|

市场调查报告书

商品编码

1846226

异戊二烯:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Isoprene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

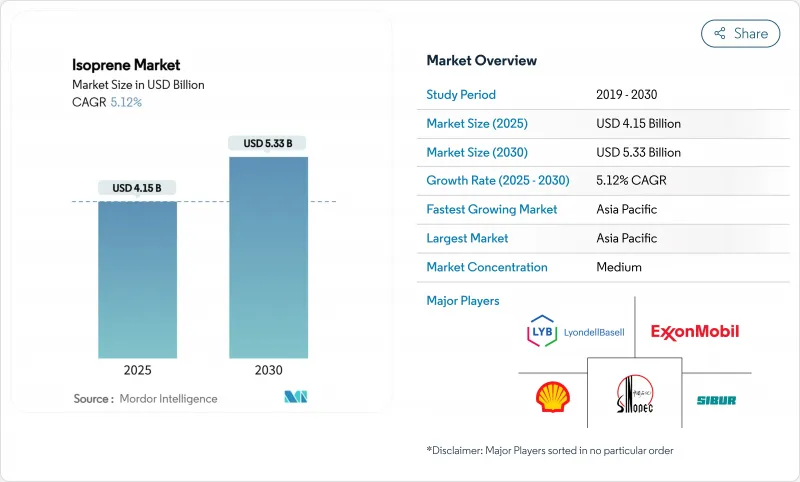

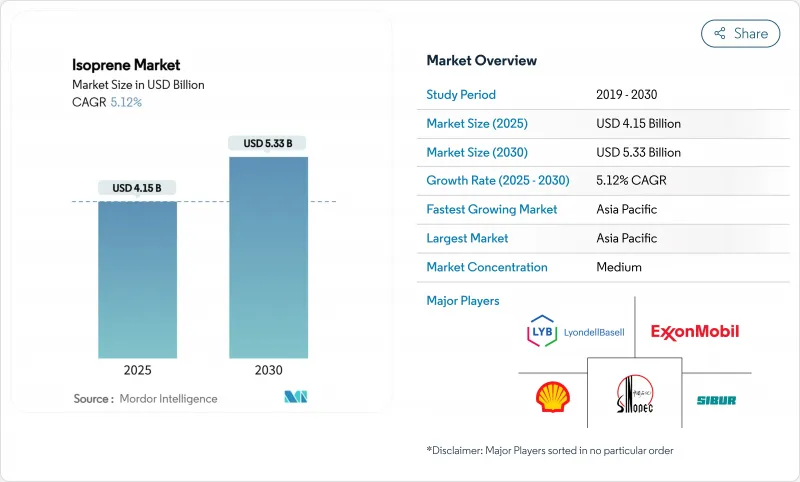

预计到 2025 年,异戊二烯市场规模将达到 41.5 亿美元,到 2030 年将达到 53.3 亿美元,在此期间的复合年增长率为 5.12%。

汽车製造商转向使用高性能合成弹性体製造电动汽车轮胎、生物基原料测试的扩展以及亚太地区(占全球产量一半以上)的生产,共同推动了成长。由于轮胎製造商优先考虑硫化率的稳定性,聚合物级材料保持溢价;同时,医疗设备创新推动了医疗保健产业对超纯聚异戊二烯的需求加速成长。随着石化製造商透过整合可再生能源来规避原油价格波动风险,生物发酵路线的战略重要性日益凸显,近期大量资金流入发酵新兴企业也为此提供了支持。发酵专家和替代橡胶创新者对传统C5裂解的经济效益提出质疑,导致竞争加剧,促使现有企业转向合资和原料多元化。

全球异戊二烯市场趋势与洞察

电动车推动高性能轮胎对合成橡胶的需求激增

电动车的高扭矩负载要求使用具有卓越拉伸强度和更低滚动阻力的聚合物,这促使轮胎製造商寻求天然橡胶无法保证的稳定异戊二烯配方。美国环保署 (EPA) 指出,每年生产超过 30 亿条轮胎,而电动车专用配方需要更高的耐久性以维持电池续航里程。米其林对生物基合成橡胶的探索凸显了轮胎配方重新设计的必要性。亚太地区电动车製造的集中度提高了该地区对异戊二烯的需求,从而维持了超越典型更换週期的结构性需求。

投资生物基异戊二烯可降低石油基风险

诸如IFPEN的Atol和BioButterfly计划等发酵技术证实了将可再生乙醇转化为聚合物级异戊二烯的技术可行性。 Global Bioenergies的工业异丁烯生产以及Insempra的2000万美元资金筹措凸显了投资者对可再生C5化学品日益增长的需求。成本持平预测表明,在预测期内,发酵製程的成本将接近石油路线,尤其是在生质乙醇过剩的地区。

原油原料价格波动扩大了生产商的净利率。

炼油厂运转率的波动会影响C5馏分油的供应,推高非一体化加工商的投入成本,并在原油价格高企时期挤压利润空间。虽然生物基路线价格稳定,但目前甘蔗衍生的C5馏分油价格比化石燃料路线高出280%至752%,构成短期竞争挑战。

细分市场分析

到2024年,聚合物级产品将占总收益的62.95%,预计到2030年将以6.19%的复合年增长率成长。生产商正采用先进的聚合技术来实现低支化和高分子量,从而减少热量积聚,并延长轮胎寿命。化学级产品继续供应特定领域的中间体,但随着汽车和医疗保健产业对聚合物一致性的日益重视,其市场份额正逐渐下降。外科器械对纯度要求的不断提高支撑了其高价,并使供应合约与週期性的汽车需求脱钩。

区域分析

预计到2025年,亚太地区异戊二烯市场规模将达到21.5亿美元,得益于其与汽车原始设备製造商(OEM)的地理位置接近,可节省运输成本并增强区域供应安全。中国正透过加工技术的进步,缩小天然橡胶和合成橡胶之间的产能差距,进而投资实现弹性体自给自足。印度蓬勃发展的化学工业将扩大下游需求,而泰国的生物乙烯中心将为可再生C5燃料的整合提供跳板。

北美製造商将生物聚合物产能扩大至每年26万吨,反映出企业对永续轮胎和医疗设备的需求日益增长。欧盟的脱碳政策指导着对发酵和催化转化平台的投资。加拿大卫生署的致癌性分类影响原料采购,原始设备製造商更倾向于选择拥有完善安全通讯协定的供应商。随着成本溢价的下降,南美的甘蔗价值链展现出战略机会。中东的综合设施将廉价的石脑油原料与出口物流连接起来,以供应非洲新兴的汽车产业中心。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电动车推动高性能轮胎用合成橡胶需求激增

- 投资生物基异戊二烯以降低石油基风险

- 医疗保健产业对超纯聚异戊二烯医疗设备的需求不断增长

- 亚太地区汽车产能扩张促进C5提取

- 在3D列印鞋中使用异戊二烯基热可塑性橡胶

- 改用低气味聚异戊二烯作为低VOC室内黏合剂

- 市场限制

- 原油价格波动导致生产商利润率上升

- 加强异戊二烯单体(致癌性)职场接触法规

- 发酵规模化瓶颈延缓了生物异戊二烯的商业化过程

- 来自银胶菊和蒲公英橡胶替代品的竞争

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按年级

- 聚合物级

- 化学级

- 透过製造路线

- 石油化工C5分解

- 生物基发酵

- 生质乙醇的催化转化

- 透过使用

- 胎

- 卫生保健

- 服饰和鞋类

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Braskem

- Chevron Phillips Chemical Company LLC.

- China Petrochemical Corporation

- ENEOS Corporation

- Exxon Mobil Corporation

- JSR Corporation

- Kraton Corporation

- KURARAY CO., LTD.

- LLC Tolyattikauchuk

- LOTTE Chemical CORPORATION

- LyondellBasell Industries Holdings BV

- PJSC SIBUR Holding

- Shell plc

- The Goodyear Tire & Rubber Company

- Zeon Corporation

第七章 市场机会与未来展望

The isoprene market is valued at USD 4.15 billion in 2025 and is forecast to reach USD 5.33 billion in 2030, reflecting a 5.12% CAGR over the period.

Growth is propelled by automakers' shift toward high-performance synthetic elastomers for electric-vehicle (EV) tires, expanding bio-based feedstock trials, and Asia-Pacific's dominance in manufacturing that supplies over half of global volumes. Polymer-grade materials retain a premium as tire manufacturers prioritize consistent cure rates, while healthcare demand for ultra-pure polyisoprene accelerates on the back of medical-device innovation. Bio-fermentation routes gain strategic importance as petrochemical producers hedge crude-oil volatility through renewable integration, supported by recent capital flows into fermentation start-ups. Competitive intensity rises as fermentation specialists and alternative-rubber innovators challenge conventional C5-cracking economics, nudging incumbents toward joint ventures and feedstock diversification.

Global Isoprene Market Trends and Insights

EV-Led Surge in Synthetic-Rubber Demand for High-Performance Tires

Higher torque loads in EVs mandate polymers with superior tensile strength and reduced rolling resistance, directing tire makers toward consistent isoprene formulations that natural rubber cannot guarantee. The US EPA notes over 3 billion tires produced annually, with EV-specific compounds requiring enhanced durability for battery-range preservation. Michelin's exploration of bio-based synthetic rubber underscores the redesign imperative facing tire compounds. Asia-Pacific's EV manufacturing concentration magnifies regional pull for isoprene, thereby sustaining a structural uplift in demand beyond the typical replacement cycle.

Investments in Bio-Based Isoprene Routes to Cut Petro-Feedstock Risk

Fermentation technologies such as IFPEN's Atol and the BioButterfly project confirm the technical feasibility of converting renewable ethanol into polymer-grade isoprene. Global Bioenergies' industrial isobutene output and Insempra's USD 20 million funding round highlight the growing investor appetite for renewable C5 chemistry. Cost-parity forecasts indicate fermentation will approach petro-routes within the forecast window, particularly in regions with surplus bio-ethanol.

Crude-Oil Feedstock Price Volatility Widening Producer Margins

Refinery utilization swings alter C5 fraction availability, pushing input costs higher for non-integrated processors and squeezing margins during crude-price spikes. Although bio-based routes offer price stability, current sugarcane-derived options command premiums between 280% and 752% over fossil routes, challenging near-term competitiveness.

Other drivers and restraints analyzed in the detailed report include:

- Rising Healthcare Demand for Ultra-Pure Polyisoprene Medical Devices

- Asia-Pacific Automotive Capacity Expansion Boosting C5 Extraction

- Stricter Workplace Exposure Limits for Isoprene Monomer (Carcinogen)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polymer grade commanded 62.95% of 2024 revenue and is forecast to advance at 6.19% CAGR to 2030, mirroring demand for uniform cure rates in EV tires. Producers deploy advanced polymerization to achieve lower branching and higher molecular weights that curb heat build-up, benefiting tire longevity. Chemical grade continues serving niche intermediates but faces gradual share erosion as automotive and healthcare sectors value polymer consistency. Elevated purity requirements for surgical devices sustain premium pricing and insulate supply contracts from cyclical auto demand.

The Isoprene Market Report is Segmented by Grade (Polymer Grade and Chemical Grade), Production Route (Petrochemical C5 Cracking, Bio-Based Fermentation, and Catalytic Conversion of Bio-Ethanol), Application (Tyres, Healthcare, Apparels and Footwear, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's isoprene market size hit USD 2.15 billion in 2025, and proximity to automotive OEMs offers freight savings that strengthen regional supply stability. China invests in elastomer self-sufficiency through processing advancements that bridge natural and synthetic rubber capability gaps. India's chemical-industrial growth broadens downstream demand, while Thailand's bio-ethylene hub creates a springboard for renewable C5 integration.

North American producers expand bio-polymer capacity to 260 kt per year, reflecting corporate attention to consumer pressure for sustainable tires and medical devices. The European Union's decarbonization policies steer investment toward fermentation and catalytic conversion platforms. Health Canada's carcinogen classification influences procurement, prompting OEMs to favor suppliers with robust safety protocols. South America's sugarcane value chain presents a strategic opportunity once cost premiums shrink. Middle Eastern complexes bundle inexpensive Naphtha feed with export logistics that reach Africa's emerging automotive hubs, while African demand growth hinges on vehicle assembly expansion and infrastructure improvement.

- Braskem

- Chevron Phillips Chemical Company LLC.

- China Petrochemical Corporation

- ENEOS Corporation

- Exxon Mobil Corporation

- JSR Corporation

- Kraton Corporation

- KURARAY CO., LTD.

- LLC Tolyattikauchuk

- LOTTE Chemical CORPORATION

- LyondellBasell Industries Holdings B.V.

- PJSC SIBUR Holding

- Shell plc

- The Goodyear Tire & Rubber Company

- Zeon Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV-led surge in synthetic-rubber demand for high-performance tyres

- 4.2.2 Investments in bio-based isoprene routes to cut petro-feedstock risk

- 4.2.3 Rising healthcare demand for ultra-pure polyisoprene medical devices

- 4.2.4 Asia-Pacific automotive capacity expansion boosting C5 extraction

- 4.2.5 3-D-printed footwear adopting isoprene-based thermoplastic elastomers

- 4.2.6 Low-VOC interior adhesives shifting towards low-odor polyisoprene

- 4.3 Market Restraints

- 4.3.1 Crude-oil feedstock price volatility widening producer margins

- 4.3.2 Stricter workplace exposure limits for isoprene monomer (carcinogen)

- 4.3.3 Fermentation scale-up bottlenecks delaying commercial BioIsoprene

- 4.3.4 Competition from guayule & dandelion natural-rubber alternatives

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Grade

- 5.1.1 Polymer Grade

- 5.1.2 Chemical Grade

- 5.2 By Production Route

- 5.2.1 Petrochemical C5 Cracking

- 5.2.2 Bio-based Fermentation

- 5.2.3 Catalytic Conversion of Bio-Ethanol

- 5.3 By Application

- 5.3.1 Tyres

- 5.3.2 Heathcare

- 5.3.3 Apparels and Footwear

- 5.3.4 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Braskem

- 6.4.2 Chevron Phillips Chemical Company LLC.

- 6.4.3 China Petrochemical Corporation

- 6.4.4 ENEOS Corporation

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 JSR Corporation

- 6.4.7 Kraton Corporation

- 6.4.8 KURARAY CO., LTD.

- 6.4.9 LLC Tolyattikauchuk

- 6.4.10 LOTTE Chemical CORPORATION

- 6.4.11 LyondellBasell Industries Holdings B.V.

- 6.4.12 PJSC SIBUR Holding

- 6.4.13 Shell plc

- 6.4.14 The Goodyear Tire & Rubber Company

- 6.4.15 Zeon Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-needs assessment

- 7.2 Introducing New Manufacturing Techniques to Reduce Hazardous Waste