|

市场调查报告书

商品编码

1850043

文件管理系统:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Document Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

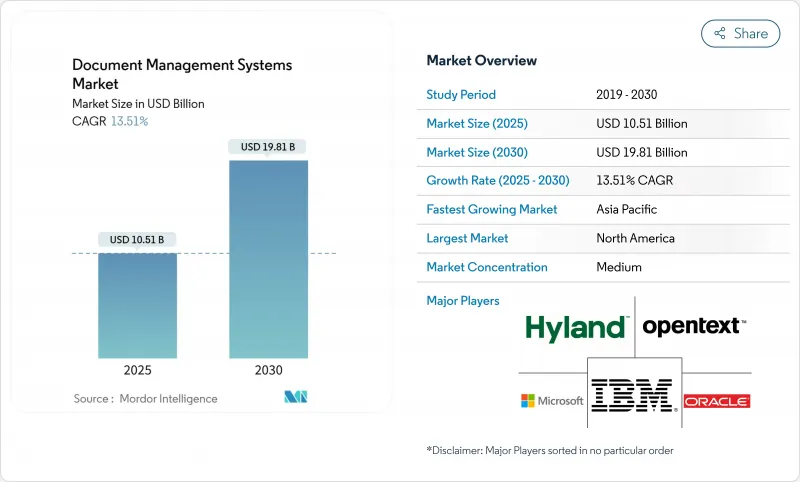

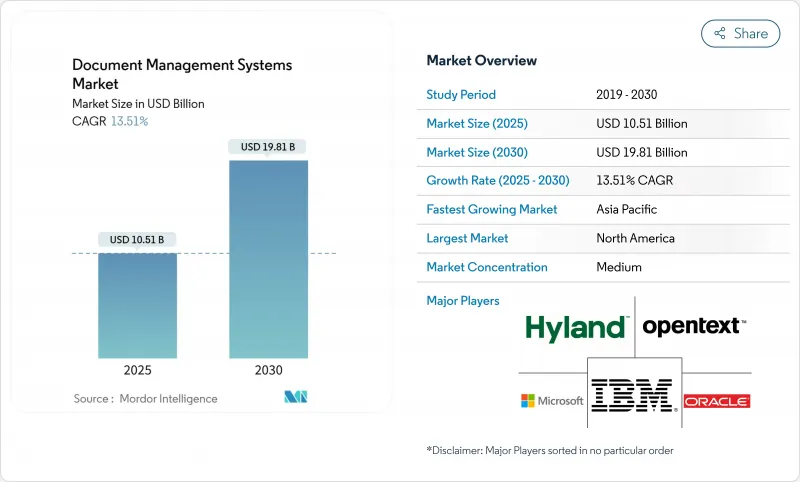

预计到 2025 年,文件管理系统市场规模将达到 105.1 亿美元,到 2030 年将达到 198.1 亿美元,在此期间的复合年增长率为 13.5%。

企业对以文件为中心的流程进行数位转型、用搜寻的数位储存库取代纸本檔案以及满足日益严格的合规要求的需求,推动了文件管理系统市场的成长。企业正积极采用人工智慧技术,将静态储存库转化为知识引擎,并从非结构化文件中挖掘洞察,从而显着提升效率并改善管治。文件管理系统市场也受益于云端迁移、模组化平台设计(简化了与协作工具的整合)以及针对特定区域、满足新的资料主权规则的产品。供应商正竞相将生成式人工智慧助理嵌入到日常业务应用程式中,这些助理能够摘要、撰写文件并将其路由到日常业务应用中。

全球文件管理系统市场趋势与洞察

快速转向无纸化流程推动企业采用

随着企业为了降低营运成本和实现ESG目标而逐步淘汰纸本檔案,许多企业正在围绕数位化优先的工作流程调整策略。文件管理系统市场解决方案的普及应用已使营运成本降低高达30%,处理时间缩短近50%。已实施电子文檔工作流程的医院报告称,记录处理速度提高了40-50%,HIPAA合规性也得到了增强。这些成功案例正在推动文件管理系统的普及。随着初步投资回报的显现,企业主管迅速将应用范围扩大到客户服务、人力资源和供应链团队。这种广泛的应用巩固了文件管理系统市场的持续成长动能。

一个重新定义整合能力的云端原生DMS平台

云端协作套件中文件功能的加入正在再形成买家的预期。微软在2025年第三季处理了超过100兆个AI令牌,云端服务收入飙升22%,达到424亿美元。企业倾向于使用熟悉的介面,将内容创建、储存和管治整合到统一的身份验证框架下,这迫使传统供应商加强互通性。在远端和混合办公环境中,这一趋势尤其明显,因为在这些环境中,无缝的跨装置存取至关重要。因此,文件管理系统市场正倾向于提供即插即用整合方案的供应商,而不是提供独立功能清单的供应商。

使用者持续的抵制阻碍了成功实施。

儘管投资报酬率显而易见,但根深蒂固的后勤部门团队往往将新的工作流程视为一种干扰。 70% 的组织认为使用者抵触是推广缓慢的主要原因。在医疗保健和金融业,这种怀疑态度尤其突出,因为审核追踪在这些行业至关重要。培训投入和变革管理蓝图通常落后于技术推广,延长了投资回报期,阻碍了文件管理系统市场充分发挥其潜力。然而,那些拥有专门推广计划的公司,其用户满意度提高了 62%,价值实现速度提高了 41%,这表明文化契合度与功能同等重要。

细分市场分析

实施的复杂性正在推动企业在专业服务和託管服务方面的支出增加。 2024年,软体在文件管理系统市场中占据76%的份额,预计从2025年到2030年将以18.9%的复合年增长率成长,因为企业正在寻求与ERP、CRM和特定产业平台进行客製化整合。文件管理系统即服务(DMaaS)的市场规模预计将比任何其他组件类别增长更快,这反映出对持续优化服务和合规性审核的需求不断增长。供应商报告称,与人工智慧模型调优和元资料策略相关的咨询服务目前是他们最盈利的服务项目。

这项转变也凸显出,成功的关键不仅在于许可,更在于流程再造。咨询团队负责组织使用者验收试点、建立模板,并制定符合监管机构要求的资料保留策略。随着隐私权法的日益普及,对管治为重点的咨询服务的需求也随之增长。因此,拥有垂直行业专业知识的系统整合商在文件管理系统市场中占据了越来越大的计划预算份额。

文件管理系统市场按元件(软体和服务)、配置(云端和本地部署)、最终用户产业(银行和金融服务、製造业和建设业等)以及地区进行细分。市场预测以美元计价。

区域分析

2024年,北美将维持全球35%的收入份额,这主要得益于早期云端迁移和成熟的法规结构(该框架要求提供精细的审核追踪)。金融服务和医疗保健行业的买家将主导该地区的支出,他们正在整合先进的人工智慧模组以挖掘非结构化数据。微软、IBM和Adobe等领先供应商正在利用现有的企业授权来扩展其文件管理模组,从而巩固其区域规模优势。政府鼓励无纸化采购的激励措施进一步刺激了支出,文件管理系统市场仍然是美国和加拿大数位转型蓝图的核心。

亚太地区是成长最快的地区,预计2025年至2030年的复合年增长率将达到15.8%。印度、中国和韩国的政策主导数位化计画正在加速公共和私营部门的数位化应用。印度的《资料保护和资料保护法》(DPDP法案)鼓励银行和保险公司部署地理围篱储存节点,而中国企业通常选择国内供应商以满足其网路安全法的要求。在日本,文件管理系统(DMS)在製造业的应用日益普及,并纳入精实生产实务。超大规模云端服务供应商正在扩展区域资料中心,以解决先前阻碍跨境部署的居住问题,从而帮助文件管理系统市场更好地服务亚太地区企业的现代化进程。

欧洲市场正受到GDPR和各国隐私权法的影响,合规性成为重要的采购筛选标准。英国和德国在采购量上领先,尤其註重受控记录管理和自动保留。各组织倾向于选择能够确保内容永不离开欧盟指定边界的平台,这推动了对拥有主权证书的欧洲供应商的需求。永续性倡议正在推动减少纸张使用的目标,并进一步促进计划的发展。南欧国家的采用率也不断提高,但由于需要多方相关人员的核准,采购週期有所延长。整体而言,严格的资料管治使欧洲在全球文件管理系统市场中,凭藉其以隐私为先的功能,成为领先者。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 快速转向无纸化流程(企业成本与环境、社会及公司治理义务)

- 整合协作套件的云端原生文件管理系统平台

- AI增强搜寻和自动分类的准确率显着提高(>95%)

- 推广部署符合严格资料主权规则(欧盟GDPR、印度DPDP)的DMS系统

- 更多特定产业范本(医疗、法律、建筑、工程和施工)可缩短部署週期。

- 生成式人工智慧助理释放情境化内容工作流程(报告不足)

- 市场限制

- 受监管的后勤部门功能中,使用者对变更的持续抵制

- 元资料管理不善导致电子讯息披露成本上升

- 以DMS为中心的勒索软体事件(报道不足)导致网路保险费上涨

- 对供应商锁定的担忧正在减缓从传统企业内容管理 (ECM) 系统向其他系统的迁移(未充分报告)。

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 定价分析

- 产业生态系分析

- 宏观经济影响评估

第五章 市场规模与成长预测

- 按组件

- 软体

- 服务

- 透过部署

- 云

- 本地部署

- 按最终用户行业划分

- 银行和金融服务

- 製造业及建设业

- 教育

- 卫生保健

- 零售

- 法律事务

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Microsoft Corp.

- OpenText Corp.

- IBM Corp.

- Hyland Software Inc.

- Oracle Corp.

- Box Inc.

- Adobe Inc.

- Laserfiche

- M-Files Corp.

- Alfresco(-Hyland)

- Dropbox Business

- Zoho Corp.

- DocStar(Epicor)

- AODocs

- LogicalDOC Srl

- Agiloft Inc.

- Synergis Technologies

- Everteam

- FileHold Systems

- PaperSave

第七章 市场机会与未来展望

The document management systems market is valued at USD 10.51 billion in 2025 and is forecast to reach USD 19.81 billion by 2030, advancing at a 13.5% CAGR throughout the period.

Growth rests on the enterprise need to digitize document-centric workflows and replace paper archives with searchable digital repositories that satisfy expanding compliance mandates. Organizations are aggressively embedding AI to turn static repositories into knowledge engines that surface insights from unstructured files, driving measurable efficiency gains and improved governance. The document management systems market is also benefitting from cloud migration, modular platform designs that simplify integration with collaboration tools, and region-specific offerings that address emerging data-sovereignty rules. Competitive intensity is rising as vendors race to embed generative AI copilots able to summarize, draft, and route content inside everyday business applications.

Global Document Management Systems Market Trends and Insights

Rapid Shift Toward Paper-Free Processes Driving Enterprise Adoption

Organizations are discarding paper archives to reduce operating costs and meet ESG targets, and many are realigning policies around digital-first workflows. Implementations of document management systems market solutions are delivering operating-cost reductions up to 30% and processing-time improvements near 50%. Hospitals that introduce electronic document workflows report 40-50% faster record handling and tighter HIPAA compliance. Success stories are reinforcing an adoption flywheel: once early ROI appears, executives rapidly extend deployments across customer-service, HR, and supply-chain teams. This widening footprint underpins the sustained momentum of the document management systems market.

Cloud-Native DMS Platforms Redefining Integration Capabilities

The embedding of document functionality inside cloud collaboration suites is reshaping buyer expectations. Microsoft processed more than 100 trillion AI tokens in Q3 2025, and revenue from cloud services jumped 22% to USD 42.4 billion, underscoring demand for integrated platforms. Enterprises prefer familiar interfaces that blend content creation, storage, and governance under unified authentication, pressuring legacy vendors to deepen interoperability. The trend is especially powerful within remote and hybrid workplaces, where seamless cross-device access is non-negotiable. Consequently, the document management systems market is tilting toward vendors capable of drop-in integrations rather than standalone feature checklists.

Persistent User Resistance Hampering Implementation Success

Despite clear ROI, entrenched back-office teams often view new workflows as disruptive. Seventy percent of organizations cite user resistance as the key factor behind delayed deployments. Skepticism is especially acute in healthcare and finance where audit trails are mission critical. Training investments and change-management roadmaps frequently lag technical rollout, stretching payback periods and muting the full potential of the document management systems market. Enterprises with dedicated adoption programs, however, record 62% higher user satisfaction and 41% faster value realization, illustrating that cultural alignment is as important as functionality.

Other drivers and restraints analyzed in the detailed report include:

- AI-Enhanced Search Transforming Information Retrieval

- Data Sovereignty Regulations Reshaping Implementation Strategies

- Industry-Specific Templates Shorten Deployment Cycles

- Generative-AI Copilots Unlock "Content-in-Context" Workflows

- Vendor Lock-In Concerns Creating Implementation Hesitancy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Implementation complexity is tilting spending toward professional and managed services. Although software captured 76% of the document management systems market in 2024, services revenue is rising at an 18.9% CAGR from 2025-2030 as enterprises seek customized integrations with ERP, CRM, and industry-specific platforms. The document management systems market size for services is forecast to expand faster than any other component category, reflecting growing demand for continuous optimization contracts and compliance audits. Vendors report that advisory engagements tied to AI model tuning and metadata strategy are now the most profitable service lines.

The shift also underscores how success hinges on process re-engineering rather than licensing alone. Consulting teams orchestrate user-acceptance pilots, build templates, and craft retention policies that satisfy regulators. Demand for governance-centric consulting is climbing as privacy laws proliferate. Consequently, system integrators with vertical know-how are capturing a larger portion of overall project budgets within the document management systems market.

Document Management System Market Segmented by Component (Software and Services), Deployment (Cloud and ), End-User Industry (Banking and Financial Services, Manufacturing and Construction and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 35% of global revenue in 2024, anchored by early cloud migration and mature regulatory frameworks that mandate granular audit trails. Financial services and healthcare buyers dominate regional spending, integrating advanced AI modules to unlock unstructured insights. Leading vendors such as Microsoft, IBM, and Adobe leverage existing enterprise licenses to expand document management modules, reinforcing regional scale advantages. Government incentives that reward paper-free procurement further stimulate spending, ensuring the document management systems market remains a core pillar of broader digital-transformation roadmaps across the United States and Canada.

Asia-Pacific is the fastest growing geography with a 15.8% CAGR projected for 2025-2030. Policy-driven digitization programs in India, China, and South Korea are accelerating adoption across public and private sectors. India's DPDP Act is prompting banks and insurers to implement geo-fenced storage nodes, while Chinese firms often select domestic vendors to satisfy cybersecurity law requirements. Japan shows robust uptake among manufacturers embedding DMS in lean production systems. Hyperscale cloud providers are expanding regional data centers, addressing residency concerns that once slowed cross-border deployments and helping the document management systems market capture modernizing enterprises throughout APAC.

Europe's market is shaped by GDPR and country-specific privacy laws, making compliance functionality a critical purchase filter. The United Kingdom and Germany lead in volume, emphasizing controlled records-management and retention automation. Organizations favour platforms guaranteeing that content never leaves designated EU zones, boosting demand for European vendors with sovereignty credentials. Sustainability initiatives promote paper-reduction targets, further fuelling projects. Southern European adoption is rising, yet procurement cycles are lengthier due to multi-stakeholder approvals. Overall, data governance stringency positions Europe as a bellwether for privacy-first capabilities within the global document management systems market.

- Microsoft Corp.

- OpenText Corp.

- IBM Corp.

- Hyland Software Inc.

- Oracle Corp.

- Box Inc.

- Adobe Inc.

- Laserfiche

- M-Files Corp.

- Alfresco (-Hyland)

- Dropbox Business

- Zoho Corp.

- DocStar (Epicor)

- AODocs

- LogicalDOC Srl

- Agiloft Inc.

- Synergis Technologies

- Everteam

- FileHold Systems

- PaperSave

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid shift toward paper-free processes (enterprise cost and ESG mandates)

- 4.2.2 Cloud-native DMS platforms bundled inside collaboration suites

- 4.2.3 Surge in AI-enhanced search and auto-classification accuracy (>95 %)

- 4.2.4 Strict data-sovereignty rules (EU GDPR, India DPDP) triggering compliant DMS roll-outs

- 4.2.5 Rise of industry-specific templates (health, legal, AEC) shortening deployment cycles

- 4.2.6 Generative-AI copilots unlocking content-in-context workflows (under-reported)

- 4.3 Market Restraints

- 4.3.1 Persistent user-change resistance in regulated back-office functions

- 4.3.2 High e-discovery costs from poor metadata hygiene

- 4.3.3 Cyber-insurance premiums rising after DMS-centred ransomware events (under-reported)

- 4.3.4 Vendor lock-in concerns slowing migration from legacy ECMs (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Pricing Analysis

- 4.9 Industry Ecosystem Analysis

- 4.10 Macroeconomic Impact Assessment

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 Cloud

- 5.2.2 On-Premise

- 5.3 By End-User Industry

- 5.3.1 Banking and Financial Services

- 5.3.2 Manufacturing and Construction

- 5.3.3 Education

- 5.3.4 Healthcare

- 5.3.5 Retail

- 5.3.6 Legal

- 5.3.7 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Australia

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Israel

- 5.4.5.1.2 Saudi Arabia

- 5.4.5.1.3 United Arab Emirates

- 5.4.5.1.4 Turkey

- 5.4.5.1.5 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Microsoft Corp.

- 6.4.2 OpenText Corp.

- 6.4.3 IBM Corp.

- 6.4.4 Hyland Software Inc.

- 6.4.5 Oracle Corp.

- 6.4.6 Box Inc.

- 6.4.7 Adobe Inc.

- 6.4.8 Laserfiche

- 6.4.9 M-Files Corp.

- 6.4.10 Alfresco (-Hyland)

- 6.4.11 Dropbox Business

- 6.4.12 Zoho Corp.

- 6.4.13 DocStar (Epicor)

- 6.4.14 AODocs

- 6.4.15 LogicalDOC Srl

- 6.4.16 Agiloft Inc.

- 6.4.17 Synergis Technologies

- 6.4.18 Everteam

- 6.4.19 FileHold Systems

- 6.4.20 PaperSave

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment