|

市场调查报告书

商品编码

1849849

欧洲服务机器人:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Europe Service Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

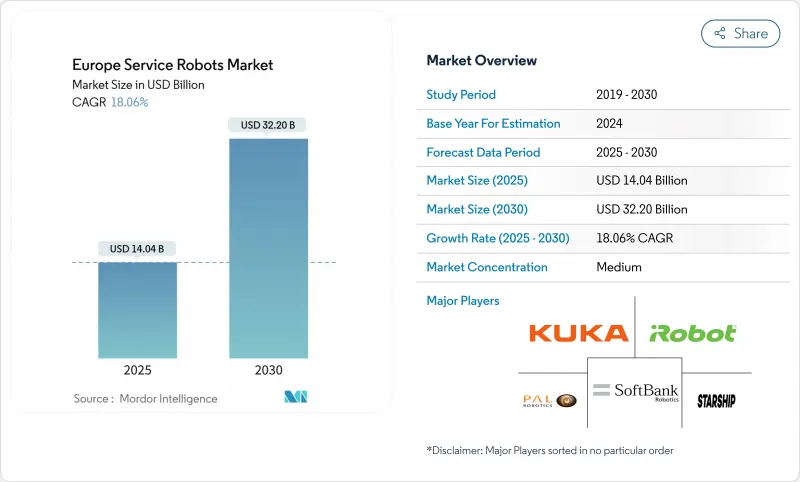

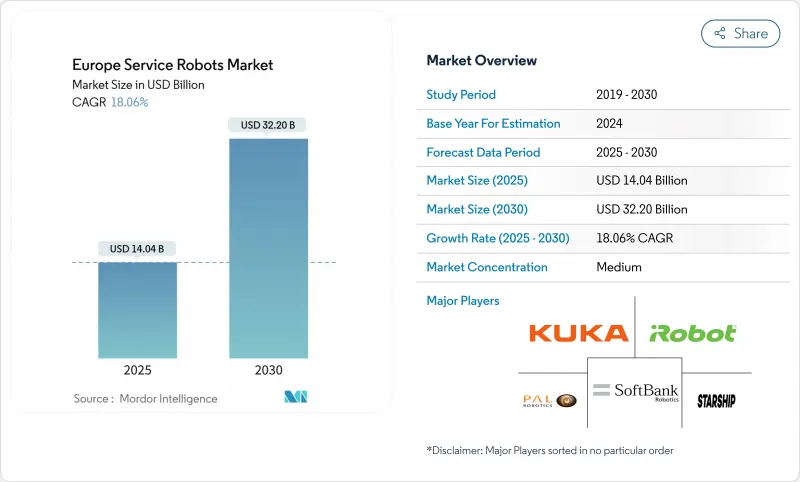

欧洲服务机器人市场预计到 2025 年将达到 140.4 亿美元,到 2030 年将达到 322 亿美元,年复合成长率为 18.06%。

这条成长路径的驱动力来自政策支持的自动化项目、大规模的人口结构变化以及不断扩张的电子商务网络,这些因素正在加速对自主系统的资本投入。欧盟「地平线欧洲」计画提供的近5亿欧元(5.48亿美元)战略资金正在降低机器人新兴企业和深度技术供应商的研发风险。同时,医疗保健、旅馆和物流业超过一百万人的劳动力短缺持续收紧工资结构,凸显了机器人技术的商业价值。儘管商用平台目前凭藉其在仓库、医院和农场替代重复性体力劳动方面的卓越能力,主导着欧洲服务型机器人市场,但随着应对老龄化政策为社会辅助设备腾出预算空间,个人机器人市场正在迅速扩张。

欧洲服务机器人市场趋势与洞察

劳动力短缺推动物流和食品杂货履约对自主移动机器人(AMR)的需求激增

随着电子商务交易量持续超过仓储劳动力需求,第三方物流供应商正积极采用自主移动机器人。 DHL预计到2030年,其30%的物料输送设备将由机器人完成。丰田物料输送欧洲公司也已确认,全天候运作已势在必行,仅靠人工操作的工作流程成本过高。像Movu Robotics这样的德国整合商已签订多站点合同,将储存、拣选和码垛模组整合到自动化系统中,使零售商即使在季节性劳动力短缺的情况下也能缩短订单到发货週期。由于机器人租赁和机器人即服务(RaaS)模式降低了中型企业的资产负债表风险,投资意愿依然强劲。因此,欧洲服务机器人市场的自主部署基准较高。

欧盟「从农场到餐桌」补贴将加速农业机器人的普及应用。

欧盟委员会斥资3,000万欧元(约3,290万美元)的农业食品技术出口促进基金(AgrifoodTEF)项目,提供测试平台和咨询服务,旨在加速农业机器人的认证,并将政策转化为西班牙、法国和荷兰农场的具体资本计划。一位西班牙葡萄园主报告称,其电动拖曳式除草机器人的能耗为1.42千瓦时/小时,证明其与燃油拖拉机相比具有经济可行性。德国机器人协会表示,轻型田间机器人取代拖拉机后,可显着减少土壤压实和排放气体,从而产生环境效益,这不仅吸引了监管机构,也吸引了投资者。补贴政策将持续到2027年,这正在加速订单成长,提高製造商在订单簿上的可见度,并强化欧洲服务机器人市场对户外应用的关注。

分散的安全标准减缓了多国推广进程

从机械指令过渡到新机械法规以及同时推出的人工智慧法案,造成了一系列认证障碍。开发商被迫进行重复的合格评定,延长了开发週期,增加了合规成本。在等待ISO 13482修订版的同时,TUV认证的瓶颈也延缓了中小企业的产品上市时间。儘管欧盟计划在2025年建立统一的服务台,但目前的不确定性抑制了泛欧服务机器人车队的规模扩张,并削弱了欧洲服务机器人市场的积极发展势头。

细分市场分析

商用机器人已被证实是欧洲服务机器人市场的经济支柱,预计2024年将占总销售额的63%。其应用主要集中在物流、医疗保健和农业领域,这些领域可量化的劳动成本和运作节省能够带来快速的投资回报。随着第三方物流公司和连锁医院的机器人车队扩张计划,欧洲商用平台服务机器人市场规模预计将同步成长,而机器人即服务(RaaS)合约的实施将支出从资本支出(CapEx)转移到营运支出(OpEx)。库卡(KUKA)以软体为中心的策略性倡议表明,现有企业正在将增值分析与硬体结合,这一趋势增加了企业客户的转换成本。

个人机器人虽然在绝对数量上仍属于少数,但却是成长最快的细分市场,预计到2030年将以19.8%的复合年增长率成长。居家养老补贴、零件价格下降以及云端连结等因素,为行动助理处理日常家务和社交互动创造了有利的经济条件。北欧试点计画的数据显示,使用护理机器人可以在不影响病人疗效的前提下,减少12%的看护者探访次数,从而减轻国家医疗保健预算的负担。随着社会接受度研究的深入,欧洲服务机器人市场的需求曲线很可能更接近智慧型手机的普及週期,而非工业自动化的发展速度。

到2024年,地面机器人将占总收入的71%,这反映出监管环境的成熟以及在结构化室内环境中已证实的投资报酬率。仓库、医院和饭店提供可控环境,在这些环境中,自主移动机器人(AMR)可以以较低的风险利用即时定位与地图建置(SLAM)导航,从而确保可预测的吞吐量成长。随着零售商将棕地改造为自动化微型履约中心,欧洲地面服务机器人市场规模持续扩大。

同时,受基础建设巡检和精密农业应用场景的推动,空中平台正以21.4%的复合年增长率成长。超视距飞行豁免和5G独立组网的部署,为无人机在电力线、管道和农田上空进行例行巡检提供了所需的频宽和监管清晰度。一家德国公用事业公司估计,基于无人机的巡检已将停电相关的罚款减少了15%,显着降低了整体拥有成本。随着基于风险的服务机器人评估(SORA)框架在成员国之间逐步统一,预计空中飞行量将在欧洲服务机器人市场中占据越来越重要的份额。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 劳动力短缺推动物流和生鲜履约对自主移动机器人(AMR)的需求激增

- 欧盟的农场到餐桌补助加速了农业机器人的普及应用

- 医院感染控制通讯协定推广使用紫外线C波段消毒机器人

- 旨在促进养老陪伴机器人普及的居家照护政策

- Start-Ups利用低成本空间人工智慧晶片打造微型行动配送机器人

- 付费使用制的RaaS模式减轻了中小企业的财务负担。

- 市场限制

- 分散的安全标准减缓了多个国家的实施进程。

- 历史悠久的城市中心对自主系统普遍持怀疑态度。

- 认证服务机器人技术人员短缺

- 锂离子电池供应的不确定性推高了物料清单成本。

- 价值/供应链分析

- 监管环境

- 技术展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争的激烈程度

第五章 市场规模与成长预测

- 按类型

- 个人机器人

- 家

- 研究与教育

- 娱乐

- 专业机器人

- 部门(农业、林业)

- 国防与安全

- 医疗保健

- 物流/仓库自主移动机器人

- 其他的

- 个人机器人

- 透过操作环境

- 航空(无人机/无人飞行器)

- 地面/陆地

- 海洋和水下

- 按组件

- 感应器

- 致动器

- 控制系统和边缘人工智慧

- 软体(导航、视觉、车队管理)

- 动力系统(电池、燃料电池)

- 按最终用户行业划分

- 军事与国防

- 农业、建筑业、矿业

- 运输/物流

- 医疗保健和生命科学

- 政府和地方政府服务

- 饭店和零售业

- 其他的

- 按国家/地区

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 瑞典

- 丹麦

- 芬兰

- 挪威

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- KUKA AG

- iRobot Corporation

- SoftBank Robotics Group

- PAL Robotics

- Starship Technologies

- Amazon Robotics

- Northrop Grumman Corporation

- DJI

- Parrot SA

- Blue Ocean Robotics

- Boston Dynamics

- ANYbotics

- Lely Holding

- SeaRobotics Corporation

- GeckoSystems Corporation

- RedZone Robotics

- Dyson Ltd.

- Robotnik Automation

- Husqvarna Group

- Robobuilder Co. Ltd.

第七章 市场机会与未来展望

The Europe service robots market size is valued at USD 14.04 billion in 2025 and is forecast to reach USD 32.20 billion by 2030, advancing at an 18.06% CAGR.

The growth path is propelled by policy-backed automation programs, large-scale demographic shifts, and expanding e-commerce networks that collectively accelerate capital spending on autonomous systems. Strategic EU funding of nearly EUR 500 million (USD 548 million) under Horizon Europe has de-risked R&D for robotics start-ups and deep-tech suppliers, while labor shortages exceeding 1 million vacancies in health, hospitality, and logistics continue to tighten wage structures and sharpen the return-on-investment logic for robotic deployments. Professional platforms currently dominate the Europe service robots market through their proven ability to replace repetitive manual tasks in warehouses, hospitals, and farms, yet the personal segment is scaling rapidly as aging-in-place initiatives create budget lines for socially assistive devices.

Europe Service Robots Market Trends and Insights

Rapid Labour-Shortage-Driven Demand for AMRs in Logistics & Grocery Fulfilment

E-commerce volumes continue to outpace available warehouse labor, pushing third-party logistics providers toward aggressive adoption of autonomous mobile robots. DHL expects 30% of its material-handling assets to be robotic by 2030, a position echoed by Toyota Material Handling Europe, which confirms that 24/7 uptime imperatives are no longer negotiable and human-only workflows are uneconomical. German integrators such as Movu Robotics are securing multi-site contracts that bundle storage, picking, and pallet transport modules into unified automation stacks, allowing retailers to compress order-to-ship cycles even during seasonal labor crunches. Investment appetite remains strong as robotics leasing and robots-as-a-service arrangements lower balance-sheet risk for mid-sized operators. The result is a structurally higher baseline for autonomous deployments in the Europe service robots market.

EU "Farm to Fork" Subsidies Accelerating Agri-Robot Adoption

The European Commission's EUR 30 million (USD 32.9 million) AgrifoodTEF program offers test beds and advisory services that speed certification for agricultural robots, translating policy into tangible capital projects on Spanish, French, and Dutch farms. Vineyard operators in Spain report energy use of 1.42 kWh/h for electric tracked weed-removal robots, proving economic viability against fuel-powered tractors. Germany's robotics association notes measurable drops in soil compaction and emissions when lightweight field robots replace tractors, creating an environmental co-benefit that appeals to regulators and investors alike. Subsidy certainty through 2027 has pulled orders forward, lifting visibility in manufacturer order books and reinforcing the Europe service robots market's pivot toward outdoor applications.

Fragmented Safety Standards Delaying Multi-Country Roll-Outs

The transition from the Machinery Directive to the new Machinery Regulation and the simultaneous introduction of the AI Act create a patchwork of certification hurdles. Manufacturers must perform redundant conformity assessments that lengthen development cycles and increase compliance costs. ISO 13482's pending revision adds another moving target, while TUV-certification bottlenecks slow time-to-market for SMEs. An EU-level Service Desk is planned for 2025, yet the interim uncertainty curbs the scale-up ambitions of pan-European fleets, tempering the otherwise strong trajectory of the Europe service robots market

Other drivers and restraints analyzed in the detailed report include:

- Hospital Infection-Control Protocols Boosting UV-C Disinfection Robots

- Ageing-in-Place Policies Spurring Elder-Care Companion Robots

- Persistent Public Scepticism Over Autonomous Systems in Heritage City Centres

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Professional robots generated 63% of 2024 revenue, confirming their status as the economic backbone of the Europe service robots market. Uptake is concentrated in logistics, healthcare, and agriculture, where quantifiable savings on labor and uptime deliver rapid payback. The Europe service robots market size for professional platforms is forecast to expand in sync with fleet expansion programs at 3PLs and hospital chains, supported by robots-as-a-service contracts that shift spending from CapEx to OpEx. Software-centric moves by KUKA underline how incumbents are wrapping value-added analytics around hardware, a trend that reinforces switching costs for enterprise clients.

Personal robots remain a minority in absolute dollars yet emerge as the fastest-growing slice at 19.8% CAGR through 2030. Aging-in-place subsidies, falling component prices, and cloud connectivity create favorable economics for mobile assistants that handle routine chores and social interaction. Pilot data from Nordic programs confirm that care-robot usage cuts caregiver visits by 12% without compromising patient outcomes, offering fiscal relief for national health budgets. As social-acceptance studies progress, the Europe service robots market will likely witness a demand curve that mirrors the smartphone diffusion cycle rather than industrial automation pacing.

Ground robots captured 71% of 2024 sales, reflecting regulatory maturity and proven ROI in structured indoor settings. Warehouses, hospitals, and hotels provide controlled environments where AMRs can leverage SLAM navigation with limited risk, ensuring predictable throughput gains. The Europe service robots market size associated with ground deployments continues to grow as retailers convert brownfield sites into automated micro-fulfilment hubs.

Aerial platforms, however, post a 21.4% CAGR on the back of infrastructure inspection and precision-agriculture use cases. BVLOS exemptions and the rollout of 5G standalone networks furnish the bandwidth and regulatory clarity needed for routine unmanned flights over power lines, pipelines, and crop fields. German utilities estimate that drone-based inspections cut outage-related penalties by 15%, creating a compelling TCO narrative. As risk-based SORA frameworks harmonize across member states, aerial volumes are expected to carve out an increasingly material share of the Europe service robots market.

The Europe Service Robots Market is Segmented by Type (Personal Robots, Professional Robots), Operating Environment (Aerial, Land, and More), Components (Sensors, Actuators, and More), End-User Industry (Military and Defense, Agriculture, Construction and Mining, and More), and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- KUKA AG

- iRobot Corporation

- SoftBank Robotics Group

- PAL Robotics

- Starship Technologies

- Amazon Robotics

- Northrop Grumman Corporation

- DJI

- Parrot SA

- Blue Ocean Robotics

- Boston Dynamics

- ANYbotics

- Lely Holding

- SeaRobotics Corporation

- GeckoSystems Corporation

- RedZone Robotics

- Dyson Ltd.

- Robotnik Automation

- Husqvarna Group

- Robobuilder Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid labour-shortage-driven demand for AMRs in logistics & grocery fulfilment

- 4.2.2 EU Farm to Fork subsidies accelerating agri-robot adoption

- 4.2.3 Hospital infection-control protocols boosting UV-C disinfection robots

- 4.2.4 Ageing-in-place policies spurring elder-care companion robots

- 4.2.5 Start-ups exploiting low-cost spatial-AI chips for micro-mobility delivery bots

- 4.2.6 Pay-per-use RaaS models unlocking SME affordability

- 4.3 Market Restraints

- 4.3.1 Fragmented safety standards delaying multi-country roll-outs

- 4.3.2 Persistent public scepticism over autonomous systems in heritage city centres

- 4.3.3 Shortage of certified service-robot technicians

- 4.3.4 Lithium-ion supply volatility inflating BoM costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Personal Robots

- 5.1.1.1 Domestic

- 5.1.1.2 Research & Education

- 5.1.1.3 Entertainment

- 5.1.2 Professional Robots

- 5.1.2.1 Field (Agriculture, Forestry)

- 5.1.2.2 Defense and Security

- 5.1.2.3 Medical and Healthcare

- 5.1.2.4 Logistics and Warehouse AMRs

- 5.1.2.5 Others

- 5.1.1 Personal Robots

- 5.2 By Operating Environment

- 5.2.1 Aerial (UAV/Drone)

- 5.2.2 Ground / Land

- 5.2.3 Marine and Underwater

- 5.3 By Component

- 5.3.1 Sensors

- 5.3.2 Actuators

- 5.3.3 Control Systems and Edge AI

- 5.3.4 Software (Navigation, Vision, Fleet-Mgmt)

- 5.3.5 Power Systems (Batteries, Fuel-cells)

- 5.4 By End-User Industry

- 5.4.1 Military and Defense

- 5.4.2 Agriculture, Construction & Mining

- 5.4.3 Transportation and Logistics

- 5.4.4 Healthcare and Life-Sciences

- 5.4.5 Government and Municipal Services

- 5.4.6 Hospitality and Retail

- 5.4.7 Others

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Sweden

- 5.5.8 Denmark

- 5.5.9 Finland

- 5.5.10 Norway

- 5.5.11 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 KUKA AG

- 6.4.2 iRobot Corporation

- 6.4.3 SoftBank Robotics Group

- 6.4.4 PAL Robotics

- 6.4.5 Starship Technologies

- 6.4.6 Amazon Robotics

- 6.4.7 Northrop Grumman Corporation

- 6.4.8 DJI

- 6.4.9 Parrot SA

- 6.4.10 Blue Ocean Robotics

- 6.4.11 Boston Dynamics

- 6.4.12 ANYbotics

- 6.4.13 Lely Holding

- 6.4.14 SeaRobotics Corporation

- 6.4.15 GeckoSystems Corporation

- 6.4.16 RedZone Robotics

- 6.4.17 Dyson Ltd.

- 6.4.18 Robotnik Automation

- 6.4.19 Husqvarna Group

- 6.4.20 Robobuilder Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment