|

市场调查报告书

商品编码

1850013

粉末涂料:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030)Powder Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

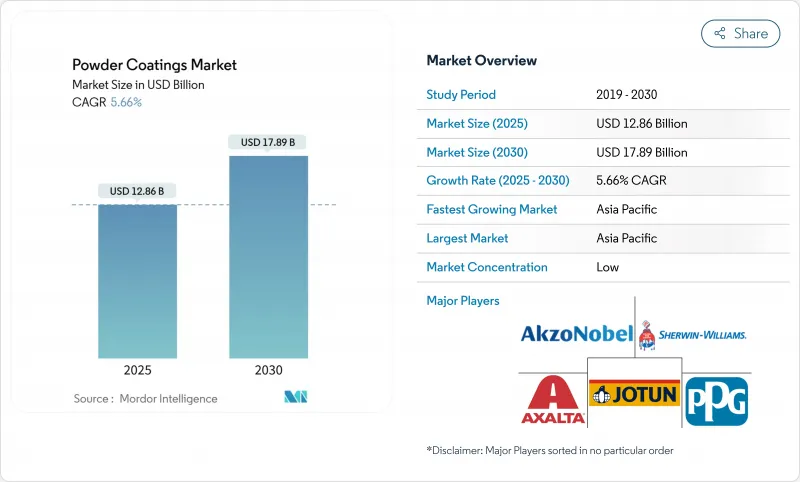

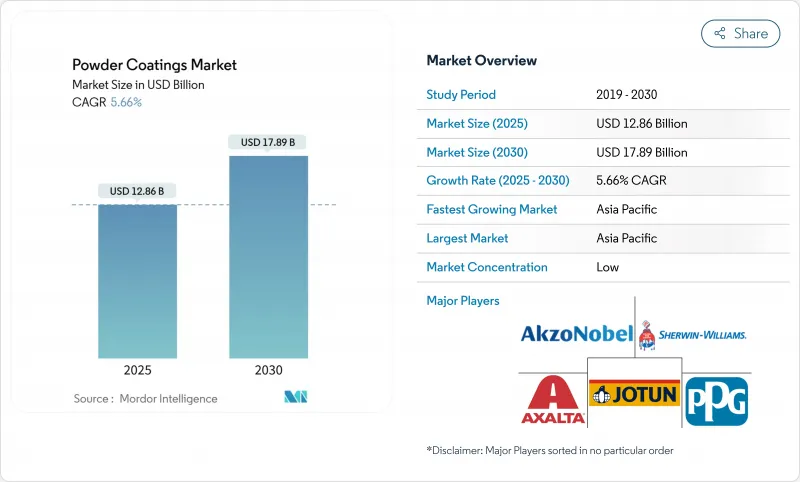

粉末涂料市场规模预计在 2025 年为 128.6 亿美元,预计到 2030 年将达到 178.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.66%。

这项技术的需求正在成长,因为它能够提供无溶剂、单涂层涂料,符合日益严格的挥发性有机化合物 (VOC) 法规,同时最大限度地减少生产废弃物。亚太地区强劲的工业活动、热敏基材加速采用低温化学品以及原始设备製造商 (OEM) 努力实现供应链本地化,这些都是支撑粉末涂料市场的大趋势。聚酯树脂、低温烘烤配方和薄膜系统正在设定新的性能标准,拓宽最终用途应用范围,使其超越传统的金属零件。儘管原料波动和超薄薄膜应用限制抑制了市场发展势头,但在效率提升和碳减排指令的支撑下,整体上升趋势仍然稳健。

全球粉末涂料市场趋势与洞察

严格的VOC排放法规改变涂料技术

监管机构认为粉末涂料是污染最低的工业整理加工剂,因为它们几乎不排放挥发性有机化合物 (VOC),并且省去了昂贵的溶剂回收过程。根据汽车生命週期研究,与液体涂料相比,粉末涂料每辆车可减少 23.40 公斤二氧化碳排放和 1.47 公斤挥发性有机化合物排放,产生可衡量的永续性红利,与原始设备製造商的脱碳蓝图图产生共鸣。欧洲绿色新政和更新的美国环保署国家排放标准正在鼓励涂料製造商加快更换溶剂底漆底漆。领先的配方设计师正在抢在法规收紧之前推出不含 TGIC 和无铬的产品,以应对未来的禁令。碳定价的上升进一步加强了商业案例,证明与多级液体喷房相比,粉末涂装线的能耗强度更低。因此,全球粉末涂料涂装线的装置容量扩张速度比其他任何技术都快。

低温化学扩大了应用可能性

最新突破使得在低于120°C的温度下即可完全固化,从而能够使用传统工艺流程下容易翘曲的中密度纤维板、塑胶和复合材料。在248°F下运行的先进系统可为组装家具、相框和装饰面板提供低光泽、耐刮擦的饰面。亚太地区家具产业受益匪浅,无需使用多种无VOC涂层即可获得鲜艳的色彩。由于静电喷涂粉末可以回收和再利用过喷材料,并提高一次通过率,生产线操作员也实现了两位数的材料节省。当炉温设定值降低导致能源需求下降时,实际回报迅速。全球供应商不断改进树脂化学成分,以缩短固化时间,提高传送带速度并提升日产量。

薄膜应用挑战限制市场渗透

25µm 超光滑薄膜难以均匀涂覆,尤其是在尖角和凹槽周围。随着涂层品质的减少,抗刮性和不透明度也会下降,这使得薄膜粉末对需要完美表面的高端电子产品机壳的吸引力降低。虽然施用器正在适应更严格的製程视窗和线上涂层测厚仪,但在复杂几何形状下仍存在差异。对于智慧型手机和笔记型电脑,雾化涂层可以轻鬆达到 10µm 且不会出现橘皮现象,因此液体涂层替代品仍能保持市场份额。设备维修,例如先进的电晕枪和流化料斗,增加了资本支出,减缓了小型加工商的采用。儘管如此,供应商正在设计更细的粒径分布和专有的流动剂来缩小差距。

細項分析

到2024年,聚酯组合物将占据粉末涂料市场份额的38%,主导建筑、家电和汽车内装线市场。预计复合年增长率为6.25%,这意味着聚酯在粉末涂料市场中的份额反映了该树脂的耐候性和丰富的色彩选择。不含TGIC和低温固化交联剂的改良符合《生态设计指令》,而颜料的进步即使在沿海气候条件下也能保持光泽。随着聚酯共混物中加入功能性奈米颗粒,在不影响固化速度的情况下改善去污性能,粉末涂料市场将继续受益。

环氧粉末凭藉其优异的耐化学性,在开关设备和管道阀门等严苛的室内环境中占据着重要的地位。然而,它们易受紫外线照射,限制了其在户外的应用,与聚酯树脂相比,销售量有所下降。环氧-聚酯混合材料可有效缓解粉化现象,提升其在家用电器中的货架吸引力,并推动亚洲新兴生产中心的需求成长。聚氨酯粉末开闢了一个高端市场,其优异的耐化学性和耐磨性使其更高的成本物有所值。科思创的低温固化技术为复合材料车轮和碳纤维部件开闢了应用前景。丙烯酸、聚氯乙烯和聚烯解决方案可满足特殊需求,例如防涂鸦运输面板和洗碗机架,展现了支持树脂多样化成长的广泛选择。

到2024年,热固性粉末涂料将占据90%的市场份额,这得益于其不可逆交联网络结构,能够抵抗紫外线、化学物质和磨损。热塑性塑胶在汽车车轮、管道和建筑建筑幕墙占有重要地位,凭藉高产量和规模优势,确保了其成本领先地位。然而,热塑性塑胶正处于上升期,复合年增长率高达6.01%,因为加工商重视其可重熔和可修復的表面特性,而这些特性在重型机械和购物车框架中尤为重要,因为在这些应用中,柔韧且抗衝击的表面至关重要。

技术创新是这项转变的核心。 IFS Puroplaz PE16 展示了改性聚烯如何在保持延展性的同时实现类似钢材的黏合力,从而拓展了热塑性塑胶在装饰围栏和游乐场设备製造中的应用范围。同样,尼龙基粉末可用于支撑海上紧固件中厚实的抗碎裂薄膜。改良的阻燃配方使热塑性塑胶与电气机壳相容,从而减少了传统热固性材料的份额。虽然热塑性塑胶需要高温熔体流动,因此需要较高的固化能量,但对感应加热和红外线面板的深入研究旨在在 2025 年至 2030 年期间的部署中弥补这一差距。

区域分析

到2024年,亚太地区将占全球粉末涂料需求的55%,到2030年,复合年增长率将达到5.89%,占同期粉末涂料市场规模成长的一半以上。中国建设业的復苏、印度资本财生产的加速以及东协白色家电组装的激增都将推动该地区的粉末涂料消费。阿克苏诺贝尔的瓜廖尔工厂计划于2024年9月运作,年产量为5,166吨,显示市场对国内需求的持续信心。

北美受益于回流政策。美国环保署(EPA)严格的挥发性有机化合物(VOC)限值正在推动工厂升级,墨西哥组装现在也指定使用粉末来製造底盘支架和轮毂,以满足《美墨加协定》(USMCA)的含量规定。区域负责人指出,由于粉末可以在当地进行大量生产,因此无需高溶剂实验室的安全控制,配色週期更快。

欧洲成熟的设备基础更注重技术创新而非产量。欧盟将于2025年对亚洲进口环氧树脂征收临时反倾销税,这将保护欧盟生产商免受价格波动的影响,并稳定国内粉末製造商的原材料利润。永续性的挑战正在推动生物基树脂和可再生能源固化系统的研发,确保其继续保持低碳领先地位。

受NEOM、多哈地铁延长线和阿联酋物流区等价值10亿美元的大型计划的推动,中东和非洲粉末涂料市场正在显着增长。 Al Taiseer Aluminum在沿岸地区挤压精加工市场占有21%的份额,这清楚地表明了该地区的龙头企业正在如何塑造规范标准。拉丁美洲的绝对规模仍然较小,但巴西和阿根廷的汽车投资逐渐推动消费,尤其是聚酯面漆的消费。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 严格的VOC排放法规和脱碳法规加速无溶剂涂料

- 低温烧成化学为中密度纤维板和热敏基板开闢了商机,尤其是在亚洲

- 外商直接投资推动东协和印度家电产量激增

- 随着汽车生产回归墨西哥和欧洲,OEM 需求增加

- 海湾合作委员会大型基础设施计划推动建筑铝挤压涂布的发展

- 市场限制

- 粉末涂料稀释困难

- 紫外光固化粉末对复杂形状的适应性有限

- 聚酯和环氧树脂原料价格波动正在挤压利润空间

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场规模及成长预测(价值)

- 依树脂类型

- 环氧树脂

- 聚酯纤维

- 环氧聚酯

- 聚氨酯

- 丙烯酸纤维

- 其他树脂种类(聚氯乙烯、聚烯)

- 按涂层类型

- 热固性粉末涂料

- 热塑性粉末涂料

- 按最终用途行业

- 建筑和装饰

- 车

- 产业

- 其他(家具、家电等)

- 按基材

- 金属

- 中密度纤维板和木材

- 塑胶和复合材料

- 玻璃及其他非导电基板

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Advanced Powder Coatings

- Akzo Nobel NV

- Asian Paints PPG Pvt. Ltd.

- Axalta Coating Systems, LLC

- BASF

- Berger Paints India

- Cardinal

- Hempel A/S

- IFS Coatings

- IGP Pulvertechnik AG

- Jotun

- Kansai Paint Co.,Ltd.

- NATIONAL PAINTS FACTORIES CO. LTD.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.(TCI Powder Coatings)

- SAK Coat

- Teknos Group

- The Sherwin-Williams Company

- TIGER Coatings GmbH & Co. KG

第七章 市场机会与未来展望

The Powder Coatings Market size is estimated at USD 12.86 billion in 2025, and is expected to reach USD 17.89 billion by 2030, at a CAGR of 5.66% during the forecast period (2025-2030).

Demand is rising as the technology offers solvent-free, single-coat finishes that comply with tightening VOC rules while minimizing production waste. Strong industrial activity across Asia-Pacific, accelerating adoption of low-temperature chemistries for heat-sensitive substrates, and OEM efforts to localize supply chains are broad trends sustaining the powder coatings market. Polyester resins, low-bake formulations, and thin-film systems are setting new performance benchmarks that widen end-use scope beyond traditional metal parts. Although raw-material volatility and application limits on very thin films temper momentum, the overall trajectory remains firmly upward, supported by efficiency gains and carbon-reduction mandates.

Global Powder Coatings Market Trends and Insights

Stringent VOC-Emission Regulations Transforming Coating Technologies

Regulatory agencies now view powder coatings as the lowest-polluting industrial finish because the process emits negligible VOCs and eliminates costly solvent recovery steps. Automotive life-cycle studies show powder conversion cuts 23.40 kg CO2 and 1.47 kg VOCs per vehicle versus liquid paint, creating a measurable sustainability dividend that resonates with OEM decarbonization roadmaps. Europe's Green Deal and the United States EPA's updated National Emission Standards are pushing coaters to accelerate replacement of solventborne primers. Leading formulators have pre-empted tighter limits by launching TGIC-free and chrome-free chemistries that anticipate future bans. Rising carbon-pricing schemes further strengthen the business case, as powder lines demonstrate lower energy intensity than multi-stage liquid booths. As a result, global installed capacity for powder coatings market finishing lines is expanding faster than for any other technology.

Low-Bake Chemistries Expanding Application Possibilities

Recent breakthroughs allow full cure below 120°C, unlocking MDF, plastics, and composites that once warped under conventional schedules. Pioneering systems processed at 248°F enable low-gloss, scratch-resistant finishes on assembled furniture, picture frames, and decorative panels. The Asia-Pacific furniture cluster is the immediate beneficiary, as producers gain a VOC-free route to vibrant colors without multiple topcoats. Line operators also record double-digit material savings because an electrostatically applied powder recovers overspray for reuse, improving first-pass transfer. Practical payback occurs quickly when energy demand falls, given the lower oven set-points. Global suppliers continue to refine resin chemistry to shorten curing time, letting conveyor speeds rise and daily throughput climb.

Thin Film Application Challenges Limiting Market Penetration

Ultra-smooth, 25 µm films remain difficult to deposit uniformly, especially on sharp edges and recessed cavities. Reduced coating mass can lower scratch resistance and opacity, making thin-film powders less attractive for premium electronics housings that demand flawless surfaces. Applicators compensate with tighter process windows and in-line thickness gauges, yet variability persists on intricate geometries. Liquid alternatives keep share in smartphones and laptops because atomized paints easily hit 10 µm without orange peel. Equipment retrofits-such as advanced corona guns and fluidized hoppers-raise capital outlays, slowing adoption among small job shops. Nonetheless, suppliers are engineering finer grind distributions and proprietary flow agents to close the gap.

Other drivers and restraints analyzed in the detailed report include:

- Domestic Appliance Manufacturing Surge in Asia

- Automotive Production Reshoring Driving Regional Demand

- UV-Curable Powder Limitations Constraining Growth

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyester compositions account for 38% of the powder coatings market share in 2024, giving the group an unrivaled footprint across architectural, appliance, and automotive trim lines. Their 6.25% CAGR forecast means the polyester portion of the powder coatings market reflects the resin's weather fastness and wide color palette. Reformulation to TGIC-free and low-bake cross-linkers aligns with eco-design directives, while pigmentation advances retain gloss even in coastal climates. The powder coatings market continues to benefit as polyester blends incorporate functional nanoparticles that improve stain release without compromising cure speed.

Epoxy powder retains a strategic position in heavy-duty indoor settings such as switchgear and pipe valves because of superior chemical resistance. Yet UV fragility limits outdoor exposure, capping volume growth versus polyester. Epoxy-polyester hybrids mitigate chalking and expand shelf appeal for home appliances, driving incremental demand in emerging Asian production hubs. Polyurethane powders carve out premium niches where chemical and abrasion resistance justify added cost; Covestro's low-temperature cures open composite wheels and carbon fiber parts to this chemistry. Acrylic, PVC, and polyolefin solutions address specialized requirements such as anti-graffiti transit panels or dishwasher racks, illustrating the breadth of options sustaining resin-diversified growth.

Thermoset grades dominated 90% of the powder coatings market in 2024, thanks to irreversible cross-linked networks that withstand UV, chemicals, and abrasion. Their entrenched position in automotive wheels, pipelines, and building facades keeps volume high, and production scale ensures cost leadership. However, thermoplastics are trending upward at 6.01% CAGR as processors value the ability to remelt or repair surfaces, a feature prized in heavy machinery and shopping-cart frames. Over the forecast horizon, the thermoplastic slice of the powder coatings market size may double, particularly where flexible, impact-resistant skins are essential.

Innovation is central to this shift. IFS Puroplaz PE16 demonstrates how modified polyolefins achieve steel-like adhesion while preserving ductility, broadening thermoplastic reach into decorative fencing and playground structures. Similarly, nylon-based powders support thick, chip-resistant films on offshore fasteners. Improved flame-retardant formulations make thermoplastics compatible with electrical enclosures, eroding legacy thermoset share. While curing energy remains higher because thermoplastics require melt flow at elevated temperatures, intensified research on inductive heating and infrared panels aims to narrow that gap during 2025-2030 deployments.

The Powder Coatings Market Report Segments the Industry by Resin Type (Epoxy, Polyester, and More), Coating Type (Thermoset Powder Coatings and Thermoplastic Powder Coatings), End-Use Industry (Architecture and Decorative, Automotive, and More), Substrate (Metal, Plastics and Composites, and More), and Geography (Asia Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 55% of global demand in 2024 and is on track for a 5.89% CAGR to 2030, translating into more than one-half of incremental powder coatings market size growth over the period. China's construction rebound, India's accelerating capital goods output, and ASEAN's surge in white-goods assembly all feed regional consumption. Multinationals continue to add local capacity; AkzoNobel's Gwalior plant brought 5,166 t/y online in September 2024, signaling sustained confidence in domestic appetite.

North America benefits from reshoring policies. The United States Environmental Protection Agency's strict VOC cap catalyzes plant upgrades, and Mexico's assembly corridor now specifies powder on chassis brackets and wheel rims to meet USMCA content rules. Regional formulators highlight faster color-match turnaround because powders can be batched locally without high-solvent lab safety controls.

Europe's mature installation base focuses on innovation rather than volume. The provisional anti-dumping duty on Asian epoxy resin imports adopted in 2025 shields EU producers from price swings, stabilizing raw-material margins for domestic powder makers. Sustainability agendas spur R&D into bio-based resins and renewable-energy-powered cure systems, ensuring continued low-carbon leadership.

The Middle East and Africa powder coatings market sees pronounced upside from billion-dollar megaprojects such as NEOM, Doha Metro extensions, and UAE logistics zones. Al Taiseer Aluminium commands 21% of the Gulf extrusion finishing segment, underscoring how regional champions shape specification norms. Latin America remains smaller in absolute terms, yet automotive investments in Brazil and Argentina gradually lift consumption, particularly of polyester topcoats.

- Advanced Powder Coatings

- Akzo Nobel N.V.

- Asian Paints PPG Pvt. Ltd.

- Axalta Coating Systems, LLC

- BASF

- Berger Paints India

- Cardinal

- Hempel A/S

- IFS Coatings

- IGP Pulvertechnik AG

- Jotun

- Kansai Paint Co.,Ltd.

- NATIONAL PAINTS FACTORIES CO. LTD.

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc. (TCI Powder Coatings)

- SAK Coat

- Teknos Group

- The Sherwin-Williams Company

- TIGER Coatings GmbH & Co. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent VOC-emission and decarbonization regulations accelerating solvent-free coatings

- 4.2.2 Low-bake chemistries opening MDF and heat-sensitive substrate opportunities, especially in Asia

- 4.2.3 Surging domestic appliance output in ASEAN and India backed by FDI inflows

- 4.2.4 Re-shoring of automotive production in Mexico and Europe boosting OEM demand

- 4.2.5 GCC infrastructure megaprojects driving architectural aluminium extrusion coatings

- 4.3 Market Restraints

- 4.3.1 Difficulty in Obtaining Thin Film of Powder Coating

- 4.3.2 Limited UV-curable powder compatibility with complex geometries

- 4.3.3 Volatile polyester and epoxy feedstock pricing eroding margins

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value )

- 5.1 By Resin Type

- 5.1.1 Epoxy

- 5.1.2 Polyester

- 5.1.3 Epoxy-Polyester

- 5.1.4 Polyurethane

- 5.1.5 Acrylic

- 5.1.6 Other Resin Types (Polyvinyl Chloride, Polyolefins)

- 5.2 By Coating Type

- 5.2.1 Thermoset Powder Coatings

- 5.2.2 Thermoplastic Powder Coatings

- 5.3 By End-use Industry

- 5.3.1 Architecture and Decorative

- 5.3.2 Automotive

- 5.3.3 Industrial

- 5.3.4 Others (Furniture, Appliances, etc.)

- 5.4 By Substrate

- 5.4.1 Metal

- 5.4.2 MDF and Wood

- 5.4.3 Plastics and Composites

- 5.4.4 Glass and Other Non-conductive Substrates

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Advanced Powder Coatings

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Asian Paints PPG Pvt. Ltd.

- 6.4.4 Axalta Coating Systems, LLC

- 6.4.5 BASF

- 6.4.6 Berger Paints India

- 6.4.7 Cardinal

- 6.4.8 Hempel A/S

- 6.4.9 IFS Coatings

- 6.4.10 IGP Pulvertechnik AG

- 6.4.11 Jotun

- 6.4.12 Kansai Paint Co.,Ltd.

- 6.4.13 NATIONAL PAINTS FACTORIES CO. LTD.

- 6.4.14 Nippon Paint Holdings Co., Ltd.

- 6.4.15 PPG Industries, Inc.

- 6.4.16 RPM International Inc. (TCI Powder Coatings)

- 6.4.17 SAK Coat

- 6.4.18 Teknos Group

- 6.4.19 The Sherwin-Williams Company

- 6.4.20 TIGER Coatings GmbH & Co. KG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment