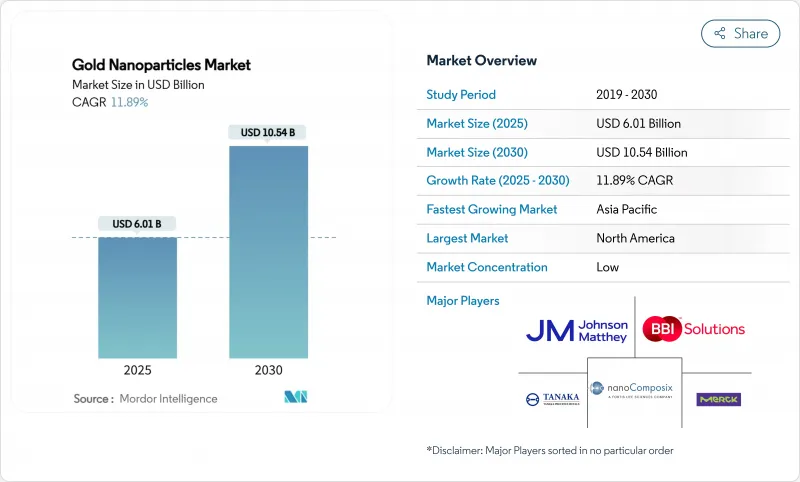

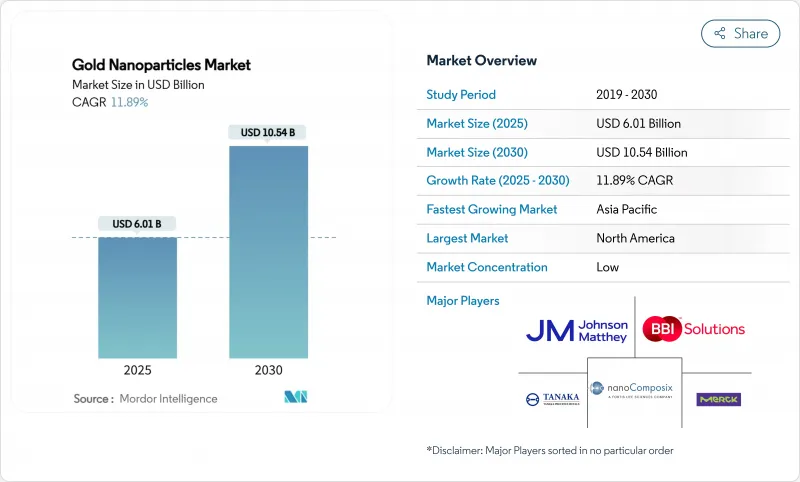

预计 2025 年金奈米粒子市场规模将达到 60.1 亿美元,预计到 2030 年将达到 105.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.89%。

精准医疗计画的兴起、电子产品的持续微型化以及连续流绿色合成技术的进步,共同推动了医疗保健、半导体、能源和环境等领域对高纯度奈米颗粒的需求。标靶药物输送平台已占目前销售额的26.11%,并且随着监管机构核准更多诊疗测试,其持续吸引投资。连续流和微流体合成生产线正在快速扩展,减少了批次差异和危险废弃物,同时降低了生产商的营运成本。在需求方面,医疗保健产业正经历最快的成长,而随着柔性和印刷感测器从实验室走向量产,电子产业正经历最快的成长。虽然黄金价格波动仍然是一个商业风险,但降低单位贵金属负载的涂层和回收计划将在短期内缓解利润率波动。

全球黄金奈米粒子市场趋势与洞察

奈米技术在医疗产业的应用日益广泛

医院、受託研究机构和设备製造商正在从被动药物载体转向多功能治疗诊断结构,将成像和治疗结合在一个金核中,使临床医生能够透过光热加热摧毁肿瘤,同时即时追踪治疗。 DNA条码奈米粒子库使肿瘤学家能够在单一患者样本中筛检多种有效载荷组合,缩短临床前测试时间并提高难治性恶性肿瘤的反应率。监管机构正在加快对錶现出明确生物相容性的奈米药物的审查途径,帮助三个美国临床计画在2025年推进到第二阶段。调查团队也正在研究可以将相同的等离子体加热原理应用于微创脑刺激的神经介面涂层。随着数据集检验了长期安全性,医院采购集团正在为与标准影像处理主机整合的奈米粒子引导消融系统累计。到2025年,这些转变将使金奈米粒子市场总合年增长率增加3.2个百分点。

扩大在高阶电子和光电领域的应用

智慧型手錶、电子纺织品和嵌入式感测器製造商正在将金奈米线插入超薄电路中,以提高导电性,同时将弯曲半径限制在 1 毫米以内。光电研究表明,在有机太阳能电池的光吸收器中嵌入 10 奈米球体,可透过局部表面等离子体放大将能量转换效率提高 30% 以上。 RFID 开发人员正在利用金种子来提高吉赫频率下的天线增益,从而无需增加标籤尺寸即可扩大读取范围。可喷墨列印的奈米粒子油墨在低于 120°C 的温度下烧结,使其与穿戴式装置中使用的 PET 和 TPU 薄膜相容,从而有助于生产准备。日本、韩国和台湾的工厂已经开始商业出货,为全球提供笔记型电脑、智慧型手机和物联网模组。

黄金价格波动

2025 年上半年,由于投资人在地缘政治衝击中寻求避风港,基准裸金属价格上涨近 25%,导致奈米颗粒製造商的原物料成本升至多年高点。同期,交易所交易基金 (ETF) 增持超过 160 吨,从工业通路吸走了供应。虽然许多设备原始设备製造商每季度都会签订合同,但现货价格上涨会在几週内反映在特种油墨和试剂目录中,从而减缓了诊断和印刷电子等利基领域的计划推出。避险可以部分缓解压力,但会增加营运资金需求,挤压小型企业。保护涂层可以将每个晶片的金属含量降低 30%,虽然可以缓解衝击,但其应用主要局限于需要厚实、生物相容性外壳的医疗应用。这种限制将使短期复合年增长率降低 2.3 个百分点,直到裸金属价格稳定或回收产量比率率提高。

細項分析

到2024年,化学还原法将占金奈米颗粒市场规模的40.55%,这一地位源自于北美和欧洲成熟的批量生产基础设施。然而,下游用户如今要求更严格的粒径分布和更低的溶剂足迹,这使得采购决策倾向于连续管线。预计到2030年,连续流水线的复合年增长率将达到12.45%。工厂营运商正在改造涡流流体模组,将前体流剪切成微米级薄膜,促进均匀成核,同时将副产物氢气就地捕获用作锅炉燃料。人工智慧引导的感测器即时调整停留时间环路,使多分散性指数低于0.08,并提高製药客户的批次间可重复性。

此外,连续流反应器采用水性介质和大气压力,与柠檬酸盐间歇製程相比,能耗强度降低了近三分之一。同一滑轨上的堆迭式种子介导生长方案允许在不打开系统的情况下製造棒状、棱柱状和核壳结构,从而最大限度地降低了污染风险。高解析度生物感测器的开发商越来越多地采用由流量开关编程生成的客製化几何形状,从而获得了比商品胶体更高的利润率。分析师预计,随着检验批次规模的扩大,到2028年,连续流产能份额将超过30%,巩固其作为受监管治疗和诊断终端用途新基准的地位。

区域分析

到2024年,北美将占全球销售额的36.33%,这得益于雄厚的研发预算、FDA对品质的监管以及连接学术实验室和契约製造製造商的一体化供应链。波士顿和圣地牙哥的产学研联盟正在支持新兴企业的分拆,这些公司将获得奈米颗粒智慧财产权的授权,用于肿瘤学、心臟病学和神经病学领域的应用。美国国立卫生研究院(NIH)将于2025年提供一项刺激计画津贴,将进一步扩大美国试点产能,并缩短临床级材料的前置作业时间。

亚太地区的复合年增长率为12.98%,是最快的,这得益于中国的大型胶体反应器、印度不断扩张的学名药行业以及日本的传感器创新生态系统。广东省和浙江省推出了政策奖励,为符合ISO 14001标准的连续流水线提供高达20%的资本支出返还,以加快其绿色生产足迹的步伐。首尔和新竹的半导体公司正在消耗大量奈米颗粒用于高密度中介层和热感垫片,而东盟的电子产品出口商则将印刷天线用于物流追踪器和智慧包装标籤。

欧洲正在平衡监管的严谨性与永续性的领导力,并透过「地平线欧洲」津贴支持市场发展,优先发展绿色化学升级和循环经济试点计画。一家德国汽车供应商正在检验一款专为下一代燃料电池汽车设计的金催化氮氧化物减排模组。同时,一个北欧医疗技术丛集正在将奈米颗粒标籤纳入一种旨在即时诊断的快速初步试验检测中,以应对欧盟「战胜癌症计划」下的一项公共卫生优先事项。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 奈米技术在医疗产业的应用不断扩大

- 扩大在高阶电子和光电领域的应用

- 永续的绿色合成方法,降低监管风险

- 精准肿瘤学对诊疗药物的需求

- 用于物联网设备的下一代柔性/印刷感测器

- 市场限制

- 黄金价格波动

- 安全性和长期毒性问题

- 奈米材料替代品的出现(例如量子点)

- 价值链分析

- 五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 依合成方法

- 化学还原

- 绿色/生物合成

- 种子型成长

- 常规流动和微流体

- 其他方法

- 按用途

- 影像学

- 药物输送

- 感应器

- 体外诊断

- 探测

- 催化作用

- 其他用途

- 按最终用户产业

- 电子和半导体

- 医疗保健和生命科学

- 化学/催化

- 能源与环境

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 北欧

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Abcam

- Aurion

- BBI Solutions

- Creative Diagnostics

- Cytodiagnostics Inc.

- Johnson Matthey Plc

- Meliorum Technologies Inc.

- Merck KGaA

- nanoComposix

- NanoHybrids

- Nanopartz Inc.

- Sona Nanotech Inc.

- TANAKA Holdings Co., Ltd.

第七章 市场机会与未来展望

The Gold Nanoparticles Market size is estimated at USD 6.01 billion in 2025, and is expected to reach USD 10.54 billion by 2030, at a CAGR of 11.89% during the forecast period (2025-2030).

Escalating precision-medicine programs, persistent electronics miniaturization, and progress in continuous-flow green synthesis collectively lift demand for high-purity nanoparticles across healthcare, semiconductor, energy, and environmental use cases. Targeted drug-delivery platforms already account for 26.11% of current revenue and continue to attract investment as regulators approve more theranostic trials. Continuous-flow and microfluidic synthesis lines are scaling rapidly, lowering batch variability and hazardous-waste volumes while cutting operating expenses for producers. On the demand side, healthcare commands the largest uptake, yet the electronics segment registers the highest growth velocity as flexible and printed sensors migrate from lab to mass production. Gold-price volatility remains an operational risk, but coatings that reduce precious-metal loading per unit and recycling initiatives buffer near-term margin swings.

Global Gold Nanoparticles Market Trends and Insights

Rising Nanotechnology Applications in Medical Industry

Hospitals, contract research organizations, and device makers are moving beyond passive drug carriers to multifunction theranostic constructs that combine imaging and therapy on a single gold core, enabling clinicians to destroy tumors via photothermal heating while concurrently tracking treatment in real time. DNA-barcoded nanoparticle libraries now let oncologists screen several payload combinations inside one patient sample, cutting preclinical timelines and raising response rates for hard-to-treat malignancies. Regulatory agencies have accelerated review pathways for nanomedicines that demonstrate clear biocompatibility, helping three US clinical programs move into Phase II during 2025. Research teams are also probing neural-interface coatings that could translate the same plasmonic heating principle to minimally invasive brain stimulation. As datasets validate long-term safety profiles, hospital purchasing groups are earmarking budget for nanoparticle-guided ablation systems that integrate with standard imaging consoles. These transitions collectively add 3.2 percentage points to the gold nanoparticles market CAGR through mid-decade.

Growing Adoption in High-End Electronics & Photonics

Smart-watch, e-textile, and implantable sensor makers insert gold nanowires into ultrathin circuitry to raise conductivity while keeping bending radii below 1 mm, a key threshold for comfortable skin-mounted patches. Photonics research shows that embedding 10 nm spheres inside organic solar-cell photo-absorbers can lift power-conversion efficiency by more than 30% through localized surface-plasmon amplification RFID developers leverage gold seeds to boost antenna gain at gigahertz frequencies, widening read ranges without increasing tag size. Production readiness is high thanks to inkjet-printable nanoparticle inks that sinter at temperatures below 120 °C, compatible with PET and TPU films used in wearables. The electronics driver injects 2.8 points into forecast CAGR, with commercial shipments already ramping at factories in Japan, South Korea, and Taiwan that supply the global notebook, smartphone, and IoT modules sectors.

Volatility in Gold Prices

Benchmark bullion prices climbed almost 25% during the first half of 2025 as investors sought havens amid geopolitical shocks, pushing nanoparticle producers' raw-material spend to multi-year highs. Exchange-traded funds added more than 160 tonnes during the same window, siphoning supply from industrial channels. Many device OEMs lock quarterly contracts, yet spot spikes feed through to specialty ink and reagent catalogs within weeks, delaying project launches in diagnostics and printed-electronics niches. Hedging offers partial relief but raises working-capital needs, squeezing small firms that lack scale. Protective coatings that enable 30% metal-content reduction per chip are mitigating the blow, though adoption is uneven in medical segments that demand thicker biocompatible shells. The restraint subtracts 2.3 points from near-term CAGR until bullion prices stabilize or recycling yields improve.

Other drivers and restraints analyzed in the detailed report include:

- Sustainable Green Synthesis Methods Lowering Regulatory Risk

- Precision Oncology Demand for Theranostic Agents

- Safety & Long-Term Toxicity Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Chemical reduction accounted for 40.55% of the gold nanoparticles market size in 2024, a legacy position rooted in established batch infrastructure across North America and Europe. Yet downstream users now demand tighter particle-size distributions and lower solvent footprints, tipping procurement decisions toward continuous-flow lines that log a robust 12.45% CAGR to 2030. Plant operators retrofit vortex-fluidic modules that shear precursor streams into micron-thick films, promoting uniform nucleation while capturing hydrogen coproduct for on-site boiler fuel. AI-guided sensors adjust residence-time loops in real time, holding polydispersity indexes below 0.08 and elevating lot-to-lot reproducibility for pharmaceutical customers.

The shift also intersects with green-chemistry imperatives because flow reactors use aqueous media and ambient pressure, slashing energy intensity by nearly one-third versus citrate batch routes. Seed-mediated growth schemes layered onto the same skid allow production of rods, prisms, and core-shell configurations without opening the system, minimizing contamination risk. Developers of high-resolution biosensors increasingly embed bespoke shapes generated via flow-switch programming, capturing margin premiums well above commodity colloids. As validation batches scale, analysts expect continuous-flow capacity share to pass 30% by 2028, cementing its status as the new reference standard for regulated therapeutic and diagnostic end uses.

The Gold Nanoparticles Market Report is Segmented by Synthesis Method (Chemical Reduction, Green/Biological Synthesis, and More), Application (Imaging, Targeted Drug Delivery, and More), End-User Industry (Electronics & Semiconductors, Healthcare & Life Sciences, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 36.33% of global revenue in 2024, underpinned by deep R&D budgets, FDA oversight that standardizes quality, and integrated supply chains bridging academic labs with contract manufacturers. Academic-industry consortia in Boston and San Diego help spin off start-ups that license nanoparticle IP for oncology, cardiology, and neurology applications. Stimulus grants channeled through the National Institutes of Health in 2025 further enlarge domestic pilot capacities, ensuring short lead times for clinical-grade material.

Asia-Pacific posts the swiftest 12.98% CAGR, reflecting China's large-scale colloid reactors, India's expanding generics sector, and Japan's sensor innovation ecosystem. Policy incentives in Guangdong and Zhejiang provinces reimburse up to 20% of capital outlays for continuous-flow lines that meet ISO 14001 benchmarks, fast-tracking green production footprints. Semiconductor companies headquartered in Seoul and Hsinchu consume rising nanoparticle volumes for high-density interposers and thermal-interface pads, while ASEAN electronics exporters use printed antennas in logistics trackers and smart-package labels.

Europe balances regulatory rigour with sustainability leadership, supporting market development through Horizon Europe grants that prioritize green-chemistry upgrades and circular-economy pilot trials. German automotive suppliers validate gold-catalyzed NOx-reduction modules engineered for next-generation fuel-cell vehicles. Meanwhile, Nordic med-tech clusters incorporate nanoparticle tags into rapid-sepsis tests aimed at point-of-care settings, addressing public-health priorities under the EU's Beating Cancer Plan.

- Abcam

- Aurion

- BBI Solutions

- Creative Diagnostics

- Cytodiagnostics Inc.

- Johnson Matthey Plc

- Meliorum Technologies Inc.

- Merck KGaA

- nanoComposix

- NanoHybrids

- Nanopartz Inc.

- Sona Nanotech Inc.

- TANAKA Holdings Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Nanotechnology Applications in Medical Industry

- 4.2.2 Growing Adoption in High-end Electronics and Photonics

- 4.2.3 Sustainable Green Synthesis Methods Lowering Regulatory Risk

- 4.2.4 Precision Oncology Demand for Theranostic Agents

- 4.2.5 Next-Gen Flexible/Printed Sensors for IoT Devices

- 4.3 Market Restraints

- 4.3.1 Volatility in Gold Prices

- 4.3.2 Safety and Long-term Toxicity Concerns

- 4.3.3 Emerging Nano-material Substitutes (e.g., Quantum Dots)

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Synthesis Method

- 5.1.1 Chemical Reduction

- 5.1.2 Green/Biological Synthesis

- 5.1.3 Seed-mediated Growth

- 5.1.4 Continuous Flow and Microfluidic

- 5.1.5 Other Methods

- 5.2 By Application

- 5.2.1 Imaging

- 5.2.2 Targeted Drug Delivery

- 5.2.3 Sensors

- 5.2.4 In Vitro Diagnostics

- 5.2.5 Probes

- 5.2.6 Catalysis

- 5.2.7 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Electronics and Semiconductors

- 5.3.2 Healthcare and Life Sciences

- 5.3.3 Chemicals and Catalysts

- 5.3.4 Energy and Environmental

- 5.3.5 Other End-User Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 NORDIAC

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global Overview, Market Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Abcam

- 6.4.2 Aurion

- 6.4.3 BBI Solutions

- 6.4.4 Creative Diagnostics

- 6.4.5 Cytodiagnostics Inc.

- 6.4.6 Johnson Matthey Plc

- 6.4.7 Meliorum Technologies Inc.

- 6.4.8 Merck KGaA

- 6.4.9 nanoComposix

- 6.4.10 NanoHybrids

- 6.4.11 Nanopartz Inc.

- 6.4.12 Sona Nanotech Inc.

- 6.4.13 TANAKA Holdings Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Innovation in the Field of Electronics