|

市场调查报告书

商品编码

1849916

汽车安全气囊充气机:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Airbag Inflator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

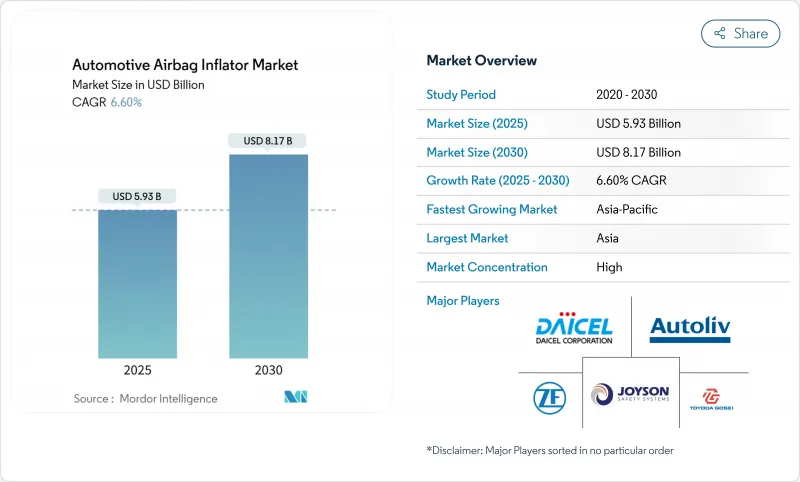

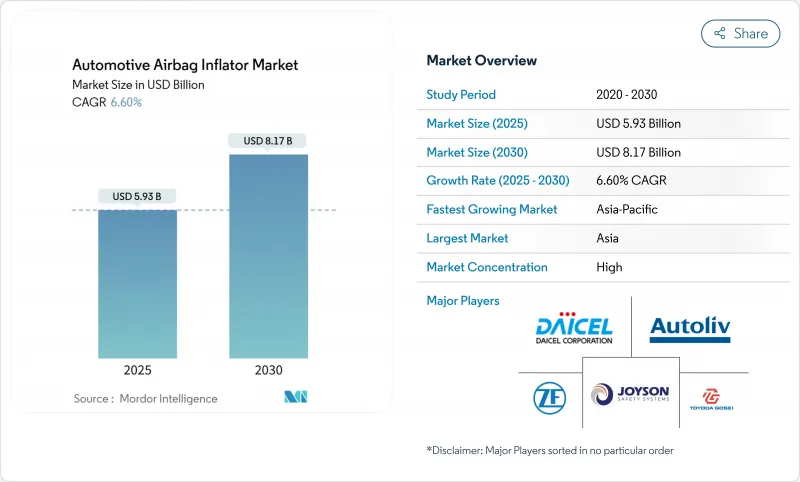

预计到 2025 年,汽车安全气囊充气机市场规模将达到 59.3 亿美元,到 2030 年将达到 81.7 亿美元,2025 年至 2030 年的复合年增长率为 6.60%。

日益严格的碰撞安全法规、消费者对乘员保护日益增长的关注,以及充气机化学成分和包装技术的不断改进,共同推动了汽车安全气囊充气机市场的成长。掌控从设计到製造全流程的供应商,比依赖代工组装的公司能够更快地回应新的监管测试,从而确保更高的净利率。北美和欧洲的监管机构已发出即将进行的侧面碰撞和网路安全审核的信号,这将推高成本并增加更换量,即使汽车生产週期趋于平缓,也能维持汽车安全气囊充气机市场的成长。亚太地区已呈现7.50%的复合年增长率,主要得益于技术实力雄厚的中国中型SUV项目以及快速扩张的出口中心印度。

全球汽车安全气囊充气机市场趋势及洞察

加强碰撞安全法规

加强正面、侧面和行人保护的通讯协定迫使汽车製造商采用更先进的约束系统,从而扩大了汽车安全气囊充气机的市场。北美联邦机动车辆安全标准 (FMVSS) 的更新和欧洲通用安全法规提高了侧面躯干和帘式气囊解决方案的基准基准。如今,原始设备製造商 (OEM)竞标时会要求供应商提供合规文件,这缩短了设计週期,并倾向于选择垂直整合的供应商。审核频率的提高促使製造商在靠近组装线的位置安装现场推进剂测试装置,从而将认证週期缩短了多达四周。不断增长的更换量部分抵消了成本转嫁,使充气机的整体需求保持强劲。监管机构开始将网路安全准备与气体输出指标结合起来考虑,引导产业朝向智慧充气机模组发展。

ADAS主导了多级充气装置的应用

一款由中国品牌生产的、配备丰富感测器的中型SUV,将碰撞严重程度数据与充气机逻辑融合,实现精准的气体释放,从而更好地保护乘员。五星级新车评估项目(NCAP)评分提升了该车在展示室的吸引力,并切实证明了多级充气机在高级驾驶辅助系统(ADAS)中的价值。在多级充气机方面落后的汽车製造商将面临展示室销售对比不佳和来自其他厂商的快速跟进压力。软体更新支援未来的校准微调,从而避免了OEM厂商重新校准的成本。零件供应商利用这一趋势,推销韧体提升销售合同,增加了类似年金的收入来源。因此,感测器融合和充气机调节技术的结合,使得汽车安全气囊充气机在市场上保持了较高的价格分布。

氦气供不应求

地缘政治动盪推高了工业氦气现货价格,进而推高了储气式充气装置的材料成本,挤压了净利率。坦尚尼亚的勘探宣传活动旨在寻找绿色氦气,初步流量数据显示,安全系统製造商可以获得可行的商业性供应。原始设备製造商(OEM)正在透过转向混合式充气装置来应对这项挑战,该装置使用烟火气体稀释氦气。合约条款中现在包含了氦气价格调整条款,将部分风险转移回供应商。儘管成本上涨只是暂时的,但它已经延缓了新型储气式充气装置的设计,并减缓了汽车安全气囊充气装置市场这一细分领域的近期增长。

细分市场分析

侧帘式气囊在汽车气囊充气机市场占有34.10%的份额。侧帘式气囊的主导地位源自于星级评定通讯协定,该标准要求其具备强大的侧撞保护能力。近期的改进主要集中在分段式气体通道上,以提高沿着狭窄车顶导轨的充气均匀性。由于最新的Gigacast EV框架使导轨更加纤细,椭截面气缸可在不增加车顶高度限制的情况下确保气体容量。汽车气囊充气机市场持续青睐那些将创新外型与可靠化学技术结合的平台。

膝部气囊预计将以8.60%的复合年增长率实现最快成长。碰撞测试假碰撞测试人偶专注于下肢损伤的保险评分模型正在推动其普及。供应商现在提供可卡入现有仪表板下方横樑的一体成型外壳,从而缩短生产线上的组装时间。车队采购商强调膝部保护可以减少工伤赔偿,这推动了膝部气囊的选配率上升。不断增长的市场需求巩固了汽车气囊充气机行业的长期多元化发展趋势,该行业受益于多个增长点,而不是单一的主导类别。

预计到2024年,烟火式安全气囊充气装置的销售额将达到32.8亿美元,占汽车安全气囊充气装置市占率的59.25%。其紧凑的外形、久经考验的可靠性以及对氦气供应波动的耐受性,使其成为驾驶侧安全气囊的首选。由于不含迭氮化物,工程师可以使用更薄的金属壁,从而减轻重量并符合车队平均排放目标。工厂数据显示,以硝酸胍混合物取代传统混合物可以减少展开后的颗粒物排放,并简化无尘室维护。

混合式充气装置预计将以7.90%的复合年增长率成长。混合式充气装置的设计理念是将小型储气室与烟火式主装药结合,从而在保持调节灵活性的同时降低氦气消耗。原始设备製造商(OEM)将混合式组件视为一种采购对冲手段,并指出双化学生产线能够缓解供应链衝击。发展蓝图显示,混合式充气装置将在双级侧帘式气囊和远端气囊中广泛使用。因此,汽车气囊充气装置产业将混合式充气装置视为应对未来大宗商品价格波动的保障。

区域分析

预计到2024年,北美将占全球销售额的近31.10%。美国国家公路交通安全管理局(NHTSA)对某些安全气囊充气装置的调查,导致潜在的法律诉讼风险增加,促使原始设备製造商(OEM)优先考虑成熟的设计和可追溯的生产记录。符合UN-R155标准的网路安全型安全气囊充气装置模组正变得越来越普遍,为区域供应链增加了一层软体检验。市场的成熟推动了竞争向全生命週期服务(例如碰撞数据分析)的转移,并将关注点从硬体定价转向增值支援。

亚太地区将以7.50%的复合年增长率领跑,主要驱动力来自中国、印度和东协。中国中型SUV平台配备双级充气装置,展现了本土创新如何达到全球标准,其五星级安全评级也提升了其出口吸引力。印度製造中心将凭藉成本优势和本地供应商集群,填补其他地区的产能缺口,从而占据更大的汽车安全气囊充气装置市场份额。在清奈和普纳附近拥有推进剂实验室和测试设施的供应商可以降低物流风险,缩短认证週期。

欧洲市场需求稳定,主要受合规性驱动。该地区已基本完成向非迭氮化物化学製程的过渡,并透过改造项目维持了健康的售后市场销售。碳中和承诺使材料选择与企业永续性目标保持一致,并鼓励在充气机外壳中使用再生铝。碳边境关税正在影响采购和单位成本,促使加工业务逐步转移到东欧。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场驱动因素

- 欧盟和日本逐步淘汰迭氮化物推进剂推动了改造需求。

- ADAS主导的多级充气装置在国产中型SUV的应用

- 印度出口基地的崛起导致国内对充气机的需求增加

- 电动车千兆广播底盘催生了对超薄帘幕充气机的需求

- 北美地区采用 UN-R155 网路安全合规性驱动智慧充气模组

- L4/L5级自动驾驶车辆的部署需要先进的多方向充气装置阵列。

- 市场限制

- 氦气供不应求,储气充气机的价格

- 欧盟碳排放边境关税提高亚洲通膨产品进口成本

- MEA地区假冒充气泵氾滥破坏了OEM项目

- 锂离子电池起火风险延缓电动车安全气囊系统的整合

- 价值/供应链分析

- 监管或技术前景

- 波特五力模型

- 新进入者的威胁

- 买方/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(价值及数量)

- 依安全气囊类型

- 乘客

- 窗帘

- 膝盖

- 边

- 行人保护

- 依充气机类型

- 焰火

- 储存气体

- 杂交种

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 大型商用车辆

- 透过推进剂化学

- 迭氮碱

- 非迭氮化物(例如,硝酸胍)

- 按技术水平

- 单级

- 双级和多级

- 按销售管道

- 原厂适配

- 售后/召回更换

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 北欧国家

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 波湾合作理事会

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Autoliv Inc.

- ZF Friedrichshafen AG

- Joyson Safety Systems(Key SS)

- Daicel Corporation

- Nippon Kayaku Co.

- ARC Automotive Inc.

- Toyoda Gosei Co.

- Hyundai Mobis Co.

- Continental AG

- Denso Corporation

- Yanfeng Safety Systems

- Nihon Plast Co.

- Ashimori Industry Co.

- Takata(Residual Recall Operations)

- Kolon Industries Inc.

- GWR Safety Systems

- ARC China Ltd.

- Tenaris Inflators

- Jinzhou Jinheng Automotive

第七章 市场机会与未来展望

The automotive airbag inflator market size stands at USD 5.93 billion in 2025 and is forecast to touch USD 8.17 billion by 2030, advancing at a 6.60% CAGR between 2025 and 2030.

Stronger crash-safety legislation, heightened consumer attention to occupant protection, and continuous inflator chemistry and packaging gains underpin the automotive airbag inflator market climb. Suppliers that control design-to-manufacture workflows secure higher margins because they answer new regulatory tests faster than firms that rely on contract assemblers. Regulators in North America and Europe have signalled upcoming side-impact and cybersecurity audits, which will raise costs and lift replacement volumes, sustaining the automotive airbag inflator market even during flat vehicle-production cycles. The Asia-Pacific region already shows a 7.50% CAGR, led by technology-rich Chinese mid-SUV programs and India's fast-scaling export hubs, suggesting the region could represent nearly half of new inflator units by the decade's close

Global Automotive Airbag Inflator Market Trends and Insights

Stricter Crash-Safety Mandates

Upgraded frontal, side-impact, and pedestrian-protection protocols push automakers to adopt higher-performance restraint systems, expanding the automotive airbag inflator market. North American FMVSS updates and Europe's General Safety Regulation lift baseline fitment for side-torso and curtain solutions. OEMs now tender inflators with compliance documentation, compressing design windows, and favouring vertically integrated suppliers. Increased audit frequency has prompted on-site propellant test cells near final assembly lines, shortening certification loops by up to four weeks. Higher replacement volumes partially offset cost pass-through, keeping overall inflator demand buoyant. Regulators have begun referencing cybersecurity readiness alongside gas-output metrics, nudging the industry toward smart inflator modules.

ADAS-Led Adoption of Multi-Stage Inflators

Sensor-rich mid-SUVs manufactured by Chinese brands fuse crash-severity data with inflator logic, allowing tailored gas releases that protect a wider occupant range. Five-star New Car Assessment Program scores support showroom appeal and showcase multi-stage inflators as visible proof of ADAS value. Automakers that lag in multi-stage deployment risk negative showroom comparisons, creating fast-follower pressure. Software updates allow future calibration tweaks, shielding OEMs from retooling costs. Component suppliers leverage the trend to upsell firmware maintenance contracts, adding an annuity-style revenue layer. Therefore, the convergence of sensor fusion and inflator modulation sustains premium price points within the automotive airbag inflator market.

Helium Supply Crunch

Geopolitical disruptions lifted industrial-grade helium spot prices, inflating the bill of materials for stored-gas inflators and squeezing margins. Exploration campaigns in Tanzania seek green helium, with preliminary flow-rate data suggesting a viable commercial supply for safety-system producers. OEMs react by shifting procurements toward hybrid inflators that dilute helium use with pyrotechnic gas. Contract clauses now include helium-price adjustment formulas, transferring part of the risk back to suppliers. While temporary, cost spikes have already slowed new stored-gas design iterations, moderating near-term growth for that sub-segment of the automotive airbag inflator market.

Other drivers and restraints analyzed in the detailed report include:

- Phase-Out of Azide Propellants

- Emergence of Indian Export Hubs

- EU Carbon Border Tariff

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Curtain airbags representing 34.10% of the automotive airbag inflator market share. Their dominance rests on star-rating protocols that mandate robust side-impact protection. Recent refreshes reveal interest in segmented gas channels that enhance fill uniformity along narrow roof rails. Emerging giga-cast EV frames create slimmer rails, so oval-section cylinders preserve gas volume without raising roof-height constraints. The automotive airbag inflator market continues to reward platforms that mix shape innovation with reliable chemistry.

Knee airbags register the fastest 8.60% CAGR outlook. Crash dummies that weigh more on lower-leg injuries and insurance scoring models reinforce uptake. Suppliers now offer one-piece housings that clip into existing under-dash beams, trimming line-side assembly minutes. Fleet buyers highlight lower worker-compensation claims when knee protection is present, boosting specification rates. Growing traction strengthens the long-term diversity of the automotive airbag inflator industry, which benefits from multiple growth vectors rather than a single dominant category.

Pyrotechnic inflators earned USD 3.28 billion in revenue during 2024, equal to 59.25% of the automotive airbag inflator market size. Their compact form, proven reliability, and immunity to helium supply swings keep them the default for driver airbags. Non-azide compounds let engineers thin metal walls, saving grams and supporting fleet-average emissions objectives. Plant data show particulate emissions after deployment drop when guanidine-nitrate blends replace legacy mixes, easing clean-room maintenance.

Hybrid inflators are forecast for a 7.90% CAGR. Their design marries a small stored-gas chamber with a pyrotechnic main charge, cutting helium volumes while retaining modulation latitude. OEMs view hybrid assemblies as procurement hedges, noting that dual-chemistry lines dampen supply-chain shocks. Development road maps point to wider use in dual-stage curtain and far-side airbags. The automotive airbag inflator industry, therefore, treats hybrid capacity as an insurance policy against future commodity swings.

The Automotive Airbag Inflator Market Report is Segmented by Airbag Type (Driver, Passenger, and More), Inflator Type (Pyrotechnic, Stored Gas, Hybrid), Vehicle Type (Passenger Cars, LCV, and More), Propellent Chemistry (Azide-Based, Non-Azide), Technology Stage ( Single Stage and Multi-Stage), Sales Channel (OEM Fitted and Aftermarket) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America contributed nearly 31.10% of global revenue in 2024. The National Highway Traffic Safety Administration's probe into specific inflator variants focuses on legal exposure, motivating OEMs to favour proven designs and traceable manufacturing records. Cyber-secure inflator modules that comply with UN-R155 have gained traction, adding software validation layers to the regional supply chain. High market maturity channels competition toward lifecycle services such as crash-data analytics, shifting emphasis from hardware pricing to value-added support.

Asia-Pacific records the strongest 7.50% CAGR, driven by China, India, and ASEAN economies. Chinese mid-SUV platforms with dual-stage inflators demonstrate how local innovations meet global benchmarks, and five-star safety ratings raise export appeal. Indian manufacturing hubs leverage cost advantages and local supplier parks to backfill capacity gaps elsewhere, thereby capturing a larger slice of the automotive airbag inflator market. Suppliers that co-locate propellant labs and test rigs near Chennai and Pune compress logistics risk and win shorter certification cycles.

Europe shows steady, compliance-centred demand. The region's near-complete shift to non-azide chemistry keeps aftermarket volumes healthy through retrofit programs. Carbon-neutrality pledges drive aluminium recyclate adoption for inflator casings, aligning material choices with corporate sustainability goals. Pedestrian safety requirements encourage research into external airbags, which could incrementally widen the inflator addressable market.Carbon border tariffs influence sourcing as much as unit price, prompting a gradual relocation of machining steps to Eastern Europe.

- Autoliv Inc.

- ZF Friedrichshafen AG

- Joyson Safety Systems (Key SS)

- Daicel Corporation

- Nippon Kayaku Co.

- ARC Automotive Inc.

- Toyoda Gosei Co.

- Hyundai Mobis Co.

- Continental AG

- Denso Corporation

- Yanfeng Safety Systems

- Nihon Plast Co.

- Ashimori Industry Co.

- Takata (Residual Recall Operations)

- Kolon Industries Inc.

- GWR Safety Systems

- ARC China Ltd.

- Tenaris Inflators

- Jinzhou Jinheng Automotive

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Phase-out of Azide Propellants Driving EU & Japan Retrofit Demand

- 4.1.2 ADAS-Led Adoption of Multi-Stage Inflators in Chinese Mid-SUVs

- 4.1.3 Emergence of Indian Export Hubs Elevating Captive Inflator Off-take

- 4.1.4 EV Giga-Casting Chassis Creating Need for Ultra-Slim Curtain Inflators

- 4.1.5 UN-R155 Cyber-Security Compliance Boosting Smart Inflator Modules in NA

- 4.1.6 L4/L5 Autonomous Vehicle Rollout Demanding Advanced Multi-Directional Inflator Arrays

- 4.2 Market Restraints

- 4.2.1 Helium Supply Crunch Inflating Stored-Gas Inflator Pricing

- 4.2.2 EU Carbon Border Tariff Raising Cost of Asian Inflator Imports

- 4.2.3 Proliferation of Counterfeit Inflators in MEA Eroding OEM Programs

- 4.2.4 Lithium-ion Battery Fire Risks Delaying EV Airbag System Integration

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory or Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value & Volume)

- 5.1 By Airbag Type

- 5.1.1 Passenger

- 5.1.2 Curtain

- 5.1.3 Knee

- 5.1.4 Side

- 5.1.5 Pedestrian Protection

- 5.2 By Inflator Type

- 5.2.1 Pyrotechnic

- 5.2.2 Stored-Gas

- 5.2.3 Hybrid

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Heavy Commercial Vehicles

- 5.4 By Propellant Chemistry

- 5.4.1 Azide-Based

- 5.4.2 Non-Azide (e.g., Guanidine Nitrate)

- 5.5 By Technology Stage

- 5.5.1 Single-Stage

- 5.5.2 Dual-Stage & Multi-Stage

- 5.6 By Sales Channel

- 5.6.1 OEM Fitted

- 5.6.2 Aftermarket / Recall Replacement

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.1.4 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Nordics

- 5.7.3.5 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East

- 5.7.5.1 Gulf Cooperation Council

- 5.7.5.2 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Nigeria

- 5.7.6.3 Rest of Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Autoliv Inc.

- 6.4.2 ZF Friedrichshafen AG

- 6.4.3 Joyson Safety Systems (Key SS)

- 6.4.4 Daicel Corporation

- 6.4.5 Nippon Kayaku Co.

- 6.4.6 ARC Automotive Inc.

- 6.4.7 Toyoda Gosei Co.

- 6.4.8 Hyundai Mobis Co.

- 6.4.9 Continental AG

- 6.4.10 Denso Corporation

- 6.4.11 Yanfeng Safety Systems

- 6.4.12 Nihon Plast Co.

- 6.4.13 Ashimori Industry Co.

- 6.4.14 Takata (Residual Recall Operations)

- 6.4.15 Kolon Industries Inc.

- 6.4.16 GWR Safety Systems

- 6.4.17 ARC China Ltd.

- 6.4.18 Tenaris Inflators

- 6.4.19 Jinzhou Jinheng Automotive