|

市场调查报告书

商品编码

1848290

人工举升系统:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Artificial Lift Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

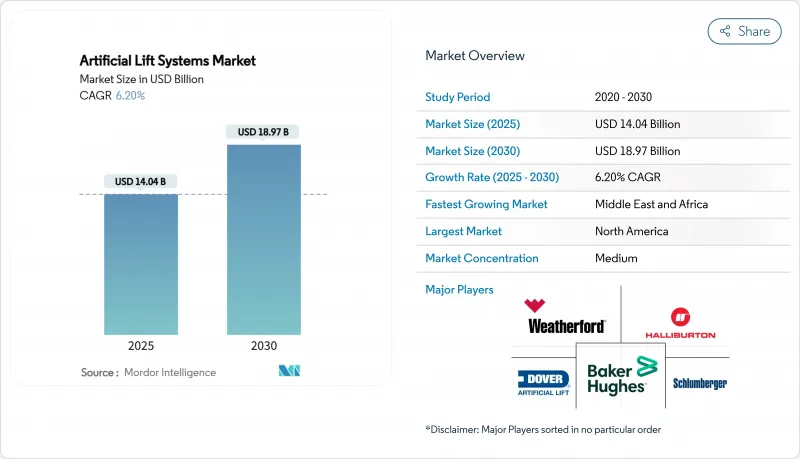

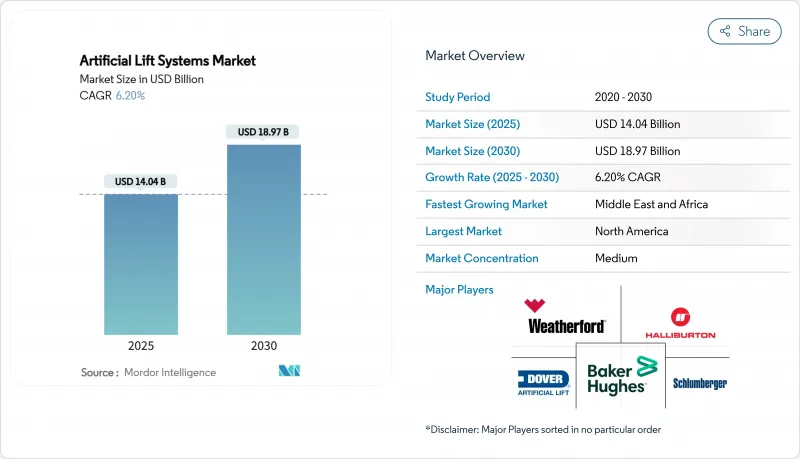

人工举升系统市场规模预计在 2025 年为 140.4 亿美元,预计到 2030 年将达到 189.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.20%。

随着营运商利用技术提高现有油井的采收率而非钻探新井,成长正从产能的快速扩张转向性能的稳定提升。页岩水平钻井、成熟油田修井作业的增加以及数位优化平台仍然是主要的需求驱动力。永磁电机、人工智慧变速驱动器和长寿命弹性体正在延长运行时间并降低电力成本。 SLB与ChampionX等併购交易表明,规模和数据整合如今已成为关键的竞争优势。

全球人工举升系统市场趋势与洞察

老井的修復与升级改造

营运商正寻求将资金转向从老化油井中榨取更多产量。沙特阿美公司计划在2024年投资35亿美元用于人工智慧驱动的生产最佳化,展现了对延长资产寿命的长期承诺。 (1) 资料来源:OilPrice员工,“沙特阿美押注人工智慧进行生产优化”,oilprice.com。据生产工程师称,添加合适的人工泵管柱可以将油井的生产寿命延长15至20年,并推迟废弃责任。服务公司预计需求将保持稳定,因为成熟油田活动受油价波动的影响小于前沿探勘。油价仍在每桶60美元以上也支撑着这项活动,但如果油价下跌,资本释放可能会放缓。

传统型油藏水平储存

二级页岩油气田目前正进入开发阶段,其陡峭的产量递减曲线将迫使其在首次产油后12至18个月内部署举升系统。阿根廷的瓦卡穆埃尔塔油田预计到2024年12月产量将达到757,122桶/日,这将需要先进的举升系统来应对不断增长的横向库存。机器学习工具可以改善井底压力预测,并将设备尺寸过大的情况减少25%至30%。中国鄂尔多斯盆地早期采用举升系统将有助于实现緻密气产量目标,并将经济成本维持在40美元/桶。这些因素共同作用,正在将传统型人工举升系统的潜在市场拓展到北美以外的地区。

油价导致资本支出压缩週期

当布兰特原油价格跌破每桶60美元(例如2020年)时,业者会将人工举升预算延后高达30%。儘管新的模组化管柱可以分阶段安装,但在动盪的市场环境下,18至24个月的投资回收期似乎仍然风险相当高。分析师预计,到2025年,油井成本将进一步小幅下降1%,但这并不能完全抵消价格不不确定性:“2025年油井成本展望”,aogr.com。供应商正在透过提供租赁和基于绩效的合约来应对,但银行贷款条款仍然与大宗商品预测挂钩,限制了经济低迷时期的资金可用性。

細項分析

电潜泵以其处理流量从100桶/天到30,000桶/天的多功能性而着称,预计到2024年其销售额将维持39%的成长率。然而,由于单转子设计,螺桿泵的复合年增长率高达8%,这使得它们能够处理重质原油和砂石,且不易快速磨损。 SLB的PowerEdge ESPCP Hybrid将ESP的可靠性与PCP的耐磨性结合,可将二氧化碳排放减少55%。

升降杆因其低运行成本,仍然支援传统的陆上油井;而气举则在海上油井中表现出色,因为海上油井对井下硬体的最小化至关重要。液压活塞泵和喷射泵适用于特殊环境、砂质环境或偏远地区。柱塞举升则适用于低压气井的除液。目前趋势是采用两种或多种方法相结合的混合方案,随着储存的成熟,为作业者提供客製化的解决方案。随着永磁马达将电潜泵(ESP)的效率提高20%,供应商预期未来ESP和PCP平台之间的竞争将更加激烈。

2024年,水平井将贡献人工举升市场50%的收益,到2030年,其复合年增长率将达到6.5%。其复杂的流动状态将推动气体处理分离器和更小型ESP级的创新,以适应紧密的完井环境。永磁马达能够在较短的壳体内提供高功率,适用于水平空间有限的场合,到2024年,其在水平井中的应用率将达到11%。

在重视成熟设备和低干预成本的传统型油田中,垂直井仍然至关重要。水平完井工具的标准化缩小了安装成本差距,但水平井的人工泵送成本仍高出150%至200%。如今,自主泵送控制设备可将水平井的泵送速率降低80%甚至更多,延长泵浦的使用寿命,并降低泵送成本曲线。这种技术回馈循环正在强化到水平井的转变,即使在曾经以垂直井为主的地区也是如此。

人工举升系统市场报告按泵送类型(电动潜水泵、升降杆、其他)、井向(水平井、垂直井)、储存类型(传统型、传统型)、应用(陆上、海上)、组件(泵、电机、其他)、服务(安装、试运行、其他)和地区(北美、亚太、中东和非洲、其他)细分。

区域分析

预计到2024年,北美将占据人工举升系统市场36%的份额,这得益于强劲的页岩油产量和快速技术应用的文化。 SLB报告称,由于将天然气处理设计与人工维修相结合,二迭纪盆地的ESP运作寿命提高了400%。自动化有助于缓解该地区的劳动力短缺,但熟练劳动力和专业弹性体的短缺仍然是人工举升系统市场的瓶颈。随着基础设施的成熟,市场正转向优化服务,而不是新硬体。

中东和非洲是成长最快的地区,复合年增长率为7.2%,这得益于到2030年7,300亿美元的上游支出以及一系列提高采收率的计划。阿布达比国家石油公司的Robowell计画将气举使用量减少了30%,凸显了该地区对高阶数位解决方案的需求。各国石油公司正将研发承诺与大宗采购捆绑在一起,以锁定有利于综合供应商的长期服务关係。

南美洲的成长主要围绕在阿根廷的瓦卡穆埃尔塔油田和巴西的盐层下。 SLB与巴西石油公司签订的价值10亿美元的海底合同,显示其对能够耐受腐蚀性二氧化碳和硫化氢的长寿命增压系统充满信心。预计到2025年,圭亚那的石油日产量将超过80万桶,这将进一步扩大对海底举升设备的需求。技术转移协议旨在打造本地供应中心,缩短前置作业时间,并培养技术纯熟劳工。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 增加成熟井的复垦支出

- 传统型油藏快速水平储存。

- 电梯优化数位化(支援 AI 的 VSD)

- 向更深的海上盐层下下层迁移

- 对 ESG主导的节能电梯系统的需求

- ESP管柱的利基地热再利用

- 市场限制

- 原油价格波动与资本支出压缩週期

- 超深水作业成本高

- 特种弹性体供应链瓶颈

- 自动化维修中技术纯熟劳工短缺

- 供应链分析

- 监管格局

- 技术展望

- 五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 按电梯类型

- 电动潜水帮浦(ESP)

- 单轴螺旋泵浦浦(PCP)

- 升降杆(梁、抽油桿)

- 气举

- 液压活塞泵和喷射泵

- 柱塞举升

- 其他利基系统(液压潜水器、毛细管系统)

- 井位定位

- 水平井

- 垂直井

- 依水库类型

- 传统的

- 传统型(页岩/緻密)

- 按用途

- 陆上

- 海上

- 按组件

- 泵浦

- 引擎

- 变速驱动器和控制器

- 地面设施

- 辅助零件(感测器、密封件、填料)

- 按服务

- 安装和试运行

- 优化和监控

- 维护、修理和大修(MRO)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 北欧国家

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略性倡议(併购、伙伴关係、购电协议)

- 市占率分析(主要企业的市占率及份额)

- 公司简介

- Baker Hughes Company

- Halliburton Company

- Schlumberger NV

- Weatherford International Plc

- NOV Inc.

- Dover(Artificial Lift)

- Borets International Limited

- ChampionX Corp

- Alkhorayef Petroleum

- JJ Tech

- AccessESP

- Odessa Separator

- RAGHOEBAR

- Novomet

- Shengli Oilfield Highland

- Torqueflow Sydex

- Canadian Advanced ESP

- GE Power Conversion

- PCM Artificial Lift

- OptiLift

- OilSERV

第七章 市场机会与未来展望

The Artificial Lift Systems Market size is estimated at USD 14.04 billion in 2025, and is expected to reach USD 18.97 billion by 2030, at a CAGR of 6.20% during the forecast period (2025-2030).

Growth is shifting from rapid capacity additions to steady performance gains as operators use technology to recover more from existing wells rather than drill new ones. Horizontal drilling in shale, rising mature-field workovers, and digital optimization platforms remain the main demand engines. Permanent-magnet motors, AI-enabled variable-speed drives, and longer-life elastomers are raising run times and trimming power costs. Mergers like SLB's ChampionX deal illustrate how scale and data integration are now the primary competitive advantages.

Global Artificial Lift Systems Market Trends and Insights

Mature Well Rejuvenation Up-cycle

Operators are redirecting capital toward squeezing more barrels from aging wells because workovers cost 60-70% less than new drilling and deliver internal rates of return above 30%. Saudi Aramco alone earmarked USD 3.5 billion for AI-driven production optimization in 2024, underscoring the long-range commitment to asset life extension. (1)Source: OilPrice Staff, "Saudi Aramco Bets on AI for Production Optimization," oilprice.com Production engineers report that adding the right artificial lift string can lengthen a well's producing life by 15-20 years and defer abandonment liabilities. Service firms see stable demand because mature-field activity is less sensitive to oil-price swings than frontier exploration. Continued crude prices above USD 60 per barrel support this driver, though lower pricing would slow capital release.

Horizontal Drilling in Unconventional Reservoirs

Tier-2 shale acreage now moves to the development phase, and its steep decline curves force lift deployment within 12-18 months of first oil. Argentina's Vaca Muerta hit 757,122 barrels per day in December 2024, requiring sophisticated lift systems across a growing inventory of laterals. Machine-learning tools improve bottom-hole pressure forecasting and reduce equipment oversizing by 25-30%. Early lift adoption in China's Ordos Basin supports tight-gas production goals and keeps the economics viable at USD 40 per barrel. These factors combine to widen the addressable artificial lift system market within the unconventional sector well past North America.

Crude-Price CAPEX Compression Cycles

When Brent drops below USD 60 per barrel, operators defer artificial lift budgets by up to 30% as seen in 2020. Despite new modular strings that can be installed incrementally, payback horizons of 18-24 months still look risky in choppy markets. Analysts expect modest 1% further well-cost reductions in 2025, which will not fully counteract price uncertainty.(2)Source: American Oil & Gas Reporter, "Well-Cost Outlook 2025," aogr.com Suppliers respond by offering rental and performance-based contracts, but bank lending terms remain tied to commodity forecasts, limiting capital availability during downturns.

Other drivers and restraints analyzed in the detailed report include:

- Digitalization of Lift Optimization (AI-Enabled VSDs)

- Shift to Deeper Offshore Pre-Salt Developments

- High Work-Over Costs in Ultra-Deepwater

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electric submersible pumps retained 39% revenue in 2 024, confirming their versatility for flow rates from 100 to 30,000 barrels per day. Progressive cavity pumps, however, are advancing at an 8% CAGR because their single-rotor design handles heavy crude and sand without rapid wear. SLB's PowerEdge ESPCP hybrid now blends ESP reliability with PCP tolerance for abrasives while lowering CO2 output by 55%.

Rod-lift still anchors legacy onshore wells because of low running costs, while gas-lift excels offshore, where minimal downhole hardware is valued. Hydraulic piston and jet pumps stay in niche, sandy, or remote environments. Plunger-lift clears liquids in low-pressure gas wells. The direction is toward hybrid packages that combine two or more methods, giving operators tailored solutions as reservoirs mature. As permanent-magnet motors push ESP efficiency up 20%, suppliers expect stiffer competition between ESP and PCP platforms over the forecast horizon.

Horizontal wells supplied 50% of the 2024 artificial lift market revenue and will expand at a 6.5% CAGR to 2030. Their complex flow regimes drive innovation in gas-handling separators and slim-line ESP stages that fit tighter completions. Permanent-magnet motors reached 11% horizontal-well adoption in 2024 because they deliver higher power in shorter housings, an asset where lateral space is scarce.

Vertical wells remain vital in conventional provinces that value proven equipment and low intervention cost. Standardization in horizontal completion tools has narrowed the installation cost gap, yet horizontal wells still carry 150-200% higher artificial lift outlays. Autonomous inflow control devices now cut water cut by more than 80% in horizontals, extending pump life and shrinking lifting cost curves. This technological feedback loop reinforces the shift toward laterals, even in regions once dominated by vertical producers.

The Artificial Lift Systems Market Report is Segmented by Lift Type (Electric Submersible Pumps, Rod Lift, and More), Well Orientation (Horizontal Wells and Vertical Wells), Reservoir Type (Conventional and Unconventional), Application (Onshore and Offshore), Component (Pump, Motor, and More), Service (Installation and Commissioning, and More), and Geography (North America, Asia-Pacific, Middle East and Africa, and More).

Geography Analysis

North America secured a 36% share of the artificial lift systems market in 2024, anchored by prolific shale plays and a culture of rapid technology adoption. SLB reported 400% ESP run-life improvements in the Permian Basin after combining gas-handling designs with engineered completions. Automation helps counter regional labor tightness, yet shortages of skilled crews and specialty elastomers remain bottlenecks for the artificial lift system market. The market is moving toward optimization services rather than new hardware as infrastructure matures.

The Middle East and Africa is the fastest-growing region at a 7.2% CAGR, propelled by USD 730 billion in upstream spending through 2030 and a pipeline of enhanced-oil-recovery projects. ADNOC's RoboWell program cut gas-lift use by 30%, revealing the region's appetite for high-end digital solutions. National oil companies are bundling R&D commitments with large procurement lots, locking in long-term service relationships that favor integrated suppliers.

South America's growth revolves around Argentina's Vaca Muerta and Brazil's pre-salt. SLB's USD 1 billion subsea contracts with Petrobras demonstrate confidence in long-life boosting systems that withstand corrosive CO2 and H2S. Guyana will exceed 800,000 barrels daily by 2025, further enlarging demand for subsea lift packages. Technology transfer agreements aim to build local supply hubs, shortening lead times and fostering skilled labor pools.

- Baker Hughes Company

- Halliburton Company

- Schlumberger NV

- Weatherford International Plc

- NOV Inc.

- Dover (Artificial Lift)

- Borets International Limited

- ChampionX Corp

- Alkhorayef Petroleum

- JJ Tech

- AccessESP

- Odessa Separator

- RAGHOEBAR

- Novomet

- Shengli Oilfield Highland

- Torqueflow Sydex

- Canadian Advanced ESP

- GE Power Conversion

- PCM Artificial Lift

- OptiLift

- OilSERV

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Up-cycle in mature well rejuvenation spending

- 4.2.2 Rapid horizontal drilling in unconventional reservoirs

- 4.2.3 Digitalization of lift optimization (AI-enabled VSDs)

- 4.2.4 Shift to deeper offshore pre-salt plays

- 4.2.5 ESG-driven demand for energy-efficient lift systems

- 4.2.6 Niche geothermal repurposing of ESP strings

- 4.3 Market Restraints

- 4.3.1 Volatile crude-price CAPEX compression cycles

- 4.3.2 High work-over costs in ultra-deepwater

- 4.3.3 Supply-chain bottlenecks in specialty elastomers

- 4.3.4 Skilled-labor shortages for automation retrofits

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Lift Type

- 5.1.1 Electric Submersible Pumps (ESP)

- 5.1.2 Progressive Cavity Pump (PCP)

- 5.1.3 Rod Lift (Beam, Sucker-Rod)

- 5.1.4 Gas Lift

- 5.1.5 Hydraulic Piston and Jet Pumps

- 5.1.6 Plunger Lift

- 5.1.7 Other Niche Systems (Hydraulic Submersible, Capillary)

- 5.2 By Well Orientation

- 5.2.1 Horizontal Wells

- 5.2.2 Vertical Wells

- 5.3 By Reservoir Type

- 5.3.1 Conventional

- 5.3.2 Unconventional (Shale/Tight)

- 5.4 By Application

- 5.4.1 Onshore

- 5.4.2 Offshore

- 5.5 By Component

- 5.5.1 Pump

- 5.5.2 Motor

- 5.5.3 Variable Speed Drive and Controls

- 5.5.4 Surface Equipment

- 5.5.5 Ancillary (Sensors, Seal-Sections, Packers)

- 5.6 By Service

- 5.6.1 Installation and Commissioning

- 5.6.2 Optimization and Monitoring

- 5.6.3 Maintenance, Repair and Overhaul (MRO)

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 United Kingdom

- 5.7.2.2 Germany

- 5.7.2.3 France

- 5.7.2.4 Spain

- 5.7.2.5 Nordic Countries

- 5.7.2.6 Russia

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 South Korea

- 5.7.3.5 ASEAN Countries

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Colombia

- 5.7.4.4 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 United Arab Emirates

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 South Africa

- 5.7.5.4 Egypt

- 5.7.5.5 Rest of Middle East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Baker Hughes Company

- 6.4.2 Halliburton Company

- 6.4.3 Schlumberger NV

- 6.4.4 Weatherford International Plc

- 6.4.5 NOV Inc.

- 6.4.6 Dover (Artificial Lift)

- 6.4.7 Borets International Limited

- 6.4.8 ChampionX Corp

- 6.4.9 Alkhorayef Petroleum

- 6.4.10 JJ Tech

- 6.4.11 AccessESP

- 6.4.12 Odessa Separator

- 6.4.13 RAGHOEBAR

- 6.4.14 Novomet

- 6.4.15 Shengli Oilfield Highland

- 6.4.16 Torqueflow Sydex

- 6.4.17 Canadian Advanced ESP

- 6.4.18 GE Power Conversion

- 6.4.19 PCM Artificial Lift

- 6.4.20 OptiLift

- 6.4.21 OilSERV

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment