|

市场调查报告书

商品编码

1848308

农业喷雾器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Agricultural Sprayers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

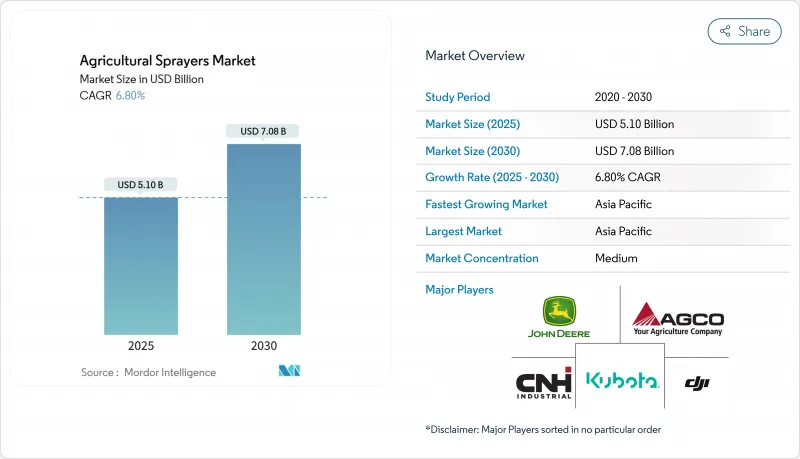

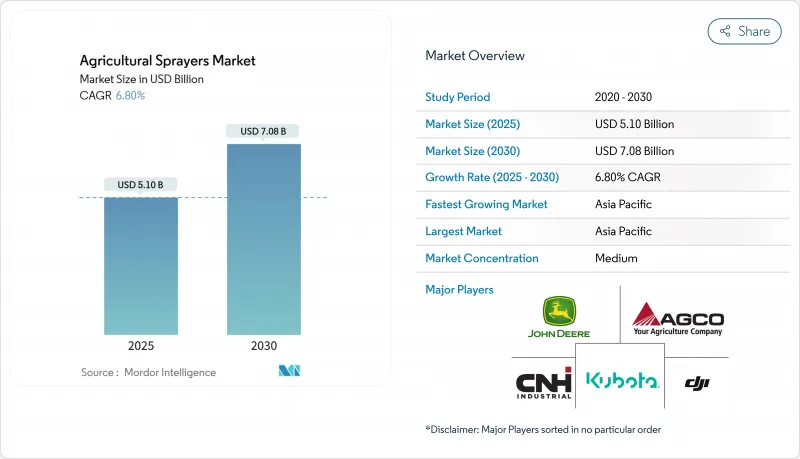

预计到 2025 年,农业喷雾器市场规模将达到 51 亿美元,到 2030 年将达到 70.8 亿美元,年复合成长率为 6.80%。

感测器、机器学习演算法和变数施肥技术的集成,正将机械喷雾器转变为精准、数据驱动的平台,从而减少化学药剂浪费并应对不断上涨的人事费用。在鼓励采用智慧机械的补贴计画的支持下,亚太地区将在2024年占据农业喷雾器市场最大的收入份额。由于农民优先考虑降低营业成本和获得碳信用额,电池驱动型喷雾器的成长速度最快。随着法律规范的完善,无人机和自动喷雾器正从试点阶段走向商业应用,而人工智慧系统也展现出显着减少农药用量的能力。随着全球竞争对手将视觉系统和分析功能整合到其设备中,以及中小企业推出改造套件以升级现有设备,市场竞争日益激烈。

全球农业喷雾器市场趋势与洞察

农药使用量增加

预计2022年作物保护需求将达370万吨,比上年增加4%,几乎是1990年的两倍。全球农药销售量持续成长,尤其是除草剂,其需求量需要使用专用喷嘴。在中国,预计到2025年,植物保护无人机的需求将超过6万台,随着服务供应商扩大无人机机队,农业喷雾器市场也将随之扩张。向生物製品和精准配方的转变需要配备更先进控制系统的喷雾器,因为这些产品比传统化学品需要更专业的施用参数。巴西生物投入品产业的施用面积在上个季度增加了35%以上,推动了对用于施用活性微生物的超低容量喷雾器的投资。

喷嘴、感测器和基于人工智慧的控制方面的技术进步

在一项大面积测试中,约翰迪尔的「目视喷洒」(See and Spray)系统在保持有效杂草控制的同时,实现了除草剂用量减少77%,检验了嵌入式视觉和深度学习模型的有效性。纽荷兰的IntelliSense自动化系统计画于2026年安装在Guardian喷雾器上,该系统在堪萨斯州的田间测试中,以25英里/小时的速度喷洒时,氮肥用量减少了10%。 Ecorobotix配备摄影机的ARA平台在2025年世界农业博览会上进行了评估,实现了厘米级的精度,标誌着自动化喷洒应用领域的重大革新。

高额的初始资本投入与资金筹措障碍

自1990年以来,200马力拖拉机的价格上涨了287%,远远超过了农场收购价格的通膨率。自2017年以来,利率上涨了213%,迫使许多生产者转向租赁,目前租赁交易占11%。预计到2024年,农业净现金收入将下降近20%,这将导致新喷雾器的流动性减少。二手设备库存积压严重,随着经销商减少库存,竞标成交率不断上升。自2011年以来,化学品、肥料和机械的投入成本上涨了37.5%,为农场盈利和设备购买决策带来了多重压力。加拿大农业设备销售也面临类似的挑战,尤其是在拖拉机和联合收割机等大型设备类别中,由于大宗商品价格下跌、营业成本上升和利润下降,需求疲软限制了2025年的销售量。

细分市场分析

燃油动力喷雾器将在2024年占据农业喷雾器市场47.0%的份额,这主要得益于完善的加油基础设施和在长时间田间作业中的可靠性能。目前市占率较小的电池动力喷雾器预计到2030年将以17.9%的复合年增长率成长,这主要得益于营运成本的降低、碳信用奖励以及柴油价格的上涨。研究表明,自动驾驶电动拖拉机的温室气体排放量比柴油动力车辆减少72%。欧盟法规2023/1542要求电池必须含有回收成分并标註碳足迹,这将促进本地电池回收的发展,但也可能增加遵循成本。

内燃机在农业喷雾器领域仍占据主导地位,尤其是在电力充电基础设施有限的偏远农业地区。製造商正透过推出混合动力系统和电池改装套件来适应不断变化的市场。约翰迪尔和GUSS Automation将于2024年底推出电动喷雾器,久保田已与Agtonomy合作开髮用于特种作物的电动拖拉机。在亚太地区,政府支持太阳能充电设施的倡议预示着市场正逐步转型为电动喷雾器技术。

由于其附件相容性强且成本优势优于自走式喷药机,预计到2024年,拖拉机式喷药机将占总收入的36.5%。农业无人机的复合年增长率将达到20.2%,这主要得益于简化的许可要求以及其能够在陡峭和积水地形上作业的能力。密苏里州的一项研究发现,当年度处理面积超过980英亩时,拥有无人机才具有经济可行性,此时无人机所有者的营运成本为每英亩12.27美元,而租用无人机的成本仅为每英亩7.39美元。

对于北美的大规模农业生产而言,自走式机械仍然至关重要。约翰迪尔500R于2025年6月上市,它拥有更佳的操作员视野,采用PowrSpray管线技术,喷洒精度高达98%。对于规模较小的农场而言,背负式喷雾器由于投资成本低、漂移控制性能优异,在特种作物喷洒方面仍具有重要意义。儘管自主系统不断革新传统设备类别,但农业喷雾器技术的这种市场细分仍然存在。

区域分析

预计到2024年,亚太地区将以35.7%的市占率主导农业喷雾器市场,年增率达8.0%。中国已调整补贴结构,优先扶持履带式拖拉机和智慧农具;印度的《农业机械化方案》(SMAM)则为小农户购买喷雾器提供高达80%的成本补贴。机械化趋势与环境目标相符,研究表明,农业机械化呈现U型排放模式:初期拖拉机的引入导致排放增加,随后随着精准农业系统的应用,环境影响逐渐降低。

北美保持着其技术领先的市场地位。至2024年,精准喷洒技术将覆盖超过100万英亩的土地,并减少800万加仑的除草剂用量。然而,该地区面临许多挑战,包括预计2024年农场现金收入下降20%,以及利率上升将延长资本投资的回收期。美国农业部拨款30亿美元用于气候智慧型试点项目,其中包括对精密农业设备的补贴,这将有助于缓解市场放缓的影响。

欧洲农业喷雾器市场的成长主要得益于管理方案。欧盟电池法规将实施回收材料含量要求,将从2028年起影响动力喷雾器的规格。欧洲领先的喷雾设备製造商Excel Industries报告称,儘管由于农民推迟订单下降,但其2023-2024财年的农业产品销售额仍达到5.781亿美元(5.03亿欧元),占总销售额的46%。环境法规和「绿色新政」的要求持续推动精准设备的普及,有助于在充满挑战的经济状况下稳定市场。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 农药使用量增加

- 喷嘴、感测器和基于人工智慧的控制方面的技术进步

- 人事费用上升和操作人员严重短缺

- 政府对机械化和智慧农业的补贴

- 碳信用计画旨在鼓励浮动利率申请

- 自动喷雾器的商业化

- 市场限制

- 高昂的初始资本支出和资金筹措障碍

- 农艺师或操作人员技能有限

- 网路安全和资料完整性风险

- 电池报废处置限制

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(价值及数量)

- 透过动力来源

- 手动的

- 电池供电/电动

- 太阳能发电

- 燃油动力

- 依产品类型

- 手持/背包

- 联结机式

- 拖着

- 自推进式

- 无人机/无人喷洒器

- 透过使用

- 田间作物

- 果园和葡萄园

- 温室作物

- 草坪和园艺

- 按喷雾量

- 超低容量

- 低容量

- 高容量

- 按技术水准

- 传统的

- 精准/GPS导航

- 人工智慧赋能与自主

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Deere & Company

- AGCO Corporation

- CNH Industrial NV

- Mahindra & Mahindra Ltd.

- Kubota Corporation

- DJI

- Exel Industries

- KUHN SAS

- ASPEE Agro Equipment Pvt. Ltd.

- Hockley International Ltd

- Jacto SA

- GUSS Automation LLC

- Yamaha Motor Co., Ltd.

- Hylio, Inc.

- Goldacres Pty Ltd

- Chafer Machinery Ltd.

第七章 市场机会与未来展望

The agricultural sprayers market size is valued at USD 5.10 billion in 2025 and is projected to reach USD 7.08 billion by 2030, growing at a CAGR of 6.80%.

The integration of sensors, machine-learning algorithms, and variable-rate technologies is transforming mechanical sprayers into precise, data-driven platforms that reduce chemical waste and address increasing labor costs. The Asia-Pacific region dominates the agricultural sprayers market with the highest revenue share in 2024, supported by Chinese and Indian government subsidy programs that promote smart machinery adoption. Battery-powered units show the fastest growth as farmers prioritize reduced operating costs and carbon credits. Drone and autonomous sprayers are transitioning from pilot scale to commercial applications as regulatory frameworks develop, while AI-enabled systems demonstrate significant reductions in agrochemical usage. Market competition is intensifying as global OEMs integrate vision systems and analytics with equipment, and smaller companies introduce retrofit kits to upgrade existing fleets.

Global Agricultural Sprayers Market Trends and Insights

Growth in Agrochemical Usage

Pesticide demand reached 3.70 million metric tons in 2022, up 4% year on year and nearly double 1990 levels, compelling growers to acquire equipment capable of handling larger volumes with precise application. Global agrochemical sales continue to increase, particularly in herbicides that require specialized nozzles. In China, plant-protection drone demand is projected to exceed 60,000 units by 2025, expanding the agricultural sprayers market as service providers increase their fleets. The transition toward biological products and precision formulations necessitates sprayers with enhanced control systems, as these products require more specific application parameters compared to conventional chemicals. Brazil's bio-input segment increased treated acreage by more than 35% in the last season, driving investment in ultra-low-volume sprayers designed for live microbe applications.

Technological Advancements in Nozzle, Sensor and AI-Based Control

John Deere's See and Spray system demonstrated a 77% reduction in herbicide usage during broad-acre trials while maintaining weed control effectiveness, validating the efficacy of embedded vision and deep-learning models. New Holland's IntelliSense automation system, scheduled for implementation in 2026 Guardian sprayers, demonstrated 10% nitrogen reduction at 25 mph field speeds during Kansas field trials, establishing the correlation between enhanced productivity and decreased input costs, boosting adoption across the agricultural sprayer market. Ecorobotix's camera-equipped ARA platform, which received recognition at World Ag Expo 2025, achieves centimeter-level precision, indicating the evolution of automated spray applications.

High Upfront Capital Expenditure and Financing Hurdles

Prices for 200-horsepower tractors have climbed 287% since 1990, far outpacing farm-gate inflation, and interest rates have soared 213% since 2017, pushing many growers toward leases that now cover 11% of deals. Net cash farm income is forecast to fall nearly 20% in 2024, shrinking liquidity for new sprayers. Used equipment lists are bloated, and auction clearance rates are rising as dealers trim inventory. Input costs for chemicals, fertilizers, and machinery have increased 37.5% since 2011, creating compound pressure on farm profitability and equipment purchasing decisions. Canadian farm equipment sales face similar challenges, with weak demand limiting 2025 sales due to falling commodity prices, high operating costs, and reduced profits, particularly affecting large equipment categories like tractors and combines.

Other drivers and restraints analyzed in the detailed report include:

- Rising Labor-Cost and Acute Operator Shortages

- Government Mechanization and Smart-Farming Subsidies

- Limited Agronomist or Operator Skill Sets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fuel-powered sprayers dominated the agricultural sprayers market with a 47.0% revenue share in 2024, supported by widespread refueling infrastructure and reliable performance in extended field operations. Battery-powered units, currently representing a smaller market segment, are projected to grow at a 17.9% CAGR through 2030, driven by reduced operational costs, carbon credit incentives, and increasing diesel prices. Research indicates that autonomous electric tractors generate 72% lower greenhouse gas emissions compared to diesel alternatives. The EU Regulation 2023/1542 implementation requires recycled content and carbon-footprint labeling for batteries, potentially increasing compliance expenses while encouraging regional battery recycling development.

Combustion engines remain prevalent in agricultural sprayers, particularly in remote farming areas with limited electric charging infrastructure. Manufacturers are adapting to market changes by introducing hybrid systems and battery conversion kits. John Deere and GUSS Automation introduced an electric sprayer variant in late 2024, while Kubota partnered with Agtonomy to develop electric tractors for specialty crop applications. In the Asia-Pacific region, government initiatives supporting solar-powered charging facilities indicate a gradual market transition toward electric sprayer technologies.

Tractor-mounted sprayers constituted 36.5% of 2024 sales due to their attachment compatibility and cost advantages compared to self-propelled units. Agricultural drones demonstrate a 20.2% CAGR, attributed to streamlined licensing requirements and their capability to operate in steep or waterlogged terrain. Missouri research indicates that drone ownership becomes economically viable when annual treated areas exceed 980 acres, with operational costs of USD 12.27 per acre for owners compared to USD 7.39 for custom hiring services.

Self-propelled machines remain essential for large-scale North American agricultural operations. The John Deere 500R, released in June 2025, incorporates enhanced operator visibility and PowrSpray plumbing technology, delivering 98% application precision. In small-scale farming operations, knapsack units maintain their relevance for specialized crop applications due to reduced capital requirements and superior drift management. This market segmentation in agricultural sprayer technology persists while autonomous systems continue to transform traditional equipment categories.

The Agricultural Sprayers Market Report is Segmented by Source of Power (Manual, and More), by Product Type (Handheld/Knapsack, Tractor-Mounted, and More), by Application/Usage (Field Crops, and More), by Spray Volume Capacity (Ultra-Low Volume, and More), Technology Level (Conventional, and More), and by Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific dominates the agricultural sprayers market with a 35.7% share in 2024 and projects an 8.0% annual growth rate. China has modified its subsidy structure to prioritize crawler tractors and smart implements, while India's Sub-Mission on Agricultural Mechanization (SMAM) provides up to 80% cost coverage for smallholder sprayer purchases. The mechanization trend aligns with environmental objectives, as research indicates a U-shaped emissions pattern where initial tractor adoption increased emissions, but subsequent precision system implementation reduced environmental impact.

North America maintains a technologically advanced market position. In 2024, See and Spray technology covered more than 1 million acres, reducing herbicide usage by 8 million gallons. However, the market faces challenges from a projected 20% decrease in 2024 cash farm income and increased interest rates, extending equipment investment recovery periods. The USDA's USD 3 billion allocation for climate-smart pilot programs, which includes precision agriculture equipment reimbursement, helps mitigate market slowdown impacts.

Europe's agricultural sprayers market growth stems from regulatory initiatives. The EU Battery Regulation implements recycled-content requirements that will influence electric sprayer specifications post-2028. EXEL Industries, the region's primary spray equipment manufacturer, reported agriculture revenue of USD 578.1 million (Euro 503 million) in fiscal 2023-2024, comprising 46% of total revenue, despite noting reduced orders due to farmers postponing equipment updates. Environmental regulations and green-deal requirements continue to drive precision equipment adoption, supporting market stability despite challenging economic conditions.

- Deere & Company

- AGCO Corporation

- CNH Industrial N.V.

- Mahindra & Mahindra Ltd.

- Kubota Corporation

- DJI

- Exel Industries

- KUHN SAS

- ASPEE Agro Equipment Pvt. Ltd.

- Hockley International Ltd

- Jacto S.A.

- GUSS Automation LLC

- Yamaha Motor Co., Ltd.

- Hylio, Inc.

- Goldacres Pty Ltd

- Chafer Machinery Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Agrochemical Usage

- 4.2.2 Technological Advancements in Nozzle, Sensor and AI-Based Control

- 4.2.3 Rising Labor-Cost and Acute Operator Shortages

- 4.2.4 Government Mechanization and Smart-Farming Subsidies

- 4.2.5 Carbon-Credit Programs Rewarding Variable-Rate Applications

- 4.2.6 Commercialization of Autonomous Sprayers

- 4.3 Market Restraints

- 4.3.1 High Upfront Capital Expenditure and Financing Hurdles

- 4.3.2 Limited Agronomist or Operator Skill Sets

- 4.3.3 Cyber-Security and Data-Integrity Risks

- 4.3.4 Battery End-of-Life Disposal Constraints

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Source of Power

- 5.1.1 Manual

- 5.1.2 Battery-Operated/Electric

- 5.1.3 Solar-Powered

- 5.1.4 Fuel-Operated

- 5.2 By Product Type

- 5.2.1 Handheld/Knapsack

- 5.2.2 Tractor-Mounted

- 5.2.3 Trailed/Pull-Type

- 5.2.4 Self-Propelled

- 5.2.5 UAV/Drone Sprayers

- 5.3 By Application/Usage

- 5.3.1 Field Crops

- 5.3.2 Orchards and Vineyards

- 5.3.3 Greenhouse Crops

- 5.3.4 Turf and Gardening

- 5.4 By Spray Volume Capacity

- 5.4.1 Ultra-Low Volume

- 5.4.2 Low Volume

- 5.4.3 High Volume

- 5.5 By Technology Level

- 5.5.1 Conventional

- 5.5.2 Precision/GPS-Guided

- 5.5.3 AI-Enabled and Autonomous

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 UAE

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Deere & Company

- 6.4.2 AGCO Corporation

- 6.4.3 CNH Industrial N.V.

- 6.4.4 Mahindra & Mahindra Ltd.

- 6.4.5 Kubota Corporation

- 6.4.6 DJI

- 6.4.7 Exel Industries

- 6.4.8 KUHN SAS

- 6.4.9 ASPEE Agro Equipment Pvt. Ltd.

- 6.4.10 Hockley International Ltd

- 6.4.11 Jacto S.A.

- 6.4.12 GUSS Automation LLC

- 6.4.13 Yamaha Motor Co., Ltd.

- 6.4.14 Hylio, Inc.

- 6.4.15 Goldacres Pty Ltd

- 6.4.16 Chafer Machinery Ltd.