|

市场调查报告书

商品编码

1849825

抗菌涂料:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Anti-microbial Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

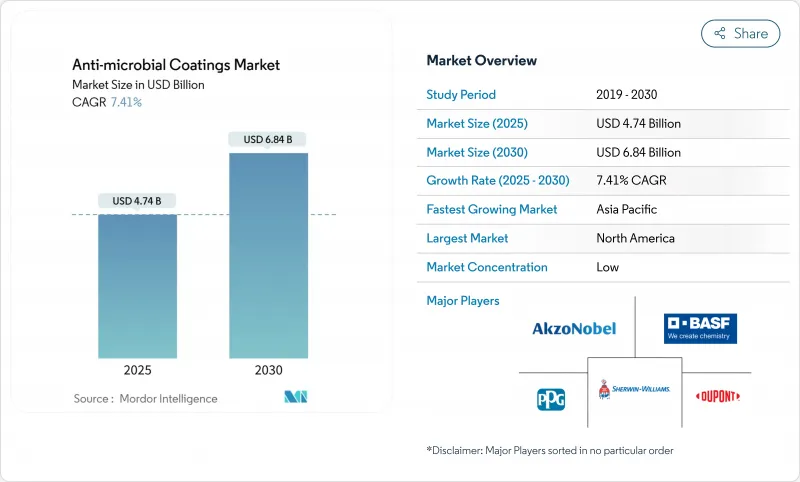

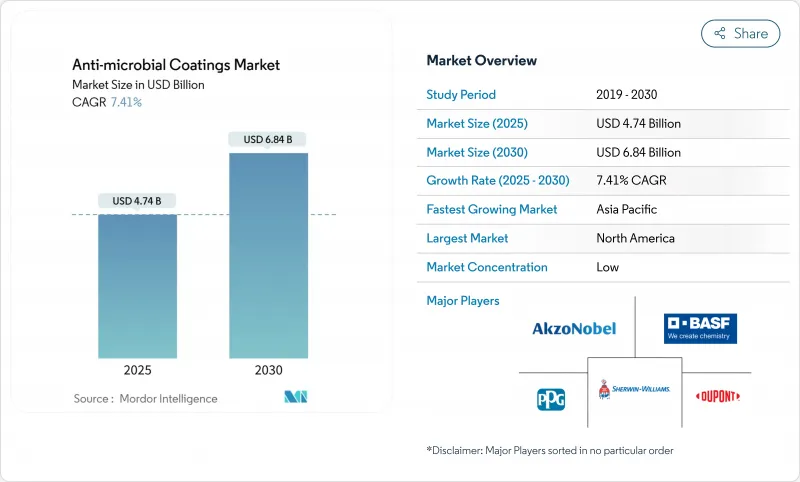

抗菌涂料市场规模预计在 2025 年为 47.4 亿美元,预计到 2030 年将达到 68.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.41%。

医院更严格的感染控制标准、低温运输物流的成长以及更严格的挥发性有机化合物法规正在加强长期需求。

银基配方将保持主导地位,到2024年将占销售额的49%。而水基有机化合物的复合年增长率将达到9.67%,因为买家更重视低环境影响。受严格的医院内感染 (HAI) 规程的推动,北美地区的需求最大;而亚太地区则凭藉其广泛的工业基础和不断扩张的製造能力,发展最为迅速。竞争的焦点不再是价格,而是功能创新、奈米结构活性剂、非浸出性黏合剂以及能够与复合材料和工程聚合物黏合的多性能係统。规模较小的专业化公司正透过提供触控介面电子产品、冷藏物流和卫生建筑材料的客製化解决方案,逐渐获得发展。

全球抗菌涂料市场趋势与洞察

北美减少HAI倡议

临床研究表明,医院泳池感染率降低 36%,加护病房细菌量降低 75-79%,因此医院管理人员正在实施表面处理。虽然抗菌涂料的成本比标准涂料高出 20-50%,但其成本的增加是合理的,因为它可以缩短患者康復时间并降低再入院率。透明面漆可用于美观维修,奈米级面漆在定期清洁之间也能保持有效。

印度和东协的低温运输成长

随着温控仓库的扩张,最终用户更青睐能够在低温下均匀固化且能够承受冷冻设备磨损的粉末系统。随着东协食品安全法规的协调一致以及抗菌规范的日益标准化,工厂安装的输送机框架、货架和隔热板解决方案正变得越来越受欢迎。

缺乏技术意识

在许多新兴国家,设施管理人员仍对生命週期成本节约缺乏信心,承包商往往缺乏应用训练。分销管道分散,限制了技术支援的获取,即使资金到位,也阻碍了技术应用的推进。产业联盟正在公立医院试点示范计划,以展示透过感染预防来节省医疗成本的效果。

細項分析

银凭藉其频谱功效和监管机构的熟悉度,将在2024年占据抗菌涂料市场的49%。银奈米颗粒能够抑制细菌呼吸和酵素活性,防止抗药性的产生,并有助于在高风险环境中应用。生物来源银系统的进展不仅具有抗菌保护作用,还具有抗氧化功效,从而扩大了食品接触的应用范围。

预计源自天然抗菌剂的有机化学品的复合年增长率将达到9.67%,这对寻求无重金属标籤和更佳报废特性的品牌具有吸引力。铜仍然是一种耐用的选择,但智利矿山的罢工事件造成了供应不确定性,挤压了利润空间并延长了前置作业时间。聚合物界面活性剂填补了一个利基市场,在该市场中,柔韧性、透明度以及与弹性体的相容性比最大杀菌效力更重要。

虽然银的高成本历来限制其在医疗保健以外的应用,但透过奈米化处理,银的表面积得以增加,剂量阈值也得以降低,如今它已能够经济高效地应用于暖通空调 (HVAC) 散热片、电梯按钮、消费电器产品等领域。基于季铵盐、几丁聚醣或植物来源的有机体系在满足过敏原安全阈值的同时,具有较高的杀虫率,为学校、办公室和住宅涂料开闢了新的应用前景。随着配方师不断优化分散性,并保持与传统压克力涂料相当的漆膜透明度和硬度,其应用正在加速。

区域分析

到2024年,北美将占抗菌涂料市场收入的45%。更严格的医院感染标准正在推动医院的维修,联邦基础设施支出也包括用于卫生公共建筑材料的拨款。预计到2030年,亚太地区的复合年增长率将达到8.98%。中国正在扩大其先进製造业的规模,印度的「印度製造」计画正在加速国内功能性添加剂的生产,东协在冷藏物流的投资将提振粉末涂料订单。

欧洲占了很大份额,并得到了化学品安全法规的支持。该地区的REACH框架加速了向无金属体系的转变,并支持对生物基活性剂的研发税收激励。

中东、非洲和南美洲的需求尚处于萌芽阶段但正在增长,随着肉类旅游业的兴起,波湾合作理事会国家的医院正在投资感染预防措施,巴西的肉类加工厂维修维修以满足出口标准。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 北美医院感染减少计画加速医院表面涂层的采用

- 印度和东协低温运输扩张将推动抗菌粉需求

- 触控介面的卫生要求推动电子OEM涂层集成

- 抗菌耐用品需求不断成长

- 北美和欧洲的VOC限值合规需求转向水基和奈米配方

- 市场限制

- 开发中国家和低度开发国家缺乏技术意识

- 释放活性成分

- 智利铜矿石供应罢工导致原物料价格飙升

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 产业间竞争

第五章市场规模及成长预测

- 按材质

- 银

- 铜

- 聚合物

- 有机的

- 其他成分

- 按涂层类型

- 粉末

- 液体(溶剂型和水基型)

- 其他(奈米加工喷膜、表面改质处理)

- 按用途

- 建筑/施工

- 食品加工

- 纤维

- 家电

- 卫生保健

- 海洋

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略性倡议(併购、合资、资金筹措)

- 市占率分析

- 公司简介

- 3M

- Advanced Nanotech Lab

- AGC Inc.

- Akzo Nobel NV

- AST Products, Inc.

- Axalta Coating Systems, LLC

- BASF

- BioCote Limited

- Bio-Fence

- Covalon Technologies Ltd.

- Diamond Vogel

- dsm-firmenich

- DuPont

- Henkel AG & Co. KGaA

- Hydromer

- Lonza

- Microban International

- NEI Corporation

- Novapura AG

- PPG Industries, Inc.

- Sciessent LLC

- Sono-Tek Corporation

- Specialty Coating Systems Inc.

- The Sherwin-Williams Company

第七章 市场机会与未来展望

The Anti-microbial Coatings Market size is estimated at USD 4.74 billion in 2025, and is expected to reach USD 6.84 billion by 2030, at a CAGR of 7.41% during the forecast period (2025-2030).Heightened infection-control standards in hospitals, cold-chain logistics growth, and tighter volatile-organic-compound rules are reinforcing long-term demand.

Silver-based formulations retained primacy with 49% of 2024 revenue, yet waterborne organic chemistries are accelerating on a 9.67% CAGR as buyers prioritize lower environmental impact. North America accounted for the largest regional demand, supported by strict hospital-acquired infection (HAI) protocols, whereas Asia-Pacific is advancing fastest on a broad industrial base and expanding manufacturing capacity. Competitive intensity centers on functional innovation, nanostructured actives, non-leaching binders, and multi-property systems capable of bonding to composites and engineered polymers, rather than on price. Smaller specialists are gaining traction by tailoring solutions to touch-interface electronics, refrigerated logistics, and high-hygiene construction materials.

Global Anti-microbial Coatings Market Trends and Insights

HAI-reduction initiatives in North America

Hospital administrators are installing surface treatments after clinical studies recorded 36% lower pooled HAIs and 75-79% bacterial load reductions on treated intensive-care surfaces. Although antimicrobial paints cost 20-50% more than standard coatings, shorter recovery times and lower readmission rates justify the premium. Transparent top-coats enable retrofits without altering aesthetics; nano-enabled variants sustain efficacy between routine cleanings.

Cold-chain Growth in India and ASEAN

Temperature-controlled warehousing is expanding, and end users prefer powder systems that cure uniformly at lower temperatures and resist abrasion inside refrigeration units. Harmonized ASEAN food-safety rules are standardizing antimicrobial specifications, prompting factory-installed solutions for conveyer frames, shelving, and insulated panels.

Lack of technological awareness

Facility managers in many developing countries remain unconvinced of life-cycle savings, and contractors often lack application training. Fragmented distribution limits access to technical support, slowing uptake even where financing exists. Industry coalitions are piloting demonstration projects in public hospitals to showcase healthcare cost reductions from infection prevention.

Other drivers and restraints analyzed in the detailed report include:

- Touch-interface Hygiene Adoption

- VOC-cap Regulations

- Emission of active ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Silver commanded 49% of the anti-microbial coatings market in 2024 thanks to broad-spectrum efficacy and regulatory familiarity. Silver nanoparticles disrupt bacterial respiration and enzyme activity, stalling resistance development and supporting adoption in high-risk settings. Advances in biogenic silver systems now deliver antioxidant benefits alongside antimicrobial protection, widening food-contact use cases.

Organic chemistries, rooted in natural antimicrobials, are forecast to rise at 9.67% CAGR. They appeal to brands seeking heavy-metal-free labels and improved end-of-life profiles. Copper remains a durable option, yet supply volatility-intensified by labor strikes at Chilean mines-tightens margins and extends lead times. Polymeric actives occupy niche roles where flexibility, clarity, or compatibility with elastomers outweigh maximum microbicidal strength.

Silver's premium pricing historically limited use outside healthcare, but nano-enabled surface area gains and lower dosage thresholds now support cost-effective deployment in HVAC fins, elevator buttons, and consumer appliances. Organic systems based on quaternary ammonium, chitosan, or plant-derived extracts demonstrate high kill rates while meeting allergen-safety thresholds, unlocking school, office, and residential coatings. Adoption accelerates as formulators optimize dispersion to preserve film clarity and hardness comparable to conventional acrylics.

The Antimicrobial Coatings Market Report Segments the Industry by Material (Silver, Copper, Polymeric, Organic, and Other Materials), Coating Form (Powder, Liquid, and Others), Application (Building and Construction, Food Processing, Textiles, Home Appliances, Healthcare, Marine, and Other Applications) and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

North America represented 45% of the anti-microbial coatings market revenue in 2024. Stringent HAI standards drive hospital retrofits, and federal infrastructure spending includes allocations for hygienic public-facility materials. Asia-Pacific is forecast to post an 8.98% CAGR through 2030. China scales advanced manufacturing, India's "Make in India" accelerates domestic output of functional additives, and ASEAN capital spending on refrigerated logistics boosts powder-coating orders.

Europe holds a sizeable share, underpinned by chemical-safety legislation. The region's REACH framework hastens the pivot to metal-free systems and drives research and development tax incentives for bio-based actives.

The Middle East and Africa, and South America show nascent but rising demand. Gulf Cooperation Council hospitals invest in infection-control measures as medical tourism grows, while Brazilian meat-processing plants retrofit cold rooms to meet export standards. Limited local manufacturing capacity opens partnership opportunities for global suppliers.

- 3M

- Advanced Nanotech Lab

- AGC Inc.

- Akzo Nobel N.V.

- AST Products, Inc.

- Axalta Coating Systems, LLC

- BASF

- BioCote Limited

- Bio-Fence

- Covalon Technologies Ltd.

- Diamond Vogel

- dsm-firmenich

- DuPont

- Henkel AG & Co. KGaA

- Hydromer

- Lonza

- Microban International

- NEI Corporation

- Novapura AG

- PPG Industries, Inc.

- Sciessent LLC

- Sono-Tek Corporation

- Specialty Coating Systems Inc.

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 HAI-Reduction Programs Accelerating Hospital Surface Coating Uptake in North America

- 4.2.2 Cold-Chain Expansion in India and ASEAN Propelling Antimicrobial Powder Demand

- 4.2.3 Touch-Interface Hygiene Requirements Driving Electronics OEM Coating Integration

- 4.2.4 Increasing Demand for Germ Resistant Durable Goods

- 4.2.5 VOC-Cap Compliance Shifting Demand Toward Water-borne and Nano Formulations in North America and Europe

- 4.3 Market Restraints

- 4.3.1 Lack of Technological Awareness in Developing and Under-developed Nations

- 4.3.2 Emission of Active Ingredients

- 4.3.3 Chilean Copper-Ore Supply Strikes Inflating Raw-Material Costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material

- 5.1.1 Silver

- 5.1.2 Copper

- 5.1.3 Polymeric

- 5.1.4 Organic

- 5.1.5 Other Materials

- 5.2 By Coating Form

- 5.2.1 Powder

- 5.2.2 Liquid (Solvent- and Water-borne)

- 5.2.3 Others (Nano-Engineered Sprays and Films, Surface Modification Treatments)

- 5.3 By Application

- 5.3.1 Building and Construction

- 5.3.2 Food Processing

- 5.3.3 Textiles

- 5.3.4 Home Appliances

- 5.3.5 Healthcare

- 5.3.6 Marine

- 5.3.7 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquisitions, JV, Funding)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 3M

- 6.4.2 Advanced Nanotech Lab

- 6.4.3 AGC Inc.

- 6.4.4 Akzo Nobel N.V.

- 6.4.5 AST Products, Inc.

- 6.4.6 Axalta Coating Systems, LLC

- 6.4.7 BASF

- 6.4.8 BioCote Limited

- 6.4.9 Bio-Fence

- 6.4.10 Covalon Technologies Ltd.

- 6.4.11 Diamond Vogel

- 6.4.12 dsm-firmenich

- 6.4.13 DuPont

- 6.4.14 Henkel AG & Co. KGaA

- 6.4.15 Hydromer

- 6.4.16 Lonza

- 6.4.17 Microban International

- 6.4.18 NEI Corporation

- 6.4.19 Novapura AG

- 6.4.20 PPG Industries, Inc.

- 6.4.21 Sciessent LLC

- 6.4.22 Sono-Tek Corporation

- 6.4.23 Specialty Coating Systems Inc.

- 6.4.24 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Development of Multi-functional Coatings

- 7.3 Growing Demand for HVAC Applications