|

市场调查报告书

商品编码

1849901

量子点(QD):市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Quantum Dots (QD) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

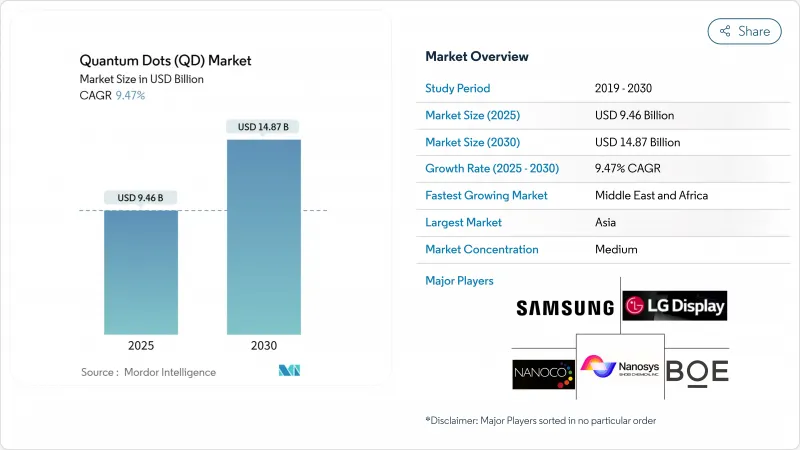

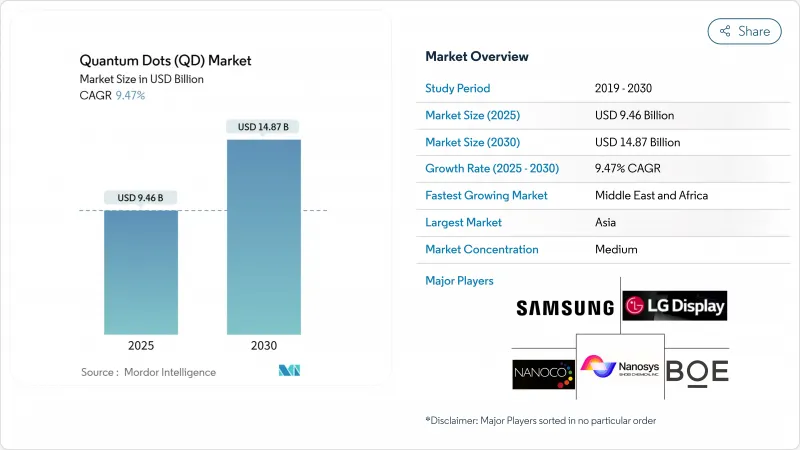

全球量子点(QD)市场预计到 2025 年将达到 94.6 亿美元,到 2030 年将达到 148.7 亿美元。

量子点(QDs)的商业性进程正在加速,从实验室研发走向大规模生产,应用于超高清显示器、量子安全通讯节点、下一代生物成像平台等领域。量子点电视在中国的快速普及、符合欧盟RoHS指令的无镉化学技术的出现,以及亚洲和中东地区政府的持续投入,都支撑着量子点技术的长期需求。亚太地区的规模优势,加上钙钛矿技术的突破性进展(提高了效率和色彩纯度),使得量子点产品的单位成本下降速度超过传统OLED,从而为主流消费价格分布开闢了新的道路。同时,基于半导体量子点的量子运算架构以及癌症诊断灵敏度五倍的提升,也为量子点技术的应用拓展了更多可能性,使其应用范围远远超出显示器领域。

全球量子点(QD)市场趋势与洞察

中国在超高清电视面板中率先采用量子点(QD)技术

国内面板厂商正在推出高产量能量子点(QD)薄膜生产线,可实现超过100%的NTSC色域覆盖范围。 TCL的QM6K系列面板凭藉其超高能量LED背光,实现了超过98%的DCI-P3色域覆盖范围和53%的高亮度。京东方投资90亿美元的第八代半AMOLED工厂预计将于2026年运作,将进一步巩固其成本领先地位,并确保对区域品牌的供应。从RGB OLED架构到QD-OLED架构的过渡将简化生产流程,提高产量比率,并降低4K和8K萤幕的平方公尺资本支出。

欧盟推动对家用电子电器中不含镉的量子点进行监管

欧盟RoHS指令规定的镉含量上限为0.01 wt%,推动了铜铟和磷酸铟氧化物配方的早期应用。 UbiQD公司2000万美元的B轮融资将用于扩大无镉产品的生产规模,而应用材料公司已展示了性能与镉在颜色转换层中相当的无铅装置。各大学正在将水相合成路线商业化,这些路线无需使用有机溶剂,并能减少製程排放,为采用这些路线的公司带来成本和合规性优势。

高纯度磷化铟前驱体供应链瓶颈

预计6G基础设施对铟的需求将占年产量的4%,将导致磷化铟量子点(QDs)供应紧张,并推高价格。苏乔大学的油墨工程路线预计将太阳能发电成本降低至0.06美元/瓦,但这需要纯度稳定的铟,而这种纯度的铟除了少数几家精炼厂外,其他地方都非常稀缺。微波辅助合成和离子液体合成虽然减少了有害试剂的使用,但仍需要安全的金属原料,因此至少在2028年之前,供应风险仍然很高。

细分市场分析

镉基II-VI族化合物将占2024年收入的48.3%,凭藉其成熟的供应链和高量子产率,为量子点(QD)市场提供支撑。然而,随着欧盟和加州政策趋向于更轻元素的化学体系,监管方面可能会产生影响。钙钛矿材料以11.7%的复合年增长率成长,正从实验室新奇材料向可量产的发送器转型,其室温单光子纯度可与镉的亮度相媲美,并拓展了其在安全通讯的应用。磷化铟平台受益于UbiQD的规模化投资和应用材料公司的製程优化,但前驱体短缺阻碍了其在短期内的广泛应用。硅和碳量子点(QD)正在生物医学领域开闢一片新天地,在临床相关剂量下细胞毒性极低,可用于萤光导航手术。历史数据显示,2020 年至 2024 年间,镉替代品的年增长率将达到 15-20%,而现有镉材料的年增长率将低于 5%,这预示着量子点 (QD) 市场将发生结构性转变。

第二代材料正在拓展其终端应用领域。石墨烯量子点(QDs)与硅奈米壳融合后,成功将蚜虫数量减少了71%,使奈米材料的应用范围从显示器扩展到精密农业。钙钛矿发光层现在可以以140 PPI的解析度进行印刷,从而便于整合到中型显示器中。硅点可提供稳定的红外线致发光,这对于穿戴式生物感测器至关重要。预计无镉量子点(QD)市场规模将达到两位数成长,这将促使供应商转向使用毒性较低的化学品。企业日益增长的ESG目标以及RoHS豁免即将到期,进一步巩固了这条转型路径。

量子点薄膜仍将是重要的收入驱动因素,预计到2024年将占据72.1%的市场份额,这主要得益于电视OEM厂商寻求即插即用的色彩转换器,以便整合到现有的LCD堆迭中。然而,片上量子点(QD)的复合年增长率将达到12.7%,成为成长最快的技术,因为半导体代工厂可以将光子发送器直接整合到晶圆代工厂平台中。剑桥大学开发的13000自旋量子暂存器,实现了69%的保真度和130微秒的相干时间,凸显了晶片级量子节点的巨大潜力。微流体,其尺寸分散度已低于5%,这对于连贯光发射至关重要。在波纹晶圆上进行电泳沉淀,可以製备出无裂纹的近红外线检测器,从而为汽车雷射雷达和医疗内视镜等应用开闢了市场。随着线宽缩小达到平台期,整合光电提供了摩尔定律式的扩展,而量子点 (QD) 则提供了硅光电蓝图中缺少的单光子源。

扩展路径正在分化。喷墨列印的QD-OLED面板已实现31.5吋的对角线尺寸商业化生产,而电液动力喷射技术则正在为微型LED阵列生产微米级RGB像素。随着量子运算性能的提升,量子点(QD)市场规模将在晶片级应用中进一步扩大。对原子层沉淀和原子级精度微影术的投资将使量子点位置与电晶体闸极精准对齐,并降低量子汇流排互连延迟。装置OEM厂商正透过整合封装、温度控管和微影术对准等方面的智慧财产权来建构新的防御体系。

区域分析

亚太地区将持续维持领先地位,预计2024年将占全球销售额的38.4%,主要得益于垂直整合的面板製造商和各国计画中的研发投入。三星显示器向QD-OLED生产线转型(投资109亿美元)以及韩国的量子计划(投资4910亿韩元)将进一步强化亚太生态系统,而中国的京东方将投资90亿美元建设第八代半OLED产能,以支持本地供应链。日本正透过製造工艺创新来提升产能,并举办研讨会以解决毒性和耐久性方面的瓶颈问题。亚洲量子点(QD)市场规模的成长主要受国内高阶电视需求以及对北美和欧洲出口的驱动。

在北美,剑桥大学(剑桥-美国合作计画)、麻省理工学院林肯实验室和洛斯阿拉莫斯国家实验室的深厚研究实力正推动量子安全链路和高效太阳能的发展。创业投资的强劲动能也印证了这一点,UbiQD 完成资金筹措并收购 IonQ 便是明证。强而有力的智慧财产权保护和联邦政府的资助确保了商业化进程的顺利进行,而美国对镉化合物的出口管制则促使供应商转向磷化铟的生产。欧洲则充分利用监管影响力:列日大学的水相合成技术减少了有害废弃物的产生。政府的绿色新政基金也为节能建筑引进了量子点(QD)窗膜。

中东和非洲的复合年增长率最高,达10.6%。阿联酋的诺玛中心、卡达一项价值1000万美元的项目以及沙乌地阿拉伯的研发基金正在推动量子点(QD)计算丛集的发展,以实现经济多元化,摆脱对石油的依赖。进口替代政策鼓励在当地组装量子点增强型太阳能板和医疗设备。拉丁美洲对农业技术的需求正在萌芽,例如量子点温室薄膜可以提高高海拔农场的蔬果产量,但市场渗透率仍低于3%。整体而言,地理收入多元化可以降低集中风险:到2030年,随着中东和非洲吸引投资,以及西方地区在关键材料加工领域实现本土化,亚洲的市场份额将下降至35%。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 中国在超高清电视面板中主导采用量子点(QD)技术

- 欧盟推动消费性电子产品中无镉量子点(QD)监管。

- 钙钛矿量子点(QDs)在显示器背光领域的快速商业化

- 医疗保健领域基于量子点(QD)的生物成像剂的激增

- 韩国政府资助的量子材料研发项目

- 市场限制

- 高纯度磷化铟前驱体供应链瓶颈

- 钙钛矿量子点在潮湿环境下的表现劣化

- 欧洲镉监管的环境合规成本

- 量子点微型LED整合的大规模生产基础设施有限

- 产业生态系分析

- 技术展望(生产技术)

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 投资分析

第五章 市场规模与成长预测

- 依材料类型

- 镉 II-VI 族(CdSe、CdS、CdTe)

- 无镉 III-V 族(InP、GaAs)

- 钙钛矿量子点(QDs)

- 硅量子点(QDs)

- 石墨烯和碳量子点(QDs)

- 按设备外形尺寸

- 量子点薄膜

- 片上量子点(QDs)

- 核心-外壳架构与壳内架构

- 透过使用

- 展示

- QD-LCD

- QD-OLED

- 微型LED集成

- 照明

- 一般照明

- 特殊照明

- 太阳能电池和光伏电池

- 医学影像诊断

- 药物递送及治疗诊断学

- 感测器和仪器

- 量子计算与安全

- 农业和食品

- 其他的

- 展示

- 按最终用途行业划分

- 消费性电子产品

- 医疗保健和生命科学

- 能源与电力

- 国防与安全

- 农业

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 其他南美洲

- 亚太地区

- 中国

- 日本

- 印度

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- GCC

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Samsung Electronics Co., Ltd.

- Nanosys Inc.

- LG Display Co., Ltd.

- BOE Technology Group Co., Ltd.

- Nanoco Group PLC

- Quantum Materials Corporation

- UbiQD, Inc.

- Ocean NanoTech LLC

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Avantama AG

- Quantum Solutions Inc.

- QD Laser, Inc.

- OSRAM Licht AG

- Sony Corporation

- TCL CSOT

- Crystalplex Corporation

- Evident Technologies

- NN-Labs(NNCrystal US Corp.)

- Nanophotonica Inc.

- Quantum Science Ltd.

- Toray Industries, Inc.

第七章 市场机会与未来展望

The global quantum dots market stood at USD 9.46 billion in 2025 and is forecast to reach USD 14.87 billion by 2030, reflecting a 9.47% CAGR over the period.

Commercial maturity is accelerating as the technology migrates from laboratory discovery to mass-produced components in ultra-high-definition displays, quantum-secure communication nodes, and next-generation bio-imaging platforms. China's rapid uptake of quantum-dot televisions, the emergence of cadmium-free chemistries that comply with EU RoHS limits, and sustained government funding in Asia and the Middle East are sustaining long-term demand. Manufacturing scale advantages in Asia-Pacific, combined with perovskite breakthroughs that lift efficiency and color purity, are lowering unit costs faster than legacy OLED alternatives, opening mainstream consumer price points. In parallel, quantum computing architectures based on semiconductor quantum dots, and five-fold sensitivity gains in cancer diagnostics, are expanding total addressable opportunities well beyond displays.

Global Quantum Dots (QD) Market Trends and Insights

Quantum-dot adoption in ultra-high-definition television panels, led by China

Domestic panel makers have installed high-capacity quantum-dot film lines that deliver more than 100% NTSC color gamut, while TCL's QM6K series achieves 98%+ DCI-P3 coverage and 53% higher brightness through Super High Energy LED back-lights. BOE's USD 9 billion Gen-8.6 AMOLED facility, coming online in 2026, reinforces cost leadership and secures supply for regional brands. The shift from RGB OLED to QD-OLED architectures simplifies manufacturing, enhancing yield and lowering capex per square meter for 4K and 8K screens.

Regulatory push for cadmium-free quantum dots in EU consumer electronics

The EU's 0.01 wt% cadmium cap under RoHS is driving early movers toward copper-indium and indium-phosphide formulations. UbiQD's USD 20 million Series B round will scale cadmium-free production, while Applied Materials has proven lead-free devices matching cadmium performance in color conversion layers. Universities are commercializing aqueous synthesis routes that remove organic solvents and cut process emissions, creating cost and compliance advantages for adopters.

Supply-chain bottlenecks for high-purity indium-phosphide precursors

Indium demand from 6G infrastructure is projected to consume 4% of annual production, squeezing availability for indium-phosphide quantum dots and pushing prices higher. Soochow University's ink-engineering route lowers photovoltaic costs to USD 0.06/Wp but relies on consistent indium purity, which remains scarce outside a handful of refiners. Microwave-assisted and ionic-liquid syntheses reduce hazardous reagents yet still require secure metal feedstocks, keeping supply risk elevated through at least 2028.

Other drivers and restraints analyzed in the detailed report include:

- Rapid commercialization of perovskite quantum dots in display back-lighting

- Surge in quantum-dot bio-imaging agents in healthcare applications

- Performance degradation of perovskite quantum dots under moisture exposure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cadmium-based II-VI compounds held 48.3% of 2024 revenues, anchoring the quantum dots market through well-established supply chains and high quantum yields. Regulatory exposure, however, compresses their outlook as EU and California policies converge on lighter-element chemistries. Perovskite variants, supported by 11.7% CAGR, move from lab novelty to production-ready emitters that match cadmium brightness and achieve room-temperature single-photon purity, broadening relevance for secure communications. Indium-phosphide platforms benefit from UbiQD's scale-up funding and Applied Materials' process optimization, yet precursor shortages temper near-term penetration. Silicon and carbon quantum dots are carving biomedical niches, showing negligible cytotoxicity at clinically relevant doses and enabling fluorescence-guided surgery. Historic data reveal cadmium alternatives growing 15-20% annually versus sub-5% for cadmium incumbents from 2020-2024, signaling a structural pivot in the quantum dots market.

Second-generation materials diversify end-use reach. Graphene quantum dots fused with silicon nanoshells achieve 71% aphid-population suppression, positioning nanomaterials for precision agriculture beyond displays. Perovskite glow layers are now printable at 140 PPI, easing integration into mid-sized monitors, while silicon dots deliver stable infrared photoluminescence critical for wearable biosensors. The quantum dots market size for cadmium-free segments is projected to rise at double-digit rates, reinforcing supplier pivots toward low-toxicity chemistries. Heightened corporate ESG targets, plus upcoming RoHS exemptions sunsets, cement the transition path.

QD films remain revenue mainstays with 72.1% share in 2024, favored by television OEMs seeking plug-and-play color converters that slip into existing LCD stacks. Yet on-chip quantum dots display the highest 12.7% CAGR as semiconductor fabs capture photonic emitters directly on foundry platforms. University of Cambridge's 13,000-spin quantum register, achieving 69% fidelity at 130 µs coherence, underscores leapfrog potential for chip-scale quantum nodes. Core-shell nanopillars grown through microfluidic reactors now exhibit sub-5% size dispersion, crucial for coherent emission. Electrophoretic deposition on corrugated wafers yields crack-free near-infrared detectors, opening automotive LiDAR and medical endoscope markets. As line width reductions plateau, integrated photonics offers Moore-than-More scaling, with quantum dots supplying the single-photon sources missing from silicon photonics roadmaps.

Scaling pathways diverge. Inkjet printed QD-OLED panels already hit 31.5-inch diagonals at commercial yield, while electrohydrodynamic jetting produces micron-scale RGB pixels for microLED arrays. The quantum dots market size captured by on-chip formats is set to widen as performance gains in quantum computing justify higher ASPs. Investments in atomic-layer deposition and atomic-precision lithography will further align dot placement with transistor gateways, shrinking interconnect delays in quantum buses. Device OEMs are bundling intellectual property around packaging, thermal management, and lithographic alignment, creating new defensible moats.

The Quantum Dots (QD) Market is Segmented by Material Type (Cadmium-Based II-VI (CdSe, Cds, Cdte), Cadmium-Free III-V (InP, Gaas), and More), Device Form Factor (QD Films, On-Chip Quantum Dots, and More), Application (Displays, Lighting, Solar Cells and Photovoltaics, and More), End-Use Industry (Consumer Electronics, Healthcare and Life Sciences, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific maintains leadership with 38.4% of 2024 revenue due to vertically integrated panel makers and deliberate national R&D funding. Samsung Display's USD 10.9 billion conversion to QD-OLED lines and South Korea's KRW 491 billion quantum program cement the ecosystem, while China's BOE invests USD 9 billion in Gen-8.6 capacity that anchors local supply chains. Japan complements manufacturing heft with process innovation, hosting seminars to solve toxicity and durability bottlenecks. The quantum dots market size in Asia remains underpinned by domestic demand for premium TVs and by export flows into North America and Europe.

North America follows with deep research assets at University of Cambridge (Cambridge-US collaborations), MIT Lincoln Laboratory, and Los Alamos National Laboratory driving quantum-secure links and high-efficiency photovoltaics. Venture capital traction is robust, proven by UbiQD's USD 20 million raise and IonQ's headline acquisitions. Strong IP protection and federal funding ensure commercialization pipelines, and US export-control scrutiny over cadmium compounds nudges suppliers toward indium-phosphide builds. Europe leverages regulatory influence: RoHS compliance sparks cadmium-free adoption, while University of Liege's aqueous syntheses cut hazardous waste. Government green-deal funds deploy quantum-dot window films for energy-positive buildings.

The Middle East and Africa record the fastest 10.6% CAGR. UAE's Norma Center, Qatar's USD 10 million program, and Saudi R&D funds foster quantum-dot computing clusters, aiming to diversify oil economies. Import substitution policies encourage local assembly of QD-enhanced solar panels and medical devices. Latin America sees nascent demand in agrotechnology, where quantum-dot greenhouse sheets improve fruit yield in high-altitude farms, yet market penetration remains under 3%. Overall, geographic revenue dispersion reduces concentration risk: Asia's share inches lower toward 35% by 2030 as Middle East and Africa capture investment flows and as Western regions on-shore critical materials processing.

- Samsung Electronics Co., Ltd.

- Nanosys Inc.

- LG Display Co., Ltd.

- BOE Technology Group Co., Ltd.

- Nanoco Group PLC

- Quantum Materials Corporation

- UbiQD, Inc.

- Ocean NanoTech LLC

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Avantama AG

- Quantum Solutions Inc.

- QD Laser, Inc.

- OSRAM Licht AG

- Sony Corporation

- TCL CSOT

- Crystalplex Corporation

- Evident Technologies

- NN-Labs (NNCrystal US Corp.)

- Nanophotonica Inc.

- Quantum Science Ltd.

- Toray Industries, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Quantum Dot Adoption in Ultra-High-Definition Television Panels, Led by China

- 4.2.2 Regulatory Push for Cadmium-Free Quantum Dots in EU Consumer Electronics

- 4.2.3 Rapid Commercialization of Perovskite Quantum Dots in Display Back-Lighting

- 4.2.4 Surge in Quantum Dot-Based Bio-Imaging Agents in Healthcare Applications

- 4.2.5 Government-Funded Quantum-Materials R&D Programs in South Korea

- 4.3 Market Restraints

- 4.3.1 Supply-Chain Bottlenecks for High-Purity Indium-Phosphide Precursors

- 4.3.2 Performance Degradation of Perovskite QDs Under Moisture Exposure

- 4.3.3 Environmental-Compliance Costs of Cadmium Regulations in Europe

- 4.3.4 Limited Mass-Manufacturing Infrastructure for QD Micro-LED Integration

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook (Production Technology)

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Material Type

- 5.1.1 Cadmium-based II-VI (CdSe, CdS, CdTe)

- 5.1.2 Cadmium-Free III-V (InP, GaAs)

- 5.1.3 Perovskite Quantum Dots

- 5.1.4 Silicon Quantum Dots

- 5.1.5 Graphene and Carbon Quantum Dots

- 5.2 By Device Form Factor

- 5.2.1 QD Films

- 5.2.2 On-Chip Quantum Dots

- 5.2.3 Core-Shell and In-Shell Architectures

- 5.3 By Application

- 5.3.1 Displays

- 5.3.1.1 QD-LCD

- 5.3.1.2 QD-OLED

- 5.3.1.3 Micro-LED Integration

- 5.3.2 Lighting

- 5.3.2.1 General Illumination

- 5.3.2.2 Specialty Lighting

- 5.3.3 Solar Cells and Photovoltaics

- 5.3.4 Medical Imaging and Diagnostics

- 5.3.5 Drug Delivery and Theranostics

- 5.3.6 Sensors and Instruments

- 5.3.7 Quantum Computing and Security

- 5.3.8 Agriculture and Food

- 5.3.9 Others

- 5.3.1 Displays

- 5.4 By End-Use Industry

- 5.4.1 Consumer Electronics

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Energy and Power

- 5.4.4 Defense and Security

- 5.4.5 Agriculture

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Rest of South America

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South-East Asia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Gulf Cooperation Council Countries

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Samsung Electronics Co., Ltd.

- 6.4.2 Nanosys Inc.

- 6.4.3 LG Display Co., Ltd.

- 6.4.4 BOE Technology Group Co., Ltd.

- 6.4.5 Nanoco Group PLC

- 6.4.6 Quantum Materials Corporation

- 6.4.7 UbiQD, Inc.

- 6.4.8 Ocean NanoTech LLC

- 6.4.9 Thermo Fisher Scientific Inc.

- 6.4.10 Merck KGaA

- 6.4.11 Avantama AG

- 6.4.12 Quantum Solutions Inc.

- 6.4.13 QD Laser, Inc.

- 6.4.14 OSRAM Licht AG

- 6.4.15 Sony Corporation

- 6.4.16 TCL CSOT

- 6.4.17 Crystalplex Corporation

- 6.4.18 Evident Technologies

- 6.4.19 NN-Labs (NNCrystal US Corp.)

- 6.4.20 Nanophotonica Inc.

- 6.4.21 Quantum Science Ltd.

- 6.4.22 Toray Industries, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment