|

市场调查报告书

商品编码

1849808

网路分析:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)Network Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

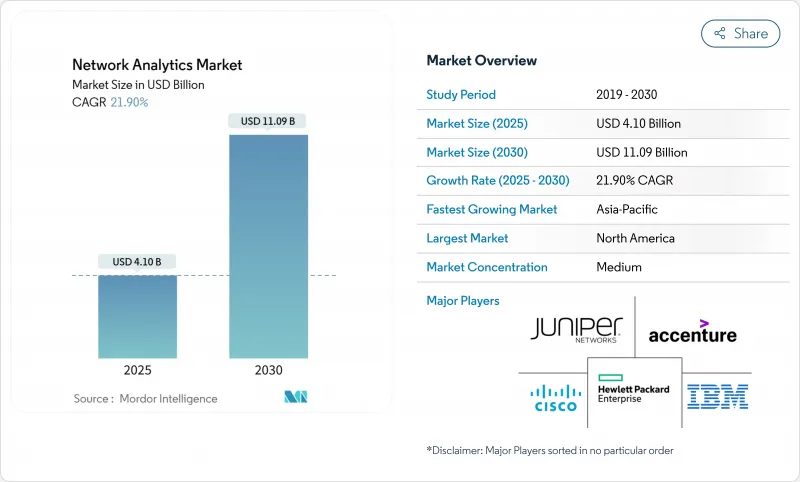

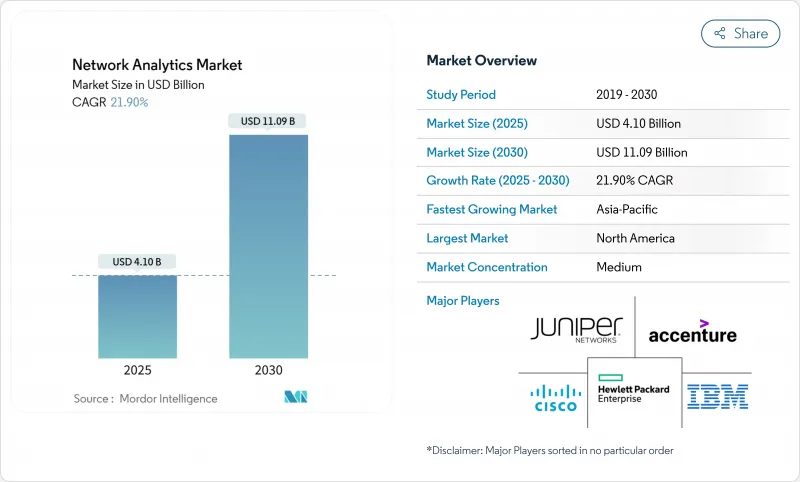

预计 2025 年网路分析市场的现值为 41 亿美元,到 2030 年将达到 110.9 亿美元,复合年增长率为 21.9%。

数据流量的快速成长、5G 的部署以及连网设备的激增,正在将网路分析从简单的监控提升为数位基础设施策略的核心要素。企业将分析视为预测性维护、容量规划和安全的关键,而服务供应商则利用它来实现可编程网路的收益。人工智慧如今已为大多数主流平台提供支持,60% 的技术高管计划利用人工智慧实现营运自动化和精简。以 IBM 斥资 64 亿美元收购 HashiCorp 为例,供应商整合标誌着对端到端堆迭的需求,该堆迭将分析与更广泛的 IT 管理相结合。虽然高昂的初始成本和缺乏专业技能仍然是采用该技术的障碍,但云端交付模式和託管服务正在降低进入门槛。

全球网路分析市场趋势与洞察

对自主和自我管理网络的需求

网路复杂性日益增加,停机成本不断上升(以云端为中心的企业每分钟 9,000 美元),这推动了对可自我修復基础设施的需求。基于人工智慧的分析平台可以预测和修復故障,从而优化故障排除,从被动到主动。运行关键任务工作负载的架构越来越依赖人工智慧运作 (AIOps),72% 的 IT 领导者正在规划基于平台的架构,该架构整合了分析、自动化和可观察性。因此,供应商正在整合即时异常检测和策略驱动的编配,以缩短平均修復时间并实现服务等级目标。

物联网和机器对机器通讯的兴起

网路分析平台增加了设备级可视性、通讯协定解码和行为基准测试,以管理异质流量。在製造业、公共和智慧城市部署中,即时分析支援预测性维护和能源最佳化,从而实现可衡量的成本节约并延长正常运作。

初始成本高且投资收益不确定

全面部署需要软体许可证、支援远端检测的硬体、系统整合和员工培训。量化减少停机时间和改善客户体验所带来的财务回报仍然很困难,尤其对于中小型组织而言。虽然基于订阅的云端交付方式可以减轻资本负担,但新兴经济体的预算紧张仍然阻碍了其采用。

細項分析

云端运算的采用率将以 24% 的复合年增长率成长,超过整体网路分析市场。这一趋势的驱动力在于弹性可扩展性、付费使用制的经济性以及分散式团队的便利存取。儘管如此,由于日益增长的安全和主权需求,到 2024 年,本地安装仍将保持 56% 的收入份额。随着企业将传统投资与未来敏捷性结合,混合架构正日益受到青睐,91% 的金融机构已着手实施云端现代化计画。

混合营运模式代表了一种务实的观点:对资料管理要求严格的工作负载仍保留在本地,而突发性分析任务则迁移至公共云端。这种二元性支援成本优化,且无需牺牲管治。分析师估计,目前 30% 的企业工作负载迁移至公共云端,其中分析和 DevOps主导迁移。供应商正积极响应这一趋势,提供容器化收集器、SaaS 仪表板以及横跨私有和公共领域的统一策略引擎。持续整合管道将分析进一步嵌入日常营运中,并缩短了开发週期。

到2024年,解决方案将占总收益的63%,但随着企业对专业知识的持续追求,服务预计将以每年23.1%的速度成长。咨询和整合服务使分析架构与业务目标保持一致,而託管服务则减轻了日常调整和规则维护的负担。服务浪潮反映了更广泛的IT外包模式,预计到2024年,託管服务供应商的规模将达到3,500亿美元,到2033年将超过1兆美元。

服务合作伙伴越来越多地提供人工智慧主导的咨询服务,将绩效洞察与业务成果连结起来。采用此模式的企业报告称,成本节省了20-30%,生产力提升了高达25%。为了满足需求,供应商正在整合运作手册、预训练模型和远端SOC功能,以加快价值实现速度并缩小人工智慧技能差距。这些进步已牢固确立了服务作为网路分析市场基石的地位,并带来了经常性收益和更深层的客户关係。

区域分析

由于早期采用、庞大的IT预算以及领先的供应商生态系统,北美地区将在2024年维持38%的收入份额。美国金融服务和医疗保健公司正在采用融合人工智慧的分析技术,以满足严格的运作和隐私要求。加拿大通讯业者正在利用分析技术优化全国范围内的5G部署,并管理农村地区的覆盖义务。清晰的监管和充足的人才资源正在推动预测自动化的实验,使该地区走在创新的前沿。

亚太地区是成长最快的地区,到2030年的复合年增长率将达到23.3%。中国和印度正在资助大规模的5G、智慧城市和工业IoT计划,这些项目需要对多供应商环境有更细緻的可视性。日本和韩国正在将人工智慧与网路监控相结合,以支援自动驾驶汽车测试和工厂自动化;而澳洲则正在利用分析技术保护关键基础设施免受网路威胁。

在监管趋严、安全意识不断增强的背景下,欧洲正在不断发展。英国和德国在金融服务和製造业领域引领着这一趋势,并致力于在混合架构中寻求符合 GDPR 标准的洞察。法国和义大利正在加大通讯业者的采用力度,以在竞争激烈的行动市场中保持客户满意度。北欧和东欧的能源和公共产业正在部署分析技术,以检测智慧电网遥测中的异常情况。该地区的成功供应商注重资料主权管理、精细的使用者存取策略以及自动化合规报告。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 市场驱动因素

- 对自主和自我管理网络的需求

- 物联网 (IoT) 和机器对机器通讯的兴起

- 指数级数据流量和5G部署的压力

- 封闭回路型人工智慧(AI)数位双胞胎优化

- 基于 API 的网路即程式码收益需要即时分析

- 市场限制

- 初始成本高且投资收益(RoI) 不确定

- 资料隐私和监管限制

- 网路资料管道中的 AI/ML Ops 技能差距

- 由于专有遥测通讯协定导致的供应商锁定

- 价值/供应链分析

- 监管格局

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 按部署模型

- 本地部署

- 云

- 杂交种

- 按组件

- 解决方案

- 网路智慧平台

- 绩效管理

- 安全分析

- 根本原因和异常检测

- 流量优化

- 服务

- 专业服务

- 託管服务

- 解决方案

- 按用途

- 绩效管理

- 故障管理

- 客户体验管理

- 安全和异常检测

- 智慧路由与交通最佳化

- 按最终用户

- 通讯服务供应商

- 通讯业者

- 网际网路服务供应商

- 卫星通讯业者

- 有线网路供应商

- 云端服务供应商

- 公司

- 银行、金融服务和保险(BFSI)

- 卫生保健

- 零售与电子商务

- 製造业

- 政府和公共部门

- 通讯服务供应商

- 按地区

- 北美洲

- 美国

- 加拿大

- 南美洲

- 巴西

- 南美洲其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Accenture PLC

- Cisco Systems Inc.

- Hewlett Packard Enterprise Co.

- IBM Corporation

- Juniper Networks Inc.

- SAS Institute Inc.

- Sandvine Corporation

- Alcatel-Lucent Enterprise SA

- TIBCO Software Inc.

- Broadcom Inc.(incl. VMware)

- Nokia Corporation

- Ericsson Inc.

- Huawei Technologies Co. Ltd.

- Dell Technologies Inc.

- Oracle Corporation

- NetScout Systems Inc.

- Allot Ltd.

- NEC Corporation

- ZTE Corporation

- Amdocs Ltd.

- F5 Networks Inc.

- Splunk Inc.

- Keysight Technologies Inc.

第七章 市场机会与未来趋势

- 閒置频段和未满足需求评估

The network analytics market holds a present value of USD 4.10 billion in 2025 and is forecast to reach USD 11.09 billion by 2030, advancing at a 21.9% CAGR.

Rapid data-traffic growth, 5G roll-outs, and the surge in connected devices have pushed network analytics from simple monitoring to a core element of digital infrastructure strategy. Enterprises view analytics as essential for predictive maintenance, capacity planning, and security, while service providers use it to monetize programmable networks. Artificial intelligence now underpins most leading platforms, with 60% of technology executives planning AI-enabled automation to streamline operations. Consolidation among vendors, illustrated by IBM's USD 6.4 billion acquisition of HashiCorp, signals demand for end-to-end stacks that blend analytics with broader IT management. Although high initial costs and specialized skill shortages still hinder adoption, cloud delivery models and managed services are easing entry barriers.

Global Network Analytics Market Trends and Insights

Need for Autonomous and Self-Managing Networks

Escalating network complexity and the cost of downtime-USD 9,000 per minute for cloud-centric firms-have intensified demand for self-healing infrastructure. AI-infused analytics platforms now predict and remediate faults, enabling a shift from reactive troubleshooting to proactive optimisation. Industries running mission-critical workloads increasingly depend on AIOps, with 72% of IT leaders planning platform-based architectures that merge analytics, automation, and observability. As a result, vendors are embedding real-time anomaly detection and policy-driven orchestration to cut mean-time-to-repair and protect service-level objectives.

Rise of IoT and Machine-to-Machine Communications

Network analytics platforms have added device-level visibility, protocol decoding, and behavioural baselining to manage heterogeneous traffic. In manufacturing, utilities, and smart-city roll-outs, real-time analytics supports predictive maintenance and energy optimisation, unlocking measurable cost savings and uptime improvements.

High Initial Costs and Uncertain Return on Investment

Comprehensive deployments require software licences, telemetry-ready hardware, systems integration, and staff training. Quantifying financial returns linked to reduced outages or improved customer experience remains challenging, particularly for small and mid-sized organisations. Subscription-based cloud delivery eases capital burdens, yet budget pressures in emerging economies still slow adoption.

Other drivers and restraints analyzed in the detailed report include:

- Exponential Data Traffic and 5G Roll-Out Pressure

- Closed-Loop AI Digital-Twin Optimisation

- API-Based Network-as-Code Monetisation Needs Real-Time Analytics

- Data-Privacy and Regulatory Constraints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployments are set to expand at a 24% CAGR, outpacing the overall network analytics market. The move is driven by elastic scalability, pay-as-you-go economics, and easier access for distributed teams. Despite that momentum, on-premise installations retained 56% revenue in 2024 due to heightened security and sovereignty needs. Hybrid architectures have gained favour as organisations bridge legacy investments with future agility, a trend reinforced by financial institutions, where 91% have already begun their cloud modernisation journeys.

Hybrid operating patterns illustrate a pragmatic view: workloads with stringent data-control requirements remain on-premise, while bursty analytic tasks shift to public clouds. This duality supports cost optimisation without sacrificing governance. Analysts note that 30% of enterprise workloads now sit in public clouds, with analytics and DevOps leading migrations. Vendors have responded by delivering containerised collectors, SaaS dashboards, and unified policy engines that span private and public domains. Continuous integration pipelines further embed analytics into daily operations, compressing development cycles.

Solutions dominated 2024 revenue with 63%, yet services are forecast to grow 23.1% annually as organisations seek specialised expertise. Consulting and integration engagements align analytics architectures with business objectives, while managed services offload daily tuning and rule-maintenance. The services wave mirrors broader IT outsourcing patterns; the managed service provider segment is projected to reach USD 350 billion in 2024 and top USD 1 trillion by 2033.

Service partners increasingly deliver AI-driven advisory offerings that contextualise performance insights into business outcomes. Enterprises adopting such models have reported 20-30% cost savings and up to 25% productivity gains. To meet demand, vendors package runbooks, pre-trained models, and remote SOC capabilities, shortening time to value and mitigating the AI skills gap. This evolution cements services as a cornerstone of the network analytics market, unlocking recurring revenue and deeper client relationships.

Network Analytics Market Report is Segmented by Deployment Model (On-Premise, Cloud, and Hybrid), Component (Solutions and Services), Application (Performance Management, Fault Management, and More), End-User (Communication Service Providers, Cloud Service Providers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 38% revenue share in 2024, supported by early adoption, sizeable IT budgets, and an advanced supplier ecosystem. United States financial-services and healthcare organisations deploy AI-infused analytics to satisfy stringent uptime and privacy mandates. Canadian carriers use analytics to optimise nationwide 5G roll-outs and manage rural-coverage obligations. Regulatory clarity and abundant talent expedite experimentation with predictive automation, keeping the region at the forefront of innovation.

Asia-Pacific is the fastest-growing region with a 23.3% CAGR to 2030. China and India fund large-scale 5G, smart-city, and industrial-IoT projects that demand granular visibility into multi-vendor environments. Japan and South Korea integrate AI with network monitoring to support autonomous-vehicle trials and factory automation, while Australia leverages analytics to protect critical infrastructure from cyber threats.

Europe advances amid stringent regulations and heightened security awareness. United Kingdom and Germany lead adoption in financial services and manufacturing, seeking GDPR-compliant insights across hybrid architectures. France and Italy augment telecom deployments to maintain customer satisfaction in competitive mobile markets. Energy and utilities operators in Northern and Eastern Europe deploy analytics to detect anomalies in smart-grid telemetry. Vendors thriving in the region emphasise data-sovereignty controls, granular user-access policies, and automated compliance reporting.

- Accenture PLC

- Cisco Systems Inc.

- Hewlett Packard Enterprise Co.

- IBM Corporation

- Juniper Networks Inc.

- SAS Institute Inc.

- Sandvine Corporation

- Alcatel-Lucent Enterprise SA

- TIBCO Software Inc.

- Broadcom Inc. (incl. VMware)

- Nokia Corporation

- Ericsson Inc.

- Huawei Technologies Co. Ltd.

- Dell Technologies Inc.

- Oracle Corporation

- NetScout Systems Inc.

- Allot Ltd.

- NEC Corporation

- ZTE Corporation

- Amdocs Ltd.

- F5 Networks Inc.

- Splunk Inc.

- Keysight Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Need for autonomous and self-managing networks

- 4.2.2 Rise of Internet of Things (IoT) and machine-to-machine communications

- 4.2.3 Exponential data traffic and 5G roll-out pressure

- 4.2.4 Closed-loop Artificial Intelligence (AI) digital-twin optimisation

- 4.2.5 API-based network-as-code monetisation needs real-time analytics

- 4.3 Market Restraints

- 4.3.1 High initial costs and uncertain Return on Investment (RoI)

- 4.3.2 Data-privacy and regulatory constraints

- 4.3.3 AI/ML Ops skills gap for network data pipelines

- 4.3.4 Vendor lock-in via proprietary telemetry protocols

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Deployment Model

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.1.3 Hybrid

- 5.2 By Component

- 5.2.1 Solutions

- 5.2.1.1 Network intelligence platforms

- 5.2.1.2 Performance management

- 5.2.1.3 Security analytics

- 5.2.1.4 Root-cause and anomaly detection

- 5.2.1.5 Traffic optimisation

- 5.2.2 Services

- 5.2.2.1 Professional services

- 5.2.2.2 Managed services

- 5.2.1 Solutions

- 5.3 By Application

- 5.3.1 Performance management

- 5.3.2 Fault management

- 5.3.3 Customer experience management

- 5.3.4 Security and anomaly detection

- 5.3.5 Smart routing and traffic optimisation

- 5.4 By End User

- 5.4.1 Communication service providers

- 5.4.1.1 Telecom providers

- 5.4.1.2 Internet service providers

- 5.4.1.3 Satellite communication providers

- 5.4.1.4 Cable network providers

- 5.4.2 Cloud service providers

- 5.4.3 Enterprises

- 5.4.3.1 Banking, Financial Services, and Insurance (BFSI)

- 5.4.3.2 Healthcare

- 5.4.3.3 Retail and e-commerce

- 5.4.3.4 Manufacturing

- 5.4.3.5 Government and public sector

- 5.4.1 Communication service providers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Accenture PLC

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Hewlett Packard Enterprise Co.

- 6.4.4 IBM Corporation

- 6.4.5 Juniper Networks Inc.

- 6.4.6 SAS Institute Inc.

- 6.4.7 Sandvine Corporation

- 6.4.8 Alcatel-Lucent Enterprise SA

- 6.4.9 TIBCO Software Inc.

- 6.4.10 Broadcom Inc. (incl. VMware)

- 6.4.11 Nokia Corporation

- 6.4.12 Ericsson Inc.

- 6.4.13 Huawei Technologies Co. Ltd.

- 6.4.14 Dell Technologies Inc.

- 6.4.15 Oracle Corporation

- 6.4.16 NetScout Systems Inc.

- 6.4.17 Allot Ltd.

- 6.4.18 NEC Corporation

- 6.4.19 ZTE Corporation

- 6.4.20 Amdocs Ltd.

- 6.4.21 F5 Networks Inc.

- 6.4.22 Splunk Inc.

- 6.4.23 Keysight Technologies Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment