|

市场调查报告书

商品编码

1849862

蜡:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Wax - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

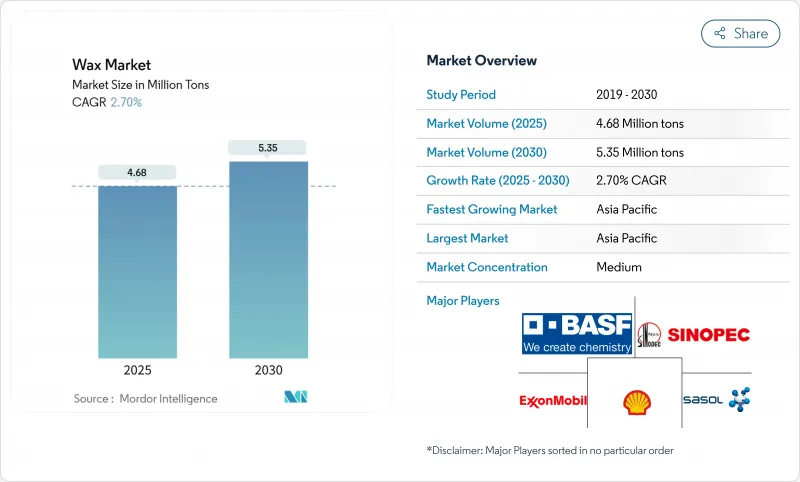

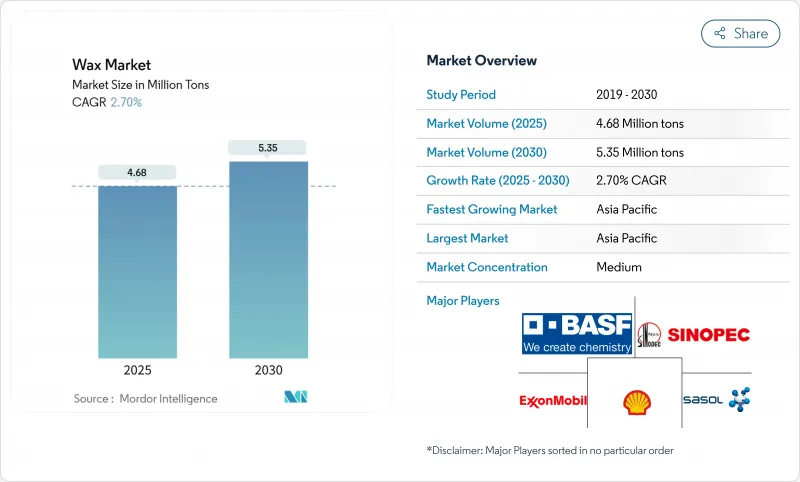

预计到 2025 年,蜡市场规模将达到 468 万吨,到 2030 年将达到 535 万吨,在预测期(2025-2030 年)内,复合年增长率将达到 2.70%。

蜡市场正从以石油为主导的供应模式转型为包含天然蜡和高性能合成蜡在内的多元化混合供应模式。更清洁的配方、快速发展的电子商务物流以及新型乙烷裂解装置生产的成本优势聚乙烯蜡,为生产商开闢了新的增长途径,即便成熟的蜡烛、包装和橡胶应用市场增长趋于平缓。亚太地区的领先地位得益于其一体化的炼油能力、庞大的消费品产业以及全球成长最快的线上零售通路。在欧洲,对多环芳烃(PAHs)和一次性塑胶的监管持续推动对植物来源替代品和食品被覆剂的需求。在北美,页岩气衍生的乙烷保持着良好的生产经济效益,使区域性企业能够客製化针对涂料、复合材料和热熔胶等应用领域的蜡品等级,并开拓出口市场。

全球蜡市场趋势与洞察

亚太地区电子商务的蓬勃发展推动了对热熔胶级FT蜡的需求。

中国、印度和东南亚地区线上零售的爆炸性成长推动了对费托(FT)改性热熔胶的需求,增强了纸箱密封性和标籤黏合力。这些FT改质热熔胶具有更高的熔点和内聚强度,使包装能够在潮湿的季风地区和冷链运输中保持密封。包装加工商报告称,使用FT蜡添加剂配製的包装可减少高达35%的运输废弃物率。因此,蜡市场受益于小包裹的成长和高性能混合胶的高价位。提供区域仓库库存的供应商也看到了前置作业时间的缩短以及来自寻求坚固耐用、防潮包装解决方案的物流网络的重复业务。

欧洲洁净标示化妆品加速向植物来源巴西棕榈蜡和蜂蜡转型

欧洲美妆品牌正迅速转向成分透明化标註,鼓励负责人用巴西棕榈蜡、小烛树蜡和蜂蜡替代合成蜡和石蜡。这些生物基原料能为唇部护理产品、润唇膏和润肤棒提供所需的天然光泽、成膜性和润肤特性。一项2025年的研究表明,以巴西棕榈蜡为基础的、结构合理的纯素唇膏,其硬度、显色度和熔化稳定性可与蜂蜡媲美。在巴西和东南亚拥有可追溯供应链的蜡製品市场参与企业维持着价格溢价,而欧洲的契约製造则寻求更短的前置作业时间。

欧洲加强了对石蜡玩具和化妆品中多环芳烃的限制(REACH法规)。

欧洲REACH法规更新后的多环芳烃(PAH)基准值现已适用于玩具和免冲洗保养品中使用的石蜡。合规认证增加了成本和复杂性,不合规的进口产品将面临海关扣押和零售商下架的风险。跨国品牌所有者仅对上游来源明确的蜡品进行预认证,这促使买家转向合成费托蜡和植物来源替代品。因此,在精炼厂全面完成技术升级之前,传统石蜡市场的利润率将会受到压缩。

细分市场分析

预计到2024年,石蜡和矿物蜡将保持58%的蜡市场份额,这主要得益于其成本竞争力以及在蜡烛、板材施胶和橡胶化合物等领域的广泛应用。然而,以巴西棕榈蜡、小烛树蜡和蜂蜡为代表的天然蜡市场预计将以3.43%的复合年增长率增长,凸显了消费者对可再生原材料的显着转向。可追溯来源、低多环芳烃含量和纯素产品的需求不断增长,使得巴西和墨西哥的认证人工林成为重要的策略资产。以费托合成蜡和聚乙烯蜡为代表的合成蜡则占据了创新优势,能够为对高温和高湿环境敏感的应用提供客製化的熔融特性和硬度等级。

高端洁净标示化妆品、可食用水果和蔬菜被覆剂和特殊包装被覆剂是推动天然蜡市场成长的主要动力。相反,对成本敏感的领域,例如瓦楞纸箱尺寸,仍然更青睐石蜡混合物。在预测期内,气转液(GTL)装置的产能扩张可望缓解合成蜡的价格波动,而无溶剂萃取的新技术旨在提高植物性蜡的产量。生产商与欧洲美容品牌之间的策略性承购协议将确保供应,并进一步推动天然替代品融入蜡市场。

到2024年,以固态蜡为燃料基质和香料载体的蜡烛将占据蜡市场60%的份额。这种长期主导地位在註重氛围产品的成熟经济体以及家居装饰支出不断增长的新兴市场中得以维持。然而,化妆品将以3.65%的复合年增长率实现最高增长,因为负责人越来越依赖蜡来构建唇部、头髮和身体护理产品的结构、提升显色度和改善肤感。直接面向消费者的品牌正在选择符合其清洁美容定位的高纯度或生物基蜡,并加速小批量产品的推出。

用于电商包装的热熔胶、纸箱的阻隔被覆剂以及PVC型材的挤出润滑剂的应用范围正在不断扩大。可食用被覆剂正在取代用于水果和乳酪的石油化学包装,这不仅体现了其与永续性的协同效应,也突显了蜡的多功能性。研发工作将蜡的市场配方定位在功能性和循环性的交汇点,使品牌所有者能够共同开发特定应用的配方,并在创纪录的时间内扩大试点生产规模。

区域分析

预计亚太地区将在2024年占据45%的蜡市场份额,并在2030年前维持3.2%的复合年增长率,成为成长最快的地区。中国庞大的蜡烛、包装和个人护理丛集将支撑市场需求,而印度不断壮大的中产阶级正在推动化妆品和家居香氛消费的成长。东协物流枢纽将促进热熔胶的应用,使蜡市场成长与小包裹量直接挂钩。印尼和马来西亚政府对下游石化产业的激励措施将继续吸引对合成蜡装置的投资,从而实现在地化供应并缩短从运输到商店的週期。

北美蜡市场格局平衡,既有成熟的蜡烛和板材应用,也有特种聚乙烯蜡领域的创新发展。低成本的页岩乙烷为新的裂解装置提供原料,使美国和加拿大生产商能够扩大出口,特别是对拉丁美洲和欧洲的出口。汽车轻量化、粉末涂料和3D列印丝材添加剂的应用,为精细分级馏合成纤维开闢了下一代应用领域。美国墨加协定(USMCA)框架下的跨国物流确保了上游中间体和成品蜡混合物的免税流通。

欧洲蜡市场在极其严格的法规环境下运作,推动消费转向低多环芳烃(PAH)含量的石蜡、全合成费托蜡和经认证的天然蜡。德国和荷兰拥有用于高端化妆品的精炼中心,而义大利的水果出口产业正在扩大食用巴西棕榈蜡涂层的试验规模,以满足零售保质期规定。一次性塑胶的禁令正在使涂有生物蜡阻隔层的纸质包装重获新生,并为乳液配方创造了新的市场需求。研究表明,涂蜡的农产品包装有助于实现欧盟从农场到餐桌的目标,并将零售环节的食物浪费减少两位数百分比。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚太地区电子商务的蓬勃发展推动了对热熔胶级FT蜡的需求。

- 欧洲洁净标示化妆品加速向植物来源巴西棕榈蜡和蜂蜡转型

- 北美乙烷裂解装置扩建降低了聚乙烯蜡的生产成本

- 亚太地区个人护理产业的成长

- 食品级蜡:欧洲生鲜食品供应链中塑胶薄膜的替代涂层

- 市场限制

- REACH法规对欧洲玩具和化妆品用增强型石蜡中的多环芳烃含量限制

- 原油和天然气价格的波动会影响合成油和石蜡油的利润率。

- 纯素化妆品趋势:用油性乳化剂代替蜂蜡

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模及成长预测(销售)

- 按类型

- 石蜡和矿物蜡

- 合成蜡

- 天然蜡

- 透过使用

- 蜡烛製作

- 包裹

- 化妆品

- 胶水

- 橡皮

- 其他用途

- 按年级

- 食品级

- 工业级

- 化妆品和製药业

- 按形式

- 固体的

- 粉末

- 乳液和液体

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- BASF SE

- BP plc

- Calumet, Inc.,

- CALWAX

- China Petrochemical Corporation

- CLARIANT

- Evonik Industries AG

- Exxon Mobil Corporation

- H&R GROUP

- Honeywell International Inc.

- Ilumina Wax doo

- Koster Keunen

- Moeve

- NIPPON SEIRO CO., LTD.

- Petrobras

- Petro-Canada Lubricants Inc.

- Sasol Ltd.

- Shell plc

- Strahl & Pitsch LLC

- The International Group, Inc.

第七章 市场机会与未来展望

The Wax Market size is estimated at 4.68 Million tons in 2025, and is expected to reach 5.35 Million tons by 2030, at a CAGR of 2.70% during the forecast period (2025-2030).

The Wax market is moving from a petroleum-centric supply base toward a wider mix that includes natural and high-performance synthetic grades. Cleaner formulations, fast-moving e-commerce logistics, and cost-advantaged polyethylene wax from new ethane crackers are giving producers fresh avenues for growth even as mature candle, packaging, and rubber uses level off. Asia-Pacific's dominance rests on its integrated refining capacity, large consumer goods sector, and the world's fastest-growing online retail channel. Europe's regulations on polycyclic aromatic hydrocarbons (PAHs) and single-use plastics continue to funnel demand toward plant-based alternatives and food-grade coatings. In North America, shale-derived ethane keeps production economics favorable, allowing regional players to penetrate export markets with tailored grades that target coatings, composites, and hot-melt adhesives.

Global Wax Market Trends and Insights

Asia-Pacific E-commerce Boom Driving Hot-Melt Adhesive-Grade FT Waxes Demand

Explosive online retail growth across China, India, and Southeast Asia requires stronger carton sealing and label adhesion, which in turn raises demand for Fischer-Tropsch (FT) wax-modified hot-melt adhesives. These FT grades deliver higher melting points and cohesive strength, containing packages in humid monsoon zones and cold-chain routes alike. Packaging converters report up to 35% fewer shipment failures when formulations include FT wax additives. The Wax market therefore benefits from both higher volume of parcels and premium-priced performance blends. Suppliers that offer regionally warehoused inventories shorten lead times and secure repeat contracts from logistics networks seeking robust, moisture-resistant packaging solutions.

Clean-Label Cosmetics in Europe Accelerating Shift to Plant-Based Carnauba & Beeswax

European beauty brands have moved rapidly to transparent ingredient statements, pushing formulators to swap synthetic and paraffin waxes for carnauba, candelilla, and beeswax. These bio-based options supply natural gloss, film-forming, and emollient properties required in lip care, balms, and skin sticks. A 2025 study shows properly structured vegan lipsticks based on carnauba wax can match hardness, pay-off, and melting stability achieved with beeswax. As retailers widen eco-certified shelf space, Wax market participants that secure traceable supply chains in Brazil and Southeast Asia hold a pricing premium, while contract manufacturers in Europe seek shorter lead times for boutique batches.

REACH PAH Limits Tightening on Paraffin Wax in Europe Toys & Cosmetics

Europe's updated PAH thresholds under REACH now apply to paraffin wax used in toys and leave-on skin products, compelling refiners to invest in deep-hydrotreatment or source alternative feedstock. Compliance certificates drive up cost and complexity, while non-compliant imports face customs seizures and retailer delistings. Multinational brand owners pre-qualify only wax grades with transparent upstream provenance, encouraging buyers to shift toward synthetic Fischer-Tropsch or plant-based substitutes. The Wax market therefore confronts margin compression in conventional paraffin segments until refiners fully execute technology upgrades.

Other drivers and restraints analyzed in the detailed report include:

- North American Ethane Cracker Expansions Lowering PE Wax Production Costs

- Growing Personal Care Industry in the Asia-Pacific Region

- Vegan Cosmetics Trend Substituting Beeswax with Oleochemical Emulsifiers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paraffin and mineral waxes retained a 58% Wax market share in 2024, buoyed by their broad availability and cost competitiveness across candles, board sizing, and rubber compounding. Yet the natural wax segment, anchored by carnauba, candelilla, and beeswax, is set to grow at a 3.43% CAGR, highlighting a decisive consumer tilt toward renewable ingredients. Heightened demand for traceable supply, low-PAH content, and vegan compliance positions certified plantations in Brazil and Mexico as strategic assets. Synthetic waxes, principally Fischer-Tropsch and polyethylene variants, occupy an innovation sweet spot, offering custom melting profiles and hardness levels that address high-temperature or moisture-sensitive applications.

Premium clean-label cosmetics, edible produce coatings, and specialty packaging coatings drive the strongest natural wax pull-through. Conversely, cost-sensitive sectors such as corrugated box sizing still prefer paraffin blends. Over the forecast window, capacity expansions in gas-to-liquids (GTL) facilities are expected to temper price volatility for synthetic grades, while new solvent-free extraction technologies aim to raise yields in plant-based operations. Strategic offtake agreements between growers and European beauty houses lock in supply assurance, embedding natural alternatives more firmly into the Wax market.

Candles commanded 60% of the Wax market size in 2024 by virtue of their fundamental dependence on solid wax as both fuel matrix and fragrance carrier. This long-standing dominance persists in mature economies that value ambience products and in emerging markets experiencing rising home decor spending. Nonetheless, cosmetics exhibits the highest 3.65% CAGR as formulators exploit waxes for structure, payoff, and skin feel in lip, hair, and body products. Direct-to-consumer brands accelerate small-batch launches, selecting high-purity or bio-origin wax grades that align with clean beauty positioning.

Hot-melt adhesives for e-commerce packaging, barrier coatings for cartons, and extrusion lubricants for PVC profiles represent rising application niches. Edible coatings demonstrate sustainability synergy by replacing petrochemical wraps on fruit and cheese, underscoring wax versatility. Research placing Wax market formulations at the intersection of functionality and circularity encourages brand owners to co-develop application-specific blends, bringing pilot runs to scale in record timelines.

The Wax Market Report Segments the Industry by Type (Paraffin and Mineral Wax, Synthetic Wax, and More), Application (Candle Making, Packaging, Cosmetics, and More), Grade (Food Grade, Industrial Grade, and More), Form (Solid, Powdered, Emulsions and Liquids) and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific secured 45% of the Wax market share in 2024 and is forecast to record the fastest 3.2% CAGR through 2030. China anchors demand with its vast candle, packaging, and personal care clusters, while India's surging middle class elevates consumption across cosmetics and home fragrance. ASEAN logistics hubs propel hot-melt adhesive usage, linking Wax market growth directly to parcel volumes. Government incentives for downstream petrochemicals in Indonesia and Malaysia continue to attract investment in synthetic wax units, delivering localized supply and shortening ship-to-shelf cycles.

North America maintains a balanced Wax market, coupling mature candle and board applications with innovative strides in specialized polyethylene waxes. Low-cost shale ethane feeds new cracker capacity, positioning U.S. and Canadian producers for export gains, especially to Latin America and Europe. Automotive lightweighting, powder coatings, and 3D-printing filament additives open next-generation uses for finely fractionated synthetic wax streams. Cross-border logistics within the United States-Mexico-Canada Agreement (USMCA) ensure duty-free flow of upstream intermediates and finished wax blends.

Europe's Wax market operates under the strictest regulatory environment, steering consumption toward low-PAH paraffin, fully synthetic Fischer-Tropsch, and certified natural grades. Germany and the Netherlands host refinement hubs that feed high-end cosmetics, while Italy's fruit-export sector scales trials of edible carnauba coatings to meet retailer shelf-life mandates. Single-use plastic bans energize paper-based packaging coated with bio-wax barriers, opening demand pockets for emulsified formulations. Research indicates that wax-coated produce packs cut retail food waste by double-digit percentages, supporting EU Farm-to-Fork objectives.

- BASF SE

- BP p.l.c.

- Calumet, Inc.,

- CALWAX

- China Petrochemical Corporation

- CLARIANT

- Evonik Industries AG

- Exxon Mobil Corporation

- H&R GROUP

- Honeywell International Inc.

- Ilumina Wax d.o.o.

- Koster Keunen

- Moeve

- NIPPON SEIRO CO., LTD.

- Petrobras

- Petro-Canada Lubricants Inc.

- Sasol Ltd.

- Shell plc

- Strahl & Pitsch LLC

- The International Group, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Asia-Pacific E-commerce Boom Driving Hot-Melt Adhesive-Grade FT Waxes Demand

- 4.2.2 Clean-Label Cosmetics in Europe Accelerating Shift to Plant-Based Carnauba and Beeswax

- 4.2.3 North American Ethane Cracker Expansions Lowering PE Wax Production Costs

- 4.2.4 Growing Personal Care Industry in the Asia-Pacific Region

- 4.2.5 Food-Grade Wax Coatings Replacing Plastic Films in Europe Fresh Produce Supply Chain

- 4.3 Market Restraints

- 4.3.1 REACH PAH Limits Tightening on Paraffin Wax in Europe Toys and Cosmetics

- 4.3.2 Crude and Gas Price Volatility Impacting Synthetic and Paraffin Wax Margins in APAC

- 4.3.3 Vegan Cosmetics Trend Substituting Beeswax with Oleochemical Emulsifiers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Paraffin and Mineral Wax

- 5.1.2 Synthetic Wax

- 5.1.3 Natural Wax

- 5.2 By Application

- 5.2.1 Candle Making

- 5.2.2 Packaging

- 5.2.3 Cosmetics

- 5.2.4 Adhesives

- 5.2.5 Rubber

- 5.2.6 Other Applications

- 5.3 By Grade

- 5.3.1 Food Grade

- 5.3.2 Industrial Grade

- 5.3.3 Cosmetic and Pharmaceutical garde

- 5.4 By Form

- 5.4.1 Solid

- 5.4.2 Powdered

- 5.4.3 Emulsions and Liquids

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 BP p.l.c.

- 6.4.3 Calumet, Inc.,

- 6.4.4 CALWAX

- 6.4.5 China Petrochemical Corporation

- 6.4.6 CLARIANT

- 6.4.7 Evonik Industries AG

- 6.4.8 Exxon Mobil Corporation

- 6.4.9 H&R GROUP

- 6.4.10 Honeywell International Inc.

- 6.4.11 Ilumina Wax d.o.o.

- 6.4.12 Koster Keunen

- 6.4.13 Moeve

- 6.4.14 NIPPON SEIRO CO., LTD.

- 6.4.15 Petrobras

- 6.4.16 Petro-Canada Lubricants Inc.

- 6.4.17 Sasol Ltd.

- 6.4.18 Shell plc

- 6.4.19 Strahl & Pitsch LLC

- 6.4.20 The International Group, Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Increasing Use of Mineral Wax in Rubber Production