|

市场调查报告书

商品编码

1846238

智慧空间:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Smart Spaces - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

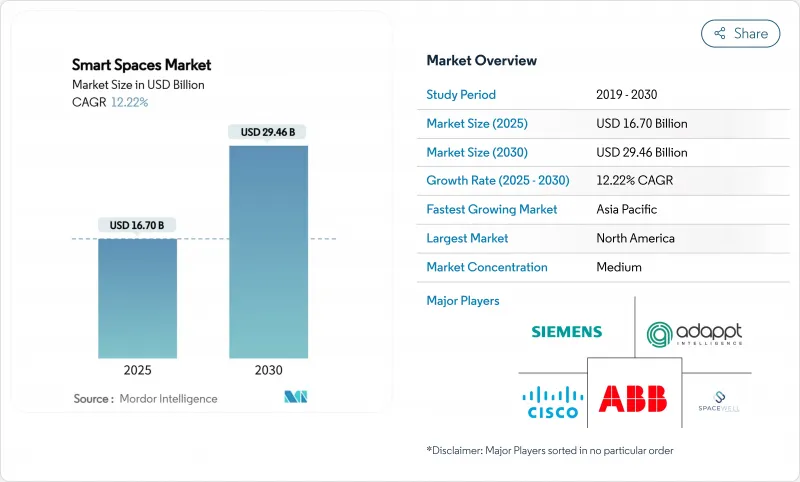

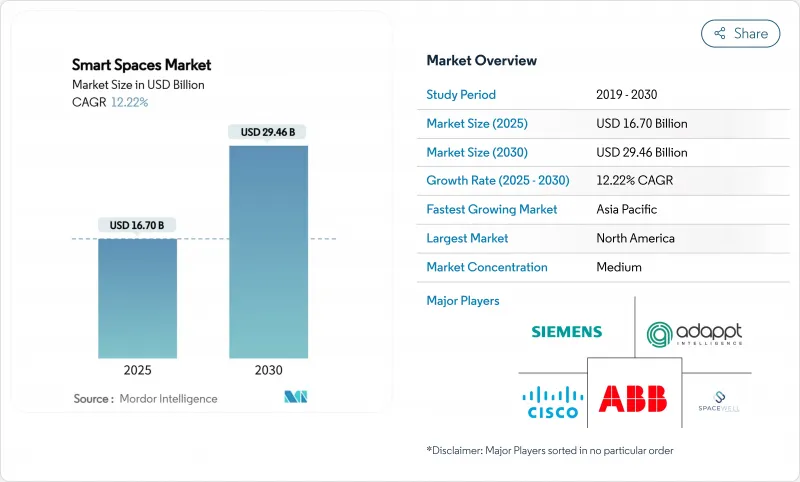

预计到 2025 年,智慧空间市场规模将达到 167 亿美元,并以 12.22% 的复合年增长率成长,到 2030 年将达到 294.6 亿美元。

这一上升趋势的驱动因素包括:物联网感测器价格的下降简化了大规模部署;净零排放建筑规范的强制要求加速了数位化维修;以及鼓励即时空间优化的混合办公模式。诸如Thread 1.4之类的互通标准(预计到2025年第一季将有超过670种产品获得认证)消除了整合风险,并缩短了投资回报週期。商业园区的私人5G部署正在支援预测性工作场所服务,同时支援进阶分析,从而降低公用事业和维护成本。供应商也在扩展SaaS模式,将持续优化与基于结果的定价相结合,这种转变将一次性资本支出转化为经常性收益。因此,智慧空间市场既受益于合规性带来的收入需求,也受益于效率带来的利润成长。

全球智慧空间市场趋势与洞察

物联网设备的普及和感测器价格的下降

自 2023 年以来,半导体供应过剩导致感测器平均售价出现两位数下降,使得楼宇业主能够在其物业上部署大量感测器,用于监测运转率、空气品质和电錶等,并将精细数据传输到云端进行分析。到 2025 年初,已有超过 670 款通过 Thread 认证的设备出货,凸显了该供应商对多厂商互通性的重视。 Milesight 在其总部部署的 352 个感测器每年可节省 4.5 万美元的公用事业成本。边缘 AI 晶片扩展的记忆体频宽消除了延迟,并支援即时控制迴路,但棕地的整合仍然依赖传统的布线和控制系统。随着资本成本的下降,决策的关键在于节能效果的验证,而非硬体的价格。

加速重新设计办公室混合办公模式

混合式排班模式会使工作日员工人数有所波动,从而导致传统的按时调整暖通空调(HVAC)系统过时。江森自控在2025年第一季收到的自适应控制设备订单增加了16%,这类设备能够根据实际入住率而非历史平均值来调节气流和照明。华盛顿特区的一栋办公大楼透过多感测器运转率资料取代静态设定值,实现了33%的节能效果。人工智慧通风模型在将二氧化碳浓度维持在1000ppm以下的同时,降低了12.5%的通风能耗,从而兼顾了健康目标和收益目标。商业地产业主正尝试根据检验入住率动态调整租金,将数据排放转化为收益来源。然而,即时分析需要网路安全加固的网路和安全的资料湖,以根据GDPR和CCPA保护租户隐私。

破旧建筑物的初期维修成本很高。

老旧建筑通常配备专有的暖通空调和照明系统,这些系统难以相容于开放通讯协定。 QuadReal公司在3000万平方英尺的面积上建构了无源光纤骨干网,需要整合不同的子系统。 Limbach公司对20个不同年代暖通空调系统的站点进行数位化,结果发现资料粒度不一致,导致分析复杂。像PHOENIX这样的试点计画实现了39%至61%的效率提升,但需要客製化中间件来规范遥测资料。能源服务公司提供的资金筹措和基于绩效的租赁模式有助于将现金支出转化为服务费,但当相关人员需要在同一计划章程下协调机械、电气和IT升级时,决策週期仍然很长。

细分市场分析

解决方案将占2024年营收的68%,智慧空间市场总规模将达到113.6亿美元。硬体设备和监控软体构成了数位基础设施,但终端用户越来越多地将优化工作外包给第三方。预计服务将以13.87%的复合年增长率成长,这反映出市场对持续试运行、远距离诊断和人工智慧驱动的决策支援的需求。 BrainBox AI于2024年3月推出了一款生成式建筑助手,支援对能源异常情况进行对话式查询并提供相应的调整建议。 Trane Technologies迅速将此功能整合到其售后市场产品组合中,将自主式暖通空调控制系统捆绑到基于结果的合约中,从而保证两位数的能源成本节省。託管服务供应商透过将每小时的遥测资料输入演算法收益,这些演算法可以将冷水机组的温度维持在狭窄的范围内,从而减少磨损和碳排放。由于劳动力短缺限制了内部设施团队的能力,高阶主管将外部专业知识视为避免绩效处罚的风险保障。

从长远来看,随着设备韧体、分析模型和安全性修补程式的持续更新,混合云架构将模糊产品和服务之间的界限。同时拥有边缘设备和云端平台的供应商将能够透过无线方式推送增强功能,无需现场访问,从而加深市场锁定,并挤压纯硬体竞争对手的生存空间。因此,智慧空间市场将奖励那些将重心从一次性安装转向全生命週期管理的公司,从而提升服务成长溢价。

到2024年,商业房地产、医疗保健、旅馆和零售业将占据智慧空间市场59%的份额,即98.5亿美元的收入。办公室正在寻求灵活的座位安排,这需要可分析的运转率数据;而医院则在追踪空气交换和设备运作,以控制感染。同时,住宅空间的需求,尤其是多用户住宅的需求,预计将以13.75%的复合年增长率成长。 Logical Buildings计划投资1.1亿美元,在多用户住宅中建造一个虚拟电厂,以实现需量反应的收益,并展示大规模住宅经济效益。 SmartRent已累计1000万美元,用于在2024年12月推广房东采用自助式居住者入口网站、门禁系统和分錶计量。在电力市场自由化的地区,公共产业正在为智慧恆温器提供现金奖励,并配合抑低尖峰负载计划,使房主的利益与电网的稳定性保持一致。儘管消费者对价格的敏感度仍然是一个限制因素,但捆绑式宽频和能源套餐将降低购买摩擦,到 2030 年将使智慧空间市场向各行业的平衡需求倾斜。

欧盟部分地区和美国一些州的监管机构也鼓励家庭能源管理,强制要求新建公寓大楼安装分錶。这些政策推动了住宅单元的销售,但每个单元的收入仍低于商业平均水平。供应商正透过平台多产品交叉销售来应对利润率下降的问题,这些交叉销售涵盖安防、健康和老年护理监控等领域。随着服务组合的不断完善,住宅市场与现有商业市场的差距正在缩小,这印证了智慧空间产业正向无所不在的基础设施层演进。

智慧空间市场报告按类型(解决方案和服务)、最终用户行业(商业和住宅)、应用(能源管理、居住和空间分析、照明和暖通空调控制、其他)、连接技术(Wi-Fi、Zigbee、Z-Wave、其他)和地区进行细分。

区域分析

北美地区贡献了2024年37%的收入,这主要得益于各州严格的能源法规以及混合工作分析技术的早期应用。加州严格的标准和联邦扣除额支持了大规模的维修,而物流园区的私人5G初步试验检验延迟敏感的应用场景。Honeywell2025年第一季楼宇自动化产品实现了8%的内部成长,这主要得益于美国对云端原生仪錶板的需求。网路安全法规的推出加速了託管服务的普及,企业纷纷将合规任务外包给值得信赖的供应商。儘管老旧设备的维修成本限制了推广速度,但将费用与实际节省挂钩的绩效合约正在释放保守的预算,智慧空间市场依然保持着稳健的成长动能。

亚太地区预计将以13.53%的复合年增长率成长,进一步推动全球市场发展。中国在2024年预算中拨款45亿美元用于智慧城市试点项目,并规定所有新建市政厅都必须整合数位孪生技术。日本的「社会5.0」蓝图将智慧建筑与更广泛的机器人和行动网路结合,而印度的「智慧城市计画」涵盖了8000个正在进行的计划,总价值达196.7亿美元。企业投资也与公共支持同步成长:丰田在富士山附近打造的「编织之城」项目,就是一个用于测试感测器密集型社区的私人试验场。儘管不同的监管环境为跨国公司的规模化发展带来了挑战,但城市密度、能源安全和人口老化等通用驱动因素支撑全部区域的需求。

在应对气候变迁政策的背景下,欧洲保持着稳健的成长。欧盟的零排放指令确保了低效率控制设备的替代市场,而GDPR则确保了隐私设计功能能够获得溢价。西门子投资7.5亿欧元,利用数位双胞胎技术改造柏林西门子城,体现了其对智慧园区模式的信心。中东和非洲的普及速度较为缓慢,但计划展现了其潜力:沙乌地阿拉伯的Neom和阿联酋的马斯达尔城都采用了完全数位化的建筑结构,并成为区域性的试验场。儘管预算波动和政治风险使得政府支持的项目占据主导地位,但长期来看,已证实的收益正在吸引私人联合投资者,从而扩大了智慧空间市场的潜在规模。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 物联网设备的普及和感测器价格的下降

- 加速新冠疫情后混合办公模式的办公室改造

- 绿建筑/净零排放标准

- 在商业场所快速部署5G专用网络

- 透过基于人工智慧的工作场所分析降低房地产营运成本

- 基于入住率的保险和租赁模式的兴起

- 市场限制

- 棕地建筑的初期维修成本高昂

- 网路安全与资料隐私责任

- 供应商互通性差距与标准分散化

- 商业地产估值波动

- 价值链分析

- 监管状况

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场规模与成长预测

- 按类型

- 解决方案

- 软体平台

- 硬体和边缘设备

- 服务

- 专业服务

- 託管服务

- 解决方案

- 按最终用户产业

- 商业设施

- 办公室、共享办公空间

- 零售和购物中心

- 医疗机构

- 饭店及休閒

- 住房

- 独立式住宅

- 多用户住宅

- 商业设施

- 透过使用

- 能源管理

- 运转率和空间分析

- 照明和空调控制

- 安全和存取控制

- 设备自动化整合平台

- 透过连接技术

- Wi-Fi

- Bluetooth Low Energy(BLE)

- Zigbee

- 线/物质

- Z-Wave

- NB-IoT 和 LoRaWAN

- 有线(乙太网路/PoE)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 阿根廷

- 巴西

- 其他南美

- 欧洲

- 英国

- 法国

- 德国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 奈及利亚

- 南非

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- ABB Ltd

- Siemens AG

- Cisco Systems Inc.

- Schneider Electric SE

- IBM Corporation

- Microsoft Corporation

- Honeywell International Inc.

- Johnson Controls International

- Huawei Technologies Co. Ltd.

- Hitachi Vantara LLC

- ICONICS Inc.

- Spacewell(Nemetschek Group)

- SmartSpace Software PLC

- Ubisense Ltd.

- Adappt Intelligence Inc.

- Enlighted Inc.(Siemens)

- Bosch Building Technologies

- Legrand SA

- Crestron Electronics Inc.

- Verkada Inc.

第七章 市场机会与未来展望

The Smart spaces market size stood at USD 16.70 billion in 2025 and is forecast to expand at a 12.22% CAGR, reaching USD 29.46 billion by 2030.

The upward trajectory is shaped by falling IoT sensor prices that simplify large-scale deployment, mandatory net-zero building codes that accelerate digital retrofits, and hybrid-work policies that reward real-time space optimisation. Interoperable standards such as Thread 1.4, certified on more than 670 products by Q1 2025, remove integration risks and shorten payback windows. Private 5G rollouts across commercial campuses underpin advanced analytics that lower utilities and maintenance costs while enabling predictive workplace services. Vendors are also scaling software-as-a-service models that bundle continuous optimisation with outcome-based pricing, a shift that converts one-time capital expenditure into recurring revenue. The Smart space market, therefore, benefits from both top-line demand for compliance and bottom-line demand for efficiency.

Global Smart Spaces Market Trends and Insights

IoT-enabled device proliferation and falling sensor prices

Semiconductor oversupply has pushed sensor average selling prices down by double-digits since 2023, allowing building owners to blanket properties with occupancy, air-quality and power-meter nodes that feed granular data to cloud analytics. More than 670 Thread-certified devices shipped by early 2025, a clear signal that vendors now view multi-vendor interoperability as table stakes. A 352-sensor deployment at Milesight's headquarters cut annual utilities by USD 45,000, a case that has circulated widely among facilities managers. Expanded memory bandwidth in edge AI chips eliminates latency penalties and supports real-time control loops, yet brownfield integration still varies by legacy wiring and controls. As capital costs decline, decisions hinge on energy-saving proof points rather than hardware affordability, a pivot that keeps the Smart space market in a demand-led cycle.

Accelerated hybrid-work redesign of offices

Hybrid scheduling fluctuates weekday headcounts, making legacy time-of-day HVAC programming obsolete. Johnson Controls logged 16% order growth in Q1 2025 for adaptive controls that modulate airflow and lighting to actual presence rather than historical averages. A Washington D.C. office building realised 33% energy savings after replacing static set-points with multi-sensor occupancy data that instructs chillers to follow demand curves. AI ventilation models have kept CO2 concentrations below 1,000 ppm while trimming ventilation energy by 12.5%, aligning wellness goals with bottom-line targets. The commercial landlord community is experimenting with dynamic rent that flexes by verified utilisation, turning data exhaust into revenue streams. Real-time analytics, however, require cyber-hardened networks and secure data lakes to protect tenant privacy under GDPR and CCPA.

High upfront retrofit costs for brown-field buildings

Older properties often contain proprietary HVAC or lighting systems that resist open-protocol overlays. QuadReal required a passive optical backbone across 30 million sq ft to unify disparate subsystems, a capital project justifiable only by projected 50-70% operational savings. Limbach's digitisation of 20 sites spanning multiple HVAC vintages exposed inconsistent data granularity that complicated analytics. Pilot programmes such as PHOENIX delivered headline efficiency gains of 39-61% but demanded customised middleware to normalise telemetry. Energy-service-company financing and outcome-based leases help convert cash outlays into service fees, yet decision cycles still elongate when stakeholders must coordinate mechanical, electrical, and IT upgrades under one project charter.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory green-building / net-zero regulations

- Rapid 5G private-network rollouts in commercial estates

- Cyber-security and data-privacy liabilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions retained the lion's share at 68% of 2024 revenue, equal to USD 11.36 billion of the Smart space market size. Hardware devices and supervisory software form the digital backbone, yet end-users increasingly outsource optimisation to third parties. Services are set to post a 13.87% CAGR, reflecting appetite for continuous commissioning, remote diagnostics, and AI-driven decision support. BrainBox AI launched its generative building assistant in March 2024, enabling conversational queries about energy anomalies and prescriptive adjustments. Trane Technologies quickly folded the capability into its aftermarket portfolio, bundling autonomous HVAC controls inside outcome-based contracts that guarantee double-digit utility cuts. Managed-service vendors monetise hourly telemetry by feeding algorithms that keep chillers within narrow set-point bands, reducing wear and curbing carbon fees. As labour shortages constrain in-house facility teams, executives view external expertise as risk insurance against performance penalties.

In the long run, hybrid cloud architectures will blur product and service boundaries because device firmware, analytics models, and security patches update continuously. Vendors that own both edge devices and cloud platforms can push over-the-air enhancements without onsite visits, deepening lock-in while squeezing pure-play hardware rivals. The Smart space market therefore rewards firms that pivot from one-and-done installations toward lifecycle stewardship, reinforcing the Services growth premium.

Commercial real estate, healthcare, hospitality and retail collectively generated 59% of 2024 revenue, or USD 9.85 billion of the Smart space market size. Offices pursue flexible seating that demands analytics-ready occupancy data, whereas hospitals track air exchange and device uptime for infection control. Yet residential demand, especially in multi-dwelling units, is forecast to rise at a 13.75% CAGR. Logical Buildings is orchestrating a USD 110 million virtual power plant across multifamily stock to monetise demand response, demonstrating fleet-scale residential economics. SmartRent earmarked USD 10 million in December 2024 to widen landlord adoption of self-service resident portals, access control, and sub-metering. Utilities in deregulated markets offer cash incentives for smart thermostats linked to peak-shave programmes, aligning homeowner interests with grid stability. While consumer price sensitivity remains a restraint, bundled broadband plus energy packages lower acquisition friction, tilting the Smart space market toward balanced demand across sectors by 2030.

Regulators also push home energy management via mandatory sub-meters in new apartments across parts of the EU and select US states. This policy tailwind elevates residential volumes, though per-unit revenue lags commercial averages. Vendors combat margin dilution through platform multiproduct cross-sales spanning security, wellness and eldercare monitoring. As service portfolios deepen, the residential curve narrows its gap with commercial incumbents, confirming the Smart space industry's evolution into a ubiquitous infrastructure layer.

Smart Spaces Market Report is Segmented by Type (Solutions and Services), End-User Industry (Commercial and Residential), Application (Energy Management, Occupancy and Space Analytics, Lighting and HVAC Control, and More), Connectivity Technology (Wi-Fi, Zigbee, Z-Wave, and More), and Geography.

Geography Analysis

North America contributed 37% of 2024 revenue, driven by stringent state-level energy codes and early adoption of hybrid-work analytics. California's aggressive standards and federal tax credits support deep retrofits, while private 5G pilots in logistics parks validate latency-sensitive use cases. Honeywell recorded 8% organic growth across its building automation lines in Q1 2025, underpinned by US demand for cloud-native dashboards. Cyber-security regulation accelerates managed-service uptake as firms outsource compliance tasks to trusted vendors. Retrofit costs for ageing stock temper rollout pace, but outcome-based contracts that tie fees to measured savings unlock conservative budgets, keeping the Smart space market on a solid expansion path.

Asia Pacific is on track for a 13.53% CAGR and will increasingly tilt global volume. China allocated USD 4.5 billion to smart city pilots in its 2024 budget, stipulating that all new municipal buildings integrate digital twins. Japan's Society 5.0 roadmap bundles smart buildings with wider robotics and mobility networks, while India's Smart Cities Mission spans 8,000 live projects worth USD 19.67 billion. Corporate investments match the public push: Toyota's Woven City near Mount Fuji serves as a private testbed for sensor-dense neighbourhoods. Heterogeneous regulatory landscapes complicate multinational scaling, but common motivations-urban density, energy security and ageing populations-sustain demand across the region.

Europe maintains disciplined growth on the back of climate policy. The EU's zero-emission mandate guarantees a replacement market for inefficient controls, and GDPR ensures that privacy-by-design features carry premium pricing. Siemens committed EUR 750 million to regenerate Berlin's Siemensstadt with digital twins, reflecting confidence in smart campus models. Middle East and Africa trail in adoption but showcase showcase megaprojects: Saudi Arabia's Neom and the UAE's Masdar City rely on fully digital building fabrics, serving as regional proof points. Budget volatility and political risk keep deployment skewed to government-backed ventures, yet demonstrable returns draw private co-investors over time, widening the addressable Smart spaces market.

- ABB Ltd

- Siemens AG

- Cisco Systems Inc.

- Schneider Electric SE

- IBM Corporation

- Microsoft Corporation

- Honeywell International Inc.

- Johnson Controls International

- Huawei Technologies Co. Ltd.

- Hitachi Vantara LLC

- ICONICS Inc.

- Spacewell (Nemetschek Group)

- SmartSpace Software PLC

- Ubisense Ltd.

- Adappt Intelligence Inc.

- Enlighted Inc. (Siemens)

- Bosch Building Technologies

- Legrand SA

- Crestron Electronics Inc.

- Verkada Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 IoT-enabled device proliferation and falling sensor prices

- 4.2.2 Accelerated post-COVID hybrid-work redesign of offices

- 4.2.3 Mandatory green-building / net-zero regulations

- 4.2.4 Rapid 5G private-network roll-outs in commercial estates

- 4.2.5 AI-driven workplace analytics reducing real-estate OPEX

- 4.2.6 Rise of occupancy-based insurance and leasing models

- 4.3 Market Restraints

- 4.3.1 High upfront retro-fit costs for brown-field buildings

- 4.3.2 Cyber-security and data-privacy liabilities

- 4.3.3 Inter-vendor interoperability gaps and standards fragmentation

- 4.3.4 Volatility in commercial real-estate valuations

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Solutions

- 5.1.1.1 Software Platforms

- 5.1.1.2 Hardware and Edge Devices

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By End-user Industry

- 5.2.1 Commercial

- 5.2.1.1 Offices and Co-working Spaces

- 5.2.1.2 Retail and Malls

- 5.2.1.3 Healthcare Facilities

- 5.2.1.4 Hospitality and Leisure

- 5.2.2 Residential

- 5.2.2.1 Single-family Homes

- 5.2.2.2 Multi-dwelling Units

- 5.2.1 Commercial

- 5.3 By Application

- 5.3.1 Energy Management

- 5.3.2 Occupancy and Space Analytics

- 5.3.3 Lighting and HVAC Control

- 5.3.4 Security and Access Management

- 5.3.5 Facility Automation Integration Platforms

- 5.4 By Connectivity Technology

- 5.4.1 Wi-Fi

- 5.4.2 Bluetooth Low Energy (BLE)

- 5.4.3 Zigbee

- 5.4.4 Thread / Matter

- 5.4.5 Z-Wave

- 5.4.6 NB-IoT and LoRaWAN

- 5.4.7 Wired (Ethernet / PoE)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Argentina

- 5.5.2.2 Brazil

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 France

- 5.5.3.3 Germany

- 5.5.3.4 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 Nigeria

- 5.5.5.2.2 South Africa

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Siemens AG

- 6.4.3 Cisco Systems Inc.

- 6.4.4 Schneider Electric SE

- 6.4.5 IBM Corporation

- 6.4.6 Microsoft Corporation

- 6.4.7 Honeywell International Inc.

- 6.4.8 Johnson Controls International

- 6.4.9 Huawei Technologies Co. Ltd.

- 6.4.10 Hitachi Vantara LLC

- 6.4.11 ICONICS Inc.

- 6.4.12 Spacewell (Nemetschek Group)

- 6.4.13 SmartSpace Software PLC

- 6.4.14 Ubisense Ltd.

- 6.4.15 Adappt Intelligence Inc.

- 6.4.16 Enlighted Inc. (Siemens)

- 6.4.17 Bosch Building Technologies

- 6.4.18 Legrand SA

- 6.4.19 Crestron Electronics Inc.

- 6.4.20 Verkada Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment