|

市场调查报告书

商品编码

1849860

结构绝缘板:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Structural Insulated Panels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

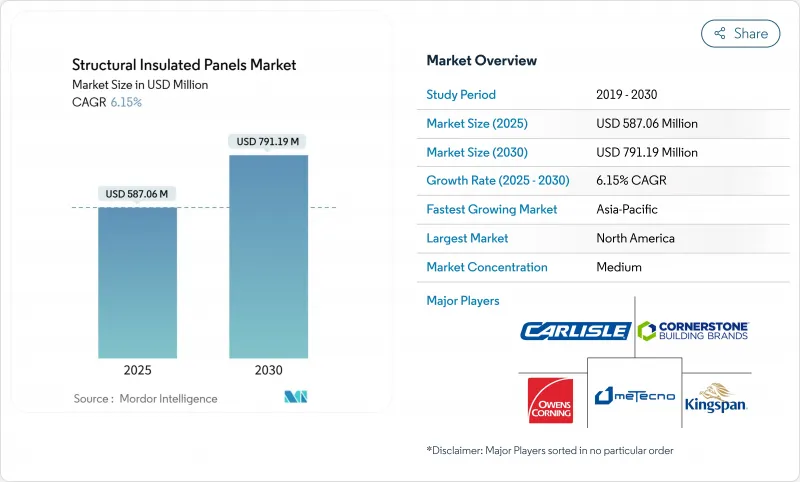

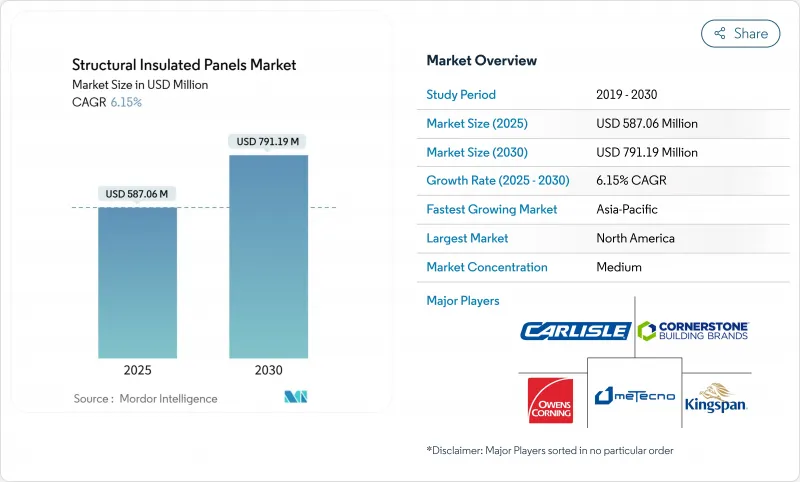

结构绝缘板市场预计到 2025 年将达到 5.8706 亿美元,到 2030 年将达到 7.9119 亿美元,复合年增长率为 6.15%。

强劲的成长势头源于日益严格的能源效率法规、预製化进程的加速以及低温运输基础设施的扩张。北美将保持其监管主导,而亚太地区则将因快速都市化而实现最快的销售成长。资料中心建置和温控物流将开启高端市场,从而刺激产品创新。同时,定向纤维板(OSB) 供应链的不稳定和高昂的初始成本阻碍了其广泛应用。

全球结构绝缘板市场趋势与见解

能源效率法规加速采用

2021年国际节能规范 (IECC) 将美国资助住房的性能标准提高34.4%。结构隔热板市场参与企业将从中受益,因为SIP墙体和屋顶组件可以减少空气渗透,同时满足规定的R值,而无需修改框架结构。科罗拉多率先采用IECC,显示州政府的强制规定可以立即引发材料转型,该州能源规范委员会强调SIP是承包合规途径。商业开发商也开始采用SIP封套来获得LEED积分,将需求扩展到独栋住宅以外的领域。

扩大全球低温运输基础设施

冷库、疫苗仓库和最后一哩履约中心需要高R值的持续隔热材料。 PUR和PIR芯材SIP可提供零下温度所需的尺寸稳定性和蒸气阻隔性,同时比传统板材节能25%。模组化冷库采用工厂预製SIP,可将安装时间缩短40%,并支援亚太地区食品、药品和水产品分销的快速扩充性。

与传统框架相比,初始成本更高

EPS核心太阳能板的平均价格为每平方英尺10至18美元,比总建筑成本高出2-3%。即使这些太阳能板透过降低能源费用,其生命週期回报期不到五年,但这对于注重预算的计划来说可能是一个阻碍。目前,只有1-2%的美国家庭使用太阳能板,而且安装人员的认知度较低,导致人们对此有持续的误解。根据《通膨控制法》,联邦税收优惠政策目前已部分抵消了价格差异,但新兴市场的价格敏感度仍在抑制销售量。

細項分析

到2024年,EPS板材的销售额将占到79.87%,这反映了该材料的性价比优势,因为建筑商正在采用SIP板材以满足更严格的监管要求。 EPS板材在结构保温板市场占据主导地位,这与北美和亚太地区广泛的EPS产能相符,从而确保了价格和供应的稳定。轻质板材还能降低运费,使开发商能够利用起重机受限的乡村土地。

结构保温板市场预测,2025年至2030年,EPS(聚苯乙烯)销量的复合年增长率将达到6.29%。聚氨酯/聚异氰酸酯(PUR/PIR)板用于保护冷藏室和无尘室,其低k值和封闭式刚度使其高昂的成本合理化。真空隔热和气凝胶芯材概念在净零能耗原型中已展现出良好的前景,但由于价格和操作复杂性,仍处于小众市场。同时,玻璃绒芯材在声学计划中也备受关注,为寻求多功能组件的建筑师拓展了结构保温板行业的套件。

到2024年,OSB板将占据结构保温板市场份额的57.28%,这得益于OSB闆对框架施工工人的熟悉程度以及与传统钢筋墙紧固件的兼容性。建商看重OSB板的螺丝抗拔强度,这使得OSB板可以直接安装护套,无需使用龙骨条。

然而,介壳虫和工厂火灾导致的纤维短缺凸显了供应风险,促使设计师转向钢材、纤维水泥和氧化镁外皮,预计到2030年复合年增长率将达到7.06%。金属饰面用于资料中心围护结构,其防火和电磁屏蔽至关重要,而氧化镁板则可在潮湿气候下提供防霉性能。虽然这些选择使采购管道更加多样化,但改装必须调整其工具和紧固件的选择,这使得结构绝缘板市场面临漫长的学习曲线。

区域分析

2024年,北美将占全球销售额的37.12%,其中美国位居前列。美国联邦担保抵押房屋抵押贷款采用IECC 2021标准,使得SIP级性能成为新房屋的标准。儘管存在贸易关税摩擦,加拿大製造商仍在为国内框架商和美国计划提供产品,因为该地区寒冷的气候增加了对耐用组件的需求。维吉尼亚、德克萨斯州和魁北克省的资料中心建设正在蓬勃发展,为结构绝缘板市场注入了优质流量。

到2030年,亚太地区的复合年增长率最高,达7.28%。中国的新建筑建筑占地面积法规包含绿色建筑比例,旨在促进多用户住宅使用模组化整合框架(SIP),而印度的智慧城市专案则资助模组化经济适用房,其中的面板有助于场地週转。本地的EPS树脂产能和具有竞争力的劳动力使面板交付成本保持在较低水平,即使是规模较小的开发商也开始采用。日本的抗震标准推动了钢木混合SIP设计的发展,这种设计兼具轻量化和框架的弹性,并在建筑领域获得了广泛的认可。

在欧洲,受《建筑能效指令》的推动,维修预算转向「外观优先」策略的趋势保持了稳定的需求。斯堪地那维亚的建筑商正在将交叉层压木材与聚苯乙烯(EPS)芯材相结合,以打造碳负性模组化小木屋。除上述三大地区外,中东地区正在为区域粮食安全提供冷藏设施资金,智利正在试验抗震的SIP社会住宅原型。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 能源效率法规正在加速实施

- 扩大全球低温运输基础设施

- 增加经济适用房及房屋装修

- 人们对快速异地施工的兴趣日益浓厚

- 木质SIP的碳信用收益

- 市场限制

- 与传统框架相比,初始成本更高

- 先进预製墙体系统取代的威胁

- OSB 供应不稳定(甲虫侵扰和工厂停工)

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章市场规模及成长预测

- 按产品

- EPS(发泡聚苯乙烯)板

- 硬质聚氨酯 (PUR) 和聚异氰酸酯(PIR) 面板

- 玻璃绒板

- 其他产品(例如真空绝缘)

- 依皮肤类型

- 定向纤维板(OSB)

- 合板

- 其他外墙材质(纤维水泥板、镀锌钢板等)

- 按用途

- 建筑墙体

- 建筑屋顶

- 冷资料储存

- 其他模组化结构(例如资料中心、地板、甲板等)

- 按最终用户产业

- 住宅

- 商业的

- 工业和公共部门

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Alubel SpA

- ArcelorMital

- Balex-Metal

- Carlisle Companies Inc.

- Cornerstone Building Brands, Inc.

- DANA Group of Companies

- Italpannelli SRL

- Jiangsu Jingxue Energy Saving Technology Co., Ltd.

- Kingspan Group

- Manni Group

- Metecno

- Multicolor Steels(India)Pvt. Ltd.

- Nucor Building Systems

- Owens Corning

- Premium Building Systems

- Rautaruukki Corporation(Ruukki Construction)

- Structall Building Systems

- Tata Steel

- Thermocore Structural Insulated Panel Systems

- Zamil Steel Buildings India Private Limited

第七章 市场机会与未来展望

The structural insulated panels market is valued at USD 587.06 million in 2025 and is forecast to reach USD 791.19 million by 2030, advancing at a 6.15% CAGR.

Strong momentum stems from tighter energy-efficiency codes, accelerating prefabrication adoption, and expanding cold-chain infrastructure. North America retains regulatory leadership, while Asia-Pacific posts the fastest volume gains due to rapid urbanization. Data-center construction and temperature-controlled logistics open premium niches that spur product innovation. Meanwhile, supply-chain volatility for oriented strand board (OSB) and higher upfront costs remain near-term brakes on broad adoption.

Global Structural Insulated Panels Market Trends and Insights

Energy-Efficiency Regulations Accelerating Adoption

Global building codes now prioritize lower operational carbon, and the 2021 International Energy Conservation Code (IECC) raises performance thresholds by 34.4% for federally financed housing in the United States. Structural insulated panels market participants benefit because SIP wall and roof assemblies cut air infiltration while meeting prescriptive R-values without additional framing changes. Colorado's early IECC adoption demonstrates how state mandates trigger immediate material shifts, with its Energy Code Board highlighting SIPs as a turnkey compliance route. Commercial developers also lean on SIP envelopes to secure LEED points, extending demand beyond single-family housing.

Expansion of Global Cold-Chain Infrastructure

Cold stores, vaccine depots, and last-mile fulfillment centers require high-R-value continuous insulation. PUR and PIR-core SIPs offer the dimensional stability and vapor-barrier integrity needed for temperatures well below freezing, enabling 25% energy savings against conventional panels. Modular cold rooms leverage factory-fabricated SIPs to slash installation time by 40% and support rapid scalability for grocery, pharma, and seafood logistics across Asia-Pacific.

Higher Upfront Costs vs. Conventional Framing

EPS-core SIPs average USD 10-18 per ft2, translating to a 2-3% premium on total build cost, which can deter budget-driven projects despite life-cycle payback within five years through lower energy bills. Misconceptions persist because only 1-2% of U.S. homes currently use panels, keeping installer familiarity low. Federal tax incentives under the Inflation Reduction Act now offset part of that delta, but price sensitivity in emerging markets still restrains volume.

Other drivers and restraints analyzed in the detailed report include:

- Rising Affordable-Housing & Residential Remodeling

- Growing Preference for Rapid, Off-Site Construction

- OSB Supply Volatility (Beetle Infestation & Mill Outages)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

EPS panels held 79.87% of 2024 revenue, underlining the material's cost-performance balance as builders adopt SIP shells to comply with stricter codes. This dominant slice of the structural insulated panels market size aligns with widespread EPS manufacturing capacity, which ensures stable pricing and supply in North America and Asia-Pacific. Lightweight boards also reduce freight, letting developers tap rural lots with limited crane access.

Over 2025-2030, the structural insulated panels market expects EPS volumes to grow at 6.29% CAGR, supported by flame-retardant grades and recycled content innovations. PUR/PIR panels protect cold rooms and cleanrooms where lower k-values and closed-cell rigidity justify higher cost. Vacuum-insulated and aerogel-core concepts show promise in net-zero prototypes yet remain niche due to price and handling complexity. In parallel, glass-wool cores attract acoustic projects, broadening the structural insulated panels industry toolkit for architects seeking multifunctional assemblies.

OSB skins accounted for 57.28% of structural insulated panels market share in 2024, leveraging familiarity among framing crews and compatibility with fasteners used in conventional stick-built walls. Builders appreciate OSB's screw-withdrawal strength that supports direct cladding attachment without furring strips.

However, beetle-related fiber shortages and mill fires have spotlighted supply risk, nudging designers toward steel, fiber-cement, and magnesium-oxide skins growing at 7.06% CAGR through 2030. Metal facings serve data-center envelopes where non-combustibility and electromagnetic shielding matter, while MgO boards provide mold resistance in humid climates. These alternatives diversify procurement, although retrofit crews must adjust tooling and fastener choices, extending learning curves in the structural insulated panels market.

The Structural Insulated Panels Market Report Segments the Industry by Product (EPS (Expanded Polystyrene) Panels, Glass-Wool Panels, and More), Skin Material (Oriented Strand Board (OSB), Plywood, and More), Application (Building Wall, Building Roof, and More), End-User Industry (Residential, Commerical, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 37.12% of global revenue in 2024, anchored by the United States where IECC 2021 adoption for federally backed mortgages effectively makes SIP-level performance mainstream for new housing. Canadian manufacturers supply both domestic framers and U.S. projects despite trade-tariff friction, and the cold regional climate reinforces the need for high-R assemblies. Rapid data-center construction in Virginia, Texas, and Quebec injects a premium commercial stream into the structural insulated panels market.

Asia-Pacific logs the fastest regional CAGR at 7.28% to 2030. China's new-build floor-area quotas include green-building ratios that elevate SIP use in apartment blocks, while India's Smart Cities program funds modular affordable housing where panels accelerate site turnover. Local EPS resin capacity and competitive labor help keep delivered panel cost low, encouraging uptake even among smaller developers. Japan's seismic codes spur hybrid timber-steel SIP designs that pair light weight with moment-frame resilience, widening architectural acceptance.

Europe maintains stable demand underpinned by the Energy Performance of Buildings Directive, which increasingly channels renovation budgets into envelope first strategies. Scandinavian builders integrate cross-laminated timber skins with EPS cores to produce carbon-negative modular cottages, whereas Germany and the Netherlands drive public procurement toward low-embodied-carbon materials. Outside the big three regions, the Middle East funds cold-store capacity for regional food security, and Chile experiments with SIP social-housing prototypes that withstand seismic events.

- Alubel SpA

- ArcelorMital

- Balex-Metal

- Carlisle Companies Inc.

- Cornerstone Building Brands, Inc.

- DANA Group of Companies

- Italpannelli SRL

- Jiangsu Jingxue Energy Saving Technology Co., Ltd.

- Kingspan Group

- Manni Group

- Metecno

- Multicolor Steels (India) Pvt. Ltd.

- Nucor Building Systems

- Owens Corning

- Premium Building Systems

- Rautaruukki Corporation (Ruukki Construction)

- Structall Building Systems

- Tata Steel

- Thermocore Structural Insulated Panel Systems

- Zamil Steel Buildings India Private Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Energy-efficiency regulations accelerating adoption

- 4.2.2 Expansion of global cold-chain infrastructure

- 4.2.3 Rising affordable-housing & residential remodeling

- 4.2.4 Growing preference for rapid, off-site construction

- 4.2.5 Carbon-credit monetisation for timber-based SIPs

- 4.3 Market Restraints

- 4.3.1 Higher upfront costs vs. conventional framing

- 4.3.2 Substitution threat from advanced prefab wall systems

- 4.3.3 OSB supply volatility (beetle infestation & mill outages)

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products & Services

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 EPS (Expanded Polystyrene) Panels

- 5.1.2 Rigid Polyurethane (PUR) and Rigid Polyisocyanurate (PIR) Panels

- 5.1.3 Glass-wool Panels

- 5.1.4 Other Products (e.g., Vacuum-insulated, etc.)

- 5.2 By Skin Material

- 5.2.1 Oriented Strand Board (OSB)

- 5.2.2 Plywood

- 5.2.3 Other Skin Materials (Fibre-cement Board, Galvanised Steel Sheet), etc.)

- 5.3 By Application

- 5.3.1 Building Wall

- 5.3.2 Building Roof

- 5.3.3 Cold Storage

- 5.3.4 Other Modular Structures (e.g., Data Centres, Floor and Deck, etc.)

- 5.4 By End-User Industry

- 5.4.1 Residential

- 5.4.2 Commercial

- 5.4.3 Industrial and Institutional

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.1.1 South Africa

- 5.5.5.1.2 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Alubel SpA

- 6.4.2 ArcelorMital

- 6.4.3 Balex-Metal

- 6.4.4 Carlisle Companies Inc.

- 6.4.5 Cornerstone Building Brands, Inc.

- 6.4.6 DANA Group of Companies

- 6.4.7 Italpannelli SRL

- 6.4.8 Jiangsu Jingxue Energy Saving Technology Co., Ltd.

- 6.4.9 Kingspan Group

- 6.4.10 Manni Group

- 6.4.11 Metecno

- 6.4.12 Multicolor Steels (India) Pvt. Ltd.

- 6.4.13 Nucor Building Systems

- 6.4.14 Owens Corning

- 6.4.15 Premium Building Systems

- 6.4.16 Rautaruukki Corporation (Ruukki Construction)

- 6.4.17 Structall Building Systems

- 6.4.18 Tata Steel

- 6.4.19 Thermocore Structural Insulated Panel Systems

- 6.4.20 Zamil Steel Buildings India Private Limited

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment