|

市场调查报告书

商品编码

1846225

丙醇:市占率分析、产业趋势、统计、成长预测(2025-2030)Propanol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

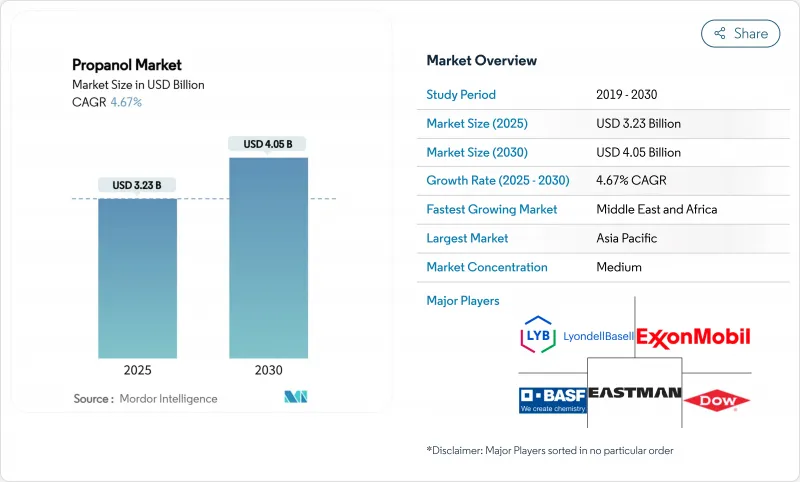

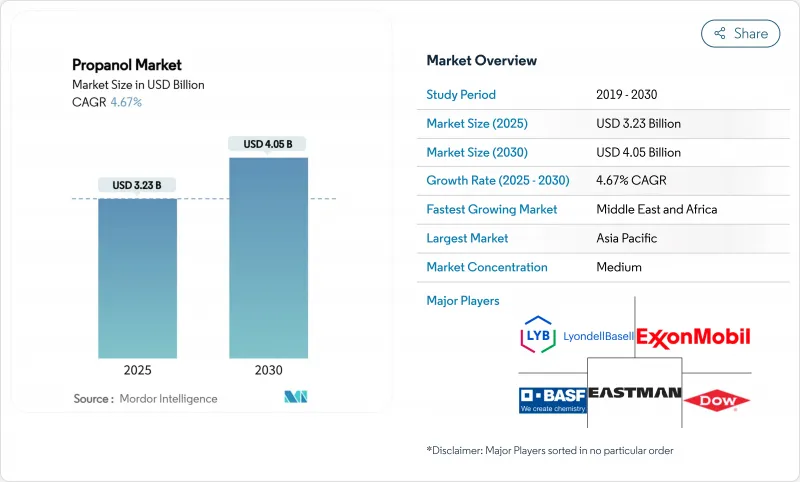

丙醇市场规模预计在 2025 年为 32.3 亿美元,预计到 2030 年将达到 40.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.67%。

半导体清洁、永续航空燃料途径和药物合成领域应用的日益普及推动了异丙醇的适度扩张,同时监管压力正在重塑溶剂配方。 5奈米以下晶片製造对高纯度异丙醇的需求、亚洲新的原料药)生产基地以及北美的酒精喷射计划,支撑着整体销量的稳健增长。儘管原料波动和不断变化的挥发性有机化合物(VOC)法规抑制了增长势头,但持续的Oxo醇一体化和对净化技术的投资正在帮助生产商确保利润。因此,综合石化製造商保持了成本优势,而生物基参与企业则在整个丙醇市场中开拓出成长利基。

全球丙醇市场趋势与洞察

电子产品清洁对高纯度 IPA 的需求

纯度超过99.999%的超高纯度异丙醇已成为先进节点半导体製造的关键原料。埃克森美孚正在升级其位于巴吞鲁日的工厂,以便在2027年前供应该等级的异丙醇,确保美国晶片製造商的国内供应。兆分之一的污染会降低晶圆产量比率,促使设备製造商需要更干净的溶剂。因此,电子产品清洁剂的成长速度超过了丙醇市场的整体成长速度,供应商正在增加蒸馏塔、过滤系统和即时分析设备,以验证产品纯度。由此产生的溢价部分抵消了原材料的波动性,使综合製造商能够在满足严格的客户审核的同时保护价差。

建筑业主导对油漆和涂料溶剂的需求

亚太地区和中东地区住宅和商业建筑的蓬勃发展,推动了对建筑被覆剂的需求。这些涂料依赖丙醇基助溶剂来平衡黏度、开放时间和成膜性能。美国和欧洲的监管机构持续收紧挥发性有机化合物 (VOC)基准值,促使配方转向水性体系,而水性体系则需要控制丙醇含量以控制闪蒸。美国环保署已将气溶胶涂料的合规截止日期延长至2027年1月,这为製造商提供了在保持性能的同时重新设计产品的关键时间。持续的溶剂创新正在帮助涂料製造商在不违反排放法规的情况下满足耐久性标准,从而支持丙醇整体消费量的增加。

溶剂混合物的VOC法规更加严格

美国国家挥发性有机化合物(VOC)排放标准正在降低消费和商用涂料的允许限值,迫使其在2027年1月的最后期限前进行再製造。欧盟也正在推行类似的政策,迫使用户取代或减少传统溶剂的使用。合规成本、额外的测试和认证要求正在减缓传统被覆剂、油墨和黏合剂应用的需求成长,从而削弱了丙醇市场的部分潜力。

細項分析

异丙醇凭藉其快速蒸发、抗菌功效和在医药、个人护理和工业清洁领域的广泛溶解性,将在2024年占据丙醇市场的54.77%。半导体製造商透过签订99.999%纯度的供应合同,进一步凸显了异丙醇的优势,埃克森美孚的巴吞鲁日生产线也已承诺为超高纯度批次提供资本支持。正丙醇在特种油墨和化学中间体领域保持小众但可靠的地位,使需要较低蒸发速度和特定反应性的配方设计师受益。受永续航空燃料政策奖励的推动,生物基丙醇将经历最强劲的成长轨迹,复合年增长率达到6.89%。美国生物能源公司的投资增强了人们对承购协议将为规模化扩张提供保障,并使可再生能源生产商能够进入更广阔的丙醇市场的信心。

异丙醇拥有广泛的全球分销网络和成熟的製造地,确保可靠的供应,但日益增长的半导体需求给物流和品管能力带来了压力。生产商正在更新净化系统,采用离子交换、超过滤和先进的气相层析法技术,以检验万亿分之一的杂质阈值。相反,生物基生产必须克服发酵生产力的限制和原料供应的波动。可再生等级的加速成长将在预测期内缩小差距,但丙醇的绝对市场规模仍远超异丙醇,这显示了稳固的生产资产和客户熟悉度所造成的惯性。

区域分析

至2024年,亚太地区将以40.24%的市占率引领丙醇市场。印度的PLI计画和大宗药品园区等政府计画正在鼓励使用药用级丙醇的原料药(API)合成生产线进行投资。中国仍是全球最大的化学品生产国,占全球产量的50%,推动了涂料、油墨和电子组装领域的溶剂需求。日本和韩国的先进半导体製程将进一步扩大高纯度溶剂的需求,因为这些国家的工厂对污染门槛要求严格。在东南亚,炼油厂和化工园区的整合程度不断提高,进一步稳定了该地区的原料供应。

北美消费市场成熟且富有韧性。预计2023年美国丙醇出口额将达3.45亿美元,进口额将达1.28亿美元,反映了美国国内自给自足的现况以及对特种丙醇的需求。埃克森美孚计画在路易斯安那州生产纯度高达99.999%的异丙醇,这与美国国内半导体产业的激励措施一致,并减少了对进口高规格原料的依赖。同时,美国生物能源公司在德克萨斯的SAF计划正在提升该地区可再生丙醇的知名度,预示着需求的多元化。

欧洲面临能源价格上涨和环境标准趋严带来的成本压力。BASF2023年的销售额下降21%,显示工业生产放缓,但医药和个人护理专用级产品仍保持盈利。中东和非洲地区未来复合年增长率潜力最高。先进石化和SK Gas正在朱拜勒建造一座异丙醇工厂,利用当地过剩的丙烯和综合基础设施。南美洲成长温和,巴西推广利用甘蔗废弃物和生物甲烷生产SAF,释放了未来对生物丙醇的需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 电子设备清洁对高纯度(异丙醇)IPA的需求

- 建设产业主导油漆和涂料的溶剂需求

- 增加亚太地区的原料药产量

- 生物丙醇作为低碳航空燃料的兴起

- 透过持续整合Oxo醇来降低成本

- 市场限制

- 丙烯原料价格不稳定

- 溶剂配方中VOC法规更加严格

- 生物丙醇发酵规模化的障碍

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 依产品类型

- 正丙醇

- 异丙醇

- 生物基丙醇

- 按最终用途行业

- 製药

- 化学(溶剂和中间体)

- 个人护理和化妆品

- 印刷油墨

- 油漆和涂料

- 电子产品清洁

- 黏合剂和密封剂

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- BASF SE

- Deepak Fertilisers & Petrochemicals

- Dow

- Eastman Chemical Company

- Exxon Mobil Corporation

- HiMedia Laboratories

- Honeywell International Inc.

- INEOS

- LCY

- LyondellBasell Industries NV

- Mitsui Chemicals Inc.

- Moeve

- Sasol Limited

- Shell plc

- Solvay

- Solventis

- Tokuyama Corporation

第七章 市场机会与未来展望

The Propanol Market size is estimated at USD 3.23 billion in 2025, and is expected to reach USD 4.05 billion by 2030, at a CAGR of 4.67% during the forecast period (2025-2030).

Moderate expansion stems from rising adoption in semiconductor cleaning, sustainable aviation fuel pathways, and pharmaceutical synthesis, even as regulatory pressures reshape solvent formulations. High-purity isopropanol demand for 5 nm and below chip fabrication, new API production hubs in Asia, and alcohol-to-jet projects in North America collectively underpin steady volume gains. Feedstock volatility and evolving VOC limits temper momentum, but continuous oxo-alcohol integration and investment in purification technologies help producers defend margins. Integrated petrochemical players therefore retain cost advantages, while bio-based entrants carve out growth niches within the wider propanol market.

Global Propanol Market Trends and Insights

High-purity IPA Demand in Electronics Cleaning

Ultra-high-purity isopropanol exceeding 99.999% purity has become indispensable for advanced node semiconductor fabrication. ExxonMobil is upgrading its Baton Rouge unit to supply this grade by 2027, ensuring secure domestic supply for United States chipmakers. Contamination at parts-per-trillion levels can impair wafer yields, pushing device makers to specify ever-cleaner solvents. Electronics cleaning consequently grows faster than the overall propanol market, and suppliers are installing additional distillation columns, filtration trains, and real-time analytics to certify product purity. The resulting price premiums partly offset feedstock volatility, allowing integrated producers to protect spreads while meeting stringent customer audits.

Construction-led Solvent Demand in Paints & Coatings

Strong residential and commercial construction in Asia Pacific and the Middle East is driving demand for architectural coatings that rely on propanol-based co-solvents to balance viscosity, open time, and film formation. Regulators in the United States and Europe continue tightening VOC thresholds, spurring formulation shifts toward waterborne systems that still require controlled levels of propanol for flash-off control. The U.S. Environmental Protection Agency has extended aerosol coating compliance deadlines to January 2027, giving manufacturers critical runway to redesign products while maintaining performance. Continuous solvent innovation helps coatings producers satisfy durability criteria without breaching emission limits, supporting incremental consumption across the propanol market.

Stricter VOC Rules for Solvent Formulations

The U.S. National VOC Emission Standards impose lower allowable limits on consumer and commercial coatings, forcing reformulation to meet January 2027 deadlines. Similar policies are unfolding in the European Union, compelling users to substitute or reduce traditional solvent volumes. Compliance costs, additional testing, and certification requirements slow demand growth in legacy coatings, inks, and adhesives application areas, dampening part of the propanol market's potential.

Other drivers and restraints analyzed in the detailed report include:

- Rising Pharma API Output in Asia Pacific

- Emerging Bio-propanol for Low-carbon Aviation Fuel

- Scale-up Hurdles for Bio-propanol Fermentation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Isopropanol accounted for 54.77% of the propanol market in 2024, leveraging its quick evaporation rate, antimicrobial efficacy, and versatile solvency for pharmaceuticals, personal care, and industrial cleaning. Semiconductor manufacturers are sharpening this dominance by contracting supply of 99.999% grades, and ExxonMobil's upcoming Baton Rouge line illustrates capital commitment toward ultra-high-purity batches. N-propanol maintains a niche but reliable presence in specialty inks and chemical intermediates, benefiting formulators requiring slower evaporation and distinct reactivity. Bio-based propanol delivers the steepest growth curve at 6.89% CAGR, aided by policy incentives targeting sustainable aviation fuel. USA BioEnergy's investment has increased confidence that offtake agreements can underwrite scale-up, positioning renewable producers for entry into the broader propanol market.

Isopropanol's extensive global distribution network and mature manufacturing footprint underpin reliable supply, yet escalating semiconductor demand is pressuring logistics and quality-control capacity. Producers are updating purification trains with ion-exchange, ultrafiltration, and advanced gas chromatography to verify part-per-trillion impurity thresholds. Conversely, bio-based output must overcome fermentation productivity limits and variable feedstock availability. Over the forecast horizon, the faster growth of renewable grades narrows the gap, but the absolute propanol market size for isopropanol remains well ahead, illustrating the inertia of entrenched production assets and customer familiarity.

The Propanol Market Report is Segmented by Product Type (n-Propanol, Isopropanol, Bio-Based Propanol), End-Use Industry (Pharmaceutical, Chemicals, Personal Care & Cosmetics, Printing Inks, Paints & Coatings, Electronics Cleaning, Adhesives & Sealants, Others), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific leads the propanol market with 40.24% share in 2024. Government programmes like India's PLI scheme and Bulk Drug Parks funnel investment into API synthesis lines that consume pharmaceutical-grade propanol. China remains the largest chemical producer globally, commanding 50% share of world output and driving solvent needs across paints, inks, and electronics assembly. High-purity demand is amplified by advanced node semiconductor activity in Japan and South Korea, where fabs stipulate stringent contamination thresholds. Growing integration between refineries and chemical complexes in Southeast Asia further stabilizes regional feedstock supply.

North America exhibits mature but resilient consumption. The United States exported USD 345 million of propanol in 2023 while importing USD 128 million, a sign of domestic self-sufficiency coupled with specialized grade requirements. ExxonMobil's plan to produce 99.999% purity isopropanol in Louisiana aligns with the domestic semiconductor incentive framework, reducing dependence on imported high-spec material. Concurrently, USA BioEnergy's Texas SAF project elevates the region's renewable propanol profile, signaling diversification of demand.

Europe faces cost-side pressure from energy prices and stricter environmental norms. BASF saw a 21% sales decline in 2023, emblematic of subdued industrial output, yet specialty grades for pharmaceuticals and personal care protect pockets of profitability. The Middle East and Africa region holds the highest forward CAGR potential. Advanced Petrochemical and SK Gas are constructing an isopropanol plant at Jubail, harnessing local propylene surpluses and integrated infrastructure. South America registers moderate growth, with Brazil's push toward SAF via sugarcane waste and biomethane unlocking future bio-propanol demand.

- BASF SE

- Deepak Fertilisers & Petrochemicals

- Dow

- Eastman Chemical Company

- Exxon Mobil Corporation

- HiMedia Laboratories

- Honeywell International Inc.

- INEOS

- LCY

- LyondellBasell Industries N.V.

- Mitsui Chemicals Inc.

- Moeve

- Sasol Limited

- Shell plc

- Solvay

- Solventis

- Tokuyama Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High-purity (isopropyl alcohol) IPA demand in electronics cleaning

- 4.2.2 Construction-led solvent demand in paints and coatings

- 4.2.3 Rising pharma API output in Asia Pacific

- 4.2.4 Emerging bio-propanol for low-carbon aviation fuel

- 4.2.5 Cost cuts via continuous oxo-alcohol integration

- 4.3 Market Restraints

- 4.3.1 Volatile propylene feedstock prices

- 4.3.2 Stricter VOC rules for solvent formulations

- 4.3.3 Scale-up hurdles for bio-propanol fermentation

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts

- 5.1 By Product Type

- 5.1.1 n-Propanol

- 5.1.2 Isopropanol

- 5.1.3 Bio-based Propanol

- 5.2 By End-use Industry

- 5.2.1 Pharmaceutical

- 5.2.2 Chemicals (Solvents and Intermediates)

- 5.2.3 Personal Care and Cosmetics

- 5.2.4 Printing Inks

- 5.2.5 Paints and Coatings

- 5.2.6 Electronics Cleaning

- 5.2.7 Adhesives and Sealants

- 5.2.8 Others

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacifc

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Deepak Fertilisers & Petrochemicals

- 6.4.3 Dow

- 6.4.4 Eastman Chemical Company

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 HiMedia Laboratories

- 6.4.7 Honeywell International Inc.

- 6.4.8 INEOS

- 6.4.9 LCY

- 6.4.10 LyondellBasell Industries N.V.

- 6.4.11 Mitsui Chemicals Inc.

- 6.4.12 Moeve

- 6.4.13 Sasol Limited

- 6.4.14 Shell plc

- 6.4.15 Solvay

- 6.4.16 Solventis

- 6.4.17 Tokuyama Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Substituting Gasoline as Fuel