|

市场调查报告书

商品编码

1846276

邮政自动化系统:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Postal Automation System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

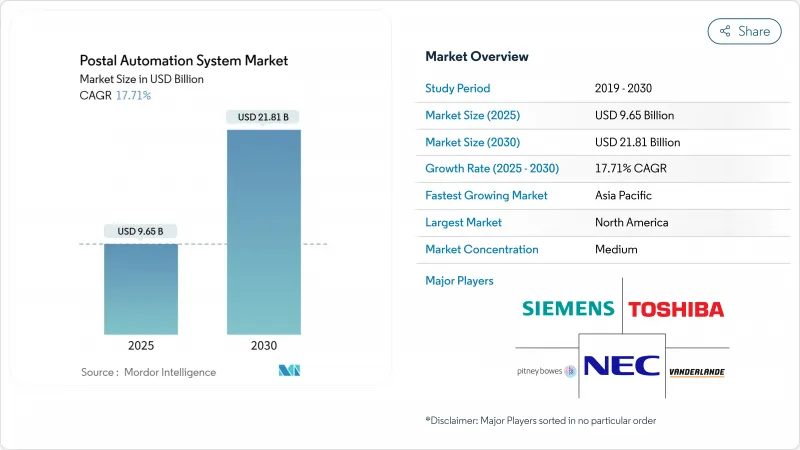

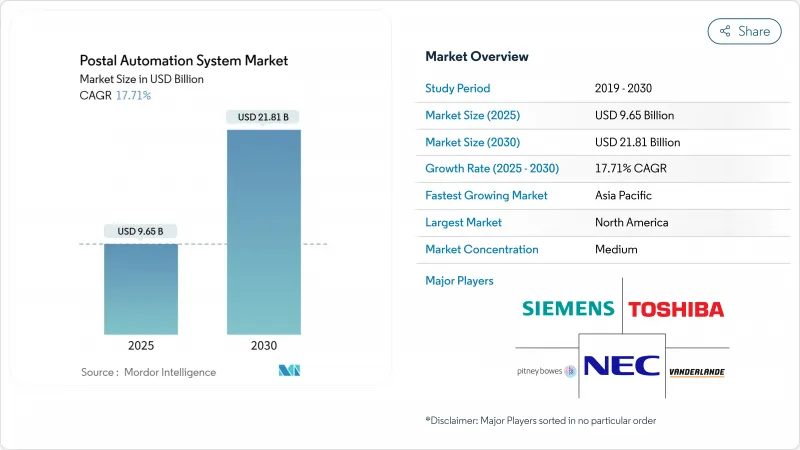

预计到 2025 年邮政自动化系统市场规模将达到 96.5 亿美元,到 2030 年将达到 218.1 亿美元,复合年增长率为 17.71%。

这一增长反映了跨境电子商务需求的不断增长、邮政现代化计划以及持续的人事费用压力,这些因素使得自动化在经济上具有吸引力。由于公共部门的大量投资和有利于下一代设备的能源效率法规,北美和欧洲的安装数量最多。随着中国邮政、菜鸟网路和日本邮政加快农村和都市区地区的自动化计划,亚太地区是一个快速成长的地区,这缩短了交货时间并降低了人事费用。虽然硬体仍然是主要的采购重点,但需求正在转向服务合约和机器人即服务模式,这些模式将效能风险转移给供应商。范德兰德收购西门子物流和 BlueCrest 收购 Fluence Automation 正在透过硬体和软体的整合重新定义规模优势。

全球邮政自动化系统市场趋势与洞察

跨境电商小包裹激增推动高吞吐量分类机的发展

跨境电商小包裹流量持续成长,预计到2023年,美国小包裹量将达到217亿件,儘管单件收入有所下降,但这凸显了对高效高吞吐量自动化的需求。亚马逊物流的包裹量已超过UPS,证明了速度优化的分类网路能够带来市场优势。中国邮政和菜鸟网路引入了自动读取运单的视觉引导系统,降低了农村地区的人事费用,缩小了都市区服务差距。自动化技术能够在不增加员工数量的情况下实现大量处理,因此营运商现在更重视处理密度而非单件成本。

美国邮政「为美国递送」现代化措施推动自动化升级

美国邮政总局 (USPS) 投资 400 亿美元进行网路现代化改造,将每日小包裹处理能力提升至 6,000 万个包裹,并简化和提升了邮件和小包裹流的可靠性。 Zebra Technologies 印表机、全新远端传输系统以及 USPS Ship 的迁移增强了物理自动化背后的数位层面。供应商正在利用 USPS 规范在全球扩展类似的解决方案,从而产生技术连锁反应,加速其他地区的采用。

传统 IT 整合的复杂性限制了新兴市场的采用

发展中的邮局通常采用过时的平台运营,无法轻鬆连接现代分拣机,从而延长了计划工期并增加了成本。国际货币基金组织指出,支付管道也面临类似的挑战,这反映了物流瓶颈,凸显了在先进自动化技术推广之前,基础数位基础设施的必要性。

細項分析

2024年,邮件分拣系统市场规模(归因于硬体)达到62亿美元,这反映了对资本密集输送机、感测器和光学字元辨识(OCR)的投资。服务收益基数较小,但预计到2030年将以20.8%的复合年增长率成长,因为营运商更注重管理成果而非设备所有权。软体授权连接了两者,支援即时效能仪錶板、路线优化和预测性维护,从而延长资产寿命。

Quadient 和 BlueCrest 透过采用基于绩效的合同,保证了吞吐量水准和运作,将风险转移给供应商。此类安排使中型企业无需前期投资即可使用高级功能,从而扩大了邮件分拣系统市场的潜在用户群。虽然硬体支出仍将保持高额,但收益结构分析表明,随着固定费率和按分类付费模式的推广,到 2030 年,服务收入将缩小差距。

得益于久经考验的交叉带式和翻盘式设计,小包裹分拣机将在2024年占据邮件分拣系统市场份额的42%。然而,成长动力将来自自动导引车和协作机器人,到2030年,其复合年增长率将达到24.1%。机器人技术打破了固定轨道的限制,使营运商能够快速重新配置枢纽,以应对季节性高峰。

根据法国邮政的数据,到2024年,其邮件收入份额将从2010年的52%下降到15.8%,这表明其业务结构将从以信件为中心的机器转向以小包裹为中心的机器人。彩色盖销机在高容量邮票领域占据一席之地,但整合了自动导引车(AGV)、视觉系统和编码模组的混合站点提供了更大的灵活性。供应商现在正在将车队管理软体与移动机器人捆绑在一起,从而提高受城市枢纽房地产限制的营运商的投资回报率。

区域分析

受美国邮政「Delivering for America」(为美国递送)计画的推动,北美地区引领全球销售成长。该计画投资400亿美元用于设施升级,并将每日递送能力提升至6,000万个包裹。加拿大也紧跟在后,采用机器人来缓解多伦多和温哥华等主要城市枢纽的劳动力短缺问题。稳定的管理体制和可预测的包裹流量缩短了回报期,使得供应商越来越倾向于在该地区儘早部署产品。

在《净零工业法案》的支持下,欧洲正经历强劲成长。该法案优先考虑节能设备,并加快了设备更换週期。在德国,邮政法的修订赋予了德国邮政在优化路线方面更大的灵活性,而DHL在邮件和小包裹分别拥有63%和40%的市场份额,为全国自动化带来了规模经济效益。在英国,DHL电子商务与Every的合併获得核准,这将创建一个每年可处理超过10亿小包裹的综合网络,并带来进一步的自动化投资。

亚太地区复合年增长率最高,这得益于中国邮政和菜鸟的自动化部署,以及日本为解决驾驶人而提案的500公里自动化输送机网路。韩国正在利用其先进的通讯基础设施来推广RFID分类技术,而印度则正努力应对设备关税问题,这导致计划成本不断上涨。人口分散的澳洲对机器人技术的兴趣日益浓厚,希望藉此灵活扩展远距运输能力。

拉丁美洲发展不平衡。墨西哥受益于与美国-墨西哥-加拿大协定(USMCA)的接近性,吸引了大量跨境小包裹,这为在北部枢纽部署自动化提供了理由。巴西的合规计画支持电子商务成长,但进口自动化产品的关税仍拖累整体拥有成本。阿根廷的经济波动延长了投资决策週期,限制了高端解决方案的市场渗透。

中东和非洲仍在发展中,但前景光明。海湾国家正在投资城市微型仓配设施,这需要一个紧凑的模组化系统,但在非洲,传统的IT障碍阻碍了其应用。旨在实现邮政基础设施现代化的国际援助计画或许能释放未来的需求,尤其是在智慧型手机主导的商业活动在主要城市走廊不断扩张的背景下。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 亚洲跨境电子商务小包裹数量激增

- 美国邮政「为美国递送」现代化

- 欧盟绿色交易推动节能係统更换

- 劳动力短缺和工资上涨将推动机器人垄断

- 日本和韩国采用基于RFID的分类技术

- 都市区的微型仓配将推动对小型分类机的需求

- 市场限制

- 非洲和拉丁美洲邮政系统中的遗留IT集成

- 资本密集投资,投资报酬率可达 7 年以上

- 欧洲信件数量下降

- 巴西和印度对自动化进口征收关税

- 价值/供应链分析

- 监管和技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 技术简介

第五章市场规模及成长预测

- 按解决方案

- 硬体

- 软体

- 服务

- 依技术

- 彩色移相器消除器 (CFC) 系统

- 信件分类器

- 平面邮件分类机

- 小包裹分类机

- 混合邮件分类机

- 编码、列印和 OCR 系统

- 自动导引车和机器人

- 其他的

- 按用途

- 小包裹

- 邮件分类

- 地址列印和标籤

- 资料撷取和OCR

- 最后一哩配送

- 枢纽自动化

- 按最终用户

- 国家邮政服务

- 宅配、速递和小包裹(CEP) 公司

- 履约中心

- 政府机关等

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚洲其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争态势

- 策略倡议

- 市占率分析

- 公司简介

- Siemens Logistics GmbH

- Toshiba Infrastructure Systems and Solutions Corp.

- NEC Corporation

- Pitney Bowes Inc.

- Vanderlande Industries BV

- Beumer Group GmbH and Co. KG

- Solystic SAS

- Fives Group

- Bowe Systec GmbH

- Interroll Holding AG

- BlueCrest Inc.

- Opex Corporation

- EuroSort Systems

- Honeywell Intelligrated

- Dematic(Kion Group)

- KUKA AG

- Zhejiang Libiao Robotics

- Fluence Automation LLC

- Leonardo SpA

- Engineering Production and Installation(EPI)

第七章 市场机会

- 閒置频段和未满足需求评估

The postal automation system systems market size was valued at USD 9.65 billion in 2025 and is forecast to grow at a 17.71% CAGR, reaching USD 21.81 billion by 2030.

Growth reflects rising cross-border e-commerce demand, postal modernization programs and sustained labor cost pressures that make automation economically attractive. North America and Europe account for the largest installed base because of sizeable public-sector investments and energy-efficiency regulations that favor next-generation equipment. Asia-Pacific is the fastest-growing region as China Post, Cainiao and Japan Post accelerate rural and urban automation projects, shortening delivery times and lowering manual labor costs. Hardware continues to dominate purchases, yet demand is shifting toward service contracts and robotics-as-a-service models that transfer performance risk to suppliers. Competitive intensity is moderate, with Vanderlande's purchase of Siemens Logistics and BlueCrest's acquisition of Fluence Automation redefining scale advantages in integrated hardware-software offerings.

Global Postal Automation System Market Trends and Insights

Surge in Cross-Border E-Commerce Parcel Volumes Driving High-Throughput Sorters

E-commerce parcels crossing borders continue to climb, with US parcel volumes reaching 21.7 billion in 2023 even as revenue per piece declined, underscoring the need for efficient high-throughput automation. Amazon Logistics overtook UPS on volume, proving that speed-optimized sorting networks confer a market edge. China Post and Cainiao lowered rural labor costs by deploying vision-guided systems that read waybills automatically, narrowing the urban-rural service gap. Operators now focus on processing density rather than cost per piece, since automation enables higher volumes without proportional staffing increases.

USPS "Delivering for America" Modernization Spurring Automation Upgrades

USPS committed USD 40 billion to revamp its network, expanding daily package capacity to 60 million items and aligning mail and parcel flows for improved reliability. Zebra Technologies printers, a new remote forwarding system, and the USPS Ship migration reinforce the digital layer underpinning physical automation. Suppliers leverage USPS specifications to scale similar solutions globally, creating a technology spill-over that accelerates adoption in other regions.

Legacy IT Integration Complexity Limiting Emerging Market Adoption

Developing posts often run on ageing platforms that cannot easily connect to modern sorters, extending project timelines and raising costs. The IMF highlights similar challenges in payment rails that mirror logistics bottlenecks, stressing a need for basic digital infrastructure before advanced automation can scale.

Other drivers and restraints analyzed in the detailed report include:

- Labor Shortages Accelerating Robotic Singulation Adoption

- EU Green Deal Demand for Energy-Efficient Systems

- Capital-Intensive Investments Deterring Small CEP Operators

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The mail sorting systems market size attributed to hardware reached USD 6.2 billion in 2024, reflecting capital-intensive conveyor, sensor and OCR investments. Services produced a smaller revenue base but are projected to grow at a 20.8% CAGR to 2030 as operators favor managed outcomes over outright equipment ownership. Software licenses bridge the two, enabling live performance dashboards, route optimization and predictive maintenance that extend asset life.

Adoption of outcome-based contracts shifts risk to vendors, with Quadient and BlueCrest guaranteeing throughput levels and uptime. These arrangements allow even mid-tier operators to access sophisticated capabilities without upfront capital, broadening the addressable base for the mail sorting systems market. Hardware spending will remain sizeable, yet revenue mix analysis shows services closing the gap by 2030 as subscription and pay-per-sort models scale.

Parcel sorters commanded 42% of the mail sorting systems market share in 2024 on the strength of long-established cross-belt and tilt-tray designs. Growth momentum, however, lies with automated guided vehicles and collaborative robots that post a 24.1% CAGR through 2030. Robotics removes fixed-track constraints, letting operators re-configure hubs quickly to manage seasonal peaks.

La Poste's data show mail contributing only 15.8% of revenue in 2024, down from 52% in 2010, signaling a structural shift away from letter-centric machinery toward parcel-centric robotics. Culler-facer-canceller units retain a niche in high-volume philatelic segments, but hybrid sites integrating AGVs, vision systems and coding modules deliver superior flexibility. Vendors now bundle fleet-management software with mobile robots, improving ROI for operators constrained by real estate limits in urban hubs.

The Postal Automation Systems Market Report is Segmented by Solution (Hardware, Software, Services), Technology (Parcel Sorters, Letter Sorters, AGV and Robotics, and More), Application (Parcel Sorting, Mail Sorting, Last-Mile Automation, and More), End User (Postal Operators, CEP Companies, E-Commerce Centers, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America leads global revenue owing to the USPS "Delivering for America" program that injects USD 40 billion into facility upgrades and boosts daily capacity to 60 million packages. Canada follows a similar trajectory, adopting robotics to mitigate labor shortages in large urban hubs such as Toronto and Vancouver. Stable regulatory regimes and predictable parcel flows shorten payback periods, reinforcing vendor preference for early product rollouts in the region.

Europe contributes robust growth underpinned by the Net Zero Industry Act, which prioritizes energy-efficient equipment and accelerates replacement cycles. Germany's updated postal law gives Deutsche Post flexibility to optimize routes, while DHL holds 63% mail and 40% parcel market shares, creating economies of scale for nationwide automation. The United Kingdom's approval of the DHL eCommerce-Evri merger forms a combined network processing more than 1 billion parcels annually, anchoring further automation investments.

Asia-Pacific records the fastest CAGR, propelled by China Post and Cainiao's automation deployments and Japan's proposed 500-kilometer automated conveyor network to counter driver shortages. South Korea leverages advanced telecom infrastructure to roll out RFID-enabled sortation, while India wrestles with equipment tariffs that raise project costs. Australia's dispersed population boosts interest in robotics that can flexibly scale capacity across long distances.

Latin America delivers uneven performance. Mexico benefits from USMCA proximity, attracting cross-border parcel flows that justify automation in northern hubs. Brazil's compliance program supports e-commerce growth, yet tariffs on imported automation remain a drag on total cost of ownership. Argentina's economic volatility prolongs investment decision cycles, limiting market penetration for high-end solutions.

The Middle East and Africa remain nascent but promising. Gulf states invest in urban micro-fulfillment facilities that demand compact modular systems, while Africa faces legacy IT hurdles that slow deployments. International aid programs targeting postal infrastructure modernization could unlock future demand, especially as smartphone-led commerce expands across major urban corridors.

- Siemens Logistics GmbH

- Toshiba Infrastructure Systems and Solutions Corp.

- NEC Corporation

- Pitney Bowes Inc.

- Vanderlande Industries B.V.

- Beumer Group GmbH and Co. KG

- Solystic SAS

- Fives Group

- Bowe Systec GmbH

- Interroll Holding AG

- BlueCrest Inc.

- Opex Corporation

- EuroSort Systems

- Honeywell Intelligrated

- Dematic (Kion Group)

- KUKA AG

- Zhejiang Libiao Robotics

- Fluence Automation LLC

- Leonardo S.p.A.

- Engineering Production and Installation (EPI)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in cross-border e-commerce parcel volumes in Asia

- 4.2.2 USPS "Delivering for America" modernization

- 4.2.3 EU Green Deal boosting energy-efficient system replacement sales

- 4.2.4 Labor shortages and wage inflation driving robotic singulation

- 4.2.5 RFID-enabled sorting adoption in Japan and South Korea

- 4.2.6 Urban micro-fulfilment increasing demand for compact sorters

- 4.3 Market Restraints

- 4.3.1 Legacy IT integration in Africa and LatAm postal systems

- 4.3.2 Capital-intensive investments with greater than 7-year ROI

- 4.3.3 Declining letter-mail volumes in Europe

- 4.3.4 Import tariffs on automation in Brazil and India

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Technology Snapshot

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Technology

- 5.2.1 Culler-Facer-Canceller (CFC) Systems

- 5.2.2 Letter Sorters

- 5.2.3 Flat Mail Sorters

- 5.2.4 Parcel Sorters

- 5.2.5 Mixed-Mail Sorters

- 5.2.6 Coding and Printing/OCR Systems

- 5.2.7 Automated Guided Vehicles and Robotics

- 5.2.8 Others

- 5.3 By Application

- 5.3.1 Parcel Sorting

- 5.3.2 Mail Sorting

- 5.3.3 Address Printing and Labelling

- 5.3.4 Data Capture and OCR

- 5.3.5 Last-Mile Delivery

- 5.3.6 Hub Automation

- 5.4 By End User

- 5.4.1 National Postal Operators

- 5.4.2 Courier, Express and Parcel (CEP) Companies

- 5.4.3 E-commerce Fulfilment Centers

- 5.4.4 Government Agencies and Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Siemens Logistics GmbH

- 6.3.2 Toshiba Infrastructure Systems and Solutions Corp.

- 6.3.3 NEC Corporation

- 6.3.4 Pitney Bowes Inc.

- 6.3.5 Vanderlande Industries B.V.

- 6.3.6 Beumer Group GmbH and Co. KG

- 6.3.7 Solystic SAS

- 6.3.8 Fives Group

- 6.3.9 Bowe Systec GmbH

- 6.3.10 Interroll Holding AG

- 6.3.11 BlueCrest Inc.

- 6.3.12 Opex Corporation

- 6.3.13 EuroSort Systems

- 6.3.14 Honeywell Intelligrated

- 6.3.15 Dematic (Kion Group)

- 6.3.16 KUKA AG

- 6.3.17 Zhejiang Libiao Robotics

- 6.3.18 Fluence Automation LLC

- 6.3.19 Leonardo S.p.A.

- 6.3.20 Engineering Production and Installation (EPI)

7 MARKET OPPORTUNITIES

- 7.1 White-space and Unmet-Need Assessment