|

市场调查报告书

商品编码

1849939

云端基础电子邮件安全:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Cloud-based Email Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

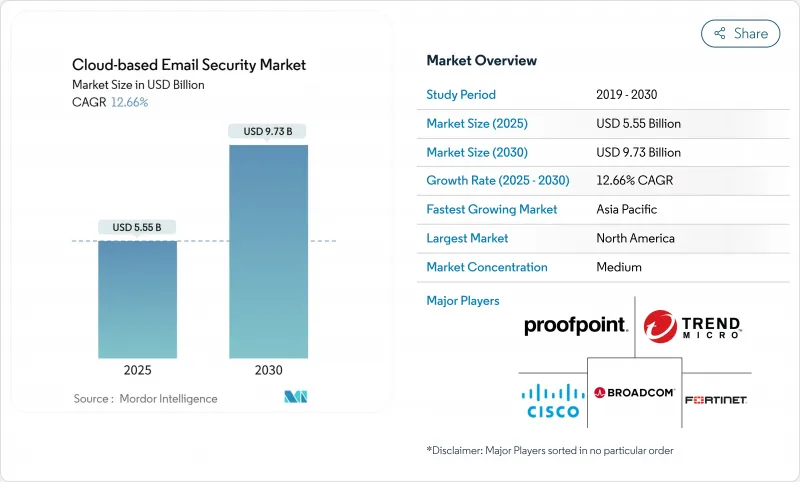

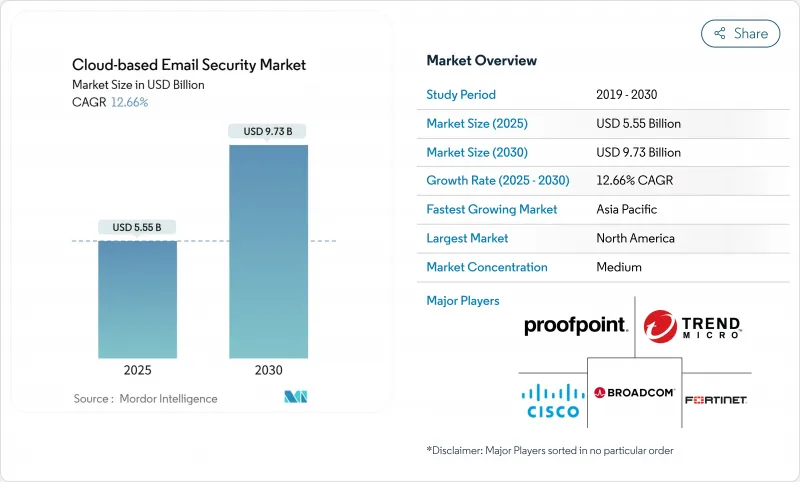

预计到 2025 年,云端基础的电子邮件安全市场规模将达到 55.5 亿美元,到 2030 年将达到 97.3 亿美元,复合年增长率为 12.7%。

从安全电子邮件闸道到整合 API 的云端原生平台的快速转型正在推动这一成长。量子级加密要求和诸如 NIS 2 指令等日益严格的区域性强制性规定,促使企业将 9% 的 IT 预算用于资讯安全。企业也优先考虑行为分析,以应对生成式人工智慧深度造假电子邮件,而经济高效的云端交付模式正在加速中小企业的采用。最后,以 Proofpoint 以 10 亿美元收购 Hornetsecurity 为例的策略性供应商整合,标誌着一场旨在提供以人性化的整合式保护的竞赛正在进行,这将填补全球 480 万网路安全人才缺口。

全球云端基础电子邮件安全市场趋势与洞察

人工智慧赋能的网路钓鱼和商业电子邮件诈骗攻击日益猖獗

生成式人工智慧工具使攻击者能够精心製作模仿高阶主管语气和发送时间的客製化电子邮件,导致网路钓鱼成功率高达 60%,预计到 2024 年,商业电子邮件洩漏造成的损失将达到 29 亿美元。暗网上出售的钓鱼套件包中有 75% 宣称具备人工智慧功能,显示网路威胁的经济效益日益增长。在医疗保健领域,人工智慧驱动的商业电子邮件诈骗事件激增 279%,平均每次事件造成的损失高达 12.5 万美元。因此,各组织正在部署自然语言处理引擎来建立通讯模式基准并标记语言异常。由于员工仍然是抵御复杂诱饵的最后查核点,因此行为意识提升培训计画是对科技的强力补充。

从SEG快速迁移到基于API的ICES

70% 的企业正在积极地以整合式云端电子邮件安全平台取代其安全电子邮件网关,这些平台透过 API 直接连接到 Microsoft 365 和 Google Workspace。 API 整合无需重新路由电子邮件流即可提供内部流量和使用者行为的可见性,从而使客户环境中的侦测效率提高 30%。来自云端套件的远端检测会提供给机器学习模型,该模型可在几分钟内隔离被盗用的帐户。供应商合作伙伴关係,例如 Proofpoint 与 Azure 安全 API 的集成,正在将部署时间从数月缩短至数天,从而加速架构迁移。

云端保全行动领域持续存在的技能缺口

全球共有550万网路安全专业人员,但仍有480万的缺口,90%的公司表示云端安全和人工智慧安全专业人员是最难招募的。欧盟网路安全和资讯安全局(ENISA)已证实,99%的云端安全故障是由客户配置错误造成的,而非服务提供者的缺陷。金融服务和科技公司的职缺率约28%,而需要专门调优的行为分析工具的部署也较为落后。因此,许多公司正在转向託管安全服务和人工智慧辅助工具来填补人手不足,但自动化仍需要策略管治方面的监督。

细分市场分析

至2024年,过滤和反垃圾邮件将占云端基础电子邮件安全市场41.5%的份额。然而,预防资料外泄)预计将以13.5%的复合年增长率(CAGR)实现最快成长。这主要是由于远距办公导致电子邮件工作流程中非结构化资料的暴露速度加快。目前,各组织机构正着重强调上下文感知型DLP,它能够即时追踪内容、使用者和位置元资料,从而取代传统的正规表示式模式匹配。恶意软体和进阶威胁防护服务正在整合大规模语言模型,这些模型能够扫描附件中的行为指标,而非静态签章。加密和代币化服务也在快速扩展,迅速整合后量子演算法,以应对美国标准与技术研究院(NIST)的过渡计画。总而言之,这些转变标誌着安全策略正从边界防御转向以资料为中心的管理。

随着 HIPAA 和 PCI-DSS 等法律规范的不断扩展,企业需要记录和审核透过电子邮件传输的资料。谷歌为企业 Gmail 用户提供的端对端加密服务,显示供应商正在将合规性融入预设配置中。云端基础电子邮件安全产品不仅能够应对外部攻击手法,还能应对内部风险,其在总支出中的份额预计将会成长。供应商还将安全意识提升培训模组与安全策略执行机制捆绑在一起,并建立整合平台,以减少警报疲劳和合规成本。

到2024年,安全电子邮件闸道仍将占总营收的55.6%,但支援API的整合式云端电子邮件安全解决方案预计将以13.9%的复合年增长率成长,这反映了云端原生套件中网关代理程式的架构限制。 ICES可直接连接到Microsoft 365和Google Workspace以分析内部流量,进而将社交工程的侦测率提高30%。云端原生电子邮件安全平台还提供自动扩充功能,使其对突发性工作负载和地理位置分散的团队极具吸引力。在严格监管的行业,混合方案正逐渐普及,该方案保留本地网关用于合规性日誌记录,同时透过API进行封装以进行行为分析。

随着伙伴关係的深化,例如微软近期与Proofpoint扩展了基于Azure的威胁讯号共用,客户可以获得整合遥测数据,这些数据可提供给下游的XDR平台,从而使事件平均检测时间缩短高达40%。受API优先部署模式的驱动,云端基础电子邮件安全市场预计到2029年(装置更新週期结束时)将超过SEG的分配规模。

区域分析

北美将在2024年引领云端基础电子邮件安全市场,占38.6%的市场。微软365的普及和高事件揭露率推动了投资,而严格的资料外洩通知期限则促使自动化回应工具的快速部署。该地区正经历供应商整合加剧和更广泛的平台涌现,这些平台可在单一合约下提供电子邮件、终端和身分安全服务。美国网路安全战略等政府指令正在推动零信任电子邮件架构的发展,从而支撑着持续的需求。

亚太地区正经历快速的数位转型,并占全球网路攻击的31%,预计到2030年将以13.0%的复合年增长率(CAGR)领先全球。中国和日本预计到2028年将以16.9%的复合年增长率成长,这主要得益于资料在地化需求推动了对嵌入国家特定资料中心的电子邮件安全控制的主权云端实例的需求。印度正崛起为成长热点,这得益于其不断扩张的IT服务业以及政府主导的「数位印度」计划,该计划为网路安全投资提供税收优惠。

欧洲的发展势头取决于严格的监管:GDPR 对电子邮件资料外洩的罚款以及新的 NIS 2 指令已将安全支出推高至 IT 预算的 9% 左右。德国和法国公司要求供应商提供动态加密技术和通过 ESG检验的资料中心。在其他地区,南美和中东及非洲仍是发展中市场,但由于云端供应商的区域扩张和勒索软体的兴起,这些地区的采用率正在逐步提高。随着超大规模云端服务商开放本地可用区,延迟门槛正在降低,电子邮件安全服务也将符合新的资料居住法规。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 人工智慧驱动的网路钓鱼和商业电子邮件诈骗攻击日益增多

- 从SEG快速迁移到基于API的ICES

- 云端交付的成本和敏捷性优势

- 利用生成式人工智慧製作深度造假电子邮件

- 抗量子密码学的迫切性

- ESG主导Carbonite电子邮件安全的需求

- 市场限制

- 云端保全行动领域持续存在技能缺口

- 延迟和数据主权合规性障碍

- 多重云端中的可利用错误配置

- 基于人工智慧的沙盒规避的兴起

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估宏观经济趋势对市场的影响

第五章 市场规模与成长预测

- 按服务类型

- 过滤和反垃圾邮件

- 恶意软体和进阶威胁防护

- 预防资料外泄

- 加密和令牌化

- 其他的

- 透过平台集成

- 安全电子邮件闸道 (SEG)

- 整合云端电子邮件安全 (ICES/API)

- 云端原生电子邮件安全平台

- 混合网关和 API

- 按组织规模

- 大公司

- 小型企业

- 按行业

- BFSI

- 政府和国防部

- 资讯科技和通讯

- 医疗保健和生命科学

- 零售与电子商务

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度分析

- 策略倡议与发展

- 市占率分析

- 公司简介

- Barracuda Networks Inc.

- Proofpoint Inc.

- Mimecast Ltd.

- Cisco Systems Inc.

- Trend Micro Inc.

- Microsoft Corporation

- Google LLC(Google Cloud)

- Fortinet Inc.

- Broadcom Inc.(Symantec)

- Check Point Software Technologies Ltd.

- Sophos Group PLC

- Forcepoint LLC

- Dell Technologies Inc.

- Zscaler Inc.

- Cloudflare Inc.

- Ironscales Ltd.

- Egress Software Technologies Ltd.

- Trellix(Musarubra US LLC)

- OpenText Cybersecurity

第七章 市场机会与未来展望

The cloud-based email security market size stands at USD 5.55 billion in 2025 and is forecast to expand to USD 9.73 billion by 2030, registering a 12.7% CAGR.

A rapid pivot from secure email gateways to API-integrated, cloud-native platforms underpins this growth as enterprises confront AI-powered phishing campaigns that post 24% higher success rates than human-crafted attacks. Quantum-resilient encryption requirements and regionally tighter mandates such as the NIS 2 Directive are pushing organizations to direct 9% of IT budgets to information security. Enterprises also prioritize behavioral analytics to counter generative-AI deepfake emails, while cost-efficient cloud delivery models accelerate adoption among small and mid-sized businesses. Finally, strategic vendor consolidation-exemplified by Proofpoint's USD 1 billion agreement for Hornetsecurity-signals a race to deliver integrated, human-centric protection that fills the 4.8 million global cybersecurity workforce gap.

Global Cloud-based Email Security Market Trends and Insights

Rise in AI-driven phishing and BEC attacks

Generative-AI tooling now allows adversaries to craft tailored emails that mimic executive tone and timing, driving phishing success rates to 60% and pushing 2024 business email compromise losses to USD 2.9 billion. Seventy-five percent of phishing kits marketed on the dark web advertise AI functionality, underscoring an industrialized threat economy. Healthcare recorded a 279% jump in AI-enabled BEC incidents with average losses of USD 125,000 per case. Organizations therefore deploy natural-language processing engines that baseline communication patterns and flag linguistic anomalies. Behavioral awareness programs complement technology as employees remain the final checkpoint against well-crafted lures.

Rapid migration from SEG to API-based ICES

Seventy percent of enterprises are actively replacing secure email gateways with Integrated Cloud Email Security platforms that connect directly into Microsoft 365 or Google Workspace via APIs. API integration brings visibility into internal traffic and user behavior without mail-flow rerouting, improving detection efficacy by 30% in customer environments. Real-time telemetry from cloud suites feeds machine-learning models that isolate compromised accounts within minutes. Vendor alliances-such as Proofpoint's integration with Azure security APIs-lower deployment timelines from months to days, hastening the architectural shift.

Persistent skills gap in cloud-security operations

The global workforce counts 5.5 million cybersecurity professionals, yet faces a 4.8 million shortfall, and 90% of companies cite cloud and AI security expertise as the hardest to hire. ENISA confirms that 99% of cloud security failures originate from customer misconfigurations rather than provider flaws. Financial services and technology firms hold vacancy rates around 28%, slowing the rollout of behavioral analytics tools that demand specialized tuning. Many organizations therefore shift to managed security services and AI-assisted tooling to offset human shortages, though automation still requires oversight for policy governance.

Other drivers and restraints analyzed in the detailed report include:

- Cost and agility benefits of cloud delivery

- Generative-AI deepfake emails

- Latency and data-sovereignty compliance hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Filtering and Anti-Spam retained 41.5% of the cloud-based email security market in 2024. Data Loss Prevention, however, is projected to grow fastest at 13.5% CAGR because remote work accelerates unstructured data exposure in email workflows. Organizations now value context-aware DLP that tracks content, user, and location metadata in real time, replacing legacy regex pattern matching. Malware and Advanced Threat Protection services integrate large language models that scan attachments for behavioral indicators rather than static signatures. Encryption and Tokenization offerings expand as early movers embed post-quantum algorithms, preparing customers for National Institute of Standards and Technology transition timelines. Collectively, these shifts mark a pivot from perimeter defense to data-centric controls.

Expanding regulatory frameworks such as HIPAA and PCI-DSS compel enterprises to log and audit email-borne data flows. Google's delivery of end-to-end encryption for Gmail enterprise users illustrates how vendors package compliance inside default settings. The cloud-based email security market size for DLP-driven offerings is expected to capture a rising share of total spend as organizations tackle insider risk alongside external threat vectors. Vendors also bundle security-awareness training modules that reinforce policy adherence, creating unified platforms that reduce alert fatigue and compliance overhead.

Secure Email Gateways still controlled 55.6% revenue in 2024, yet API-enabled Integrated Cloud Email Security solutions are forecast to rise at 13.9% CAGR, reflecting architectural limitations of gateway proxies in cloud-native suites. ICES connects directly into Microsoft 365 and Google Workspace to analyze internal traffic, delivering 30% uplift in social-engineering detection rates. Cloud-native email security platforms also auto-scale, making them attractive for burst workloads and geographically distributed teams. Hybrid approaches persist where heavily regulated sectors maintain on-prem gateways for compliance logging but wrap APIs for behavioral analytics.

As partnerships deepen-Microsoft recently extended Azure-based threat-signal sharing with Proofpoint-customers gain unified telemetry that feeds downstream XDR platforms. Resulting efficiencies shorten mean-time-to-detect incidents by up to 40%. The cloud-based email security market size attached to API-first deployments is projected to overtake SEG allocations before 2029 as refresh cycles retire appliance footprints.

The Cloud-Based Email Security Market Report is Segmented by Service Type (Filtering and Anti-Spam, Malware and Advanced Threat Protection, and More), Platform Integration (Secure Email Gateway (SEG), and More), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), Industry Vertical (BFSI, Government and Defense, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the cloud-based email security market with 38.6% revenue in 2024. Widespread Microsoft 365 adoption and high incident disclosure rates drive investment, while tight breach-notification windows compel rapid deployment of automated response tooling. Vendor consolidation in the region accelerates platform breadth, offering bundled email, endpoint, and identity security under single contracts. Government directives such as the US Cybersecurity Strategy promote zero-trust email architectures, underpinning continued demand.

Asia-Pacific is forecast for the highest 13.0% CAGR through 2030 amid rapid digital transformation and the region's 31% share of global cyberattacks. China and Japan together are projected to expand at 16.9% CAGR through 2028 as data-localization requirements fuel demand for sovereign cloud instances that embed email security controls in country-specific data centers. India emerges as a growth hotspot, buoyed by its expanding IT services sector and government-led "Digital India" program that offers tax incentives for cybersecurity investment.

Europe's momentum rests on stringent regulations: GDPR fines for data-exfiltration via email and the new NIS 2 Directive have elevated security spending to 9% of IT budgets on average. Organizations in Germany and France push suppliers for quantum-resilient encryption and ESG-validated data centers. Elsewhere, South America and the Middle East and Africa remain nascent markets, yet cloud vendor region launches combined with rising ransomware incidents foster gradual uptake. As hyperscalers open local availability zones, latency barriers fall, and email security services become compliant with emerging data-residency laws.

- Barracuda Networks Inc.

- Proofpoint Inc.

- Mimecast Ltd.

- Cisco Systems Inc.

- Trend Micro Inc.

- Microsoft Corporation

- Google LLC (Google Cloud)

- Fortinet Inc.

- Broadcom Inc. (Symantec)

- Check Point Software Technologies Ltd.

- Sophos Group PLC

- Forcepoint LLC

- Dell Technologies Inc.

- Zscaler Inc.

- Cloudflare Inc.

- Ironscales Ltd.

- Egress Software Technologies Ltd.

- Trellix (Musarubra US LLC)

- OpenText Cybersecurity

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in AI-driven phishing and BEC attacks

- 4.2.2 Rapid migration from SEG to API-based ICES

- 4.2.3 Cost and agility benefits of cloud delivery

- 4.2.4 Generative-AI-powered deepfake emails

- 4.2.5 Urgency around quantum-resilient encryption

- 4.2.6 ESG-driven demand for carbon-light email security

- 4.3 Market Restraints

- 4.3.1 Persistent skills gap in cloud-security ops

- 4.3.2 Latency and data-sovereignty compliance hurdles

- 4.3.3 Exploitable mis-configurations in multi-cloud

- 4.3.4 Emerging AI-based evasion of sandboxing

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Filtering and Anti-Spam

- 5.1.2 Malware and Advanced Threat Protection

- 5.1.3 Data Loss Prevention

- 5.1.4 Encryption and Tokenization

- 5.1.5 Others

- 5.2 By Platform Integration

- 5.2.1 Secure Email Gateway (SEG)

- 5.2.2 Integrated Cloud Email Security (ICES/API)

- 5.2.3 Cloud-Native Email Security Platform

- 5.2.4 Hybrid Gateway and API

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Industry Vertical

- 5.4.1 BFSI

- 5.4.2 Government and Defense

- 5.4.3 IT and Telecommunications

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Retail and E-Commerce

- 5.4.6 Other Industry Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Barracuda Networks Inc.

- 6.4.2 Proofpoint Inc.

- 6.4.3 Mimecast Ltd.

- 6.4.4 Cisco Systems Inc.

- 6.4.5 Trend Micro Inc.

- 6.4.6 Microsoft Corporation

- 6.4.7 Google LLC (Google Cloud)

- 6.4.8 Fortinet Inc.

- 6.4.9 Broadcom Inc. (Symantec)

- 6.4.10 Check Point Software Technologies Ltd.

- 6.4.11 Sophos Group PLC

- 6.4.12 Forcepoint LLC

- 6.4.13 Dell Technologies Inc.

- 6.4.14 Zscaler Inc.

- 6.4.15 Cloudflare Inc.

- 6.4.16 Ironscales Ltd.

- 6.4.17 Egress Software Technologies Ltd.

- 6.4.18 Trellix (Musarubra US LLC)

- 6.4.19 OpenText Cybersecurity

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment