|

市场调查报告书

商品编码

1849872

云端加密软体:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Cloud Encryption Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

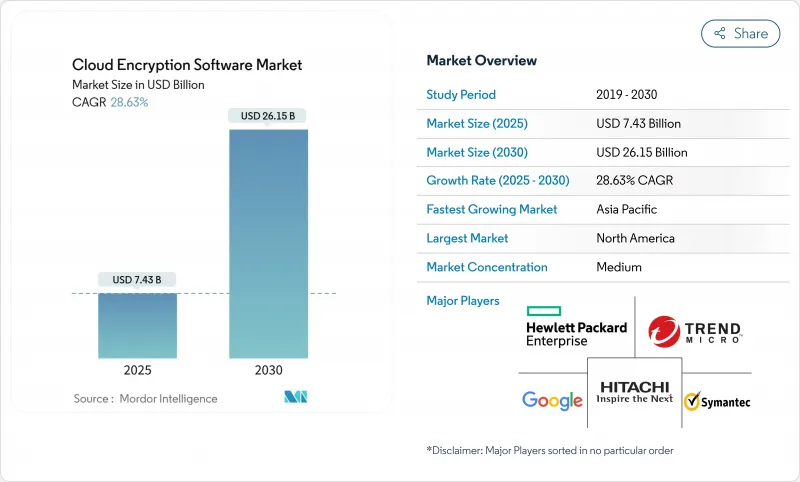

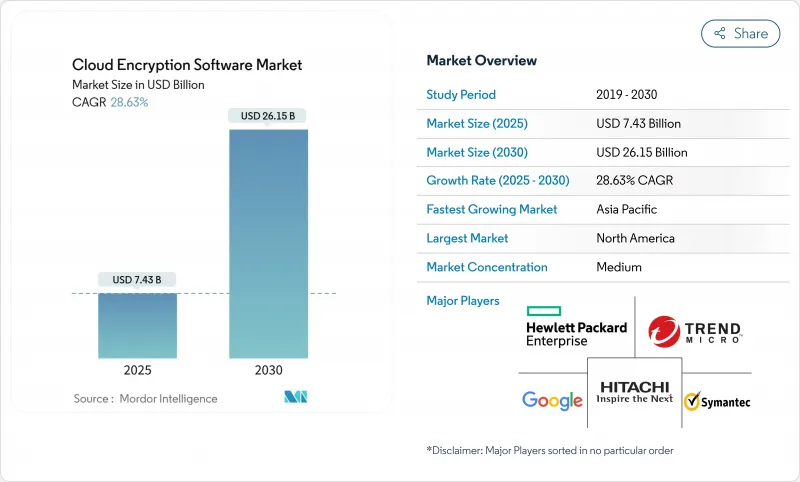

预计到 2025 年云端加密软体市场规模将达到 74.3 亿美元,到 2030 年将达到 261.5 亿美元,复合年增长率为 28.6%。

这种快速成长是由三股强大力量共同推动的:持续不断的网路攻击、日益增长的监管压力以及向多重云端运算的转变。美国国家标准与技术研究院 (NIST) 于 2024 年 8 月最终确定了后量子密码学标准,这加速了企业迁移蓝图的製定,因为董事会认识到「先收穫后解密」的风险已经出现。同时,98% 的金融服务公司在公有云中运作工作负载,迫切需要跨异质平台的统一金钥管理。在 FedRAMP 和美国国防部对量子安全演算法的授权的推动下,北美地区在采用方面处于领先地位,而亚太地区则由于主权云政策而经历了最快的复合年增长率。效能优化的对称工具、突破性的全同态加密以及用于密封使用中资料的硬体辅助机密运算技术也塑造了密码学生态系统。

全球云端加密软体市场趋势与洞察

加强资料保护条例

全球法规正在提高安全基准值。 PCI DSS 4.0(2025 年 3 月生效)要求所有拥有者环境每年进行加密审查和多因素身份验证。欧洲的数位营运弹性法案和 NIS 2 指令要求在 2030 年之前对银行和关键基础设施进行量子安全加密。在美国,量子计算网路安全准备法案要求联邦机构过渡到 NIST核准的后量子演算法,为私营部门提供遵循的模板。 FedRAMP 已经要求所有联邦云端服务都采用 FIPS 140-2检验的模组,使合规性成为事实上的市场准入门票。由于 2002 年的 FERPA 框架没有预料到学生资料储存在云端中,因此大学也在加强控制并要求超过法定最低标准的加密措施。

针对云端的复杂网路攻击激增

2024年,云端工作负载将吸收31%的已记录网路事件,金融服务领域的勒索软体成本平均为537万美元。高级持续性威胁行为者押注未来的量子密码技术来获取加密资料集,这推动了即时加密监控以及混合经典和后量子金钥交换的普及。 44%的公共云端云漏洞是由于配置错误造成的,这使得能够加密所有物件且不受管理员技能限制的自动化策略引擎成为必要。攻击者越来越多地将目标锁定在控制平面身份而非端点上,这推动了对以资料为中心的保护的需求,即使在边界控制失效的情况下,这种保护仍然有效。

效能开销和延迟

加密资料会增加计算週期和 I/O 延迟。传统的静态加密会使大型资料库的 SQL查询降低数百毫秒。全同态加密虽然在隐私方面具有突破性进展,但如果不使用硬体加速,则会使处理时间增加 1,000 倍。最近发表在《电脑、材料与连续体》杂誌上的一项基准研究发现,GPU 辅助框架可将此开销降低约 12%。在边缘运算场景中,加密延迟会加剧现有的网路延迟,架构师必须在即时回应和机密性之间取得平衡,而这种损失最为明显。此外,后量子演算法由于金钥较大,计算量庞大,对低功耗设备的效能预算提出了挑战。

細項分析

对称加密方法因其速度快、CPU 开销低等优势,将在 2024 年占据云端加密软体市场的 35.6% 份额。儘管全同态加密尚处于起步阶段,但它是成长最快的技术,预计随着机密运算用例的扩展,其复合年增长率将达到 29.0%。 FIPS 203、FIPS 204 和 FIPS 205 将于 2024 年 8 月发布,它们为后量子金钥封装、数位签章和基于无状态杂凑的签章设定了基准,鼓励供应商将这些演算法纳入其产品蓝图。

企业正在采用混合加密技术(将经典椭圆曲线与后量子格技术结合)来规避演算法故障。格式保留加密技术也正在蓬勃发展,因为它允许旧版应用程式无需重新设计架构即可储存受保护的资料。随着 NIST 于 2025 年 3 月将 HQC 选为第五种演算法,并要求提高演算法的多样性,敏捷加密工具正成为董事会层面的优先事项。因此,对称工作负载的云端加密软体市场规模预计将稳定成长,其中量子安全方案将占新部署的很大一部分。

静态资料仍将主导应用堆迭,到2024年将占据云端加密软体市场36.8%的份额。然而,随着可信任执行环境(TEE)消除了长期以来明文处理的障碍,使用中资料加密正以29.7%的复合年增长率飙升。因此,用于敏感工作负载处理的云端加密软体市场的成长速度将超过任何其他细分市场。

传输层保护对于云间链路仍然至关重要,但性能调优正在转向后量子握手演算法。 SaaS 协作工具正在广泛部署用户端加密,并由组织机构控制加密金钥。搜寻的对称加密已在巨量资料环境中出现,在这种环境中,高价值查询的延迟开销是可以容忍的。这些转变正在推动对整个资料生命週期进行无状态、持久保护的愿景。

区域分析

在 FedRAMP 授权、国防部指令以及企业积极向后量子控制迁移的支持下,北美将在 2024 年占据云端加密软体市场的 38.9%。多重云端采用率很高,供应商正在透过託管金钥服务和加密敏捷编配来确保收益。大型医疗保健和金融客户也在大规模测试机密运算框架,加速创新週期。

亚太地区是成长最快的地区,到2030年的复合年增长率将达到29.5%。澳洲、日本、韩国和印度的主权云端蓝图要求加密金钥必须保留在国内,这刺激了外部金钥管理闸道和硬体安全模组的销售,这些模组可在需要时支援国家演算法。亚洲开发银行预测,改善的云端政策预计在2024年至2028年间使该地区的GDP成长高达0.7%,并将加密视为关键的推动因素。中国和东南亚的超大规模企业正在与国内晶片製造商合作,提供量子安全网路加密,以跟上西方竞争对手的步伐。

在《一般资料保护规范》(GDPR)和《数位营运韧性法案》的推动下,欧洲持续稳定扩张。金融机构现在必须提交韧性计划,证明其已向抗量子演算法转型,这使得欧洲成为跨境金钥託管互通性的试验场。隐私保护分析领域对全同态加密的需求日益增长,尤其是在医疗保健和行动领域。南美、中东和非洲等规模较小的市场提供了待开发区机会,尤其是在5G部署引进需要轻量级、低延迟加密的边缘云端架构之际。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 加强资料保护条例

- 针对云端的复杂网路攻击激增

- 企业多重云端部署

- 对机密计算的需求

- 量子密码学的迫切性

- “加密即代码” DevSecOps 工具

- 市场限制

- 效能开销和延迟

- 密钥管理的复杂性

- 可信任执行缺乏互通性

- 边缘云端资料主权抑制需求

- 价值链分析

- 监管格局

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 定价分析

- 投资分析

- 评估宏观经济趋势对市场的影响

第五章市场规模及成长预测

- 按加密类型

- 对称

- 非对称/PKI

- 格式储存

- 完全同态

- 抗量子演算法

- 按用途

- 储存的资料(储存、备份)

- 传输中的资料(TLS/VPN)

- 使用中的数据/机密计算

- SaaS 檔案和协作加密

- 资料库/巨量资料加密

- 按组织规模

- 大公司

- 小型企业

- 按行业

- BFSI

- 医疗保健和生命科学

- 教育

- 零售与电子商务

- 资讯科技和通讯

- 政府和国防

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Trend Micro

- CipherCloud/Lookout CASB

- Broadcom(Symantec)

- Hewlett Packard Enterprise

- Google LLC

- Sophos

- Micro Focus(Voltage)

- CyberArk

- Thales(SafeNet)

- Hitachi Vantara

- Boxcryptor

- Microsoft Corporation

- Amazon Web Services

- IBM Corporation

- Check Point Software

- Palo Alto Networks

- Netskope

- Fortanix

- Zscaler

- Akeyless Security

第七章 市场机会与未来展望

The cloud encryption software market size stands at USD 7.43 billion in 2025 and is on course to reach USD 26.15 billion by 2030, registering a 28.6% CAGR.

The surge blends three powerful forces: unrelenting cyber-attacks, mounting regulatory pressure, and the operational shift toward multi-cloud computing. Post-quantum cryptography standards finalized by the National Institute of Standards and Technology (NIST) in August 2024 accelerated enterprise migration road maps as boards realized that harvest-now-decrypt-later risks have already materialized. At the same time, 98% of financial-services firms now operate workloads in public cloud, creating an urgent need for unified key management across heterogeneous platforms. North America leads adoption, propelled by FedRAMP and Department of Defense mandates for quantum-safe algorithms, while sovereign-cloud policies push Asia-Pacific to the fastest regional CAGR. The encryption ecosystem is also shaped by performance-optimized symmetric tools, breakthrough fully homomorphic encryption, and hardware-assisted confidential-computing technologies that seal data during use.

Global Cloud Encryption Software Market Trends and Insights

Tightening Data-Protection Regulations

Worldwide statutes are raising the security baseline. PCI DSS 4.0, effective March 2025, forces annual cryptographic reviews and multi-factor authentication across all card-holder environments. Europe's Digital Operational Resilience Act and NIS 2 directive require quantum-resistant encryption by 2030 for banking and critical infrastructure. In the United States, the Quantum Computing Cybersecurity Preparedness Act compels federal agencies to pivot to NIST-approved post-quantum algorithms, setting a template the private sector is following. FedRAMP has already mandated FIPS 140-2 validated modules for all federal cloud services, turning compliance into a de facto market entry ticket. Even universities are hardening controls because the 2002 FERPA framework never anticipated cloud-stored student data, prompting encryption measures that exceed legal minima.

Surge in Sophisticated Cyber-Attacks on Cloud

Cloud workloads absorbed 31% of recorded cyber incidents in 2024, with ransomware costs in financial services averaging USD 5.37 million. Advanced persistent-threat actors now harvest encrypted troves, betting on future quantum decryption. Real-time encryption monitoring and hybrid classical-plus-post-quantum key exchange are therefore gaining traction. Misconfigurations cause 44% of public-cloud breaches, so automated policy engines that wrap encryption around every object-independent of administrator skill-are becoming mandatory. Attackers increasingly target control-plane identities rather than endpoints, reinforcing the need for data-centric protection that stays effective even when perimeter controls fail.

Performance Overhead and Latency

Encrypting data adds compute cycles and I/O waits. Classical encryption-at-rest slows SQL queries by several hundred milliseconds in high-volume databases. Fully homomorphic encryption, while revolutionary for privacy, can inflate processing time by 1 000X unless hardware acceleration is employed. GPU-assisted frameworks cut that overhead by roughly 12% according to recent benchmark studies published in Computers, Materials and Continua. Edge-computing scenarios feel the penalty most because encryption delay compounds existing network latency, forcing architects to weigh real-time responsiveness against confidentiality. Post-quantum algorithms also raise computational tax because of larger key sizes, challenging performance budgeting in low-power devices.

Other drivers and restraints analyzed in the detailed report include:

- Enterprise Multi-Cloud Adoption

- Confidential-Computing Demand

- Key-Management Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Symmetric methods dominate the cloud encryption software market with 35.6% share in 2024, favored for their speed and low CPU overhead. Fully homomorphic encryption, despite its infancy, is the fastest-rising technique, forecast to grow at 29.0% CAGR as confidential-computing use cases blossom. The August 2024 release of FIPS 203, FIPS 204, and FIPS 205 set the baseline for post-quantum key encapsulation, digital signatures, and stateless hash-based signatures, prompting vendors to embed these algorithms into product road maps.

Enterprises are deploying hybrid cryptography that blends classical elliptic-curve methods with post-quantum lattices, hedging against algorithmic failure. Format-preserving encryption is also expanding because it lets legacy applications store protected data without schema redesign. With NIST's March 2025 selection of HQC as a fifth algorithm for additional diversity, crypto-agile tooling has become a board-level priority. As a result, the cloud encryption software market size for symmetric workloads is projected to climb steadily, while quantum-safe options capture a larger slice of new deployments.

Data-at-rest still tops the application stack with 36.8% share of the cloud encryption software market in 2024, reflecting mature backup and storage practices. Yet it is data-in-use encryption that makes headlines, surging at a 29.7% CAGR as TEEs remove the longstanding barrier of processing on plaintext. The cloud encryption software market size for confidential-computing workloads will therefore expand faster than any other segment.

Transport-layer protection remains indispensable for inter-cloud links, but performance tuning has shifted toward post-quantum handshake algorithms. SaaS collaboration tools are seeing wider client-side encryption rollouts so organizations retain control over cryptographic keys. Searchable symmetric encryption now appears in big-data environments, where latency overhead can be tolerated for high-value queries. Together these shifts advance the vision of persistent, state-agnostic protection across the entire data life cycle.

The Cloud Encryption Software Market Report is Segmented by Encryption Type (Symmetric, Asymmetric / PKI, and More), Application (Data-At-Rest, Data-In-Transit, and More), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), Industry Vertical (BFSI, Healthcare and Life Sciences, Education, Retail and E-Commerce, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 38.9% of the cloud encryption software market in 2024, underpinned by FedRAMP mandates, Department of Defense directives and aggressive enterprise migration to post-quantum controls. Multi-cloud penetration is high, and vendors secure revenue through managed key services and crypto-agile orchestration. Large healthcare and finance clients also test confidential-computing frameworks at scale, accelerating innovation cycles.

Asia-Pacific is the fastest-growing region with a 29.5% CAGR through 2030. Sovereign-cloud blueprints in Australia, Japan, South Korea and India demand that encryption keys remain on domestic soil, spurring sales of external key-management gateways and hardware security modules that support national algorithms where required. The Asian Development Bank estimates improved cloud policy could lift regional GDP by up to 0.7% during 2024-2028, and encryption is cited as a pivotal enabler. Chinese and Southeast Asian hyperscalers are forming in-country alliances with chipmakers to deliver quantum-safe network encryption, keeping pace with Western rivals.

Europe maintains steady expansion driven by GDPR enforcement and the Digital Operational Resilience Act. Financial institutions must file resilience plans outlining migration to quantum-resistant algorithms, a move that is turning Europe into a laboratory for cross-border key-escrow interoperability. Privacy-preserving analytics-especially in health and mobility-stimulate demand for fully homomorphic encryption. Smaller markets in South America and the Middle East and Africa trail but present greenfield opportunities, particularly where 5G rollouts introduce edge-cloud architectures that require lightweight, low-latency encryption.

- Trend Micro

- CipherCloud / Lookout CASB

- Broadcom (Symantec)

- Hewlett Packard Enterprise

- Google LLC

- Sophos

- Micro Focus (Voltage)

- CyberArk

- Thales (SafeNet)

- Hitachi Vantara

- Boxcryptor

- Microsoft Corporation

- Amazon Web Services

- IBM Corporation

- Check Point Software

- Palo Alto Networks

- Netskope

- Fortanix

- Zscaler

- Akeyless Security

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tightening data-protection regulations

- 4.2.2 Surge in sophisticated cyber-attacks on cloud

- 4.2.3 Enterprise multi-cloud adoption

- 4.2.4 Confidential-computing demand

- 4.2.5 Post-quantum encryption urgency

- 4.2.6 "Encryption-as-code" DevSecOps tools

- 4.3 Market Restraints

- 4.3.1 Performance overhead and latency

- 4.3.2 Key-management complexity

- 4.3.3 Lack of interoperability in trusted-execution

- 4.3.4 Edge-cloud data-sovereignty dampening demand

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing Analysis

- 4.9 Investment Analysis

- 4.10 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Encryption Type

- 5.1.1 Symmetric

- 5.1.2 Asymmetric / PKI

- 5.1.3 Format-Preserving

- 5.1.4 Fully Homomorphic

- 5.1.5 Quantum-resistant Algorithms

- 5.2 By Application

- 5.2.1 Data-at-Rest (storage, backup)

- 5.2.2 Data-in-Transit (TLS/VPN)

- 5.2.3 Data-in-Use / Confidential Computing

- 5.2.4 SaaS File and Collaboration Encryption

- 5.2.5 Database / Big-data Encryption

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Industry Vertical

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Education

- 5.4.4 Retail and e-Commerce

- 5.4.5 IT and Telecom

- 5.4.6 Government and Defense

- 5.4.7 Other Industry Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Trend Micro

- 6.4.2 CipherCloud / Lookout CASB

- 6.4.3 Broadcom (Symantec)

- 6.4.4 Hewlett Packard Enterprise

- 6.4.5 Google LLC

- 6.4.6 Sophos

- 6.4.7 Micro Focus (Voltage)

- 6.4.8 CyberArk

- 6.4.9 Thales (SafeNet)

- 6.4.10 Hitachi Vantara

- 6.4.11 Boxcryptor

- 6.4.12 Microsoft Corporation

- 6.4.13 Amazon Web Services

- 6.4.14 IBM Corporation

- 6.4.15 Check Point Software

- 6.4.16 Palo Alto Networks

- 6.4.17 Netskope

- 6.4.18 Fortanix

- 6.4.19 Zscaler

- 6.4.20 Akeyless Security

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment