|

市场调查报告书

商品编码

1939700

汽车人工智慧:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Automotive Artificial Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

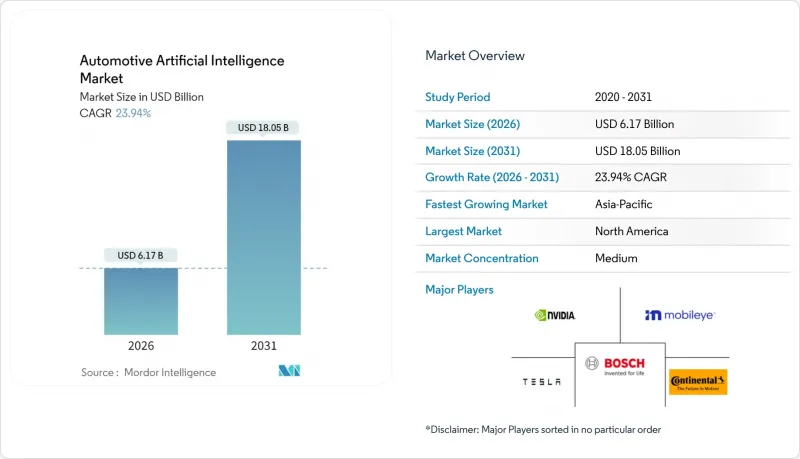

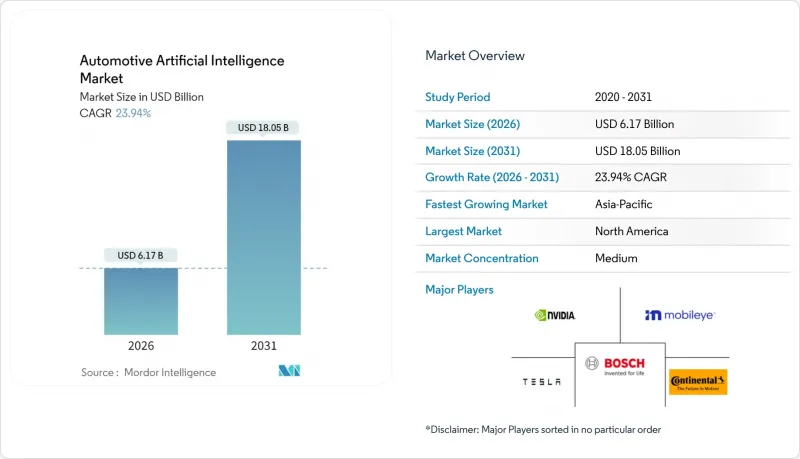

预计汽车人工智慧市场将从 2025 年的 49.8 亿美元成长到 2026 年的 61.7 亿美元,到 2031 年达到 180.5 亿美元,2026 年至 2031 年的复合年增长率为 23.94%。

软体定义车辆的快速普及、欧盟和美国强制二级高级驾驶辅助系统(ADAS)法规的实施,以及车用人工智慧运算成本的下降,正将竞争优势从机械设计转向演算法性能。汽车製造商正在扩展空中下载(OTA)更新平台,将每辆交付的车辆转变为能够创造收益的边缘节点。同时,基于晶片组的系统晶片(SoC)使得即使是中阶车型也能负担得起高性能处理器。特斯拉首创的车队学习框架已被中国主要汽车製造商采用,其辨识准确率的提升速度是闭合迴路检验所无法比拟的。在此背景下,汽车製造商、一级供应商、超大规模资料中心业者和人工智慧Start-Ups之间的策略联盟正在取代垂直整合,并创建一个模组化的创新生态系统,从而促进专业领域的差异化发展。

全球汽车人工智慧市场趋势与洞察

2级及以上ADAS安全功能的监理要求

欧盟第二版通用安全法规(GSE II)于2024年7月生效,要求所有在欧洲销售的新车必须配备自动紧急煞车、紧急车道维持和智慧速度辅助系统。美国和日本也正在推行类似的法规,迫使全球汽车製造商采用「一次设计,全球认证」的设计理念。这项合规要求将曾经的高阶附加功能转变为基本设计要素,推动了一级供应商订单系统订单的成长。联合国欧洲经济委员会第171号法规(驾驶辅助系统法规)透过制定人工智慧功能的详细虚拟测试规则,进一步加速了这项变革。因此,曾经依靠机械技术差异化竞争的汽车製造商如今在软体成熟度方面展开竞争,清晰的规则手册正在取代分散的区域性要求,降低了新进入者的市场准入门槛。

人工智慧运算能力和汽车SoC中TOPS的快速下降

英伟达的Thor处理器承诺达到2000 TOPS的运算能力,而特斯拉正在研发的AI5晶片则目标为2500 TOPS。这比目前的车载技术性能提升了10倍,从2022年起,每TOPS的成本每年可降低约40%。成本降低得益于共用资料中心规模、先进的晶圆代工厂製程以及晶片组划分技术,后者以模组化晶片取代了光罩大小的单片式晶片。 Imec的汽车晶片组专案与博世和宝马等先锋企业合作,建立了可互通的晶粒间通讯协定,从而缩短了开发週期,并实现了跨车型平台的复用。随着硅材料的日益稀缺,差异化正在转向软体,这迫使传统半导体供应商整合工具链、中间件和参考堆栈,以支援汽车製造商的大规模部署。

功能安全法规管辖权分散

ISO 26262、ISO/IEC 5469:2024 以及即将发布的 ISO/TS 5083:2025 分别针对自动驾驶技术堆迭的不同领域定义了安全流程,迫使原始设备製造商 (OEM) 协调重迭且不一致的标准。欧洲的 GSR II 标准与美国联邦指南和中国的 GB/T 标准之间存在差异,导致全球平台必须为每个地区分别维护单独的合格认证。规模较小的供应商难以应对多轨检验的负担,这往往会导致产品发布延迟和地理覆盖范围缩小。行业组织一直倡导“安全案例交换”,旨在实现不同认证机构之间审核结果的互通性,但目前尚未达成共识。在实现统一之前,这种拼凑式的标准将继续增加非重复性工程成本,并阻碍汽车人工智慧市场的发展。

细分市场分析

到2025年,软体将占汽车人工智慧市场收入的64.78%,这是由于汽车价值创造方式从钢铁转向程式码所致。如今,汽车製造商提供神经网路升级服务,即使在购车数年后也能增加新功能,使每辆联网汽车都成为一个鲜活的、收费的服务节点。硬体部分在预测期间内将以13.84%的复合年增长率成长,但随着晶片生态系统的普及,TOPS(终端处理器)的商品化,利润率将会下降。因此,汽车人工智慧市场将青睐那些能够提供程式码、工具链和生命週期支援等全方位服务的公司,而不是那些只销售晶片的公司。

诸如 Cerence CaLLM Edge 之类的边缘驻留语言模型展现了软体在无需网路费用且符合欧洲和中国隐私准则的情况下提升智慧的强大能力。监管机构对持续改进煞车和车道维持系统的要求,要求向整个运作(而不仅仅是新车)推送合规性更新,这进一步巩固了软体收入。因此,汽车人工智慧市场的顶级公司正在 DevOps 人才和空中网路安全方面投入数十亿美元,将软体确立为关键的竞争优势。

到2025年,机器学习将占据汽车人工智慧市场41.12%的份额,因为其透明的决定架构符合ISO 26262审核要求。然而,深度学习15.86%的复合年增长率表明,製造商正在转向传统演算法无法分析的多感测器融合技术。电脑视觉、自然语言处理和情境察觉技术,以及驾驶座使用者体验,正在将汽车人工智慧市场拓展到安全领域之外。

特斯拉计划推出的AI5晶片表明,只有深度卷积模型才能处理4D雷达、雷射雷达和高清摄影机的数据,从而实现高速公路车辆的融合。中国供应商也纷纷效仿,将变压器网路整合到泊车辅助模组中,使曾经小众的AI技术成为展示室中的差异化优势。因此,供应链合作伙伴正在竞相提供标註资料、可扩展的训练基础设施和检验工具,以应对复杂多变的神经网路潜在空间。

区域分析

到2025年,北美将占据汽车人工智慧市场35.89%的收入份额,这主要得益于特斯拉的数据优势、德克萨斯州州宽鬆的测试法规以及英伟达硅谷总部周边的本土人工智慧计算丛集。同时,通用汽车、福特和Waymo正在将其无人驾驶业务从凤凰城扩展到奥斯汀,不仅展现了其盈利能力,也凸显了车队级远程辅助监管法规的不足。

亚太地区年复合成长率高达22.98%,位居全球之冠。中国凭藉出口导向电动车领先地位和相对统一的监管环境,奇瑞汽车承诺在30款车型中引入人工智慧技术,华为的目标是到2025年实现50万辆自动驾驶汽车的交付量。日本的丰田、日产和本田已成立半导体联盟,以应对该国人工智慧人才短缺的问题。同时,韩国现代汽车正投资7兆韩元,建造连接其工业园区和港口的自动化物流走廊。本土电池和光达供应商正在降低区域汽车製造商的零件成本,从而推动中檔车型采用人工智慧技术。

欧洲在严格遵守资料隐私法规的同时,强制要求车辆配备基于GSR II的AI安全功能,并在所有生产平台上建立合规标准。 BMW计画于2025年在中国整合DeepSeek AI,凸显了其本土化策略;大众汽车则正在欧洲向数百万辆汽车推送Cerence Chat Pro OTA更新。 GDPR的限制推动了对边缘推理的需求,促使供应商设计出能够保护隐私的模型更新流程。儘管欧洲市场的绝对成长率落后于亚洲,但其每辆车的高附加价值仍使其对专注于驾驶员监控和网路安全OTA技术堆迭的专业供应商而言盈利。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 二级及以上ADAS安全功能的监理要求

- 人工智慧运算能力和汽车SoC所需TOPS的快速下降

- 空中软体更新(OTA)的普及使得人工智慧功能的商业化成为可能

- 利用舰队学习架构加速感知模型准确率

- 设备内多模态基础设施模型降低了对云端的依赖性

- 新兴的基于晶片组的ECU降低了大规模生产车辆的零件成本。

- 市场限制

- 功能安全法规管辖权分散

- 在极端情况下检验人工智慧模型的成本很高

- 一级企业持续缺乏汽车级人工智慧人才

- 供应链对先进节点代晶圆代工厂能的依赖

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 报价

- 硬体

- 软体

- 透过技术

- 机器学习

- 深度学习

- 电脑视觉

- 自然语言处理

- 情境察觉

- 透过流程

- 资料探勘

- 影像识别

- 讯号识别

- 透过使用

- 自动驾驶

- ADAS(进阶驾驶辅助系统)

- 人机介面

- 预测性维护和诊断

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 大型商用车辆

- 按地区

- 北美洲

- 我们

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 印尼

- 菲律宾

- 越南

- 澳洲

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 南非

- 奈及利亚

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Tesla Inc.

- Waymo LLC(Alphabet)

- NVIDIA Corporation

- Intel Corporation/Mobileye

- Horizon Robotics Inc.

- Aptiv PLC

- Continental AG

- Robert Bosch GmbH

- Qualcomm Incorporated

- Huawei Technologies Co.

- Microsoft Corporation

- Amazon Web Services Inc.

- Mercedes-Benz Group AG

- ZF Friedrichshafen AG

- BMW AG

- Toyota Motor Corporation

- Uber Technologies Inc.

- Hyundai Motor Company

- Hyundai Mobis Co. Ltd.

- Magna International Inc.

第七章 市场机会与未来展望

The Automotive AI market is expected to grow from USD 4.98 billion in 2025 to USD 6.17 billion in 2026 and is forecast to reach USD 18.05 billion by 2031 at 23.94% CAGR over 2026-2031.

Rapid software-defined vehicle adoption, mandatory Level-2 ADAS regulations in the EU and the United States, and falling costs of automotive-grade AI compute are shifting competitive advantage from mechanical engineering to algorithm performance. Automakers are scaling over-the-air (OTA) update platforms that turn every delivered vehicle into a revenue-generating edge node, while chiplet-based system-on-chips (SoCs) make high TOPS performance affordable for mid-range models. Fleet-learning frameworks pioneered by Tesla and replicated by leading Chinese OEMs raise perception accuracy at a pace no closed-loop validation can match. Against this backdrop, strategic partnerships between carmakers, Tier-1s, hyperscalers, and AI start-ups are replacing vertical integration, creating a modular innovation ecosystem that encourages specialist differentiation.

Global Automotive Artificial Intelligence Market Trends and Insights

Regulatory Mandates For Level-2+ ADAS Safety Features

The EU General Safety Regulation II, which came into force in July 2024, obliges every new car sold in Europe to include automatic emergency braking, emergency lane-keeping, and intelligent speed assistance. Comparable requirements are gaining traction in the United States and Japan, nudging global automakers to design once and certify everywhere. Compliance needs have therefore transformed what used to be premium add-ons into baseline design elements, stimulating larger order volumes for perception stacks from Tier-1 suppliers. The United Nations ECE Regulation 171 on Driver Control Assistance Systems reinforces this shift by detailing virtual-testing rules for AI functions. As a result, OEMs that once differentiated through mechanical refinement now compete on software maturity timelines, and market entry barriers for newcomers fall when a clear rulebook replaces fragmented local requirements.

Rapid Decline In AI Compute And TOPS For Automotive SoCs

NVIDIA's Thor processor promises 2,000 TOPS, and Tesla's forthcoming AI5 chip targets 2,500 TOPS-ten times today's in-car performance while cutting cost per TOPS by roughly 40% every year since 2022. Cost deflation comes from shared data-center volumes, advanced foundry nodes, and chiplet partitioning that substitutes reticle-size monoliths with modular tiles. Imec's Automotive Chiplet Programme unites Bosch, BMW, and other pioneers around interoperable die-to-die protocols that compress development cycles and enable platform reuse across vehicle lines. As silicon ceases to be scarce, differentiation migrates to software, forcing traditional semiconductor suppliers to embed toolchains, middleware, and reference stacks that help automakers deploy at scale.

Fragmented Functional-Safety Regulations Across Jurisdictions

ISO 26262, ISO/IEC 5469:2024, and forthcoming ISO/TS 5083:2025 each define safety processes for different slices of the autonomy stack, leaving OEMs to reconcile overlaps and contradictions. Europe's GSR II departs from emerging US federal guidelines and China's GB/T standards, forcing global platforms to maintain separate compliance evidence for each region. Smaller suppliers struggle with the overhead of multi-track validation, often delaying launches or narrowing geographic scope. Industry consortia advocate a "safety case exchange" where audit artefacts could be ported between homologation authorities, but consensus remains distant. Until unification arrives, the patchwork saps the Automotive AI market growth by raising non-recurring engineering costs.

Other drivers and restraints analyzed in the detailed report include:

- Explosion of Over-the-Air SW Updates Enabling AI Feature Monetisation

- Fleet-Learning Architectures Accelerating Perception Model Accuracy

- High Validation Cost Of AI Models For Edge-Case Scenarios

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software generated 64.78% of the automotive artificial intelligence market revenue in 2025 as vehicle value creation migrated from iron and steel to lines of code. Automakers now ship neural-network upgrades that add features years after purchase, turning every connected car into a living, billed service node. Hardware segment grows at a CAGR of 13.84% during the forecast period, yet its margin compresses when chiplet ecosystems commoditise TOPS. The Automotive AI market, therefore, rewards companies able to bundle code, toolchains, and life-cycle support rather than those selling silicon alone.

Edge-resident language models like Cerence CaLLM Edge illustrate how software can boost perceived intelligence without network fees, meeting privacy guidelines in Europe and China. Regulatory mandates that require continuous improvement of braking or lane-keeping further lock in software revenues, because compliance updates must reach every in-use unit, not just fresh builds. As a result, the Automotive AI market sees Tier-1s investing billions in DevOps talent and OTA cybersecurity, cementing software as the primary moat.

Machine learning owns 41.12% of the automotive artificial intelligence market share in 2025 because its transparent decision trees satisfy ISO 26262 audit needs. Still, deep learning's 15.86% CAGR indicates manufacturers' migration toward multi-sensor fusion that classic algorithms cannot parse. Computer vision, natural language processing, and context awareness tie into cockpit user experience, widening the Automotive AI market beyond safety alone.

Tesla's planned AI5 chip demonstrates that only deep convolutional models can manage 4D radar, LiDAR, and HD-camera fusion at freeway speed. Chinese suppliers follow by embedding transformer networks inside parking-assist modules, making once-exotic AI a showroom differentiator. Consequently, supply-chain partners race to supply annotated data, scalable training infrastructure, and verification tools that handle opaque neural latent spaces.

The Automotive Artificial Intelligence Market is Segmented by Offering (Hardware and Software), Technology (Machine Learning, Deep Learning, and More), Process (Data Mining, Image Recognition, and More), Application (Autonomous Driving, and More), Vehicle Type (Passenger Cars, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 35.89% of the automotive artificial intelligence market in 2025 revenue, anchored by Tesla's data advantage, Texas's permissive testing statutes, and a domestic AI-compute cluster around NVIDIA's Silicon Valley headquarters. In the meantime, General Motors, Ford, and Waymo are scaling driverless operations from Phoenix to Austin, validating monetisation and spotlighting gaps in fleet-wide remote assistance regulation.

Asia-Pacific records a 22.98% CAGR, the fastest worldwide. China combines export-oriented EV leadership with a comparatively unified regulatory sandbox, letting Chery pledge AI rollout across 30 models and Huawei target 500,000 autonomous-capable vehicles by 2025. Japan's Toyota, Nissan, and Honda have formed a semiconductor consortium to address domestic AI shortages. In contrast, South Korea's Hyundai invests KRW 7 trillion in self-driving logistics corridors linking factory zones with ports. Local battery and lidar suppliers reduce the bill of materials for regional OEMs, boosting the Automotive AI market adoption in mid-segment vehicles.

Europe maintains strict data-privacy rules yet mandates AI safety functions under GSR II, creating a compliance-driven baseline for every volume platform. BMW's 2025 integration of DeepSeek AI in China underscores its localisation strategy, while Volkswagen rolls out Cerence Chat Pro OTA to millions of European vehicles. GDPR constraints amplify demand for edge inference, spurring suppliers to design privacy-preserving model-update pipelines. Although the market trails Asia in absolute growth, high per-vehicle content keeps Europe profitable for specialist vendors focusing on driver-monitoring and cyber-secure OTA stacks.

- Tesla Inc.

- Waymo LLC (Alphabet)

- NVIDIA Corporation

- Intel Corporation / Mobileye

- Horizon Robotics Inc.

- Aptiv PLC

- Continental AG

- Robert Bosch GmbH

- Qualcomm Incorporated

- Huawei Technologies Co.

- Microsoft Corporation

- Amazon Web Services Inc.

- Mercedes-Benz Group AG

- ZF Friedrichshafen AG

- BMW AG

- Toyota Motor Corporation

- Uber Technologies Inc.

- Hyundai Motor Company

- Hyundai Mobis Co. Ltd.

- Magna International Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory Mandates for Level-2+ ADAS Safety Features

- 4.2.2 Rapid Decline in AI-compute and TOPS for Automotive SoCs

- 4.2.3 Explosion of Over-the-air (OTA) SW Updates Enabling AI Feature Monetization

- 4.2.4 Fleet-learning Architectures Accelerating Perception Model Accuracy

- 4.2.5 On-device Multimodal Foundation Models Reducing Cloud Dependency

- 4.2.6 Emerging Chiplet-Based ECUs Lowering BOM for Mass-market Vehicles

- 4.3 Market Restraints

- 4.3.1 Fragmented Functional-Safety Regulations Across Jurisdictions

- 4.3.2 High Validation Cost of AI Models for Edge-case Scenarios

- 4.3.3 Persistent Scarcity of Automotive-grade AI Talent in Tier-1s

- 4.3.4 Supply-chain Exposure to Advanced-node Foundry Capacity

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.2 Software

- 5.2 By Technology

- 5.2.1 Machine Learning

- 5.2.2 Deep Learning

- 5.2.3 Computer Vision

- 5.2.4 Natural Language Processing

- 5.2.5 Context Awareness

- 5.3 By Process

- 5.3.1 Data Mining

- 5.3.2 Image Recognition

- 5.3.3 Signal Recognition

- 5.4 By Application

- 5.4.1 Autonomous Driving

- 5.4.2 Advanced Driver-Assistance Systems (ADAS)

- 5.4.3 Human-Machine Interface

- 5.4.4 Predictive Maintenance & Diagnostics

- 5.5 By Vehicle Type

- 5.5.1 Passenger Cars

- 5.5.2 Light Commercial Vehicles

- 5.5.3 Heavy Commercial Vehicles

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Italy

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Indonesia

- 5.6.4.6 Philippines

- 5.6.4.7 Vietnam

- 5.6.4.8 Australia

- 5.6.4.9 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 South Africa

- 5.6.5.5 Nigeria

- 5.6.5.6 Egypt

- 5.6.5.7 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Tesla Inc.

- 6.4.2 Waymo LLC (Alphabet)

- 6.4.3 NVIDIA Corporation

- 6.4.4 Intel Corporation / Mobileye

- 6.4.5 Horizon Robotics Inc.

- 6.4.6 Aptiv PLC

- 6.4.7 Continental AG

- 6.4.8 Robert Bosch GmbH

- 6.4.9 Qualcomm Incorporated

- 6.4.10 Huawei Technologies Co.

- 6.4.11 Microsoft Corporation

- 6.4.12 Amazon Web Services Inc.

- 6.4.13 Mercedes-Benz Group AG

- 6.4.14 ZF Friedrichshafen AG

- 6.4.15 BMW AG

- 6.4.16 Toyota Motor Corporation

- 6.4.17 Uber Technologies Inc.

- 6.4.18 Hyundai Motor Company

- 6.4.19 Hyundai Mobis Co. Ltd.

- 6.4.20 Magna International Inc.