|

市场调查报告书

商品编码

1848306

塑胶添加剂:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Plastic Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

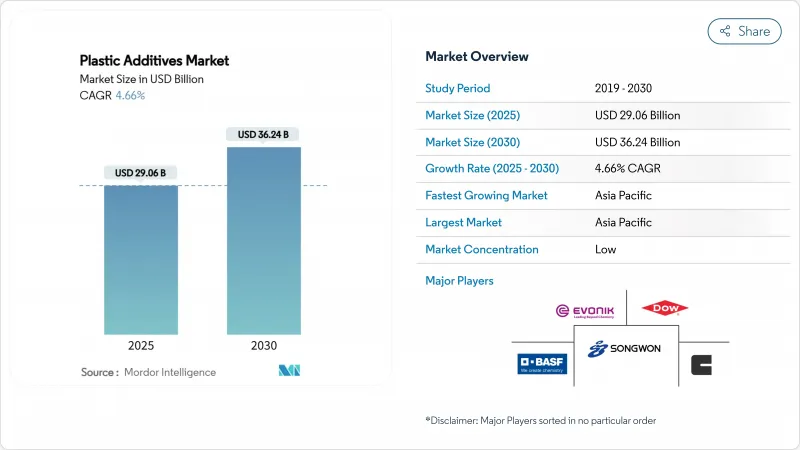

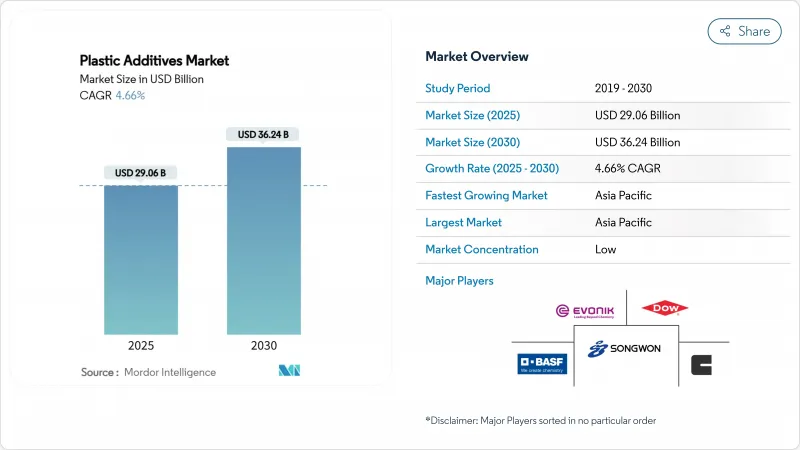

塑胶添加剂市场规模预计在 2025 年为 290.6 亿美元,预计到 2030 年将达到 362.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.66%。

儘管原材料价格波动和化学品监管趋严,但轻量化电动车 (EV) 零件的强劲需求、亚太地区快速的都市化以及严格的全球包装法规仍在支撑成长。受中国和印度特种化学品生产扩张的推动,亚太地区占全球销售额的 54%。加工助剂是成长最快的添加剂类型,受益于向不含 PFAS 化学品的过渡。同时,随着品牌优先考虑更安全的成分,消费品应用的成长速度超过了所有其他终端用途。BASF和科莱恩计划在 2024 年前完成 PFAS 的淘汰工作,以领先欧盟和美国的新法规。

全球塑胶添加剂市场趋势与洞察

转向轻量化电动车零件

电动车的日益普及推动了对耐热、耐压和抗振添加剂的需求。BASF的无卤化阻燃剂 Ultramid T6000 PPA 可实现更薄更轻的接线端子,进而降低潮湿环境下的腐蚀风险。目前,汽车製造商使用的塑胶约占平均汽车重量的 15%,而下一代电动车的设计目标将使这一比例达到 25%,从而推动添加剂的使用。沙乌地基础工业公司的 NORYL GTX LMX310 树脂等类似创新可将充电埠的碳足迹减少 30%,Avient 的 Hydrocerol发泡可将车门面板的重量减轻 20%。随着电池组重量的增加,结构部件节省的每一公斤都变得更有价值,这使得电动车成为塑胶添加剂市场的长期催化剂。

替代传统材料

由于成本和使用寿命的考虑,塑胶正日益取代木材、钢骨和混凝土在建筑领域的应用。BASF稳定剂可延长PVC屋顶板和复合墙板的户外使用寿命,减少重新涂漆週期和维护成本。电气机壳领域也发生了类似的转变,阻燃添加剂使符合IEC标准的聚合物机壳变得更薄。这种材料转变正在推动塑胶添加剂市场的发展,因为每种新的聚合物应用都需要抗氧化剂、紫外线稳定剂、抗衝改质剂和其他添加剂来匹配先前聚合物的性能。

原物料价格波动

2024-2025年,由于亚洲和拉丁美洲的采矿中断,有机锡稳定剂和亚磷酸酯抗氧化剂的供应趋紧,锡和磷的价格大幅波动。由于缺乏对冲工具,小型配方商被迫征收临时额外费用,这削弱了买家信心,并推迟了合约续约。一些生产商正在重新配製稳定剂,以取代钙锌或受阻胺,但直接替代很少能实现无缝衔接。

細項分析

加工助剂是成长最快的类别,预计到2030年复合年增长率将达到4.71%。日益严格的PFAS法规正推动加工商转向新型无氟化学品,例如百尔罗赫的Baerolub AID。 「其他」类别,包括抗氧化剂、阻燃剂和抗衝改质剂,将在2024年占据塑胶添加剂市场份额的70%,这反映了包装、建筑和移动等多样化的终端用途需求。新型防滑和防雾添加剂正在满足对再生材料薄膜的需求,进一步扩大其应用范围。

受大规模包装和管道需求的推动,聚乙烯将在2024年保持17%的收入份额,支撑大宗树脂塑胶添加剂的市场规模。回收内容要求推动了对相容剂和扩链剂的需求,以恢復再生聚乙烯(rPE)流的熔体强度。相较之下,长期以来受回收障碍困扰的聚苯乙烯,由于化学回收技术的突破,将废聚苯乙烯转化为乙苯,用于永续航空燃料添加剂,正在復苏。

聚氯乙烯在窗框和电线涂层中应用广泛,但因其残留邻苯二甲酸酯而受到严格审查。生物来源聚氯乙烯(PVC) 稳定剂的创新,使生产商能够摆脱对化石基原料的依赖,并符合绿色建筑标籤的要求。

区域分析

预计到2024年,亚太地区将占全球塑胶添加剂总收入的54%,该地区塑胶添加剂市场规模将以5.23%的复合年增长率持续扩张。中国的石化自力更生奖励策略和印度放鬆外商投资管制将吸引性能稳定剂和色母粒的新产能,从而确保国内供应链的稳定。

北美市场依然成熟且富有创新精神。美国汽车製造商优先发展电动车平台,推动了温度控管零件对阻燃剂和高流动性添加剂的需求;而加拿大对一次性塑胶的禁令则推动了符合 ASTM D6400 标准的可堆肥母粒的需求。墨西哥受益于近岸外包,吸引了许多挤出机製造商在地采购采购母粒以缩短前置作业时间。这两个地区都经历了温和的成长,但利润率较高。

欧洲的政策是世界上最严格的政策之一。 《包装和包装废弃物法规》规定,塑胶必须在2030年之前实现可回收,并鼓励加工商透过经认可的实验室证明添加剂的兼容性。南美洲和中东/非洲的市场规模较小,但具有良好的上升潜力。巴西对生物聚合物的推动与支持淀粉和聚乳酸(PLA)混合物的添加剂一致。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 电动车轻量化零件的转变推动了对高性能添加剂的需求

- 塑胶在某些应用中取代了传统材料

- 快速的都市化和不断增长的消费者购买力推动了塑胶的需求

- 可堆肥包装要求推动生物基添加剂母粒的采用

- 医疗保健和食品接触塑料中抗菌表面的快速增长

- 市场限制

- 锡、磷等原物料价格波动对利润率造成压力

- 欧洲和北美逐步淘汰邻苯二甲酸酯类塑化剂并缩小其范围

- 对基于 PFAS 的加工助剂的监管审查限制了其采用

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场规模及成长预测

- 按类型

- 润滑剂

- 加工助剂(含氟氟聚合物基)

- 流动改进剂

- 滑爽添加剂

- 抗静电添加剂

- 颜料润湿剂

- 填料分散剂

- 防雾添加剂

- 塑化剂

- 其他类型(发泡、防黏剂、偶联剂等)

- 按塑胶类型

- 聚乙烯(PE)

- 聚丙烯(PP)

- 聚氯乙烯(PVC)

- 聚苯乙烯(PS)

- 聚对苯二甲酸乙二醇酯(PET)

- 聚碳酸酯(PC)

- 聚酰胺(PA)

- 其他类型的塑料

- 按形式

- 母粒

- 粉末

- 液体浓缩物

- 按用途

- 包裹

- 消费品

- 建造

- 车

- 其他(医疗、3D列印)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介{包括全球概况、市场层级、核心细分市场、财务状况、策略资讯、市场排名/份额、产品和服务、最新发展}

- BASF

- ADEKA CORPORATION

- Albemarle Corporation

- Arkema

- Avient Corporation

- Baerlocher GmbH

- Clariant

- Croda International Plc

- Dow

- Emery Oleochemicals

- Evonik Industries AG

- Exxon Mobil Corporation

- KANEKA CORPORATION

- LANXESS

- Mitsui & Co.Plastics Ltd.

- Nouryon

- Peter Greven GmbH & Co. KG

- SABO SpA

- Songwon Industrial Co. Ltd.

- Struktol Company of America, LLC

第七章 市场机会与未来展望

The Plastic Additives Market size is estimated at USD 29.06 billion in 2025, and is expected to reach USD 36.24 billion by 2030, at a CAGR of 4.66% during the forecast period (2025-2030).

Strong demand from lightweight electric-vehicle (EV) components, rapid urbanization in Asia-Pacific, and stringent global packaging rules sustain growth despite feedstock volatility and tightening chemical regulations. Asia-Pacific accounts for 54% of global revenue as China and India scale specialty-chemical output. Processing aids are the fastest-rising additive type, gaining from the move to PFAS-free chemistries, while consumer-goods applications outpace all other end-uses as brands prioritize safer ingredients. Producers are shifting portfolios toward bio-based and PFAS-free grades; BASF and Clariant finished their PFAS exits in 2024 to stay ahead of new EU and U.S. restrictions.

Global Plastic Additives Market Trends and Insights

Shift to Lightweight EV Components

Growing EV adoption is lifting demand for additives that can withstand heat, voltage, and vibration. BASF's non-halogen flame-retardant Ultramid T6000 PPA enables thinner, lighter terminal blocks and reduces corrosion risk in humid environments. Automakers currently use plastic for roughly 15% of average vehicle weight; design targets for next-generation EVs push that ratio toward 25%, magnifying additive volumes. Parallel innovations such as SABIC's NORYL GTX LMX310 resin cut charging-port carbon footprints by 30% while Avient's Hydrocerol foaming agents shave 20% from door-panel mass. As battery packs grow heavier, every kilogram saved in structural parts becomes more valuable, cementing EVs as a long-run catalyst for the plastic additives market.

Replacement of Conventional Materials

Plastics are displacing wood, steel, and concrete in construction owing to cost and longevity. BASF stabilizers extend the outdoor life of PVC roofing sheets and composite siding, reducing repaint cycles and maintenance costs. Similar shifts appear in electrical housings where flame-retardant additives allow thinner polymer casings that meet IEC standards. This material swap boosts the plastic additives market because each new polymer application needs antioxidants, UV stabilizers, and impact modifiers to match incumbent performance.

Volatility in Feedstock Prices

Tin and phosphorous prices swung sharply in 2024-2025 as mining disruptions hit Asia and Latin America, tightening the supply of organotin stabilizers and phosphite antioxidants. Smaller formulators lack hedging tools, forcing ad-hoc surcharges that erode buyer confidence and slow contract renewals. Some producers are redesigning stabilizers around calcium-zinc or hindered amine alternatives, though drop-in replacement is seldom seamless.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory Compostable-Packaging Laws

- Growth of Antimicrobial Surfaces

- Phase-Out of Phthalate Plasticizers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Processing aids represent the fastest-advancing category, forecast at 4.71% CAGR through 2030. Rising PFAS restrictions push converters toward new fluoro-free chemistries like Baerlocher's Baerolub AID, which improves extrusion stability without legacy environmental baggage. The "Others" group, including antioxidants, flame retardants, and impact modifiers, dominated 70% of the plastic additives market share in 2024, reflecting diverse end-use needs across packaging, construction, and mobility. Novel slip and antifog agents fitting demanding recycled-content films further widen the application scope.

Polyethylene sustained a 17% revenue share in 2024, underpinned by large packaging and pipe demand, anchoring the plastic additives market size for commodity resins. Recycled-content mandates amplify needs for compatibilizers and chain extenders that restore melt strength in rPE streams. In contrast, long constrained by recycling hurdles, polystyrene is rebounding on chemical-recycling breakthroughs that turn waste PS into ethylbenzene for sustainable aviation-fuel additives.

Polyvinyl chloride remains entrenched in window profiles and wire coatings yet faces scrutiny over residual phthalates. Innovations in bio-attributed PVC stabilizers allow producers to decouple from fossil-based feedstocks and comply with green-building labels.

The Plastic Additives Market Report Segments the Industry by Type (Lubricants, Processing Aids, Flow Improvers, Slip Additives, and More), Plastic Type (Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), and More), Form (Masterbatch, Powder, and Liquid Concentrate), Application (Packaging, Consumer Goods, Construction, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific continues to anchor global volume, holding 54% of revenue in 2024 and expanding the region's plastic additives market size at 5.23% CAGR. China's stimulus for petrochemical self-reliance and India's relaxation of foreign-investment ceilings invite fresh capacity in performance stabilizers and color concentrates, securing domestic supply chains.

North America remains a mature but innovative market. U.S. automakers prioritizing EV platforms spur flame-retardant and high-flow additives for thermal-management parts, while Canada's single-use plastics ban boosts demand for compostable masterbatches that meet ASTM D6400 criteria. Mexico benefits from near-shoring, attracting extruders who source masterbatch locally to shorten lead times. The combined region posts modest growth yet commands premium margins.

Europe's policy landscape is the world's most stringent. The Packaging and Packaging Waste Regulation dictates recyclability by 2030, pushing converters to certify additive compliance through accredited labs. South America and the Middle-East and Africa are smaller in value but show healthy upside. Brazil's bio-polymer push aligns with additives that support starch and PLA blends,

- BASF

- ADEKA CORPORATION

- Albemarle Corporation

- Arkema

- Avient Corporation

- Baerlocher GmbH

- Clariant

- Croda International Plc

- Dow

- Emery Oleochemicals

- Evonik Industries AG

- Exxon Mobil Corporation

- KANEKA CORPORATION

- LANXESS

- Mitsui & Co.Plastics Ltd.

- Nouryon

- Peter Greven GmbH & Co. KG

- SABO S.p.A.

- Songwon Industrial Co. Ltd.

- Struktol Company of America, LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift to Lightweight EV Components Stimulating High-Performance Additive Demand

- 4.2.2 Replacement of Conventional Materials by Plastic in Several Applications

- 4.2.3 Increasing Demand for Plastic Due to Rapid Urbanization and Rising Purchasing Power Among Consumers

- 4.2.4 Mandatory Compostable-Packaging Laws Accelerating Bio-Based Additive Masterbatches

- 4.2.5 Rapid Growth of Antimicrobial Surfaces in Healthcare and Food-Contact Plastics

- 4.3 Market Restraints

- 4.3.1 Volatility in Tin and Phosphorous Feedstock Prices Compressing Margins

- 4.3.2 Europe nad North America Phase-Out of Phthalate Plasticizers Reducing Addressable Volume

- 4.3.3 Regulatory Scrutiny on PFAS-Based Processing Aids Limiting Adoption

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Lubricants

- 5.1.2 Processing Aids (Fluro-polymer-based)

- 5.1.3 Flow Improvers

- 5.1.4 Slip Additives

- 5.1.5 Antistatic Additives

- 5.1.6 Pigment Wetting Agents

- 5.1.7 Filler Dispersants

- 5.1.8 Antifog Additives

- 5.1.9 Plasticizers

- 5.1.10 Other Types (Blowing Agent, Anti-blocking Agents, Coupling agents, etc.)

- 5.2 By Plastic Type

- 5.2.1 Polyethylene (PE)

- 5.2.2 Polypropylene (PP)

- 5.2.3 Polyvinyl Chloride (PVC)

- 5.2.4 Polystyrene (PS)

- 5.2.5 Polyethylene Terephthalate (PET)

- 5.2.6 Polycarbonate (PC)

- 5.2.7 Polyamides (PA)

- 5.2.8 Other Plastic Types

- 5.3 By Form

- 5.3.1 Masterbatch

- 5.3.2 Powder

- 5.3.3 Liquid Concentrate

- 5.4 By Application

- 5.4.1 Packaging

- 5.4.2 Consumer Goods

- 5.4.3 Construction

- 5.4.4 Automotive

- 5.4.5 Others (Medical, 3D Printing)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Nordics

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments}

- 6.4.1 BASF

- 6.4.2 ADEKA CORPORATION

- 6.4.3 Albemarle Corporation

- 6.4.4 Arkema

- 6.4.5 Avient Corporation

- 6.4.6 Baerlocher GmbH

- 6.4.7 Clariant

- 6.4.8 Croda International Plc

- 6.4.9 Dow

- 6.4.10 Emery Oleochemicals

- 6.4.11 Evonik Industries AG

- 6.4.12 Exxon Mobil Corporation

- 6.4.13 KANEKA CORPORATION

- 6.4.14 LANXESS

- 6.4.15 Mitsui & Co.Plastics Ltd.

- 6.4.16 Nouryon

- 6.4.17 Peter Greven GmbH & Co. KG

- 6.4.18 SABO S.p.A.

- 6.4.19 Songwon Industrial Co. Ltd.

- 6.4.20 Struktol Company of America, LLC

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Rising Research Activities Research to Develop Bio-based Plastics