|

市场调查报告书

商品编码

1850035

资料中心刀锋伺服器:市场占有率分析、产业趋势、统计资料和成长预测(2025-2030 年)Data Center Blade Server - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

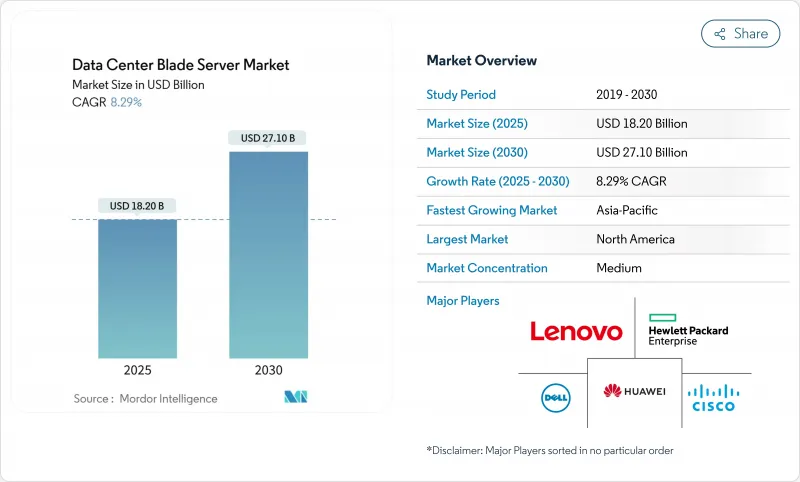

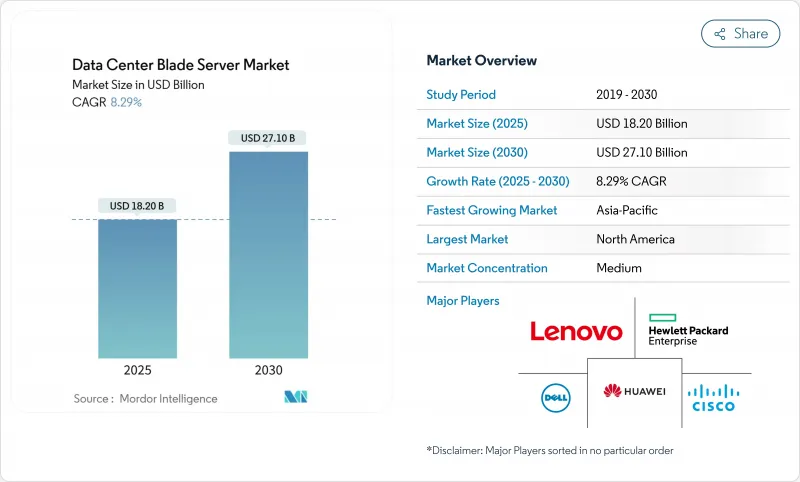

资料中心刀锋伺服器市场预计将从 2025 年的 182 亿美元成长到 2030 年的 271 亿美元,复合年增长率为 8.29%。

随着人工智慧和机器学习工作负载的采用率不断提高,以及运算密度需求的变化,供应商正转向可组合、分解的刀片设计,将运算、储存和网路资源分开。这种架构转变可实现更高的利用率和更快的工作负载重新分配,而直接液冷、硅光电背板和先进的底盘管理软体则有助于管理目前超过 30kW 的机架功率。北美仍然是规模领导者,但由于印度、中国和新加坡的大规模待开发区建设,亚太地区正在加速成长。虽然主机託管设施仍然是最大的客户群,但超大规模资料中心营运商正在製定技术议程,转向可提供更高机架级效率的专用人工智慧刀片系统。

全球资料中心刀锋伺服器市场趋势与洞察

AI/ML 工作负载的机架级功率密度激增

AI推理和训练集群目前正在将机架功率从10-15千瓦推高至30-50千瓦。开放运算专案的OSAI规范目标机架架构功率范围为250千瓦至1兆瓦,鼓励刀锋伺服器供应商整合高效稳压器和直接液冷技术。戴尔的PowerEdge XE9680L证明了底盘级气流、冷却板迴路和AI专用加速器可以共存,而无需进行热感节流。国际能源总署(IEA)预测,到2030年,以AI为中心的资料中心的能耗可能达到945太瓦时,因此,节能刀片设计将成为营运商策略的核心。

边缘和云融合加速微模组化资料中心的采用

5G 部署和超低延迟服务正在将运算推向网路边缘,从而催生了对预接线、预冷却、微模组资料中心的需求。谷歌的模组化边缘设备专利强调了整合电源和热交换的安全多租户机架组件的重要性。电讯营运商正在将其 6000 亿美元资本支出计划中的很大一部分分配给此类边缘站点,这使得刀片伺服器供应商有机会提供针对有限空间定制的四分之一高度节点。

硅光电和 800GbE 背板迁移推动资本支出

切换到光子积体电路和 800GbE 结构可以改善延迟和频宽,但需要新的底盘、中板连接器和重定时器卡。国家机构承认效率提升,但警告称,初始部署需要大量资本投入,尤其是对中型企业而言。对 CXL 记忆体分区的研究表明,投资回收期需要数年,这迫使营运商错开升级。

細項分析

到2024年,Tier 3资料中心将占据资料中心刀锋伺服器市场的42.21%,因为它们的N+1冗余配置符合主流企业SLA。 Tier 4资料中心虽然数量较少,但预计在AI训练丛集的弹性需求推动下,复合年增长率将达到12.2%。这股势头使Tier 4成为100%液冷底盘和硅光电互连的试验场。

一级和二级资料中心设施的营运商通常服务于边缘聚合和分支工作负载,他们正在采用标准化刀片伺服器,以在提高自动化程度的同时保持成本控制。根据Infrastructure Masons的报告,目前90%的电力成长源自于AI模型训练,而这种压力逐渐转移到规模较小的资料中心,这些资料中心必须适应更高的电力消耗和机架密度。因此,供应商正在打包套件,用于改造具有存储通道和后门热交换器的低层机房,从而保持更广泛的资料中心刀片伺服器市场的强劲成长势头。

半高刀锋伺服器支援双路 CPU、充足的 DIMM 插槽和 PCIe 扩展,足以处理大多数虚拟化和资料库任务。半高刀锋伺服器仍然是企业主机代管机架的主力,而全高刀锋伺服器则继续支援四路、记忆体受限的工作负载,例如记忆体内分析。

四分之一高度和微刀片节点是成长最快的切片,复合年增长率为 14.12%,因为它们每个 10U 机架支援 16 到 32 个运算托架,非常适合有限的边缘空间。供应商现在正在将 GPU 加速器整合到这些紧凑的切片中,以便在基地台站点实现即时推理。与 Open Rack v3 规范的兼容性允许在同一机柜内进行混合部署,从而支援资料中心刀锋伺服器市场的边缘扩展。

资料中心刀锋伺服器市场报告按类型(一级刀锋伺服器、二级刀锋伺服器、其他)、外形规格(半高刀锋伺服器、全高刀锋伺服器、其他)、最终用户垂直领域(金融服务、保险和保险业、製造业、其他)、资料中心类型(超大规模资料中心/云端服务供应商、其他)和地区(亚太地区、欧洲、其他)对产业进行分类。市场预测以美元计算。

区域分析

受北维吉尼亚、德克萨斯和硅谷超大规模园区的推动,北美将在2024年占据资料中心刀锋伺服器市场的42.23%。劳伦斯柏克莱国家实验室估计,2023年美国资料中心的用电量将达到176太瓦时,无疑加剧了液冷刀片在降低设施PUE的迫切性。加拿大和墨西哥将透过区域主权云和灾难復原区进一步增加对液冷刀片的需求。

亚太地区将成为成长最快的地区,2025年至2030年的复合年增长率将达到12.54%。中国正在部署大型人工智慧云端丛集,而印度需要在2030年前将装置容量从1.35兆瓦扩大到50兆瓦,才能实现其数位经济目标。新加坡的政策框架优先考虑包含高密度刀片和热回收冷却器的设计,并赋予其容量许可权。日本和澳洲正在沿海底电缆登陆站扩展其边缘运算覆盖范围,并采用四分之一高度的刀片用于内容缓存。

在严格的效率和数据主权规则下,欧洲市场正在稳步扩张。生态设计2019/424的修订鼓励刀片底盘支援35°C以上的热水冷却,从而简化与区域供热环路的整合。中东和非洲正在吸引投资,为金融科技和游戏客户提供云端服务。南美地区以巴西的互联网交换中心为中心的部署正在增加,运营商正在部署可组合刀片以应对季节性流量高峰。这些区域动态正在提升资料中心刀锋伺服器市场的全球重要性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 为 AI/ML 工作负载提供飙升的机架级功率密度

- 透过边缘云端整合加速微模组资料中心的部署

- 高度伺服器整合可降低营运成本和房地产成本

- 液冷底盘获得监管激励措施(欧盟、新加坡)

- 超超大规模资料中心业者越来越青睐可组合分散式刀片

- 市场限制

- 硅光电和 800 Gb E 背板迁移推动资本支出

- 供应商集中在独特的底盘生态系统中

- 管理多结构、分散式架构的技能差距

- ORAN/5G收益的延迟将延长通讯业者中心的投资回报

- 供应链分析

- 监管和永续性格局

- 技术展望(PCIe 6.0、CXL 3.0、硅光电)

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争的激烈程度

- 评估宏观经济趋势对市场的影响

第五章市场规模与成长预测(价值)

- 资料中心层

- 1级和2级

- 第 3 层

- 第 4 层

- 按外形规格

- 半高刀片

- 全高刀片

- 四分之一高度/微刀片

- 按应用程式/工作负载

- 虚拟化和私有云端

- 高效能运算 (HPC)

- 人工智慧/机器学习和数据分析

- 以储存为中心

- 边缘/物联网网关

- 依资料中心类型

- 超大规模资料中心业者/云端服务供应商

- 主机代管设施

- 企业和边缘

- 按最终用途行业

- BFSI

- IT 和通讯/CSP

- 医疗保健和生命科学

- 製造业和工业4.0

- 能源和公共产业

- 政府和国防

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 新加坡

- 澳洲

- 马来西亚

- 其他亚太地区

- 南美洲

- 巴西

- 智利

- 阿根廷

- 南美洲其他地区

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- Strategic Initiatives

- 市占率分析

- 公司简介

- Cisco Systems Inc.

- Dell Technologies

- Hewlett Packard Enterprise

- Huawei Technologies Co. Ltd.

- IBM Corporation

- Fujitsu Ltd.

- Lenovo Group Ltd.

- NEC Corporation

- Oracle Corporation

- Super Micro Computer Inc.

- Inspur Group

- Quanta Cloud Technology

- Gigabyte Technology

- Hitachi Ltd.

- AMD(Pensando)

- Nvidia Corp.(Grace Superchip platforms)

- Marvell Technology(DPU-centric blades)

- Broadcom Inc.(Switch-on-Blade)

- Advantech Co. Ltd.

- Silicom Ltd.

- ZTE Corporation

第七章 市场机会与未来展望

The Data Center Blade Server market is valued at USD 18.2 billion in 2025 and is forecast to reach USD 27.10 billion by 2030, expanding at an 8.29% CAGR.

Rising deployment of AI and machine-learning workloads is reshaping compute density requirements, pushing vendors toward composable, disaggregated blade designs that separate compute, storage and networking resources. This architectural shift enables higher utilization and rapid workload re-allocation, while direct liquid cooling, silicon-photonics backplanes and advanced chassis management software help operators manage rack power envelopes that now exceed 30 kW. North America retains scale leadership, yet Asia-Pacific is growing faster on the back of large greenfield builds in India, China and Singapore. Colocation facilities remain the largest customer group, but hyperscalers are setting the technical agenda as they move to purpose-built AI blade systems that deliver higher rack-level efficiency.

Global Data Center Blade Server Market Trends and Insights

Surging Rack-Level Power Density Accommodates AI/ML Workloads

AI inference and training clusters now push rack envelopes from 10-15 kW toward 30-50 kW. The Open Compute Project's OSAI specification targets 250 kW to 1 MW rack architectures, encouraging blade vendors to integrate high-efficiency voltage regulators and direct liquid cooling. Dell's PowerEdge XE9680L demonstrates how chassis-level airflow, cold-plate loops, and AI-specific accelerators can coexist without thermal throttling. The International Energy Agency projects that AI-focused data centers could consume 945 TWh by 2030, which keeps power-efficient blade design at the center of operator strategies

Edge-Cloud Convergence Accelerating Deployment in Micro-Modular DCs

5G rollouts and ultra-low-latency services push compute to the network edge, spawning demand for micro-modular data centers that can ship pre-wired and pre-cooled. Google's patent for modular edge facilities confirms the importance of secure, multitenant rack assemblies with integrated power and heat exchange. Telecom operators are allocating a sizeable share of their USD 600 billion CAPEX plan to such edge sites, giving blade vendors an opening to supply quarter-height nodes tailored for constrained footprints

CapEx Spike from Silicon-Photonics and 800 GbE Backplane Migration

Switching to photonic integrated circuits and 800 GbE fabrics unlocks latency and bandwidth gains but demands new chassis, mid-plane connectors and retimer cards. National agencies acknowledge the efficiency upside yet caution that early deployments bear heavy capital costs, particularly for mid-sized enterprises. Research into memory disaggregation over CXL suggests a multi-year payback, forcing operators to stagger upgrades

Other drivers and restraints analyzed in the detailed report include:

- High Server Consolidation Ratios Lower OPEX and Real-Estate Cost

- Liquid-Cooling Ready Chassis Gaining Regulatory Incentives

- Supplier Concentration in Proprietary Chassis Ecosystems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tier 3 facilities owned 42.21% of the Data Center Blade Server market in 2024, as their N+1 redundancy profile aligns with mainstream enterprise SLAs. Tier 4 sites, though smaller in count, are forecast to grow at 12.2% CAGR thanks to fault-tolerance demands from AI training clusters. This momentum positions Tier 4 as the proving ground for 100% liquid-cooled chassis and silicon-photonics interconnects.

Operators of Tier 1 and Tier 2 facilities, typically serving edge aggregation or branch workloads, adopt standardized blades to maintain cost discipline while gaining better automation. The Infrastructure Masons report links 90% of current power growth to AI model training, a load now propagating into even modest sites that must accommodate higher power draw and rack density. As a result, vendors are packaging kits that retrofit lower-tier rooms with containment aisles and rear-door heat exchangers, preserving momentum for the wider Data Center Blade Server market.

Half-height blades delivered 48.41% revenue in 2024, supporting dual-socket CPUs, ample DIMM slots and PCIe expansion for most virtualization and database tasks. They remain the workhorse of enterprise colocation racks. Full-height models continue to serve quad-socket, memory-bound workloads such as in-memory analytics.

Quarter-height and micro-blade nodes are the fastest-growing slice at 14.12% CAGR because they fit 16-32 compute sleds per 10U shelf, ideal for limited edge footprints. Vendors now integrate GPU accelerators into these compact sleds, enabling real-time inference at cell-tower sites. Compatibility with Open Rack v3 specifications allows mixed deployment inside the same cabinet, sustaining the Data Center Blade Server market's edge expansion narrative.

Data Center Blade Server Market Report Segments the Industry Into Type (Tier 1, Tier 2, and More), Form Factor(Half-Height Blades, Full-Height Blades, and More), End-User Verticals (BFSI, Manufacturing, and More), Data Center Type(Hyperscalers/Cloud Service Provider, and More) and Geography (Asia-Pacific, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 42.23% of the Data Center Blade Server market in 2024, fueled by hyperscale campuses in Northern Virginia, Texas and Silicon Valley. The Lawrence Berkeley National Laboratory calculated 176 TWh of US data-center electricity use in 2023, raising urgency for liquid-cooled blades that cut facility PUEs. Canada and Mexico add incremental demand through regional sovereign-cloud and disaster-recovery zones.

Asia-Pacific is the fastest-growing theater at 12.54% CAGR from 2025-2030. China deploys massive AI cloud clusters, while India needs to expand installed capacity from 1.35 GW to 5 GW by 2030 to keep pace with digital-economy targets. Policy frameworks in Singapore award capacity licenses preferentially to designs that include high-density blades and heat-recovery chillers. Japan and Australia extend the edge footprint along subsea cable landing stations, embedding quarter-height blades for content caching.

Europe shows steady expansion under strict efficiency and data-sovereignty rules. Ecodesign 2019/424 revisions encourage blade chassis that support warm-water cooling above 35 °C, easing integration with district-heat loops. The Middle East and Africa attract investment for cloud on-ramps serving fintech and gaming customers. South America's installations cluster around Brazil's internet exchange hubs, where operators deploy composable blades to meet seasonal traffic peaks. These regional dynamics reinforce the global relevance of the Data Center Blade Server market.

- Cisco Systems Inc.

- Dell Technologies

- Hewlett Packard Enterprise

- Huawei Technologies Co. Ltd.

- IBM Corporation

- Fujitsu Ltd.

- Lenovo Group Ltd.

- NEC Corporation

- Oracle Corporation

- Super Micro Computer Inc.

- Inspur Group

- Quanta Cloud Technology

- Gigabyte Technology

- Hitachi Ltd.

- AMD (Pensando)

- Nvidia Corp. (Grace Superchip platforms)

- Marvell Technology (DPU-centric blades)

- Broadcom Inc. (Switch-on-Blade)

- Advantech Co. Ltd.

- Silicom Ltd.

- ZTE Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging rack-level power density accommodates AI/ML workloads

- 4.2.2 Edge-cloud convergence accelerating deployment in micro-modular DCs

- 4.2.3 High server consolidation ratios lower OPEX and real-estate cost

- 4.2.4 Liquid-cooling ready chassis gaining regulatory incentives (EU, Singapore)

- 4.2.5 Growing hyperscaler preference for composable disaggregated blades

- 4.3 Market Restraints

- 4.3.1 CapEx spike from silicon photonics and 800 Gb E backplane migration

- 4.3.2 Supplier concentration in proprietary chassis ecosystems

- 4.3.3 Skill-gap in managing multi-fabric, disaggregated architectures

- 4.3.4 Delayed ORAN/5G monetisation lengthening ROI for telco DCs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory and Sustainability Landscape

- 4.6 Technological Outlook (PCIe 6.0, CXL 3.0, silicon photonics)

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Assessment of the Impact on Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Data-Center Tier

- 5.1.1 Tier 1 and 2

- 5.1.2 Tier 3

- 5.1.3 Tier 4

- 5.2 By Form Factor

- 5.2.1 Half-height Blades

- 5.2.2 Full-height Blades

- 5.2.3 Quarter-height / Micro-blades

- 5.3 By Application / Workload

- 5.3.1 Virtualisation and Private Cloud

- 5.3.2 High-Performance Computing (HPC)

- 5.3.3 Artificial Intelligence/Machine Learning and Data Analytics

- 5.3.4 Storage-centric

- 5.3.5 Edge / IoT Gateways

- 5.4 By Data Center Type

- 5.4.1 Hyperscalers/Cloud Service Provider

- 5.4.2 Colocation Facilities

- 5.4.3 Enterprise and Edge

- 5.5 By End-use Industry

- 5.5.1 BFSI

- 5.5.2 IT and Telecom / CSPs

- 5.5.3 Healthcare and Life-Sciences

- 5.5.4 Manufacturing and Industry 4.0

- 5.5.5 Energy and Utilities

- 5.5.6 Government and Defence

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Singapore

- 5.6.3.5 Australia

- 5.6.3.6 Malaysia

- 5.6.3.7 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Chile

- 5.6.4.3 Argentina

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 United Arab Emirate

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Initiatives

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Cisco Systems Inc.

- 6.4.2 Dell Technologies

- 6.4.3 Hewlett Packard Enterprise

- 6.4.4 Huawei Technologies Co. Ltd.

- 6.4.5 IBM Corporation

- 6.4.6 Fujitsu Ltd.

- 6.4.7 Lenovo Group Ltd.

- 6.4.8 NEC Corporation

- 6.4.9 Oracle Corporation

- 6.4.10 Super Micro Computer Inc.

- 6.4.11 Inspur Group

- 6.4.12 Quanta Cloud Technology

- 6.4.13 Gigabyte Technology

- 6.4.14 Hitachi Ltd.

- 6.4.15 AMD (Pensando)

- 6.4.16 Nvidia Corp. (Grace Superchip platforms)

- 6.4.17 Marvell Technology (DPU-centric blades)

- 6.4.18 Broadcom Inc. (Switch-on-Blade)

- 6.4.19 Advantech Co. Ltd.

- 6.4.20 Silicom Ltd.

- 6.4.21 ZTE Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment