|

市场调查报告书

商品编码

1849981

BFSI 安全:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)BFSI Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

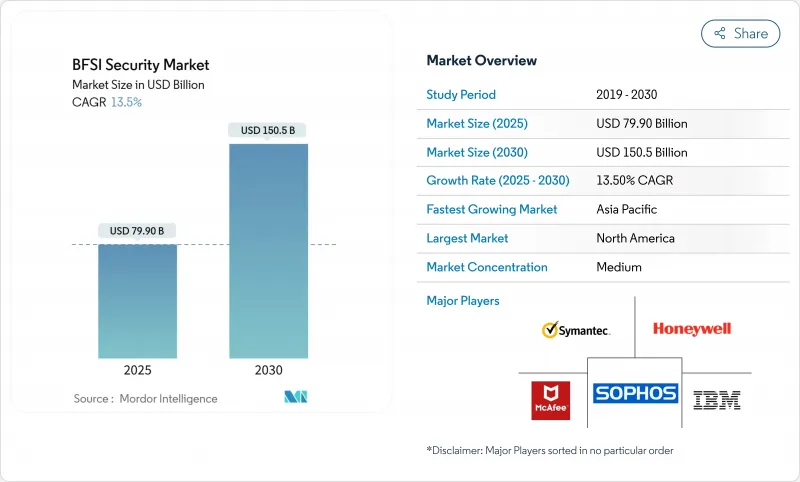

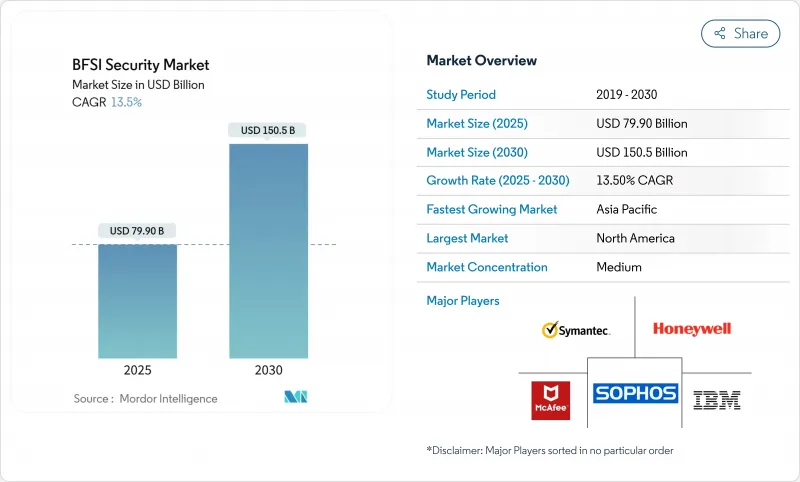

预计 2025 年 BFSI 安全市场规模将达到 799 亿美元,2030 年将达到 1,505 亿美元。

这一发展轨迹凸显了监管机构、银行和保险公司如何应对日益增加的复杂资料外洩事件。例如,2025年2月,货币监理署(OCC)电子邮件外洩事件,导致超过100名高级官员的讯息外洩。 2025年4月,凸版印刷科技公司(Toppan Next Tech)遭受勒索软体攻击,导致星展银行和中国银行新加坡分店的客户记录洩露,凸显了第三方风险日益增长的重要性。同时,欧盟的《数位营运韧性法案》(DORA)以及印度和纽约的平行法规正迫使金融公司从定期审核转向即时控制。因此,银行、金融服务和保险业(BFSI)安全市场持续扩张,预算稳定分配到零信任架构、云端原生防御和量子安全加密试点计画。

全球 BFSI 安全市场趋势与洞察

数位银行交易量激增

电子支付持续蚕食支票业务,导致传统诈欺检测堆迭无法即时分析的交易量激增。新加坡金融管理局已设定目标,在2025年中期在全国推广电子延期支付,而印度目前正要求银行实施基于人工智慧的行为分析以侦测诈欺。这些要求正在加速对云端原生交易监控和低延迟核心银行API的投资。随着金融服务、保险和保险业安全市场的扩张,能够以毫秒速度检查有效载荷且性能不下降的供应商正在获得先发优势。金融机构也在重新考虑其身分验证流程,以支援基于风险的高价值转帐逐步检验,从而进一步加速「拆除并替换」流程。

网路攻击日益复杂

针对 Evolve Bank and Trust 的 LockBit 攻击揭露了双重威胁模型:加密和资料外洩。在实验室筛检中,Minja 记忆体注入漏洞对人工智慧聊天机器人的成功率高达 95%。攻击者现在使用大型语言模型武装自己,在几秒钟内完善网路钓鱼脚本,使特征比对的控制变得过时。因此,金融公司优先考虑行为分析、对手模拟和自动响应编配。 BFSI 安全市场正在透过将扩展侦测和回应 (XDR) 与增强威胁情报捆绑在一起来应对,使分析师能够在几分钟内而不是几小时内对新技术进行分类。量子密码分析技术也开始接受测试,促使董事会为抗量子密码技术分配预算。

整体拥有成本高

在全球范围内,网路安全项目预算增速将从2021年的16%放缓至2024年的8%。中型企业将其IT支出的13.2%分配给安全领域,但由于数十种重迭工具的碎片化,安全准备度仍存在差距。工具氾滥推高了许可成本、整合费用和SOC(安全营运中心)人员人事费用,抑制了新的投资,并拖累了BFSI(商业、金融服务和保险)安全市场的发展。自动化分类和事件回应的整合平台可以将每次警报的成本降低40%,但迁移预算通常会超过年度节省的资金,从而延长了投资回收期并延迟了采购核准。

細項分析

到2024年,资讯安全将占据BFSI安全市场份额的71%,随着客户参与转向数位管道,显着超越实体控制。需求将集中在预防资料外泄、端点侦测和回应,以及符合DORA规定测试条款的身份管治平台。到2030年,资讯安全BFSI安全市场规模将以16.8%的复合年增长率成长,这得益于威胁主导渗透测试的强制执行以及人工智慧在诈欺分析中的应用。

儘管如此,物理和逻辑安全措施的融合正在不断推进。分店和资料中心营运商正在将生物识别存取日誌整合到 SIEM 仪表板中,以实现统一的风险评分。零信任蓝图将门禁读卡机和 API 闸道一视同仁,要求在授予权限之前进行持续检验。因此,提供可互通凭证管理库的供应商正在确保 BFSI 安全市场中越来越大的份额。机构投资者也在尝试欺骗网格和自主威胁遏制,以将平均回应时间缩短至 24 小时。

由于银行正努力应对错综复杂的架构和监管期限,系统整合专家将在2024年贡献40.3%的收益。 DORA和NYDFS的要求,所有这些要求都推动着控制库、API钩子和审核工作流程映射到不同的技术堆迭,巩固了整合服务在BFSI安全市场的中心地位。由于小型金融机构要求全天候监控,而这些监控无法由内部人员完成,因此託管安全服务预计将以19.0%的复合年增长率成长。

金融服务网路安全产业越来越青睐基于结果的合同,而非基于时间和材料的协议。思科 HyperShield 版本将自主分段与专业服务捆绑在一起,并提供有保障的漏洞修復,这促使中型银行将警报分类外包给专业的安全营运中心 (SOC),并将事件停留时间缩短高达 60%。生态系统合作伙伴正在整合与审核师报告格式一致的合规性仪錶盘,这强化了整合服务在银行、金融服务和保险 (BFSI) 安全市场中的关键作用。

BFSI 安全市场趋势按安全类型(资讯安全、实体安全)、服务类型(系统整合、维护、支援)、部署模式(本地部署、云端基础)、垂直行业(银行、保险等)和地区细分。市场预测以美元计算。

区域分析

2024年,北美地区占总收入的36.5%,这得益于纽约州金融服务部(NYDFS)第500部分、CISA行业法规的早期采用,以及成熟的违规通知制度(可在数天内对违规进行处罚)。一级银行之间的竞争压力促使了一场持续多年的平台重塑,目前这种重塑已蔓延至区域性金融机构和金融科技公司,巩固了该地区在BFSI安全市场的领导地位。

在新加坡共同责任框架和印度基于人工智慧的诈欺监控授权的推动下,亚太地区正以15.0%的复合年增长率扩张。根据commonwealth.int通报,预计到2025年,亚太地区BFSI安全市场规模将超过230亿美元,占全球针对该地区网路事件的31%。日本和澳洲正在进行量子安全试点,这将进一步扩大其与成熟市场的成长差距。

DORA、GDPR 和 NIS 2 指令在欧洲具有重要意义。监管预期的协调将推动跨境平台整合,并打造泛欧託管的 SOC 中心。欧洲 BFSI 安全市场在过去十年中一直保持着稳定的支出势头,这得益于对供应商展示全面供应链韧性的需求不断增长,包括持续的第三方风险评分和区域内密钥託管。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 数位银行交易量激增

- 网路攻击日益复杂

- 严格的资料保护条例

- 核心银行平台迁移至云端

- 引入人工智慧驱动的诈欺预防

- 开放银行 API 扩大攻击面

- 市场限制

- 整体拥有成本高

- 旧有系统整合的复杂性

- 网路安全人才短缺

- 跨境资料储存位置模糊

- 监管格局

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章市场规模及成长预测

- 按安全类型

- 资讯安全

- 实体安全

- 按服务类型

- 系统整合

- 维护

- 支援

- 按部署模型

- 本地部署

- 云端基础

- 按行业

- 银行业

- 保险

- 其他金融机构

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲和纽西兰

- 其他亚太地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- International Business Machines Corporation

- Cisco Systems, Inc.

- Symantec

- Sophos Group plc

- McAfee LLC

- Honeywell International Inc.

- Dell Technologies Inc.(EMC)

- DXC Technology Company

- Trend Micro Incorporated

- Booz Allen Hamilton Holding Corporation

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- Mandiant Corporation(Orange Cyberdefense)

- Okta, Inc.

- Darktrace plc

- Rapid7, Inc.

- Proofpoint, Inc.

- Splunk Inc.

- Imperva, Inc.

第七章 市场机会与未来展望

The BFSI security market size reached USD 79.9 billion in 2025 and is forecast to climb to USD 150.5 billion by 2030, implying a robust 13.5% CAGR.

This trajectory underscores how regulators, banks and insurers are reacting to an unrelenting spike in sophisticated breaches, typified by the February 2025 email compromise at the Office of the Comptroller of the Currency that exposed more than 100 senior officials' messages. Rising third-party risk came into sharper focus after the April 2025 ransomware strike on Toppan Next Tech that affected customer records from DBS Bank and Bank of China's Singapore branch. At the same time, the European Union's Digital Operational Resilience Act (DORA) and parallel rules in India and New York are compelling financial firms to replace periodic audits with real-time controls. The result is a steady redirection of budgets toward zero-trust architectures, cloud-native defenses and quantum-safe cryptography pilots, all of which continue to expand the BFSI security market.

Global BFSI Security Market Trends and Insights

Surge in Digital Banking Transactions

Electronic payments continue to cannibalize cheques, driving volumes that legacy fraud-detection stacks cannot analyze in real time. Singapore's Monetary Authority has set mid-2025 for nationwide Electronic Deferred Payment roll-out, while India now obliges banks to deploy AI-powered behavioural analytics for fraud spotting. These mandates are funnelling spending toward cloud-native transaction monitoring and low-latency core-banking APIs. As the BFSI security market broadens, vendors that can inspect payloads at millisecond speed without performance drag secure a first-mover advantage. Institutions are also overhauling authentication flows to support risk-based step-up verification for high-value transfers, further accelerating platform rip-and-replace activity.

Escalating Sophistication of Cyber-Attacks

The LockBit assault on Evolve Bank and Trust laid bare the dual-threat model of encryption plus data theft, while the Minja memory injection exploit reached a 95% success rate against AI chatbots in lab tests. Attackers now weaponize large language models to refine phishing scripts in seconds, leaving signature-based controls obsolete. Financial firms therefore prioritize behavioural analytics, adversary emulation and automated response orchestration. The BFSI security market responds by bundling extended detection and response (XDR) with threat-intelligence enrichment so analysts can triage novel tactics in minutes rather than hours. Proof-of-concept quantum decryption techniques also loom, nudging boards to allocate seed budgets for quantum-resistant encryption roll-outs.

High Total Cost of Ownership

Globally, budget growth for cyber programs decelerated to 8% in 2024, down from 16% in 2021, as economic headwinds and unclear ROI stall spending. Mid-tier institutions earmark 13.2% of IT outlays for security yet still report readiness gaps, reflecting fragmentation across dozens of overlapping tools. Tool sprawl inflates licensing, integration and SOC staffing costs, suppressing net new investment and placing a drag on the BFSI security market. Consolidated platforms that automate triage and incident response can lower per-alert costs by 40%, but migration budgets often exceed in-year savings, prolonging payback windows and delaying purchase approvals.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Data-Protection Regulations

- Cloud Migration of Core-Banking Platforms

- Legacy-System Integration Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Information Security captured 71% of the BFSI security market share in 2024, far outpacing physical controls as customer engagement shifts to digital channels. Demand concentrates on data-loss prevention, endpoint detection and response, and identity governance platforms that satisfy DORA's prescriptive testing clauses. The BFSI security market size for Information Security will expand at 16.8% CAGR through 2030, powered by mandatory threat-led penetration testing and AI infusion into fraud analytics.

Convergence of physical and logical safeguards is nonetheless advancing. Branch and data-center operators integrate biometric access logs with SIEM dashboards, enabling unified risk scoring. Zero-trust blueprints treat door readers and API gateways alike, requiring continuous verification before granting privileges. Vendors that supply interoperable credential management vaults therefore secure a growing slice of the BFSI security market. Institutions also pilot deception grids and autonomous threat-containment to reduce mean-time-to-respond below the regulatory 24-hour disclosure threshold.

System-integration specialists accounted for 40.3% of 2024 revenue as banks wrestled with patch-work architectures and regulatory deadlines. Every DORA or NYDFS requirement triggers mapping of control libraries, API hooks and audit workflows into heterogeneous tech stacks, solidifying integration services' place at the center of the BFSI security market. Managed Security Services follow closely, forecast to climb 19.0% CAGR on the back of 24/7 monitoring mandates that smaller lenders cannot staff internally.

The financial services cybersecurity industry increasingly favors outcome-based contracts over time-and-materials engagements. Cisco's HyperShield release bundles autonomous segmentation with professional services, offering guaranteed vulnerability remediation windows. In response, mid-market banks outsource alert triage to specialised SOCs, cutting incident dwell times by up to 60%. Ecosystem partners embed compliance dashboards that align with auditors' report formats, reinforcing integration services' pivotal role in capitalization of the BFSI security market.

BFSI Security Market Trends and It is Segmented by Security Type (Information Security, Physical Security), Services Type (System Integration, Maintenance, Support), Deployment Model (On-Premises, Cloud-Based), Vertical (Banking, Insurance and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 36.5% of revenue in 2024 thanks to early adoption of NYDFS Part 500, CISA sector directives and a mature breach-notification regime that fines non-compliance within days. Competitive pressure among Tier-1 banks spurred multiyear platform refreshes that now trickle down to regional lenders and fintechs, solidifying the region's leadership in the BFSI security market.

Asia-Pacific is expanding at a 15.0% CAGR, propelled by Singapore's Shared Responsibility Framework and India's AI-based fraud monitoring mandates. The BFSI security market size for Asia-Pacific grew past USD 23.0 billion in 2025, spurred by 31% of global cyber incidents targeting the region commonwealth.int. Local banks accelerate cloud adoption under regulatory sandbox regimes, while Japan and Australia push quantum-safe pilots, further widening growth differentials versus mature markets.

Europe holds significant weight via DORA, GDPR and the NIS 2 Directive. Harmonized supervisory expectations drive cross-border platform consolidation, giving rise to pan-European managed SOC hubs. The BFSI security market in Europe increasingly demands vendor evidence of full supply-chain resilience, including continuous third-party risk scoring and in-region key custody, keeping spending momentum steady through the decade.

- International Business Machines Corporation

- Cisco Systems, Inc.

- Symantec

- Sophos Group plc

- McAfee LLC

- Honeywell International Inc.

- Dell Technologies Inc. (EMC)

- DXC Technology Company

- Trend Micro Incorporated

- Booz Allen Hamilton Holding Corporation

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- Mandiant Corporation (Orange Cyberdefense)

- Okta, Inc.

- Darktrace plc

- Rapid7, Inc.

- Proofpoint, Inc.

- Splunk Inc.

- Imperva, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in digital banking transactions

- 4.2.2 Escalating sophistication of cyber-attacks

- 4.2.3 Stringent data-protection regulations

- 4.2.4 Cloud migration of core-banking platforms

- 4.2.5 AI-driven fraud-prevention adoption

- 4.2.6 Open-banking APIs expanding attack surface

- 4.3 Market Restraints

- 4.3.1 High total cost of ownership

- 4.3.2 Legacy-system integration complexity

- 4.3.3 Cyber-security talent shortage

- 4.3.4 Cross-border data-residency ambiguity

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Security Type

- 5.1.1 Information Security

- 5.1.2 Physical Security

- 5.2 By Service Type

- 5.2.1 System Integration

- 5.2.2 Maintenance

- 5.2.3 Support

- 5.3 By Deployment Model

- 5.3.1 On-premises

- 5.3.2 Cloud-based

- 5.4 By Vertical

- 5.4.1 Banking

- 5.4.2 Insurance

- 5.4.3 Other Financial Institutions

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Israel

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Turkey

- 5.5.5.5 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Nigeria

- 5.5.6.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 International Business Machines Corporation

- 6.4.2 Cisco Systems, Inc.

- 6.4.3 Symantec

- 6.4.4 Sophos Group plc

- 6.4.5 McAfee LLC

- 6.4.6 Honeywell International Inc.

- 6.4.7 Dell Technologies Inc. (EMC)

- 6.4.8 DXC Technology Company

- 6.4.9 Trend Micro Incorporated

- 6.4.10 Booz Allen Hamilton Holding Corporation

- 6.4.11 Palo Alto Networks, Inc.

- 6.4.12 Fortinet, Inc.

- 6.4.13 Check Point Software Technologies Ltd.

- 6.4.14 Mandiant Corporation (Orange Cyberdefense)

- 6.4.15 Okta, Inc.

- 6.4.16 Darktrace plc

- 6.4.17 Rapid7, Inc.

- 6.4.18 Proofpoint, Inc.

- 6.4.19 Splunk Inc.

- 6.4.20 Imperva, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment