|

市场调查报告书

商品编码

1849933

勒索软体防护:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Ransomware Protection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

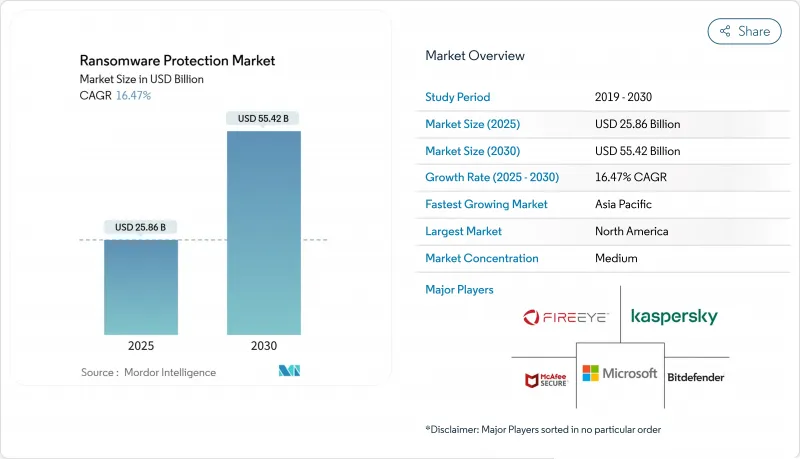

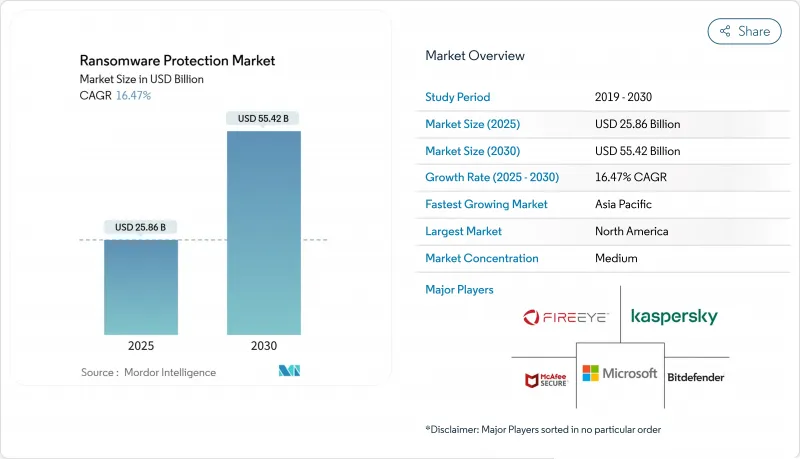

预计到 2025 年反勒索软体市场规模将达到 258.6 亿美元,到 2030 年将达到 554.2 亿美元,复合年增长率为 16.5%。

不断扩张的勒索软体即服务生态系统、三重提取威胁的兴起以及由操作技术驱动的不断扩大的攻击面,持续推动着支出成长势头。企业现在优先考虑整合预防、检测和快速恢復,以便在加密成功的情况下保持业务永续营运。暴露的云端工作负载、日益严格的全球资讯揭露法律以及不断提高的网路保险阈值,正在将预算转向零信任控制、不可变备份和行为分析。随着最终用户青睐将端点、身分、云端和备份功能与託管侦测和回应服务相结合的整合平台,供应商整合正在兴起。

全球反勒索软体市场趋势与洞察

网路钓鱼和针对性攻击激增

生成式人工智慧语音克隆将把传统的网路钓鱼转变为令人信服的“语音钓鱼”,到2025年,凭证洩漏率将上升。 Microsoft Defender XDR 的网路钓鱼分类代理现在会自动标记可疑讯息,使安全团队能够缩短回应週期并提高准确性。金融机构报告称,近期56%的资料外洩是由未修补的VPN漏洞造成的,这促使他们部署用户和实体行为分析来标记异常会话活动。对社会工程对策的日益关注,推动了对电子邮件、端点和身分的持续监控的需求。

勒索软体即服务的繁荣

地下论坛上出售的活跃恶意软体套件中,超过一半是勒索软体变种,RaaS 业者通常会收取 10% 到 40% 的勒索费用。较低的技术门槛使得关联组织能够攻击工业企业,导致以 OT 为重点的事件激增 87%。越来越多的企业订阅威胁情报来源,这些情报来源可以精准定位新兴的关联组织和预发布攻击指标,从而能够在侦测规则被武器化之前更新侦测规则。

免费的基本端点工具可控制费用

Windows 和主流浏览器平台整合的防护功能无需额外付费即可提供基本的恶意软体防护。这些工具很少能够缓解商用勒索软体,并且提供行为分析、欺骗或自动回溯功能。一些小企业主错误地判断了自身的风险敞口,并推迟了付费升级,从而降低了专业供应商的潜在收益。因此,商业供应商强调先进的回应能力、供应链远端检测和保险合格报告,以证明其保费合理。

細項分析

到2024年,本地部署将占总收入的68.7%,这凸显了受到严格监管的企业对合规性和资料主权的需求。即便如此,到2030年,云端订阅量仍将以18.1%的复合年增长率成长。随着买家接受弹性分析和简化更新,云端交付勒索软体防护的市场规模预计将激增。将本地感测器与基于SaaS的关联引擎相结合的混合设计正在成为常态,使团队能够在现场维护遥测资料的同时,充分利用场外外部部署的规模。

自动简介编配缩短了平均恢復时间。 Commvault 的 Cloud Rewind 现在可以在几分钟内恢復整个租户环境,吸引了先前因恢復不确定性而犹豫不决的组织的兴趣。持续的态势监控、整合金钥管理和策略即程式码管道进一步吸引了那些重视 DevSecOps 完整性而非硬体更新週期的开发团队。

端点保护仍是勒索软体防御堆迭中购买率最高的产品,占2024年收入的44.2%。然而,备份和復原的复合年增长率在所有应用组中最高,为17.2%。如果预防层失效,不可变的空气间隙储存库是最后的选择。 ExaGrid的非面向网路层和延迟删除功能就是防止攻击者窜改还原点的设计范例。

电子邮件和 Web 网关模组正在不断发展,其安全存取服务边际架构可透过云端侦测节点路由流量,从而降低分散式员工的延迟。这些平台也内建了网路分段功能,在增强遏制能力的同时,模糊了类别之间的界线。随着买家不断整合平台,供应商正在将先前分散的模组捆绑到统一的许可证中,这种模式正在推动勒索软体防护市场的发展。

勒索软体保护市场报告按部署(本地、云端)、应用程式(端点保护、电子邮件保护等)、最终用户行业(BFSI、医疗保健等)、组织规模(大型企业、中小型企业 (SME))和地区进行细分。

区域分析

2024年,北美将占据36.5%的收入份额,这主要得益于成熟的合规制度以及金融和医疗保健领域庞大的企业预算。关键基础设施强制事件通报等联邦措施进一步提升了基本的安全预期。随着承保方收紧承保要求,美国企业的勒索软体防护市场规模将持续成长。

到 2030 年,亚太地区的复合年增长率将达到 17.4%,位居榜首。澳洲推出新法律,要求披露赎金支付情况,东南亚在 2024 年记录了超过 135,000 起勒索软体案件,这些都凸显了该地区的损失。许多亚太地区的政府已经启动了资助计划,帮助中型企业采用零信任控制,从而加速跨国公司总部以外的采用。

在欧洲,NIS2 指令涵盖多达 15 万个关键营业单位,违规罚款高达 1,000 万欧元。随着欧盟中小企业实施强制性风险评估和供应链监控,预计其在勒索软体防护领域的市场份额将有所提升。同时,随着企业加大对生成式人工智慧分析和违规回应保留金的投资,预计到 2025 年,中东和非洲地区的安全支出将超过 30 亿美元。拉丁美洲的勒索软体感染率远高于全球平均水平,巴西出台了新的法规,要求企业在三天内披露信息,这为託管安全提供商带来了区域机会。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 网路钓鱼和有针对性的攻击日益增多

- 勒索软体即服务(RaaS)的繁荣

- 云端/SaaS迁移扩大了攻击面

- 高阶主管必须购买网路保险

- 实施零信任和微分段

- 资料窃盗与三重勒索手段的兴起

- 市场限制

- 使用免费的基本端点工具节省资金

- 减少赎金支付有利于执法

- 复杂部署所需的网路人才短缺

- 中小企业全端 XDR 整体成本高昂

- 价值链分析

- 监管格局

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

- 评估宏观经济趋势对市场的影响

第五章市场规模及成长预测

- 按部署

- 本地部署

- 云

- 按用途

- 端点保护

- 电子邮件保护

- 网路/网路安全

- 备份和恢復/灾难復原

- 按最终用户产业

- BFSI

- 卫生保健

- 政府和公共部门

- 资讯科技和通讯

- 製造业和工业

- 教育

- 按公司规模

- 大公司

- 小型企业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- CrowdStrike Holdings, Inc.

- Microsoft(Defender/XDR)

- Trend Micro Inc.

- Palo Alto Networks

- SentinelOne

- Sophos Ltd.

- Symantec(Broadcom)

- McAfee LLC

- Kaspersky Lab

- Bitdefender

- FireEye/Trellix

- Zscaler Inc.

- Cisco(Secure Endpoint)

- Fortinet, Inc.

- Acronis International

- Datto(Kaseya)

- Veeam Software

- Barracuda Networks

- Webroot(OpenText)

- Check Point Software

第七章 市场机会与未来展望

The ransomware protection market size stands at USD 25.86 billion in 2025 and is forecast to climb to USD 55.42 billion by 2030, advancing at a 16.5% CAGR.

Expanding ransomware-as-a-service ecosystems, the rise of triple-extortion threats, and a widening operational-technology attack surface keep spending momentum strong. Enterprises now emphasize integrated prevention, detection, and rapid recovery so they can maintain business continuity even when encryption succeeds. Cloud workload exposure, tightening global disclosure laws, and higher cyber-insurance thresholds are shifting budgets toward zero-trust controls, immutable backups, and behavioral analytics. Vendor consolidation intensifies because end users favor unified platforms that blend endpoint, identity, cloud, and backup capabilities with managed detection and response services.

Global Ransomware Protection Market Trends and Insights

Escalating Phishing and Targeted Breaches

Generative-AI voice cloning turns conventional phishing into persuasive "vishing," increasing credential compromise rates in 2025. Microsoft's Phishing Triage Agent in Defender XDR now auto-labels suspicious messages, allowing security teams to shorten response cycles while boosting accuracy. Financial institutions say 56% of recent breaches originated from unpatched VPN flaws, pushing them to deploy user-entity behavior analytics that flag anomalous session activity. Heightened focus on social-engineering countermeasures fuels demand for continuous email, endpoint, and identity monitoring that work in concert rather than in silos.

Ransomware-as-a-Service Boom

More than half of active malware kits sold on underground forums are ransomware variants, and RaaS operators typically collect a 10%-40% cut of every extortion payment. Low technical barriers enable affiliates to attack industrial firms, driving an 87% surge in OT-focused incidents. Enterprises increasingly subscribe to threat-intelligence feeds that pinpoint emerging affiliate groups and pre-release indicators of compromise, allowing them to update detection rules before weaponization.

Free Basic Endpoint Tools Depress Spend

Integrated protections inside Windows and major browser platforms deliver baseline anti-malware at no added cost. While these tools curb commoditized ransomware strains, they rarely offer behavioral analytics, deception, or automated rollback. Some SMB owners, misjudging their exposure, delay paid upgrades, eroding prospective revenue for specialist vendors. Commercial suppliers therefore highlight advanced response functions, supply-chain telemetry, and insurance-eligibility reports to justify premium tiers.

Other drivers and restraints analyzed in the detailed report include:

- Cloud and SaaS Migration Enlarging Attack Surface

- Cyber-Insurance Mandates for Advanced Controls

- Law-Enforcement Wins Cutting Ransom Payments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, on-premises implementations accounted for 68.7% of revenue, underlining compliance and data-sovereignty demands among heavily regulated enterprises. Nevertheless, cloud subscriptions are sprinting forward at an 18.1% CAGR through 2030. The ransomware protection market size for cloud-delivered offerings is projected to rise sharply as buyers embrace elastic analytics and simplified updates. Hybrid designs are now standard, pairing local sensors with SaaS-based correlation engines so teams keep telemetry on-site while leveraging off-premises scale.

Automated snapshot orchestration shortens mean time to recover. Commvault's Cloud Rewind now restores full tenant environments in minutes, rallying interest from organizations that previously hesitated due to recovery uncertainty. Continuous posture monitoring, integrated key management, and policy-as-code pipelines further attract development teams that favor DevSecOps alignment over hardware refresh cycles.

Endpoint protection delivered 44.2% of 2024 revenue and remains the first purchase in any ransomware defence stack. Still, backup and recovery are on track for a 17.2% CAGR, the highest among application groups. Immutable and air-gapped repositories now act as a last-line assurance when prevention layers fail. ExaGrid's non-network-facing tier and delayed delete feature exemplify designs that stop attackers from tampering with restore points.

Email and web-gateway modules evolve via secure access service edge architectures that route traffic through cloud inspection nodes, lowering latency for distributed workforces. Network segmentation features also move into these platforms, blurring lines between categories while strengthening containment. As buyers push toward platform consolidation, vendors bundle previously discrete modules into unified licences, a pattern reinforcing the ransomware protection market momentum.

The Ransomware Protection Market Report is Segmented by Deployment (On-Premises and Cloud), Application (Endpoint Protection, Email Protection, and More), End-User Industry (BFSI, Healthcare, and More), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), and Geography.

Geography Analysis

North America led with 36.5% revenue share in 2024, anchored by mature compliance regimes in finance and healthcare plus sizeable enterprise budgets. Federal initiatives such as mandatory incident reporting for critical infrastructure further elevate baseline security expectations. The ransomware protection market size for United States-based organizations will continue to climb as insurance underwriters harden coverage terms.

Asia-Pacific posts the fastest 17.4% CAGR to 2030. New laws in Australia require ransom-payment disclosures, and Southeast Asia recorded more than 135,000 ransomware cases in 2024, spotlighting regional exposure. Many APAC governments launch subsidy programs that help mid-market firms adopt zero-trust controls, accelerating uptake beyond multinational headquarters.

Europe benefits from the NIS2 directive, which covers up to 150,000 essential entities and sets fines at EUR 10 million for non-compliance. The ransomware protection market share for EU-based SMEs is expected to rise as they implement mandatory risk assessments and supply-chain monitoring. Meanwhile, the Middle East and Africa foresee security outlays exceeding USD 3 billion in 2025 as enterprises invest in generative-AI analytics and breach-response retainers. Latin America grapples with a ransomware involvement rate notably higher than the global average, driving new regulation in Brazil that forces disclosure within three days, thereby enlarging regional opportunity for managed security providers.

- CrowdStrike Holdings, Inc.

- Microsoft (Defender/XDR)

- Trend Micro Inc.

- Palo Alto Networks

- SentinelOne

- Sophos Ltd.

- Symantec (Broadcom)

- McAfee LLC

- Kaspersky Lab

- Bitdefender

- FireEye / Trellix

- Zscaler Inc.

- Cisco (Secure Endpoint)

- Fortinet, Inc.

- Acronis International

- Datto (Kaseya)

- Veeam Software

- Barracuda Networks

- Webroot (OpenText)

- Check Point Software

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating phishing and targeted breaches

- 4.2.2 Ransomware-as-a-Service (RaaS) boom

- 4.2.3 Cloud/SaaS migration enlarging attack surface

- 4.2.4 Cyber-insurance mandates for advanced controls

- 4.2.5 Zero-trust and micro-segmentation adoption

- 4.2.6 Rise of data-exfiltration and triple-extortion tactics

- 4.3 Market Restraints

- 4.3.1 Free basic endpoint tools depress spend

- 4.3.2 Law-enforcement wins cutting ransom payments

- 4.3.3 Cyber-talent shortage for complex roll-outs

- 4.3.4 High total cost of full-stack XDR for SMBs

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

- 4.9 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-Premises

- 5.1.2 Cloud

- 5.2 By Application

- 5.2.1 Endpoint Protection

- 5.2.2 Email Protection

- 5.2.3 Network / Web Security

- 5.2.4 Backup and Recovery / DR

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 Government and Public Sector

- 5.3.4 IT and Telecom

- 5.3.5 Manufacturing and Industrial

- 5.3.6 Education

- 5.4 By Organisation Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 CrowdStrike Holdings, Inc.

- 6.4.2 Microsoft (Defender/XDR)

- 6.4.3 Trend Micro Inc.

- 6.4.4 Palo Alto Networks

- 6.4.5 SentinelOne

- 6.4.6 Sophos Ltd.

- 6.4.7 Symantec (Broadcom)

- 6.4.8 McAfee LLC

- 6.4.9 Kaspersky Lab

- 6.4.10 Bitdefender

- 6.4.11 FireEye / Trellix

- 6.4.12 Zscaler Inc.

- 6.4.13 Cisco (Secure Endpoint)

- 6.4.14 Fortinet, Inc.

- 6.4.15 Acronis International

- 6.4.16 Datto (Kaseya)

- 6.4.17 Veeam Software

- 6.4.18 Barracuda Networks

- 6.4.19 Webroot (OpenText)

- 6.4.20 Check Point Software

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment