|

市场调查报告书

商品编码

1846229

十二烷基硫酸钠:市场占有率分析、产业趋势、统计、成长预测(2025-2030)Sodium Lauryl Sulfate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

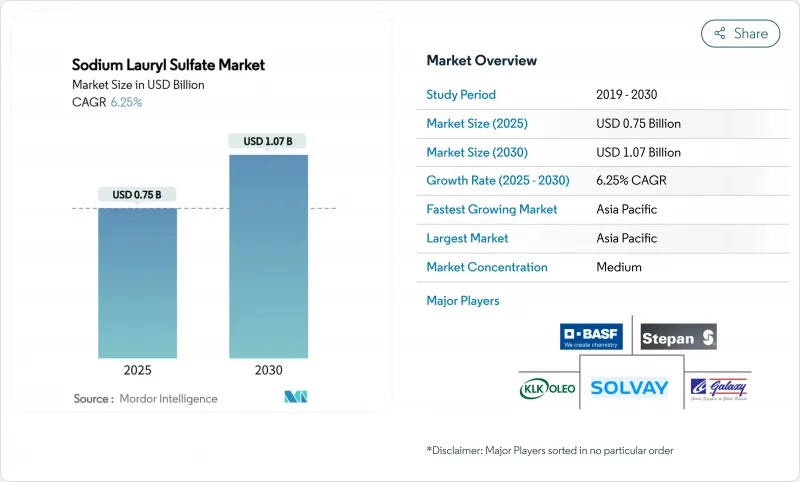

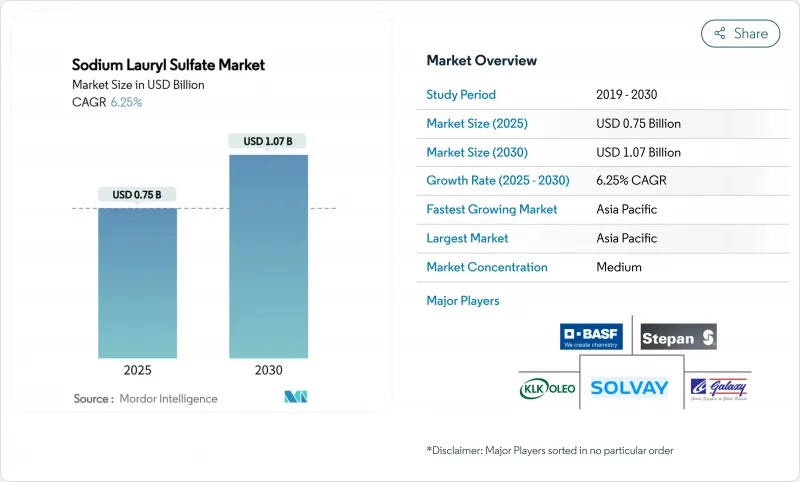

预计 2025 年十二烷基硫酸钠市场规模为 7.5 亿美元,到 2030 年将达到 10.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.25%。

这一势头源于该化合物在清洁剂、个人保健产品、油田化学品和作物保护助剂中的强大作用,儘管「无硫酸盐」标籤促使配方师寻求更温和的替代品。原料(尤其是棕榈衍生的脂醇类)的波动性正在挤压生产商的净利率,但同时也凸显了其相对于全生物基界面活性剂的成本优势。受中国、马来西亚和印尼产能扩张的推动,亚太地区在结构上维持了成本领先地位,而跨国巨头积极的脱碳计画则保障了该化合物在北美和欧洲的监管认可。

全球十二烷基硫酸钠市场趋势与洞察

家用清洁剂和清洁剂需求激增

家电保有量快速成长和洗衣频率不断提升是十二烷基硫酸钠市场最强劲的需求驱动力。配方师非常重视这种阴离子界面活性剂在硬水条件下的稳定性,这使得他们能够在保持洗涤效果的同时降低助洗剂用量。其泡沫特性还能使浓缩液提供消费者期望的感官体验——这在新兴经济体中至关重要,因为在这些经济体中,视觉泡沫等同于功效。改良的高效能洗衣解决方案利用十二烷基硫酸钠与蛋白酶、脂肪酶和纤维素酶的兼容性,促进低温洗涤,进而降低能源费用。凭藉2024年美国环保署「更安全选择」认证,该化合物进一步巩固了其作为大众市场清洁剂中主流且经监管机构认可的成分的地位。

扩大亚太地区个人护理製造地

由BASF投资100亿美元建设的湛江巴邦德综合体牵头的大型资本投资计划,展现了品牌所有者如何实现原材料本地化,以满足中国、印度和东南亚地区对护髮和沐浴产品日益增长的需求。获得价格具竞争力的棕榈油原料和可再生电力,可降低单位成本,同时减少碳排放。丛集效应将契约製造製造商和包装供应商聚集在一起,缩短了全球快速消费品巨头的前置作业时间。这些动态增强了亚太地区十二烷基硫酸钠市场的韧性,即使在高端无硫酸盐产品日益普及的情况下也是如此。

人类和水生生物毒性问题推动「无硫酸盐」标籤

儘管美国食品药物管理局 (FDA) 和化妆品成分审查机构 (COI) 的冲洗毒性评估再次确认了其安全性,但社交媒体的讨论却加剧了有关头皮刺激的传闻,促使中高端护髮品牌纷纷推出无硫酸盐产品。这些产品在北美的价格溢价 20-30%。市场区隔已为「清洁美容」开闢了专属空间,高端市场的十二烷基硫酸钠市场也明显呈现碎片化。欧洲生态标章计画收紧了排放毒性阈值,促使洗洁精的机构买家尝试更温和的配方。

細項分析

预计到2024年,SLS液体製剂将占总收益的61.35%,超过十二烷基硫酸钠市场的整体成长,复合年增长率为6.85%。线上计量、全自动配料和即时溶解的特性使SLS液体製剂成为中国和美国百万吨级清洁剂工厂的预设选择。液体製剂还能最大限度地减少粉尘暴露,这是职业安全合规的首要任务。干式SLS在出口主导的纺织助剂和SDS-PAGE试剂领域保持稳固的地位,这些领域的运输量减少意味着物流成本的降低,但成长率仍低于5%。

针对浓缩胶囊和清洁剂的配方师会添加粉末状十二烷基硫酸钠 (SLS) 来控制黏度并减少水分携带。喷雾干燥过程的改进使能耗降低了 15%,并略微提高了粉末的经济性。儘管如此,马来西亚和德克萨斯宣布的 2026 年液体产能扩张计画表明,十二烷基硫酸钠市场将继续倾向于自由流动的形式。

十二烷基硫酸钠报告按产品形式(十二烷基硫酸钠 (SLS) 液体、十二烷基硫酸钠 (SLS) 干)、等级(工业级、化妆品和个人护理级、医药级、食品级)、最终用户行业(清洁剂和清洁剂、个人保健产品、工业清洁剂、其他应用)和地区(亚太地区、北美、欧洲、其他细分市场)。

区域分析

亚太地区将占全球销售额的45.16%,到2030年,复合年增长率将达到8.03%。低成本原料、强劲的消费品生产以及马来西亚、泰国和中国沿海地区新建的油脂化工项目将保持该地区的结构性优势。湛江巴林提供的阴离子界面活性剂基质足以满足亚太地区到2030年三分之一的需求。

北美市场成熟且稳定,由历史悠久的清洁剂品牌和蓬勃发展的油田化学物品部门支撑。 Stepan收购PerformanX将扩大其增值农业界面活性剂的生产能力,并减少对进口的依赖。

儘管欧洲正在努力製定更严格的法规,但十二烷基硫酸钠在工业洗碗机和织物护理片中仍根深蒂固,这给新参与企业带来了同样严峻的生物降解障碍。根据修订后的清洁剂法规,数位标籤试验将详细的成分数据发送到智慧型手机,引导负责人找到可追溯、永续且经过认证的棕榈衍生物。中端製造商正在透过采用类似BASF生态平衡牌号的生物质平衡模型来应对利润率的下降。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 家用清洁剂和清洁剂需求激增

- 扩大亚太地区个人护理製造地

- 新兴国家卫生意识不断增强

- 生物基界面活性剂的成本竞争力

- 高价值除草剂混合物的助剂系统

- 市场限制

- 人类和水生生物毒性问题推动「无硫酸盐」标籤

- 生物基和温和表面活性剂替代品的快速商业化

- 棕榈仁油价格波动导致原物料成本上涨

- 价值链分析

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 按产品形态

- 液态十二烷基硫酸钠(SLS)

- 十二烷基硫酸钠(SLS)干粉

- 按年级

- 工业级(活性93%以上)

- 化妆品和个人护理级

- 医药级

- 食品级

- 按最终用户产业

- 清洁剂和清洁剂

- 个人保健产品

- 工业清洁剂

- 其他用途(油田化学品、提高采收率等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Aarti Surfactants

- Alpha Chemicals Pvt Ltd

- BASF

- Croda International Plc

- Dongming Jujin Chemical Co., Ltd

- Dow

- Galaxy

- Indorama Ventures Public Company Limited.

- Kao Chemicals Europe, SLU

- KLK OLEO

- Sasol Limited

- Solvay

- Spectrum Chemical

- Stepan Company

- Taiwan NJC Corporation

第七章 市场机会与未来展望

The Sodium Lauryl Sulfate Market size is estimated at USD 0.75 billion in 2025, and is expected to reach USD 1.07 billion by 2030, at a CAGR of 6.25% during the forecast period (2025-2030).

This momentum stems from the compound's entrenched role in detergents, personal-care products, oilfield chemicals, and crop-protection adjuvants, even as "sulfate-free" labeling pushes formulators toward milder alternatives. Feedstock volatility, especially in palm-derived fatty alcohols, is compressing producer margins and simultaneously highlighting cost advantages over fully bio-based surfactants. Capacity expansions in China, Malaysia, and Indonesia keep Asia-Pacific in a structural cost-lead position, while aggressive decarbonization programs by multinational majors safeguard the compound's regulatory acceptance in North America and Europe.

Global Sodium Lauryl Sulfate Market Trends and Insights

Demand Surge from Household Detergents and Cleaners

Surging appliance ownership and rising laundry frequency underpin the most resilient outlet for the sodium lauryl sulfate market demand. Formulators value the anionic surfactant's stability under hard-water conditions, enabling lower builder loading while preserving wash performance. Its foaming profile also allows concentrated liquids to deliver the sensory cues consumers expect, a critical success factor in emerging economies where visual foam is equated with efficacy. Reformulated high-efficiency laundry liquids rely on sodium lauryl sulfate's compatibility with protease, lipase, and cellulase enzymes, facilitating lower-temperature washes that trim energy bills. EPA Safer Choice recertification in 2024 further elevates the compound's status as a mainstream, regulatory-endorsed ingredient for mass-market cleaners.

Expansion of Personal-Care Manufacturing Bases in APAC

Massive capital projects, most notably BASF's USD 10 billion Zhanjiang Verbund complex, illustrate how brand owners are localizing ingredient supply to match explosive demand for hair-care and bath-care products in China, India, and Southeast Asia. Access to competitively priced palm lipid feedstocks and renewable electricity keeps unit costs low while trimming embedded carbon. The clustering effect attracts contract manufacturers and packaging suppliers, shortening lead times for global FMCG leaders. These dynamics strengthen the sodium lauryl sulfate market's resilience in APAC even as premium sulfate-free lines proliferate.

Human and Aquatic-Toxicity Concerns Driving "Sulfate-Free" Labeling

Although wash-off toxicology reviews from the FDA and the Cosmetic Ingredient Review reaffirm safety, social-media discussions amplify anecdotal scalp-irritation claims, pushing mid- to high-end hair-care brands toward sulfate-free positioning. These products achieve price premiums of 20-30% in North America. Retail shelf resets allocate dedicated "clean beauty" space, visibly fragmenting the sodium lauryl sulfate market in prestige segments. European eco-label schemes tighten discharge-toxicity thresholds, nudging institutional buyers of dish-wash liquids to pilot milder blends.

Other drivers and restraints analyzed in the detailed report include:

- Heightened Post-COVID Hygiene Focus in Emerging Economies

- Cost-Competitiveness Versus Bio-Based Surfactants

- Rapid Commercialization of Bio-Based and Mild Surfactant Substitutes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SLS Liquid captured 61.35% of 2024 revenue and is forecast to outpace the overall sodium lauryl sulfate market at a 6.85% CAGR. Inline dosing, fully automated batching, and instant solubility make liquids the default choice for megatonne detergent plants in China and the United States. Liquid format also minimizes dust exposure, a growing occupational-safety compliance priority. Dry SLS retains a foothold in export-driven textile auxiliaries and SDS-PAGE reagents, where lower freight mass drives logistics savings, but clocks sub-5% growth.

Formulators targeting concentrated pods or bar detergents add powder SLS for viscosity control and reduced water carry. Process improvements in spray-drying cut energy use by 15%, modestly improving powder economics. Even so, liquid capacity expansions announced for 2026 in Malaysia and Texas point to a continued tilt toward flowable formats in the sodium lauryl sulfate market.

The Sodium Lauryl Sulfate Report is Segmented by Product Form (Sodium Lauryl Sulfate (SLS) Liquid and Sodium Lauryl Sulfate (SLS) Dry), Grade (Industrial Grade, Cosmetic and Personal Care Grade, Pharmaceutical Grade, and Food Grade), End-User Industry (Detergents and Cleaners, Personal Care Products, Industrial Cleaners, and Other Applications), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific anchors 45.16% of global sales and will accelerate at 8.03% CAGR to 2030. Low-cost feedstock, robust consumer-goods output, and new oleochemical complexes in Malaysia, Thailand, and coastal China preserve the region's structural advantage. Zhanjiang Verbund alone supplies enough anionic surfactant base to serve one-third of the incremental APAC demand through 2030.

North America holds a mature yet steady position, bolstered by long-lived laundry-detergent brands and a vibrant oilfield-chemicals sector. Stepan's PerformanX acquisition expands value-added agriculture surfactant capacity, mitigating import reliance.

Europe grapples with stiffer regulatory overhead, but sodium lauryl sulfate remains entrenched in industrial dish-washers and fabric-care tablets, where biodegradability hurdles for newcomers are equally onerous. Digital labeling pilots under the revised Detergent Regulation funnel granular ingredient data to smartphones, nudging formulators toward traceable, certified-sustainable palm derivatives. Mid-tier manufacturers counter margin erosion by adopting biomass-balance models similar to BASF's EcoBalanced grades.

List of Companies Covered in this Report:

- Aarti Surfactants

- Alpha Chemicals Pvt Ltd

- BASF

- Croda International Plc

- Dongming Jujin Chemical Co., Ltd

- Dow

- Galaxy

- Indorama Ventures Public Company Limited.

- Kao Chemicals Europe, S.L.U.

- KLK OLEO

- Sasol Limited

- Solvay

- Spectrum Chemical

- Stepan Company

- Taiwan NJC Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand Surge from Household Detergents and Cleaners

- 4.2.2 Expansion of Personal-Care Manufacturing Bases in Asia-Pacific

- 4.2.3 Heightened Hygiene Focus in Emerging Economies

- 4.2.4 Cost-Competitiveness Versus Bio-Based Surfactants

- 4.2.5 Adoption in Adjuvant Systems for High-Value Herbicide Blends

- 4.3 Market Restraints

- 4.3.1 Human and Aquatic-Toxicity Concerns Driving "Sulfate-Free" Labeling

- 4.3.2 Rapid Commercialisation of Bio-Based and Mild Surfactant Substitutes

- 4.3.3 Palm-Kernel Oil Price Volatility Inflating Feedstock Costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Form

- 5.1.1 Sodium Lauryl Sulfate (SLS) Liquid

- 5.1.2 Sodium Lauryl Sulfate (SLS) Dry

- 5.2 By Grade

- 5.2.1 Industrial Grade (Greater than or equal to 93% active)

- 5.2.2 Cosmetic and Personal Care Grade

- 5.2.3 Pharmaceutical Grade

- 5.2.4 Food Grade

- 5.3 By End-User Industry

- 5.3.1 Detergents and Cleaners

- 5.3.2 Personal Care Products

- 5.3.3 Industrial Cleaners

- 5.3.4 Other Applications (Oilfield Chemicals and Enhanced Oil Recovery, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Australia and New Zealand

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Aarti Surfactants

- 6.4.2 Alpha Chemicals Pvt Ltd

- 6.4.3 BASF

- 6.4.4 Croda International Plc

- 6.4.5 Dongming Jujin Chemical Co., Ltd

- 6.4.6 Dow

- 6.4.7 Galaxy

- 6.4.8 Indorama Ventures Public Company Limited.

- 6.4.9 Kao Chemicals Europe, S.L.U.

- 6.4.10 KLK OLEO

- 6.4.11 Sasol Limited

- 6.4.12 Solvay

- 6.4.13 Spectrum Chemical

- 6.4.14 Stepan Company

- 6.4.15 Taiwan NJC Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Growing Application Footprint Across Various Industries