|

市场调查报告书

商品编码

1846239

认知安全:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Cognitive Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

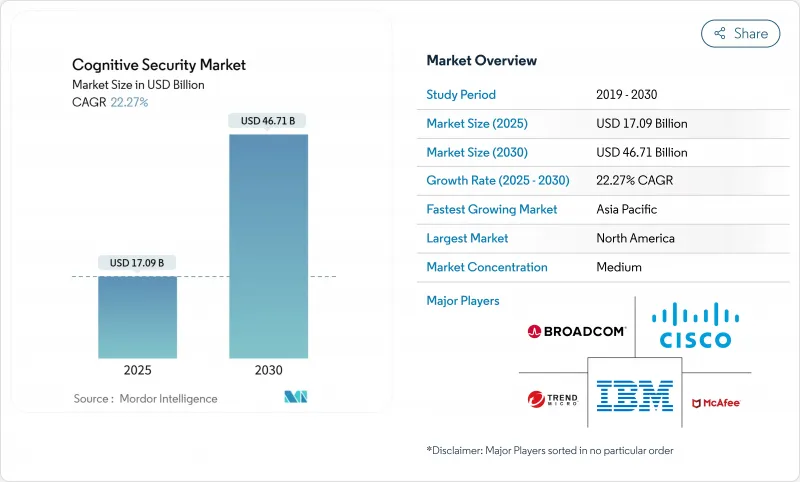

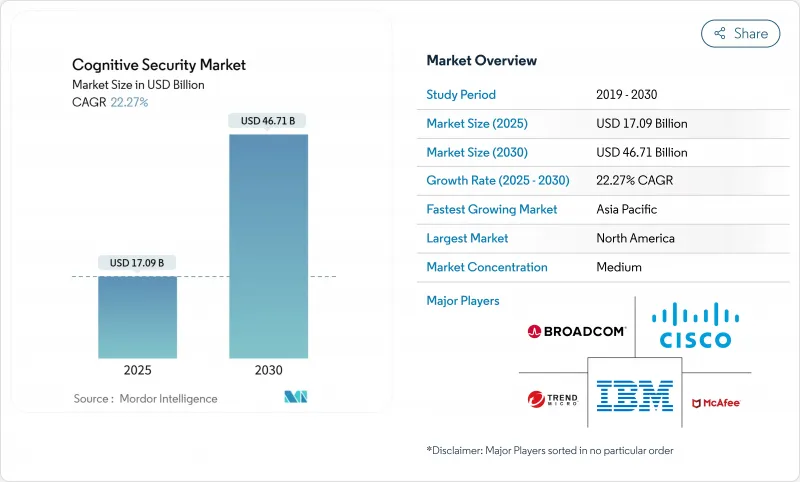

预计到 2025 年,认知安全市场规模将达到 170.9 亿美元,到 2030 年将达到 467.1 亿美元,复合年增长率高达 22.27%。

人工智慧驱动的持续性威胁、云端运算普及带来的攻击面扩大以及日益严格的监管审查,共同推动了认知安全市场的成长。企业发现传统工具无法识别人工智慧特有的漏洞,例如模型投毒、对抗性提示和合成资料洩露,因此投入巨资,加速转型为高阶分析和自主防御。同时,企业工作流程中大规模语言模式的采用也日益普及,这意味着每次部署生成式人工智慧都会产生一个新的入口点,必须持续监控并加强防护。供应商正透过将自学习演算法整合到事件回应手册中来应对这一挑战,从而将检测和遏制安全漏洞的平均时间从数小时缩短到数分钟,同时减少大量误报,避免人工分析师疲于应对。这些动态使得认知安全市场成为网路安全领域成长最快的细分市场之一。

全球认知安全市场趋势与洞察

非结构化企业资料的指数级成长

电子邮件、协作文件、感测器读数和多媒体的激增,加剧了安全可见性的挑战,并扩大了攻击面。认知引擎能够处理Terabyte的原始日誌,并精确定位使用者行为的异常,从而将误报率降低95%,并突出显示绕过规则系统的隐藏横向移动。但攻击者也从中获益匪浅,他们抓取内容以发动具有上下文感知能力的鱼叉式网路钓鱼宣传活动。安全团队正在将自学习分析直接整合到资料湖中,以近乎即时地关联身分、设备和网路遥测数据,将休眠的存檔转化为可操作的情报,并提高入侵侦测能力。认知安全市场具有在所有垂直领域持续扩张的潜力。

物联网暗数据的激增

工业和消费物联网的普及带来了数十亿个未受管理的终端,产生了大量的运行遥测数据,而标准的SIEM平台无法对其进行分析。认知引擎能够对每类设备的基准行为进行建模,并标记异常情况,例如异常的韧体变更或意外的东西向流量。在电网和智慧工厂车间,这项功能能够直接降低停机风险,同时保护生命安全系统。随着OT网路与IT骨干网路的整合,安全漏洞日益扩大,促使製造商和公共产业公司投资在严格延迟限制下运行的边缘AI分析技术。因此,到2030年,认知安全市场对可扩展、与设备无关的平台的需求将持续成长。

人工智慧/机器学习网路分析人才短缺

全球对能够编写强化学习防御程式码、调整即时防护模型并解读威胁遥测资料的专家的需求远远超过供应。为了因应这项挑战,各组织纷纷选择将相关工作外包给託管服务专家,或投资于低程式码编配层,以便用更少的工程师保护更大的资产基础。虽然一级安全分流已由自动化完成,但二级和三级安全升级仍需要包含数学、安全编码和法规解释在内的综合技能。因此,薪资上涨推高了计划总拥有成本 (TCO),导致一些中小企业转而采用基于消费的云端订阅模式,而非客製化开发。

细分市场分析

到2024年,随着国防机构、金融机构和关键基础设施营运商继续强制要求本地资料驻留和空气间隙环境,本地部署解决方案仍将占据认知安全市场60.40%的份额。然而,随着超大规模云端服务商将专用远端检测收集器和模型一致性检验整合到其平台中,降低了准入门槛,云端采用率正以27.10%的复合年增长率快速成长。预计随着订阅定价和持续的威胁情报更新缩短采购週期并将资本支出转移到营运预算,云端基础的认知安全市场规模将迅速扩大。

将边缘推理节点与中央云分析结合,建构全球威胁情报图谱的混合架构,如今已成为新兴部署方案的主流。供应商正在预先打包参考蓝图,以支援跨本地和公共云端区域的安全运算集群,从而实现联合训练,同时对静态训练资料进行加密。安全营运中心受益于统一的仪表板,这些仪表板能够规范跨环境的侦测结果,并弥补攻击者在工作流程跨越多种託管模型时可能利用的可见性漏洞。这些功能使云端版本成为认知安全市场到 2030 年的主要扩展引擎。

预计到2024年,咨询和整合活动将占据60.40%的收益份额,因为企业在认知控制发挥价值之前,需要客製化的资料管道、模型检验框架和监管映射。随着企业将全天候监控、模型重训练和对抗性模拟演练外包,託管服务预计将以28.40%的复合年增长率成长,从而带动认知安全市场规模的成长。

专业服务提供者现在将威胁狩猎团队与 MLOps 工程师结合,以维护与每位客户不断变化的风险状况相符的动态基准。政府合同,例如授予 GovCIO 的价值 20 亿美元的 NSIN 任务订单,表明公共机构如何利用外部专业知识来加快采购进度,同时满足机密认证要求。商业买家也在效仿这种模式,将预算从人员投入转向基于结果的订阅模式,以确保检测准确性的服务等级协定。因此,託管服务的蓬勃发展是一种结构性而非暂时性的现象,它支撑着认知安全市场的成长轨迹。

认知安全市场按配置、服务(专业服务、託管服务)、应用(认知威胁情报、预测性维护等)、终端用户行业(银行、金融服务和保险、医疗保健和生命科学等)、组件(解决方案和服务)以及地区进行细分。市场预测以美元计价。

区域分析

北美仍是最大的区域丛集,预计到2024年将占据认知安全市场35.70%的份额。各国和联邦机构正在投入数十亿美元用于保护关键基础设施,例如美国国防部的国家安全资讯网路(NSIN)任务订单(20亿美元)和F-35网路安全支援合约(1.85亿美元)。企业也面临类似的复杂环境。人工智慧风险管理法规正在与现有的资料隐法规并行发展,不仅增加了合规成本,也扩大了平台供应商可控的支出范围。资金筹措依然充裕,为众多致力于即时注入测试和自主红队演练等利基技术商业化的新兴企业提供了支持。儘管如此,与新兴地区相比,北美地区的成长速度较为温和,因为许多财富1000强企业已经实施了第一代人工智慧安全计划,目前更专注于渐进式优化,而非待开发区部署。

亚太地区以25.66%的复合年增长率领先。中国、新加坡和韩国的政府计画正在推动人工智慧的应用,同时投资建置国家网路安全中心,采购国内外先进技术。数位支付和智慧城市部署的快速发展产生了大量的遥测数据,为机器学习主导的防御提供了丰富的素材,但也吸引了拥有自动化侦察能力的网路犯罪组织。因此,企业从一开始就优先考虑人工智慧原生安全,而不是拖延,从而缩短了全端平台的销售週期。儘管语言多样性和监管差异带来了整合方面的挑战,但超大规模资料中心不断扩大的区域布局正在缓解基础设施的限制,并推动对可扩展认知控制的需求。

在欧洲,欧盟人工智慧法律正稳步推进,将模糊的规定转化为关于透明度、稳健性和资料管治的明确义务。虽然合规成本增加了计划的复杂性,但法律的清晰性促使董事会核准对可解释人工智慧安全进行长期投资。供应商正在对仪錶板和审核追踪进行本地化,以适应特定地区的报告模式,许多供应商还提供託管在认证资料中心的自主云端选项,以遵守跨境传输限制。在德国的製造业中心和法国的航太与国防领域,人工智慧的采用尤其强劲,因为这些领域同时面临网实整合风险和智慧财产权保护的双重挑战。这些因素共同确保了欧洲仍将是认知安全市场的重要战略收益驱动力,即使其成长速度落后于亚太地区的快速发展。

其他好处

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 非结构化企业资料的指数级成长

- 物联网/连网型设备中暗数据的激增

- 云端原生人工智慧工具链降低了进入门槛

- 开放原始码和云端平檯面临的网路威胁日益加剧

- 市场限制

- 人工智慧/机器学习和网路分析人才短缺

- 多司法管辖区资料管治的复杂性

- 价值/供应链分析

- 监管状况

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过部署

- 本地部署

- 云端基础

- 透过服务

- 专业服务

- 託管服务

- 透过使用

- 认知威胁情报

- 预测性维护

- 交叉调查分析

- 自动化合规管理

- 其他应用

- 按最终用户产业

- BFSI

- 医疗保健和生命科学

- 零售与电子商务

- 政府/国防

- 通讯/IT

- 製造业

- 按组件

- 解决方案

- 服务

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- IBM Corporation

- Microsoft Corp.(Azure)

- Amazon Web Services Inc.

- SAP SE

- Cisco Systems Inc.

- Trend Micro Inc.

- Broadcom Inc.(Symantec)

- Darktrace plc

- McAfee LLC

- LogRhythm Inc.

- Fortinet Inc.

- SAS Institute Inc.

- Splunk Inc.

- Google LLC

- Oracle Corp.

- Micro Focus Intl.

- Dell Technologies(EMC)

- Palantir Technologies

- CrowdStrike Holdings

- SAS Institute Inc.

第七章 市场机会与未来展望

The cognitive security market stands at USD 17.09 billion in 2025 and is forecast to reach USD 46.71 billion by 2030, translating into a robust 22.27% CAGR.

Persistent AI-enabled threats, expanding attack surfaces created by cloud adoption, and mounting regulatory scrutiny combine to fuel this growth. Enterprises invested heavily after discovering that conventional tools miss AI-specific vulnerabilities such as model poisoning, adversarial prompts, and synthetic data leakage, prompting an accelerated pivot toward advanced analytics and autonomous defense. Parallel advances in large-language-model deployments inside corporate workflows further sharpen demand, because every generative-AI rollout creates new entry points that must be continuously monitored and hardened. Vendors respond by embedding self-learning algorithms into incident-response playbooks, reducing mean time to detect and contain breaches from hours to minutes while simultaneously shrinking false-positive noise that overwhelms human analysts. These dynamics position the cognitive security market as one of the fastest-expanding segments within broader cybersecurity spending.

Global Cognitive Security Market Trends and Insights

Exponential Rise of Unstructured Enterprise Data

Massive growth in emails, collaboration files, sensor readings, and multimedia escalates both the visibility challenge and the attack surface. Cognitive engines ingest terabytes of raw logs to pinpoint deviations in user behavior, cutting false-positive alerts by 95% while surfacing stealthy lateral movements that bypass rule-based systems. However, attackers benefit from the same information richness, scraping content to craft context-aware spear-phishing campaigns. Security teams therefore integrate self-learning analytics directly into data-lakes to correlate identity, device, and network telemetry in near real time, turning previously dormant archives into actionable intelligence that enhances breach-detection accuracy. The net result is an elevated baseline for analytic depth that positions the cognitive security market for sustained expansion across all verticals.

Surge in IoT Dark Data

Industrial and consumer IoT deployments add billions of unmanaged endpoints, creating a torrent of operational telemetry that standard SIEM platforms cannot parse. Cognitive engines model baseline behavior for each device class and flag deviations such as anomalous firmware changes or unexpected east-west traffic. In energy grids and smart-factory floors, this functionality directly mitigates downtime risks while protecting life-safety systems. The security gap widens as OT networks converge with IT backbones, prompting manufacturing and utilities firms to invest in edge-resident AI analytics that operate under stringent latency constraints. Consequently, demand for scalable, device-agnostic platforms inside the cognitive security market continues to accelerate through 2030.

Scarcity of AI/ML Cyber-Analytics Talent

Demand for practitioners able to code reinforcement-learning defenses, tune prompt-shield models, and interpret threat telemetry vastly exceeds global supply. Organizations counter by outsourcing to managed-service specialists and by investing in low-code orchestration layers that let fewer engineers protect larger asset bases. Although automation handles level one triage, level two and level three escalations still require hybrid skill sets spanning mathematics, secure coding, and regulatory interpretation. The resulting wage inflation inflates project TCO, nudging some smaller firms toward consumption-based cloud subscription models instead of bespoke builds.

Other drivers and restraints analyzed in the detailed report include:

- Cloud-Native AI Toolchains Democratizing Cognitive Security

- Escalating Threats on Open-Source and Cloud Stacks

- Multi-Jurisdictional Data Governance Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premises solutions retained 60.40% cognitive security market share in 2024 because defense agencies, financial institutions, and critical-infrastructure operators continue to mandate local data residency and air-gapped environments. However, cloud deployments are expanding at a 27.10% CAGR as hyperscalers integrate purpose-built telemetry collectors and model-integrity validation into their platforms, lowering entry cost. The cognitive security market size for cloud-based offerings is projected to rise steeply as subscription pricing and continuous threat-feed updates shorten procurement cycles and transfer capital expenditure into operating budgets.

Hybrid architectures now dominate new implementations, pairing edge inference nodes with central cloud analytics that feed global threat-intel graphs. Vendors pre-package reference blueprints that encrypt training data at rest while enabling secure compute enclaves for federated learning between on-prem and public-cloud zones. Security-operations centers benefit from unified dashboards that normalize detections across environments, closing visibility gaps that attackers exploit when workflows straddle multiple hosting models. These capabilities collectively position cloud variants as the principal expansion engine within the cognitive security market through 2030.

Consulting and integration engagements captured 60.40% revenue share in 2024 because enterprises require customized data pipelines, model-validation frameworks, and regulatory mappings before cognitive controls deliver value. The cognitive security market size attributed to managed services is forecast to grow at a 28.40% CAGR as organizations outsource round-the-clock monitoring, model retraining, and adversarial-simulation exercises.

Specialist providers now bundle threat-hunting squads with MLOps engineers to maintain dynamic baselines tuned to each client's evolving risk profile. Government contracts such as the USD 2 billion NSIN task order awarded to GovCIO illustrate how public agencies leverage external expertise to accelerate acquisition timelines while meeting classified accreditation requirements. Commercial buyers mirror this pattern, shifting budget from headcount to outcome-based subscriptions that guarantee detection-accuracy service-level agreements. The managed-services boom is therefore a structural, not temporary, phenomenon underpinning the growth trajectory of the cognitive security market.

Cognitive Security Market Segmented by Deployment, Service (Professional Services, Managed Services), Application (Cognitive Threat Intelligence, Predictive Maintenance, and More), End-User Industry (BFSI, Healthcare and Life Sciences and More), Component (Solutions and Services) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remains the largest regional cluster, holding 35.70% cognitive security market share in 2024. State and federal agencies allocate multibillion-dollar budgets to safeguard critical infrastructure, exemplified by the USD 2 billion Department of Defense NSIN task order and the USD 185 million F-35 cybersecurity support contract. Enterprises face an equally complex environment as AI-specific risk-management rules emerge alongside existing data-privacy statutes, raising compliance overhead yet simultaneously expanding addressable spend for platform vendors. Venture funding remains abundant, sustaining a pipeline of startups that commercialize niche capabilities such as prompt-injection testing and autonomous red-teaming. Nevertheless, growth rates moderate relative to emerging regions because many Fortune 1000 firms have already executed first-generation AI-security programs and now focus on incremental optimization rather than green-field rollouts.

Asia-Pacific records the fastest trajectory at a 25.66% CAGR. Government programs in China, Singapore, and South Korea promote AI adoption while investing in national cybersecurity centers that procure local and international technology. Rapid digital-payment expansion and smart-city rollouts generate enormous telemetry volumes, providing fertile data for machine-learning-driven defenses but also luring cybercriminal syndicates that weaponize automated reconnaissance. Enterprises therefore prioritize AI-native security from the outset rather than layering it later, shortening sales cycles for full-stack platforms. Linguistic diversity and regulatory heterogeneity pose integration hurdles, yet hyperscalers' growing regional footprints alleviate infrastructure constraints, reinforcing demand for scalable cognitive controls.

Europe advances steadily as the EU AI Act transforms ambiguity into prescriptive obligations around transparency, robustness, and data governance. While compliance costs elevate project complexity, the legislative clarity encourages board-level approval for long-term investments in explainable-AI security. Vendors localize dashboards and audit trails to meet region-specific reporting schemas, and many offer sovereign-cloud options hosted in accredited data centers to respect cross-border transfer restrictions. Uptake is especially strong in Germany's manufacturing heartland and France's aerospace and defense sector, where cyber-physical risks intersect with intellectual-property protection imperatives. Together these factors ensure Europe remains a strategic revenue pillar for the cognitive security market, even if growth percentages trail Asia-Pacific's breakneck pace.

- IBM Corporation

- Microsoft Corp. (Azure)

- Amazon Web Services Inc.

- SAP SE

- Cisco Systems Inc.

- Trend Micro Inc.

- Broadcom Inc. (Symantec)

- Darktrace plc

- McAfee LLC

- LogRhythm Inc.

- Fortinet Inc.

- SAS Institute Inc.

- Splunk Inc.

- Google LLC

- Oracle Corp.

- Micro Focus Intl.

- Dell Technologies (EMC)

- Palantir Technologies

- CrowdStrike Holdings

- SAS Institute Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exponential rise of unstructured enterprise data

- 4.2.2 Surge in IoT / connected-device dark data

- 4.2.3 Cloud-native AI toolchains lowering entry barrier

- 4.2.4 Escalating cyber-threats on open-source and cloud stacks

- 4.3 Market Restraints

- 4.3.1 Scarcity of AI/ML and cyber-analytics talent

- 4.3.2 Multi-jurisdictional data-governance complexity

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-Premise

- 5.1.2 Cloud-Based

- 5.2 By Service

- 5.2.1 Professional Services

- 5.2.2 Managed Services

- 5.3 By Application

- 5.3.1 Cognitive Threat Intelligence

- 5.3.2 Predictive Maintenance

- 5.3.3 Cross-Investigation Analytics

- 5.3.4 Automated Compliance Management

- 5.3.5 Other Applications

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Retail and eCommerce

- 5.4.4 Government and Defense

- 5.4.5 Telecom and IT

- 5.4.6 Manufacturing

- 5.5 By Component

- 5.5.1 Solutions

- 5.5.2 Services

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Israel

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 United Arab Emirates

- 5.6.5.1.4 Turkey

- 5.6.5.1.5 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corp. (Azure)

- 6.4.3 Amazon Web Services Inc.

- 6.4.4 SAP SE

- 6.4.5 Cisco Systems Inc.

- 6.4.6 Trend Micro Inc.

- 6.4.7 Broadcom Inc. (Symantec)

- 6.4.8 Darktrace plc

- 6.4.9 McAfee LLC

- 6.4.10 LogRhythm Inc.

- 6.4.11 Fortinet Inc.

- 6.4.12 SAS Institute Inc.

- 6.4.13 Splunk Inc.

- 6.4.14 Google LLC

- 6.4.15 Oracle Corp.

- 6.4.16 Micro Focus Intl.

- 6.4.17 Dell Technologies (EMC)

- 6.4.18 Palantir Technologies

- 6.4.19 CrowdStrike Holdings

- 6.4.20 SAS Institute Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment