|

市场调查报告书

商品编码

1846240

云端发现:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Cloud Discovery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

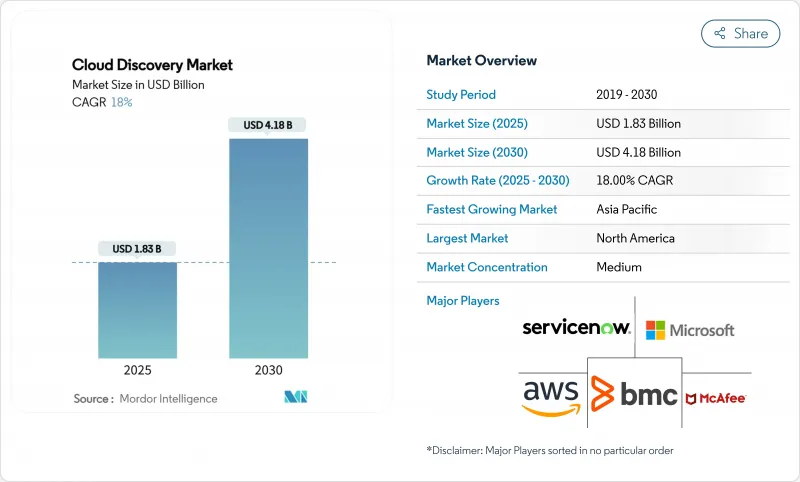

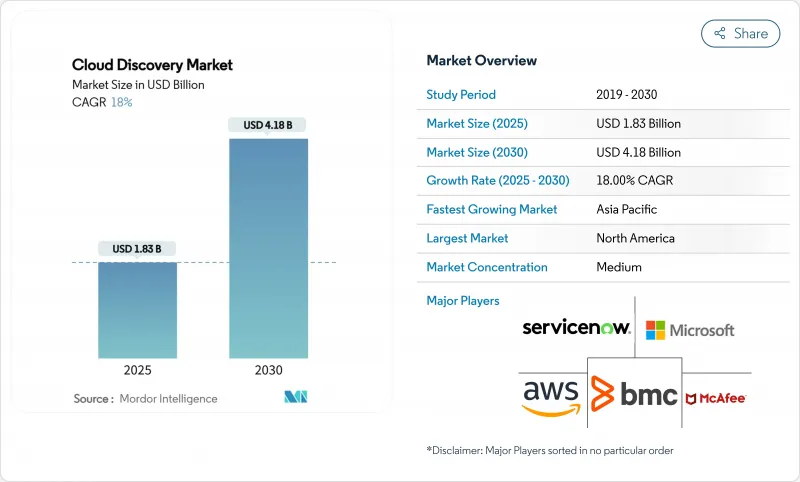

预计云端发现市场在 2025 年将达到 18.3 亿美元,在 2030 年将达到 41.8 亿美元,在市场估计和预测期(2025-2030 年)内以 18% 的复合年增长率增长。

多重云端的快速普及、日益严格的零信任要求以及永续性报告法规,使得持续的资产视觉性成为董事会层面的优先事项,并重塑了企业安全架构。随着企业从一次性审核转向即时监控,将无代理发现、自动分类和支援 FinOps 的分析功能融入其平台的供应商正在赢得市场份额。北美的需求继续受到联邦合规框架的驱动,而亚太地区的主权云端倡议正在加速区域应用。小型组织的预算限制以及分段网路中持续存在的凭证存取障碍正在减缓整体成长,但人工智慧主导的自动化领域的持续创新将继续扩大整体可寻址需求。

全球云端发现市场趋势与洞察

全球 2000 强企业多重云端采用率不断扩大

企业目前平均在 3.2 个公共云端上运行生产工作负载。因此,发现引擎需要近乎即时地与多个提供者 API、容器编配层和服务网格进行互动。主权云强制要求亚洲的早期采用者同时经营国内和国际云,从而推动了对平台无关发现的需求。 ServiceNow 与主要超大规模云端供应商的整合展示了工作流程自动化和发现如何整合,以缩短混合云平台的回应时间。如果没有这些功能,企业报告的发现延迟时间将长达 72 小时,暴露出监管机构日益严厉的安全和合规盲点。

对即时配置可见性的需求日益增长,以增强网路弹性

由于绝大多数云端漏洞是由于配置错误造成的,监管机构正在强制要求持续监控。美国国防部的云端条款已更新,要求承包商追踪资料位置并立即修正任何偏差。面临健康保险流通与责任法案 (HIPAA) 和勒索软体威胁的医疗保健提供者正在主导即时发现和资料安全态势管理的投资。整合了人工智慧主导的威胁分析和发现技术的供应商报告称,平均侦测时间缩短了 30% 或更多。製造商报告称,透过将持续资产发现技术融入工业IoT环境,整体设施效率实现了两位数的提升。

高度分段的网路中持续存在的凭证存取障碍

零信任设计刻意限制了横向移动,要求发现引擎分别对每个微分段进行身份验证。医疗保健提供者在隔离受保护的健康资讯时也面临类似的挑战。虽然无代理方法可以减少一些摩擦,但它们在深度方面仍然举步维艰,并且必须在广度和粒度之间做出权衡。企业估计,光是凭证管理任务就消耗了其 40-60% 的发现预算。

細項分析

到2024年,专业服务将占据云端发现市场的68%,这凸显了企业对专业架构师的依赖,他们将发现引擎与复杂的身份、网路和工作流程层整合在一起。专业服务通常涵盖需要深厚供应商专业知识的任务,例如多重云端API映射、策略调整和CMDB建置。然而,随着企业意识到发现必须持续进行而非专案,预计到2030年,託管服务将以24%的复合年增长率加速成长。

託管服务的成长标誌着支出结构性转变,从企划为基础的部署转向由持续视觉性支援的订阅模式。 ServiceNow 的託管发现订阅服务将为其 2024 年第四季度 28.66 亿美元的经常性收益做出重要贡献,彰显了基于运作的合约的吸引力。采用「始终在线发现」服务的製造业客户报告称,由于异常检测速度加快,营运效率提高了 10-15%。这种转变也使供应商受益,因为自动分类可以降低交付成本,并提高缺乏专职云端安全人员的组织的采用率。

云端发现市场按服务类型(专业、主机)、最终用户垂直领域(IT 和通讯、BFSI、零售和消费品、工业製造、医疗保健和其他垂直领域)和地区进行细分。

区域分析

到2024年,北美将占总收入的38%,这得益于企业云的早期采用、成熟的超大规模生态系统以及联邦政府要求在政府合约中加入发现条款的规定。金融机构、国防承包商和医疗保健网路构成了最大的买家丛集,而加拿大公司也越来越多地采用託管发现机制来应对跨境资料流动。由于现有的IT服务管理供应商将发现机制整合到更广泛的工作流程套件中,竞争依然激烈,但财富1000强企业的市场饱和引发了人们对成长放缓的担忧。

由于主权云端政策和在地化法律迫使企业在区域层级盘点资产,预计亚太地区在2025年至2030年间的复合年增长率将达到22%,成为全球成长最快的地区。超过三分之一的亚太地区政府计划在2026年前采用主权云,要求企业详细记录其工作负荷的位置。到2024年,该地区的资料中心容量将超过12,000兆瓦,另有14,000兆瓦正在建置中,这将进一步提升对混合云端可视性的需求。金融服务和国防等产业正在引领混合云端的采用,而数位原民企业的崛起正在加速託管服务的采用。

欧洲是一个庞大的合规主导市场,GDPR 和企业永续性报告指令使资料发现对于资料保护和排放核算都至关重要。企业正在利用发现引擎来映射资料流并分配范围 3 碳因子,从而实现透明的 ESG 揭露。德国、法国和北欧地区的采用最为普遍,这些地区的节能云区域与严格的资料居住规则交叉。成长率低于亚太地区,但由于与监管认证相关的高转换成本,供应商可受益于更长的合约期限。南美和中东及非洲仍处于起步阶段,但前景光明。通讯业者主导的云端部署和公共部门数位化计画正在为未来的需求奠定基础,前提是它们的定价能够适应有限的 IT 预算。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 全球 2000 强企业多重云端采用率不断扩大

- 增强网路弹性对即时配置可视性的需求日益增长

- FinOps 和 ITOM 的融合为成本管理堆迭添加了一个发现模组。

- 透过使用 GenAI* 进行自动分类来降低 CMDB 维护成本。

- 美国联邦零信任合约中的强制性资产发现条款*。

- 永续性报告条例 (CSRD、SEC) 要求提供云端资产清单*。

- 市场限制

- 高度隔离的网路中凭证存取的持续障碍

- 中小企业在发现许可和员工方面的预算紧张

- 主权云限制限制了您所在区域以外的发现*。

- 儘管工具不断升级,影子 IT 的成长速度仍然超过了发现覆盖率*。

- 价值/供应链分析

- 监管状况

- 技术展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

第五章市场规模及成长预测

- 按服务

- 专业的

- 託管

- 按最终用户产业

- 资讯科技/通讯

- BFSI

- 零售和消费品

- 製造业

- 卫生保健

- 其他行业

- 按地区

- 北美洲

- 南美洲

- 欧洲

- APAC

- 中东和非洲

第六章 竞争态势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- ServiceNow Inc.

- BMC Software Inc.

- Microsoft Corp.

- Amazon Web Services Inc.

- Cisco Systems Inc.

- IBM Corp.

- Broadcom Inc.(Symantec)

- McAfee LLC

- Palo Alto Networks Inc.

- Fortinet Inc.

- Splunk Inc.

- Dynatrace Inc.

- New Relic Inc.

- vArmour Networks Inc.

- Tenable Inc.

- Qualys Inc.

- Rapid7 Inc.

- Wiz Inc.

- Lacework Inc.

- Orca Security Ltd.

第七章 市场机会与未来展望

The Cloud Discovery Market size is estimated at USD 1.83 billion in 2025, and is expected to reach USD 4.18 billion by 2030, at a CAGR of 18% during the forecast period (2025-2030).

Rapid multi-cloud adoption, stricter zero-trust mandates, and sustainability reporting rules are reshaping enterprise security architecture by making continuous asset visibility a board-level priority. Vendors that embed agentless discovery, automated classification, and FinOps-ready analytics into their platforms are gaining share as enterprises shift from one-time audits to real-time monitoring. North American demand remains anchored in federal compliance frameworks, while APAC's sovereign-cloud initiatives are accelerating regional uptake. Budget constraints at smaller organizations and persistent credential-access hurdles in segmented networks moderate overall growth, but sustained innovation in AI-driven automation continues to expand total addressable demand.

Global Cloud Discovery Market Trends and Insights

Growing Multi-Cloud Adoption Among Global 2000 Enterprises

Organizations now run production workloads across an average of 3.2 public clouds, a strategy that boosts resilience but fragments visibility. Discovery engines must therefore interface with multiple provider APIs, container orchestration layers, and service meshes in near real time. Early adopters in Asia are compelled to run parallel domestic and international cloud estates because of sovereign-cloud directives, reinforcing demand for platform-agnostic discovery. ServiceNow's integration with a leading hyperscaler illustrates how workflow automation and discovery are converging to shorten response times across hybrid estates.Without these capabilities, enterprises report discovery lags of up to 72 hours, exposing security and compliance blind spots that regulators increasingly penalize.

Rising Need for Real-Time Configuration Visibility to Harden Cyber-Resilience

Misconfigurations continue to account for the overwhelming majority of cloud breaches, prompting regulators to enforce continuous monitoring requirements. The U.S. Department of Defense's updated cloud clause obliges contractors to track data location and remediate drift instantly. Healthcare providers, subject to HIPAA and ransomware threats, are leading investments in real-time discovery tied to data-security-posture management. Vendors integrating discovery with AI-driven threat analytics claim mean-time-to-detect reductions of more than 30%. Manufacturing firms report double-digit improvements in overall equipment effectiveness after embedding continuous asset discovery within industrial IoT environments.

Persistent Credential-Access Hurdles in Highly Segmented Networks

Zero-trust designs intentionally restrict lateral movement, requiring discovery engines to authenticate separately in every micro-segment. Financial services institutions must also segregate business-unit data by jurisdiction, multiplying credential overhead.Healthcare providers face comparable challenges when isolating protected health information. Agentless approaches alleviate some friction yet still struggle with depth, forcing trade-offs between breadth and granularity. Enterprises estimate that 40-60% of discovery budgets are consumed by credential management tasks alone.

Other drivers and restraints analyzed in the detailed report include:

- Convergence of FinOps and ITOM Driving Discovery Modules Into Cost-Governance Stacks

- GenAI-Powered Auto-Classification Reducing CMDB Maintenance Cost

- SMB Budget Squeeze for Discovery Licences and Staff

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Professional services captured 68% of the cloud discovery market in 2024, underscoring enterprises' reliance on specialized architects to integrate discovery engines with complex identity, network, and workflow layers. Engagement scopes typically cover multi-cloud API mapping, policy tuning, and CMDB population-all tasks requiring deep vendor expertise. Managed services, however, are forecast to accelerate at a 24% CAGR through 2030 as enterprises recognize that discovery must run continuously rather than ad-hoc.

Growth in managed offerings signals a structural shift in spending from project-based deployments to subscription models anchored in ongoing visibility. ServiceNow's managed discovery subscriptions contributed materially to its USD 2,866 million Q4 2024 recurring revenue, illustrating the appeal of outcome-based contracts. Manufacturing clients adopting always-on discovery have reported 10-15% boosts in operational effectiveness through faster anomaly detection. The shift also benefits vendors, as automated classification reduces marginal delivery costs and widens adoption among organizations lacking full-time cloud-security staff.

The Cloud Discovery Market is Segmented by Service (Professional, Managed), End-User Industry (IT and Telecommunication, BFSI, Retail and Consumer Goods, Industrial Manufacturing, Healthcare and Other Industries), and Geography

Geography Analysis

North America held 38% of 2024 revenue thanks to early enterprise cloud adoption, a mature hyperscale ecosystem, and federal mandates that embed discovery clauses in government contracts. Financial institutions, defense contractors, and healthcare networks represent the largest buyer clusters, while Canadian firms increasingly adopt managed discovery to address cross-border data movement. Competition remains intense as established IT-service-management vendors integrate discovery into broader workflow suites, yet market saturation among Fortune 1000 firms tempers incremental growth.

APAC is projected to post a 22% CAGR from 2025-2030, the fastest worldwide, driven by sovereign-cloud policies and localization laws that force companies to inventory assets at the regional level. More than one-third of Asia-Pacific governments plan to deploy sovereign clouds by 2026, compelling enterprises to maintain granular records of workload residency. Data-center capacity in the region topped 12,000 MW in 2024, and a further 14,000 MW is under construction, magnifying the need for hybrid-cloud visibility. Industries such as financial services and sovereign defense lead adoption, while emerging digital-native enterprises accelerate managed-service uptake.

Europe represents a sizable, compliance-driven market where GDPR and the Corporate Sustainability Reporting Directive make discovery essential for both data protection and emissions accounting. Enterprises leverage discovery engines to map data flows and assign Scope 3 carbon factors, enabling transparent ESG disclosures. Uptake is most pronounced in Germany, France, and the Nordics, where energy-efficient cloud zones intersect stringent data-residency rules. While growth rates are lower than in APAC, vendors benefit from long contract tenures due to high switching costs tied to regulatory certification. South America and the Middle East & Africa remain nascent but promising; telco-led cloud rollouts and public-sector digitization programs are laying the groundwork for future demand, provided pricing aligns with constrained IT budgets.

- ServiceNow Inc.

- BMC Software Inc.

- Microsoft Corp.

- Amazon Web Services Inc.

- Cisco Systems Inc.

- IBM Corp.

- Broadcom Inc. (Symantec)

- McAfee LLC

- Palo Alto Networks Inc.

- Fortinet Inc.

- Splunk Inc.

- Dynatrace Inc.

- New Relic Inc.

- vArmour Networks Inc.

- Tenable Inc.

- Qualys Inc.

- Rapid7 Inc.

- Wiz Inc.

- Lacework Inc.

- Orca Security Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.1.1 Market Drivers

- 4.1.1.1 Growing multi-cloud adoption among Global 2000 enterprises

- 4.1.1.2 Rising need for real-time configuration visibility to harden cyber-resilience

- 4.1.1.3 Convergence of FinOps and ITOM driving discovery modules into cost-governance stacks

- 4.1.1.4 GenAI-powered auto-classification reducing CMDB maintenance cost*

- 4.1.1.5 Mandatory asset-discovery clauses in new U.S. Federal Zero-Trust contracts*

- 4.1.1.6 Sustainability reporting rules (CSRD, SEC) demanding cloud-asset inventories*

- 4.1.2 Market Restraints

- 4.1.2.1 Persistent credential-access hurdles in highly segmented networks

- 4.1.2.2 SMB budget squeeze for discovery licences and staff

- 4.1.2.3 Sovereign-cloud restrictions limiting discovery scope outside region*

- 4.1.2.4 Shadow-IT growth outpacing discovery coverage despite tool upgrades*

- 4.1.3 Value/Supply-Chain Analysis

- 4.1.4 Regulatory Landscape

- 4.1.5 Technological Outlook

- 4.1.6 Porter's Five Forces

- 4.1.6.1 Threat of New Entrants

- 4.1.6.2 Bargaining Power of Buyers

- 4.1.6.3 Bargaining Power of Suppliers

- 4.1.6.4 Threat of Substitutes

- 4.1.6.5 Competitive Rivalry

- 4.1.1 Market Drivers

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service

- 5.1.1 Professional

- 5.1.2 Managed

- 5.2 By End-user Industry

- 5.2.1 IT and Telecommunication

- 5.2.2 BFSI

- 5.2.3 Retail and Consumer Goods

- 5.2.4 Industrial Manufacturing

- 5.2.5 Healthcare

- 5.2.6 Other Industries

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 South America

- 5.3.3 Europe

- 5.3.4 APAC

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ServiceNow Inc.

- 6.4.2 BMC Software Inc.

- 6.4.3 Microsoft Corp.

- 6.4.4 Amazon Web Services Inc.

- 6.4.5 Cisco Systems Inc.

- 6.4.6 IBM Corp.

- 6.4.7 Broadcom Inc. (Symantec)

- 6.4.8 McAfee LLC

- 6.4.9 Palo Alto Networks Inc.

- 6.4.10 Fortinet Inc.

- 6.4.11 Splunk Inc.

- 6.4.12 Dynatrace Inc.

- 6.4.13 New Relic Inc.

- 6.4.14 vArmour Networks Inc.

- 6.4.15 Tenable Inc.

- 6.4.16 Qualys Inc.

- 6.4.17 Rapid7 Inc.

- 6.4.18 Wiz Inc.

- 6.4.19 Lacework Inc.

- 6.4.20 Orca Security Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment