|

市场调查报告书

商品编码

1846251

硬脂酸镁:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)Magnesium Stearate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

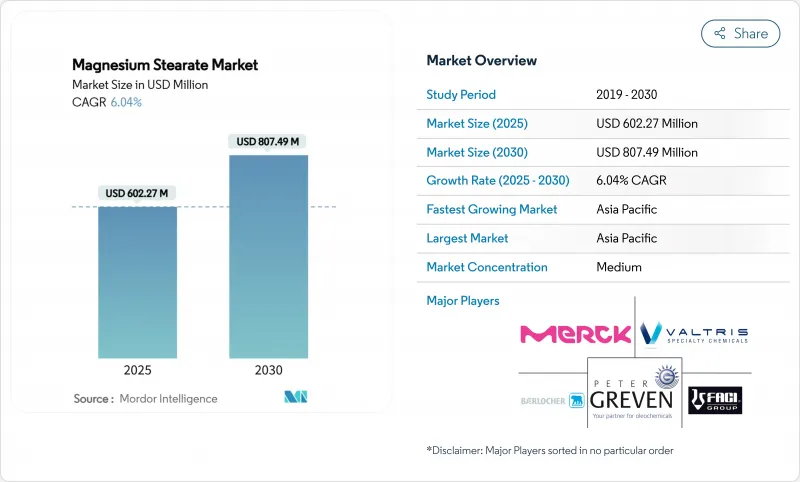

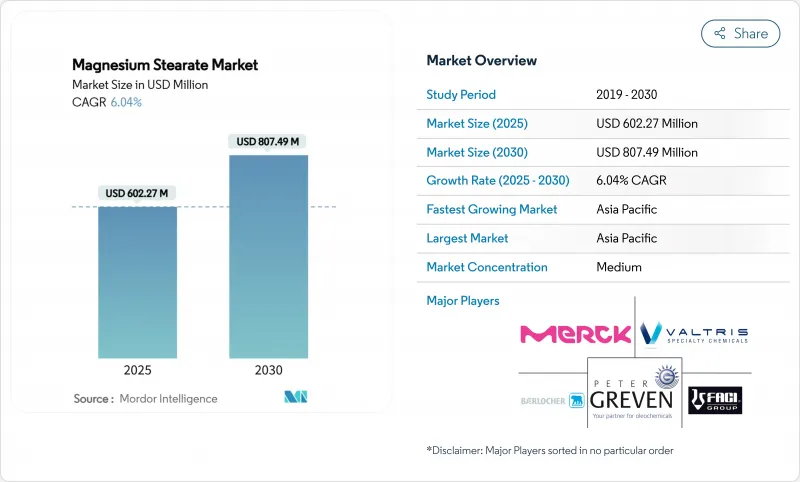

预计到 2025 年,硬脂酸镁市场规模将达到 6.0227 亿美元,到 2030 年将达到 8.0749 亿美元,预测期(2025-2030 年)复合年增长率为 6.04%。

目前的成长动能反映了该化合物在药物压片、个人护理黏合剂、食品防结块系统和聚合物热稳定剂等领域的成熟应用。需求旺盛,尤其是在北美和欧洲,因为对连续口服固体製剂生产的投资促使设备製造商指定使用能够在高通量条件下保持润滑性的辅料。同时,洁净标示的需求正推动供应商推出植物来源或不含棕榈油的等级产品,在不降低核心产品销售量的情况下提供更高价格的替代品。在亚太地区,学名药生产的扩张和人均药品摄取量的成长正在推动大众消费,而电动车线束的出现则为硬脂酸稳定PVC开闢了一个虽小但具有重要战略意义的市场。竞争的核心在于分析一致性、脂肪酸链检验和可追溯性计划,以确保注重品质的买家放心。

全球硬脂酸镁市场趋势及洞察

固态製剂生产加速向连续生产线转型

辉瑞和礼来等领先製造商目前已运作商业性的连续生产运营,在一体化撬装设备上完成片剂的混合、压片和包衣,从而消除了以往因停机而掩盖辅料差异的情况。能确保粒径分布窄、脂肪酸比例稳定的硬脂酸镁市场参与企业,正巩固其作为首选供应商的地位。监管机构透过缩短连续加工厂的核准时间来鼓励这种转变,进一步强化了对高规格辅料的需求。连续生产放大了每种原料对关键品质属性的影响,促使一级采购商将供应商名单缩减至拥有强大随线分析工具的公司。

洁净标示膳食补充剂的纯素/无棕榈油等级产品的出现

随着消费者对辅料来源的关注程度与对活性成分的关注程度不相上下,膳食补充剂配方师正尽可能避免使用动物性或棕榈基硬脂酸盐。像Biogrund这样的供应商已将CompactCel LUB商业化,这是一种植物性产品,其性能与传统润滑剂相当,但符合纯素标籤标准和可持续棕榈油圆桌会议(RSPO)的承诺。虽然功能等效性降低了改良的门槛,但製造商仍会在测试中检验产品的流动性、永续和溶解度,从而维持实验室测试的收益。零售商正在透过强制要求自有品牌补充剂的辅料成分透明化来推动这一趋势,这促使即使是注重成本的自有品牌製造商也使用经过认证的纯素成分。

更严格的棕榈油可追溯性法规推高了原料成本

欧盟的森林砍伐法规和美国海关的审核要求硬脂酸生产商记录每一吨棕榈油衍生的硬脂酸。合规需要卫星监测、同位素指纹图谱和区块链记录,这增加了小型工厂难以承受的采购成本。马来西亚棕榈油局等机构的分析要求提高了检测频率,增加了实验室的资本成本,并延长了前置作业时间。然而,大型跨国公司可以透过向优先考虑道德采购的个人护理品牌出售溢价的经认证的永续辅料来收回成本。

细分市场分析

到2024年,医药应用将占硬脂酸镁市场收益的44.18%,这得益于其数十年来获得的监管认可和成本效益。片剂、胶囊和颗粒剂通常含有浓度低于2%的辅料,但由于口服固体製剂的销量庞大,累积销量仍可观。由于对现有产品进行重新配方需要新的生物等效性证明文件,品牌药和非专利生产商都在保留现有的硬脂酸盐等级,从而保护该领域免受短期替代风险的影响。同时,在压製粉末和干洗髮的推动下,个人护理业务正以6.45%的复合年增长率呈现最快成长动能。这一增长将使高端化妆品级产品在较小的基数上实现销售增长。

食品和饮料製造商将硬脂酸镁粉末用作糖粉、烘焙混合料和粉状饮料基料中的抗结块剂和流动剂。即使在低添加量下,硬脂酸镁也能可靠地控制水分,这使其成为兼顾输送机吞吐量和消费者倾倒体验的关键因素。塑胶加工商已为耐热聚氯乙烯(PVC) 开闢了一片市场,尤其是在电动车线束领域,因为电动车的引擎室温度可能很高。这类产品虽然规模不大,但却能使收益来源多元化,并减少对医药週期的依赖。总而言之,这些因素共同保护了硬脂酸镁市场免受任何单一产业需求衝击的影响。

该报告涵盖了硬脂酸镁市场参与者,并根据最终用户产业(製药、食品饮料、个人护理、塑胶及其他最终用户产业)和地区(亚太、北美、南美以及中东和非洲)对其进行细分。报告以收益为单位,提供了上述所有细分市场的硬脂酸镁市场规模和预测。

区域分析

亚太地区是硬脂酸镁市场的主要驱动力,预计2024年将占全球营收的41.65%,并有望在2030年前以6.32%的复合年增长率成长。中国镁金属产能预计在2024年成长24.5%,超过102万吨,进而缓解区域原料供应紧张的局面。同时,印度合约开发和製造企业大幅提高了片剂产量,以出口到非洲和拉丁美洲,进一步提振了对润滑剂的需求。东南亚国家作为消费和二次加工中心也从中受益,其中越南和印尼为邻近的东协市场提供高性价比的配方服务。

北美仍然是技术领先者,其多家获得美国食品药物管理局(FDA) 批准的连续生产工厂为严格的辅料规格树立了标竿。买家坚持要求完全符合美国药典 (USP)、欧洲药典 (EP) 和日本药典 (JP) 的专论,迫使供应商维护统一的文檔资料包。在美国,清洁标籤声明更为普遍,供应商正致力于推出纯素认证产品线,因为天然产品零售商已将动物性硬脂酸盐列入黑名单。欧洲也提出了类似的品质要求,加强了对永续性的审查,并强制要求在采购决策前进行棕榈油供应链审核和生命週期评估。

棕榈油在南美洲、中东和非洲的使用量较低,但在全球范围内呈上升趋势。巴西国家卫生监督局 (ANVISA) 致力于加快学名药的核准,沙乌地阿拉伯和南非的公开竞标竞标优先考虑在地采购。然而,当地的生产能力较为分散,且往往缺乏先进的分析设备,这为提供承包优质服务的跨国在地采购创造了机会。儘管产量较低,但随着人均医疗保健支出的成长,这些地区能够提供风险分散和长期成长潜力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 加速固态製剂连续生产线的转型

- 纯素/无棕榈油等级的出现瞄准了洁净标示膳食补充剂市场。

- 提高低收入国家口服固体製剂的摄取量

- 电动车线束中聚氯乙烯(PVC)热稳定性的需求

- 化妆品粉饼产品线的快速扩张

- 市场限制

- 由于棕榈油可追溯性法规严格,投入成本上升。

- 采用硬脂酰富马酸钠作为高性能洁净标示替代品

- 小型供应商带来的品质波动风险

- 价值链分析

- 五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按最终用户产业

- 製药

- 饮食

- 个人护理

- 塑胶

- 其他终端用户产业(油漆等)

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Baerlocher GmbH

- FACI Corporate SpA

- Huzhou City Linghu Xinwang Chemical Co., Ltd

- IRRH Specialty Chemicals

- James M. Brown Ltd.

- Kemipex

- Kirsch Pharma GmbH

- Merck KGaA

- MLA Group of Industries

- NB Entrepreneurs

- Nimbasia

- Peter Greven GmbH & Co. KG

- Roquette Freres

- Struktol Company of America, LLC

- Thermo Fisher Scientific Inc.

- Valtris Specialty Chemicals

第七章 市场机会与未来展望

The Magnesium Stearate Market size is estimated at USD 602.27 Million in 2025, and is expected to reach USD 807.49 Million by 2030, at a CAGR of 6.04% during the forecast period (2025-2030).

Current growth momentum mirrors the compound's entrenched role in pharmaceutical compression, personal care binding, anti-caking food systems, and polymer heat stabilization. Heightened investment in continuous oral-solid-dose manufacturing, especially across North America and Europe, keeps demand buoyant as equipment makers specify excipients that sustain lubrication under high-throughput conditions. Clean-label imperatives have simultaneously pushed suppliers to introduce plant-based or palm-free grades, adding premium-priced alternatives without displacing core volumes. Asia-Pacific's expanding generic production and rising per-capita medicine intake anchor bulk consumption, while the advent of electric-vehicle wire harnesses opens a small yet strategically significant outlet for stearate-stabilized PVC. Competitive intensity revolves around analytical consistency, fatty-acid-chain verification, and traceability programs that reassure quality-focused buyers.

Global Magnesium Stearate Market Trends and Insights

Accelerated Shift to Continuous-manufacturing Lines in Solid-dose Pharma

Large producers such as Pfizer and Eli Lilly now run commercial continuous-manufacturing assets that blend, compress, and coat tablets in integrated skids, eliminating stoppages that once masked excipient variability. Magnesium stearate market participants able to guarantee narrow particle-size distributions and stable fatty-acid ratios secure preferred-supplier status because any deviation escalates the risk of lubrication overshoot that damages tensile strength. Regulators back the switch by shortening approval review times for continuous plants, further entrenching high-specification excipient demand. Continuous processing magnifies every input's contribution to critical-quality attributes, encouraging tier-one buyers to pare their vendor lists to firms with robust in-line analytical tools.

Emergence of Vegan / Palm-free Grades Targeting Clean-label Nutraceuticals

Consumers scrutinize excipient origins as closely as active ingredients, prompting nutraceutical formulators to abandon animal-derived or palm-based stearates where feasible. Suppliers such as Biogrund commercialized CompactCel LUB, a vegetable-sourced grade that matches traditional lubrication yet aligns with vegan labeling and Roundtable on Sustainable Palm Oil commitments . While functional equivalence lowers reformulation hurdles, manufacturers still validate flow, compressibility, and dissolution in pilot runs, sustaining testing revenues for analytical houses. Retailers amplify momentum by mandating excipient transparency for store-brand supplements, nudging even cost-sensitive private-labelers toward certified vegan inputs.

Stringent Palm-oil Traceability Regulations Increasing Input Costs

The European Union's deforestation regulation and parallel the United States Customs audits oblige stearate producers to document every tonne of palm-derived stearic acid. Compliance entails satellite monitoring, isotopic fingerprinting, and blockchain recordkeeping, driving procurement overheads that smaller mills struggle to absorb. Analytical mandates from bodies like the Malaysian Palm Oil Board have raised testing frequency, adding laboratory capital expense and elongating lead times . Larger multinationals, however, recoup costs by marketing certified-sustainable excipients at premiums to personal-care brands prioritizing ethical sourcing.

Other drivers and restraints analyzed in the detailed report include:

- Rising Intake of Oral-Solid-Dosage Forms in Low-income Economies

- Rapid Expansion of Cosmetic Pressed-powder Lines

- Adoption of Sodium Stearyl Fumarate as a High-performance Clean-label Alternative

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, pharmaceutical applications accounted for 44.18% of the Magnesium Stearate market revenue, underscoring decades of regulatory acceptance and cost-efficient performance. Tablets, capsules, and granules integrate the excipient at concentrations usually below 2%, yet cumulative volumes remain high due to sheer output of oral-solid doses. Because reformulating legacy products demands new bioequivalence dossiers, brand and generic manufacturers retain existing stearate grades, insulating this segment from short-term substitution risk. Meanwhile, the personal care business, anchored by pressed-powder and dry shampoo launches, shows the fastest trajectory at a 6.45% CAGR. This growth adds premium-priced, cosmetic-grade volumes, albeit from a smaller base.

Food and beverage formulators employ the powder as an anti-caking and flow agent in icing sugar, baking mixes, and powdered drink bases. Even at low inclusion rates, dependable moisture control renders magnesium stearate indispensable where conveyor throughput and consumer pour-ability intersect. Plastics processors have carved a niche in heat-stabilized Polyvinyl Chloride (PVC), particularly for electric-vehicle wiring that experiences higher under-hood temperatures. Although representing a modest slice, this outlet diversifies revenue streams and lowers reliance on pharmaceutical cycles. Collectively, these patterns safeguard the broader magnesium stearate market against demand shocks in any single vertical.

The Report Covers Magnesium Stearate Market Companies and is Segmented by End-User Industry (Pharmaceutical, Food & Beverage, Personal Care, Plastics, and Other End-User Industries) and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Size and Forecasts for Magnesium Stearate Market are Provided in Revenue (USD Million) for all the Above Segments.

Geography Analysis

Asia-Pacific led with 41.65% revenue in 2024 and is on track for a 6.32% CAGR through 2030, making it the linchpin of the magnesium stearate market. China's magnesium-metal capacity surged 24.5% in 2024, surpassing 1.02 Million tonnes and cushioning regional raw-material supply. Concurrently, India's contract-development and manufacturing organizations ramped tablet output for exports to Africa and Latin America, further lifting lubricant demand. Southeast Asian nations benefit as both consumption and secondary processing hubs, with Vietnam and Indonesia offering cost-advantaged blending services that feed neighboring Association of Southeast Asian Nations (ASEAN) markets.

North America remains a technology pacesetter, hosting several Food and Drug Administration (FDA)-approved continuous-manufacturing plants that set stringent excipient specification benchmarks. Buyers insist on full United States Pharmacopeia (USP), European Pharmacopoeia (EP), and Japanese Pharmacopoeia (JP) monograph compliance, compelling vendors to maintain harmonized documentation packs. Clean-label advocacy is more pronounced in the United States, where natural-product retailers blacklist animal-derived stearates, nudging suppliers toward certified vegan lines. Europe mirrors these quality demands and intensifies sustainability scrutiny, compelling palm-supply chain audits and life-cycle assessments before purchasing decisions.

South America, the Middle East, and Africa collectively contribute a smaller but rising parcel of global uptake. Brazil's Agencia Nacional de Vigilancia Sanitaria (ANVISA) fast-track for generic approvals fuels tablet output, while Saudi Arabian and South African public tenders prioritize local sourcing where feasible. However, fragmented local production capacity often lacks advanced analytical instruments, creating opportunity for multinational suppliers offering turnkey quality services. Despite lower volume, these geographies offer risk diversification and long-run upside as healthcare spend per capita climbs.

- Baerlocher GmbH

- FACI Corporate S.p.A.

- Huzhou City Linghu Xinwang Chemical Co., Ltd

- IRRH Specialty Chemicals

- James M. Brown Ltd.

- Kemipex

- Kirsch Pharma GmbH

- Merck KGaA

- MLA Group of Industries

- NB Entrepreneurs

- Nimbasia

- Peter Greven GmbH & Co. KG

- Roquette Freres

- Struktol Company of America, LLC

- Thermo Fisher Scientific Inc.

- Valtris Specialty Chemicals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Shift to Continuous-manufacturing Lines in Solid-dose Pharma

- 4.2.2 Emergence of Vegan/palm-free Grades Targeting Clean-label Nutraceuticals

- 4.2.3 Rising Intake of Oral Solid Dosage Forms in Low-income Economies

- 4.2.4 Polyvinyl Chloride (PVC) Heat-stabilization Demand in Electric-vehicle Wire Harnesses

- 4.2.5 Rapid Expansion of Cosmetic Pressed-powder Lines

- 4.3 Market Restraints

- 4.3.1 Stringent Palm-oil Traceability Regulations Increasing Input Costs

- 4.3.2 Adoption of Sodium Stearyl Fumarate as a High-performance Clean-label Alternative

- 4.3.3 Quality-variance Risk From Micro-scale Suppliers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By End-User Industry

- 5.1.1 Pharmaceutical

- 5.1.2 Food & Beverage

- 5.1.3 Personal Care

- 5.1.4 Plastics

- 5.1.5 Other End-iser Industries (Paints & Coatings, etc.)

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 Japan

- 5.2.1.3 India

- 5.2.1.4 South Korea

- 5.2.1.5 ASEAN Countries

- 5.2.1.6 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Spain

- 5.2.3.6 Russia

- 5.2.3.7 NORDIC Countries

- 5.2.3.8 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Baerlocher GmbH

- 6.4.2 FACI Corporate S.p.A.

- 6.4.3 Huzhou City Linghu Xinwang Chemical Co., Ltd

- 6.4.4 IRRH Specialty Chemicals

- 6.4.5 James M. Brown Ltd.

- 6.4.6 Kemipex

- 6.4.7 Kirsch Pharma GmbH

- 6.4.8 Merck KGaA

- 6.4.9 MLA Group of Industries

- 6.4.10 NB Entrepreneurs

- 6.4.11 Nimbasia

- 6.4.12 Peter Greven GmbH & Co. KG

- 6.4.13 Roquette Freres

- 6.4.14 Struktol Company of America, LLC

- 6.4.15 Thermo Fisher Scientific Inc.

- 6.4.16 Valtris Specialty Chemicals

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment

- 7.2 Microencapsulation Technology Enhancing Magnesium Stearate's Performance