|

市场调查报告书

商品编码

1848321

单宁:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Tannin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

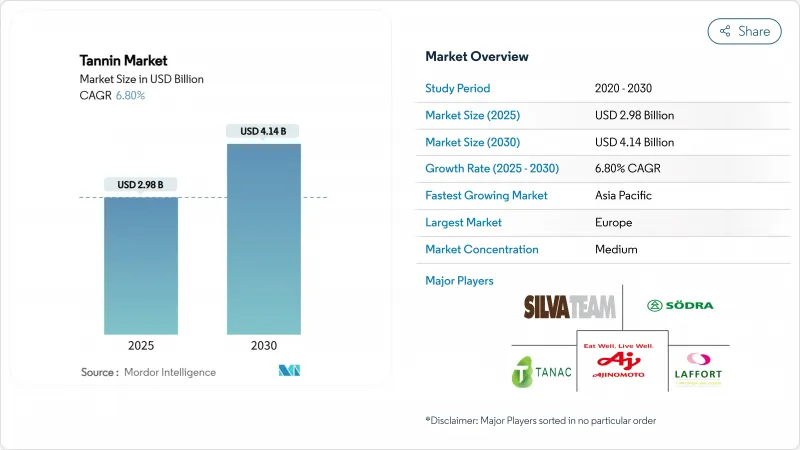

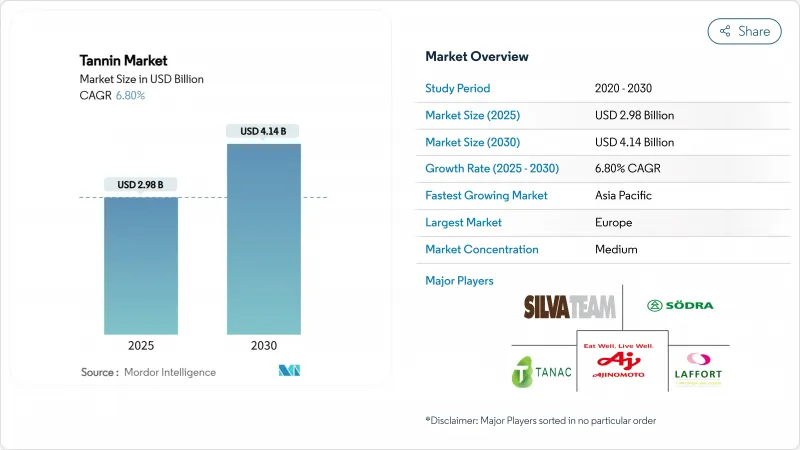

预计到 2025 年,单宁市场规模将达到 29.8 亿美元,到 2030 年将达到 41.4 亿美元,预测期内复合年增长率为 6.80%。

这项繁荣主要得益于皮革、葡萄酒、木质复合材料和特殊营养品等产业对天然材料的日益青睐。随着监管日益严格,消费者对永续和环保产品的需求不断增长,合成添加剂的使用量显着减少。尤其是在农业废弃物、树皮和海藻等原料的利用方面,创新增强了供应链的韧性,并与循环经济的目标相契合。这些进步不仅减少了对传统原料的依赖,也有助于环境的永续性。此外,无铬皮革、有机葡萄酒标准和无甲醛木材黏合剂的迅速普及,也证明了产业和消费者对生物基多酚的需求激增。儘管市场竞争依然温和,但拥有先进萃取技术和垂直整合能力的公司正在脱颖而出,占据明显的优势。这些先行企业不仅提高了营运效率,还获得了高价合同,巩固了其市场地位。在技术创新、永续性和消费者偏好转变的共同推动下,这一发展趋势预示着单宁市场长期前景光明。

全球单宁市场趋势与洞察

皮革业对天然环保鞣剂的需求很高

随着皮革产业将重点转向永续鞣製,环保型植物鞣剂作为传统铬基化学品的替代品,需求显着成长。欧盟的REACH法规收紧了对皮革加工中有害化学品使用的限制,促使製造商转向天然替代品。在北美,美国环保署将某些铬化合物列为致癌性后,植物来源鞣剂的普及速度加快。植物鞣革不仅在奢侈品市场享有溢价,也与领先时尚品牌的永续性最后加工不谋而合。这些品牌如今在其采购政策中优先考虑无铬材料,既满足了消费者的偏好,也符合监管要求。此外,先进生物整理系统的出现正在革新皮革加工,提供可生物降解的解决方案,在提升耐用性和美观性的同时,也符合永续发展标准。这些行业范围内的变化清晰地表明,消费者对永续性产品的需求日益增长,同时也响应了减少工业化学品使用的法规要求。推动这项变革的关键产业包括汽车内部装潢建材、高檔皮革製品和鞋类,这些产业对永续的高品质材料的需求日益增长。此外,对循环经济原则的日益重视也促使皮革产业朝着减少废弃物和提高资源利用效率的方向发展,从而支持永续鞣革製程的转型。

葡萄酒和饮料生产中单宁用量不断增加

随着酿酒商寻求提高葡萄酒的色彩稳定性、改善口感、优化陈年特性,同时还要满足不断变化的监管要求,酿酒单宁的需求正在显着增长。在美国,酒精和烟草税收贸易局 (TTB) 制定了明确的使用限量,允许红葡萄酒中单宁的含量最高为每千加仑 24 磅,白葡萄酒中最高为每千加仑 6.4 GAE。这些标准化指南促进了整个产业的统一应用。在欧洲,欧洲食品安全局已核准在动物饲料中使用单宁酸,含量最高可达每公斤 15 毫克,将其用途扩展到传统葡萄酒生产之外。在全球范围内,国际葡萄与葡萄酒组织 (OIV) 透过制定植物来源(包括坚果、栗子、橡木和葡萄籽)的品质标准,使酿酒单宁的使用合法化。此外,美国食品药物管理局(FDA)对某些化合物的「公认安全」(GRAS)认定,促进了它们在更广泛的食品和饮料应用中的推广。有机认证体系则透过为天然单宁提供高端市场机会,进一步加剧了市场分散化。

复杂的提取工艺限制了商业性规模生产。

单宁提取製程的技术复杂性和资金需求阻碍了市场扩张,小型生产商和新进入者深受其害。美国专利商标局登记的200多项单宁提取方法专利证明了高效生产所需的技术复杂性。国际标准化组织(ISO)对单宁产品製定了严格的品质标准,要求对提取参数进行精确控制,这对缺乏尖端设备的公司构成了挑战。同时,欧洲药品管理局(EMA)的《药品单宁良好生产规范》(GMP)要求先进的品管和经过验证的萃取方法。同样,美国食品药物管理局(FDA)现行的《膳食补充剂良好生产规范》(GMP)指南对植物萃取物提出了详细的要求,推高了合规成本并增加了技术难度。这些监管和技术障碍不仅延缓了市场准入,也推高了生产成本。这可能会削弱单宁基产品与合成替代品的竞争力,尤其是在价格敏感型产业和新兴市场。

细分市场分析

2024年,植物来源单宁将占据市场主导地位,市占率高达82.43%。这得益于数十年来不断改进的提取方法和可靠的供应链。这些单宁主要来自奎布拉乔树、相思树、栗树和橡树等传统树种。完善的农业实践和加工设施进一步巩固了其市场领先地位,确保了产品的一流品质和稳定供应。美国林务局对从美国本土森林中提取树皮单宁进行了深入研究,为建立可靠的供应链铺平了道路。同时,欧洲森林协会制定了永续树皮采伐指南,以平衡森林活力与单宁原料需求。这些传统来源已被监管机构广泛认可,美国食品药物管理局(FDA)已认定某些植物来源宁可安全用于食品。此外,国际森林研究组织联合会也支持永续的采购方式,确保在不损害环境标准的前提下,单宁供应稳定。

褐藻已成为成长最快的来源,预计到2030年将以8.04%的复合年增长率成长。这种快速成长归功于褐藻中优异的间苯三酚生物活性及其在医药领域日益增长的应用。美国海洋暨大气总署(NOAA)已将褐藻养殖认定为一种永续的海洋资源,其收穫不会对环境造成损害。欧洲海洋和渔业基金也支持这一观点,并资助海洋生物技术研究,重点关注间苯三酚的萃取及其在医药和营养保健品领域的应用。在日本,日本海洋地球科学技术厅(JAMSTEC)率先采用先进的养殖方法,确保褐藻间苯三酚的稳定全年生产。国际海藻协会(ISCA)制定了这些海洋来源单宁的品质标准,促进了其在高端应用中的整合。这些进展不仅使褐藻成为小众应用领域备受追捧的资源,而且还解决了与陆生植物收穫相关的永续性挑战。

区域分析

到2024年,欧洲将占据全球34.11%的市场份额,这得益于严格的环境法规和强大的产业框架,这些都为天然单宁的应用提供了支持。欧洲食品安全局已製定了明确的食品、饲料和工业应用中单宁的安全通讯协定,为吸引投资提供了监管确定性。同时,欧洲药品管理局已批准某些单宁化合物作为药品,从而开拓了利润丰厚的市场。欧盟的REACH法规限制了工业中危险化学品的使用,并强制要求转向更安全的天然替代品,例如单宁。欧盟委员会的循环经济行动计画鼓励将农业和废弃物转化废弃物生物基化学品。从金融角度来看,欧洲投资银行正在支持包括单宁提取和加工在内的永续技术企业,从而加强该地区的基础设施建设。

亚太地区正经历快速成长,预计到2030年将以7.74%的复合年增长率增长,这主要得益于快速的工业化进程和有利于天然产品使用的法规的不断完善。中国国家发展和改革委员会主导的战略发展规划重点发展生物基化学品,为单宁的生产铺平了道路。在印度,化学和肥料部推出了与生产挂钩的激励措施,以加强天然产品的生产,特别是从农产品中提取单宁。日本厚生劳动省扩大了机能性食品的范围,将各种形式的单宁基成分纳入其中。东南亚国家联盟(ASNAN)制定了天然产品的区域标准,以简化单宁原料的贸易。在澳大利亚,农业部启动了有机认证计划,为天然单宁的高端市场铺平了道路,并使区域市场格局更加多元化。

北美市场正稳步成长,这主要得益于有利于天然替代品而非合成替代品的监管措施。美国食品药物管理局(FDA)对单宁化合物的GRAS认证,为其在食品饮料产业的应用铺平了道路。美国环保署(EPA)制定的甲醛排放标准也支持在木材加工中使用单宁基黏合剂。同时,美国酒精和烟草税收贸易局(ATTB)完善了葡萄酒处理材料的监管规定,并制定了明确的单宁使用指南和限制,力求在创新与安全之间取得平衡。在原料丰富的南美洲,巴西正主导永续林业的投资,并持续强化其单宁供应链。在中东和非洲,受倡导农业废弃物回收的国际计画以及人们对循环经济理念日益增长的认识的推动,单宁市场也呈现出蓬勃发展的态势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 皮革产业对天然环保鞣剂的需求日益增长

- 葡萄酒和饮料生产中单宁用量不断增加

- 食品业对永续和天然成分的偏好

- 木材胶粘剂和塑合板行业的成长

- 永续提取自农业废弃物和树皮提取物

- 单宁的抗氧化特性和其他特性使其在膳食补充剂中得到应用。

- 市场限制

- 复杂的提取工艺限制了商业化规模生产。

- 提取产量的区域差异

- 严格的FDA和欧盟法规增加了合规成本。

- 来自合成替代品的竞争

- 供应链分析

- 监理展望

- 波特五力模型

- 新进入者的威胁

- 买方/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按原料

- 植物

- 褐藻

- 透过使用

- 食品/饮料

- 药品和营养补充剂

- 皮革产业

- 木材工业

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市场排名分析

- 公司简介

- Sodra Skogsagarna

- Ajinomoto Co., Inc

- Silvateam Group

- Laffort Holding

- TANAC

- Ulrich Holding GmbH

- Esseco Group Srl

- Tanin dd Sevnica

- Tannin Corporation

- NTE Company(Pty)Limited

- Gallotannin Co. Ltd

- Forestal Quebracho SA

- Polson Ltd.

- UCL Company(Pty)Ltd

- Silvateam group

- Xi'an Prius Biological Engineering Co.,Ltd

- Forestal Mimosa Limited

- ChemFaces Biochemical Co., Ltd.

- Glentham Life Sciences Limited

- FUJIFILM Wako Pure Chemical Corporation

第七章 市场机会与未来展望

The tannin market size reached USD 2.98 billion in 2025 and is projected to reach USD 4.14 billion by 2030, expanding at a compound annual growth rate (CAGR) of 6.80% during the forecast period.

This upswing is largely fueled by a rising inclination towards natural inputs in sectors like leather, wine, wood composites, and specialty nutrition. As regulations tighten and consumers increasingly demand sustainable, eco-friendly products, there's a pronounced shift away from synthetic additives. Innovations in sourcing, especially with agro-waste, bark, and seaweed, bolster supply chain resilience and resonate with circular economy goals. Such strides not only lessen reliance on conventional raw materials but also champion environmental sustainability. Furthermore, the swift embrace of chrome-free leather, organic wine standards, and formaldehyde-free wood adhesives underscores the burgeoning appetite for bio-based polyphenols in both industrial and consumer realms. While market competition remains moderate, firms excelling in extraction technology and pursuing vertical integration are carving out a distinct advantage. These pioneers are not only enhancing operational efficiencies but also clinching premium contracts and solidifying their market stance. This trajectory paints a bullish long-term outlook for the tannin market, propelled by innovation, sustainability, and shifting consumer tastes.

Global Tannin Market Trends and Insights

High demand for natural and eco-friendly tanning agents in leather industry

As the leather industry pivots towards sustainable tanning, there's a notable surge in demand for vegetable tannins, seen as eco-friendly alternatives to traditional chromium-based chemicals. Stricter limitations on hazardous chemicals in leather processing, driven by the European Union's REACH regulation, are pushing manufacturers towards natural substitutes. In North America, the U.S. Environmental Protection Agency's designation of certain chromium compounds as carcinogenic has hastened the shift to plant-based tanning agents. Reports highlight that vegetable-tanned leather not only fetches a premium in luxury markets but also resonates with the sustainability ethos of leading fashion brands. These brands are now prioritizing chrome-free materials in their sourcing policies, aligning with both consumer preferences and regulatory demands. Moreover, the advent of advanced bio-finishing systems is transforming leather processing, offering biodegradable solutions that boost durability and aesthetic appeal while meeting sustainability benchmarks. This industry-wide shift underscores a response to heightened consumer demand for eco-friendly products and regulatory pushes to curtail industrial chemical use. Key sectors championing this change include automotive upholstery, luxury leather goods, and footwear, all witnessing a rising appetite for sustainable, high-quality materials. Furthermore, a growing emphasis on circular economy principles is steering the leather industry towards waste minimization and resource efficiency, bolstering the move to sustainable tanning.

Increasing use of tannins in wine and beverage production

The demand for oenological tannins is witnessing significant growth as winemakers aim to improve color stability, enhance mouthfeel, and optimize aging characteristics, all while adhering to evolving regulatory requirements. In the United States, the Alcohol and Tobacco Tax and Trade Bureau (TTB) has established precise usage limits, allowing up to 24 pounds of tannins per 1000 gallons in red wine and 6.4 GAE per 1000 gallons in white wine. These standardized guidelines are driving consistent adoption across the industry. In Europe, the European Food Safety Authority has approved tannic acid for use in animal feed at concentrations up to 15 mg/kg, thereby expanding its applications beyond traditional wine production. Globally, the International Organisation of Vine and Wine (OIV) has legitimized the use of oenological tannins by defining quality standards for botanical sources such as nutgalls, chestnut, oak, and grape seeds. Additionally, the FDA's GRAS (Generally Recognized As Safe) designation for specific tannin compounds has facilitated their integration into broader food and beverage applications. Organic certification programs further contribute to market segmentation by creating premium opportunities for naturally sourced tannins.

Complex extraction processes limit commercial scaling

Market expansion faces hurdles due to the technical intricacies and capital demands of tannin extraction processes, with smaller producers and newcomers feeling the pinch. Over 200 patents on tannin extraction methods, recorded by the U.S. Patent and Trademark Office, underscore the technological finesse needed for efficient production. The International Organization for Standardization has set stringent quality benchmarks for tannin products, necessitating meticulous control over extraction parameters. This poses challenges for firms without cutting-edge equipment. Meanwhile, the European Medicines Agency's Good Manufacturing Practice mandates for pharmaceutical-grade tannins call for advanced quality control and validated extraction methods. Similarly, the FDA's Current Good Manufacturing Practice guidelines for dietary supplements stipulate detailed botanical extraction requirements, driving up compliance costs and adding to technical challenges. Such regulatory and technical hurdles not only decelerate market entry but also inflate production expenses. This could hinder the competitiveness of tannin-based products, especially against synthetic counterparts, in price-sensitive sectors and emerging markets.

Other drivers and restraints analyzed in the detailed report include:

- Tannin's antioxidant and other properties drives its use in nutraceuticals

- Growth in the wood adhesive and particleboard industry

- Variability in extraction yiels across geography

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, plant-based tannins dominate the market with an 82.43% share, a testament to decades of refined extraction methods and dependable supply chains. These tannins are sourced from traditional favorites like quebracho, acacia, chestnut, and oak. This market leadership is bolstered by robust agricultural practices and processing facilities, ensuring top-notch quality and dependable supply. The U.S. Department of Agriculture's Forest Service has conducted in-depth studies on extracting bark tannins from the nation's forests, paving the way for a solid supply chain. Meanwhile, the European Forest Institute has rolled out sustainable bark harvesting guidelines, balancing forest vitality with the demand for tannin raw materials. These traditional sources enjoy broad regulatory acceptance, with the FDA deeming specific plant-derived tannins safe for food use. Furthermore, the International Union of Forest Research Organizations champions sustainable sourcing practices, ensuring a steady supply of tannins without compromising environmental standards.

Brown algae is emerging as the fastest-growing source, boasting an 8.04% CAGR projected through 2030. This surge is attributed to the algae's superior phlorotannin bioactivity and its burgeoning role in pharmaceuticals. The National Oceanic and Atmospheric Administration vouches for brown algae cultivation, deeming it a sustainable marine resource that can be harvested without harming the environment. Backing this, the European Maritime and Fisheries Fund is funding research into marine biotechnologies, spotlighting phlorotannin extraction for both pharmaceutical and nutraceutical applications. In Japan, the Agency for Marine-Earth Science and Technology has pioneered advanced cultivation methods, ensuring brown algae consistently yield phlorotannins year-round. The International Seaweed Association has set quality benchmarks for these marine-derived tannins, facilitating their integration into premium applications. Such advancements not only elevate brown algae as a sought-after source for niche applications but also address the sustainability challenges tied to harvesting terrestrial plants.

The Tannin Market Report is Segmented by Source (Plant and Brown Algae); Application (Food and Beverage, Pharmaceutical and Nutraceutical, Leather Industry, Wood Industry, and Others); and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, Europe commands a dominant 34.11% market share, bolstered by stringent environmental regulations and a robust industrial framework that champions natural tannin applications. The European Food Safety Authority has set forth definitive safety protocols for tannins in food, feed, and industrial uses, fostering a climate of regulatory certainty that attracts investments. Meanwhile, the European Medicines Agency has greenlit specific tannin compounds for pharmaceutical use, carving out lucrative market niches. The EU's REACH regulation curbs hazardous chemicals in industries, mandating a shift towards safer, natural alternatives like tannins. Further underscoring the region's commitment, the European Commission's Circular Economy Action Plan champions the transformation of agricultural and forestry waste into bio-based chemicals. On the financial front, the European Investment Bank is backing sustainable tech ventures, including tannin extraction and processing, bolstering the region's infrastructure.

Asia-Pacific is on a rapid ascent, projected to grow at a 7.74% CAGR through 2030, fueled by swift industrialization and evolving regulations that endorse natural product uses. China's strategic development plans, spearheaded by the National Development and Reform Commission, now spotlight bio-based chemicals, paving the way for tannin production. In India, the Ministry of Chemicals and Fertilizers rolls out production-linked incentives, bolstering the manufacturing of natural products, notably tannin extraction from agricultural byproducts. Japan's Ministry of Health, Labour and Welfare broadens the horizon for functional foods, now embracing tannin-based ingredients in varied formats. The Association of Southeast Asian Nations sets the stage with regional standards for natural products, streamlining trade for tannin materials. Down under, Australia's Department of Agriculture launches organic certification programs, paving the way for a premium market for naturally sourced tannins, thus diversifying the regional market landscape.

North America charts a steady growth trajectory, driven by regulatory measures that champion natural substitutes over synthetic ones. The U.S. Food and Drug Administration's GRAS determinations for tannin compounds pave their way into the food and beverage sector. The U.S. Environmental Protection Agency's standards on formaldehyde emissions bolster the case for tannin-based adhesives in wood manufacturing. Meanwhile, the Alcohol and Tobacco Tax and Trade Bureau refines regulations on wine treating materials, setting clear guidelines and limits for tannin use, balancing innovation with safety. South America, with its rich tapestry of raw material sources, sees Brazil spearheading investments in sustainable forestry, fortifying tannin supply chains. In the Middle East and Africa, there's a burgeoning interest, spurred by international programs advocating agricultural waste valorization and a rising consciousness of circular economy tenets.

- Sodra Skogsagarna

- Ajinomoto Co., Inc

- Silvateam Group

- Laffort Holding

- TANAC

- Ulrich Holding GmbH

- Esseco Group Srl

- Tanin d.d. Sevnica

- Tannin Corporation

- NTE Company (Pty) Limited

- Gallotannin Co. Ltd

- Forestal Quebracho S.A.

- Polson Ltd.

- UCL Company (Pty) Ltd

- Silvateam group

- Xi'an Prius Biological Engineering Co.,Ltd

- Forestal Mimosa Limited

- ChemFaces Biochemical Co., Ltd.

- Glentham Life Sciences Limited

- FUJIFILM Wako Pure Chemical Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Demand for Natural and Eco-Friendly Tanning Agents in Leather Industry

- 4.2.2 Increasing Use of Tannins in Wine and Beverage Production

- 4.2.3 Preference of Sustainable, And Natural Ingredients in Food Industry

- 4.2.4 Growth in the Wood Adhesive and Particleboard Industry

- 4.2.5 Sustainable Sourcing from Agro-Waste and Bark Extracts

- 4.2.6 Tannin's Antioxidant and Other Properties Drives Its Use in Nutraceuticals

- 4.3 Market Restraints

- 4.3.1 Complex Extraction Processes Limit Commercial Scaling

- 4.3.2 Variability In Extraction Yield Across Geography

- 4.3.3 Stringent FDA And EU Regulation Increase Compliance Costs

- 4.3.4 Competition From Synthetic Alternatives

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Source

- 5.1.1 Plant

- 5.1.2 Brown Algae

- 5.2 By Application

- 5.2.1 Food and Beverage

- 5.2.2 Pharmaceutical and Nutraceutical

- 5.2.3 Leather Industry

- 5.2.4 Wood Industry

- 5.2.5 Others

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Italy

- 5.3.2.4 France

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Sodra Skogsagarna

- 6.4.2 Ajinomoto Co., Inc

- 6.4.3 Silvateam Group

- 6.4.4 Laffort Holding

- 6.4.5 TANAC

- 6.4.6 Ulrich Holding GmbH

- 6.4.7 Esseco Group Srl

- 6.4.8 Tanin d.d. Sevnica

- 6.4.9 Tannin Corporation

- 6.4.10 NTE Company (Pty) Limited

- 6.4.11 Gallotannin Co. Ltd

- 6.4.12 Forestal Quebracho S.A.

- 6.4.13 Polson Ltd.

- 6.4.14 UCL Company (Pty) Ltd

- 6.4.15 Silvateam group

- 6.4.16 Xi'an Prius Biological Engineering Co.,Ltd

- 6.4.17 Forestal Mimosa Limited

- 6.4.18 ChemFaces Biochemical Co., Ltd.

- 6.4.19 Glentham Life Sciences Limited

- 6.4.20 FUJIFILM Wako Pure Chemical Corporation