|

市场调查报告书

商品编码

1849925

精对苯二甲酸:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Purified Terephthalic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

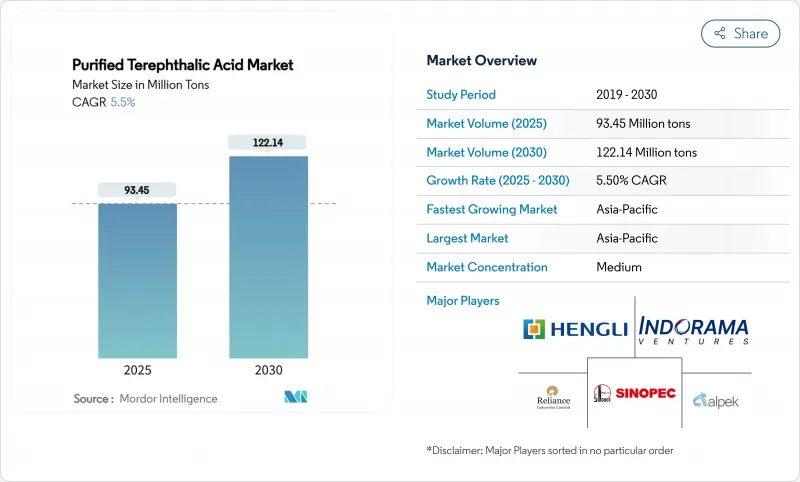

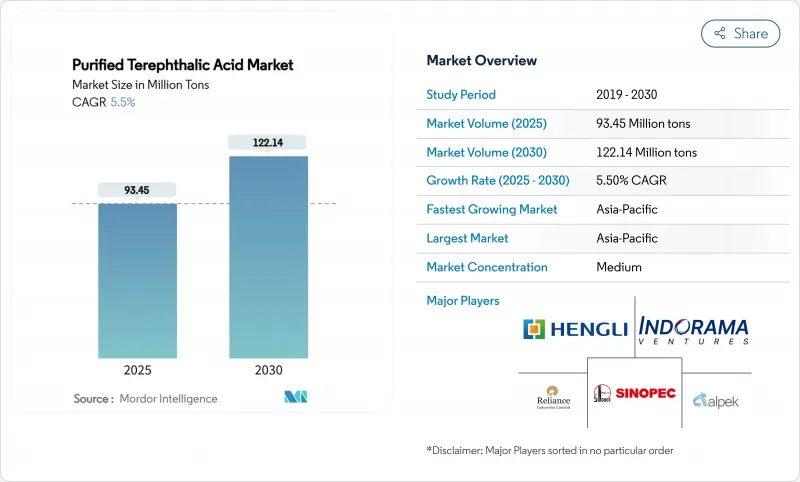

预计到 2025 年,精对苯二甲酸的市场规模将达到 9,345 万吨,到 2030 年将达到 1.2214 亿吨,在预测期(2025-2030 年)内复合年增长率为 5.5%。

包装、纤维和新兴汽车终端应用领域对聚对苯二甲酸乙二醇酯(PET)的强劲需求支撑着这一扩张,即便成熟地区正在调整其产能。中国和印度正日益整合其石化产业链,巩固其成本领先地位,而化学回收技术则正在开拓新的原料来源和溢价空间。原料价格波动挤压了独立生产商的净利率,促使企业明显转向后向整合和提高营运效率。监管部门,特别是欧盟,要求提高PET包装的回收率,正在推动筹资策略的重组和对闭合迴路系统的投资。

全球高纯度对苯二甲酸市场趋势及洞察

电子商务领域对PET包装的强劲需求

电子商务运输倾向于使用轻质PET容器,这种容器能够承受自动化分拣和长时间的运输,从而推动了高等级PTA的回收。印度和东南亚的品牌正在采用阻隔增强型瓶子,以在直销高峰期保持碳酸饮料的碳酸化程度和风味。诸如双十一和排灯节(农历新年)等季度促销活动会导致PTA的突然召回,从而收紧本地库存并维持现货溢价。北美食品和饮料供应商也在重新设计用于宅配的包装,并提高PTA的抗应力开裂性能。这些设计变化正在推动玻璃和金属包装向PET的转换,从而在数量和以金额为准扩大PTA市场。季节性价格飙升促使供应商签订基于公式定价的供应合同,从而保护加工商免受PX价格波动的影响。

聚酯纤维产量成长

中国的PTA-纤维整合产业园区利用现场公用设施和物流的综效,以经济高效的方式大规模生产纤维,进而支撑PTA的长期需求。印度炼油商正效法这项做法。印度石油公司正将其位于帕尼帕特的PTA产能从55.3万吨提升至70万吨,并计划在2026年中期之前在帕拉迪普新增一条120万吨的生产线,巩固印度作为PTA灵活供应国的地位。汽车用不织布、地工织物和功能性服饰不断拓展聚酯纤维的终端用途,这些产品对PTA杂质含量的要求非常严格,因此价格溢价显着。中石化亿征公司聚对聚丁烯对苯二甲酸酯增加6万吨,标誌着其战略重心转向工程聚合物,以应对PET的周期性波动。与时尚週期相比,这些纤维面向耐用消费品市场,能够支撑更稳定的高纯度PTA市场。

毒理学方面的担忧

欧洲化学品管理局 (ECHA) 註册文件将对苯二甲酸归类于欧洲经济区 (EEA) 100 万至 1000 万吨的产量范围内,导致污水和粉尘暴露的监测力度加大。儘管其口服半数致死量 (LD50) 超过 5000 毫克/公斤,但新的生殖毒性研究促使监管机构提案加强对工业废水的监测。缺乏先进处理系统的中小型生产商面临资本投入和潜在的停产风险,这限制了欧洲高纯度对苯二甲酸的短期市场容量。此外,由于欧盟《一般产品安全规范》(GDPR) 要求製造商在产品上市前提供对苯二甲酸衍生最终产品的安全性证明,合规成本也随之增加。

细分市场分析

到2024年,聚对苯二甲酸乙二醇酯(PET)将占全球PET衍生品消费量的64.18%,占据精对苯二甲酸(PTA)需求的大部分。一体化企业正在现场将PTA转化为PET,从而确保转化利润并节省物流成本,增强其竞争优势。预计该细分市场将实现6.56%的复合年增长率,这反映了销量成长以及用于热填充、填充用和阻隔增强包装的高附加价值树脂的需求。聚对聚丁烯对苯二甲酸酯)仍然是一种高耐热性的特种衍生品,中石化亿征工厂8万吨的扩建凸显了该材料在汽车和电子行业的巨大潜力。聚对苯二甲酸丙二醇酯(PT)凭藉其弹性恢復性和柔软性,正在功能性运动服装领域占有一席之地。

经济分析表明,PTA 直接酯化优于对苯二甲酸二甲酯 (DMT)。 Oxynova 于 2022 年关闭其德国 DMT 装置,凸显了其结构性成本劣势。儘管如此,如果政策奖励得以落实,利用催化製程从 PET废弃物中获得 99.9% 的 DMT 收率,则为 DMT 的循环利用提供了一条途径。总体而言,PET 产业的整合策略持续支撑着精对苯二甲酸市场,而高利润率的衍生性商品则有助于分散收入来源,抵御 PET 价格週期波动的影响。

区域分析

预计到2024年,亚太地区将维持其在全球PTA消费量中53.62%的份额,年增长率达7.18%,这主要得益于中国和印度在芳烃制聚酯领域的综合投资。中国创纪录的1480万桶/日原油加工能力将提供充足的对苯二甲酸(PX)原料,而中石化在江苏省建设的300万吨单系列PTA装置则体现了规模经济效益。印度正崛起为平衡供应国,印度石油公司位于帕尼帕特和帕拉迪普的工厂扩建预计将在2026年中期前使印度国内PTA产量增加135万吨。韩国和日本正专注于高价值树脂和製程许可,而东南亚生产商则利用其靠近原料产地的优势和国内需求的激增。这些动态巩固了亚太地区作为纯对苯二甲酸市场引擎的地位。

北美纯对苯二甲酸市场受益于具有竞争力的液态天然气供应和完善的回收基础设施。主要碳酸饮料製造商的需求以及汽车用PET用量的成长维持了运转率,但由于投资者倾向于消除瓶颈和整合对二甲苯装置,新增产能仍然有限。欧洲面临能源成本上涨和更严格的排放法规带来的结构性挑战。诸如Indorama对其鹿特丹工厂的审查等合理化倡议表明,市场正在转向特种等级产品和再生原料,而不是扩大对苯二甲酸的生产规模。对亚洲PET进口征收的反倾销税提供了暂时的缓解,但并不能弥补该地区在原料方面的劣势。

南美洲和中东及非洲蕴藏着新的成长潜力。巴西的聚酯产业链正吸引着许多跨国公司的关注,它们寻求收购布拉斯科(Braskem)的股份,以确保进入巴西国内市场。在中东,沙乌地基础工业公司(SABIC)投资64亿美元的福建综合体项目和道达尔能源投资110亿美元的阿米拉尔计划,标誌着一项旨在整合炼油、对甲苯(PX)和对苯二甲酸(PTA)装置,并将生产集中于高增长的亚洲市场的战略正在酝酿之中。这些长期投资将逐步扩大对苯二甲酸市场的地域覆盖范围,有助于平衡需求丛集与原料供应。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务领域对PET包装的需求强劲。

- 聚酯纤维产量增加

- PET在汽车产业的应用日益广泛

- 强制回收PET循环材料

- 电池隔膜级PTA的使用日益增多

- 市场限制

- 毒性问题

- PX和原油价格波动

- PEF及其他生物聚合物的兴起

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 导数

- 聚对苯二甲酸乙二醇酯(PET)

- 聚丁烯对苯二甲酸酯(PBT)

- 聚对苯二甲酸丙二醇酯(PTT)

- 对苯二甲酸二甲酯(DMT)

- 透过技术

- PX氧化(常规方法)

- 生物基PTA

- 化学回收的PTA

- 透过使用

- 包裹

- 纤维

- 油漆和涂料

- 胶水

- 其他用途(工程塑胶、药品和中间体等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Alpek SAB de CV

- BP plc

- China Petroleum & Chemical Corporation.

- Eastman Chemical Company

- FCFC

- HENGLI PETROCHEMICAL(DALIAN)CHEMICAL CO., LTD.

- Indian Oil Corporation Ltd

- Indorama Ventures Public Company Limited.

- INEOS

- JBF Industries Limited

- LOTTE Chemical Corporation.

- Mitsubishi Chemical Corporation.

- Oriental Petrochemical(Taiwan)Co., Ltd.

- PetroChina Company Limited

- Reliance Industries Limited

- SABIC

- Samnam Petrochemical Co.,Ltd.

第七章 市场机会与未来展望

The Purified Terephthalic Acid Market size is estimated at 93.45 Million tons in 2025, and is expected to reach 122.14 Million tons by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

Strong polyethylene terephthalate (PET) demand across packaging, textile and emerging automotive end-uses underpins this expansion, even as mature regions restructure capacity. Integration of petrochemical chains in China and India is reinforcing cost leadership, while chemical recycling technologies are unlocking fresh sources of feedstock and premium price pools. Feedstock volatility is narrowing margins for stand-alone producers, prompting a visible shift toward backward integration and operational efficiencies. Regulatory pushes for higher recycled content in PET packaging, especially in the European Union, are reshaping procurement strategies and spurring investment in closed-loop systems.

Global Purified Terephthalic Acid Market Trends and Insights

Strong PET Packaging Demand from E-commerce Sector

E-commerce shipping formats now favor lightweight PET containers that withstand automated sortation and long transit cycles, driving higher-grade PTA offtake. Brands in India and Southeast Asia are adopting barrier-enhanced bottles that preserve carbonation and flavor during direct-to-consumer delivery peaks. Quarterly promotions such as Singles' Day and Diwali generate sudden PTA call-offs, keeping regional inventories tight and sustaining spot premiums. North American food and beverage suppliers are also redesigning packaging for parcel carriers, lifting PTA specifications for stress-crack resistance. These design changes convert glass and metal volumes to PET, broadening the purified terephthalic acid market in both volume and value terms. Seasonal spikes incentivize supply contracts with formula-based pricing that protect converters from PX price swings.

Growing Production of Polyester Fiber

China's integrated PTA-to-fiber parks leverage onsite utilities and logistics synergies to deliver cost-effective fiber at scale, anchoring long-term PTA demand. Indian refiners are following suit; IndianOil is lifting PTA capacity from 553,000 tons to 700,000 tons at Panipat and adding a 1.2 million-ton line at Paradip by mid-2026, cementing India's role as a swing supplier. Automotive nonwovens, geotextiles and functional apparel continue to diversify end-uses for polyester fibers, each requiring narrow PTA impurity windows that command a modest price premium. Sinopec Yizheng's incremental 60,000 tons of polybutylene terephthalate illustrates strategic migration into engineering polymers that buffer against PET cyclicality. The durable-goods orientation of these fibers supports steadier purified terephthalic acid market volumes compared with fashion cycles.

Toxicological Concerns

ECHA registration dossiers classify terephthalic acid in the 1-10 million-ton production band within the European Economic Area, prompting heightened scrutiny over wastewater and dust exposures. Although oral LD50 values exceed 5,000 mg/kg, newer reproductive studies have led regulators to propose stricter monitoring of plant effluents. Small and mid-size producers lacking advanced treatment systems face capital outlays or possible shutdowns, trimming short-term purified terephthalic acid market capacity in Europe. Compliance costs also rise under the EU's General Product Safety Regulation, requiring manufacturers to document the safety of PTA-derived finished goods before market entry.

Other drivers and restraints analyzed in the detailed report include:

- Growing Utilization of PET from Automotive Industry

- Recycled-PET Loop Mandates

- Volatile PX & Crude Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene terephthalate represented 64.18% of global derivative consumption in 2024, translating into the bulk of purified terephthalic acid market demand. Integrated players convert PTA to PET on-site, securing conversion margins and logistical savings that reinforce competitive barriers. The segment's anticipated 6.56% CAGR reflects both volume growth and higher-value resins for hot-fill, refillable and barrier-enhanced packaging. Polybutylene terephthalate remains a specialty derivative with stronger heat resistance, and Sinopec Yizheng's 80,000-ton expansion underscores the material's automotive and electronics prospects. Polytrimethylene terephthalate is carving out a niche in functional sportswear, benefiting from its elastic recovery and softness.

Economic analyses now favor direct esterification of PTA over dimethyl terephthalate (DMT). Oxxynova's 2022 closure of its German DMT unit underlined structural cost disadvantages. Nonetheless, catalytic processes achieving 99.9% DMT yields from PET waste demonstrate a pathway to circular DMT streams if policy incentives materialize. Overall, PET integration strategies continue to anchor the purified terephthalic acid market, while higher-margin derivatives diversify revenue against PET price cycles.

The Purified Terephthalic Acid Market Report Segments the Industry by Derivative (Polyethylene Terephthalate (PET), Polybutylene Terephthalate (PBT), and More), Technology (PX Oxidation (Conventional), Bio-Based PTA, and More), Application (Packaging, Fibers, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific retained 53.62% share of global PTA consumption in 2024 and is set to grow 7.18% annually, reflecting integrated aromatics-to-polyester investments in China and India. China's record 14.8 million barrels per day crude throughput enables ample PX feed, while Sinopec's 3 million-ton single-train PTA plant in Jiangsu epitomizes economies of scale. India is emerging as a balancing supplier; IndianOil's expansions at Panipat and Paradip will lift national PTA output by 1.35 million tons before mid-2026. South Korea and Japan focus on high-value resins and process licensing, whereas Southeast Asian producers exploit proximity to feedstock sources and burgeoning domestic demand. These dynamics cement Asia-Pacific's status as the engine room of the purified terephthalic acid market.

North America's purified terephthalic acid market benefits from competitive natural-gas liquids feed and established recycling infrastructure. Demand from carbonated soft-drink giants and rising automotive PET usage maintain utilization rates, yet new grassroots capacity remains limited as investors favor debottlenecking and integration with paraxylene units. Europe confronts structural headwinds from high energy costs and tightened emissions schemes. Facility rationalizations, such as Indorama's review of Rotterdam operations, signal a pivot toward specialty grades and recycled feedstock rather than green-field PTA additions. Anti-dumping duties on Asian PET imports offer temporary relief but do not offset the region's feedstock disadvantage.

South America and the Middle East & Africa present emerging growth avenues. Brazil's polyester chain draws attention from multinational players eyeing stakes in Braskem to secure domestic market access. In the Middle East, SABIC's USD 6.4 billion Fujian complex and TotalEnergies' USD 11 billion Amiral project illustrate a strategy to integrate refining, PX and PTA units, then channel output into high-growth Asian markets. These long-cycle investments will gradually widen the geographic footprint of the purified terephthalic acid market, balancing demand clusters against feedstock availability.

- Alpek S.A.B. de C.V.

- BP p.l.c.

- China Petroleum & Chemical Corporation.

- Eastman Chemical Company

- FCFC

- HENGLI PETROCHEMICAL ( DALIAN ) CHEMICAL CO., LTD.

- Indian Oil Corporation Ltd

- Indorama Ventures Public Company Limited.

- INEOS

- JBF Industries Limited

- LOTTE Chemical Corporation.

- Mitsubishi Chemical Corporation.

- Oriental Petrochemical (Taiwan) Co., Ltd.

- PetroChina Company Limited

- Reliance Industries Limited

- SABIC

- Samnam Petrochemical Co.,Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Strong PET packaging demand from e commerce sector

- 4.2.2 Growing production of polyester fiber

- 4.2.3 Growing utilization of PET from the automotive industry

- 4.2.4 Recycled-PET loop mandates

- 4.2.5 Growing usage of Battery separator grade PTA

- 4.3 Market Restraints

- 4.3.1 Toxicological concerns

- 4.3.2 Volatile PX & crude prices

- 4.3.3 Rise of PEF & other bio-polymers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Volume)

- 5.1 By Derivative

- 5.1.1 Polyethylene Terephthalate (PET)

- 5.1.2 Polybutylene Terephthalate (PBT)

- 5.1.3 Polytrimethylene Terephthalate (PTT)

- 5.1.4 Dimethyl Terephthalate (DMT)

- 5.2 By Technology

- 5.2.1 PX Oxidation (Conventional)

- 5.2.2 Bio-based PTA

- 5.2.3 Chemical Recycling-based PTA

- 5.3 By Application

- 5.3.1 Packaging

- 5.3.2 Fibers

- 5.3.3 Paints and Coatings

- 5.3.4 Adhesives

- 5.3.5 Other Applications (Engineering Plastics, Pharmaceuticals and Intermediates, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Alpek S.A.B. de C.V.

- 6.4.2 BP p.l.c.

- 6.4.3 China Petroleum & Chemical Corporation.

- 6.4.4 Eastman Chemical Company

- 6.4.5 FCFC

- 6.4.6 HENGLI PETROCHEMICAL ( DALIAN ) CHEMICAL CO., LTD.

- 6.4.7 Indian Oil Corporation Ltd

- 6.4.8 Indorama Ventures Public Company Limited.

- 6.4.9 INEOS

- 6.4.10 JBF Industries Limited

- 6.4.11 LOTTE Chemical Corporation.

- 6.4.12 Mitsubishi Chemical Corporation.

- 6.4.13 Oriental Petrochemical (Taiwan) Co., Ltd.

- 6.4.14 PetroChina Company Limited

- 6.4.15 Reliance Industries Limited

- 6.4.16 SABIC

- 6.4.17 Samnam Petrochemical Co.,Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

- 7.2 Advancement in Production Technology