|

市场调查报告书

商品编码

1850048

医疗资产管理:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Healthcare Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

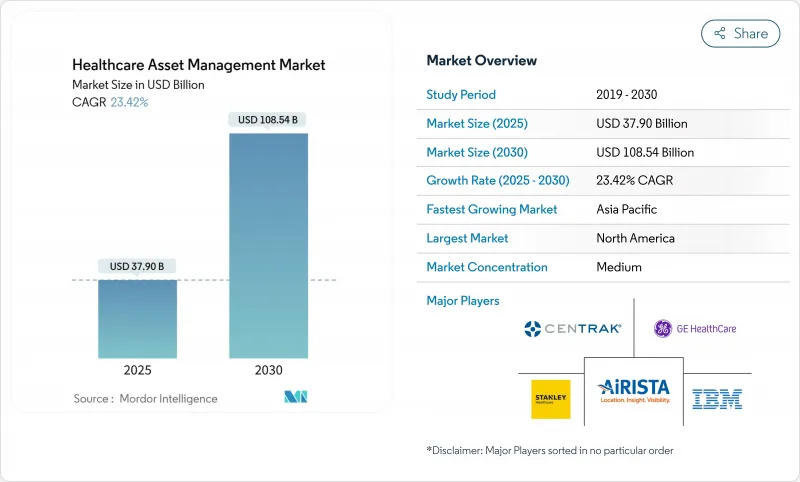

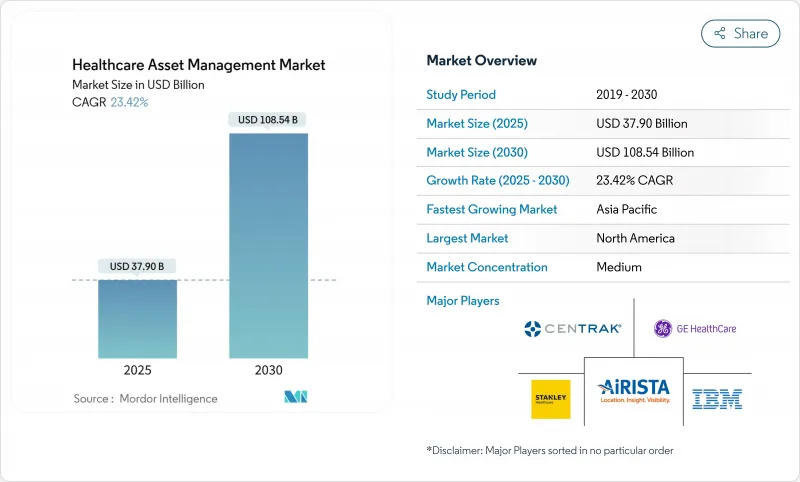

预计 2025 年医疗资产管理市场规模为 379 亿美元,到 2030 年将达到 1,085.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 23.42%。

这一成长轨迹反映出监管要求、劳动力短缺和网路安全预期如何汇聚在一起,将资产追踪从成本控制工具重新定位为数位医疗营运的策略支柱。医院不仅转向条码库存管理,还转向互联平台,以简化对 FDA 2024 年设备安全指南的合规性。需求也与护理人员的限制直接相关。临床容量的萎缩正在扩大系统的价值,这些系统使护理人员无需再寻找设备,而可以专注于患者的结果。同时,嵌入在标籤中的预测分析正在将维护从被动维护转变为预测维护,从而减少停机时间并延长资产寿命。这些因素共同创造了一种医疗资产管理市场环境,在这种环境中,医院、製药厂和实验室将综合可视性、网路安全和分析视为必备功能,而不是可选的附加元件。

全球医疗资产管理市场趋势与洞察

RFID 防伪需求不断成长

据估计,假药每年对全球经济造成 2,000 亿美元的损失,这促使监管机构实施序列化和谱係要求,使得端到端可视性至关重要。根据美国《药品供应链安全法》,药品製造商、批发商和配药药局必须在每个交货点验证产品来源。目前,大多数此类部署都采用经过加密认证的 RFID,将单品级识别与温度敏感型生技药品所需的即时环境监测相结合。虽然 2024 年起的半导体短缺导致标籤价格上涨高达 20%,但该公司仍在投资,因为违规罚款和召回成本远远超过硬体支出。 SATO 等供应商正在推出耐灭菌标籤,可在单一流程步骤中同时提供身分验证和工作流程效率。这些因素支持製药和生物技术製造客户预计从 2025 年到 2030 年的复合年增长率达到 26.8%。

护理人员短缺导致效率提升压力

由于大型都市区医院的护理空缺率超过15%,护理团队捉襟见肘,管理人员也面临着尽可能从支援技术提高效率的压力。研究表明,护士每班次有超过五分之一的时间用于寻找丢失的设备。实施即时定位系统 (RTLS) 可将搜寻时间缩短90%以上,无需增加人员即可提供直接劳动力,确保床位已配备到位。英国一家医疗机构已证明,每台设备的使用时间从60分钟缩短至10分钟,提高了病患安全评分和员工留任率。先进的部署结合了蓝牙低功耗 (BLE) 徽章、紧急按钮和预测分析,可在临床医生发出请求之前将设备放置在病房,从而减轻工作流程负担并提高满意度。

资料隐私和网路安全问题

到2024年,医疗资料外洩的平均成本将达到每次977万美元,安全风险成为快速部署的关键阻碍力。 FDA 2024年的指南草案要求加强上市前安全测试,并强制要求采购方在产品上运作前承担加密、网路分段和持续监控的费用。因此,许多医院选择本地部署或隔离网络,限制资料流向云端,牺牲部分分析能力以降低风险。缺乏安全韧体的旧设备进一步增加了整合的复杂性,延长了计划工期,并增加了预算。

細項分析

到2024年,RFID将占总收入的56.2%,这证实了数十年来通讯协定的成熟度和强大的供应链使其成为追踪药品库存和手术套件的预设技术。 RFID医疗资产管理市场规模预计到2024年将达到213亿美元,显示该技术已深入渗透到照护现场柜和中央无菌处理领域。然而,软体定义的工作流程除了识别之外,越来越需要位置资讯。因此,预计到2030年,利用低功耗蓝牙、Wi-Fi和超宽频的即时定位系统将以28.1%的复合年增长率成长,超过静态RFID的成长。

随着供应商将RFID和RTLS整合到多模标籤中,从而弥合被动ID和即时遥测之间的差距,第二阶段的成长将会出现。被动RFID可以限制昂贵药物的损耗,而RTLS则可以确保输液帮浦在病人病情最严重的地方流通。虽然硬体仍然占据支出的主导地位,标籤、网关和激励器已覆盖整个院区,但利润来源正转向将设备识别、定位和使用情况整合到单一仪表板的平台许可。随着这种融合的持续,医疗资产管理市场可能会将单模产品视为利基市场。

受数百万标籤、阅读器和吸顶式信标持续购买的推动,硬体将在2024年占据62.4%的收入。然而,随着医院从资本支出转向成果管理,服务将以25.6%的复合年增长率领先。透过订阅执行时间,供应商可以保证正常运行时间、韧体和监管审核日誌,使IT团队能够专注于服务患者。预计到2030年,医疗资产管理市场(即服务)的规模将达到326亿美元,这标誌着一个成熟週期的到来:基础设施将变得无所不在,差异化将转向咨询式最佳化。

专业託管服务还能解决一些最具挑战性的难题,例如变更管理、系统整合和网路安全认证。服务合约通常包含远端设备健康检查、演算法更新和合规性文檔,费用在多年期内平均分摊,并与报销週期保持一致。医院越来越多地透过证明每月费用可以透过避免护理人员加班、提高床位周转率和降低设备租金来抵消,以此来证明其合约的合理性。

医疗资产管理市场按技术(RFID、即时定位系统等)、组件(硬体、软体、服务)、应用(设备/器械追踪、库存/供应链管理等)、最终用户(医院/诊所、实验室/诊断中心等)和地区细分。市场预测以美元(USD)计算。

区域分析

2024年,北美将占全球收入的37.8%,这得益于美国全面的序列化法律、成熟的电子病历(EHR)骨干网路以及日益增多的医疗设备网路威胁事件,这些事件有利于整合式安全平台的发展。加拿大各省正在采取类似的政策,墨西哥的私立医院正在投资资产追踪,以确保医疗游客的安全并满足美国保险公司的审核。政府对不安全行为进行惩罚的报销模式已将可追溯性列为董事会层面的指标,这将进一步推动该地区医疗资产管理市场的采用。

亚太地区是成长最快的地区,预计到2030年复合年增长率将达到22.5%。中国、印度和东南亚的公立医院建设计画正在推动待开发区部署,这些项目无需传统的条码步骤,从一开始就实现了RFID-RTLS整合。许多此类设施正在将资产管理与国家数位健康云集成,从而实现整个地区供应链的即时药品认证。随着资本投资与全民健康覆盖目标的契合,供应商报告已签订涵盖数百家新医院的多年期主合约。

受欧盟医疗器材法规 (EU-MDR) 的强制要求、欧洲医疗器材资料管理系统 (EUDAMED)资料库的推出以及支持生命週期优化的国家永续性目标的推动,欧洲的医疗器材采用率正在稳步提升。德国和英国在早期采用方面处于领先地位,但随着结构性基金优先考虑数位转型,东欧的资金筹措机制正在迎头赶上。 GDPR 之后,人们对网路安全的预期推动了对本地部署和混合云端的需求,而本地资料驻留为平台供应商提供了更丰富的配置选项。由于英国脱欧增加了跨境医疗贸易的海关复杂性,英国的供应商正在优先考虑可追溯性,以避免港口延误和产品浪费。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 市场驱动因素

- RFID 防伪需求不断成长

- 护理人员短缺导致效率提升压力

- 病人安全法规(例如 UDI、EU-MDR)

- 嵌入标籤的基于人工智慧的预测性维护

- 与资产可追溯性挂钩的绩效薪酬

- 市场限制

- 资料隐私和网路安全问题

- RTLS/RFID 基础设施前期成本高

- 对关键无线医疗设备的无线电干扰

- 碎片化的旧式 CMMS 阻碍了集成

- 产业价值链分析

- 监管格局

- 技术展望

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 影响市场的宏观经济因素

第五章市场规模与成长预测(价值)

- 依技术

- RFID

- 即时定位系统(RTLS)

- 低功耗蓝牙 (BLE) 和 Wi-Fi

- 红外线和超音波

- 按组件

- 硬体(标籤、阅读器、网关)

- 软体(分析、中介软体)

- 服务(实施、管理、训练)

- 按用途

- 设备和装置追踪

- 库存/供应链管理

- 患者和工作人员追踪

- 床位和容量管理

- 环境和状态监测

- 按最终用户

- 医院和诊所

- 实验室和诊断中心

- 製药和生物技术製造

- 长期照护及疗养院

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 新加坡

- 其他亚太地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Stanley Healthcare(Stanley Black & Decker)

- CenTrak Inc.

- AiRISTA Flow Inc.

- GE HealthCare Technologies Inc.

- IBM Corporation

- Infor Inc.

- Motorola Solutions Inc.

- Siemens Healthineers AG

- Accenture plc

- Sonitor Technologies AS

- Zebra Technologies Corporation

- Johnson Controls(Tyco International)

- Honeywell International Inc.

- Impinj Inc.

- Alien Technology LLC

- HID Global Corporation

- Ascom Holding AG

- Midmark Corporation(Versus RTLS)

- Trimble Inc.(Atrius)

- Cerner Corporation(Oracle Health)

- TagMaster AB

- Radianse LLC

- Kontakt.io Inc.

- Litum IoT Technologies

- Elpas Ltd.(Securitas)

第七章 市场机会与未来趋势

- 閒置频段和未满足需求评估

The Healthcare Asset Management Market size is estimated at USD 37.90 billion in 2025, and is expected to reach USD 108.54 billion by 2030, at a CAGR of 23.42% during the forecast period (2025-2030).

The growth trajectory reflects how regulatory mandates, workforce shortages, and cybersecurity expectations converge to reposition asset tracking from a cost-containment tool to a strategic pillar of digital health operations. Hospitals are looking beyond bar-code inventory toward connected platforms that streamline compliance with the FDA's 2024 device-security guidance, an obligation that can consume 5% or more of a manufacturer's annual revenue. Demand also ties directly to nursing-staff constraints; shrinking clinical capacity magnifies the value of systems that free caregivers from locating equipment and instead let them focus on patient outcomes. In parallel, predictive analytics embedded in tags move maintenance from reactive to anticipatory, trimming downtime and extending asset life. Taken together, these forces enable a healthcare asset management market environment in which hospitals, pharma plants, and laboratories regard integrated visibility, cybersecurity, and analytics as non-negotiable features rather than optional add-ons.

Global Healthcare Asset Management Market Trends and Insights

Rising demand for RFID to curb drug counterfeiting

Pharmaceutical counterfeiting drains an estimated USD 200 billion from the global economy each year, prompting regulators to impose serialisation and pedigree requirements that make end-to-end visibility indispensable. Under the U.S. Drug Supply Chain Security Act, drug makers, wholesalers, and dispensers must prove product provenance at every hand-off. RFID with cryptographic authentication now underpins most of these deployments because it combines item-level identification with real-time environmental monitoring, a necessity for temperature-sensitive biologics. Semiconductor shortages since 2024 lifted tag prices by up to 20%, yet organisations still invest because non-compliance fines and recall costs far exceed hardware spending. Vendors such as SATO have introduced sterilisation-resistant tags that deliver both authentication and workflow efficiency in one process step. These factors underpin the 26.8% CAGR projected for pharmaceutical and biotech manufacturing customers between 2025 and 2030.

Efficiency pressures from nursing-staff shortages

Nursing vacancy rates above 15% in major urban hospitals leave care teams stretched and force administrators to squeeze every efficiency gain possible from support technology. Studies reveal that nurses spend over one-fifth of each shift searching for missing equipment; RTLS implementations that cut search time by more than 90% therefore provide a direct labour dividend that keeps beds staffed without adding headcount. British facilities have demonstrated time reductions from 60 minutes to 10 minutes per device, translating into heightened patient-safety scores and improved staff retention. Advanced deployments now combine BLE badges, panic buttons, and predictive analytics that stage equipment on units before clinicians request it, easing workflow strain and boosting satisfaction.

Data-privacy and cybersecurity concerns

Average breach costs in healthcare reached USD 9.77 million per incident in 2024, making security risk a material deterrent to rapid roll-outs. The FDA's 2024 draft guidance urges stronger pre-market security testing, compelling buyers to fund encryption, network segmentation, and continuous monitoring before go-live. Many hospitals, therefore, begin with on-premises deployments or air-gapped networks that limit data flow to the cloud, trading some analytics capability for risk reduction. Legacy devices without secure firmware further complicate integrations, extending project timelines and inflating budgets.

Other drivers and restraints analyzed in the detailed report include:

- Patient-safety regulations (UDI, EU-MDR)

- AI-based predictive maintenance embedded in tags

- High upfront RTLS/RFID infrastructure cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

RFID accounted for 56.2% of 2024 revenue, underlining decades of protocol maturity and robust supply chains that made the technology the default for drug inventory and surgical kit tracking. The healthcare asset management market size for RFID was USD 21.3 billion in 2024, showing how deeply the modality is entrenched at point-of-care cabinets and central sterile processing. Yet software-defined workflows increasingly require location, not just identity. Real-Time Location Systems leveraging BLE, Wi-Fi, and ultra-wideband are therefore forecast to compound at 28.1% CAGR to 2030, eating into static RFID growth.

A second growth phase emerges as vendors collapse RFID and RTLS into multi-mode tags that pivot between passive ID and real-time telemetry, a design that preserves prior capital investment while enabling richer analytics. Deployments at paediatric-care centres demonstrate this twin-mode value: passive RFID limits shrinkage of high-value drugs, while RTLS ensures infusion pumps circulate where patient acuity is highest. Hardware still dominates spending because tags, gateways, and exciters blanket entire campuses; however, the profit pool is shifting toward platform licences that unite device identity, location, and utilisation into one dashboard. As this convergence proceeds, the healthcare asset management market will likely regard single-mode offerings as a niche.

Hardware captured 62.4% of 2024 sales thanks to ongoing purchases of millions of tags, readers, and ceiling-mounted beacons. Even so, services are pacing ahead with a 25.6% CAGR as hospitals pivot from capital expense toward managed outcomes. Under subscription agreements, vendors guarantee uptime, firmware currency, and regulatory-ready audit logs, freeing IT teams to focus on patient-facing initiatives. The healthcare asset management market size tied to services is forecast to reach USD 32.6 billion by 2030, pointing to a maturation cycle where infrastructure becomes ubiquitous and differentiation shifts to consultative optimisation.

Professional and managed services also address the hardest obstacles-change management, systems integration, and cybersecurity accreditation-that no amount of shelf hardware alone can solve. Service contracts typically bundle remote device health checks, algorithm updates, and compliance documentation generation, costs that spread evenly across multi-year terms and match reimbursement cycles. Hospitals increasingly justify deals by showing that avoided nursing overtime, faster bed turnover, and reduced device rentals offset monthly subscription fees.

Healthcare Asset Management Market is Segmented by Technology (RFID, Real-Time Location Systems, and More), Component (Hardware, Software, and Services), Application (Equipment and Device Tracking, Inventory/Supply-Chain Management, and More), End-User (Hospitals and Clinics, Laboratories and Diagnostic Centers, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 37.8% of 2024 revenue, sustained by the United States' comprehensive serialisation law, a mature EHR backbone, and rising incidents of medical device cyber threats that favour integrated, secure platforms. Canadian provinces are adopting similar policies, while Mexican private-sector hospitals invest in asset tracking to retain medical tourists and satisfy U.S. insurer audits. Government reimbursement models that penalise safety lapses make traceability a board-level metric, further supporting healthcare asset management market adoption across the region.

Asia-Pacific is the fastest-growing area with a 22.5% CAGR expected through 2030. Public-hospital construction programmes in China, India, and Southeast Asia enable greenfield deployments that skip legacy bar-code steps and implement RFID-RTLS convergence from day one. Many of these facilities integrate asset management with national digital-health clouds, allowing real-time drug authentication across regional supply chains. As capital investment aligns with universal health-coverage goals, vendors report multi-year master contracts covering hundreds of new hospitals.

Europe shows steady uptake led by the EU-MDR mandate, EUDAMED database roll-outs, and national sustainability targets that favour lifecycle optimisation. Germany and the United Kingdom drive early deployments, but funding mechanisms in Eastern Europe are catching up as structural funds emphasise digital transformation. Cybersecurity expectations anchored in GDPR elevate demand for on-premises or hybrid clouds with local data residency, nudging platform suppliers to broaden configuration options. With Brexit adding customs complexity for cross-channel medical trade, British providers rely on traceability to avoid port delays and product waste.

- Stanley Healthcare (Stanley Black & Decker)

- CenTrak Inc.

- AiRISTA Flow Inc.

- GE HealthCare Technologies Inc.

- IBM Corporation

- Infor Inc.

- Motorola Solutions Inc.

- Siemens Healthineers AG

- Accenture plc

- Sonitor Technologies AS

- Zebra Technologies Corporation

- Johnson Controls (Tyco International)

- Honeywell International Inc.

- Impinj Inc.

- Alien Technology LLC

- HID Global Corporation

- Ascom Holding AG

- Midmark Corporation (Versus RTLS)

- Trimble Inc. (Atrius)

- Cerner Corporation (Oracle Health)

- TagMaster AB

- Radianse LLC

- Kontakt.io Inc.

- Litum IoT Technologies

- Elpas Ltd. (Securitas)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for RFID to curb drug counterfeiting

- 4.2.2 Efficiency pressures from nursing?staff shortages

- 4.2.3 Patient-safety regulations (e.g., UDI, EU-MDR)

- 4.2.4 AI-based predictive maintenance embedded in tags

- 4.2.5 Pay-for-performance reimbursement tied to asset traceability

- 4.3 Market Restraints

- 4.3.1 Data-privacy and cybersecurity concerns

- 4.3.2 High upfront RTLS/RFID infrastructure cost

- 4.3.3 Radio-interference with critical wireless medical devices

- 4.3.4 Fragmented legacy CMMS slowing integration

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Technology

- 5.1.1 RFID

- 5.1.2 Real-Time Location Systems (RTLS)

- 5.1.3 Bluetooth Low Energy (BLE) and Wi-Fi

- 5.1.4 Infrared and Ultrasound

- 5.2 By Component

- 5.2.1 Hardware (Tags, Readers, Gateways)

- 5.2.2 Software (Analytics, Middleware)

- 5.2.3 Services (Deployment, Managed, Training)

- 5.3 By Application

- 5.3.1 Equipment and Device Tracking

- 5.3.2 Inventory/Supply-Chain Management

- 5.3.3 Patient and Staff Tracking

- 5.3.4 Bed and Capacity Management

- 5.3.5 Environmental and Condition Monitoring

- 5.4 By End-user

- 5.4.1 Hospitals and Clinics

- 5.4.2 Laboratories and Diagnostic Centers

- 5.4.3 Pharmaceutical and Biotech Manufacturing

- 5.4.4 Long-Term Care and Assisted-Living Facilities

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Malaysia

- 5.5.4.7 Singapore

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Stanley Healthcare (Stanley Black & Decker)

- 6.4.2 CenTrak Inc.

- 6.4.3 AiRISTA Flow Inc.

- 6.4.4 GE HealthCare Technologies Inc.

- 6.4.5 IBM Corporation

- 6.4.6 Infor Inc.

- 6.4.7 Motorola Solutions Inc.

- 6.4.8 Siemens Healthineers AG

- 6.4.9 Accenture plc

- 6.4.10 Sonitor Technologies AS

- 6.4.11 Zebra Technologies Corporation

- 6.4.12 Johnson Controls (Tyco International)

- 6.4.13 Honeywell International Inc.

- 6.4.14 Impinj Inc.

- 6.4.15 Alien Technology LLC

- 6.4.16 HID Global Corporation

- 6.4.17 Ascom Holding AG

- 6.4.18 Midmark Corporation (Versus RTLS)

- 6.4.19 Trimble Inc. (Atrius)

- 6.4.20 Cerner Corporation (Oracle Health)

- 6.4.21 TagMaster AB

- 6.4.22 Radianse LLC

- 6.4.23 Kontakt.io Inc.

- 6.4.24 Litum IoT Technologies

- 6.4.25 Elpas Ltd. (Securitas)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment