|

市场调查报告书

商品编码

1846314

可再分散聚合物粉末:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Redispersible Polymer Powder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

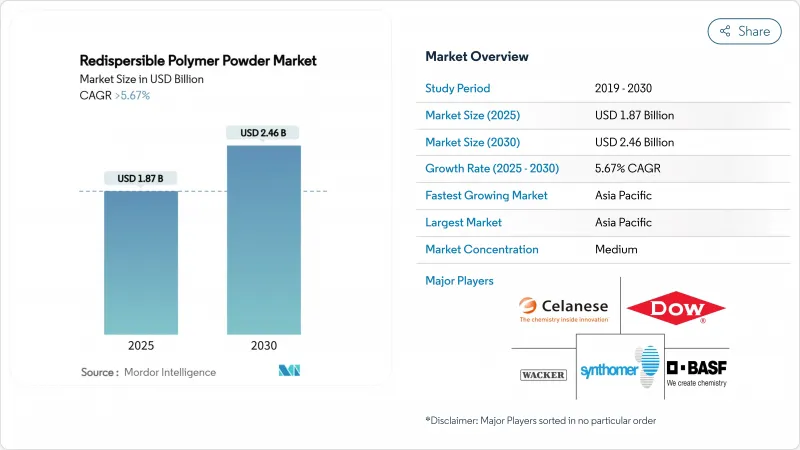

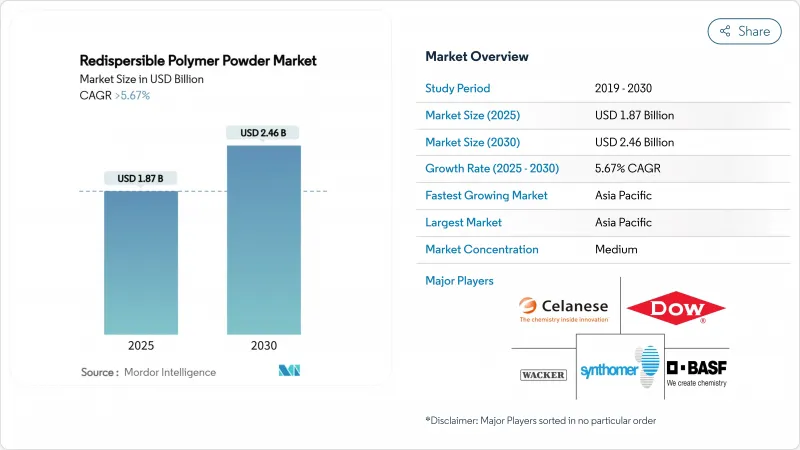

预计到 2025 年,可再分散聚合物粉末市场价值将达到 18.7 亿美元,到 2030 年将达到 24.6 亿美元,在预测期(2025-2030 年)内,复合年增长率将超过 5.67%。

随着政策制定者大力推广耐久节能建筑,高性能干粉砂浆添加剂的需求日益增长。新兴国家不断增加的基础设施支出将提供强劲的市场需求,而欧洲和北美地区的维修计划将推动产品创新,朝着低挥发性有机化合物(VOC)和生物基等级发展。自2024年起,醋酸乙烯单体价格的波动将对利润率构成压力,但主要製造商的垂直整合将有助于稳定供应。改良的喷雾干燥技术和专为3D列印混凝土订製的聚合物粉末正在拓展可再分散聚合物粉末市场的范围。

全球可再分散聚合物粉末市场趋势及洞察

新兴国家的建筑业蓬勃发展

中国的碳中和计画和印度的住房建设热潮占亚太地区消费量的60%以上,该地区的基础设施扩张也支撑着长期成长。BASF已向其湛江巴万德工厂投资100亿美元,以确保建筑聚合物的生产采用可再生能源。预计到2025年,印度的建筑化学品销售额将达到2,000亿卢比,而Master Builders Solutions公司则设定了到2028年实现50亿卢比销售的目标。沙乌地阿拉伯的NEOM计划已累计13亿沙特里亚尔用于机器人建造,这凸显了对适用于自动化组装的专用黏合剂的偏好。此类多年期公共专案确保了可再分散聚合物粉末市场在常规住房週期之外也能保持良好的发展前景。

快速过渡到预拌干砂浆体系

由于工厂生产的砂浆能够减少现场施工,并最大限度地降低混合误差,因此,从传统配料方式向标准化配方的转变正在全球范围内加速推进。德国和法国的早期应用已证明是迈向通用品质标准的有效途径,类似的政策倡议也正在美国主要大都会圈涌现。瓦克推出了VINNAPAS eco系列产品,该系列产品提供生物平衡的VAE粉末,专为自动化料仓和泵送而设计。预拌砂浆技术的进步提高了计量精度,使承包商能够满足更严格的瓷砖黏合剂剪切强度要求。在熟练技术纯熟劳工短缺的情况下,自动化计量提供了一种避免成本的策略,进一步扩大了可再分散聚合物粉末的市场。

醋酸乙烯单体和乙烯价格波动

自2024年起,原物料成本上涨迫使BASF和塞拉尼斯提高了部分醋酸盐衍生物的价格。塞拉尼斯采取的因应措施是在德克萨斯州新建一座年产130万吨的醋酸装置,并在南京新建一座年产7万吨的醋酸乙烯酯(VAE)产能提升装置,从而实现了规模经济。大型的、后向整合的集团公司正在寻求对冲风险,而缺乏长期合约的小型公司则面临利润率压力,这加速了可再分散聚合物粉末行业的整合进程。

细分市场分析

VAE凭藉其成本竞争力以及广泛的应用范围(包括瓷砖黏合剂、抹灰材料和自流平化合物),预计到2024年将占据可再分散聚合物粉末市场47.18%的份额。集中的需求带来了规模经济效益,从而支撑了其目前的价格主导。然而,高端建筑的兴起正在加速VAE-VeoVa系列产品的普及,其复合年增长率高达6.21%。 VAE-VeoVa系列产品是外墙隔热系统的首选,因为在气候压力下,耐碱性和柔韧性至关重要。丙烯酸粉末在紫外线照射下的建筑幕墙中占有一席之地,而乙烯-氯乙烯混合物则用于需要耐化学腐蚀的工业涂料。

成长前景取决于生产商维持喷雾干燥稳定性的能力。瓦克(WACKER)的可再生资源基底产品线旨在降低碳足迹,同时不降低剪切强度。塞拉尼斯(Celanese)推出了经认证的生物基ECO-B醋酸乙烯酯,以满足建筑商对永续性声明的需求。因此,可再分散聚合物粉末市场正面临两大驱动力:醋酸乙烯酯(VAE)的销售成长和特种子类型的利润成长。

区域分析

亚太地区将主导可再分散聚合物粉末市场,预计到2024年将占全球销售量的45.28%,并维持5.97%的最快复合年增长率。政府对铁路、公路和保障性住房计划的奖励策略正在推动基准用量的成长,而中国的碳中和目标也促进了环保认证聚合物等级的需求。像西卡在中国和印尼的双工厂这样的製造商,如果能够实现产能在地化,就能在确保供应可靠性的同时,获得关税和运费方面的优惠。这将导致全球需求结构性地向该地区倾斜。

由于严格的能源性能法规和庞大的维修库存,北美和欧洲保持了其市场份额。美国能源部2.4亿美元的津贴将鼓励各州采纳领先立法,并引导建筑商采用能减少热桥效应的聚合物解决方案。欧盟关于隐含碳报告的指令将加速生物基VAE(VeoVa)粉末的普及。这两个地区成熟的分销网络能够实现定制等级产品的即时交付,从而保证了稳健的利润率,即使其绝对增长率落后于亚太地区。

南美洲和中东/非洲地区将推动经济成长,因为特大城市正在建造交通走廊,并使沿海基础设施具备应对气候变迁的能力。沙乌地阿拉伯耗资13亿沙特里亚尔的基于机器人技术的NEOM计画制定了有利于耐用黏合剂的采购通讯协定。巴西正将基础设施奖励策略用于下水道和道路维修,从而刺激了对用于修补砂浆的聚合物的需求。当地供不应求促使企业与全球公司成立合资企业,这些企业在利用国内原材料的同时进行技术转移。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 新兴国家的建筑业蓬勃发展

- 快速过渡到预拌干砂浆体系

- 装修中对高性能磁砖黏合剂的需求

- 政府节能建筑标准

- 采用可再分散聚合物黏合剂的3D列印混凝土配方

- 市场限制

- 醋酸乙烯单体和乙烯价格波动

- 实现稳定喷雾干燥品质的技术复杂性

- 加强对保护性胶体的VOC监管

- 价值链分析

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按类型

- 醋酸乙烯酯(VAE)

- 醋酸乙烯酯/维萨提酸乙烯酯(VAE-VeoVa)

- 丙烯酸粉末

- 其他类型(乙烯-氯乙烯、苯乙烯-丁二烯等)

- 透过使用

- 石膏和抹灰

- 磁砖黏合剂

- 水泥浆

- 砂浆添加剂

- 其他应用(例如外墙外保温组合系统(ETICS)等)

- 按最终用户行业划分

- 住房

- 商业的

- 业/设施

- 基础设施

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧国家

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率(%)/分析

- 公司简介

- Acquos

- ADA FINE CHEMICALS CO.,LTD

- Anhui Elite Industrial Co.,ltd

- Ashland

- BASF SE

- Bosson Union Tech(Beijing)Co.,Ltd

- Celanese Corporation

- Celotech Chemical Co., Ltd.

- DCC(Dairen Chemical Corporation)

- Dezhou Tengda Construction New Materials Co. , Ltd.

- Dow Inc.

- Hebei Derek Chemical Limited

- Hexion Inc.

- JSC Pigment

- Organik Kimya.

- Oscrete Construction Products

- Sakshi Chem Sciences Pvt. Ltd.

- SIDLEY CHEMICAL CO.,LTD.

- Synthomer plc

- Vinavil SpA

- Wacker Chemie AG

第七章 市场机会与未来展望

The Redispersible Polymer Powder Market size is estimated at USD 1.87 billion in 2025, and is expected to reach USD 2.46 billion by 2030, at a CAGR of greater than 5.67% during the forecast period (2025-2030).

A steady preference for high-performance dry-mortar additives is raising demand as policymakers push for durable and energy-efficient buildings. Expanding infrastructure spending across emerging economies adds a strong volume base, while renovation programs in Europe and North America redirect product innovation toward low-VOC and bio-based grades. Volatile vinyl acetate monomer prices after 2024 compressed margins, yet vertical integration by leading producers helped to stabilize supply. Technology upgrades in spray-drying, along with polymer powders tailored for 3D-printed concrete, are widening the practical scope of the redispersible polymer powder market.

Global Redispersible Polymer Powder Market Trends and Insights

Construction Boom in Emerging Economies

Infrastructure expansion in Asia-Pacific underpins long-term growth as China's carbon-neutrality roadmap and India's housing drive collectively deliver more than 60% of regional consumption. BASF allocated USD 10 billion to its Zhanjiang Verbund site, ensuring renewable-powered production of construction polymers. India's construction chemicals revenue touched INR 20,000 crore in 2025, and Master Builders Solutions set a turnover target of INR 500 crore by 2028. Saudi Arabia's NEOM project earmarked SAR 1.3 billion for robotics-enabled building, which highlights a preference for specialty binders capable of supporting automated assembly. Such multi-year public programs guarantee visibility for the redispersible polymer powder market far beyond routine housing cycles.

Rapid Shift to Ready-Mix Dry-Mortar Systems

Factory-produced mortars cut job-site labor and minimize mixing inconsistencies, accelerating the worldwide transition from traditional batching to standardized formulations. Early adoption in Germany and France has proven the pathway for universal quality standards, and similar policy moves emerge in large U.S. metropolitan areas. Wacker introduced its VINNAPAS eco range to deliver bio-balanced VAE powders designed for automated silos and pumps. Ready-mix growth improves dosing accuracy, allowing contractors to meet stricter tile adhesive shear strength requirements. As skilled labor shortages worsen, automated dosing becomes a cost-avoidance strategy that further enlarges the redispersible polymer powder market.

Volatility in Vinyl-Acetate Monomer and Ethylene Prices

Feedstock spikes since 2024 forced BASF and Celanese to raise prices for several acetate derivatives. Celanese responded with a 1.3 million-ton acetic-acid unit in Texas and a 70 kt VAE debottleneck in Nanjing to capture scale economies. Larger groups with backward integration hedge risks, yet small firms lacking long-term contracts face margin compression, amplifying consolidation inside the redispersible polymer powder industry.

Other drivers and restraints analyzed in the detailed report include:

- Renovation-Led Demand for High-Performance Tile Adhesives

- Government Energy-Efficient Building Codes

- Stricter VOC Limits on Protective Colloids

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

VAE controlled 47.18% of redispersible polymer powder market share in 2024 owing to its competitive cost and broad utility across tile adhesives, renders, and self-leveling compounds . Demand concentration allows economies of scale that underpin current price leadership. An uptick in premium construction jobs, however, is accelerating the adoption of VAE-VeoVa grades that grow at a 6.21% CAGR. Formulators prefer VAE-VeoVa for exterior insulation systems where alkaline resistance and flexibility are critical under climate stress. Acrylic powders sustain a niche in UV-exposed facades, whereas ethylene-vinyl-chloride blends serve industrial coatings that need chemical endurance.

Growth prospects hinge on producers' capacity to maintain steady spray-drying consistency. Wacker's renewable resource-based range targets carbon-footprint reductions without dampening shear strength. Celanese debuted Vinyl Acetate ECO-B with certified bio-content, catering to builders seeking verifiable sustainability claims. The redispersible polymer powder market thus shows dual momentum: volume security in VAE and margin growth in specialty subtypes.

The Redispersible Polymer Powder Market Report is Segmented by Type (Vinyl Acetate-Ethylene, Vinyl Acetate/Vinyl Ester of Versatic Acid, and More), Application (Plasters and Renders, Tile Adhesives, and More), End-User Industry (Residential, Commercial, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominates the redispersible polymer powder market, recording 45.28% of global volume in 2024 and sustaining the fastest 5.97% CAGR. Government stimulus for rail, highway, and affordable housing projects amplifies baseline usage, while Chinese carbon-neutral targets encourage eco-certified polymer grades. Producers that localize capacity, as Sika did with twin plants in China and Indonesia, secure customs and freight benefits while ensuring supply reliability. The result is a structural tilt in global demand toward the region.

North America and Europe preserve share through stringent energy-performance regulations and large renovation stock. The U.S. DOE grant pool of USD 240 million elevates state adoption of advanced codes and steers builders toward polymer solutions that cut thermal bridging. EU directives on embodied-carbon reporting accelerate adoption of bio-based VAE-VeoVa powders. Mature distribution networks in both regions enable just-in-time delivery of customized grades, which explains robust margins even though absolute growth trails Asia-Pacific.

South America and Middle-East and Africa add a growth flank as megacities overhaul transport corridors and climate-proof coastal infrastructure. Saudi Arabia's SAR 1.3 billion robotics-based NEOM agenda sets procurement protocols that favor high-durability binders. Brazil channels infrastructure stimulus toward sewer and road rehabilitation, spurring polymer demand in repair mortars. Local supply gaps invite joint ventures with global players that transfer technology while leveraging indigenous raw materials.

- Acquos

- ADA FINE CHEMICALS CO.,LTD

- Anhui Elite Industrial Co.,ltd

- Ashland

- BASF SE

- Bosson Union Tech(Beijing) Co.,Ltd

- Celanese Corporation

- Celotech Chemical Co., Ltd.

- DCC (Dairen Chemical Corporation)

- Dezhou Tengda Construction New Materials Co. , Ltd.

- Dow Inc.

- Hebei Derek Chemical Limited

- Hexion Inc.

- JSC Pigment

- Organik Kimya.

- Oscrete Construction Products

- Sakshi Chem Sciences Pvt. Ltd.

- SIDLEY CHEMICAL CO.,LTD.

- Synthomer plc

- Vinavil S.p.A.

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Construction Boom in Emerging Economies

- 4.2.2 Rapid Shift to Ready-Mix Dry-Mortar Systems

- 4.2.3 Renovation-Led Demand for High-Performance Tile Adhesives

- 4.2.4 Government Energy-Efficient Building Codes

- 4.2.5 3D-Printed Concrete Formulations Adopting Redispersible Polymer Binders

- 4.3 Market Restraints

- 4.3.1 Volatility Iin Vinyl-Acetate Monomer and Ethylene Prices

- 4.3.2 Technical Complexity in Achieving Consistent Spray-Dry Quality

- 4.3.3 Stricter VOC Limits on Protective Colloids

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Vinyl Acetate-Ethylene (VAE)

- 5.1.2 Vinyl Aceteate/Vinayl Ester of Versatic Acid (VAE-VeoVa)

- 5.1.3 Acrylic Powders

- 5.1.4 Other Types (Ethylene-Vinyl Chloride, Styrene-Butadiene, etc.)

- 5.2 By Application

- 5.2.1 Plasters and Renders

- 5.2.2 Tile Adhesives

- 5.2.3 Grouts

- 5.2.4 Mortar Additives

- 5.2.5 Other Applications (External Thermal Insulation Composite Systems (ETICS), etc.)

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial / Institutional

- 5.3.4 Infrastructure

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Analysis Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Acquos

- 6.4.2 ADA FINE CHEMICALS CO.,LTD

- 6.4.3 Anhui Elite Industrial Co.,ltd

- 6.4.4 Ashland

- 6.4.5 BASF SE

- 6.4.6 Bosson Union Tech(Beijing) Co.,Ltd

- 6.4.7 Celanese Corporation

- 6.4.8 Celotech Chemical Co., Ltd.

- 6.4.9 DCC (Dairen Chemical Corporation)

- 6.4.10 Dezhou Tengda Construction New Materials Co. , Ltd.

- 6.4.11 Dow Inc.

- 6.4.12 Hebei Derek Chemical Limited

- 6.4.13 Hexion Inc.

- 6.4.14 JSC Pigment

- 6.4.15 Organik Kimya.

- 6.4.16 Oscrete Construction Products

- 6.4.17 Sakshi Chem Sciences Pvt. Ltd.

- 6.4.18 SIDLEY CHEMICAL CO.,LTD.

- 6.4.19 Synthomer plc

- 6.4.20 Vinavil S.p.A.

- 6.4.21 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment