|

市场调查报告书

商品编码

1849973

电信云端:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Telecom Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

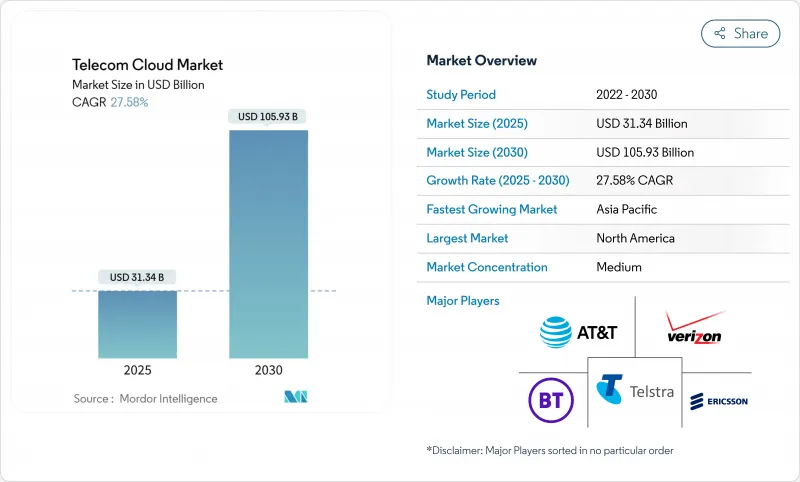

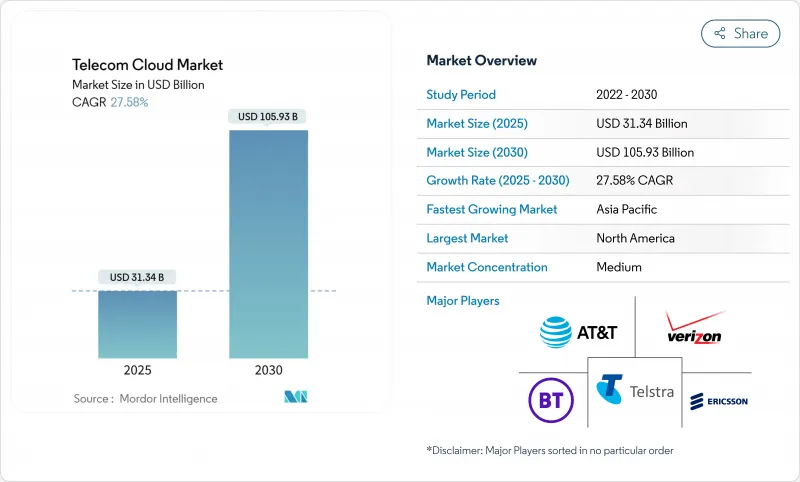

预计到 2025 年电信云端市场规模将达到 313.4 亿美元,到 2030 年将达到 1,059.3 亿美元,复合年增长率为 27.58%。

通讯业者正将资金投入云端原生核心网络,以释放5G收益、加速边缘运算并压缩营运成本。开放式无线接取网路(Open RAN)部署、网路功能虚拟化和混合云端应用等融合趋势正在改变网路连线的设计和销售方式。 AT&T与爱立信签订的140亿美元开放式无线接取网路合约等支出承诺凸显了转型的规模。沃达丰与微软签订的15亿美元协议凸显了多重云端框架如何满足效能、主权和合规性要求。 Verizon的多接入边缘运算试验将延迟缩短了一半,并展示了边缘云端联合如何帮助通讯业者在工业4.0收益池中占据有利地位。

全球电信云端市场趋势与洞察

5G部署激增呼唤云端原生核心网络

独立组网的 5G 将强制采用云端原生核心,打破单体架构,转而采用微服务,进而实现自动化网路切片和即时配置。德国电信与Google云端在 AI主导的RAN编配的合作证明,自动化对于管理 5G 流量的规模和复杂性至关重要。西班牙电信德国公司已将 4,500 万用户迁移到爱立信的云端原生 5G 核心,从而缩短了服务发布时间并增强了网路灵活性。这些转型表明,5G收益取决于营运商级的云端原生部署能力。

通讯业者越来越多地采用混合云端和多重云端

Rakuten Symphony 的多重云端蓝图展示了跨提供者工作负载的可携性,同时又能履行主权义务。混合架构允许对延迟敏感的网路功能保留在本地,同时将可扩展的工作负载迁移到公共云端。据思科称,目前有 82% 的企业正在运行混合模式,检验弹性和成本优化策略。随着营运商将合规性与创新速度相结合,这种双重环境的采用正在加速。

资料主权和安全合规障碍

Google Cloud 针对通讯业者的合规架构展现了通讯业者必须满足的错综复杂的区域隐私法规。在地化要求使运算成本增加高达 60%,削弱了电信云端市场的成本节约吸引力。当通讯业者要求在国内居住和静态加密时,VMware 的主权云端蓝图增加了架构的复杂性。不断变化的法规限制了部署灵活性并延长了计划工期。

細項分析

到2024年,解决方案细分市场的份额将达到53.6%,这反映了营运商对基础云端堆迭的首波关注。然而,服务市场正以27.7%的复合年增长率加速成长,随着通讯业者将营运外包给专业合作伙伴,预计差距将缩小。整合通讯(UC)、内容分发网路 (CDN) 和安全工作负载将继续推动解决方案的销售,而託管主机、专业服务和网路即服务合约的成长速度更快。

通讯业者越来越多地采用託管模式,以降低转型风险,并释放员工的潜力,为客户进行创新。主机託管服务使通讯业者接近性边缘区域,而专业服务协议则解决了技能短缺的问题。这一趋势标誌着整个电信云端市场正朝着基于营运支出的消费结构性转变,使通讯业者的支出与流量弹性和用户季节性保持一致。

到2024年,收费和配置将占电信云端市场规模的45.7%,为所有通讯业者的关键收益保障活动提供支援。同时,由于5G数据的快速成长给网路带来压力,流量管理预计年增率将达到28.1%。思科的超级流量优化 (Ultra Traffic Optimization) 和Opanga的RAIN AI展示了人工智慧主导的拥塞缓解技术,无需购买新频谱即可提升使用者体验品质 (QoE)。

能够预测拥塞并即时转移资料包的人工智慧引擎正成为必备功能。 HCL 的增强网路自动化 (Augmented Network Automation) 实现了 20% 的容量提升,同时降低了营运成本,这解释了这一显着增长的原因。安全分析和客户体验入口网站等辅助工作负载也正在迁移到云端,进一步丰富了电信云端市场的应用层。

电信云端市场按类型(解决方案、服务、其他类型)、应用(收费和配置、流量管理、其他)、云端平台(SaaS、IaaS、PaaS)、最终用户(BFSI、零售、製造、其他)和地区细分。市场预测以美元计算。

区域分析

受早期5G部署、已建立的超大规模伙伴关係以及有利法规的推动,北美地区将在2024年占据全球收入的35.3%。通讯业者已将边缘服务和企业连接收益,巩固了该地区在电信云端市场的领导地位。联邦政府对农村5G的资助也推动了投资动能。

预计到2030年,亚太地区的复合年增长率将达到27.3%,这得益于政府数位化专案和大规模资料中心投资的推动。 AWS在日本的150亿美元投资承诺和微软29亿美元的计画显示了该地区的资本密集度,而华为2023年云端业务收益将成长77%,这表明国内需求正在加速成长。中国将在2023年投资92亿美元用于云端基础设施建设,这将为通讯业者和本地服务提供商的成长奠定基础。

欧洲仍然是一个巨大的市场,严格的主权授权推动主权云的创建,并推动了Open RAN的实验。能源效率目标与云端整合一致,这为欧洲通讯业者带来了网路现代化的战略需求。在智慧城市计画、金融科技应用和行动优先人口结构的推动下,中东/非洲和拉丁美洲的采用曲线呈上升趋势,但监管差距和技能短缺限制了短期内的扩张。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 5G部署的快速成长需要云端原生核心网络

- 通讯业者对混合云端和多重云端的采用增加

- NFV 降低 OPEX 并提高成本效率

- Open RAN融合加速RAN云化进程

- 超低延迟企业 4.0 的边缘云端联合

- 永续性承诺推动通讯业者转向公共云端

- 市场限制

- 资料主权和安全合规障碍

- 与传统 BSS/OSS 堆迭整合的复杂性

- 通讯业者营运团队缺乏云端原生技能

- 跨境云端退出成本风险高

- 供应链分析

- 监管格局

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场中的宏观经济因素

第五章市场规模及成长预测

- 按类型

- 解决方案

- 整合通讯与协作

- 内容传递网路

- 其他解决方案

- 服务

- 主机代管服务

- 网路服务

- 专业服务

- 託管服务

- 其他类型

- 解决方案

- 按用途

- 计费和配置

- 交通管理

- 其他用途

- 透过云端平台

- 软体即服务 (SaaS)

- 基础设施即服务 (IaaS)

- 平台即服务 (PaaS)

- 按最终用户

- BFSI

- 零售

- 製造业

- 运输和交付

- 卫生保健

- 政府

- 媒体和娱乐

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 台湾

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ATandT Inc.

- Verizon Communications Inc.

- BT Group plc

- Deutsche Telekom AG

- NTT Communications Corp.

- China Telecommunications Corp.

- Telstra Corp. Ltd

- Telefonaktiebolaget LM Ericsson

- CenturyLink(Lumen Technologies)

- Singapore Telecommunications Ltd

- Telus Corp.

- Swisscom AG

- Amazon Web Services

- Microsoft Azure

- Google Cloud

- IBM Cloud

- Oracle Communications Cloud

- Huawei Cloud

- VMware(Telco Cloud Platform)

- Cisco Systems(Telco Cloud)

第七章 市场机会与未来展望

The telecom cloud market size is estimated at USD 31.34 billion in 2025 and is forecast to reach USD 105.93 billion by 2030, advancing at a 27.58% CAGR.

Operators are steering capital toward cloud-native core networks that unlock 5G monetization, accelerate edge computing, and compress operating costs. Converging trends-Open RAN deployment, network-functions virtualization, and hybrid-cloud adoption-are altering how connectivity is engineered and sold. Spending commitments such as AT&T's USD 14 billion Open RAN deal with Ericsson underscore the scale of transition. Vodafone's USD 1.5 billion pact with Microsoft highlights how multi-cloud frameworks address performance, sovereignty, and compliance expectations. Verizon's multi-access edge computing trials cutting latency in half exemplify how edge-cloud federation positions carriers for Industry 4.0 revenue pools.

Global Telecom Cloud Market Trends and Insights

Surge in 5G roll-outs demanding cloud-native core networks

Standalone 5G mandates cloud-native cores, dismantling monolithic architectures in favor of micro-services that enable automated network slicing and real-time provisioning. Deutsche Telekom's work with Google Cloud on AI-driven RAN orchestration proves that automation is now indispensable to manage the scale and complexity of 5G traffic. Telefonica Germany migrated 45 million subscribers to Ericsson's cloud-native 5G core, cutting service-activation times and fortifying network agility.These transformations signal that 5G revenue relies on cloud-native capabilities deployed at carrier grade.

Growing adoption of hybrid and multi-cloud by telecom operators

Rakuten Symphony's multi-cloud blueprint showcases workload portability across providers while guarding sovereignty obligations. Hybrid architectures allow latency-sensitive network functions to remain on-premise while scalable workloads burst to public clouds. Cisco finds 82% of enterprises now run hybrid models, validating the strategy for resilience and cost optimization. This dual-environment adoption is accelerating as operators link compliance with innovation velocity.

Data-sovereignty and security compliance hurdles

Google Cloud's telecom-specific compliance frameworks attest to the maze of regional privacy rules carriers must meet. Localization mandates inflate compute costs by up to 60%, eroding the telecom cloud market's cost-saving allure. VMware sovereign-cloud blueprints show architecture complexity rises when carriers enforce in-country residency and encryption at rest. Evolving statutes constrain deployment flexibility and lengthen project timelines.

Other drivers and restraints analyzed in the detailed report include:

- Edge-cloud federation enabling ultra-low-latency enterprise 4.0

- Convergence of Open RAN accelerating RAN-cloudification

- Integration complexity with legacy BSS/OSS stacks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024 solution segment held 53.6% share, reflecting operators' first-wave focus on foundational cloud stacks. Yet Services are accelerating at a 27.7% CAGR, forecast to close the gap as carriers outsource operations to specialist partners. Unified communication, CDN, and security workloads continue to lift Solution revenues, but managed hosting, professional services, and network-as-a-service contracts are growing faster.

Operators increasingly adopt managed models to de-risk transformation and redeploy staff toward customer innovation. Colocation footprints give carriers proximity to edge zones, while professional-service engagements address skills shortages. This trend signals a structural shift toward opex-based consumption, aligning telco spending with traffic elasticity and subscriber seasonality across the telecom cloud market.

Billing and Provisioning retained 45.7% of telecom cloud market size in 2024, underpinning revenue assurance activities critical to every carrier. Traffic Management, however, is projected to grow 28.1% annually as 5G data surges strain networks. Cisco's Ultra Traffic Optimization and Opanga's RAIN AI showcase AI-driven congestion relief that boosts QoE without fresh spectrum buys.

AI-infused engines that predict congestion and reroute packets in real time are becoming must-have capabilities. HCL's Augmented Network Automation illustrates 20% capacity lifts alongside OPEX cuts, explaining the outsized growth. Ancillary workloads such as security analytics and customer-experience portals also migrate to cloud in lockstep, reinforcing application-layer diversification within the telecom cloud market.

Telecom Cloud Market is Segmented by Type (Solution, Services, and Other Types), Application (Billing and Provisioning, Traffic Management, and More), Cloud Platform (SaaS, Iaas, and PaaS), End User (BFSI, Retail, Manufacturing, and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 35.3% revenue in 2024 as early 5G roll-outs, established hyperscaler partnerships, and favorable regulations aligned. Carriers monetized edge services and enterprise connectivity, strengthening regional leadership in the telecom cloud market. Federal funding streams for rural 5G also bolster investment momentum.

Asia-Pacific is projected to expand at 27.3% CAGR through 2030, supported by government digitalization programs and massive data-center investments. AWS's USD 15 billion commitment and Microsoft's USD 2.9 billion plan in Japan illustrate capital intensity, while Huawei's 77% cloud-service revenue jump in 2023 signals domestic demand acceleration. China's USD 9.2 billion 2023 cloud-infrastructure spend positions its carriers and local providers for growth.

Europe remains a sizeable market, where stringent sovereignty mandates foster sovereign-cloud builds and spark Open RAN experiments. Energy-efficiency goals align with cloud consolidation, giving European carriers strategic imperatives to modernize networks. Middle East and Africa and Latin America show rising adoption curves fueled by smart-city initiatives, fintech penetration, and mobile-first demographics, though regulatory gaps and skills shortages temper near-term scale.

- ATandT Inc.

- Verizon Communications Inc.

- BT Group plc

- Deutsche Telekom AG

- NTT Communications Corp.

- China Telecommunications Corp.

- Telstra Corp. Ltd

- Telefonaktiebolaget LM Ericsson

- CenturyLink (Lumen Technologies)

- Singapore Telecommunications Ltd

- Telus Corp.

- Swisscom AG

- Amazon Web Services

- Microsoft Azure

- Google Cloud

- IBM Cloud

- Oracle Communications Cloud

- Huawei Cloud

- VMware (Telco Cloud Platform)

- Cisco Systems (Telco Cloud)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in 5G roll-outs demanding cloud-native core networks

- 4.2.2 Growing adoption of hybrid and multi-cloud by telecom operators

- 4.2.3 Cost efficiency via NFV-enabled OPEX savings

- 4.2.4 Convergence of Open RAN accelerating RAN-cloudification

- 4.2.5 Edge-cloud federation enabling ultra-low-latency enterprise 4.0

- 4.2.6 Sustainability pledges shifting telcos to green public clouds

- 4.3 Market Restraints

- 4.3.1 Data-sovereignty and security compliance hurdles

- 4.3.2 Integration complexity with legacy BSS/OSS stacks

- 4.3.3 Shortage of cloud-native skills in telco ops teams

- 4.3.4 High cross-border cloud exit-cost risk exposures

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Solution

- 5.1.1.1 Unified Communication and Collaboration

- 5.1.1.2 Content Delivery Network

- 5.1.1.3 Other Solutions

- 5.1.2 Service

- 5.1.2.1 Colocation Services

- 5.1.2.2 Network Services

- 5.1.2.3 Professional Services

- 5.1.2.4 Managed Services

- 5.1.3 Other Types

- 5.1.1 Solution

- 5.2 By Application

- 5.2.1 Billing and Provisioning

- 5.2.2 Traffic Management

- 5.2.3 Other Applications

- 5.3 By Cloud Platform

- 5.3.1 Software-as-a-Service (SaaS)

- 5.3.2 Infrastructure-as-a-Service (IaaS)

- 5.3.3 Platform-as-a-Service (PaaS)

- 5.4 By End User

- 5.4.1 BFSI

- 5.4.2 Retail

- 5.4.3 Manufacturing

- 5.4.4 Transportation and Distribution

- 5.4.5 Healthcare

- 5.4.6 Government

- 5.4.7 Media and Entertainment

- 5.4.8 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Taiwan

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Middle-East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle- East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 ATandT Inc.

- 6.4.2 Verizon Communications Inc.

- 6.4.3 BT Group plc

- 6.4.4 Deutsche Telekom AG

- 6.4.5 NTT Communications Corp.

- 6.4.6 China Telecommunications Corp.

- 6.4.7 Telstra Corp. Ltd

- 6.4.8 Telefonaktiebolaget LM Ericsson

- 6.4.9 CenturyLink (Lumen Technologies)

- 6.4.10 Singapore Telecommunications Ltd

- 6.4.11 Telus Corp.

- 6.4.12 Swisscom AG

- 6.4.13 Amazon Web Services

- 6.4.14 Microsoft Azure

- 6.4.15 Google Cloud

- 6.4.16 IBM Cloud

- 6.4.17 Oracle Communications Cloud

- 6.4.18 Huawei Cloud

- 6.4.19 VMware (Telco Cloud Platform)

- 6.4.20 Cisco Systems (Telco Cloud)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment