|

市场调查报告书

商品编码

1848076

乙醛:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Acetaldehyde - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

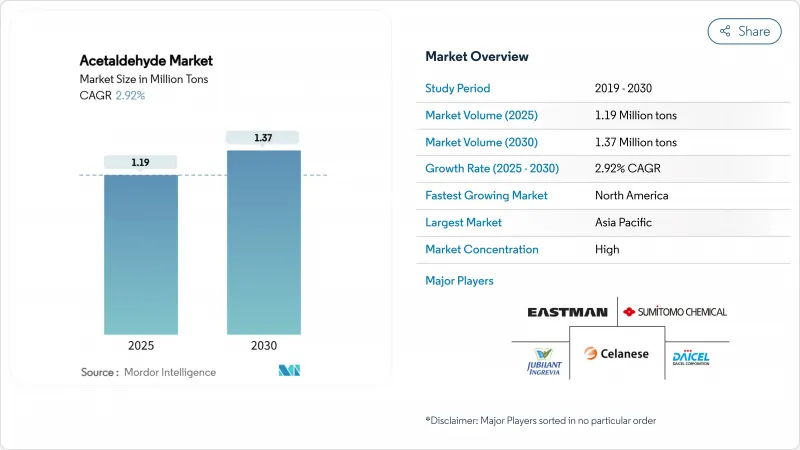

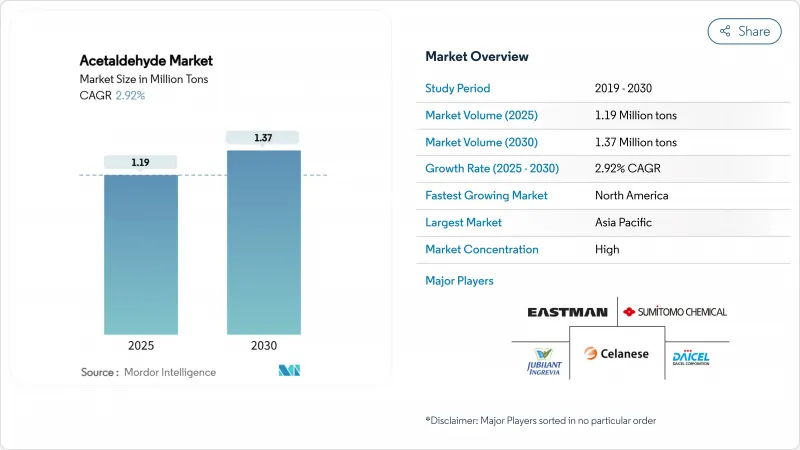

预计到 2025 年,乙醛市场规模将达到 119 万吨,到 2030 年将达到 137 万吨,预测期(2025-2030 年)复合年增长率为 2.92%。

这一增长反映了乙醛作为高价值衍生物(例如乙酸、吡啶碱、新戊四醇和乙酸酯)中间体的既定地位,这些衍生物可用于低VOC溶剂系统、永续涂料和PET循环回收解决方案。亚太地区一体化的石化网络持续主导价格发现机制,而北美生产商则凭藉页岩气衍生的乙烷和突破性的乙烷-乙醛催化反应,正获得发展动力。竞争格局正向那些能够确保原料弹性、实现用于药物合成的高纯度乙醛,以及提供用于先进PET回收的专用清除添加剂的企业倾斜。在预测期内,技术应用、监管压力和永续性认证将决定整个乙醛市场的价值获取。

全球乙醛市场趋势与洞察

对吡啶及其碱衍生物的需求不断增长

製药业正迅速扩张,复杂的药物分子越来越依赖乙醛衍生的吡啶中间体。预计到2030年,该衍生物的复合年增长率将达到3.94%,在肿瘤和神经系统疾病治疗中具有重要的战略意义,因为提高乙醛的纯度可以提高反应产率并满足FDA的cGMP要求。亚洲的学名药生产商正在扩展其多功能活性药物成分生产线,推动了该地区对高纯度乙醛的需求。个人化医疗的兴起需要专门的结构单元,这确保了吡啶链的销售稳定成长。能够证明产品残留杂质含量低的生产商正在获得高价合同,从而强化了乙醛市场中以品质主导的良性循环。

新戊四醇在醇酸树脂和紫外光固化树脂的应用日益广泛

新戊四醇由乙醛和甲醛合成,随着涂料配方师将目光转向生物基醇酸树脂和快速固化UV体系,其重要性日益凸显。北美和欧洲的供应商报告称,随着汽车製造商采用UV固化透明涂层(可缩短生产週期并降低能耗),季戊四醇的需求量正在加速成长。近期研究表明,新戊四醇基生物醇酸树脂在90天内可实现70%的生物降解率,而传统树脂的生物降解率仅为34.7%,这充分展现了其永续性优势,并支撑了其溢价。涂料产业对低VOC的需求推动了乙酸酯助溶剂的发展,并增强了乙醛价值链上各衍生物的协同效应。因此,新戊四醇的产能不断提升,从而支撑了乙醛市场的稳定需求。

乙酸生产中转向甲醇羰基化

目前,全球超过85%的乙酸产能采用甲醇羰基化法,无需生产乙醛中间体,削弱了传统的市场需求支柱。铑和铱催化法具有更高的选择性和能源效率,抑制了对乙醛基乙酸的新投资。东亚巨头的扩张凸显了这种波动性,使乙醛复合年增长率预测值下降了0.4个百分点。为了抵消这种长期下滑趋势,生产商正在重新调整其在乙醛市场的业务组合,转向生产高价值的吡啶、新戊四醇和PET回收添加剂。

细分市场分析

到2024年,乙酸将占乙醛市占率的28.39%,但由于甲醇被羰基化取代,其销售成长率将维持较低水准。相反,受亚太地区医药生产快速成长的推动,吡啶及其衍生物预计到2030年将以3.94%的强劲复合年增长率成长。涂料产业对新戊四醇的需求不断增长,而乙酸酯则有助于建构低VOC相容系统。整体而言,由于乙酸市场已趋于成熟,特种衍生物的存在使得乙醛市场规模得以维持,避免停滞不前。

向高价值细分市场的转型提高了纯度要求,推动了对提纯塔、分子筛和连续蒸馏控制系统的资本投资。精通製程分析的生产商能够获得合约溢价,而落后者则面临被降级为大宗商品的风险。丁二醇、氯醛和过氧乙酸仍然是小众市场,但化妆品、製药和水处理行业的持续需求保证了资产利用率的健康成长。这种分级衍生性商品组合,在大宗商品产量和特种产品利润率之间取得平衡,决定了乙醛市场的长期韧性。

乙醛市场报告按衍生物(吡啶及吡啶类衍生物、新戊四醇、乙酸、乙酸酯及其他)、终端用户行业(粘合剂、食品饮料、油漆涂料、医药及其他终端用户行业)和地区(亚太地区、北美地区、欧洲地区、南美地区以及中东和非洲地区)进行细分。市场预测以吨为单位。

区域分析

到 2024 年,亚太地区将占全球需求的 57.81%,这主要得益于中国世界一流的石化联合企业和一体化芳烃-乙酰产业链、日本DAICEL株式会社不断提高的技术水平,以及印度戈达瓦里生物炼製厂弥合了石化和生物基团之间的差距。

预计到2030年,北美地区将以3.18%的复合年增长率成长,这主要得益于乙烷-乙醛催化剂的蓬勃发展以及循环化学领域明确的监管力度。塞拉尼斯公司的Clear Lake平台以及在该地区PET回收业务的扩张,标誌着该地区正向低碳、高纯度生产模式转型。

南美洲和中东及非洲正透过有利于乙醇提质和原料供应的石化中心逐步扩大其产能。这种区域格局平衡了成熟的大宗市场和新兴的成长市场,从而增强了全球乙醛市场的多元化。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对吡啶及其碱衍生物的需求不断增长

- 新戊四醇在醇酸树脂和紫外光固化树脂的应用日益广泛

- 低VOC溶剂混合物中对乙酸酯的需求不断增加。

- 一种革命性的PdO催化乙烷-乙醛反应

- PET脱脱水升级以提高瓶装品质标准

- 市场限制

- 转向甲醇羰基化法生产乙酸

- 重新划分致癌性等级并加强职场接触法规

- 乙烯价格波动对瓦克製程公司的利润率带来压力。

- 价值链分析

- 五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争程度

第五章 市场规模及成长预测(销售)

- 导数

- 吡啶和吡啶碱

- 新戊四醇

- 醋酸

- 乙酸酯

- 丁二醇

- 其他衍生物(氯醛、过乙酸等)

- 按最终用户行业划分

- 胶水

- 饮食

- 油漆和涂料

- 製药

- 其他终端用户产业(水处理、塑胶、橡胶、燃料添加剂等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧的

- 土耳其

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略倡议

- 市占率(%)/排名分析

- 公司简介

- Celanese Corporation

- Daicel Corporation

- Eastman Chemical Company

- Jubilant Ingrevia Limited

- Laxmi Organic Industries Ltd.

- LCY

- Lonza

- Merck KGaA

- Resonac Corporation

- Sekab

- Sumitomo Chemical Co., Ltd.

第七章 市场机会与未来展望

The Acetaldehyde Market size is estimated at 1.19 million tons in 2025 and is expected to reach 1.37 million tons by 2030, at a CAGR of 2.92% during the forecast period (2025-2030).

This expansion reflects the chemical's entrenched role as an intermediate for high-value derivatives such as acetic acid, pyridine bases, pentaerythritol, and acetate esters that enable low-VOC solvent systems, sustainable coatings, and circular PET recycling solutions. Asia-Pacific's integrated petrochemical networks continue to shape price discovery, while North American producers gain momentum by leveraging shale-derived ethane and breakthrough ethane-to-acetaldehyde catalysis. Competitive positioning is shifting toward players that can secure feedstock flexibility, achieve superior purity grades for pharmaceutical syntheses, and offer specialized scavenging additives for advanced PET recycling. Over the forecast horizon, technology adoption, regulatory pressure, and sustainability credentials will determine value capture across the acetaldehyde market.

Global Acetaldehyde Market Trends and Insights

Rising Demand for Pyridine and Pyridine-Base Derivatives

Pharmaceutical manufacturing is scaling rapidly, and complex drug molecules increasingly rely on acetaldehyde-derived pyridine intermediates. The 3.94% CAGR to 2030 underscores the derivative's strategic relevance for oncology and neurology therapies, where acetaldehyde purity improvements deliver higher reaction yields and regulatory compliance with FDA cGMP requirements. Asian generic producers are expanding multi-purpose active-pharmaceutical-ingredient lines, which lifts regional consumption of high-purity acetaldehyde grades. The personalized-medicine shift calls for specialized building blocks, ensuring robust volume growth for pyridine chains. Producers that can certify low residual impurities win premium contracts, reinforcing a virtuous cycle of quality-driven demand in the acetaldehyde market.

Expanding Pentaerythritol Use in Alkyd and UV-Curable Resins

Coatings formulators pivot toward bio-based alkyd and fast-curing UV systems, and pentaerythritol, synthesized from acetaldehyde and formaldehyde, has become indispensable. North American and European suppliers report accelerating off-takes as automakers adopt UV-curable clear coats that shorten production cycles and cut energy consumption. Recent research showed bio-alkyds featuring pentaerythritol achieve 70% biodegradability in 90 days versus 34.7% for conventional resins, a sustainability edge that supports price premiums. The coatings industry's low-VOC imperative boosts acetate-ester co-solvents, reinforcing derivative synergies along the acetaldehyde value chain. Consequently, pentaerythritol draws incremental capacity additions, anchoring stable demand in the acetaldehyde market.

Shift to Methanol Carbonylation for Acetic-Acid Production

More than 85% of global acetic-acid capacity now employs methanol carbonylation, obviating acetaldehyde intermediacy and eroding a legacy demand pillar. The Rh- and Ir-catalyzed route delivers superior selectivity and energy efficiency, depressing new investments in acetaldehyde-based acetic acid. Incremental expansions by East-Asian giants accentuate the swing, removing 0.4 percentage points from the acetaldehyde CAGR forecast. To offset this secular decline, producers push into higher-value pyridine, pentaerythritol, and PET-recycling additives, redefining portfolio priorities within the acetaldehyde market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Acetate-Ester Demand in Low-VOC Solvent Blends

- Breakthrough Ethane-to-Acetaldehyde PdO Catalysis

- Carcinogenic Re-Classification and Tighter Workplace Exposure Limits

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acetic acid retained a 28.39% slice of the acetaldehyde market share in 2024, but its volume growth remains muted amid structural substitution by methanol carbonylation. Conversely, pyridine and pyridine bases are set to register a robust 3.94% CAGR through 2030, propelled by surging pharmaceutical output in Asia-Pacific. The paints sector's appetite for pentaerythritol drives incremental additions, while acetate esters underpin compliant low-VOC systems. Collectively, specialty derivatives insulate the acetaldehyde market size against stagnation in the mature acetic-acid pool.

The migration to high-value niches heightens purity requirements, inviting capital investments in purification columns, molecular sieves, and continuous distillation control. Producers that master in-process analytics secure contract premiums, while laggards risk relegation to commodity pools. Butylene glycol, chloral, and peracetic acid remain niche outlets, yet continued demand from cosmetics, pharmaceuticals, and water treatment keeps asset utilization healthy. This tiered derivative portfolio balances commodity volume with specialty margins, defining long-run resilience for the acetaldehyde market.

The Acetaldehyde Report is Segmented by Derivative (Pyridine and Pyridine Bases, Pentaerythritol, Acetic Acid, Acetate Esters, and More), End-User Industry (Adhesives, Food and Beverage, Paints and Coatings, Pharmaceuticals, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific commanded 57.81% of global demand in 2024, anchored by China's world-scale petrochemical complexes and integrated aromatics-to-acetyl chains. Japan's Daicel Corporation augments technological sophistication, while India's Godavari Biorefineries bridges petrochemical and bio-based streams.

North America is poised for a 3.18% CAGR through 2030, underpinned by ethane-to-acetaldehyde catalysts and clear regulatory tailwinds for circular chemistry. Celanese's Clear Lake platform and regional PET-recycling build-outs exemplify the pivot to low-carbon, high-purity production.

Europe's sustainability ethos sustains niche demand for high-performance derivatives, while South America and Middle-East and Africa gradually scale capacity via ethanol upgrading and feedstock-advantaged petrochemical hubs. This regional mosaic balances mature bulk markets with frontier growth, reinforcing global dispersion of the acetaldehyde market.

- Celanese Corporation

- Daicel Corporation

- Eastman Chemical Company

- Jubilant Ingrevia Limited

- Laxmi Organic Industries Ltd.

- LCY

- Lonza

- Merck KGaA

- Resonac Corporation

- Sekab

- Sumitomo Chemical Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Pyridine and Pyridine-Base Derivatives

- 4.2.2 Expanding Pentaerythritol Use in Alkyd And UV-Curable Resins

- 4.2.3 Growing Acetate-Ester Demand in Low-VOC Solvent Blends

- 4.2.4 Breakthrough Ethane-To-Acetaldehyde PdO Catalysis

- 4.2.5 Circular PET De-Aldehyde Upgrades Raising Bottle-Grade Quality Bar

- 4.3 Market Restraints

- 4.3.1 Shift to Methanol Carbonylation for Acetic-Acid Production

- 4.3.2 Carcinogenic Re-Classification and Tighter Workplace Exposure Limits

- 4.3.3 Ethylene Price Volatility Squeezing Wacker-Process Margins

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Derivative

- 5.1.1 Pyridine and Pyridine Bases

- 5.1.2 Pentaerythritol

- 5.1.3 Acetic Acid

- 5.1.4 Acetate Esters

- 5.1.5 Butylene Glycol

- 5.1.6 Other Derivatives (Chloral, Peracetic Acid, etc.)

- 5.2 By End-User Industry

- 5.2.1 Adhesives

- 5.2.2 Food and Beverage

- 5.2.3 Paints and Coatings

- 5.2.4 Pharmaceuticals

- 5.2.5 Other End-user Industries (Water Treatment, Plastics, Rubber, Fuel Additives, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC

- 5.3.3.8 Turkey

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Celanese Corporation

- 6.4.2 Daicel Corporation

- 6.4.3 Eastman Chemical Company

- 6.4.4 Jubilant Ingrevia Limited

- 6.4.5 Laxmi Organic Industries Ltd.

- 6.4.6 LCY

- 6.4.7 Lonza

- 6.4.8 Merck KGaA

- 6.4.9 Resonac Corporation

- 6.4.10 Sekab

- 6.4.11 Sumitomo Chemical Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment