|

市场调查报告书

商品编码

1849959

汽车感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

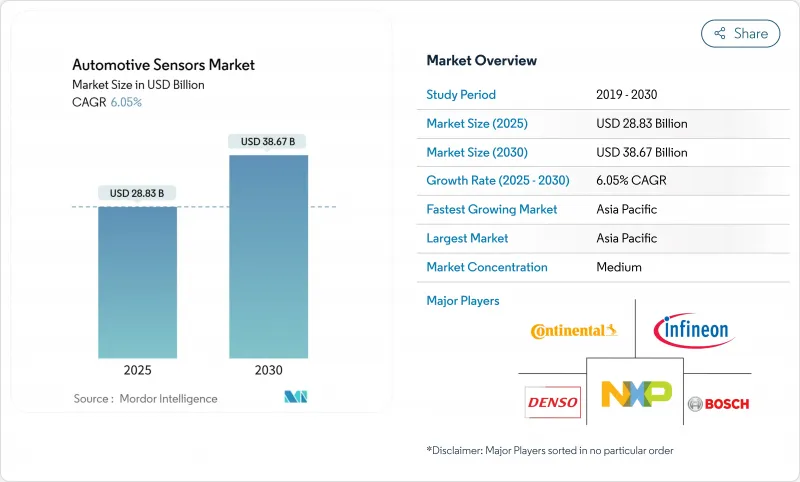

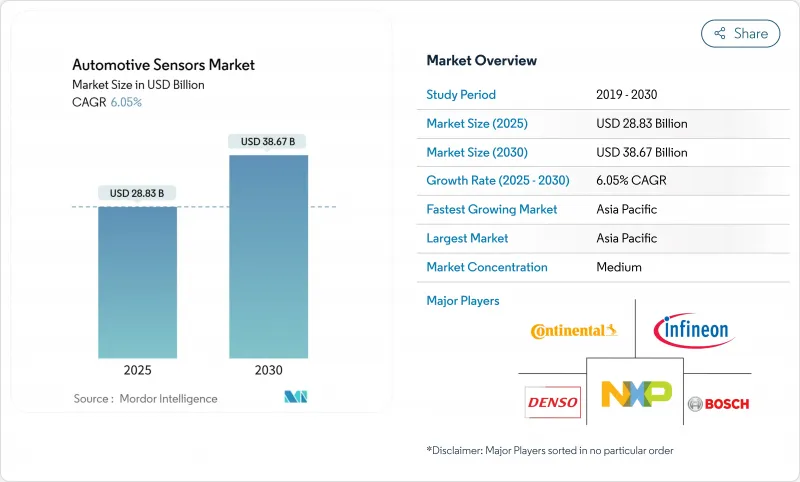

预计汽车感测器市场规模到 2025 年将达到 288.3 亿美元,到 2030 年将达到 386.7 亿美元,复合年增长率为 6.05%。

市场成长的动力源自于ADAS(高阶驾驶辅助系统)的加速部署、新增感测点的电气化指令,以及半导体产业大规模提供高性价比电子机械系统 (MEMS) 的能力。高价位的感知技术正在取代传统组件,尤其是在推进系统中。降低排放气体和防撞性能的监管压力正在稳定需求,而MEMS平均售价 (ASP) 的下降正在降低汽车各细分市场的采用门槛。因此,汽车感测器市场正在从基本的测量功能发展到能够在本地处理数据的智慧互联边缘设备。

全球汽车感测器市场趋势与洞察

ADAS 和自动驾驶感应器的普及

在未来的安全评估中,自动紧急煞车、车道维持辅助和行人侦测将推动每辆车感知器数量的增加。半导体发展蓝图预测,到2027年,ADAS将占汽车晶片需求的近三分之一,届时L2+等级功能将成为常态。中国品牌正透过以最低成本捆绑ADAS套件来加剧价格竞争,迫使全球供应商在不影响性能的情况下降低系统价格。雷达、光达和摄影机融合的侦测精度接近99.97%,产生Terabyte的资料负载,这些资料负载越来越多地在感测器边缘进行处理,以减少延迟。因此,边缘AI功能将成为汽车感测器市场的下一个差异化槓桿。

排放和安全法规推动压力和气体感测器

美国环保署的2027-2032法规要求减少50%的温室气体排放,因此需要即时监测废气后处理效率。并行的氢动力汽车法规(FMVSS 307/308)对新燃油系统增加了压力和洩漏检测要求。欧7扩大了颗粒物和氮氧化物法规,刺激了对精密气体感测器的需求;英国的Progressive Safe系统为重型卡车引入了盲点侦测功能,以保护弱势道路使用者。重迭的法规缩短了设计窗口,确保了对高精度压力和气体感测器的多年需求。

大众市场汽车的感测器成本压力

2023年至2029年间,汽车的平均半导体含量将快速成长,这将挤压价格敏感型细分市场的原始设备製造商利润。低成本的中国电动车品牌已经免费提供全套ADAS套件,这给现有供应商带来了更大的价格压力。因此,一级感测器製造商必须整合功能、缩小封装尺寸,并采用系统晶片设计,才能在不影响盈利的情况下创造价值。

細項分析

惯性感测器占2024年收入的28.13%,因为加速计和陀螺仪为电子稳定控制、导航和ADAS堆迭提供动力。更高解析度的惯性测量单元(IMU)现在正被纳入区域架构,供应商正在整合符合AEC-Q100 1级标准的自我诊断功能,以减少布线和整体系统重量。磁感测器用于电动车牵引马达控制,而气体感测器则用于处理排放和座舱空气调节。压力和温度感测器的应用范围正在从内燃机扩展到电池热失控检测。

加速系统级整合:整合加速计、陀螺仪和磁力计功能的封装可减少SKU数量,并简化OEM厂商的认证週期。随着MEMS平均售价的下降,惯性装置对于大众市场车辆而言已具备经济可行性,而边缘AI模组也正在片上出现,用于在本地预过滤运动数据。每增加一层自主性,都需要更精细的运动识别,到2030年,这个基础类别的复合年增长率将达到6.47%。

动力传动系统总成感测在燃油计量、点火、涡轮增压和后处理控制中发挥着至关重要的作用,到2024年将占据总营收的40.55%。然而,由于纯电动车架构淘汰了多项传统测量技术,其长期成长将放缓。相较之下,远端资讯处理感测器的复合年增长率将达到8.86%,这是最快的,因为基于使用情况的保险和车辆优化系统利用GPS、加速计和OBD资料流,可将碰撞频率降低高达43%。

随着舒适性功能的日益普及,车身电子将保持中等个位数成长,车辆安全也将从警报器发展到整合式入侵侦测雷达。软体定义汽车的价值将从机械驱动转向数据驱动,原始设备製造商将透过预测性维护订阅服务,越来越多地将感测器有效载荷转化为收益。这种调整将缓解纯动力传动系统需求的下降,并将收益多元化,转向互联服务。

区域分析

预计亚太地区将在2024年以42.30%的营收份额领先,并在2030年之前以9.10%的最快复合年增长率增长。中国目前已生产全球约62%的电动车和77%的电池,为感测器提供了庞大的国内市场,并保证了规模优势。比亚迪等产业龙头企业生产的半导体(包括摄影机和电磁设备)高达70%来自本土,从而增强了其本地供应环路。日本正在利用数十年的感测器技术,同时透过政府激励措施吸引新的晶圆产能,而台湾的代工厂对于尖端MEMS生产仍然至关重要。政府补贴和积极的电气化目标将促进该地区的扩张。

在严格的安全法规和晶片製造在地化资金的推动下,北美正专注于高端ADAS。 《晶片法案》(CHIPS Act) 的资本津贴和税收优惠减少了对海外代工厂的依赖,并支持了具有韧性的供应基础。美国国家公路交通安全管理局 (NHTSA) 将 ADAS 指标纳入其新车评估计划,确保 2026 年及以后车型的关键感测器基准纳入标准,从而支持各类车型的稳定需求。

在欧洲,对排放合规性和城市安全法规的重视,正在推动乘用车和重型卡车感测器密度的提高。欧7法规和不断升级的安全系统要求为气体侦测和盲点解决方案创造了新的机会。同时,来自中国进口电动车的成本竞争迫使欧洲供应商在不牺牲精度的情况下加快降低成本的步伐,这为汽车感测器市场创造了一个充满挑战但又充满创新的环境。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- ADAS和自动驾驶感应器的普及

- 排放气体和安全措施要求安装驱动压力/气体感知器

- 电动汽车热电池感测器的繁荣

- MEMS 平均售价下降,使大规模应用成为可能

- 支援OTA的自我诊断智慧感测器

- 基于使用情况的保险远端资讯处理需求

- 市场限制

- 量产车辆的感知器成本压力

- 半导体晶圆供应波动

- ADAS 责任问题推迟了新的感测器规范

- 感测器资料收益的资料隐私限制

- 价值/供应链分析

- 监管格局

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测

- 按类型

- 温度感测器

- 压力感测器

- 速度感测器

- 液位/位置感知器

- 磁感测器

- 气体感测器

- 惯性感测器

- 按用途

- 动力传动系统

- 车身电子

- 车辆安全系统

- 远端资讯处理

- 按车辆类型

- 搭乘用车

- 商用车

- 推进技术

- 内燃机汽车

- 纯电动车(BEV)

- 插电式混合动力汽车(PHEV)

- 燃料电池电动车(FCEV)

- 按销售管道

- OEM 安装的传感器

- 售后市场

- 按地区

- 北美洲

- 美国

- 加拿大

- 其他北美地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 中东和非洲

- 土耳其

- GCC

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Robert Bosch GmbH

- DENSO Corporation

- Continental AG

- Infineon Technologies AG

- NXP Semiconductors NV

- Sensata Technologies PLC

- Texas Instruments Inc.

- Analog Devices Inc.

- Aptiv PLC

- ST Microelectronics NV

- Valeo SA

- Honeywell International Inc.

- Allegro MicroSystems LLC

- Murata Manufacturing Co.

- CTS Corporation

- Littelfuse Inc.

- ON Semiconductor Corp.

- TE Connectivity Ltd.

- Autoliv Inc.

- Melexis NV

第七章 市场机会与未来展望

The automotive sensors market reached USD 28.83 billion in 2025 and is forecast to climb to USD 38.67 billion by 2030 on a 6.05% CAGR.

The market's growth is anchored in accelerating deployments of advanced driver-assistance systems (ADAS), electrification mandates that add new sensing points, and the semiconductor industry's ability to deliver cost-effective micro-electromechanical systems (MEMS) at scale. Momentum also reflects the shift from mechanical to electronic sensing, particularly in propulsion systems, where premium-priced perception technologies replace legacy components. Regulatory pressure for emissions reduction and crash-avoidance performance keeps demand steady, while falling average selling prices (ASPs) for MEMS lower adoption barriers across vehicle segments. The automotive sensors market, therefore, evolves from basic measurement functions toward intelligent, connected edge devices able to process data locally.

Global Automotive Sensors Market Trends and Insights

ADAS and autonomous-driving sensor proliferation

Automatic emergency braking, lane-keeping assist, and pedestrian detection in upcoming safety ratings drive higher sensor counts per vehicle. Semiconductor roadmaps anticipate that ADAS will capture nearly one-third of automotive chip demand by 2027 as Level 2+ functions become standard. Chinese brands intensify price competition by bundling full ADAS suites at minimal cost, compelling global suppliers to slash system prices without eroding performance. Radar, LiDAR, and camera fusion are about to reach 99.97% detection accuracy, yet create terabyte-scale data loads that are increasingly processed at the sensor edge to cut latency. Edge AI capability, therefore, becomes the next differentiation lever in the automotive sensors market.

Emission and safety mandates driving pressure / gas sensors

The U.S. Environmental Protection Agency's 2027-2032 rules require a 50% cut in greenhouse-gas output, forcing real-time sensing of exhaust after-treatment efficiency. Parallel hydrogen-vehicle regulations (FMVSS 307/308) add pressure and leak-detection requirements for new fuel systems. Euro 7 extends particulate and NOx limits, spurring precision gas-sensor demand, while the U.K. Progressive Safe System introduces blind-spot sensing on heavy trucks to protect vulnerable road users. The overlapping mandates tighten design windows and secure multi-year demand for high-accuracy pressure and gas sensors.

Sensor cost pressure on mass-market vehicles

Between 2023 and 2029, vehicles are set to see a swift uptick in their average semiconductor content, compressing OEM margins in price-sensitive segments. Low-cost Chinese EV brands already offer full ADAS suites at no extra charge, escalating pricing pressure on established suppliers. Tier-one sensor makers must, therefore, integrate functions, shrink packages, and adopt system-on-chip designs to deliver value without eroding profitability.

Other drivers and restraints analyzed in the detailed report include:

- EV thermal-battery sensing boom

- Falling MEMS ASP enabling mass adoption

- Semiconductor wafer-supply volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Inertial sensors generated 28.13% of 2024 revenue because accelerometers and gyroscopes anchor electronic stability control, navigation, and ADAS stacks. Higher-resolution inertial measurement units (IMUs) are now embedded inside zonal architectures, and suppliers integrate self-diagnostics that meet AEC-Q100 grade 1 to cut cabling and lower overall system weight. Magnetic sensors gain traction in EV traction-motor control, while gas sensors rebound on emissions and cabin-air mandates. Pressure and temperature sensors expand beyond combustion engines into battery thermal-runaway detection.

System-level integration is accelerating: combo packages merge accelerometer, gyroscope, and magnetometer functions, reducing OEM SKU counts and simplifying qualification cycles. Falling MEMS ASPs keep inertial devices economically feasible for mass-market cars, and edge AI blocks are starting to appear on-die to pre-filter motion data locally. The net result is a sustainable 6.47% CAGR through 2030 for this cornerstone category, as every additional autonomy layer requires finer motion awareness.

Powertrain sensing delivered 40.55% of 2024 revenue, through indispensable roles in fuel metering, ignition, turbo boost, and after-treatment control. Yet battery-electric architectures omit several legacy measurements, softening long-range growth. In contrast, telematics sensors post the quickest 8.86% CAGR as usage-based insurance and fleet optimization adopt GPS, accelerometer, and OBD data streams to lower crash frequency by up to 43%.

Body electronics maintain mid-single-digit expansion as comfort functions proliferate, and vehicle security evolves from alarms to integrated intrusion-detection radar. Software-defined vehicles shift value from mechanical actuation to data, and OEMs increasingly monetize sensor payloads via predictive-maintenance subscriptions. This realignment cushions the tapering of pure powertrain demand and diversifies revenue toward connected services.

The Automotive Sensors Market is Segmented by Vehicle Type (Passenger Cars, and Commercial Vehicles), Type (Temperature Sensors, Pressure Sensors, and More), Application (Powertrain, Body Electronics, and More), Propulsion Technology (ICE Vehicles, Battery-Electric Vehicles (BEV), and More), Sales Channel (OEM-Fitted Sensors, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 42.30% revenue share in 2024 and is expected to post the quickest 9.10% CAGR to 2030. China already manufactures around 62% of global EVs and 77% of batteries, providing a vast indigenous market for sensors and guaranteeing scale advantages. Vertically integrated champions such as BYD build up to 70% of semiconductor content in-house, including camera and electromagnetic devices, tightening local supply loops. Japan leverages decades of sensor know-how while attracting new wafer capacity via government incentives, and Taiwan's foundries remain pivotal to leading-edge MEMS production. Government subsidies and aggressive electrification targets reinforce the region's expansion.

North America maintains a premium ADAS focus, aided by robust safety regulations and funding to localize chip fabrication. The CHIPS Act's capital grants plus tax incentives reduce reliance on overseas foundries, supporting a resilient supply base. NHTSA's added ADAS metrics under the New Car Assessment Program guarantee baseline installation of critical sensors from model-year 2026 onwards, underpinning steady demand across vehicle classes.

Europe emphasizes emissions compliance and urban-safety mandates that raise sensor density in both passenger cars and heavy trucks. Euro 7 rules and Progressive Safe System requirements trigger new opportunities for gas detectors and blind-spot solutions. At the same time, cost competition from imported Chinese EVs forces European suppliers to accelerate cost-down initiatives without sacrificing precision, creating a challenging but innovation-rich environment for the automotive sensors market.

- Robert Bosch GmbH

- DENSO Corporation

- Continental AG

- Infineon Technologies AG

- NXP Semiconductors NV

- Sensata Technologies PLC

- Texas Instruments Inc.

- Analog Devices Inc.

- Aptiv PLC

- ST Microelectronics NV

- Valeo SA

- Honeywell International Inc.

- Allegro MicroSystems LLC

- Murata Manufacturing Co.

- CTS Corporation

- Littelfuse Inc.

- ON Semiconductor Corp.

- TE Connectivity Ltd.

- Autoliv Inc.

- Melexis NV

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 ADAS and autonomous-driving sensor proliferation

- 4.2.2 Emission and safety mandates driving pressure / gas sensors

- 4.2.3 EV thermal-battery sensing boom

- 4.2.4 Falling MEMS ASP enabling mass adoption

- 4.2.5 OTA-ready self-diagnostic smart sensors

- 4.2.6 Usage-based-insurance telematics demand

- 4.3 Market Restraints

- 4.3.1 Sensor cost pressure on mass-market vehicles

- 4.3.2 Semiconductor wafer-supply volatility

- 4.3.3 ADAS liability delaying new sensor specs

- 4.3.4 Data-privacy limits to sensor-data monetisation

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Type

- 5.1.1 Temperature Sensors

- 5.1.2 Pressure Sensors

- 5.1.3 Speed Sensors

- 5.1.4 Level / Position Sensors

- 5.1.5 Magnetic Sensors

- 5.1.6 Gas Sensors

- 5.1.7 Inertial Sensors

- 5.2 By Application

- 5.2.1 Powertrain

- 5.2.2 Body Electronics

- 5.2.3 Vehicle Security Systems

- 5.2.4 Telematics

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Propulsion Technology

- 5.4.1 ICE Vehicles

- 5.4.2 Battery-Electric Vehicles (BEV)

- 5.4.3 Plug-in Hybrid Vehicles (PHEV)

- 5.4.4 Fuel-cell Electric Vehicles (FCEV)

- 5.5 By Sales Channel

- 5.5.1 OEM-fitted Sensors

- 5.5.2 Aftermarket

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Turkey

- 5.6.5.2 GCC

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Robert Bosch GmbH

- 6.4.2 DENSO Corporation

- 6.4.3 Continental AG

- 6.4.4 Infineon Technologies AG

- 6.4.5 NXP Semiconductors NV

- 6.4.6 Sensata Technologies PLC

- 6.4.7 Texas Instruments Inc.

- 6.4.8 Analog Devices Inc.

- 6.4.9 Aptiv PLC

- 6.4.10 ST Microelectronics NV

- 6.4.11 Valeo SA

- 6.4.12 Honeywell International Inc.

- 6.4.13 Allegro MicroSystems LLC

- 6.4.14 Murata Manufacturing Co.

- 6.4.15 CTS Corporation

- 6.4.16 Littelfuse Inc.

- 6.4.17 ON Semiconductor Corp.

- 6.4.18 TE Connectivity Ltd.

- 6.4.19 Autoliv Inc.

- 6.4.20 Melexis NV

7 Market Opportunities and Future Outlook

- 7.1 White-space & Unmet-need Assessment