|

市场调查报告书

商品编码

1846227

珍珠岩:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)Perlite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

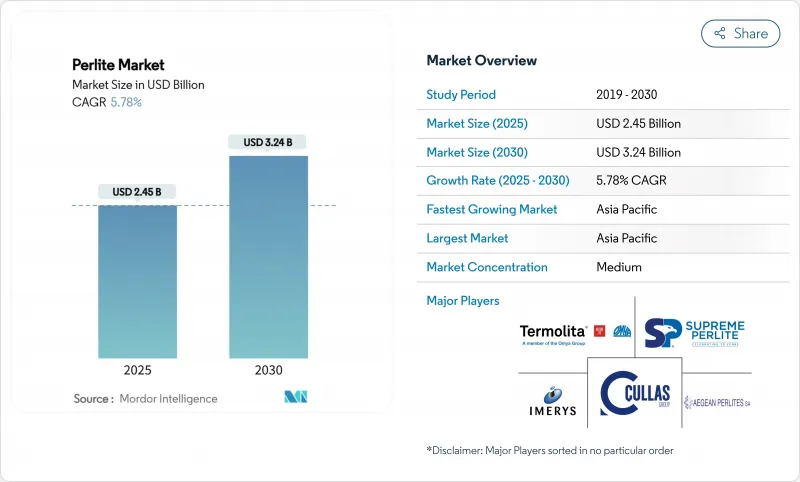

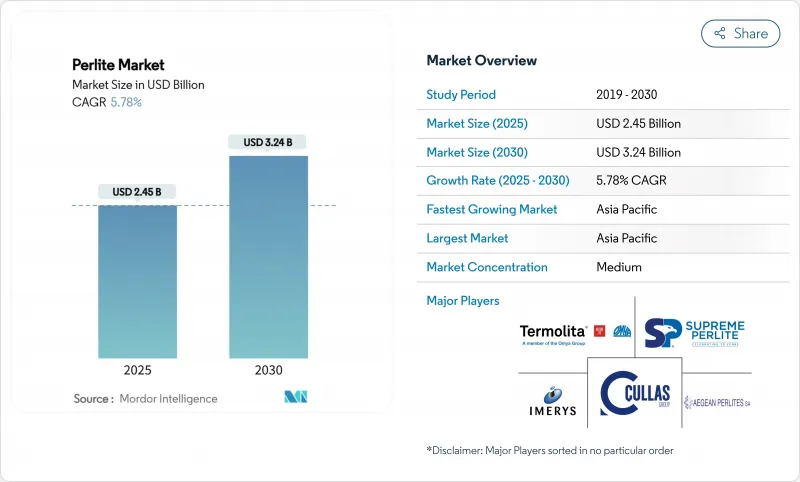

珍珠岩市场规模预计在 2025 年为 24.5 亿美元,预计到 2030 年将达到 32.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.78%。

这一前景反映了节能建筑、园艺、微过滤和隔热材料领域对轻质骨材的强劲需求。建筑规范对热性能基准的严格要求正在推动产量成长,尤其是在欧洲和北美,而亚太地区的快速都市化正在创造大规模的基础设施需求。用于低温储存、精酿饮料过滤和化妆品的特殊骨材净利率更高,并支持产品创新。儘管土耳其和美国由于火山矿石资源丰富,供应仍然充足,但物流成本正在影响地区价格差异。

全球珍珠岩市场趋势与见解

轻型结构的需求不断增长

珍珠岩混凝土和灰泥可在不牺牲热工性能的情况下降低结构负荷,从而以较小的地基建造更高的建筑。膨胀颗粒比沙子和砾石轻高达80%,节省运输成本。模组化建筑工厂越来越多地指定使用珍珠岩增强板,以减少现场组装时间并满足严格的热感桥限制。预製生产线受益于珍珠岩的一致性,从而提高了批次精度并减少了废品。中国、印度和东协地区的长期都市化使珍珠岩市场成为永续高层建筑的首选轻质骨材来源。

园艺和水耕技术应用热潮

受控环境农场重视珍珠岩,认为它是一种无菌、pH值中性、可重复使用的基材锁住水分并防止根腐病。美国和荷兰的商业温室报告称,用珍珠岩取代泥炭含量较高的混合料后,产量增加。业内人士更倾向于使用粗粒级珍珠岩,以便自动灌溉系统能够精确地维持氧气水平。专业的医用大麻种植者愿意为获得药用种植认证的超洁净级珍珠岩支付高价。东南亚城市农业的蓬勃发展,使当地加工商能够以较低的运输成本供应新鲜介质,从而支撑了该地区珍珠岩市场的需求。

现成的替代方案

蛭石、岩绒和膨胀粘土在重量和R值方面直接竞争。再生发泡聚苯乙烯(EPS)珠粒在无需高温施工的轻砂浆中的份额正在不断增长。在过滤,合成介质的截止阈值更窄,威胁珍珠岩在无菌药品生产线的地位。在园艺领域,珍珠岩面临椰壳纤维等生物基材料的竞争,这些材料声称永续性。产品创新和应用支援对于珍珠岩供应商在价格敏感的细分市场中保持份额仍然至关重要。

細項分析

膨胀珍珠岩在建筑灰泥、园艺混合料和工业鬆散填充隔热材料中广泛应用,2024年占据了珍珠岩市场67.56%的份额。成熟的应用使其价格保持竞争力,供应商也专注于提高物流效率和矿石精炼以确保净利率。特种产品製造商目前正在推广能够承受低温罐中粉尘产生的高密度电子烟和涂料级产品,而化妆品製造商则需要用于脸部磨砂膏的细粒度粉末。预计2030年,新兴的特种级产品市场将以6.45%的复合年增长率扩张,吸收专注于表面功能化的研发支出。

Vapex 和特殊等级产品在医药过滤和空间受限的液化天然气模组领域提供了不成比例的附加价值,这些领域的核准取决于技术阈值。处理供应商采用硅烷和聚合物处理,使单价比通用膨胀珍珠岩高出数倍。 Agroperlite 因其均衡的持水能力和中性 pH 值而在温室中保持稳定产量。其他产品类型,包括用于铸造炉渣清除的块矿,占据较小的市场,但受益于固定客群关係。产品组合构成显示珍珠岩市场呈现两极化:一方面是产量大的通用隔热材料,另一方面是产量小、价值高的工程级珍珠岩。

区域分析

到2024年,亚太地区将占全球轻质骨材消费量的48.75%,到2030年,复合年增长率将达到6.88%。中国「十四五」规划强调装配式住宅和绿色建筑,这两者都是轻质骨材的主要消费领域。印度的「智慧城市计画」正在资助使用珍珠岩板的混合用途开发项目,以减少静态和维修时间。日本、韩国和台湾的电子工厂和高科技温室都需要超净级珍珠岩。印尼和菲律宾的国内加工企业正在后向整合矿石开采业务,以减少对进口的依赖。

北美仍然是技术和特种等级材料的大本营。德克萨斯州和路易斯安那州的液化天然气出口终端使用鬆散填充珍珠岩来建造1亿加仑的储存槽,加拿大的大麻种植者则大量购买园艺级珍珠岩。美国暖气、冷气与空调工程师美国(ASHRAE)90.1-2025等能源标准正在推动更深层的隔热维修,包括珍珠岩空腔填充。欧洲正受惠于欧盟的零排放建筑指令,德国、法国和义大利的维修计画正在加速矿物隔热材料的采用。儘管人事费用不断上升,但来自希腊和土耳其的地中海矿石供应在到岸成本方面仍具有竞争力。

南美、中东和非洲虽小,但具有战略意义。巴西受保护的亚马逊地区允许城市中心垂直扩张,因此更青睐轻质、低能耗的骨材。智利的锂卤水作业使用珍珠岩助滤剂,在蒸发前去除细小颗粒。波湾合作理事会国家正在为液化天然气转运枢纽加装隔热层,以缓解沙漠高温;南非新兴的温室丛集正在采购园艺珍珠岩,以应对水资源短缺问题。儘管物流和规模化挑战仍然存在,但这些地区为早期市场参与企业提供了长期的上升空间。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 轻型结构的需求不断增长

- 园艺和水耕技术应用热潮

- 对冶金隔热材料的要求日益提高

- 加强节能建筑标准

- 扩大精酿饮料的过滤

- 市场限制

- 现成的替代方案

- 散装运输成本变动

- 高等级矿石区域性枯竭

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 依产品类型

- 膨胀珍珠岩

- 农珍珠岩

- Vapex 和特种等级

- 其他产品类型

- 按用途

- 隔热材料

- 填充材

- 耐火材料

- 过滤和过滤

- 磨料

- 土壤改良园艺

- 按行业

- 建筑和基础设施

- 园艺和农业

- 工业製造

- 食品和饮料加工

- 石油和天然气/冷藏

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 北欧

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Aegean Perlites SA

- Ausperl Pty Ltd

- Azer Perlite Corporation

- Blue Pacific Minerals

- Carolina Perlite Co., Inc.

- Cullas Construction Materials Industry and Foreign Trade Inc.

- Dupre Minerals Ltd.

- Genper Group

- Imerys

- Keltech Energies Ltd.

- Omya AG

- Perlite Canada Inc.

- Profilytra BV

- Resonac

- Silbrico Corporation

- Supreme Perlite

- Omya International AG

- The Schundler Company

第七章 市场机会与未来展望

The Perlite Market size is estimated at USD 2.45 Billion in 2025, and is expected to reach USD 3.24 Billion by 2030, at a CAGR of 5.78% during the forecast period (2025-2030).

The outlook reflects strong demand for lightweight aggregates in energy-efficient construction, horticulture, precision filtration and cryogenic insulation. Construction codes that tighten thermal-performance benchmarks, especially in Europe and North America, reinforce volume growth, while rapid urbanization in the Asia Pacific creates large-scale infrastructure demand. Specialty grades for cryogenic storage, craft-beverage filtration and cosmetics deliver higher margins and anchor product innovation. Supply remains adequate because of abundant volcanic ore in Turkey and the United States, yet logistics costs influence regional pricing differentials.

Global Perlite Market Trends and Insights

Growth in Lightweight Construction Demand

Perlite concrete and plasters lower structural load without sacrificing thermal performance, enabling taller buildings on smaller foundations . Transportation savings arise because expanded particles weigh up to 80% less than sand and gravel. Modular building factories increasingly specify Perlite-enhanced panels to shorten on-site assembly time and meet stringent thermal-bridge limits. Prefabrication lines benefit from the mineral's consistency, which improves batching accuracy and reduces rejects. Long-term urbanization in China, India and the ASEAN bloc positions the Perlite market as a preferred source of lightweight aggregates for sustainable, high-rise construction.

Horticulture & Hydroponics Adoption Boom

Controlled-environment farms value Perlite for sterile, pH-neutral, reusable substrates that retain moisture while preventing root rot. Commercial greenhouses in the United States and the Netherlands report yield gains when Perlite replaces peat-heavy mixes. Vertical-farm operators choose coarse grades that allow automated fertigation systems to maintain precise oxygen levels. Specialty growers of medical cannabis pay premium prices for ultra-clean grades certified for pharmaceutical cultivation. Expanding urban agriculture in Southeast Asia positions local processors to supply fresh media without high freight costs, underpinning regional Perlite market demand.

Readily Available Substitutes

Vermiculite, rock wool, and expanded clay compete directly on weight and R-value, while glass wool often offers a lower installed cost in large-scale commercial projects. Recycled expanded polystyrene (EPS) beads gain share in light screeds that do not require high service temperatures. In filtration, engineered synthetic media achieve narrower cut-off thresholds, threatening Perlite's position in sterile pharmaceutical lines. Horticulture faces bio-based rivals such as coconut coir that claim superior sustainability credentials. Product innovation and application support remain crucial for Perlite suppliers to defend their share in price-sensitive niches.

Other drivers and restraints analyzed in the detailed report include:

- Rising Metallurgical Insulation Requirements

- Energy-efficient Building Codes Tightening

- Volatile Bulk-shipping Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Expanded Perlite secured a 67.56% share of the Perlite market in 2024, reflecting broad acceptance in construction plasters, horticultural mixes, and industrial loose-fill insulation. Mature adoption keeps prices competitive, and suppliers emphasize logistics efficiency and ore purification to safeguard margins. Specialty producers now promote higher-density Vapex and coated grades that resist dusting inside cryogenic tanks, while cosmetic manufacturers demand finely classified powders for facial scrubs. The emerging specialty tier is projected to expand at a 6.45% CAGR to 2030, absorbing research and development (R&D) spend focused on surface functionalization.

Vapex & Specialty Grades add disproportionate value because technical thresholds govern approval in pharmaceutical filtration and space-constrained LNG modules. Processors apply silane or polymeric treatments that raise unit pricing several-fold relative to commodity expanded Perlite. Agro-Perlite maintains steady volumes in greenhouses that appreciate its balanced water-holding capacity and neutral pH. Other product types, including lump ore for foundry slag removal, occupy smaller niches yet benefit from captive customer relationships. The portfolio mix indicates a Perlite market trend toward bifurcation, high-volume commoditized insulation on one flank and low-volume, high-value engineered grades on the other.

The Perlite Market Report is Segmented by Product Type (Expanded Perlite, Agro-Perlite, and More), Application (Insulation, Fire-Proofing & Refractory, and More), End-Use Industry (Construction & Infrastructure, Horticulture & Agriculture, Industrial Manufacturing, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific accounted for 48.75% consumption in 2024 and is set to expand at a 6.88% CAGR through 2030. China's 14th Five-Year Plan emphasizes prefabricated housing and green buildings, both heavy consumers of lightweight aggregates. India's Smart Cities Mission funds mixed-use developments that use Perlite panels to reduce dead load and renovation timelines. Japan, South Korea, and Taiwan demand ultra-clean grades for electronics fabs and high-tech greenhouses. Domestic processors in Indonesia and the Philippines back-integrate into ore mining to reduce import reliance.

North America remains a technology and specialty-grade stronghold. United States LNG-export terminals in Texas and Louisiana consume loose-fill Perlite for 100-million-gal storage tanks, while Canadian cannabis producers buy horticultural grades in bulk. Energy codes such as American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) 90.1-2025 trigger deeper insulation retrofits, including Perlite cavity fills. Europe benefits from the EU zero-emission-building directive, with retrofit programs in Germany, France, and Italy accelerating mineral-based insulation uptake. Mediterranean ore supply from Greece and Turkey keeps landed cost competitive despite higher labor expenses.

South America and the Middle East & Africa together deliver a smaller yet strategic share. Brazil's protected Amazon region prompts urban centers to expand vertically, favoring lightweight, low-transport-energy aggregates. Chilean lithium brine operations adopt Perlite filter aids to remove fine particulates before evaporation. Gulf Cooperation Council countries insulate LNG transshipment hubs to mitigate desert heat, and South Africa's emerging greenhouse cluster sources horticultural Perlite to offset water scarcity. Although logistics and scale challenges persist, these regions present long-term upside for market participants that invest early.

- Aegean Perlites SA

- Ausperl Pty Ltd

- Azer Perlite Corporation

- Blue Pacific Minerals

- Carolina Perlite Co., Inc.

- Cullas Construction Materials Industry and Foreign Trade Inc.

- Dupre Minerals Ltd.

- Genper Group

- Imerys

- Keltech Energies Ltd.

- Omya AG

- Perlite Canada Inc.

- Profilytra BV

- Resonac

- Silbrico Corporation

- Supreme Perlite

- Omya International AG

- The Schundler Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Lightweight Construction Demand

- 4.2.2 Horticulture & Hydroponics Adoption Boom

- 4.2.3 Rising Metallurgical Insulation Requirements

- 4.2.4 Energy-efficient Building Codes Tightening

- 4.2.5 Expansion of Craft-beverage Filtration

- 4.3 Market Restraints

- 4.3.1 Readily Available Substitutes

- 4.3.2 Volatile Bulk-shipping Costs

- 4.3.3 Regional Depletion of High-grade Ore

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Expanded Perlite

- 5.1.2 Agro-Perlite

- 5.1.3 Vapex & Specialty Grades

- 5.1.4 Other Product Types

- 5.2 By Application

- 5.2.1 Insulation

- 5.2.2 Fillers

- 5.2.3 Fire-Proofing & Refractory

- 5.2.4 Filtration & Filter-Aid

- 5.2.5 Abrasives & Polishing

- 5.2.6 Soil Amendment/Horticulture

- 5.3 By End-Use Industry

- 5.3.1 Construction & Infrastructure

- 5.3.2 Horticulture & Agriculture

- 5.3.3 Industrial Manufacturing

- 5.3.4 Food & Beverage Processing

- 5.3.5 Oil & Gas/Cryogenic Storage

- 5.3.6 Others

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 NORDIAC

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Aegean Perlites SA

- 6.4.2 Ausperl Pty Ltd

- 6.4.3 Azer Perlite Corporation

- 6.4.4 Blue Pacific Minerals

- 6.4.5 Carolina Perlite Co., Inc.

- 6.4.6 Cullas Construction Materials Industry and Foreign Trade Inc.

- 6.4.7 Dupre Minerals Ltd.

- 6.4.8 Genper Group

- 6.4.9 Imerys

- 6.4.10 Keltech Energies Ltd.

- 6.4.11 Omya AG

- 6.4.12 Perlite Canada Inc.

- 6.4.13 Profilytra BV

- 6.4.14 Resonac

- 6.4.15 Silbrico Corporation

- 6.4.16 Supreme Perlite

- 6.4.17 Omya International AG

- 6.4.18 The Schundler Company

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment

- 7.2 Government Certification for its Consumption