|

市场调查报告书

商品编码

1849812

电感器:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Inductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

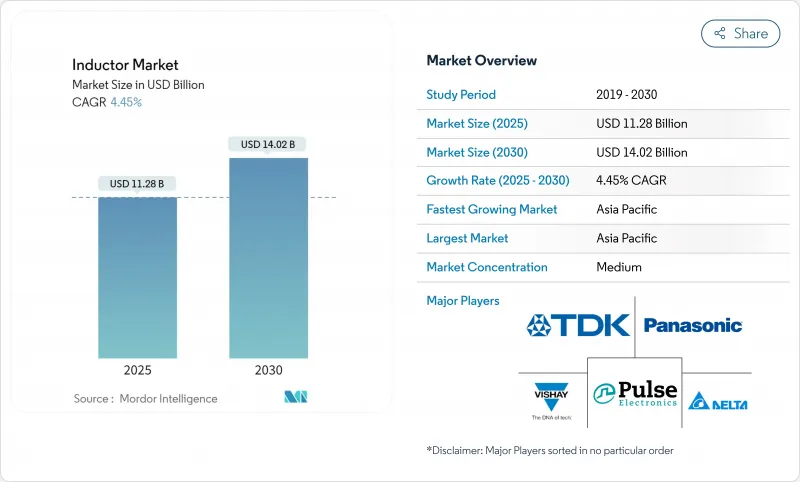

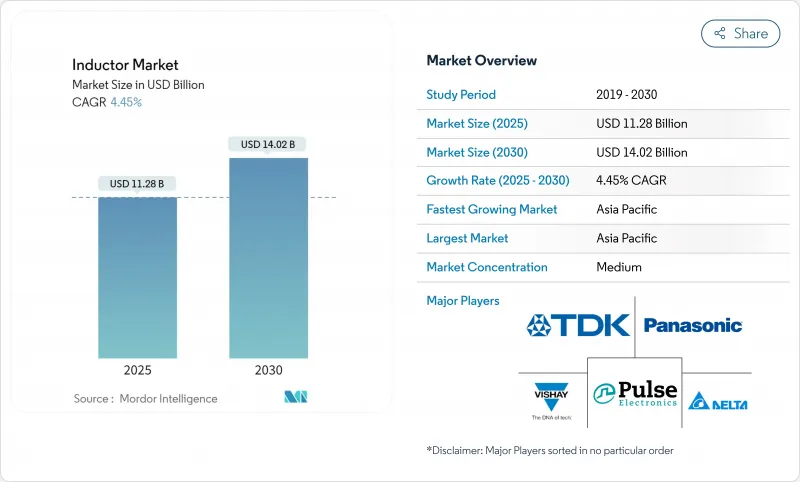

电感器市场规模预计在 2025 年达到 112.8 亿美元,预计到 2030 年将达到 140.2 亿美元,在此期间的复合年增长率为 4.45%。

即使分立元件面临来自整合被动元件的设计压力,汽车电气化、正在进行的5G基地台建设以及高功率密度的资料中心硬体仍然是成长的基本驱动力。需求正从大容量通用电感器转向针对高频开关、高散热要求的汽车动力传动系统和超紧凑可穿戴设备优化的专用部件。汽车认证(AEC-Q200)已从差异化因素转变为入门要求,表面黏着技术功率电感器在新设计中占据主导地位,金属合金磁芯正在大电流轨中稳步取代铁氧体。供应链多元化和区域化(尤其是来自中国当地的区域化)正在重塑全球生产布局,因为供应商寻求的是弹性而非最低到岸成本。

全球电感器市场趋势与洞察

对小型化消费性电子产品的需求不断增加

超小型穿戴装置、可听装置以及下一代智慧型手机需要高能源效率的被动元件,而这些元件需要更小的PCB尺寸。 TDK的0.25 x 0.125 x 0.2 mm晶片等突破性产品解决了这个限制,在不牺牲电感值(通常为0.6至3.6 nH)的情况下节省了近50%的空间。即使设计机会从智慧型手机转向AR眼镜和感测器丰富的健康监测器,行动装置的更换週期仍将增加,到2024年仍将占据家用电子电器市场42.4%的份额。供应商透过微影术图形化、细粉铁氧体和多层烧结技术来实现差异化,从而降低直流电阻并保持品质因数。

汽车产业的电气化(EV)

每辆纯电动车都整合了100多个感应器,用于DC-DC转换器、车载充电器和牵引逆变器,远远超过智慧型手机中通常20个或更少的感应器。 AEC-Q200合规性增强了振动、温度衝击和湿度测试,提高了进入门槛,并使市场份额流向合格的供应商。碳化硅逆变器的工作频率为40 kHz以上,需要能够在高磁通密度下保持电感的金属合金或粉末成型磁芯。全球汽车製造商正在中国、欧洲和美国同步发展,推动该领域到2030年的复合年增长率达到9.2%。

铜和铁氧体价格波动

铜构成绕组,铁氧体和合金粉末形成磁路,因此任何价格上涨都会直接影响销货成本。市场观察家警告称,矿山供应落后于电气化超级週期,可能从2030年起出现结构性亏损。 TDK的新款CLT32系列使用了超过50%的再生材料。规模较小的钢厂缺乏对冲风险的规模,仍面临风险,利润率受到挤压,产能扩张也受到延缓。

細項分析

到2024年,功率感应器将占据感应器市场份额的42.1%,并在稳压模组、DC-DC转换器和车载充电器领域占据主导地位。在毫米波5G节点的推动下,高频设计电感器的市场规模到2030年将以6.3%的复合年增长率成长。线绕电感器将主导汽车48V电源轨,而薄膜结构则用于行动装置的射频滤波器。耦合电感器可改善GPU供电的多相VRM的瞬态响应,并且随着AI伺服器出货量的增加,其需求也将成长。在抗振性、导热性和EMI屏蔽性能超过原料成本的领域,模塑产品正在兴起。供应商将实施自动光学检测和X射线製程控制,以维持严格的电感公差。

Resonac 的第二代金属粉末模塑料可降低 2MHz 以上的磁芯损耗,从而实现降压转换器中更小的磁路,同时保持 95% 以上的效率。随着碳化硅 MOSFET 中闸极电荷的减少,开关频率的提高,电感体积密度成为关键的设计约束。新型拓扑结构,例如用于双向电池组的双主动桥接器转换器,正在推动对饱和电流高于 60A 的低损耗电感的需求。

由于成本和磁导率的平衡,铁氧体将继续占2024年销售额的54.7%,而金属合金片预计年增长率为5.4%。在感应器市场,金属合金粉芯可实现1T以上的磁通密度,进而减少线圈数量并降低电感温度漂移。奈米晶带材产品(例如Proterial的FINEMET)在100 kHz时的插入损耗低于200 mW,使其对汽车双向车载充电器极具吸引力。空芯线圈用于GHz射频路径,磁性材料会发生涡流损耗。陶瓷基板正用于小型化蓝牙模组,以平衡热限制和紧凑的外形规格容量。製造商会调整烧结曲线和粒度,以根据最终应用客製化BH环路。

随着磁芯结构日益复杂,可靠性筛检也愈发严格,局部放电和扫频电阻测试将补充传统的饱和电流检查。生命週期碳计量的趋势促使人们对再生铁粉和闭合迴路铁氧体再生系统的兴趣日益浓厚,将环保目标与对冲原材料价格波动相结合。

区域分析

包括拉丁美洲和中东及非洲在内的世界其他地区是电感器的新兴市场,具有巨大的成长潜力。该地区市场的特点是工业自动化投资不断增加,智慧城市计画的采用日益广泛。由于通讯基础设施的扩展和物联网技术的日益普及,拉丁美洲尤其具有前景。中东市场受到石油和天然气行业自动化以及可再生能源计划的大量投资所推动。该地区的汽车产业,特别是阿联酋和沙乌地阿拉伯,对电动和混合动力汽车的兴趣日益浓厚,为电感器製造商创造了新的机会。市场也受益于製造能力投资的增加以及各行各业对先进电子产品的日益普及。智慧基础设施的发展和对能源效率的日益重视,正在为该全部区域各种类型的电感器创造额外的需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 小家电需求不断成长

- 汽车产业电气化(EV)

- 5G和高速通讯的扩展

- 可再生能源和电力电子的成长

- 内建于AI伺服器和IoT模组的电感器

- 资料中心高频电源转换器

- 市场限制

- 铜和铁氧体价格波动

- 全球供应链中断

- 嵌入式电感器的温度控管问题

- 整合式被动元件侵蚀了分立元件的需求

- 产业生态系统分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 宏观经济趋势的影响

第五章市场规模与成长预测(价值)

- 按类型

- 功率电感器

- RF/高频电感器

- 耦合电感

- 多层电感器

- 薄膜电感器

- 模压/线绕电感器

- 按磁芯材质

- 空气/陶瓷芯

- 铁氧体磁芯

- 铁和金属合金芯

- 奈米晶和非晶质磁芯

- 依安装技术

- 表面黏着技术(SMT)

- 通孔技术(THT)

- 嵌入式/整合 PCB 电感器

- 透过盾牌

- 盾

- 无屏蔽

- 由于电感

- 固定电感器

- 可变/可调电感器

- 按最终用户

- 车

- 航太和国防

- 通讯和5G基础设施

- 消费性电子与计算机

- 工业和电力

- 医疗保健和医疗设备

- 可再生能源系统

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 台湾

- 东南亚

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- TDK Corporation

- Murata Manufacturing Co. Ltd

- Vishay Intertechnology Inc.

- Panasonic Holdings Corporation

- Taiyo Yuden Co. Ltd

- Samsung Electro-Mechanics Co. Ltd

- Pulse Electronics(Yageo Corporation)

- Delta Electronics Inc.

- Coilcraft Inc.

- Bourns Inc.

- Wurth Elektronik GmbH & Co. KG

- Sumida Corporation

- TE Connectivity Ltd

- Chilisin Electronics Corporation

- AVX Corporation(Kyocera AVX)

- Bel Fuse Inc.

- Sunlord Electronics Co. Ltd

- Eaton Corporation(Coiltronics)

- KEMET Corporation(Yageo)

- API Delevan Inc.

第七章 市场机会与未来展望

The inductors market size is estimated at USD 11.28 billion in 2025 and is forecast to reach USD 14.02 billion by 2030, expanding at a 4.45% CAGR over the period.

Electrification of vehicles, continued 5G base-station build-outs, and power-dense data-center hardware form the bedrock of growth even as discrete components face design-in pressure from integrated passive devices. Demand is shifting from high-volume commodity coils toward purpose-built parts optimized for high-frequency switching, thermally challenging automotive powertrains, and ultra-compact wearables. Automotive qualification (AEC-Q200) has moved from differentiator to entry requirement, surface-mount power inductors dominate new designs, and metal-alloy cores are steadily displacing ferrite in high-current rails. Supply-chain diversification and regionalization-especially out of mainland China-are rewriting the global production footprint as vendors seek resilience rather than the lowest landed cost.

Global Inductor Market Trends and Insights

Rising demand for miniaturized consumer electronics

Ultra-compact wearables, hearables, and next-generation smartphones rely on power-efficient passives that occupy ever-smaller PCB footprints. Breakthroughs such as TDK's 0.25 X 0.125 X 0.2 mm chip addressed this constraint by delivering space savings near 50% without sacrificing inductance values, typically 0.6-3.6 nH. Design wins migrate from smartphones to AR glasses and sensor-rich health monitors, sustaining the 42.4% 2024 consumer-electronics share even as handset replacement cycles lengthen. Vendors differentiate through lithographic patterning, fine-powder ferrites, and multilayer sintering that keep direct current resistance low while maintaining Q-factor.

Electrification of automotive sector (EVs)

Each battery-electric vehicle integrates more than 100 inductors for DC-DC converters, onboard chargers, and traction inverters, sharply higher than the sub-20 count typical in smartphones. AEC-Q200 compliance elevates testing for vibration, temperature shock, and humidity, raising barriers to entry and channeling share to qualified suppliers. Silicon-carbide inverters operate above 40 kHz, demanding metal-alloy or powder-molded cores that maintain inductance under elevated flux density. Global automakers' parallel pushes in China, Europe, and the United States sustain a 9.2% segment CAGR through 2030.

Volatility in copper and ferrite prices

Copper comprises the winding while ferrite or alloy powders form the magnetic path, so any spike ripples straight to cost of goods sold. Market observers warn that mine supply lags the electrification super-cycle, risking structural deficits after 2030. Manufacturers respond with recycled metal initiatives-TDK's new CLT32 series uses more than 50% reclaimed feedstock-and with long-term offtake agreements. Smaller fabs lacking scale for hedging remain exposed, squeezing margins and slowing capacity adds.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of 5G and high-speed communications

- Growth in renewable energy and power electronics

- Global supply-chain disruptions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Power inductors delivered 42.1% of inductors market share in 2024, an advantage anchored in voltage-regulation modules, DC-DC converters, and onboard chargers. Within the inductors market size for high-frequency designs, the sub-segment climbs at 6.3% CAGR to 2030 on the back of millimeter-wave 5G nodes. Wire-wound formats dominate automotive 48 V rails, whereas thin-film structures serve handset RF filters. Coupled coils improve transient response in multiphase VRMs that feed GPUs, and demand scales with AI-server shipments. Molded products gain ground where vibration resistance, thermal conductivity, and EMI shielding trump raw cost. Vendors layer in automatic optical inspection and X-ray process control to sustain tight inductance tolerances.

Second-generation metal-powder molding compounds from Resonac cut core losses above 2 MHz, enabling buck converters to shrink magnetics while preserving >=95% efficiency. As silicon-carbide MOSFET gate charges fall, switching frequencies climb, and inductor volumetric density becomes a primary design constraint. Emerging topologies such as dual-active-bridge converters for bidirectional battery packs further amplify the need for low-loss inductors with saturation currents above 60 A.

Ferrite continued to own 54.7% of 2024 revenue thanks to its balance of cost and permeability, yet the metal-alloy slice is forecast to grow 5.4% per year. In the inductors market, metal-alloy powder cores tolerate flux densities beyond 1 T, enabling coil counts to fall and inductance drift over temperature to shrink. Nanocrystalline strip products, such as Proterial's FINEMET, post insertion losses below 200 mW at 100 kHz, appealing to automotive bidirectional on-board chargers. Air-core coils persist in GHz RF paths where magnetic materials would introduce eddy-current loss. Ceramic substrates gain purchase in miniaturized Bluetooth modules that juggle thermal limits and strict form-factor caps. Manufacturers calibrate sintering curves and particle sizes to dial in B-H loops tailored to final applications.

Reliability screening tightens as core composition complexity grows; partial-discharge and frequency-swept impedance tests now complement legacy saturation-current checks. A move toward lifecycle carbon accounting drives interest in recycled iron powders and closed-loop ferrite reclaim systems, merging environmental goals with hedging against virgin-material price swings.

The Inductor Market Report is Segmented by Type (Power, RF/High Frequency, and More), Core Material (Air/Ceramic Core, Ferrite Core, and More), Mounting Technique (Surface-Mount Technology, and More), Shielding (Shielded and Unshielded), Inductance (Fixed, Variable/Tunable), End-User Vertical (Automotive, Aerospace and Defense, Communications, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Rest of the World region, encompassing Latin America, the Middle East, and Africa, represents an emerging market for inductors with significant growth potential. The region's market is characterized by increasing investments in industrial automation and the growing adoption of smart city initiatives. Latin America has shown particular promise with its expanding telecommunications infrastructure and increasing adoption of IoT technologies. The Middle Eastern market is driven by automation in the oil and gas sector, along with significant investments in renewable energy projects. The region's automotive sector, particularly in the UAE and Saudi Arabia, is showing increased interest in electric and hybrid vehicles, creating new opportunities for inductor manufacturers. The market is also benefiting from increasing investments in manufacturing capabilities and the growing adoption of advanced electronics in various industries. The development of smart infrastructure and the increasing focus on energy efficiency are creating additional demand for various types of inductors across the region.

- TDK Corporation

- Murata Manufacturing Co. Ltd

- Vishay Intertechnology Inc.

- Panasonic Holdings Corporation

- Taiyo Yuden Co. Ltd

- Samsung Electro-Mechanics Co. Ltd

- Pulse Electronics (Yageo Corporation)

- Delta Electronics Inc.

- Coilcraft Inc.

- Bourns Inc.

- Wurth Elektronik GmbH & Co. KG

- Sumida Corporation

- TE Connectivity Ltd

- Chilisin Electronics Corporation

- AVX Corporation (Kyocera AVX)

- Bel Fuse Inc.

- Sunlord Electronics Co. Ltd

- Eaton Corporation (Coiltronics)

- KEMET Corporation (Yageo)

- API Delevan Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for miniaturized consumer electronics

- 4.2.2 Electrification of automotive sector (EVs)

- 4.2.3 Expansion of 5G and high-speed communications

- 4.2.4 Growth in renewable energy and power electronics

- 4.2.5 Embedded inductors in AI servers and IoT modules

- 4.2.6 High-frequency power converters in data centers

- 4.3 Market Restraints

- 4.3.1 Volatility in copper and ferrite prices

- 4.3.2 Global supply-chain disruptions

- 4.3.3 Thermal management issues in embedded inductors

- 4.3.4 Integrated passive devices eroding discrete demand

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

- 4.7 Impact of Macroeconomic Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Power Inductors

- 5.1.2 RF/High-Frequency Inductors

- 5.1.3 Coupled Inductors

- 5.1.4 Multilayer Inductors

- 5.1.5 Thin-Film Inductors

- 5.1.6 Molded/Wire-wound Inductors

- 5.2 By Core Material

- 5.2.1 Air/Ceramic Core

- 5.2.2 Ferrite Core

- 5.2.3 Iron and Metal-Alloy Core

- 5.2.4 Nanocrystalline and Amorphous Core

- 5.3 By Mounting Technique

- 5.3.1 Surface-Mount Technology (SMT)

- 5.3.2 Through-Hole Technology (THT)

- 5.3.3 Embedded/Integrated PCB Inductors

- 5.4 By Shielding

- 5.4.1 Shielded

- 5.4.2 Unshielded

- 5.5 By Inductance

- 5.5.1 Fixed Inductors

- 5.5.2 Variable/Tunable Inductors

- 5.6 By End-user Vertical

- 5.6.1 Automotive

- 5.6.2 Aerospace and Defense

- 5.6.3 Communications and 5G Infrastructure

- 5.6.4 Consumer Electronics and Computing

- 5.6.5 Industrial and Power

- 5.6.6 Healthcare and Medical Devices

- 5.6.7 Renewable Energy Systems

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Russia

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 South Korea

- 5.7.3.4 India

- 5.7.3.5 Taiwan

- 5.7.3.6 South East Asia

- 5.7.3.7 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Egypt

- 5.7.5.2.3 Nigeria

- 5.7.5.2.4 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TDK Corporation

- 6.4.2 Murata Manufacturing Co. Ltd

- 6.4.3 Vishay Intertechnology Inc.

- 6.4.4 Panasonic Holdings Corporation

- 6.4.5 Taiyo Yuden Co. Ltd

- 6.4.6 Samsung Electro-Mechanics Co. Ltd

- 6.4.7 Pulse Electronics (Yageo Corporation)

- 6.4.8 Delta Electronics Inc.

- 6.4.9 Coilcraft Inc.

- 6.4.10 Bourns Inc.

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Sumida Corporation

- 6.4.13 TE Connectivity Ltd

- 6.4.14 Chilisin Electronics Corporation

- 6.4.15 AVX Corporation (Kyocera AVX)

- 6.4.16 Bel Fuse Inc.

- 6.4.17 Sunlord Electronics Co. Ltd

- 6.4.18 Eaton Corporation (Coiltronics)

- 6.4.19 KEMET Corporation (Yageo)

- 6.4.20 API Delevan Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment