|

市场调查报告书

商品编码

1846269

覆膜标籤:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Laminated Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

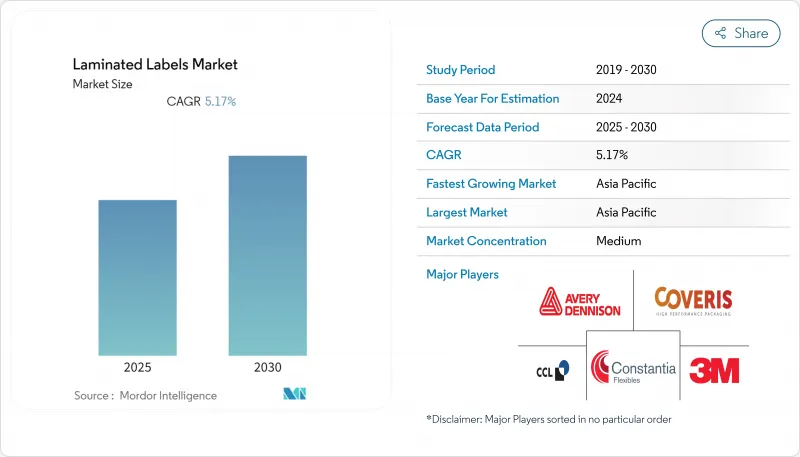

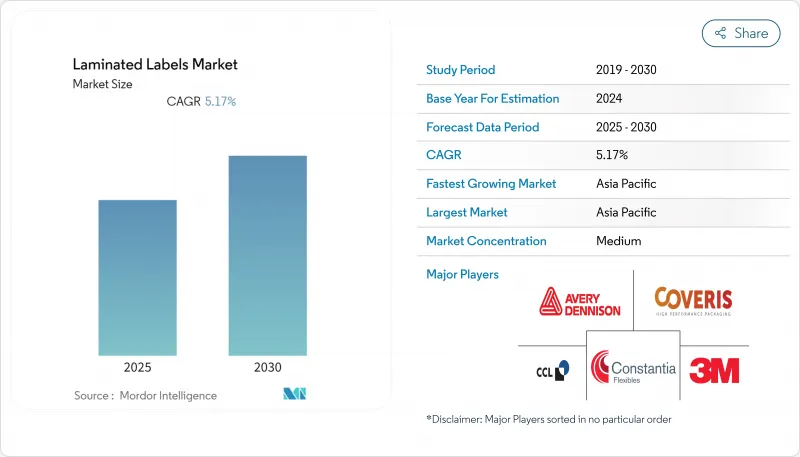

预计到 2025 年,复合标籤市场规模将达到 365 亿美元,到 2030 年将达到 483 亿美元,复合年增长率为 5.8%。

儘管电子商务出货量不断增长、食品安全标准日益严格以及药品序列化要求等因素推动了包装可回收性和碳排放披露法规的日益完善,但复合标籤市场仍在持续扩张。对能够承受自动化分类的耐用面材以及减少废弃物的无底纸包装的需求,正在扩大能够提供高性能合规产品的加工商的利润空间。虽然聚酯仍占据最大的市场份额,但聚丙烯的低成本和良好的印刷性能正推动其在食品饮料行业的应用。从区域来看,亚太地区拥有规模优势,而北美在高端和监管敏感型应用领域发展最快。

全球覆膜标籤市场趋势与洞察

电子商务的蓬勃发展推动了耐用型运输标籤的发展

线上零售的激增使小包裹处理强度提高了 60% 以上,导致普通标籤更容易受到温度变化和机械衝击的影响,从而出现分层现象。 ASTM D4169-22 标准强制要求进行顺序危险测试,敦促加工商设计能够在整个分销週期中牢固粘附在纸箱上的基材。永续性目标还包括清洁剥离的要求,以确保标籤不会干扰纺织品回收流程。像 OptiCut WashOff 这样的无底纸捲材可将标籤产量比率提高 50%,并减少运输排放,从而吸引那些关注其范围 3 碳足迹的物流运营商。加工商报告称,采用专为电子商务设计的标籤结构可提高 15% 至 20% 的利润率,而数位印刷技术则允许托运人嵌入即时代码,以便进行追踪和退货管理。

包装食品和饮料的需求激增。

都市区生活方式和单份包装偏好正在推动包装食品的销售量,随着中产阶级消费群体的不断壮大,各大品牌在印度的包装支出正以26.7%的复合年增长率增长。印度食品安全与标准局(FSSAI)现已禁止在食品接触油墨中使用甲苯,促使标籤製造商转向低迁移化学品并进行严格的迁移测试。高端零食和饮料品牌正在寻求具有亮丽货架外观和阻隔保护功能的金属化压敏薄膜。透过与赛卡-亿滋国际(Saica-Mondelez)等伙伴关係,纸基复合材料的目标是在不降低热封性能的前提下,减少25%的原生塑胶用量。区域供应多元化,尤其是在亚太地区,正在降低供应中断风险,并鼓励新增本地产能。

原物料价格波动

随着炼油厂的合理化进程不断推进,预计到2025年中期,丙烯原料价格将超过每磅40美分,推高聚酯和聚丙烯薄膜的成本。 2024年12月合约的交易价格已达每磅35.75美分,显示通膨趋势将持续到2026年。 Braidy公司已宣布,原物料成本上涨将严重拖累其2024财年的利润率。加工商正在探索使用再生树脂和生物基树脂,但目前用量仍然较低,但溢价很高。多供应商策略和区域库存缓衝正逐渐成为标准的风险管理手段。

细分市场分析

到2024年,聚酯材料将占据复合标籤市场35.45%的最大份额,这主要得益于其优异的耐化学腐蚀性能,这对于製药、化工桶以及户外应用至关重要。聚丙烯材料预计到2030年将以7.48%的复合年增长率增长,这主要得益于其低密度、高产量比率和光滑的印刷表面,这些特性使其深受食品饮料加工商的青睐。欧盟法规要求2030年包装必须使用30%的再生PET,增加了再生PET面材的需求,但供应无法满足需求,导致价格居高不下。受REACH法规对微塑胶的限制,乙烯基材料的市占率持续下降。生物膜目前仍属于小众市场,但正吸引那些寻求可堆肥和生物基讯息的品牌。

展望未来,再生材料含量强制要求可能会收紧聚酯纤维的供应,推高价格,并加速对成本敏感的产品中聚丙烯的替代。同时,生物基PET和化学再生树脂的研发一旦规模化,将为未来的大规模生产奠定基础。由于复合标籤市场青睐低碳足迹产品,那些能够在不牺牲透明度或挺度的前提下合格再生材料含量要求的供应商有望获得市场份额。

由于饮料、製药和物流的自动化施用器依赖连续捲筒纸供料,捲筒标籤将在2024年占据复合标籤市场58.35%的份额。而片状标籤的市占率仅41.65%,年复合成长率为6.54%,主要得益于手工食品、化妆品和季节性宣传活动的小批量印刷的数位印刷机的普及。像Unisplice413这样的自动化拼接系统可以将生产线运作提高10%,进一步凸显了捲筒纸的生产效率优势。

另一方面,单张纸可以让品牌所有者在多个 SKU 上使用不同的图案而无需模具,从而避免库存浪费。随着电商微型品牌的激增,单张纸在 1000 件以下的订单中将需求旺盛,因为这类订单无需承担柔版印刷的设置成本。无底纸技术提升了捲筒纸的吸引力,但对接裁切所需的印刷机维修最初可能仅限于大型印刷厂。

复合标籤市场按材料类型(聚酯、聚丙烯(BOPP、CPP)、乙烯基及其他)、形态(卷材、片材)、结构(面材、黏合剂)、印刷技术(柔版印刷、数位喷墨印刷及其他)、终端用户产业(食品饮料、製造及工业、电子及家电及其他)及地区进行细分。市场预测以美元计价。

区域分析

到2024年,亚太地区将占据复合标籤市场41.34%的份额,这主要得益于中国工业生产成长6%以及化学製造业成长12.7%,后者为薄膜生产提供了原料。印度的生产连结奖励计画旨在2025年使先进製造业对GDP的贡献达到25%,从而扩大国内需求并提升出口能力。像安姆科这样的跨国公司已在古吉拉突邦增设产能,以满足当地零食和个人护理品牌的需求,这进一步印证了该地区的规模和成本优势。日本和韩国拥有精密涂层技术,而东南亚则受益于供应链多元化。

受DSCSA序列化、EPA溶剂法规以及小包裹运输快速成长的推动,北美预计将以8.32%的复合年增长率成长。 ASTM运输标准和消费者对优质影像的偏好将推动该地区高附加价值产品的销售成长。 ProMach收购Etiflex将增强墨西哥在近岸外包领域的地位,并扩展其RFID和可变数据产品线。

欧洲透过《包装及包装废弃物法规》维持其监管领先地位。该法规要求在2028年实现包装完全可回收,并透过设定再生材料含量阈值来再形成材料选择。 FINAT的衬纸回收计画以及德国向植物来源油墨的转型,凸显了永续性作为提升竞争力的关键因素。随着西方加工商寻求低成本且符合欧盟标准的生产基地,东欧可望吸引新的涂布生产线。

中东、非洲和南美洲等规模较小的复合标籤市场正快速发展,食品加工商和农产品出口商纷纷采用可追溯标籤。基础设施不足和外汇波动目前限制市场规模,但随着各国政府呼吁投资以减少进口依赖,本地产量可望成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务的蓬勃发展推动了耐用型运输标籤的发展

- 加工食品和饮料的需求激增

- 药品强制序列化

- 无底纸层压标籤

- 碳足迹揭露标籤

- 市场限制

- 原物料价格波动

- 改用金属化箔和热缩套管

- 溶剂型油墨和黏合剂法规

- 闭环闭合迴路,不含塑胶标籤

- 供应链分析

- 监管状况

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 环境足迹分析

第五章 市场规模与成长预测

- 依材料类型

- 聚酯纤维

- 聚丙烯(双向拉伸聚丙烯 (BOPP)、共聚聚丙烯 (CPP))

- 乙烯基塑料

- 可生物降解薄膜

- 其他成分

- 按形式

- 卷

- 床单

- 按成分

- Facestock

- 黏合剂

- 离型膜

- 透过印刷技术

- 柔版印刷

- 数位喷墨

- 数位 - 静电摄影

- 凹版印刷

- 抵销

- 萤幕/报告

- 按最终用户产业

- 饮食

- 製造业和工业

- 电子产品和家用电器

- 製药和医疗保健

- 个人护理和化妆品

- 零售和物流

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 义大利

- 西班牙

- 英国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- Avery Dennison Corporation

- CCL Industries Inc.

- 3M Company

- Coveris Holdings SA

- Torraspapel Adestor

- Constantia Flexibles Group GmbH

- RR Donnelley & Sons Company

- Flexcon Company Inc.

- Stickythings Ltd.

- Gipako Ltd.

- Hub Labels Inc.

- Cenveo Corporation

- Ravenwood Packaging Ltd.

- Reflex Labels Ltd.

- UPM Raflatac Oy

- Amcor plc

- Multi-Color Corporation

- Fuji Seal International Inc.

- SATO Holdings Corp.

- Lintec Corporation

- Zebra Technologies Corp.

- Brady Corporation

第七章 市场机会与未来展望

The laminated label market size stood at USD 36.5 billion in 2025 and is forecast to reach USD 48.3 billion by 2030, advancing at a 5.8% CAGR.

Rising e-commerce shipping volumes, tougher food-safety codes, and pharmaceutical serialization mandates are expanding the laminated label market, even as packaging rules tighten around recyclability and carbon disclosures. Demand for durable facestocks that endure automated sortation, together with linerless formats that reduce waste, is widening profit margins for converters that can supply high-performance, regulation-compliant products. Polyester retains the largest material slice, yet polypropylene's lower cost and printability are lifting its uptake in food and beverage lines. Regionally, Asia-Pacific enjoys scale advantages, while North America is moving fastest on premium, regulation-driven applications.

Global Laminated Labels Market Trends and Insights

E-commerce boom driving durable shipping labels

Surging online retail volumes have pushed parcel handling intensity up by more than 60%, exposing ordinary labels to temperature swings and mechanical shocks that cause delamination. ASTM D4169-22 now requires sequential hazard testing, prompting converters to engineer substrates that stay bonded to corrugate throughout distribution cycles. Sustainability goals add a removal-cleanly prerequisite so that labels do not disrupt fiber recycling streams. Linerless rolls such as OptiCut WashOff increase label yield by 50% and slash transport emissions, attracting logistics operators that track Scope 3 footprints. Converters report 15-20% higher margins on e-commerce-specific constructions, while digital print lets shippers embed real-time codes for tracking and returns management.

Packaged food and beverage demand surge

Urban lifestyles and single-serve preferences are lifting packaged food volumes, with India's packaging spend growing at 26.7% CAGR as brands court rising middle-class consumers. India's FSSAI now bans toluene in food-contact inks, pushing label makers toward low-migration chemistries and rigorous migration testing. Premium snack and beverage lines want metalized pressure-sensitive films that give brighter shelf appeal and barrier protection. Paper-based laminates from partnerships such as Saica-Mondelez target a 25% virgin-plastic cutback without losing heat-sealability. Regional supply diversification, especially within Asia-Pacific, is mitigating disruption risks and stimulating new local capacity additions.

Raw-material price volatility

Propylene feedstock is forecast to top 40 cents/lb by mid-2025 following refinery rationalizations, raising polyester and polypropylene film costs. December 2024 contracts already traded at 35.75 cents, telegraphing lasting inflation into 2026. Brady Corporation disclosed raw-material spikes as a chief drag on FY 2024 margins. Converters are exploring recycled or bio-based resins, yet volumes remain low and premiums high. Multi-supplier strategies and regional inventory buffers are becoming standard risk-management playbooks.

Other drivers and restraints analyzed in the detailed report include:

- Pharmaceutical serialization mandates

- Linerless laminated labels adoption

- Shift to metallized foils and shrink sleeves

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyester delivered the largest slice of the laminated label market at 35.45% in 2024 thanks to chemical resistance vital for pharma, chemical drum, and outdoor-exposure uses. Polypropylene's 7.48% CAGR through 2030 reflects food and beverage converters embracing its lower density, higher yield, and smoother print surface. EU rules dictating 30% recycled PET in packaging by 2030 are pushing buyers to recycled PET facestocks, though supply lags demand and prices remain elevated. Vinyl continues to decline amid REACH microplastics curbs. Bio-films are a niche today but attract brands pursuing compostable or bio-sourced messaging.

Looking ahead, recycled content mandates should tighten polyester's availability and buoy prices, possibly accelerating polypropylene's replacement rate in cost-sensitive SKUs. Simultaneously, R&D around bio-based PET and chemically recycled resins promises future volumes once scale materializes. Suppliers that can qualify recycled inputs without sacrificing clarity or stiffness will seize share as the laminated label market rewards low-carbon footprints.

Roll configurations dominated 58.35% of laminated label market share in 2024 because automated applicators in beverages, pharmaceuticals, and logistics depend on continuous web feeds. Sheet labels, though only 41.65%, clock a 6.54% CAGR on the back of digital presses that handle short runs for craft food, cosmetics, and seasonal campaigns. Automatic splicing systems like Unisplice 413 raised line uptime by 10%, reinforcing rolls' productivity advantage.

Sheets, however, let brand owners vary artwork across multiple SKUs without tooling, cutting inventory waste. As e-commerce microbrands proliferate, sheet demand will intensify for orders under 1,000 units where flexo setup costs are untenable. Linerless technology reinforces rolls' appeal, yet printer retrofits required for butt-cut webs may limit adoption to large fleet owners initially.

Laminated Labels Market is Segmented by Material Type (Polyester, Polypropylene (BOPP, CPP), Vinyl, and More), Form (Rolls, Sheets), Composition (Facestock, Adhesive), Printing Technology (Flexographic, Digital - Ink-Jet, and More), End-User Industry (Food and Beverage, Manufacturing and Industrial, Electronics and Appliances, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 41.34% of the laminated label market in 2024, buoyed by China's 6% industrial output rise and 12.7% jump in chemical manufacturing that secures film feedstocks. India's production-linked incentives aim for 25% GDP contribution from advanced manufacturing by 2025, enlarging domestic demand and export capacity. Multinationals such as Amcor added Gujarat capacity to serve regional snack and personal-care brands, confirming the region's scale and cost edge. Japan and South Korea contribute high-precision coating know-how, whereas Southeast Asia gains from supply-chain diversification.

North America, projected at an 8.32% CAGR, is propelled by DSCSA serialization, EPA solvent regulations, and rapid parcel-shipping growth. ASTM shipping standards and consumer preference for premium graphics position the region for value-added volumes. Mexico's role in near-shoring strengthens, illustrated by ProMach's Etiflex acquisition that expands RFID and variable-data offerings.

Europe maintains regulatory leadership through the Packaging and Packaging Waste Regulation, obliging full recyclability by 2028 and recycled-content thresholds that reshape material menus. FINAT's liner recycling drive and Germany's plant-based-ink transition underscore sustainability as the prime competitive lever. Eastern Europe may attract new coating lines as Western converters seek low-cost yet EU-compliant production bases.

Middle East & Africa and South America together form a smaller slice of the laminated label market but register brisk uptake as food-processing and agro-exporters adopt traceability stickers. Infrastructure gaps and currency swings restrain scale for now, though localized manufacturing might rise as governments court investment to cut import dependence.

- Avery Dennison Corporation

- CCL Industries Inc.

- 3M Company

- Coveris Holdings S.A.

- Torraspapel Adestor

- Constantia Flexibles Group GmbH

- R.R. Donnelley & Sons Company

- Flexcon Company Inc.

- Stickythings Ltd.

- Gipako Ltd.

- Hub Labels Inc.

- Cenveo Corporation

- Ravenwood Packaging Ltd.

- Reflex Labels Ltd.

- UPM Raflatac Oy

- Amcor plc

- Multi-Color Corporation

- Fuji Seal International Inc.

- SATO Holdings Corp.

- Lintec Corporation

- Zebra Technologies Corp.

- Brady Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom driving durable shipping labels

- 4.2.2 Packaged food and beverage demand surge

- 4.2.3 Pharmaceutical serialization mandates

- 4.2.4 Linerless laminated labels adoption

- 4.2.5 "Carbon-footprint" disclosure labels

- 4.3 Market Restraints

- 4.3.1 Raw-material price volatility

- 4.3.2 Shift to metallized foils and shrink sleeves

- 4.3.3 Solvent-borne ink and adhesive regulation

- 4.3.4 Closed-loop paper packs eliminating plastic labels

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Environmental Footprint Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Polyester

- 5.1.2 Polypropylene (BOPP, CPP)

- 5.1.3 Vinyl

- 5.1.4 Biodegradable Films

- 5.1.5 Other Material Type

- 5.2 By Form

- 5.2.1 Rolls

- 5.2.2 Sheets

- 5.3 By Composition

- 5.3.1 Facestock

- 5.3.2 Adhesive

- 5.3.3 Release Liner

- 5.4 By Printing Technology

- 5.4.1 Flexographic

- 5.4.2 Digital - Ink-jet

- 5.4.3 Digital - Electrophotography

- 5.4.4 Gravure

- 5.4.5 Offset

- 5.4.6 Screen / Letterpress

- 5.5 By End-user Industry

- 5.5.1 Food and Beverage

- 5.5.2 Manufacturing and Industrial

- 5.5.3 Electronics and Appliances

- 5.5.4 Pharmaceuticals and Healthcare

- 5.5.5 Personal Care and Cosmetics

- 5.5.6 Retail and Logistics

- 5.5.7 Other End-user Industry

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 France

- 5.6.2.3 Italy

- 5.6.2.4 Spain

- 5.6.2.5 United Kingdom

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 Saudi Arabia

- 5.6.4.1.2 United Arab Emirates

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Rest of Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Avery Dennison Corporation

- 6.4.2 CCL Industries Inc.

- 6.4.3 3M Company

- 6.4.4 Coveris Holdings S.A.

- 6.4.5 Torraspapel Adestor

- 6.4.6 Constantia Flexibles Group GmbH

- 6.4.7 R.R. Donnelley & Sons Company

- 6.4.8 Flexcon Company Inc.

- 6.4.9 Stickythings Ltd.

- 6.4.10 Gipako Ltd.

- 6.4.11 Hub Labels Inc.

- 6.4.12 Cenveo Corporation

- 6.4.13 Ravenwood Packaging Ltd.

- 6.4.14 Reflex Labels Ltd.

- 6.4.15 UPM Raflatac Oy

- 6.4.16 Amcor plc

- 6.4.17 Multi-Color Corporation

- 6.4.18 Fuji Seal International Inc.

- 6.4.19 SATO Holdings Corp.

- 6.4.20 Lintec Corporation

- 6.4.21 Zebra Technologies Corp.

- 6.4.22 Brady Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment