|

市场调查报告书

商品编码

1849902

企业防火墙:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Enterprise Firewall - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

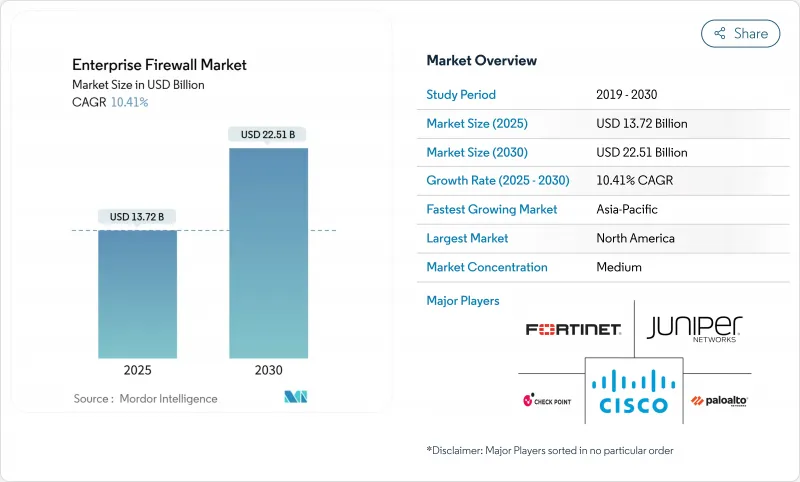

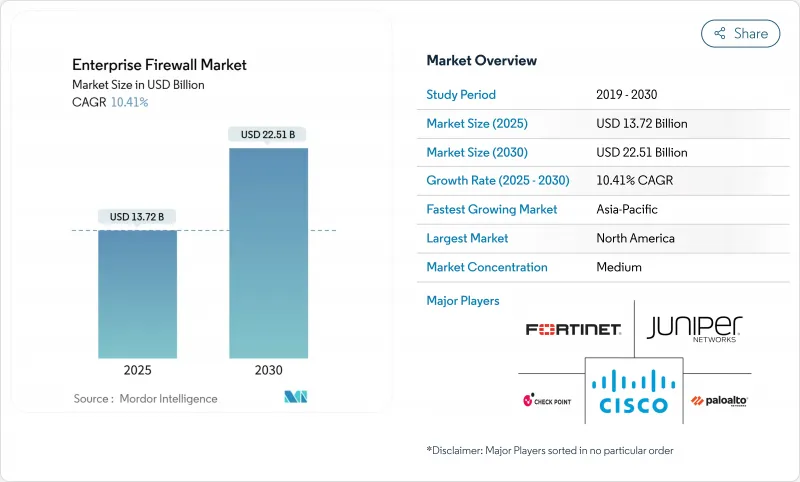

预计到 2025 年,企业防火墙市场规模将达到 137.2 亿美元,到 2030 年将达到 225.1 亿美元,预测期(2025-2030 年)的复合年增长率为 10.41%。

人工智慧主导的多向量攻击日益增多、云端工作负载快速扩张以及零信任安全策略的强制实施,正促使采购重点转向能够即时监控南北向和东西向流量的自适应威胁情报防火墙。混合办公模式的兴起加剧了这种紧迫性,促使买家转向防火墙即服务 (FaaS) 解决方案,以保护远端使用者并降低硬体开销。供应商正积极回应,推出整合网路和安全功能的整合平台,而 PCI DSS 和 DORA 等合规框架则推动了对持续策略执行和审核报告的需求。半导体阻碍因素上涨和技能短缺限制了短期内硬体的普及,但随着平台的演进,订阅收入正在支撑利润率的回升。

全球企业防火墙市场趋势与洞察

日益复杂的多向量攻击

借助合法软体和人工智慧技术,攻击者如今能够在一次宣传活动中入侵终端、云端工作负载并进行横向移动,使得静态规则集失效。 Palo Alto Networks 估计,2024 年 86% 的攻击事件将直接导致业务中断,因此敦促企业部署能够整合分散式感测器即时情报的新一代防火墙。一家全球通讯业者在其网域控制器之外发现了 200 多个特权会话,凸显了东西向安全盲点。供应商正在整合机器学习侦测技术来标记行为异常,使企业能够在几毫秒内隔离可疑流量并缩短攻击者停留时间。

快速采用混合办公和远距办公架构

分散式办公模式依赖家庭网路和非託管设备,这使得威胁面远远超出资料中心边界。企业正在转向安全存取服务边缘模型,将身分、装置健康状况和防火墙控制整合到单一的云端执行点。微软指出,由于加密的 VPN 隧道通常可以绕过传统的安全检查,许多公司正在转向防火墙即服务 (WaaS),无论用户从何处连接,都能执行统一的策略。贝尔加拿大 (Bell Canada) 和 Palo Alto Networks 等公司的伙伴关係凸显了通讯业者如何将人工智慧驱动的防火墙整合到远端团队的託管连线中。

中小企业的预算限制

许多中小企业缺乏专职的安全负责人,并且迫于压力将有限的资金分配给核心业务,这减缓了他们采用高级防火墙的速度。虽然网路保险公司现在为实施託管安全服务的投保人提供保费折扣,但在价格敏感地区,预付订阅费用仍然是购买的一大障碍。供应商正在推出入门级云端防火墙来应对这项挑战,这些防火墙包含自动化策略范本和基于使用量的收费,从而降低了采购门槛。

细分市场分析

到2024年,本地部署设备将维持47.22%的企业防火墙市场份额,这主要得益于可预测的吞吐量以及空气间隙设计带来的监管便利。儘管由于通讯协定迁移的不确定性导致更新周期延长,但就收入而言,该细分市场仍将占据企业防火墙市场规模的最大份额。在资料中心运行对延迟敏感的工作负载的企业仍然倾向于选择整合加速器的专用硬件,以实现高速TLS检测。

云端防火墙即服务(Cloud firewall-as-a-service)预计到 2030 年将以 14.04% 的复合年增长率成长,它提供集中式策略、弹性扩充性和计量收费的经济模式,深受采用多重云端和远端办公策略的企业青睐。此模式也简化了合规性证明,因为提供者会透过入口网站持续显示审核日誌。虚拟设备则介于两者之间,使企业能够在私有云端和边缘位置之间复製规则集,而无需运输硬体。这种混合方法凸显了买家如何根据工作负载的本地性调整防火墙的外形,而不是预设采用单一架构。

到2024年,硬体设备将占总收入的48.31%,这反映出市场对确定性效能、硬体加密卸载以及满足审核团队要求的防篡改设计的强劲需求。企业防火墙市场规模的这一部分预计将稳定成长,但随着买家预算转向能够充分发挥设备潜能的生命週期服务,其比例将会下降。

由于持续调优、威胁情报整合和合规性彙报的需求超出了许多内部团队的频宽,託管服务和专业服务预计将以 13.9% 的复合年增长率成长。服务提供者正在整合 DORA、HIPAA 和特定行业标准的操作手册,以帮助客户缩短平均回应时间并满足监管机构的要求。虽然供应商越来越多地将人工智慧驱动的辅助工具整合到其管理主机中,但人类专家仍然至关重要,他们能够准确地理解异常情况,并使策略与不断变化的业务目标保持一致。

企业防火墙市场按部署类型(本地设备、云端原生防火墙即服务、混合/虚拟设备)、组件(硬体设备、虚拟设备/软体、託管/专业服务)、公司规模(微企业、中小型企业、大型企业)、最终用户垂直行业(银行、金融服务和保险、医疗保健/生命科学、其他)和地区进行细分。

区域分析

北美地区引领潮流,占2024年总营收的35.4%。严格的联邦法规和高昂的资料外洩补救成本推动了积极的采购。该地区的企业越来越多地选择整合平台,以实现零信任架构的标准化并减少营运碎片化。贝尔加拿大与Palo Alto Networks的合作展示了通讯业者如何将人工智慧主导的防火墙和连接服务捆绑在一起,以服务分散式办公室团队。

到2030年,亚太地区将以12.7%的复合年增长率成为所有地区中成长最快的。印度、印尼和日本政府正在寻求对公民资料进行本地检验,并鼓励采购可在国家云端部署的防火墙。中国本土供应商透过遵守加密规则并提供可处理中文威胁情报的内嵌机器学习模组,不断扩大市场份额。跨国云端服务供应商正与区域安全营运中心(SOC)营运商合作,以满足主权条款的要求,同时维持全球远端检测覆盖范围。

欧洲在GDPR和即将推出的DORA框架方面持续保持稳定推进,后者要求进行可验证的资料隔离和事件报告。 SonicWall新建的欧洲安全营运中心(SOC)体现了该厂商为确保快速回应并符合当地资料处理和居住法律而进行的投入。德国和英国专注于工业间谍防御,而法国和西班牙则投资于具有租户级策略隔离功能的云端防火墙,以支援多重云端扩展。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 多方向网路攻击正变得越来越复杂。

- 快速采用混合/远端办公架构

- 零信任和分段的监管要求

- 云端工作负载的激增需要东西方安全保障

- 人工智慧驱动的多态恶意软体迫使防火墙采用自适应技术

- 新兴经济体的主权交通检查规定

- 市场限制

- 中小企业的预算限制

- 缺乏管理复杂政策的技能

- IPv6过渡会减缓硬体更新周期

- 主导的向区域云端安全营运中心 (SOC) 迁移

- 产业价值链分析

- 监管环境

- 技术展望

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 影响市场的宏观经济因素

第五章 市场规模与成长预测

- 依部署类型

- 现场电器

- 云端原生防火墙即服务 (FWaaS)

- 混合/虚拟设备

- 按组件

- 硬体设备

- 虚拟设备/软体

- 管理及专业服务

- 按公司规模

- 中小企业(员工人数少于100人)

- 中型企业(100-999人)

- 大型公司(超过1000人)

- 按最终用户行业划分

- BFSI

- 医疗保健和生命科学

- 製造业和工业

- 政府和国防部

- 零售与电子商务

- 通讯与媒体

- 教育与研究

- 能源与公共产业

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 新加坡

- 马来西亚

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Sophos Ltd.

- WatchGuard Technologies, Inc.

- SonicWall LLC

- Forcepoint LLC

- Barracuda Networks, Inc.

- Hillstone Networks Co., Ltd.

- Stormshield SAS

- AhnLab, Inc.

- Clavister AB

- Untangle, Inc.

- GajShield Infotech(India)Pvt. Ltd.

- F-Secure Corp.

- OPNsense(Deciso BV)

- Gateworks Corp.

- Sangfor Technologies Inc.

- Huawei Technologies Co., Ltd.

- Hillstone Networks

- Array Networks, Inc.

- Stonesoft Oy(a McAfee company)

- Netgate(ESF)

第七章 市场机会与未来趋势

- 閒置频段与未满足需求评估

The Enterprise Firewall Market size is estimated at USD 13.72 billion in 2025, and is expected to reach USD 22.51 billion by 2030, at a CAGR of 10.41% during the forecast period (2025-2030).

Rising AI-driven, multi-vector attacks, rapid cloud workload expansion, and zero-trust mandates are reshaping procurement priorities toward adaptive threat-intelligence firewalls that inspect north-south and east-west traffic in real time. Hybrid work models add urgency, pushing buyers toward Firewall-as-a-Service to protect remote users while reducing hardware overhead. Vendors respond with unified platforms that blend network and security functions, while compliance frameworks such as PCI DSS and DORA increase demand for continuous policy enforcement and audit reporting. Semiconductor cost inflation and skills shortages constrain short-term hardware rollouts, yet subscription revenues keep margins resilient as platformization gains pace.

Global Enterprise Firewall Market Trends and Insights

Escalating Sophistication of Multi-Vector Attacks

Attackers now weaponize legitimate software and AI to breach endpoints, cloud workloads, and lateral pathways in one campaign, leaving static rule sets ineffective. Palo Alto Networks observed that 86% of incidents in 2024 caused direct business disruption, prompting enterprises to deploy next-generation firewalls that correlate real-time intelligence across distributed sensors. A global telecom uncovered more than 200 privileged sessions sitting outside domain controllers, underscoring east-west blind spots. Vendors embed machine-learning inspection to flag behavioral anomalies, enabling enterprises to quarantine suspicious traffic within milliseconds and cut dwell time.

Rapid Adoption of Hybrid and Remote Work Architectures

Decentralized workforces rely on home networks and unmanaged devices, expanding the threat surface far beyond data-center perimeters. Organizations shift toward secure access service edge models that fuse identity, device health, and firewall controls inside a single cloud point of enforcement. Microsoft notes that encrypted VPN tunnels often evade traditional inspection, so many firms migrate to Firewall-as-a-Service for uniform policy wherever users connect. Partnerships such as Bell Canada with Palo Alto Networks highlight how carriers wrap AI-powered firewalls around managed connectivity for remote teams.

Budget Constraints Among SMBs

Many small firms lack full-time security personnel and face pressure to allocate limited capital to core operations, slowing the adoption of advanced firewalls. Cyber-insurance carriers now offer premium reductions to policyholders that deploy managed security services, but up-front subscription costs still deter buyers in price-sensitive regions. Vendors respond with entry-level cloud firewalls that include automated policy templates and usage-based billing, lowering procurement hurdles.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Mandates for Zero-Trust and Segmentation

- Cloud Workload Proliferation Requiring East-West Security

- Skills Shortage to Manage Complex Policies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premise appliances retained 47.22% of the 2024 enterprise firewall market share on the back of predictable throughput and regulatory comfort with air-gapped designs. In revenue terms, the segment accounted for the largest slice of the enterprise firewall market size, even as refresh cycles extend because of protocol migration uncertainty. Enterprises running latency-sensitive workloads in data centers continue to favor purpose-built hardware that embeds accelerators for high-speed TLS inspection.

Cloud-native Firewall-as-a-Service, advancing at a 14.04% CAGR through 2030, brings centralized policy, elastic scale, and pay-as-you-grow economics that resonate with firms embracing multicloud and remote work strategies. The model also simplifies compliance evidence because providers surface continuous audit logs via portals. Virtual appliances sit between both worlds, letting enterprises replicate rule sets across private clouds and edge locations without shipping hardware, which eases branch rollouts during zero-trust transitions. The blended approach underlines how buyers now map firewall form factor to workload locality rather than defaulting to a single architecture.

Hardware appliances captured 48.31% of 2024 revenues, reflecting persistent demand for deterministic performance, hardware encryption offload, and tamper-resistant designs that satisfy audit teams. This slice of the enterprise firewall market size is expected to grow steadily, yet its proportion declines as buyers shift budget toward lifecycle services that unlock the appliance's full potential.

Managed and professional services are forecast to expand at 13.9% CAGR because continuous tuning, threat-feed integration, and compliance reporting outstrip many in-house teams' bandwidth. Service providers bundle playbooks for DORA, HIPAA, and sector-specific standards, helping clients cut mean-time-to-respond and satisfy regulators. Vendors increasingly embed AI-driven copilots into management consoles, yet human specialists remain essential for contextualising anomalies and aligning policies with evolving business objectives.

Enterprise Firewall Market is Segmented by Deployment Type (On-Premise Appliance, Cloud-Native Firewall-As-A-Service, and Hybrid/Virtual Appliance), Component (Hardware Appliance, Virtual Appliance/Software, and Managed and Professional Services), Enterprise Size (Small and Micro Enterprises, Mid-Sized Enterprises, and Large Enterprises), End-User Industry (BFSI, Healthcare and Life Sciences, and More), and Geography.

Geography Analysis

North America led with 35.4% of 2024 revenues, anchored by strict federal rules and high breach remediation costs that spur proactive purchasing. Enterprises there standardize on zero-trust architectures and increasingly choose consolidated platforms to cut operational fragments. Bell Canada's alliance with Palo Alto Networks shows how telcos bundle AI-driven firewalls with connectivity to serve a dispersed workforce.

Asia-Pacific is set for a 12.7% CAGR through 2030, the fastest across regions. Governments in India, Indonesia, and Japan press for local inspection of citizen data, encouraging procurement of firewalls deployable in country-specific clouds. Domestic vendors in China gain share by aligning with encryption rules and supplying inline machine-learning modules that process Mandarin threat intel. Multinational cloud providers partner with regional SOC operators to satisfy sovereignty clauses while maintaining global telemetry reach.

Europe maintains steady momentum on GDPR and the upcoming DORA framework, which requires demonstrable segmentation and incident reporting. SonicWall's new European SOC exemplifies vendor investment to provide local data handling and rapid response aligned with residency laws. Germany and the United Kingdom focus on industrial espionage defenses, whereas France and Spain invest in cloud firewalls capable of per-tenant policy isolation for multicloud expansion.

- Fortinet, Inc.

- Palo Alto Networks, Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Sophos Ltd.

- WatchGuard Technologies, Inc.

- SonicWall LLC

- Forcepoint LLC

- Barracuda Networks, Inc.

- Hillstone Networks Co., Ltd.

- Stormshield SAS

- AhnLab, Inc.

- Clavister AB

- Untangle, Inc.

- GajShield Infotech (India) Pvt. Ltd.

- F-Secure Corp.

- OPNsense (Deciso B.V.)

- Gateworks Corp.

- Sangfor Technologies Inc.

- Huawei Technologies Co., Ltd.

- Hillstone Networks

- Array Networks, Inc.

- Stonesoft Oy (a McAfee company)

- Netgate (ESF)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating sophistication of multi-vector cyber-attacks

- 4.2.2 Rapid adoption of hybrid/remote work architectures

- 4.2.3 Regulatory mandates for zero-trust and segmentation

- 4.2.4 Cloud workload proliferation requiring east-west security

- 4.2.5 AI-driven polymorphic malware forcing adaptive firewalls

- 4.2.6 Sovereign traffic-inspection clauses in emerging economies

- 4.3 Market Restraints

- 4.3.1 Budget constraints among SMBs

- 4.3.2 Skills shortage to manage complex policies

- 4.3.3 IPv6 transition delaying hardware refresh cycles

- 4.3.4 Data-residency-driven shift to regional cloud SOCs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Deployment Type

- 5.1.1 On-Premise Appliance

- 5.1.2 Cloud-Native Firewall-as-a-Service (FWaaS)

- 5.1.3 Hybrid/Virtual Appliance

- 5.2 By Component

- 5.2.1 Hardware Appliance

- 5.2.2 Virtual Appliance/Software

- 5.2.3 Managed and Professional Services

- 5.3 By Enterprise Size

- 5.3.1 Small and Micro Enterprises ( <100 employees )

- 5.3.2 Mid-sized Enterprises (100-999)

- 5.3.3 Large Enterprises (>=1,000)

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Manufacturing and Industrial

- 5.4.4 Government and Defense

- 5.4.5 Retail and E-commerce

- 5.4.6 Telecom and Media

- 5.4.7 Education and Research

- 5.4.8 Energy and Utilities

- 5.4.9 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Singapore

- 5.5.4.6 Malaysia

- 5.5.4.7 Australia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Fortinet, Inc.

- 6.4.2 Palo Alto Networks, Inc.

- 6.4.3 Check Point Software Technologies Ltd.

- 6.4.4 Cisco Systems, Inc.

- 6.4.5 Juniper Networks, Inc.

- 6.4.6 Sophos Ltd.

- 6.4.7 WatchGuard Technologies, Inc.

- 6.4.8 SonicWall LLC

- 6.4.9 Forcepoint LLC

- 6.4.10 Barracuda Networks, Inc.

- 6.4.11 Hillstone Networks Co., Ltd.

- 6.4.12 Stormshield SAS

- 6.4.13 AhnLab, Inc.

- 6.4.14 Clavister AB

- 6.4.15 Untangle, Inc.

- 6.4.16 GajShield Infotech (India) Pvt. Ltd.

- 6.4.17 F-Secure Corp.

- 6.4.18 OPNsense (Deciso B.V.)

- 6.4.19 Gateworks Corp.

- 6.4.20 Sangfor Technologies Inc.

- 6.4.21 Huawei Technologies Co., Ltd.

- 6.4.22 Hillstone Networks

- 6.4.23 Array Networks, Inc.

- 6.4.24 Stonesoft Oy (a McAfee company)

- 6.4.25 Netgate (ESF)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment