|

市场调查报告书

商品编码

1848288

天花板片:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Ceiling Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

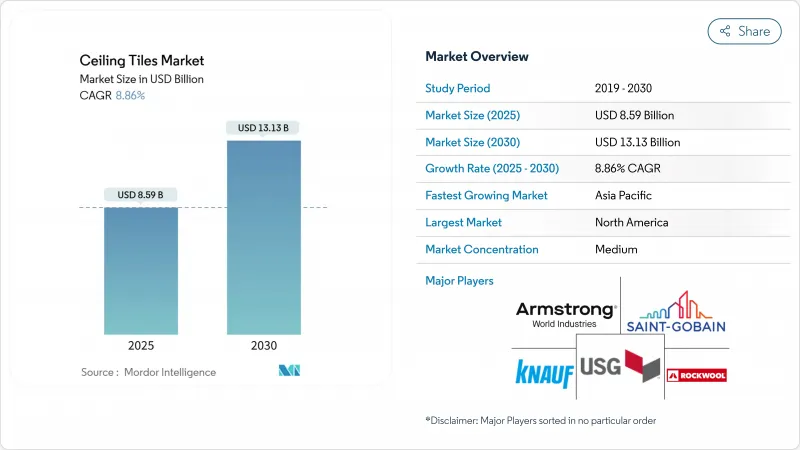

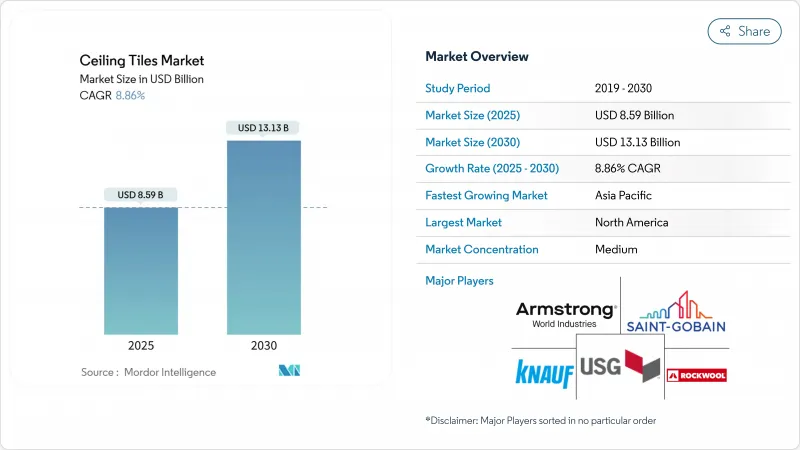

预计到 2025 年,天花板片市场规模将达到 85.9 亿美元,到 2030 年将达到 131.3 亿美元,预测期内(2025-2030 年)复合年增长率为 8.86%。

日益严格的声学法规、不断扩大的节能维修项目以及快速发展的城市交通,正推动商业和住宅天花板系统的持续投资。相变材料(PCM)面板和低碳矿棉板等节能创新产品,如今对采购决策的影响与美观性不相上下。产业领导者正将循环经济置于优先地位,经检验的回收方案在竞标评估中的重要性日益凸显。同时,中国住宅层高不断提升,以及海湾地区豪华计划采用高端数位印刷石膏板,都在扩大潜在市场,并增强天花板片市场的长期发展前景。

全球天花板片市场趋势与洞察

北美和欧洲开放式办公室迅速采用吸音天花板系统

开放式办公布局在新办公大楼中越来越普遍,但背景噪音会使员工注意力下降高达 66%。为了恢復声学舒适度,企业正在安装降噪係数为 0.90 或更高的矿棉和玻璃纤维板。 Armstrong 的 Sonata 和 Halcyon 系列板材符合这些标准,同时保持了简洁的白色外观。科技和金融公司引领了这一趋势,因为员工留任研究表明,声学隐私与心理健康密切相关。采购团队也正在为小型会议空间和客服中心指定更高等级的天花板隔音材料,从而推动了天花板片市场的订单成长。

欧洲绿建筑认证推动矿棉瓦维修需求

BREEAM 和 DGNB 框架对卓越的声学性能和再生材料含量均给予加分,因此,含有 30-70% 再生纤维的矿棉板将获得双倍积分,并在 2024 年欧盟建筑能源性能指令更新中获得更高的评分。 CertainTeed 的矿棉板由超过 50% 的再生材料製成,目前已被用于建筑幕墙和暖通空调系统的维修,使计划业主无需进行结构改造即可满足强制性能源标准。

能源价格波动推高了矿物棉成本。

由于矿物棉生产依赖超过1450 度C的炉温,天然气和电力价格的上涨导致欧洲生产线的投入成本在2024年上涨了高达40%。 Rockwool岩绒已在密西西比州投资1亿美元兴建了一座节能型工厂,并配备了优化的热回收循环系统,但短期内价格转嫁的途径仍然有限。预计的价格上涨促使设计人员转向金属和复合板材,这暂时缓解了天花板片市场矿物棉的出货量。

细分市场分析

到2024年,矿物棉将占据天花板片市场41%的最大份额,这主要得益于其卓越的吸音性能和阻燃性。计划经理通常会选择矿物棉用于办公室、教室、医疗走廊以及其他对隔音和防火要求严格的场所。然而,能源成本的波动和对体积碳排放的严格审查正迫使製造商进行创新。 Ultima LEC板材的隐含碳排放量减少了43%,这充分体现了矿物棉供应商如何将永续性重新置于其核心地位。

金属板材在交通运输和高端零售计划中日益普及,预计2030年将以8.99%的复合年增长率成长。它们符合严格的防火标准,并可实现复杂的穿孔图案,从而兼顾隔音和空气回流需求。此外,其可回收的特性也符合循环经济的目标,进一步加速了金属板材的市场成长。复合材料和生物基混合材料虽然目前应用范围有限,但它们代表未来低碳材料科学在天花板片市场的发展方向。

区域分析

北美地区在2024年以35%的市场份额领先天花板片市场,这主要得益于成熟的屋顶翻新週期、严格的隔音标准以及开放式办公文化对隔音需求的日益增长。联邦政府对节能维修的激励措施也促进了矿棉和相变材料(PCM)面板在公共建筑中的持续应用。大型企业在国内设有製造地,最大限度地减少了运费波动,并确保为经销商提供快速的服务。

欧洲也纷纷效仿,透过国家能源绩效计划,制定了严格的绿色建筑框架和维修补贴政策。矿物棉符合BREEAM和DGNB认证标准,其高回收率确保了即使在能源价格波动的情况下,订单订单仍然稳定。欧洲大陆的承包商也尝试循环回收方案,例如Rockcycle项目,以回收废旧瓷砖,从而提升其在天花板片市场的永续性形象。

亚太地区是成长最快的地区,预计2025年至2030年复合年增长率将达到10.5%,主要得益于一系列计划的推进,包括机场、地铁和综合用途大楼。中国强制要求将住宅层高提高到3米,这增加了对天花板面积的需求;而印度地铁的扩建也促进了A级防火金属板的使用。然而,当地对价格的敏感度以及根深蒂固的石膏板安装工艺,对进口石膏板构成了竞争挑战。另一方面,海湾合作委员会(GCC)国家正在追求以设计主导的高端解决方案,而中东的豪华产品市场则成为天花板片市场中利润丰厚的丛集。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 在北美和欧洲,开放式办公室正在迅速采用吸音天花板系统。

- 欧洲绿建筑认证推动矿棉瓦维修需求

- 亚洲地铁和机场建设将强制使用不可燃材料。

- 减少天花板片生产原料加工的碳足迹

- 数位印刷石膏板优质化檔次

- 市场限制

- 能源价格波动推高了矿物棉成本。

- 替代品的威胁:沥青、砂浆等。

- 低成本的石膏悬吊天花板抑制了亚太地区石膏板的使用。

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按原料

- 矿物棉

- 金属

- 石膏

- 其他(复合材料、塑胶、木材)

- 自然

- 声学

- 非声学

- 透过使用

- 住房

- 商业的

- 产业

- 公共利益组织

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- AWI Licensing LLC

- Foshan Ron Building Material Trading

- Georgia-Pacific

- Guangzhou Titan Building Materials Co., Ltd.

- Haining Shamrock Import & Export Co. Ltd.

- Hunter Douglas NV

- Imerys

- Kingspan Group

- Knauf Group

- Mada Gypsum Company

- New Ceiling Tiles LLC

- Odenwald Faserplattenwerk GmbH

- PVC Ceilings SA

- ROCKWOOL A/S

- Saint-Gobain

- SAS International

- Shandong Huamei Building Materials Co., Ltd.

- Techno Ceiling Products

- USG Corporation

第七章 市场机会与未来展望

The Ceiling Tiles Market size is estimated at USD 8.59 billion in 2025, and is expected to reach USD 13.13 billion by 2030, at a CAGR of 8.86% during the forecast period (2025-2030).

Intensifying acoustic regulations, expanding retrofit programs aimed at energy efficiency, and rapid urban transport development continue to draw sustained investment into commercial and residential ceiling systems. Energy-focused innovations such as Phase Change Material (PCM) panels and low-embodied-carbon mineral wool boards now influence procurement decisions as much as aesthetics. Segment leaders are prioritizing circularity commitments, with verified recycling schemes gaining weight in bid evaluations. Meanwhile, the shift toward taller residential ceilings in China and premium digital-print gypsum tiles in Gulf luxury projects is broadening the addressable base, strengthening the long-term outlook for the ceiling tiles market.

Global Ceiling Tiles Market Trends and Insights

Rapid adoption of acoustic ceiling systems in open-plan offices across North America & Europe

Open-plan layouts dominate new corporate fit-outs, yet background chatter cuts measured employee focus time by 66%. To restore acoustic comfort, enterprises are installing mineral-wool and fiberglass panels with Noise Reduction Coefficient values above 0.90. Armstrong Sonata and Halcyon boards match these ratings while retaining a seamless white aesthetic. Technology and financial firms lead deployments because staff retention reviews now link acoustic privacy with mental wellness. Procurement teams are also specifying high Ceiling Attenuation Class for huddle rooms and call centers, accelerating order volumes in the ceiling tiles market.

Europe green-building credits accelerating mineral-wool tile retrofit demand

BREEAM and DGNB frameworks grant premium points for both acoustic excellence and recycled content. Mineral wool tiles that contain 30-70% reclaimed fibers therefore earn double credit, lifting their score profiles under the EU Energy Performance of Buildings Directive update of 2024. CertainTeed mineral wool boards, comprising more than 50% recycled material, have become a preferred drop-in during facade and HVAC refurbishments, allowing project owners to meet mandated energy thresholds without structural overhaul.

Energy-price volatility inflating mineral-wool costs

Mineral wool production relies on furnace temperatures above 1,450 °C, so spikes in natural-gas and electricity tariffs have lifted input costs by up to 40% for European lines in 2024. ROCKWOOL responded with a USD 100 million energy-efficient facility in Mississippi that optimizes heat-recovery loops, but near-term price pass-through options remain limited. Higher quote values encourage specifiers to substitute toward metal or composite boards, temporarily softening mineral-wool shipments in the ceiling tiles market.

Other drivers and restraints analyzed in the detailed report include:

- Asian metro & airport build-outs mandating non-combustible ceiling tiles

- Reduced carbon impacts in processing of raw materials for manufacturing ceiling tiles

- Threat of substitutes, such as asphalt and mortar

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mineral wool held the largest portion of the ceiling tiles market share at 41% in 2024, anchored by its class-leading acoustic absorption and non-combustibility. Project managers routinely select it for offices, classrooms, and healthcare corridors where both sound and fire codes are strict. Yet energy cost swings and embodied-carbon scrutiny are pressuring manufacturers to innovate. Ultima LEC boards that cut embodied carbon by 43% demonstrate how mineral-wool suppliers are repositioning around sustainability.

Metal panels are capturing mindshare in transport and prestige retail projects, advancing at an 8.99% CAGR to 2030. They satisfy stringent flame-spread limits and accept complex perforation patterns that balance acoustics and air-return requirements. Integral recyclability streams additionally support circular-economy targets, reinforcing their rise. Composite and bio-based hybrids occupy niche roles but provide laboratories for future low-carbon material science in the ceiling tiles market.

The Ceiling Tiles Market Report Segments the Industry by Raw Material (Mineral Wool, Metal, Gypsum, and Others), Property (Acoustic and Non-Acoustic), Application (Residential, Commercial, Industrial, and Institutional), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the ceiling tiles market with 35% revenue share in 2024, driven by a mature reroofing cycle, tight acoustic codes, and a culture of open-plan offices that amplifies sound-control needs. Federal incentives for energy-efficient retrofits support continued mineral-wool and PCM panel adoption across public-sector buildings. Large incumbents maintain domestic manufacturing bases, minimizing freight volatility and ensuring rapid service to distributors.

Europe follows closely, fueled by stringent green-building frameworks and refurbishment subsidies under national energy-performance plans. Mineral wool's high recycled content aligns neatly with BREEAM and DGNB credit metrics, fostering steady order flow despite energy-price volatility. Continental contractors are also trialing circular take-back schemes such as the Rockcycle program that reuses end-of-life tiles, reinforcing sustainability credentials in the ceiling tiles market.

Asia Pacific is the fastest-growing theatre, posting a 10.5% CAGR from 2025-2030 on the back of megaproject pipelines encompassing airports, metros, and mixed-use towers. China's directive to raise standard residential ceiling heights to 3 m expands surface area requirements, while India's metro expansion multiplies opportunities for Class A fire-rated metal boards. Yet local price sensitivity and entrenched POP practices pose competitive challenges for imported gypsum tiles. Elsewhere, GCC states pursue design-led premium solutions, highlighting Middle-East luxury as a distinct high-margin cluster within the ceiling tiles market.

- AWI Licensing LLC

- Foshan Ron Building Material Trading

- Georgia-Pacific

- Guangzhou Titan Building Materials Co., Ltd.

- Haining Shamrock Import & Export Co. Ltd.

- Hunter Douglas N.V.

- Imerys

- Kingspan Group

- Knauf Group

- Mada Gypsum Company

- New Ceiling Tiles LLC

- Odenwald Faserplattenwerk GmbH

- PVC Ceilings SA

- ROCKWOOL A/S

- Saint-Gobain

- SAS International

- Shandong Huamei Building Materials Co., Ltd.

- Techno Ceiling Products

- USG Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of acoustic ceiling systems in open-plan offices across North America and Europe

- 4.2.2 Europe green-building credits accelerating mineral-wool tile retrofit demand

- 4.2.3 Asian metro and airport build-outs mandating non-combustible ceiling tiles

- 4.2.4 Reduced Carbon Impacts in Processing of Raw Materials for Manufacturing Ceiling Tiles

- 4.2.5 Digital-print gypsum tiles enabling premiumisation in Middle-East luxury real estate

- 4.3 Market Restraints

- 4.3.1 Energy-price volatility inflating mineral-wool costs

- 4.3.2 Threat of Substitutes, such as Asphalt and Mortar

- 4.3.3 Low-cost POP false ceilings constraining gypsum tile uptake in Asia Pacific

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Raw Material

- 5.1.1 Mineral Wool

- 5.1.2 Metal

- 5.1.3 Gypsum

- 5.1.4 Others (Composite, Plastic and Wood)

- 5.2 By Property

- 5.2.1 Acoustic

- 5.2.2 Non-Acoustic

- 5.3 By Application

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.3.4 Institutional

- 5.4 By Geography

- 5.4.1 Asia Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordics

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 AWI Licensing LLC

- 6.4.2 Foshan Ron Building Material Trading

- 6.4.3 Georgia-Pacific

- 6.4.4 Guangzhou Titan Building Materials Co., Ltd.

- 6.4.5 Haining Shamrock Import & Export Co. Ltd.

- 6.4.6 Hunter Douglas N.V.

- 6.4.7 Imerys

- 6.4.8 Kingspan Group

- 6.4.9 Knauf Group

- 6.4.10 Mada Gypsum Company

- 6.4.11 New Ceiling Tiles LLC

- 6.4.12 Odenwald Faserplattenwerk GmbH

- 6.4.13 PVC Ceilings SA

- 6.4.14 ROCKWOOL A/S

- 6.4.15 Saint-Gobain

- 6.4.16 SAS International

- 6.4.17 Shandong Huamei Building Materials Co., Ltd.

- 6.4.18 Techno Ceiling Products

- 6.4.19 USG Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Innovation in Gypsum Tiles for its Biodegradable Properties