|

市场调查报告书

商品编码

1846357

特种酵素:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)Specialty Enzymes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

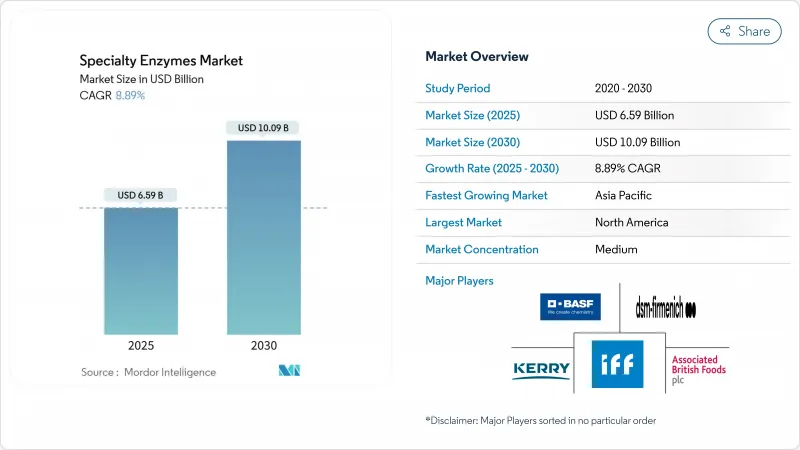

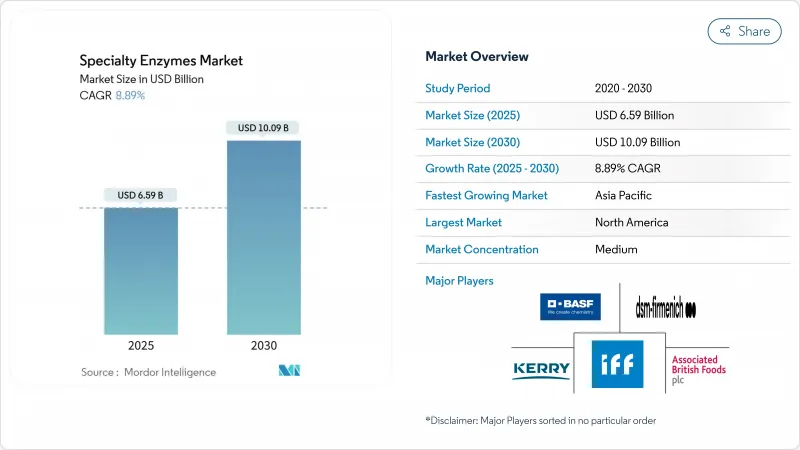

预计到 2025 年,特种酵素市场规模将达到 65.9 亿美元,到 2030 年将扩大到 100.9 亿美元,复合年增长率为 8.89%。

生物催化在药物合成中的快速应用、对环境友善工业加工日益增长的需求以及酶核准药物的广泛获批,共同推动了这一成长趋势。人工智慧引导的酵素工程研发投入正将研发週期从数年缩短至数月,从而促进快速商业化并降低成本壁垒。这些进步使製造商能够在满足不断变化的行业需求的同时,保持成本效益。有利于绿色化学的监管奖励,以及消费者对天然配方的偏好,正促使製造商转向重组酶和植物来源酶。诸如CelOCE这样的突破性技术——一种能够将纤维素转化效率提高一倍的金属酶——凸显了酶创新在生质燃料和其他资源密集型行业中的变革潜力。此类创新可望显着提高各种应用领域的永续性和营运效率。

全球特种酵素市场趋势与洞察

在製药生产中越来越多地采用环境友善生物催化剂

为了遵守环境法规并优化生产成本,製药公司正采用生物催化技术取代传统的化学催化剂。食品药物管理局(FDA) 将于 2025 年对包括 POMBILITI 和 EPKINLY 在内的生技药品进行监管审查,这预示着基于酶的治疗药物的核准流程将得到简化。与传统方法相比,工程酶能够以更高的选择性和更少的废弃物来生产掌性药物中间体。计算设计工具缩短了酵素的开发週期,使製药公司能够更有效率地开发用于特定药物合成路线的生物催化剂。这种转变在生技药品生产中至关重要,因为酵素的特异性可以减少纯化的需求。酶的应用范围正在扩展到基于酶的药物递送系统和用于治疗遗传疾病的酶,这为特种酶生产商创造了新的商机。

政府透过政策和资金支持推动市场成长。

政府倡议正透过政策架构和直接资助,加速特种酵素市场的发展,这些措施支持研究、商业化和产业应用。政府提供津贴、税收优惠和官民合作关係(PPP)项目,以支持生物製药、诊断、食品加工和工业生物催化等领域的酵素创新研发。印度的BioE3计画是政府在生物技术领域的一项重大倡议,该计画拨款919.7亿印度卢比(约合11亿美元)用于建立生物基化学品和酵素的生物製造中心。该计画的目标是到2030年实现3,000亿美元的生物经济规模,使酵素成为包括精准生物治疗和气候适应型农业在内的六大领域的关键组成部分。中国更新后的食品安全监管体系透过强制性报名手续,为酵素生产商创造了机会,该程序有利于那些拥有良好安全记录的公司。欧盟对食品酵素的上市前核准要求规范了安全评估,并降低了合规生产商的市场进入门槛。

定制酶的生产成本高昂

客製化酵素的设计、工程和规模化生产涉及复杂的流程,需要对先进技术、熟练劳动力和品管措施进行大量投资。对特殊原材料的需求以及严格的监管合规性增加了生产成本。为特定工业流程客製化酵素需要大量的研发投入,开发週期通常超过两到三年,才能实现商业化。中小型生物技术公司在从实验室生产扩展到商业规模生产方面面临巨大的挑战。必要的发酵基础设施需要大量的资本投入和专业知识。工业酵素和药用酵素的价格差异反映了它们各自的价值提案:药用蛋白每公斤价格高达数千美元,而工业酵素每公斤价格仅为几十美元。为了符合不同最终用途的监管标准,需要专门的纯化製程和品管系统,这会影响生产成本。

细分市场分析

由于重组DNA技术在酵素生产中具有扩充性和成本优势,微生物来源酵素预计在2024年将占68.84%的市场份额。受消费者对天然成分的需求以及食品和化妆品应用领域对永续性要求的推动,植物来源酶预计将以9.97%的复合年增长率增长(2025-2030年)。由于伦理问题和监管限制,动物来源酵素的需求正在下降,尤其是在欧洲市场,该市场对替代供应来源的需求日益增长。

微生物酶因其在可控发酵环境中生产而占据较高的市场份额,与植物或动物组织萃取物相比,这不仅确保了品质的稳定性,还降低了污染风险。微生物生产系统正利用合成生物学的进步来开发生产菌株,从而提高酶的分泌效率并最大限度地减少产品特异性产物的产生。从农业废弃物中提取酵素的新型萃取方法为植物来源酵素的生产提供了支持,这不仅为循环经济创造了机会,也降低了原料成本。

液体製剂将在2024年占据市场主导地位,市场份额高达57.23%,预计到2030年将以10.47%的复合年增长率增长,这主要得益于其卓越的性能和广泛的应用范围。干粉酶製剂在一些特殊应用领域仍占有一席之地,这些领域对延长保质期和降低运输成本至关重要,尤其是在动物饲料和工业清洗领域。市场对液体製剂的偏好源于其即时生物利用度和无需溶解即可无缝整合到生产过程中的优势。近年来,稳定化技术的进步显着提高了液体酵素的保质期,克服了以往液体製剂相对于干粉製剂的一个主要限制。

非水液体体係正日益被应用于需要更高基材溶解度和更低反馈抑制的领域。浓缩液体配方可在保持酵素活性的同时降低储存和运输成本。干粉配方也随着先进的喷雾干燥和冷冻干燥技术的进步而不断改进,这些技术能够在脱水过程中保持酵素的结构和活性。

区域分析

2024年,北美占据了特种酵素市场33.22%的份额,这得益于其强大的医药研发体系和高效的监管环境,后者有利于酵素製剂的核准。该地区的顶尖大学正在引领人工智慧主导的酵素设计,推动本土创新。此外,支持永续生产的税收优惠政策促进了酵素在各种工业流程中的应用,巩固了北美的市场主导地位。该地区对技术进步和产学伙伴关係的高度重视,进一步增强了其在全球市场的竞争力。

同时,亚太地区预计将以10.04%的复合年增长率占据市场主导地位。扶持政策和固有的成本优势是推动这一成长的主要动力。印度的BioE3策略,以及中国修订后的食品酶法规,为市场准入铺平了道路。此外,该地区低廉的生产成本、高素质的人才储备和先进的基础设施也吸引全球酵素生产商。尤其是在四方机制架构下进行的合作研发,正协助亚太地区实现成为酵素生产中心的愿景。该地区对生物技术的日益重视以及政府为提升酵素生产能力所采取的支持性倡议,进一步促进了该地区的快速成长。

欧洲、南美洲以及中东和非洲地区也都取得了长足进展。欧洲的优势在于其严格的安全通讯协定和先进的永续性议程。此外,该地区对绿色化学和环保酵素应用的重视,与永续性目标相契合,也有助于进一步扩大市场。同时,在南美,受益于有利的贸易协定和生物经济倡议,巴西和阿根廷的生物技术企业正在推动食品和农业领域的成长。中东和非洲地区则因加强医疗保健和解决粮食安全问题而取得进展。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 在製药生产中越来越多地采用环境友善生物催化剂

- 政府透过政策和资金支持推动市场成长。

- 酶工程和定向进化的进展

- 化妆品和皮肤科领域对酵素去角质的需求

- 对酵素伤口清除产品的需求激增

- 人们对绿色化学和永续工业过程的兴趣日益浓厚

- 市场限制

- 定制酶的生产成本高昂

- 保质期短和稳定性挑战

- 酵素疗法中过敏反应和免疫抗原性的风险

- 使用动物性酵素的伦理问题

- 供应链分析

- 监理展望

- 五力分析

- 新进入者的威胁

- 买方/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场规模与成长预测

- 按原料

- 植物

- 微生物

- 动物

- 按形式

- 液体

- 烘干

- 按类型

- 碳水化合物降解酶

- 蛋白酶

- 脂肪酶

- 其他的

- 透过使用

- 饮食

- 製药

- 餵食

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 荷兰

- 义大利

- 瑞典

- 波兰

- 比利时

- 其他欧洲

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 印尼

- 泰国

- 新加坡

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥伦比亚

- 秘鲁

- 其他南美洲

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 沙乌地阿拉伯

- 埃及

- 摩洛哥

- 土耳其

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市场排名分析

- 公司简介

- International Flavors & Fragrances

- DSM-Firmenich AG

- Kerry Group plc

- BASF SE

- Associated British Foods plc

- Amano Enzyme

- Novozymes A/S

- Specialty Enzymes & Probiotics

- Suntaq International Limited

- Biocatalysts Ltd.

- Advanced Enzyme Technologies

- ENZIQUIM

- Nagase America LLC

- AST Enzymes

- Sunson Industry Group

- Enzyme Development Corporation

- Antozyme Biotech Pvt Ltd,

- NOOR ENZYMES(DWC)LLC

- Bioseutica BV

- Apex International

第七章 市场机会与未来展望

The specialty enzymes market size stands at USD 6.59 billion in 2025 and is projected to advance to USD 10.09 billion by 2030, reflecting an 8.89% CAGR.

Rapid adoption of biocatalysts in pharmaceutical synthesis, a rising demand for eco-friendly industrial processing, and broader therapeutic approvals for enzyme-based medicines drive the growth trajectory. Investments in AI-guided enzyme engineering have shortened development cycles from years to months, facilitating quicker commercialization and reducing cost barriers. These advancements are enabling manufacturers to meet evolving industry demands while maintaining cost efficiency. Regulatory incentives favoring greener chemistries, combined with consumer preferences for natural formulations, are pushing manufacturers towards recombinant and plant-derived enzymes. Breakthroughs like the CelOCE metalloenzyme, which can double cellulose conversion efficiency, highlight the transformative potential of enzyme innovation in biofuels and other resource-intensive industries. Such innovations are expected to significantly enhance sustainability and operational efficiency across various applications.

Global Specialty Enzymes Market Trends and Insights

Increasing Adoption of Eco-friendly Biocatalysts in Pharmaceutical Manufacturing

Pharmaceutical manufacturers are adopting biocatalysts instead of traditional chemical catalysts to comply with environmental regulations and optimize manufacturing costs. The Food and Drug Administration (FDA)'s regulatory review periods for biologics, including POMBILITI and EPKINLY in 2025, indicate streamlined approval processes for enzyme-based therapeutics . Engineered enzymes enable the production of chiral pharmaceutical intermediates with improved selectivity and reduced waste compared to traditional methods. Computational design tools have shortened enzyme development cycles, enabling pharmaceutical companies to develop biocatalysts for specific drug synthesis routes more efficiently. This transition is significant in biologics production, where enzyme specificity reduces purification requirements. The applications have expanded to enzyme-based drug delivery systems and therapeutic enzymes for genetic disorders, creating new opportunities for specialty enzyme manufacturers.

Government Support Drives Market Growth Through Policy and Funding

Government initiatives are accelerating the growth of the specialty enzymes market through policy frameworks and direct funding that support research, commercialization, and industrial adoption. Governments provide grants, tax incentives, and public-private partnership (PPP) programs to support research and development in enzymatic innovations across biopharmaceuticals, diagnostics, food processing, and industrial biocatalysis sectors. India's BioE3 policy represents a major government intervention in biotechnology, with an allocation of INR 9,197 crore (USD 1.1 billion) to establish biomanufacturing hubs for bio-based chemicals and enzymes. The policy aims to achieve a USD 300 billion bioeconomy by 2030, identifying enzymes as essential components across six areas, including precision biotherapeutics and climate-resilient agriculture . China's updated food safety regulatory system has created opportunities for enzyme manufacturers through mandatory registration procedures that benefit established companies with proven safety records . The European Union's pre-market approval requirements for food enzymes have standardized safety assessments, reducing market entry barriers for compliant manufacturers.

High Production Cost for Customised Enzymes

The complex processes involved in designing, engineering, and scaling up tailored enzymes require substantial investment in advanced technologies, skilled labor, and quality control measures. The need for specialized raw materials and stringent regulatory compliance increases production costs. Customizing enzymes for specific industrial processes demands extensive research and development investments, with development timelines typically exceeding 2-3 years before commercial viability. Small and medium-sized biotechnology companies encounter significant challenges in scaling production from laboratory to commercial quantities. The required fermentation infrastructure demands substantial capital investment and specialized expertise. The pricing difference between industrial and pharmaceutical enzymes reflects their distinct value propositions, with pharmaceutical proteins priced at thousands of dollars per kilogram compared to tens of dollars for industrial applications. Manufacturing economics are impacted by the requirement for specialized purification processes and quality control systems that comply with regulatory standards for different end-use applications.

Other drivers and restraints analyzed in the detailed report include:

- Advancement in Enzyme Engineering and Directed Evolution

- Demand from Cosmetic and Dermatology Sectors for Enzymatic Peels

- Short Shelf Life and Stability Challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Microbial sources hold a 68.84% market share in 2024, due to the scalability and cost advantages of recombinant DNA technology for enzyme production. Plant-derived enzymes are growing at 9.97% CAGR (2025-2030), driven by consumer demand for natural ingredients and sustainability requirements in food and cosmetic applications. Animal-derived enzymes experience declining demand due to ethical concerns and regulatory restrictions, especially in European markets where alternative sources are increasingly required.

The high market share of microbial enzymes results from their production in controlled fermentation environments, ensuring consistent quality and reduced contamination risks compared to plant or animal tissue extraction. Microbial production systems leverage advances in synthetic biology to develop production strains with improved enzyme secretion and minimized by-product formation. The growth in plant sources is supported by new enzyme extraction methods from agricultural waste, which create circular economy opportunities and lower raw material costs.

Liquid formulations dominate the market with a 57.23% share in 2024 and are projected to grow at a CAGR of 10.47% through 2030, driven by their superior performance characteristics and application versatility. Dry enzyme formulations maintain their position in specialized applications where extended shelf life and reduced shipping costs are essential, particularly in animal feed and industrial cleaning sectors. The market preference for liquid formulations stems from their immediate bioavailability and seamless integration into manufacturing processes without dissolution requirements. Recent advances in stabilization technologies have improved the shelf life of liquid enzymes, addressing a key historical limitation compared to dry formulations.

Non-aqueous liquid systems are increasing in adoption for applications that require better substrate solubility and reduced feedback inhibition. Concentrated liquid formulations offer reduced storage and transportation costs while maintaining enzyme activity. Dry formulations continue to improve through advanced spray-drying and freeze-drying techniques that maintain enzyme structure and activity during dehydration.

The Specialty Enzymes Market is Segmented by Source (Plant, Microbial, and Animal), by Form (Liquid, and Dry), by Enzyme Type (Carbohydrases, Proteases, Lipases, and Others), by Application (Food and Beverages, Pharmaceutical, Animal Feed, and Others), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America clinched a commanding 33.22% share of the specialty enzymes market, bolstered by its robust pharmaceutical research and development landscape and efficient regulatory pathways that expedite enzyme-based drug approvals. Leading universities in the region spearhead AI-driven enzyme design, propelling domestic innovation. Furthermore, tax incentives championing sustainable manufacturing have amplified enzyme utilization across various industrial processes, solidifying North America's preeminence. The region's strong focus on technological advancements and partnerships between academia and industry further strengthens its competitive edge in the global market.

Asia-Pacific, on the other hand, is set to outpace others with a projected 10.04% CAGR. Supportive policies and inherent cost advantages underpin this growth. India's BioE3 strategy, coupled with China's revamped food-enzyme regulations, has smoothed the path for market entry. Moreover, the region's affordable production costs, a reservoir of skilled talent, and state-of-the-art infrastructure are luring global enzyme manufacturers. Collaborative research and development efforts, particularly under the Quad framework, bolster Asia-Pacific's aspirations of becoming a dominant enzyme production hub. The region's growing focus on biotechnology and government-backed initiatives to enhance enzyme production capacity further contribute to its rapid growth.

Europe, South America, the Middle East, and the Africa region are also making strides. Europe's edge lies in its stringent safety protocols and a forward-thinking sustainability agenda, both of which enhance product quality and bolster consumer trust. Additionally, the region's emphasis on green chemistry and eco-friendly enzyme applications aligns with its sustainability goals, driving further market expansion. Meanwhile, in South America, biotech ventures in Brazil and Argentina, buoyed by favorable trade agreements and bioeconomy initiatives, are driving growth in the food and agriculture sectors. The Middle East and Africa region is witnessing advancements, owing to healthcare enhancements and initiatives aimed at food security.

- International Flavors & Fragrances

- DSM-Firmenich AG

- Kerry Group plc

- BASF SE

- Associated British Foods plc

- Amano Enzyme

- Novozymes A/S

- Specialty Enzymes & Probiotics

- Suntaq International Limited

- Biocatalysts Ltd.

- Advanced Enzyme Technologies

- ENZIQUIM

- Nagase America LLC

- AST Enzymes

- Sunson Industry Group

- Enzyme Development Corporation

- Antozyme Biotech Pvt Ltd,

- NOOR ENZYMES (DWC) LLC

- Bioseutica BV

- Apex International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Adoption of Eco-friendly Biocatalysts in Pharmaceutical Manufacturing

- 4.2.2 Government Support Drives Market Growth Through Policy and Funding

- 4.2.3 Advancement in Enzyme Engineering and Directed Evolution

- 4.2.4 Demand from Cosemetic and Dermatology Sectors for Enzymatic Peels

- 4.2.5 Surge in Demand for Enzymatic Wound Debridement Products

- 4.2.6 Growing Focus on Green Chemistry and Sustainable Industrial Process

- 4.3 Market Restraints

- 4.3.1 High Production Cost for Customised Enzymes

- 4.3.2 Short Shelf Life and Stability Challenges

- 4.3.3 Risk of Allergic Reaction and Immunogenicity in Enzyme Therapy

- 4.3.4 Ethical Concern in Use of Animal-Derived Enzymes

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Source

- 5.1.1 Plant

- 5.1.2 Microbial

- 5.1.3 Animal

- 5.2 By Form

- 5.2.1 Liquid

- 5.2.2 Dry

- 5.3 By Type

- 5.3.1 Carbohydrases

- 5.3.2 Proteases

- 5.3.3 Lipases

- 5.3.4 Others

- 5.4 By Application

- 5.4.1 Food and Beverages

- 5.4.2 Pharmaceutical

- 5.4.3 Animal Feed

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Spain

- 5.5.2.5 Netherlands

- 5.5.2.6 Italy

- 5.5.2.7 Sweden

- 5.5.2.8 Poland

- 5.5.2.9 Belgium

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Indonesia

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Colombia

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Saudi Arabia

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 International Flavors & Fragrances

- 6.4.2 DSM-Firmenich AG

- 6.4.3 Kerry Group plc

- 6.4.4 BASF SE

- 6.4.5 Associated British Foods plc

- 6.4.6 Amano Enzyme

- 6.4.7 Novozymes A/S

- 6.4.8 Specialty Enzymes & Probiotics

- 6.4.9 Suntaq International Limited

- 6.4.10 Biocatalysts Ltd.

- 6.4.11 Advanced Enzyme Technologies

- 6.4.12 ENZIQUIM

- 6.4.13 Nagase America LLC

- 6.4.14 AST Enzymes

- 6.4.15 Sunson Industry Group

- 6.4.16 Enzyme Development Corporation

- 6.4.17 Antozyme Biotech Pvt Ltd,

- 6.4.18 NOOR ENZYMES (DWC) LLC

- 6.4.19 Bioseutica BV

- 6.4.20 Apex International