|

市场调查报告书

商品编码

1846256

自适应光学:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Adaptive Optics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

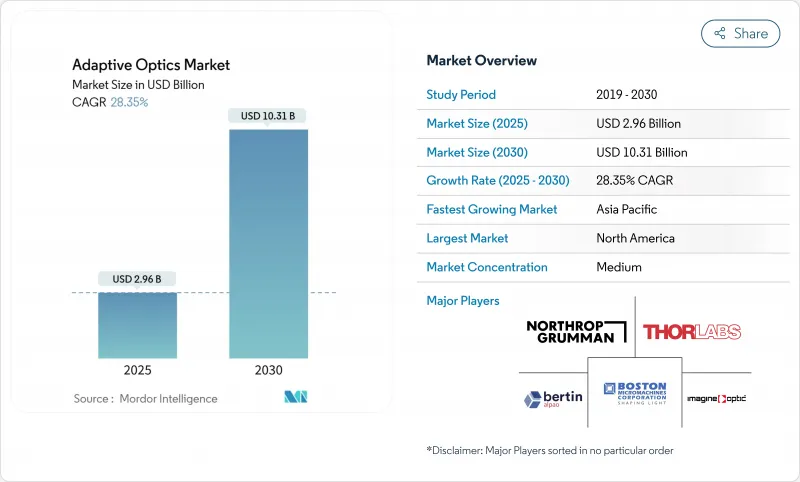

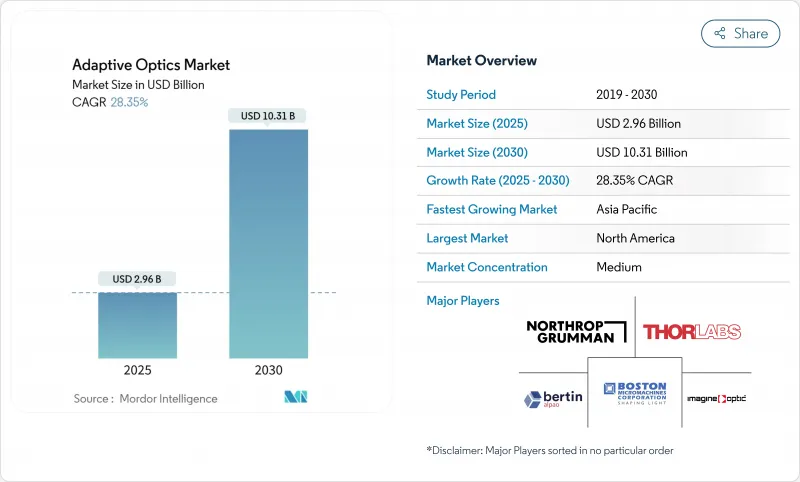

预计到 2025 年,自适应光学市场规模将达到 29.6 亿美元,到 2030 年将达到 103.1 亿美元,年复合成长率为 28.35%。

政府在定向能项目上的支出、对亚奈米级精密半导体检测的需求以及AR/VR波导管显示器等消费性电子应用的兴起,共同推动了市场需求。欧洲大型望远镜的升级改造和亚洲太空情境察觉计画的扩展,也进一步提升了这项技术的价值。基于机器学习的波前重建技术是下一代核准系统的关键组成部分,它能够缩短校准等待时间,从而扩大其商业性吸引力。此外,由于FDA的分类变更缩短了先进眼科平台的审批时间,自适应光学市场也受惠于视网膜成像设备的快速应用。

全球自适应光学市场趋势与洞察

快速采用自适应光学技术进行高解析度视网膜成像

眼科设备製造商目前正将多共轭自适应光学技术应用于视网膜细胞级成像,从而实现疾病的早期检测。美国食品药物管理局 (FDA) 将于 2024 年将超音波睫状体破坏性设备从 III 类重新分类为 II 类,为先进影像平台的发展提供更可预测的路径。爱尔康公司的 Unity VCS 和 Unity CS 获得批准,标誌着它们已具备商业性化条件,而人工智慧驱动的波前演算法则可减少椅旁校准时间。像 Profundus Imaging 这样的新兴企业正在开发原型产品,利用多个可变形反射镜来扩展校正后的视野。这些进步降低了大型学术中心以外的诊所拥有此类设备的门槛,并加速了自适应光学市场在医疗保健领域的应用。

拓展至定向能及自由空间雷射通讯项目

美国国防部每年在高能量雷射系统领域投资超过10亿美元,其中洛克希德·马丁公司正在研发功率高达300千瓦的设备,这些设备依靠自适应光学技术来实现远距光束品质。美国太空发展局的「防扩散战斗机」太空架构(预算在2029年之前为350亿美元)采用了需要精确波前控制的雷射交联。渥太华大学的TAROQQO等人工智慧湍流预测工具,目前正在即时改进自由空间量子通道。这些项目缩短了研发週期,加强了供应链,并扩大了自适应光学在军事和安全通讯的市场。

高额资本投入用于製造高致动器变形镜

具有 120x120致动器的可变形反射镜单位成本高昂,小型製造商难以承受。供应链压力,包括锗和镓的出口限制,推高了光学基板原料的价格。替代的硫系材料,例如 BDNL4,虽然减少了对受限金属的依赖,但需要重新配置设备,从而增加了近期成本。预计到 2024 年,平面光电雷射市场规模将达到 230 亿美元,这限制了供应商吸收资本支出的能力。这些因素限制了价格敏感型垂直领域的成长,并促使有意进入自适应光学市场的企业保持谨慎。

细分市场分析

到2024年,波前感测器将占据自适应光学市场38%的份额,其中以夏克-哈特曼阵列为主,该阵列可为下游控制系统提供即时像差资料。夏克-哈特曼阵列结构简单,成本较低,而金字塔感测器在极端自适应光学天文学领域日益受到关注。控制系统和软体预计将以31.44%的复合年增长率成长。时空高斯过程模式可将波前相位变化降低至非预测迴路的3.5倍。机械式变形镜正向MEMS架构过渡,其技术份额已达42%,以满足消费者的价格分布。其他组件,例如倾斜镜,则用于雷射通讯中的特定微调任务。

控制软体现已整合强化学习智能体,可在湍流条件下优化增益调度,从而在保持频宽的同时减少过衝。 SPHERE 的 SAXO+ 升级版中测试的基于频率、资料驱动驱动的控制器,透过凸优化来保护系统稳定性。开发人员将模组化硬体与支援人工智慧的韧体捆绑在一起,从而缩短了整合商的开发週期。随着预测控制的日益普及,预计到 2030 年,用于控制平台的自适应光学市场将实现显着的收益成长。

到2024年,国防与安全领域将占总收益的31.4%,这主要得益于美国国防部依赖自适应光学技术来维持雷射光束相干性的专案。 AR/ VR头戴装置装置和智慧型手机相机需要微型波前调製器。苹果的头戴式显示器推广了高像素密度的微型OLED面板,而这些面板在生产过程中需要进行自适应光学测试。

工业製造领域正利用半导体计量生产线中的MEMS微镜来测量检测站中亚奈米级的偏差。医疗和生命科学领域正凭藉细胞级视网膜诊断平台蓬勃发展,进一步丰富了自适应光学市场。研究和学术界持续开拓创新,例如基于超表面的波前感测器,从而确保了智慧财产权的源源不断涌现。

区域分析

2024年,北美将占全球销售额的37.9%,主要得益于美国国防部10亿美元的定向能预算和NASA的雷射通讯计画。诺斯罗普·格鲁曼公司旗下的Xinetics等供应商向多个军种提供铌酸铅镁合金可变形反射镜。作为一项价值350亿美元的架构计画的一部分,美国太空发展局正在将自适应反射镜整合到卫星交联中。加拿大对大气畸变的研究与美国的计画相辅相成,进一步巩固了北美自适应光学市场。

亚太地区是成长最快的地区,复合年增长率高达30.80%。日本的宇宙战略基金推动了火箭和卫星群计画的发展,而中国则不断扩大其空间情境察觉卫星的光学有效载荷。预计到2033年,中国遥感探测产业规模将达到550亿至680亿美元,将增加对精密光学元件的需求。日本宇宙航空研究开发机构(JAXA)的XRISM任务检验了一种基于自适应反射镜的软X射线感测器,展现了该地区在太空仪器领域的实力。

欧洲大型望远镜和国防研究联盟正在推动持续的订单成长。欧洲南方天文台(ESO)采购ELT望远镜为欧洲大陆供应商确保了长期合约。南美洲和中东及非洲地区虽然发展中,但随着其区域航太计画的日益成熟,这些地区也展现出巨大的发展潜力。总而言之,这些动态共同作用,使得自适应光学市场能够保持跨区域成长,而不会过度依赖任何单一地区。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 北美高解析度视网膜成像自适应光学技术的快速应用

- 在美国国防部定向能和自由空间雷射通讯计划中的部署

- 欧洲大型望远镜升级(ELT、TMT)的燃料需求

- 商用半导体晶圆和极紫外光刻掩模检测需要亚奈米级精度

- 利用AO增强计量技术製造AR/VR波导管

- 为国家航太机构资金筹措太空碎片追踪资金(亚洲和中东)

- 市场限制

- 高致动器变形镜的高额资本投入限制了其在工业领域的更广泛应用。

- 新兴市场复杂闭合迴路设计与校准技术的差距

- 国防部门自适应光学有效载荷的鑑定週期很长

- 消费级模组小型化(直径小于5毫米)面临的挑战

- 价值/供应链分析

- 监理与技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

第五章 市场规模与成长预测

- 按组件

- 波前感测器

- 变形的镜子

- 控制系统和软体

- 其他(扩束器、倾斜镜)

- 按最终用户产业

- 国防和安全

- 医学与生命科学

- 工业製造

- 消费性电子品牌及原始设备製造商

- 研究和学术机构

- 其他最终用户

- 透过使用

- 天文学与空间观测

- 眼科/视网膜成像

- 雷射通讯与定向能

- 半导体检测与测量

- AR/VR光学检测

- 其他(显微镜、自由空间光学研发)

- 依技术

- 基于MEMS的可变形镜

- 压电(PZT)可变形镜

- 液晶空间灯光调变器

- 磁/音圈镜

- 其他(混合式和新型驱动方式)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 其他亚太地区

- 中东和非洲

- 波湾合作理事会(GCC)国家

- 土耳其

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(MandA、资金筹措、伙伴关係)

- 市占率分析

- 公司简介

- Northrop Grumman Corp.(AOA Xinetics)

- Thorlabs Inc.

- Boston Micromachines Corp.

- ALPAO SAS

- Imagine Optics SA

- Flexible Optical BV

- Iris AO Inc.

- Phasics SA

- CILAS(ArianeGroup)

- Active Optical Systems

- Optos Plc

- AKA Optics SAS

- Trex Enterprises Corp.

- MKS Instruments Inc.(Newport)

- HOLOEYE Photonics AG

- Jenoptik AG

- Teledyne e2v

- Wavefront Dynamics LLC

- Physik Instrumente(PI)GmbH

- Sacher Lasertechnik GmbH

- Ophir Optronics Solutions Ltd.

- First Light Imaging SAS

- OptoCraft GmbH

第七章 市场机会与未来展望

The adaptive optics market size is valued at USD 2.96 billion in 2025 and is forecast to reach USD 10.31 billion by 2030, advancing at a 28.35% CAGR.

Demand is powered by government spending on directed-energy programs, semiconductor inspection needs at sub-nanometer precision, and rising consumer electronics applications such as AR/VR waveguide displays. Large-aperture telescope upgrades in Europe and Asia's expanding space-situational-awareness programs reinforce the technology's relevance. Machine-learning-based wavefront reconstruction, pivotal in next-generation control systems, is reducing calibration latency and broadening commercial appeal. The adaptive optics market is also benefitting from rapid adoption in retinal imaging devices as FDA classification changes shorten approval timelines for advanced ophthalmic platforms.

Global Adaptive Optics Market Trends and Insights

Rapid Adoption of Adaptive Optics for High-Resolution Retinal Imaging

Ophthalmic device makers now integrate multi-conjugate adaptive optics to capture cellular-level retinal images, enabling earlier disease detection. FDA reclassification of ultrasound cyclodestructive devices from Class III to Class II in 2024 signals a more predictable pathway for advanced imaging platforms. Alcon's Unity VCS and Unity CS clearances illustrate growing commercial readiness, while AI-powered wavefront algorithms reduce chair-time calibration. Start-ups such as Profundus Imaging are developing prototypes that widen corrected fields of view through multiple deformable mirrors. These advances lower ownership hurdles for clinics beyond major academic centers and accelerate the adaptive optics market's healthcare reach.

Deployment in Directed-Energy & Free-Space Laser Communication Programs

The U.S. Department of Defense channels more than USD 1 billion annually into high-energy laser systems, with Lockheed Martin scaling to 300 kW devices that rely on adaptive optics for beam quality over long distances. The Space Development Agency's Proliferated Warfighter Space Architecture budgets USD 35 billion through 2029, embedding laser cross-links that need precise wavefront control. AI-enabled turbulence-forecasting tools such as TAROQQO from the University of Ottawa now refine free-space quantum channels in real time. Together these programs shorten development cycles, reinforce supply chains, and enlarge the adaptive optics market for military and secure-communication uses.

High CapEx of High-Actuator Deformable Mirrors

Deformable mirrors with 120 X 120 actuators raise unit costs that small manufacturers struggle to justify. Supply chain pressures, including export restrictions on germanium and gallium, inflate raw-material pricing for optical substrates. Alternative chalcogenide materials, such as BDNL4, lower dependence on restricted metals but require re-tooling that adds near-term expenses. The flat photonics-laser market, valued at USD 23 billion in 2024, narrows suppliers' ability to absorb capital outlays. These factors trim growth in price-sensitive verticals and impose caution on prospective entrants to the adaptive optics market.

Other drivers and restraints analyzed in the detailed report include:

- Large-Aperture Telescope Upgrades (ELT, TMT)

- Commercial Semiconductor Wafer & EUV Mask Inspection

- Complex Closed-Loop Design & Calibration Skills Gap

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wavefront Sensors dominated 38% of the adaptive optics market share in 2024, anchored by Shack-Hartmann arrays that feed real-time aberration data to downstream controls. Shack-Hartmann's simplicity keeps cost low, while pyramid sensors gain traction for extreme adaptive optics astronomy. Control Systems & Software are projected to grow at 31.44% CAGR; spatiotemporal Gaussian process models cut wavefront phase variance by up to 3.5X versus non-predictive loops. Deformable Mirrors, the mechanical workhorses, are shifting toward MEMS architectures with 42% technology share that supports consumer price points. Other components, including tip-tilt mirrors, address specialized fine-pointing tasks in laser communications.

Control software now embeds reinforcement-learning agents that optimize gain schedules under turbulent conditions, reducing overshoot while preserving bandwidth. Frequency-based data-driven controllers, tested on SPHERE's SAXO+ upgrade, safeguard system stability through convex optimization. Suppliers bundle AI-ready firmware within modular hardware, shortening development cycles for integrators. As predictive control proliferates, the adaptive optics market size for control platforms is forecast to capture a larger revenue slice through 2030.

Defense & Security held 31.4% revenue share in 2024, underpinned by DoD programs that depend on adaptive optics to maintain laser-beam coherence. Government purchases remain sizable, but the fastest growth comes from Consumer Electronics, which will advance at 32.50% CAGR as AR/VR headsets and smartphone cameras require compact wavefront modulators. Apple's head-mounted displays have popularized high-pixel-density micro-OLED panels that rely on adaptive optics testing during fabrication.

Industrial Manufacturing leverages MEMS mirrors in semiconductor metrology lines, with inspection stations measuring sub-nanometer deviations. Medical & Life Sciences gain momentum from cellular-level retinal diagnosis platforms, further diversifying the adaptive optics market. Research & Academia continue to pioneer innovations such as metasurface-based wavefront sensors, ensuring a steady pipeline of intellectual property.

The Adaptive Optics Market Report is Segmented by Component (Wavefront Sensors, Deformable Mirrors, and More), End-User (Defense, Medical, Industrial, Consumer Electronics, and More), Application (Astronomy, Ophthalmology, Laser Communication, Semiconductor, AR/VR, and More), Technology (MEMS DMs, Piezoelectric DMs, LC SLMs, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 37.9% of 2024 revenue, anchored by the DoD's billion-dollar directed-energy budget and NASA laser-communications initiatives. Suppliers such as Northrop Grumman's Xinetics deliver lead-magnesium-niobate deformable mirrors for multiple military branches. The Space Development Agency integrates adaptive mirrors into satellite cross-links within its USD 35 billion architecture program. Canadian research on atmospheric distortion complements United States programs, jointly reinforcing the North American adaptive optics market.

Asia-Pacific is the fastest-growing region at 30.80% CAGR as Japan's Space Strategy Fund stimulates launch-vehicle and constellation programs, and China expands optical payloads for space-situational-awareness satellites. China's remote-sensing sector is projected to escalate toward USD 55-68 billion by 2033, magnifying demand for precision optics. JAXA's XRISM mission validates soft-X-ray sensors that depend on adaptive mirrors, illustrating regional competence in space-borne instrumentation.

Europe's large-aperture telescopes and defense research consortia drive sustained orders. ESO's procurements for the ELT secure long-term contracts for continental suppliers. South America and the Middle East & Africa are nascent but promising as local space programs mature, yet limited technical talent and capital budgets slow adoption relative to leading regions. Collectively, these dynamics keep the adaptive optics market on a multi-regional growth path without over-reliance on a single geography.

- Northrop Grumman Corp. (AOA Xinetics)

- Thorlabs Inc.

- Boston Micromachines Corp.

- ALPAO SAS

- Imagine Optics SA

- Flexible Optical B.V.

- Iris AO Inc.

- Phasics SA

- CILAS (ArianeGroup)

- Active Optical Systems

- Optos Plc

- AKA Optics SAS

- Trex Enterprises Corp.

- MKS Instruments Inc. (Newport)

- HOLOEYE Photonics AG

- Jenoptik AG

- Teledyne e2v

- Wavefront Dynamics LLC

- Physik Instrumente (PI) GmbH

- Sacher Lasertechnik GmbH

- Ophir Optronics Solutions Ltd.

- First Light Imaging SAS

- OptoCraft GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption of Adaptive Optics for High-Resolution Retinal Imaging in North America

- 4.2.2 Deployment in Directed-Energy and Free-Space Laser Communication Programs by U.S. DoD

- 4.2.3 Large-Aperture Telescope Upgrades (ELT, TMT) Accelerating Demand in Europe

- 4.2.4 Commercial Semiconductor Wafer and EUV Mask Inspection Requiring Sub-Nanometer Precision

- 4.2.5 Emergence of AR/VR Waveguide Display Manufacturing Using AO-Enhanced Metrology

- 4.2.6 National Space Agencies Funding for Space Debris Tracking (Asia and Middle East)

- 4.3 Market Restraints

- 4.3.1 High CapEx of High-Actuator Deformable Mirrors Limiting Wider Industrial Adoption

- 4.3.2 Complex Closed-Loop Design and Calibration Skills Gap in Emerging Markets

- 4.3.3 Long Qualification Cycles for AO-Enabled Optical Payloads in Defense Sector

- 4.3.4 Miniaturization Challenges for Consumer-Grade Modules (less than 5 mm Aperture)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Industry Value-Chain Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Wavefront Sensors

- 5.1.2 Deformable Mirrors

- 5.1.3 Control Systems and Software

- 5.1.4 Others (Beam Expanders, Tip-Tilt Mirrors)

- 5.2 By End-User Industry

- 5.2.1 Defense and Security

- 5.2.2 Medical and Life Sciences

- 5.2.3 Industrial Manufacturing

- 5.2.4 Consumer Electronics Brands and OEMs

- 5.2.5 Research and Academia

- 5.2.6 Other End-Users

- 5.3 By Application

- 5.3.1 Astronomy and Space Observation

- 5.3.2 Ophthalmology / Retinal Imaging

- 5.3.3 Laser Communication and Directed Energy

- 5.3.4 Semiconductor Inspection and Metrology

- 5.3.5 AR/VR Optical Testing

- 5.3.6 Others (Microscopy, Free-Space Optics RandD)

- 5.4 By Technology

- 5.4.1 MEMS-Based Deformable Mirrors

- 5.4.2 Piezoelectric (PZT) Deformable Mirrors

- 5.4.3 Liquid-Crystal Spatial Light Modulators

- 5.4.4 Magnetic / Voice-Coil Mirrors

- 5.4.5 Others (Hybrid and Novel Actuation)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Gulf Co-operation Council (GCC) Countries

- 5.5.5.2 Turkey

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA, Funding, Partnerships)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Northrop Grumman Corp. (AOA Xinetics)

- 6.4.2 Thorlabs Inc.

- 6.4.3 Boston Micromachines Corp.

- 6.4.4 ALPAO SAS

- 6.4.5 Imagine Optics SA

- 6.4.6 Flexible Optical B.V.

- 6.4.7 Iris AO Inc.

- 6.4.8 Phasics SA

- 6.4.9 CILAS (ArianeGroup)

- 6.4.10 Active Optical Systems

- 6.4.11 Optos Plc

- 6.4.12 AKA Optics SAS

- 6.4.13 Trex Enterprises Corp.

- 6.4.14 MKS Instruments Inc. (Newport)

- 6.4.15 HOLOEYE Photonics AG

- 6.4.16 Jenoptik AG

- 6.4.17 Teledyne e2v

- 6.4.18 Wavefront Dynamics LLC

- 6.4.19 Physik Instrumente (PI) GmbH

- 6.4.20 Sacher Lasertechnik GmbH

- 6.4.21 Ophir Optronics Solutions Ltd.

- 6.4.22 First Light Imaging SAS

- 6.4.23 OptoCraft GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment