|

市场调查报告书

商品编码

1846270

安全雷射扫描器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Safety Laser Scanner - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

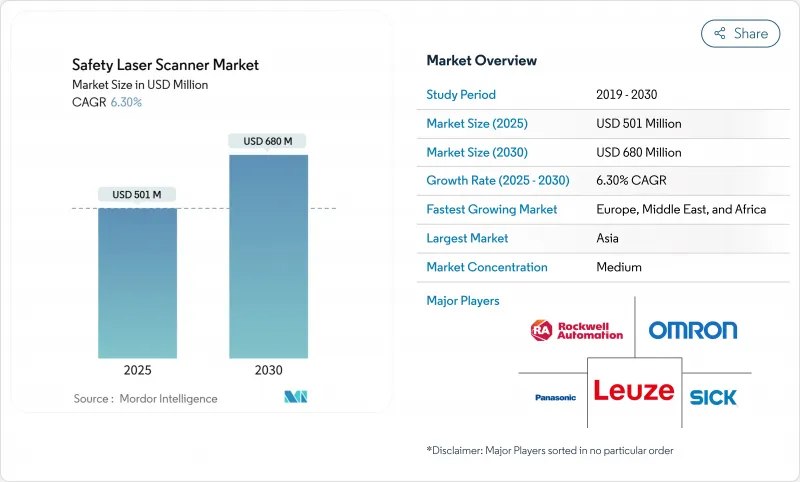

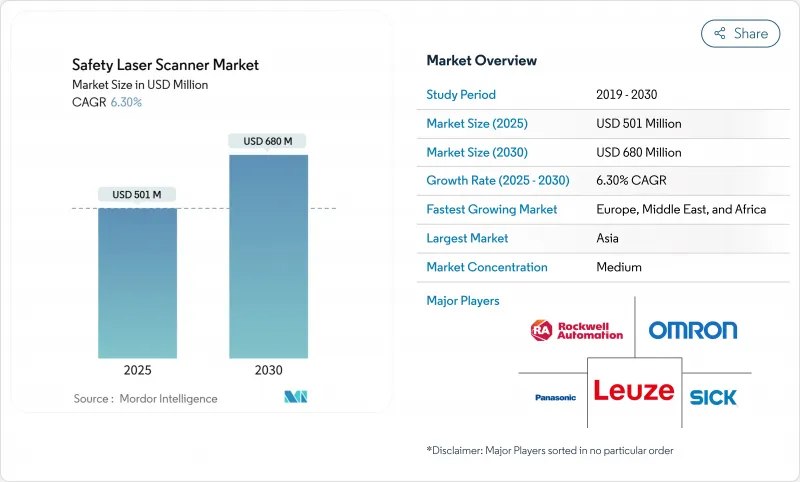

预计到 2025 年,安全雷射扫描仪市场规模将达到 5.01 亿美元,到 2030 年将达到 6.8 亿美元,复合年增长率为 6.3%。

亚太地区将以7.5%的复合年增长率成为成长最快的地区,这主要得益于中国电子自动化和日本「暗仓」计划的蓬勃发展。自动导引车(AGV)和自主移动机器人(AMR)的普及、ISO 13849-1和IEC 61496标准的实施,以及向整合工业4.0架构的预测性、数据丰富的安全系统转型,都推动了强劲的发展势头。市场竞争强度适中,领先供应商透过275度视野角、safeHDDM®滤波和板载分析等技术实现差异化,而新参与企业则致力于推广经济高效的3D超音波和视觉解决方案。巴西的NR-12和澳洲的IECEx等区域法规提高了市场进入门槛,但也为专用外壳和防爆设计带来了机会。

全球安全雷射扫描器市场趋势与洞察

欧洲内部物流枢纽快速采用自主移动机器人技术

欧洲的仓库正在部署每天执行超过1000次任务的自主移动机器人(AMR),例如ifm electronic GmbH公司的MiR100,其覆盖范围可达30公里。 ISO 3691-4标准要求动态保护区域变化,而固定防护装置无法满足这些变化。因此,具备多区域切换和乙太网路/IP介面的行动式安全雷射扫描仪正成为物料输送自动化不可或缺的关键推动因素,而不仅仅是合规设备。

德国汽车OEM厂商实施ISO 13849-1和IEC 61496标准

德国汽车製造商现在要求使用符合SIL3认证标准的扫描仪,并附带EN ISO 12100:2024风险评估文件。新标准涵盖网路安全设计以及基于人工智慧的危险预测和识别。提供自适应自诊断扫描器的供应商已获得优先供应商地位,但前期验证成本推高了系统价格。

巴西和阿根廷二级供应商的SIL2/PLd认证成本高昂

巴西的 NR-12 要求提供葡萄牙语文件并由现场工程师进行验证,这会使扫描仪的购买价格增加高达 20%,从而减缓小型供应商的采用速度并抑制该地区的增长,但同时也为拥有本地合规团队的供应商开闢了咨询业务的市场。

细分市场分析

到2024年,固定式雷射扫描器将占据安全雷射扫描器市场57.1%的份额,这得益于其在固定式压力机和输送机领域的成熟运作。然而,随着自主移动机器人(AMR)在仓库中日益普及,移动式雷射扫描器市场到2030年的复合年增长率(CAGR)将达到8.5%。行动式安全雷射扫描器市场预计到2030年将达到2.7亿美元,主要得益于其紧凑、节能的设计和符合ISO 3691-4标准。例如,Pilz公司的PSENscan最多可配置70个字段,使AMR能够在几毫秒内重新调整其防护功能。固定式雷射扫描器仍然主导着高精度汽车车体白线市场,在该市场中,可重复的防护几何形状比灵活性更为重要。

防护区域的偏好正在改变:5米扫描仪在覆盖范围和延迟之间取得了良好的平衡,预计到2024年将占总销量的42%,而配备优化光学系统的7米型号的年复合增长率将达到7.2%。同时,3D扫描仍将是复杂焊接单元的高端细分市场,而注重成本的买家则会继续选择坚固耐用的2D设备。

到2024年,输送机和包装应用将占总收入的33%,而区域防护和门禁控制领域将以7.5%的复合年增长率实现最快增长,这主要得益于更严格的人员安全法规。多区域扫描器现在取代了围绕机器人焊接工位和堆垛机的机械围栏,从而提高了生产线的灵活性。 SICK公司的microScan3可同时运作三个安全区域。随着保险公司要求认证,预计到2030年,用于区域防护的安全雷射扫描器的市占率将上升至37%。

AGV 和 AMR 目前占据第二大市场份额,但随着物流自动化获得大量资本预算(尤其是来自电商营运商的预算),它们很可能很快就会超越传送带。扫描器 OEM 厂商正在整合诊断网关,以便车队管理软体能够撷取健康资料并安排预测性维护,将运转率维持在 99% 以上。

全球安全雷射扫描器市场按类型(固定式安全雷射扫描器、行动安全雷射扫描器及其他)、应用领域(汽车、食品饮料及其他)、终端用户产业(汽车、医疗保健、製药)和地区(北美、欧洲、亚太及其他)进行细分。市场规模和预测均以美元计价。

区域分析

到2024年,欧洲将占据35%的收益,这主要得益于严格的CE设备指令和密集的整合商网路。同时,北欧地区的机器人技术正转向基于摄影机的系统,这给价格带来了压力,同时也加速了影像处理附加元件的普及。针对碳中和生产的区域津贴计画将进一步鼓励自动化,间接促进扫描仪的销售。

亚太地区正以7.5%的复合年增长率成长。中国的电子工厂需要整合协作机器人的速度和分离监控系统,而日本的物流公司则致力于实现无人值守营运。同时,台湾和韩国技术纯熟劳工短缺,促使市场对包含远距离诊断的承包安全解决方案的需求激增。印度的一级汽车供应商已开始试用乙太网路/IP扫描仪,以确保待开发区线的未来发展,但进口关税仍是限制其快速扩张的因素。

在北美,美国职业安全与健康管理局 (OSHA) 已核准雷射防护装置,明确了 NRTL 认证途径。金属成型中小企业的维修计划和新建电动车电池工厂正在推动市场需求。然而,对传统 CAN 网路的广泛依赖减缓了向资料丰富的乙太网路模型的过渡。南美洲正努力应对 NR-12 的成本负担,中小企业寻求更便宜的机械防护装置,而跨国 OEM 厂商则为了满足企业安全 KPI 而继续采购。非洲仍处于起步阶段,矿场开始采用配备扫描器的机器人钻机,但数量仍然很少。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧洲内部物流枢纽快速采用自主移动机器人技术

- 德国汽车OEM厂商实施ISO 13849-1和IEC 61496标准

- 为美国改造老旧机械设备以符合 OSHA 1910.212 标准

- 协作机器人在中国电子组装蓬勃发展

- 日本第三方物流公司的暗仓正在推动对270°行动扫描器的需求。

- 市场限制

- 巴西和阿根廷二级供应商的SIL2/PLd认证成本高昂

- 澳洲某矿场因粉尘引发的故障

- Nordic Robotics 的视觉安全摄影机正在降低价格

- 中东中小企业扫描器整合的技术工人缺口

- 价值/供应链分析

- 监理与技术展望

- 波特五力分析

- 新进入者的威胁

- 买方/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场规模与成长预测

- 按类型

- 固定式安全雷射扫描仪

- 行动安全雷射扫描仪

- 防护视野(3公尺、5公尺、7公尺)

- 扫描尺寸(2D、3D)

- 连接方式(乙太网路、CAN、IO-Link)

- 透过使用

- AGV 和 AMR

- 机器人单元

- 输送机和包装线

- 区域保护和门禁控制

- 按最终用户产业

- 汽车产业

- 饮食

- 医疗保健和製药

- 消费品和电子产品

- 物流/仓储

- 金属/重型机械

- 石油和天然气

- 按连接性

- Ethernet

- CAN

- IO-Link

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲国家

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率分析

- 公司简介

- SICK AG

- OMRON Corporation

- Keyence Corporation

- Leuze Electronic GmbH

- Panasonic Industrial Sensors

- Banner Engineering

- Hans Turck GmbH

- Hokuyo Automatic Co., Ltd.

- IDEC Corporation

- Pilz GmbH and Co. KG

- Datalogic SpA

- Rockwell Automation Inc.

- Arcus Automation Pvt Ltd.

- FARO Technologies, Inc.

- Hexagon AB

- Trimble Inc.

- Pepperl+Fuchs SE

- ABB Ltd.

- Blickfeld GmbH

- Slamcore Ltd.

第七章 市场机会与未来展望

The safety laser scanner market is valued at USD 501 million in 2025 and is forecast to expand to USD 680 million by 2030, advancing at a 6.3% CAGR.

Europe anchors demand with a 35% revenue contribution, while Asia-Pacific is set to post the fastest 7.5% CAGR, buoyed by Chinese electronics automation and "dark-warehouse" projects in Japan-and-r15-08-(industrial-mobile-robots)-implementation). Strong momentum comes from automated guided vehicles (AGVs) and autonomous mobile robots (AMRs), enforcement of ISO 13849-1 and IEC 61496, and a shift toward predictive, data-rich safety systems that integrate with Industry 4.0 architectures. Competitive intensity is moderate: leading vendors differentiate through 275-degree fields of view, safeHDDM(R) filtering, and on-board analytics, while new entrants push cost-efficient 3D ultrasonic or vision-based alternatives. Region-specific regulations, such as Brazil's NR-12 and Australia's IECEx mandates, raise entry barriers but also open opportunities for specialist housings and explosion-proof designs.

Global Safety Laser Scanner Market Trends and Insights

Rapid Adoption of AMRs in European Intralogistics Hubs

European warehouses now field AMR fleets exceeding 1,000 daily missions, such as ifm electronic GmbH's MiR100 deployment covering 30 km of routes. ISO 3691-4 obliges dynamic protective-field changes, which stationary guarding cannot meet. Consequently, mobile safety laser scanners with multi-zone switching and Ethernet/IP interfaces become essential enablers, rather than mere compliance devices, for material-handling automation.

ISO 13849-1 & IEC 61496 Enforcement at German Automotive OEMs

German carmakers now demand SIL3-validated scanners packaged with full EN ISO 12100:2024 risk-assessment files. New criteria include cybersecurity design and AI-based predictive hazard identification. Vendors that offer adaptive, self-diagnosing scanners secure preferred-supplier status, although upfront validation costs increase system pricing.

High SIL2/PLd Certification Costs for Brazilian & Argentine Tier-2 Suppliers

Brazil's NR-12 requires Portuguese documentation and on-site engineer validation, adding up to 20% of a scanner's purchase price. Smaller suppliers delay adoption, slowing regional growth yet opening consultancy niches for vendors with local compliance teams.

Other drivers and restraints analyzed in the detailed report include:

- Retrofitting Legacy Machinery in US SMEs for OSHA 1910.212 Compliance

- Collaborative-Robot Boom in Chinese Electronics Assembly

- Dust-Induced False Trips in Australian Mining Sites

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Stationary units retained 57.1% of the safety laser scanner market in 2024, supported by proven uptime on fixed presses and conveyors. Mobile variants, however, are tracking an 8.5% CAGR to 2030 as AMRs proliferate in warehouses. The safety laser scanner market size for mobile solutions is projected to reach USD 270 million by 2030, underpinned by compact battery-efficient designs and ISO 3691-4 compliance. Pilz's PSENscan, for instance, ships with up to 70 configurable fields, letting AMRs recalibrate protection in milliseconds. Stationary models still dominate high-precision automotive body-in-white lines where repeatable guard shapes outweigh flexibility.

Protective-field preference is shifting. Five-meter scanners captured 42% of 2024 revenue because they balance coverage and latency, whereas seven-meter models, equipped with optimized optics, will log a 7.2% CAGR. Meanwhile, 3D scanning remains a premium niche for complex welding cells, while cost-driven buyers stick with robust 2D units.

Conveyor and packaging applications drew 33% of 2024 revenue, but stricter personnel-safety rules elevate area protection & access control to the fastest 7.5% CAGR. Multi-zone scanners now ring robot welding bays and palletisers, replacing mechanical fences that impede line flexibility. SICK's microScan3 permits three separate safety fields running in parallel, a critical feature for dense packaging floors. The safety laser scanner market share for area protection is set to climb to 37% by 2030 as insurers demand certification evidence.

AGVs and AMRs form the second-largest bucket, yet they will soon eclipse conveyors because intralogistics automation receives the bulk of capital budgets, especially from e-commerce operators. Scanner OEMs embed diagnostic gateways so that fleet-management software can pull health data and schedule predictive maintenance, keeping uptime above 99%.

Global Safety Laser Scanners Market is Segmented Into Type(Stationary Safety Laser Scanners, Mobile Safety Laser Scanners, and More), Application(automotive, Food and Beverage, and More), End-User Industry (Automotive, Healthcare, and Pharmaceutical), and Geography (North America, Europe, Asia Pacific, and More ). The Market Sizes and Forecasts are Provided in Terms of Value in USD

Geography Analysis

Europe controlled 35% of 2024 revenue, leveraging strict CE machinery directives and a dense integrator network. German OEMs issue tightened procurement specs that elevate scanner functional safety, whereas Nordic robots shift to camera-based systems, creating price pressure yet also accelerating image-processing add-ons. Regional grant programs targeting carbon-neutral production further incentivize automation, indirectly lifting scanner sales.

Asia-Pacific is on course for a 7.5% CAGR. China's electronics plants require integrated Speed-and-Separation Monitoring for cobots, and Japan's logistics firms pursue lights-out operations. Meanwhile, skilled-labour shortages in Taiwan and Korea spur turnkey safety packages bundled with remote diagnostics. India's automotive Tier-1 suppliers begin piloting Ethernet/IP scanners to future-proof greenfield lines, yet import duties still curb rapid expansion.

North America benefits from OSHA endorsement of laser guarding and clearer NRTL certification pathways. Retrofit projects in metal-forming SMEs and new EV battery plants fuel demand. However, widespread reliance on legacy CAN networks slows the shift to data-rich Ethernet models. South America struggles with NR-12 cost burdens that push smaller outfits toward cheaper mechanical guards, though multinational OEMs maintain purchases to meet corporate safety KPIs. Africa remains nascent; mining enclaves adopt scanner-protected robotic drilling rigs but volumes stay low.

- SICK AG

- OMRON Corporation

- Keyence Corporation

- Leuze Electronic GmbH

- Panasonic Industrial Sensors

- Banner Engineering

- Hans Turck GmbH

- Hokuyo Automatic Co., Ltd.

- IDEC Corporation

- Pilz GmbH and Co. KG

- Datalogic SpA

- Rockwell Automation Inc.

- Arcus Automation Pvt Ltd.

- FARO Technologies, Inc.

- Hexagon AB

- Trimble Inc.

- Pepperl+Fuchs SE

- ABB Ltd.

- Blickfeld GmbH

- Slamcore Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption of AMRs in European Intralogistics Hubs

- 4.2.2 ISO 13849-1 and IEC 61496 Enforcement at German Automotive OEMs

- 4.2.3 Retrofitting Legacy Machinery in US SMEs for OSHA 1910.212 Compliance

- 4.2.4 Collaborative-Robot Boom in Chinese Electronics Assembly

- 4.2.5 Dark Warehouses in Japanese 3PL Driving 270° Mobile Scanner Demand

- 4.3 Market Restraints

- 4.3.1 High SIL2/PLd Certification Costs for Brazilian and Argentine Tier-2 Suppliers

- 4.3.2 Dust-Induced False Trips in Australian Mining Sites

- 4.3.3 Price Erosion from Vision-based Safety Cameras in Nordic Robotics

- 4.3.4 Skilled-Labour Gap for Scanner Integration in Middle-East SMEs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Stationary Safety Laser Scanners

- 5.1.2 Mobile Safety Laser Scanners

- 5.1.3 Protective-Field Range (3 m, 5 m, 7 m)

- 5.1.4 Scanning Dimension (2D, 3D)

- 5.1.5 Connectivity (Ethernet, CAN, IO-Link)

- 5.2 By Application

- 5.2.1 AGVs and AMRs

- 5.2.2 Robotic Cells

- 5.2.3 Conveyor and Packaging Lines

- 5.2.4 Area Protection and Access Control

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Food and Beverage

- 5.3.3 Healthcare and Pharmaceuticals

- 5.3.4 Consumer Goods and Electronics

- 5.3.5 Logistics and Warehousing

- 5.3.6 Metals and Heavy Machinery

- 5.3.7 Oil and Gas

- 5.4 By Connectivity

- 5.4.1 Ethernet

- 5.4.2 CAN

- 5.4.3 IO-Link

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 SICK AG

- 6.4.2 OMRON Corporation

- 6.4.3 Keyence Corporation

- 6.4.4 Leuze Electronic GmbH

- 6.4.5 Panasonic Industrial Sensors

- 6.4.6 Banner Engineering

- 6.4.7 Hans Turck GmbH

- 6.4.8 Hokuyo Automatic Co., Ltd.

- 6.4.9 IDEC Corporation

- 6.4.10 Pilz GmbH and Co. KG

- 6.4.11 Datalogic SpA

- 6.4.12 Rockwell Automation Inc.

- 6.4.13 Arcus Automation Pvt Ltd.

- 6.4.14 FARO Technologies, Inc.

- 6.4.15 Hexagon AB

- 6.4.16 Trimble Inc.

- 6.4.17 Pepperl+Fuchs SE

- 6.4.18 ABB Ltd.

- 6.4.19 Blickfeld GmbH

- 6.4.20 Slamcore Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment