|

市场调查报告书

商品编码

1846234

陶瓷砖:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

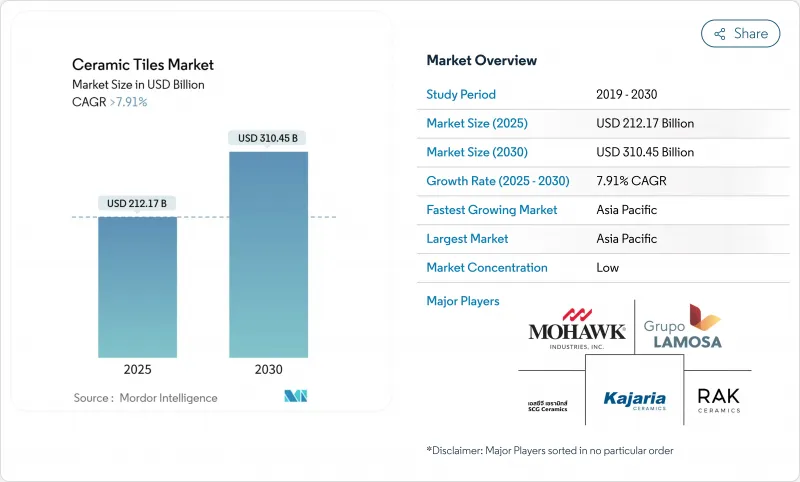

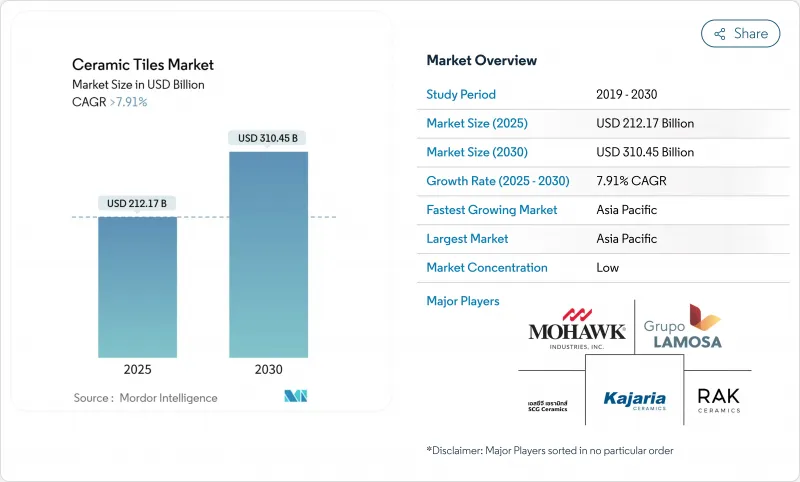

目前预计,陶瓷砖市场到 2025 年将创造 2,121.7 亿美元的收入,到 2030 年将达到 3,104.5 亿美元,年复合成长率为 7.91%。

强劲的公共部门基础设施投资、亚太地区快速发展的城市交通以及消费者对耐用、易清洁表面的偏好,都推动了这个市场扩张。美国新的政府支出计画以及印度和东南亚正在进行的地铁、机场和智慧城市建设,扩大了地板材料和墙面装饰产品的潜在市场。此外,将超逼真的石材、木材和金属效果印製到瓷体上的技术也刺激了市场需求,使消费者能够以更经济的方式享受奢华体验,而无需承担天然材料价格波动带来的风险。欧洲的环保法规正在加速低碳窑炉和废弃物混合料的推广应用,而线上零售通路则在全球扩大了产品的供应范围并提高了价格透明度。

全球陶瓷砖市场趋势与洞察

建筑和基础设施扩建

全球对交通走廊、能源工厂和综合用途设施的资本投资正在刺激陶瓷砖市场的大宗订单。在美国,一项多年联邦政府计划拨款1.2兆美元用于道路、桥樑、半导体工厂和清洁能源设施建设,从而持续刺激工厂和资料中心对耐用陶瓷瓷砖的需求。中国的「一带一路」倡议正在伙伴国家推动大量使用瓷砖的火车站和住宅建筑,而东协各国政府也在增加民用建筑预算,优先选择使用寿命长达30年的地板材料产品。骨材和水泥供应商的收入实现了两位数的成长,显示下游对陶瓷表面材料的消费强劲。

对美观耐用表面的需求

设计师们越来越注重将视觉衝击力与性能相结合,这推动了大尺寸尺寸瓷砖和仿大理石板材的流行。喷墨印表机能够复製出媲美天然石材的纹理和金属光泽,但重量更轻,色调也更稳定。尺寸最大可达 1.8 公尺 x 3.6 公尺的瓷砖减少了水泥浆,营造出开放式办公室和豪华住宅所追求的无缝衔接感。快干釉药缩短了生产週期,并允许频繁推出反映时尚潮流的新款式。在厨房和地下室等对防潮性能要求极高的场所,瓷砖市场份额也在不断增长,超过了实木地板。建筑师开始在电子组装地板中使用防静电饰面,使其用途从装饰性扩展到功能性。

建设和维护成本高

许多新兴市场持续面临熟练磁砖铺贴工短缺的问题,导致人事费用上升,计划延长。大尺寸尺寸磁砖需要专用起重设备和环氧树脂水泥浆,与标准的60公分磁砖相比,会使施工预算增加15%至25%。虽然业主可以在週末自行安装悬浮式乙烯基复合地板,但瓷砖维修需要专业的防水和基层处理。儘管行业协会正在加强认证项目,但合格工人的供应仍然落后于需求,限制了短期内的产量成长,尤其是在维修项目中。

细分市场分析

吸水率低于0.5%且耐冻性优异的陶瓷瓷砖,适用于户外广场和交通枢纽,预计在2024年将占据陶瓷砖市场51.23%的份额。在喷墨装饰技术的推动下,釉药瓷砖预计到2030年将以8.52%的复合年增长率成长,超越釉药陶瓷和马赛克瓷砖。消费者认可其通体着色和PEI IV级或更高级别的耐磨性,认为这是其使用寿命长的证据,因此瓷砖正在取代大理石,用于酒店大厅和机场等场所。

该品类的成长动能正推动整个陶瓷砖市场的发展,製造商利用连续窑炉大规模生产用于建筑幕墙的大尺寸薄板,在保持抗衝击强度的同时降低结构荷载。马赛克瓷砖虽然仍属于小众市场,但在高端水疗中心等注重工艺美感的场所,其市场份额正在不断扩大,价格也因此水涨船高。抗菌铜釉的创新应用正在拓展其在食品加工区和医院等领域的用途,这表明产品多元化如何支撑持续的收益成长。

到2024年,地面铺装应用将占陶瓷砖市场规模的48.56%,主要受潮湿区域和人流量大走廊等场所的强制性要求所推动。防滑陶瓷瓷砖和工业石板砖将主导商业厨房、仓库和转换等场所,从而确保基准规模的稳定。

预计到2030年,墙砖的复合年增长率将达到8.32%,主要得益于建筑师将纹理丰富、立体感强的瓷砖应用于墙面装饰、酒店接待区和零售店面背景墙。不断丰富的瓷砖设计选择将推高平均售价,而易于清洁的釉药则符合酒店业的卫生标准。屋顶和建筑幕墙应用将主要集中在地中海和安第斯山脉地区,这些地区特别重视陶瓷的热容量和抗冰雹性能。

陶瓷砖市场按产品类型(陶瓷瓷砖、釉药及其他)、应用领域(地面、墙面及其他)、最终用户(住宅、商业、工业)、建筑类型(新建、更换、改造)、分销渠道(独立零售商、大型五金建材超市及其他)和地区进行细分。市场预测以美元计价。

区域分析

亚太地区预计到2024年将占全球销售额的47.78%,并预计到2030年将以每年8.46%的速度成长。中国内陆地区正在粘土矿床附近增加产能,而印度的智慧城市和经济适用房计画正在扩张,并指定使用地板材料。越南北部集中了100多家製造商,这些製造商依赖进口化学品生产釉药,但到2024年仍将实现80%的釉药和20%的陶瓷瓷砖的生产比例。东协贸易协定促进了免税流通,并推动了区域整合供应链的发展。

北美市场虽然成熟,但战略地位举足轻重,国内生产商正积极对冲未来反倾销关税的风险。受房屋抵押贷款利率上升的影响,美国瓷砖消费量预计到2024年将下降至2.645亿平方米,但联邦政府对半导体和电池工厂的投入将支撑长期消费量。莫霍克工业公司利用其在田纳西州和德克萨斯州的垂直整合窑炉,缩短前置作业时间并确保公共计划符合规格要求。加拿大正在资助需要低碳材料的医院和交通设施维修,而墨西哥的拉莫萨集团则在拉丁美洲各地运营工厂,以分散其货币风险。

儘管能源成本上涨将导致2023年产量下降18%,但欧洲仍将占全球瓷砖机械出口的50%。义大利的闭合迴路工厂可100%回收未烧製废料,展现了其在环保领域的领先地位。西班牙正在试验氢窑,以实现欧盟的净零排放目标,而波兰的黏土短缺迫使其增加进口,导致现货价格波动。在中东和非洲,埃及正利用低成本的页岩资源,每年生产2亿平方公尺的瓷砖;阿联酋拉斯海马丛集拥有4万名註册工业,推动了对相关表面处理材料的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 扩大建筑和基础设施开发

- 对美观耐用的地板解决方案的需求日益增长

- 消费者越来越偏好选择环保和永续产品。

- 製造技术的进步

- 可支配所得增加和生活方式改变

- 建筑基础设施老化和翻新需求不断增长

- 市场限制

- 安装和维护成本高昂

- 脆弱性和裂缝风险

- 原物料价格波动

- 製造业的环境问题

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 陶瓷瓷砖

- 釉药陶瓷砖

- 无釉陶瓷砖

- 马赛克瓷砖

- 其他的

- 透过使用

- 地面

- 墙

- 屋顶

- 其他的

- 最终用户

- 住房

- 商业

- 工业

- 依建筑类型

- 新建工程

- 翻新和更换

- 按分销管道

- 个体零售商

- 大型家居建材商店

- 网路零售

- 直接向供应商销售

- 按地区

- 北美洲

- 加拿大

- 美国

- 墨西哥

- 南美洲

- 巴西

- 秘鲁

- 智利

- 阿根廷

- 其他南美

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 韩国

- 东南亚(新加坡、马来西亚、泰国、印尼、越南、菲律宾)

- 其他亚太地区

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 比荷卢经济联盟(比利时、荷兰、卢森堡)

- Nordix(丹麦、芬兰、冰岛、挪威、瑞典)

- 其他欧洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Mohawk Industries

- Grupo Lamosa

- SCG Ceramics Public Co. Ltd.

- Kajaria Ceramics Ltd.

- RAK Ceramics

- Pamesa Grupo Empresarial

- Guangdong Newpearl Ceramics

- Johnson Tiles

- Ceramic Industries Ltd.

- Porcelanosa Grupo

- Centura Tile

- Interceramic

- Florida Tile

- Villeroy & Boch

- Crossville Inc.

- Marazzi Group

- Iris Ceramica Group

- Noritake Co., Inc.

- Somany Ceramics

- Emser Tile*

第七章 市场机会与未来展望

The ceramic tiles market is currently generating USD 212.17 billion in 2025 and is projected to reach USD 310.45 billion by 2030, advancing at a 7.91% CAGR.

Steady public-sector infrastructure outlays, rapid urban migration in Asia-Pacific, and consumers' preference for durable, easy-to-clean surfaces anchor this expansion. New government spending packages in the United States and ongoing metro, airport, and smart-city developments in India and Southeast Asia are enlarging the addressable base for flooring and cladding products. Demand also benefits from technology that prints hyper-realistic stone, wood, and metallic effects on porcelain bodies, enabling premiumization without the price volatility of natural materials. Environmental regulations in Europe accelerate the rollout of low-carbon kilns and waste-based raw mixes, while online retail channels broaden product availability and price transparency worldwide.

Global Ceramic Tiles Market Trends and Insights

Construction and infrastructure expansion

Global capital spending on transport corridors, energy plants, and mixed-use complexes is stimulating large-volume orders for the ceramic tiles market. In the United States, multiyear federal programmed collectively allocate USD 1.2 trillion to roads, bridges, semiconductor fabs, and clean-energy facilities, generating sustained demand for heavy-duty porcelain specified in factories and data centers. China's Belt and Road Initiative drives tile-intensive rail stations and housing in partner economies, while ASEAN governments raise civil works budgets that favor flooring products with 30-year service lives. Suppliers of aggregates and cement report double-digit revenue growth, signaling robust downstream consumption of ceramic surfacing.

Demand for aesthetic, durable surfaces

Designers increasingly combine visual impact with performance, fuelling the uptake of large-format planks and marble-look slabs. Inkjet printers replicate veining and metallic highlights that rival quarried stone, but at lower weight and in repeatable colourways. Format growth-porcelain boards up to 1.8 m by 3.6 m-reduces grout lines and conveys seamless continuity valued in open-plan offices and luxury residences. Quick-fire glazes cut production cycles, enabling frequent style introductions that mirror fashion trends. The ceramic tiles market also gains share versus hardwood in kitchens and basements where moisture resistance is critical. Architects specify anti-static finishes for electronics assembly floors, widening functional appeal beyond decor.

High installation and maintenance costs

Skilled tile setters remain scarce in many developed markets, lifting labour rates and extending project timelines. Large-format porcelain slabs need specialised lifting rigs and epoxy grouts, adding 15-25% to installation budgets versus standard 60 cm products. Where homeowners can install floating vinyl planks themselves over a weekend, ceramic renovations require professional waterproofing and sub-floor preparation. Industry associations have stepped up certification schemes, yet supply of certified crews lags demand, tempering short-run volume growth, especially in refurbishments.

Other drivers and restraints analyzed in the detailed report include:

- Preference for eco-friendly products

- Manufacturing technology advances

- Raw material price volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Porcelain tiles secured 51.23% of the ceramic tiles market share in 2024 owing to water-absorption rates below 0.5% and frost resistance that suits outdoor plazas and transit hubs. Glazed porcelain, aided by inkjet decoration, is projected to register an 8.52% CAGR through 2030, outpacing glazed ceramic and mosaic formats. Consumers perceive its colour-through body and abrasion class >= PEI IV as proof of longevity, encouraging substitution for marble in hotel lobbies and airports.

The segment's momentum lifts the overall ceramic tiles market as manufacturers leverage continuous kilns to mass-produce large thin slabs for facades, reducing structural load yet retaining impact strength. Mosaic tiles, though niche, capture share in luxury spas were artisanal aesthetics command price premiums. Copper-glaze innovations offering antimicrobial action broaden use in food-handling zones and hospitals, illustrating how product diversification underpins sustained revenue growth.

Floor installations represented 48.56% of the ceramic tiles market size in 2024 driven by mandatory specification in wet areas and heavy-traffic corridors. Slip-resistant porcelain and industrial-grade quarry tiles dominate commercial kitchens, warehouses, and transit stations, ensuring baseline volume stability.

Wall applications, posting an 8.32% CAGR to 2030, flourish as architects deploy textured and 3D surfaces for feature walls, hotel receptions, and retail backdrops. Expanded design palettes increase average selling prices, and easy-clean glazes meet hospitality hygiene codes. Roof and facade uses remain concentrated in Mediterranean and Andean regions where ceramic's thermal mass and hail resistance are valued, while countertop, pool, and niche applications collectively extend total addressable demand.

The Ceramic Tiles Market Segments Into by Product Type (Porcelain Tiles, Glazed Ceramic Tiles, and More), by Application (Floor, Wall, and More), by End-User (Residential, Commercial, Industrial), by Construction (New Construction, Replacement and Renovation), by Distribution Channel (Independent Retailers, Large Home Centers and More), by Geography. The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

Asia-Pacific accounted for 47.78% of global revenue in 2024 and is forecast to compound to 8.46% annually through 2030, anchored by mass urban housing, metro extensions, and export-oriented production clusters. China's inland provinces add capacity close to clay deposits, while India scales smart-city and affordable-housing schemes that stipulate vitrified flooring. Vietnam's 100-plus manufacturers, concentrated in the north, rely on imported chemicals for glazes but still achieved a combined output mix of 80% glazed and 20% porcelain tiles in 2024. ASEAN trade agreements allow duty-free flows, favouring regionally integrated supply chains.

North America presents a mature but strategically important arena where domestic producers hedge against future antidumping duties. US tile consumption eased to 264.5 million m2 in 2024 amid high mortgage rates, yet federal outlays on semiconductor and battery plants underpin long-term volume. Mohawk Industries leverages vertically integrated Tennessee and Texas kilns to shorten lead times and secure public-project specifications. Canada funds hospital and transit refurbishments that increasingly stipulate low-carbon materials, while Mexico's Grupo Lamosa operates plants across Latin America to diversify currency exposure.

Europe, while posting an 18% output drop in 2023 due to energy spikes, still accounts for 50% of global tile-machinery exports assopiastrelle.it. Italy's closed-loop plants recycle 100% of unfired scrap, showcasing environmental leadership. Spain advances hydrogen-kiln pilots to meet EU Net-Zero targets, while Poland's clay shortages force higher imports and spot-price volatility. In the Middle East and Africa, Egypt produces 200 million m2 annually using low-cost shale resources, and the UAE's Ras Al Khaimah cluster hosts 40,000 industrial registrants, fuelling related surface-finishing demand.

- Mohawk Industries

- Grupo Lamosa

- SCG Ceramics Public Co. Ltd.

- Kajaria Ceramics Ltd.

- RAK Ceramics

- Pamesa Grupo Empresarial

- Guangdong Newpearl Ceramics

- Johnson Tiles

- Ceramic Industries Ltd.

- Porcelanosa Grupo

- Centura Tile

- Interceramic

- Florida Tile

- Villeroy & Boch

- Crossville Inc.

- Marazzi Group

- Iris Ceramica Group

- Noritake Co., Inc.

- Somany Ceramics

- Emser Tile*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Construction and Infrastructure Development

- 4.2.2 Increasing Demand for Aesthetic and Durable Flooring Solutions

- 4.2.3 Growing Preference for Eco-Friendly and Sustainable Products

- 4.2.4 Advancements in Manufacturing Technology

- 4.2.5 Rising Disposable Income and Changing Lifestyle

- 4.2.6 Increasing Ageing Building Infrastructure and Demand for Renovation Activities

- 4.3 Market Restraints

- 4.3.1 High Installation and Maintenance Costs

- 4.3.2 Fragility and Risk of Cracking

- 4.3.3 Raw Material Price Volatility

- 4.3.4 Environmental Concerns in Manufacturing

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Porcelain Tiles

- 5.1.2 Glazed Ceramic Tiles

- 5.1.3 Unglazed Ceramic Tiles

- 5.1.4 Mosaic Tiles

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Floor

- 5.2.2 Wall

- 5.2.3 Roofing

- 5.2.4 Others

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Renovation and Replacement

- 5.5 By Distribution Channel

- 5.5.1 Independent Retailers

- 5.5.2 Large Home Centers

- 5.5.3 Online Retail

- 5.5.4 Direct Sales to Contractors

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 Canada

- 5.6.1.2 United States

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Peru

- 5.6.2.3 Chile

- 5.6.2.4 Argentina

- 5.6.2.5 Rest of South America

- 5.6.3 Asia-Pacific

- 5.6.3.1 India

- 5.6.3.2 China

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.6.3.7 Rest of Asia Pacific

- 5.6.4 Europe

- 5.6.4.1 United Kingdom

- 5.6.4.2 Germany

- 5.6.4.3 France

- 5.6.4.4 Spain

- 5.6.4.5 Italy

- 5.6.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.6.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.6.4.8 Rest of Europe

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Nigeria

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Mohawk Industries

- 6.4.2 Grupo Lamosa

- 6.4.3 SCG Ceramics Public Co. Ltd.

- 6.4.4 Kajaria Ceramics Ltd.

- 6.4.5 RAK Ceramics

- 6.4.6 Pamesa Grupo Empresarial

- 6.4.7 Guangdong Newpearl Ceramics

- 6.4.8 Johnson Tiles

- 6.4.9 Ceramic Industries Ltd.

- 6.4.10 Porcelanosa Grupo

- 6.4.11 Centura Tile

- 6.4.12 Interceramic

- 6.4.13 Florida Tile

- 6.4.14 Villeroy & Boch

- 6.4.15 Crossville Inc.

- 6.4.16 Marazzi Group

- 6.4.17 Iris Ceramica Group

- 6.4.18 Noritake Co., Inc.

- 6.4.19 Somany Ceramics

- 6.4.20 Emser Tile*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment