|

市场调查报告书

商品编码

1846211

汽车终端:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Terminals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

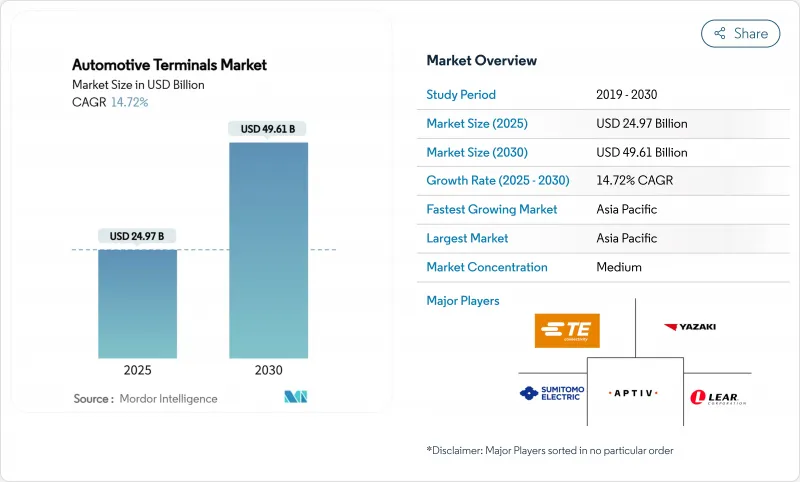

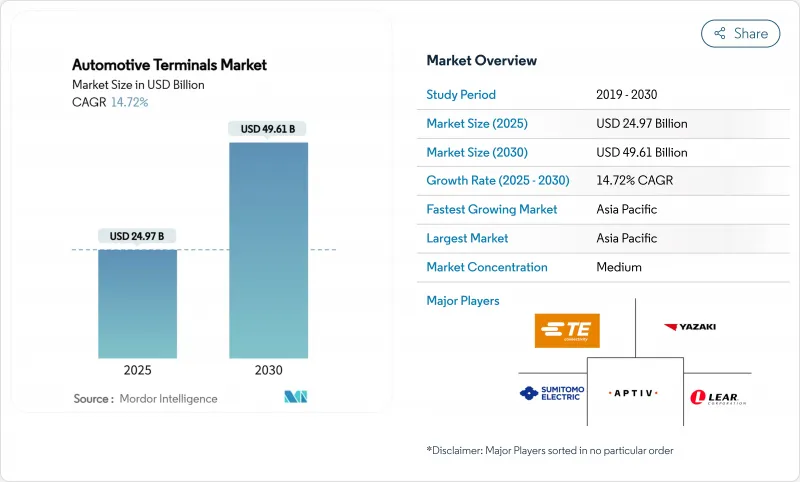

据估计,2025 年汽车终端市场规模为 249.7 亿美元,预计到 2030 年将达到 496.1 亿美元,预测期(2025-2030 年)复合年增长率为 14.72%。

以特斯拉的低压连接器标准为例,向48V低压架构的快速转型,已将连接器SKU减少至六种,同时仍能满足90%以上的讯号和电源需求,从而减轻重量、减少材料用量并加速线束自动化。终端供应商也受惠于ADAS的普及,北美和欧洲的改装计画推动了售后市场对能够进行多Gigabit传输的资料级屏蔽微型连接器的需求。同时,铜含量极高的电池系统所需的导体体积是内燃机平台的三倍,迫使OEM厂商签订多年期供应协议。

全球汽车终端市场趋势与洞察

由于电气化,低压连接点数量呈现爆炸性成长。

汽车电气化正在增加低压节点的数量,在现代纯电动平台上整合了超过200个连接点,而传统12V汽车的连接点少于100个。电池管理系统正以强劲的复合年增长率成长,需要超紧凑型端子,以毫秒的间隔监测电池电压和温度。 48V配电的高电流密度增加了接触面的热负荷,促使人们采用新型锡银镀层工艺,以承受100A的持续负载而不会发生微动腐蚀。商用车正在放大这一需求,改装48V电动涡轮增压器和能量回收配件,每辆车增加四到六个新的线束分支。

高端汽车向48V电气架构过渡

BMW、宾士和沃尔沃现已在2024年中期之后推出的所有高阶车型中配备48V子系统,为主动式底盘、电子涡轮增压器和区域控制器供电,且无需增加线径。每辆车的线束重量最多可减轻19公斤,与辅助电气设备结合使用时,可节省0.3公升/百公里燃油或延长纯电续航里程。特斯拉的低电压控制系统(LVCS)已证明,48V主干网可透过DC-DC节点与传统的12V负载共存,实现渐进式过渡,从而确保售后市场的兼容性。端子现在必须保证60V直流绝缘耐压,同时保持与现有压接工具的向下相容性。

铜价波动对终端物料清单利润率带来压力

2024年初,铜价均价为每吨10,800美元。儘管美国加征关税和美元疲软在2025年初推高了铜价,但对全球经济放缓和中国报復性关税的担忧仍然对价格和需求前景构成压力。由于智利露天矿场关闭导致矿石品位下降,中国冶炼厂面临精矿供应紧张的局面,迫使加工商就季度提价进行谈判。回收有助于抵销价格波动:美国黄铜棒材厂已确认,2025年平均回收率将超过五分之四,这将使其原生铜需求减少38吨。

细分市场分析

到2024年,电池系统将占据汽车接点市场33.25%的份额,凸显其作为整个汽车触点市场中端子密集度最高的子系统的地位。单元成长将主要得益于电芯级感测技术和电池组电压的提升,这将使下一代滑板式底盘的接点密度超过1400个引脚。由于每个摄影机和雷达模组增加了4到6个屏蔽连接,安全与ADAS(高级驾驶辅助系统)市场到2030年将以14.81%的复合年增长率成长。

新兴的固态封装正在推动间距小于0.35毫米的微型端子的应用,推高了价格。暖通空调和舒适设备产业虽然市场占有率较小,但随着48V鼓风机、座椅加热和热泵转向无刷马达、降低电流消耗并整合铜汇流排,其重要性日益凸显。

到2024年,乘用车将占据汽车终端市场64.85%的份额,复合年增长率(CAGR)为15.73%。轻型商用车(LCV)也呈现强劲成长势头,因为宅配业者正在将其最后一公里配送车辆电气化,以满足低排放气体都市区。两轮车和Scooter正在推动IP67密封直流终端的标准化以及可更换电池平台的应用。

车队营运商密切关注车辆生命週期经济效益。对于高运转率的轻型商用车而言,每次计划外路边维修都会产生可观的交付成本,奖励选择高品质、高循环利用率的终端。安波福的 CTCS 重型连接器可承受 30.6G 的振动,并可在 -40°C 至 +140°C 的温度范围内稳定运行,其卓越的运作优势足以抵消总拥有成本模型中 14-18% 的价格溢价。

区域分析

亚太地区预计到2024年将占据汽车端子市场份额的37.76%,并在2030年之前保持15.21%的复合年增长率,成为成长最快的地区。日本一级供应商凭藉数十年的精实生产经验,向全球OEM厂商提供精密冲压端子,缺陷率仅为个位数(PPM)。预计印尼和泰国等东南亚国家2024年的电动车註册量将实现三位数成长,这将促使OEM厂商在当地生产连接器和线束。

即使在通膨和能源成本上升的不利因素导致欧洲汽车收益下滑的情况下,欧洲电动车产量仍将成长。严格的车队二氧化碳排放法规将推动电动车销售达到2025年的预期水平,从而带动对高功率充电终端和数据级基板对基板连接器的需求。德国设定的87.3万辆新电动车註册目标将加强对终端供应商本地化率的要求。欧洲在ISO 19642和DIN 72036等监管标准的领先地位将为符合标准的供应商提供先发优势,即使经济低迷会压缩短期净利率。

老化的汽车市场仍然保持着活跃的售后市场,并加速了依赖优质屏蔽连接器的ADAS改装套件的销售。通用汽车斥资40亿美元进行工厂维修,现代汽车斥资210亿美元进行多年扩张,以及Clarios的投资策略,都确保了先进的48V和800V端子的稳定市场需求。到2024年,中东/非洲和南美洲将占据相当大的市场份额,其中南美洲的成长势头强劲,这得益于巴西的二氧化碳排放法规和阿根廷的锂矿开采激励措施。沙乌地阿拉伯和阿拉伯联合大公国正在其新兴的电动车组装计画中推行在地化政策,以振兴该地区的电缆和端子製造群。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 由于电气化,低压连接点数量呈现爆炸性成长。

- 高阶汽车转向48V电气架构

- ADAS改装套件推动售后市场需求激增

- 严格的 ISO 19642 线束标准加快了端子重新设计週期

- 需要高精度微型端子的固态电池BMS

- 汽车製造商推广无压接雷射焊接端子,以减少组装工时。

- 市场限制

- 铜价波动对终端物料清单利润率带来压力

- 原始设备製造商 (OEM) 正转向采用整合式连接器模组以减少端子数量

- 电动车高电流路径用铝合金环形端子的可靠性问题

- 亚洲新生产线自动压接力监测技能缺口

- 价值链分析

- 监管状况

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场规模与成长预测

- 透过使用

- 电池系统

- 照明系统

- 资讯娱乐系统

- 动力传动系统与引擎管理

- 安全与进阶驾驶辅助系统

- 暖通空调及舒适系统

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中型/大型商用车辆

- 摩托车

- 按终端类型

- 环形端子

- 铲形端子

- 快速连接端子

- 对接连接器

- 多针连接器

- 按材质

- 铜

- 黄铜

- 钢

- 其他合金

- 按额定电流

- 小于25安培

- 25至50安培

- 50安培或以上

- 按销售管道

- OEM

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- TE Connectivity

- Lear Corporation

- Aptiv PLC

- Viney Corporation

- Furukawa Electric Co., Ltd.

- Grote Industries

- Keats Manufacturing Co.

- Sumitomo Electric Industries, Ltd.

- Yazaki Corporation

- Amphenol Corporation

- KS Terminals Inc.

- Hirose Electric Co., Ltd.

- Littelfuse, Inc.

- Samtec Inc.

- Wurth Elektronik

第七章 市场机会与未来展望

The Automotive Terminals Market size is estimated at USD 24.97 billion in 2025, and is expected to reach USD 49.61 billion by 2030, at a CAGR of 14.72% during the forecast period (2025-2030).

A rapid shift toward 48 V low-voltage architectures, exemplified by Tesla's Low-Voltage Connector Standard that reduces connector SKUs to six while still covering more than 90% of signal and power needs, is compressing weight, cutting material usage, and accelerating harness automation. Terminal suppliers also benefit from ADAS proliferation, with retrofit programs in North America and Europe raising aftermarket demand for data-grade, shielded micro-connectors capable of multigigabit transmission. Meanwhile, copper-intensive battery systems require three times the conductor mass of internal-combustion platforms, pushing OEMs to lock multi-year supply contracts even as volatile spot prices pressure gross margins

Global Automotive Terminals Market Trends and Insights

Electrification-Led Explosion in Low-Voltage Connection Points

Vehicle electrification multiplies the number of low-voltage nodes: a contemporary battery electric platform integrates more than 200 distinct connection points against fewer than 100 in conventional 12 V cars. Battery management systems is growing at a robust CAGR, demanding ultra-compact terminals that monitor cell voltage and temperature at millisecond intervals. The higher current density of 48 V distribution increases the thermal load on contact surfaces, prompting the adoption of new tin-silver plating recipes that sustain 100 A continuous loads without fretting corrosion. Commercial fleets extend this demand signal, retrofitting 48 V electric turbochargers and regenerative accessories that add four to six new harness branches per vehicle.

Shift to 48 V Electrical Architectures in Premium Vehicles

BMW, Mercedes-Benz, and Volvo now fit 48 V subsystems across all premium models launched since mid-2024, delivering power for active chassis, e-turbochargers, and zone controllers without oversizing wire gauges. Harness weight falls by up to 19 kg per vehicle, translating to 0.3 L/100 km fuel savings or extended EV range when paired with auxiliary electrics. Tesla's LVCS proves that a 48 V backbone can coexist with legacy 12 V loads through DCDC nodes, allowing phased migration that protects aftermarket compatibility. Terminals must now guarantee 60 V DC dielectric strength while remaining backward-compatible with existing crimp tooling.

Copper Price Volatility is Squeezing Terminal BOM Margins

Copper averaged USD 10,800 per tonne in early 2024. Early 2025 saw rising copper prices due to U.S. tariffs and a weaker dollar, but fears of a global slowdown and China's retaliatory tariffs have weighed heavily on prices and demand outlooks. Chinese smelters face tightening concentrate availability after the closure of Chilean open-pit pits with declining ore grades, forcing fabricators to negotiate quarterly price escalators. Recycling helps offset volatility: US brass-rod mills certified average recycled content more than four fifth of the amount in 2025, reducing primary copper exposure by 38 kt.

Other drivers and restraints analyzed in the detailed report include:

- ADAS Retrofit Kits Creating Aftermarket Demand Spikes

- Stringent ISO 19642 Harness Standards Accelerate Terminal Redesign Cycles

- OEM Migration to Consolidated Connector Blocks Reduces Terminal Counts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery systems contributed 33.25% of the automotive terminals market share in 2024, underscoring their status as the most terminal-intensive sub-system across the automotive terminal market. Unit growth stems from cell-level sensing and rising pack voltages that push contact density beyond 1,400 pins in next-generation skateboard chassis. Safety & ADAS is growing at 14.81% CAGR through 2030 because each camera and radar module adds four to six shielded connections.

Emerging solid-state packs drive micro-terminal adoption, whose pitch falls below 0.35 mm, generating premium pricing. HVAC and comfort segments, despite their modest share, gain relevance as 48 V blowers, seat heaters, and heat pumps switch to brushless motors, lifting current draw and prompting copper busbar integration.

Passenger cars contributed to 64.85% of the automotive terminals market share in 2024, growing at 15.73% CAGR as stricter CO2 targets favor zero-tailpipe solutions. Light commercial vehicles (LCV) also grow steadily as parcel operators electrify last-mile fleets to comply with urban low-emission zones. Motorcycles and scooters leverage swappable battery platforms that spur standardization of IP67 sealed DC terminals.

Fleet operators measure lifecycle economics rigorously: every unscheduled roadside repair on high-utilization LCVs costs fairly in delivery penalties, incentivizing premium high-cycle terminals. Aptiv's CTCS heavy-duty connectors survive 30.6 G vibration and temperatures from -40 °C to +140 °C, offering uptime advantages that justify 14-18% price premiums in total-cost-of-ownership models.

The Automotive Terminals Market Report is Segmented by Application (Battery System, Lighting System, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Terminal Type (Ring Terminals, Spade Terminals, and More), Material (Copper, Brass, and More), Current Rating (Less Than 25 Amp and More), Sales Channel (OEM and Aftermarket), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with a 37.76% automotive terminals market share in 2024 and is showcasing the fastest 15.21% CAGR through 2030, underpinned by China's control of global new-energy vehicle production. Japan's tier-one suppliers leverage decades of lean manufacturing to ship precision-stamped contacts with single-digit PPM defect rates to global OEMs. Southeast Asian nations such as Indonesia and Thailand recorded triple-digit EV registration growth in 2024, prompting OEMs to localize connector and wire-harness production.

Europe, even after regional automotive revenue fell short amid inflation and energy-cost headwinds. Strict fleet CO2 rules lift EV sales to an expected figure in 2025, feeding demand for high-power charging terminals and data-grade board-to-board connectors, etc. Germany targets 873,000 new EV registrations, cementing local-content requirements for terminal suppliers. The region's regulatory leadership through ISO 19642 and DIN 72036 gives compliant vendors a first-mover edge even as economic stagnation tempers near-term margins.

An aging vehicle parc keeps the aftermarket vibrant and accelerates ADAS retrofit kit sales that rely on premium shielded connectors. General Motors' USD 4 billion plant overhaul, Hyundai's USD 21 billion multiyear expansion, and Clarios' investment strategy guarantee a steady pull for advanced 48V and 800V terminals. Middle East & Africa and South America collectively contributed a affairly decent share in 2024, with South America portraying steady growth on the back of Brazil's CO2 mandates and Argentina's lithium-mining incentives. Saudi Arabia and the United Arab Emirates use local-content policies within nascent EV assembly programs to stimulate regional cable and terminal manufacturing clusters.

- TE Connectivity

- Lear Corporation

- Aptiv PLC

- Viney Corporation

- Furukawa Electric Co., Ltd.

- Grote Industries

- Keats Manufacturing Co.

- Sumitomo Electric Industries, Ltd.

- Yazaki Corporation

- Amphenol Corporation

- K.S. Terminals Inc.

- Hirose Electric Co., Ltd.

- Littelfuse, Inc.

- Samtec Inc.

- Wurth Elektronik

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification-led explosion in low-voltage connection points

- 4.2.2 Shift to 48-V electrical architectures in premium vehicles

- 4.2.3 ADAS retrofit kits creating aftermarket demand spikes

- 4.2.4 Stringent ISO 19642 harness standards accelerating terminal redesign cycles

- 4.2.5 Solid-state battery BMS requiring high-precision micro-terminals

- 4.2.6 Automaker push for crimp-less laser-weld terminals to cut assembly takt-time

- 4.3 Market Restraints

- 4.3.1 Copper price volatility squeezing terminal BOM margins

- 4.3.2 OEM migration to consolidated connector blocks reducing terminal counts

- 4.3.3 Reliability issues in aluminum-alloy ring terminals for EV high-current paths

- 4.3.4 Skills gap in automated crimp-force monitoring on new Asian lines

- 4.4 Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Application

- 5.1.1 Battery System

- 5.1.2 Lighting System

- 5.1.3 Infotainment System

- 5.1.4 Powertrain & Engine Management

- 5.1.5 Safety and ADAS

- 5.1.6 HVAC and Comfort

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.2.4 Two-Wheelers

- 5.3 By Terminal Type

- 5.3.1 Ring Terminals

- 5.3.2 Spade Terminals

- 5.3.3 Quick-Connect Terminals

- 5.3.4 Butt Connectors

- 5.3.5 Multi-Pin Connectors

- 5.4 By Material

- 5.4.1 Copper

- 5.4.2 Brass

- 5.4.3 Steel

- 5.4.4 Other Alloys

- 5.5 By Current Rating

- 5.5.1 Less than 25 Amp

- 5.5.2 25 - 50 Amp

- 5.5.3 More than 50 Amp

- 5.6 By Sales Channel

- 5.6.1 OEM

- 5.6.2 Aftermarket

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Russia

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 United Arab Emirates

- 5.7.5.3 Turkey

- 5.7.5.4 South Africa

- 5.7.5.5 Nigeria

- 5.7.5.6 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 TE Connectivity

- 6.4.2 Lear Corporation

- 6.4.3 Aptiv PLC

- 6.4.4 Viney Corporation

- 6.4.5 Furukawa Electric Co., Ltd.

- 6.4.6 Grote Industries

- 6.4.7 Keats Manufacturing Co.

- 6.4.8 Sumitomo Electric Industries, Ltd.

- 6.4.9 Yazaki Corporation

- 6.4.10 Amphenol Corporation

- 6.4.11 K.S. Terminals Inc.

- 6.4.12 Hirose Electric Co., Ltd.

- 6.4.13 Littelfuse, Inc.

- 6.4.14 Samtec Inc.

- 6.4.15 Wurth Elektronik

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment