|

市场调查报告书

商品编码

1849841

POS终端:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030年)POS Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

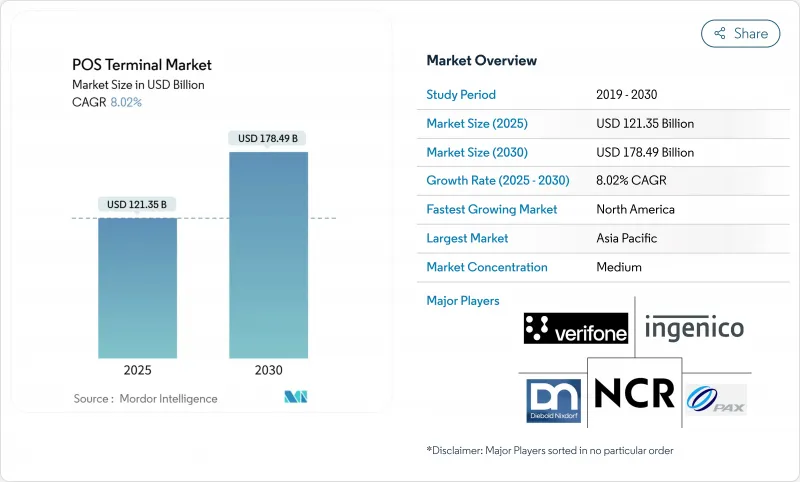

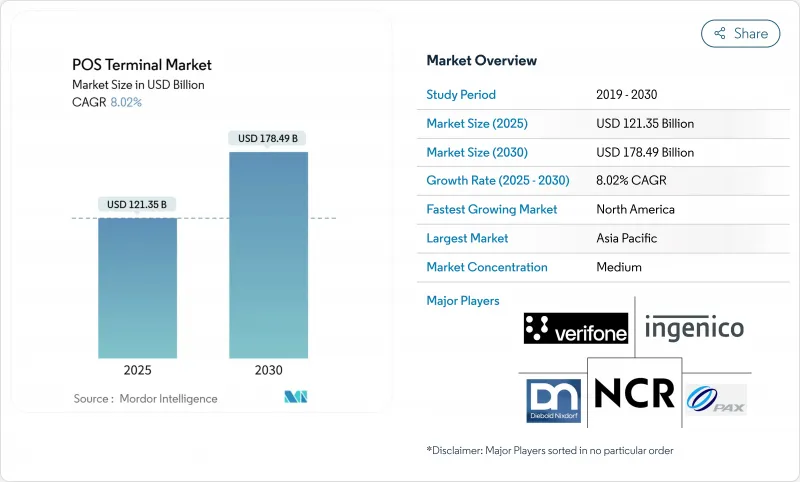

全球POS终端市场预计到2025年将达到1,213.5亿美元,到2030年将达到1,784.9亿美元,年复合成长率为8.02%。

这项成长的驱动力在于商家以云端赋能、分析主导的系统取代传统暂存器,这些系统将支付受理与库存、客户和合规管理融为一体。非接触式支付、生物识别和人工智慧正推动POS终端市场从交易处理商业智慧。半导体元件的供应链压力持续限制硬体生产,但软体订阅和混合部署模式克服了硬体瓶颈,推动了市场普及。能够将全通路支付、合规性和低总体拥有成本相结合的供应商,最有希望满足零售、酒店、医疗保健和交通运输等行业日益增长的需求。

全球POS终端市场趋势与洞察

零售业的日益普及

零售商目前正采用统一商务平台,将线上和线下交易连结起来,从而实现15-20%的效率提升和40%的排队时间缩短。库存联网的POS终端市场提供即时库存可见性,可将缺货率降低30%,并将库存积压成本降低25%。小型商家正摒弃传统暂存器,转而采用企业级云端系统。这一趋势在亚太地区尤为显着,该地区零售POS的普及率是全球平均的1.5倍。这种发展势头正在推动对整合支付、促销和履约功能的终端的需求。随着实体店向全通路模式转型,那些为小型零售商提供量身定制的价格和支援的供应商正在赢得市场份额。

云端基础POS平台的普及率不断提高

到2025年,云端解决方案将占新安装量的73%,尤其是中小企业将资本支出转向营运支出之际,云端解决方案的需求将大幅成长。与传统系统相比,持续的软体更新可将设备寿命延长60%,并能快速回应不断变化的会计准则。餐饮业者强调了使用云端POS系统进行即时菜单和餐桌管理的优势,通常可使平均客单价提高12%至18%。跨区域零售商则讚赏只需一次更新即可实施新的税收规则,而无需进行硬体升级。这一趋势将加速POS终端的市场渗透,尤其是在宽频品质能够支援始终在线的云端连线的情况下。

对资料安全和网路诈骗的担忧

预计到2024年,诈骗行为将增加37%,这将促使人们对POS环境进行更严格的审查。行动POS透过无线连线扩大了攻击面,导致每个商家每年在合规和监控方面需要投入18,000至25,000美元的安全成本。硬体更新周期落后于不断演进的威胁,留下的安全漏洞需要透过软体修补程式来弥补,并可能导致效能下降。生物辨识技术增强了身分验证,但也引发了因地区而异的隐私问题,这使得POS终端市场的全球扩张变得更加复杂。

细分市场分析

至2030年,非接触式支付解决方案将以14.9%的复合年增长率成长,到2024年,非接触式设备将占据POS终端市场71%的份额。非接触式硬体POS终端市场规模将快速扩张,到2025年,78%的部署将包含NFC功能。消费者的偏好十分明确,超过51%的消费者经常选择使用非接触式支付卡或电子钱包,尤其是在购买25美元以下的商品时。能够同时处理晶片密码和非接触式支付的混合终端可以帮助商家顺利完成转型,而不会疏远注重安全的消费者。

穿戴式装置、行动装置和生物识别技术拓展了身分验证选项,为交通运输、饭店服务和医疗保健等领域开启了便捷无阻的出行方式。与标准NFC相比,指纹辨识非接触式支付可将诈骗降低60%。这些功能使供应商能够交叉销售与令牌化身分资料关联的分析订阅服务。随着对强客户身分验证监管的日益严格,预计在POS终端市场,采用生物辨识技术的非接触式解决方案将超越通用NFC技术。

儘管到2024年固定式POS终端仍将占据POS终端市场54%的份额,但行动系统正以12.8%的复合年增长率加速成长。部署手持终端的零售连锁店报告称,排队时间缩短了28%,员工生产力提高了15-20%。支援行动电话网路的终端内建SIM卡,即使在Wi-Fi覆盖不到的地方也能确保连线。

在医疗保健领域,床边支付设备可将帐单延迟减少高达 35%,并将收款率提高 25%。行动技术也为路边取货和基于活动的商务活动提供了支援。然而,加密通讯和设备管理技术的进步正在逐步缩小差距。采用政府级安全通讯协定的供应商可以进一步推动 POS 终端市场的成长。

POS终端市场依支付方式(接触式、非接触式)、POS类型(固定POS系统、行动/可携式POS系统)、组件(硬体、软体、服务)、部署类型(云端基础、本地部署)、终端用户产业(零售、饭店、医疗保健等)和地区进行细分。市场预测以美元计价。

区域分析

亚太地区引领POS终端市场,主要得益于各国宣传活动大力推广无现金交易以及行动优先的消费文化。中国、日本和韩国的交易量庞大,而印度和新加坡则分别在「数位印度」和「智慧国家」倡议的推动下实现了快速成长。预计到2025年,该地区的卡片付款总额将达到24.7兆美元。生物辨识认证技术的日益普及正在推动人口密集城市的身份验证。然而,区域网路连接的不足和监管的差异要求建立一个能够支援离线处理的灵活架构。

南美洲是成长最快的地区,预计到2030年将以10.4%的复合年增长率成长。巴西正透过设备製造商与Stone和Pagseguro等数位收购方单机构的合作而加速发展。普惠金融计画催生了对用于管理替代支付方式的设备的需求,在许多国家,70%的成年人没有银行帐户。墨西哥和哥斯大黎加等国的电子帐单相关税法要求企业立即进行硬体或软体升级。

北美市场规模保持强劲,主要得益于其较早采用非接触式支付和人工智慧主导的分析技术。光是美国一地,到2025年POS市场规模就将达到291.1亿美元。欧洲正经历强制性财政刺激,西班牙Verifactu系统的推广应用是推动POS机更新换代的重要因素。中东和非洲智慧型手机普及率和都市化进程的交汇点蕴藏着巨大的成长潜力,但基础设施的限制仍阻碍着农村地区的普及。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 零售业的普及应用

- 云端基础POS平台的普及率不断提高

- 非接触式和行动支付的需求加速成长

- 将POS数据与高级分析和CRM集成

- 金融化和监管推动强制电子帐单

- 「POS即服务」订阅模式降低了资本支出

- 市场限制

- 资料安全和网路诈骗问题

- 硬体可靠性和维护成本问题

- 支付标准的区域碎片化

- 半导体供应链的不稳定性

- 价值链分析

- 监管环境

- 技术展望(物联网、人工智慧、边缘处理)

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 对宏观经济趋势的市场评估

第五章 市场规模及成长预测(数值)

- 透过付款方式

- 接触式

- 非接触式

- 按POS类型

- 固定式POS系统

- 行动/可携式POS系统

- 按组件

- 硬体

- 软体

- 服务

- 透过部署模式

- 云端基础的

- 本地部署

- 按最终用户行业划分

- 零售

- 饭店业

- 卫生保健

- 运输/物流

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(MandA、伙伴关係、资金筹措)

- 市占率分析

- 公司简介

- Ingenico SA(Worldline)

- VeriFone Systems Inc.

- PAX Technology Ltd.

- NCR Corporation

- Diebold Nixdorf Inc.

- Toshiba Global Commerce Solutions

- HP Inc.

- Panasonic Corporation

- Fujitsu Ltd.

- Samsung Electronics Co. Ltd.

- Newland Payment Technology

- BBPOS Ltd.

- Square Inc.(Block)

- Fiserv Inc.(Clover)

- Lightspeed Commerce Inc.

- Shopify Inc.(Shopify POS)

- Toast Inc.

- Revel Systems Inc.

- Oracle Corporation(MICROS)

- Agilysys Inc.

- Aptos Inc.

- GK Software SE

- NEC Corporation

- NEXGO(Shenzhen Xinguodu Technology)

- Qashier Pte Ltd.

- Cegid Group

- Cow Hills Retail BV

- PCMS Group Ltd.

第七章 市场机会与未来展望

The global POS terminal market is valued at USD 121.35 billion in 2025 and is forecast to reach USD 178.49 billion by 2030, advancing at an 8.02% CAGR.

Growth stems from merchants replacing legacy cash registers with cloud-enabled, analytics-driven systems that blend payment acceptance with inventory, customer, and compliance management. Contactless capability, biometric authentication, and artificial intelligence are moving the POS terminal market beyond transaction handling toward real-time business intelligence. Supply-chain pressure on semiconductor components continues to constrain hardware output, but software subscriptions and hybrid deployment models are lifting adoption despite hardware bottlenecks. Vendors that can combine omnichannel payments, regulatory compliance, and low total cost of ownership are best placed to capture incremental demand across retail, hospitality, healthcare, and transportation.

Global POS Terminal Market Trends and Insights

Growing Adoption in the Retail Sector

Retailers now deploy unified commerce platforms that connect in-store and online transactions, generating 15-20% efficiency gains and cutting queues by 40%. Inventory linked to the POS terminal market enables real-time stock visibility, which trims stockouts by 30% and excess inventory costs by 25%. Small merchants are bypassing legacy registers and embracing enterprise-grade cloud systems, a pattern most visible across Asia-Pacific where retail POS roll-outs outpace global averages by 1.5 times. The momentum reinforces demand for terminals that merge payment, promotion and fulfilment functions. Suppliers that tailor pricing and support to smaller retailers gain share as brick-and-mortar stores pivot toward omnichannel models.

Rising Adoption of Cloud-Based POS Platforms

Cloud solutions account for 73% of new installations in 2025, up sharply among small and mid-sized enterprises that convert capital expense to operating outflow. Continuous software updates extend terminal life by as much as 60% compared with traditional systems and allow rapid alignment with changing fiscal rules. Hospitality operators highlight the advantage; real-time menu and table management using cloud POS typically lifts average ticket values by 12-18%. Multi-jurisdiction retailers value the ability to roll out new tax rules through a single update rather than hardware swaps. The trend accelerates penetration of the POS terminal market, where broadband quality supports always-on cloud connectivity.

Data-Security and Cyber-Fraud Concerns

A 37% rise in fraud attempts during 2024 heightens scrutiny of POS environments. Mobile POS broadens attack surfaces through wireless links, prompting annual security outlays of USD 18,000-25,000 per merchant for compliance and monitoring. Hardware refresh cycles lag evolving threats, creating gaps that require software patches, which may erode performance. Biometrics harden authentication yet introduce privacy issues that differ across regions, complicating global roll-outs within the POS terminal market.

Other drivers and restraints analyzed in the detailed report include:

- Accelerating Demand for Contactless & Mobile Payments

- Integration of POS Data with Advanced Analytics and CRM

- Hardware Reliability and Maintenance-Cost Issues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Contact-based devices retained 71% of the POS terminal market share in 2024, but contactless solutions are scaling at a 14.9% CAGR through 2030. The POS terminal market size for contactless-enabled hardware is set to widen rapidly as 78% of 2025 deployments include NFC. Consumer preference is clear: more than 51% regularly choose tap-and-go cards or wallets, especially for purchases below USD 25. Hybrid terminals that process both chip-and-PIN and contactless help merchants manage the transition without alienating security-minded shoppers.

Wearables, mobile devices and biometric taps expand authentication options and open the door to frictionless journeys in transit, hospitality and healthcare. Fingerprint-secured contactless payments cut fraud by 60% versus standard NFC. Such capability positions vendors to cross-sell analytics subscriptions tied to tokenised identity data. As regulations tighten around strong customer authentication, contactless solutions that embed biometric checks are expected to outperform generic NFC in the POS terminal market.

Fixed units still account for 54% of the POS terminal market size in 2024, yet mobile systems are accelerating at 12.8% CAGR. Retail chains deploying handheld devices report 28% shorter queues and 15-20% higher associate productivity. Cellular-enabled terminals operating with integrated SIM cards guarantee connectivity even where Wi-Fi falters.

In healthcare, bedside payment devices cut billing delays by up to 35% and improve collection rates by 25%. Mobility also underpins curbside pickup and event-based commerce. Security remains an issue, with 43% of merchants flagging data protection as the top hurdle when evaluating mobile platforms, but progress in encrypted communication and device management is gradually closing the gap. Providers that lock in government-grade security protocols can unlock further growth in the POS terminal market.

Point of Sale Terminal Market is Segmented by Mode of Payment Acceptance (Contact-Based, Contactless), POS Type (Fixed Point-Of-Sale Systems, Mobile / Portable Point-Of-Sale Systems), Component (Hardware, Software, Services), Deployment Mode (Cloud-Based, On-Premise), End-User Industry (Retail, Hospitality, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads the POS terminal market, propelled by government campaigns for cashless economies and a mobile-first consumer culture. China, Japan, and South Korea supply high transaction volumes, while India and Singapore climb rapidly under Digital India and Smart Nation initiatives, respectively. Regional card payments are expected to reach USD 24.7 trillion in 2025. Biometric verification adoption is rising, smoothing identity checks across densely populated cities. Yet, rural connectivity gaps and heterogeneous regulations require flexible architectures that support offline processing.

South America represents the fastest-growing region with a 10.4% CAGR forecast to 2030. Brazil drives momentum through partnerships between terminal makers and digital acquirers such as Stone and Pagseguro. Financial inclusion programmes create demand for devices that manage alternative payments, as 70% of adults remain unbanked in several countries. Fiscal e-invoicing laws across Mexico, Costa Rica, and others compel rapid hardware or software upgrades.

North America maintains scale through early adoption of contactless and AI-driven analytics. The United States alone accounted for a USD 29.11 billion POS segment in 2025. Europe progresses under mandatory fiscalisation; Spain's Verifactu rollout is a prominent trigger for replacements. The Middle East and Africa offer pockets of high growth where smartphone penetration and urbanisation intersect, though infrastructure limitations continue to slow rural uptake.

- Ingenico SA (Worldline)

- VeriFone Systems Inc.

- PAX Technology Ltd.

- NCR Corporation

- Diebold Nixdorf Inc.

- Toshiba Global Commerce Solutions

- HP Inc.

- Panasonic Corporation

- Fujitsu Ltd.

- Samsung Electronics Co. Ltd.

- Newland Payment Technology

- BBPOS Ltd.

- Square Inc. (Block)

- Fiserv Inc. (Clover)

- Lightspeed Commerce Inc.

- Shopify Inc. (Shopify POS)

- Toast Inc.

- Revel Systems Inc.

- Oracle Corporation (MICROS)

- Agilysys Inc.

- Aptos Inc.

- GK Software SE

- NEC Corporation

- NEXGO (Shenzhen Xinguodu Technology)

- Qashier Pte Ltd.

- Cegid Group

- Cow Hills Retail BV

- PCMS Group Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing adoption in the retail sector

- 4.2.2 Rising adoption of cloud-based POS platforms

- 4.2.3 Accelerating demand for contactless and mobile payments

- 4.2.4 Integration of POS data with advanced analytics and CRM

- 4.2.5 Regulatory push for fiscalisation and e-invoicing mandates

- 4.2.6 "POS-as-a-Service" subscription models lowering cap-ex

- 4.3 Market Restraints

- 4.3.1 Data-security and cyber-fraud concerns

- 4.3.2 Hardware reliability and maintenance-cost issues

- 4.3.3 Fragmentation of regional payment standards

- 4.3.4 Semiconductor supply-chain volatility

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (IoT, AI, Edge-processing)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Mode of Payment Acceptance

- 5.1.1 Contact-based

- 5.1.2 Contactless

- 5.2 By POS Type

- 5.2.1 Fixed Point-of-Sale Systems

- 5.2.2 Mobile / Portable Point-of-Sale Systems

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services

- 5.4 By Deployment Mode

- 5.4.1 Cloud-based

- 5.4.2 On-Premise

- 5.5 By End-User Industry

- 5.5.1 Retail

- 5.5.2 Hospitality

- 5.5.3 Healthcare

- 5.5.4 Transportation and Logistics

- 5.5.5 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Italy

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Southeast Asia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 GCC

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA, Partnerships, Funding)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ingenico SA (Worldline)

- 6.4.2 VeriFone Systems Inc.

- 6.4.3 PAX Technology Ltd.

- 6.4.4 NCR Corporation

- 6.4.5 Diebold Nixdorf Inc.

- 6.4.6 Toshiba Global Commerce Solutions

- 6.4.7 HP Inc.

- 6.4.8 Panasonic Corporation

- 6.4.9 Fujitsu Ltd.

- 6.4.10 Samsung Electronics Co. Ltd.

- 6.4.11 Newland Payment Technology

- 6.4.12 BBPOS Ltd.

- 6.4.13 Square Inc. (Block)

- 6.4.14 Fiserv Inc. (Clover)

- 6.4.15 Lightspeed Commerce Inc.

- 6.4.16 Shopify Inc. (Shopify POS)

- 6.4.17 Toast Inc.

- 6.4.18 Revel Systems Inc.

- 6.4.19 Oracle Corporation (MICROS)

- 6.4.20 Agilysys Inc.

- 6.4.21 Aptos Inc.

- 6.4.22 GK Software SE

- 6.4.23 NEC Corporation

- 6.4.24 NEXGO (Shenzhen Xinguodu Technology)

- 6.4.25 Qashier Pte Ltd.

- 6.4.26 Cegid Group

- 6.4.27 Cow Hills Retail BV

- 6.4.28 PCMS Group Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment