|

市场调查报告书

商品编码

1850051

风险分析:市场占有率分析、产业趋势、统计、成长预测(2025-2030)Risk Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

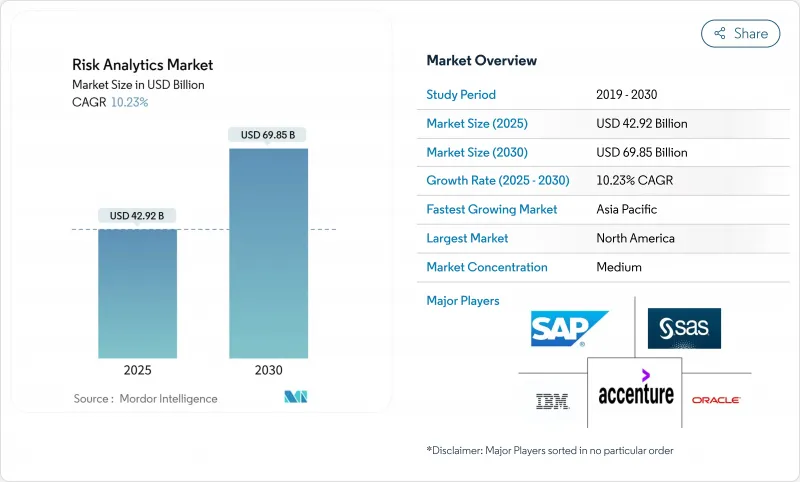

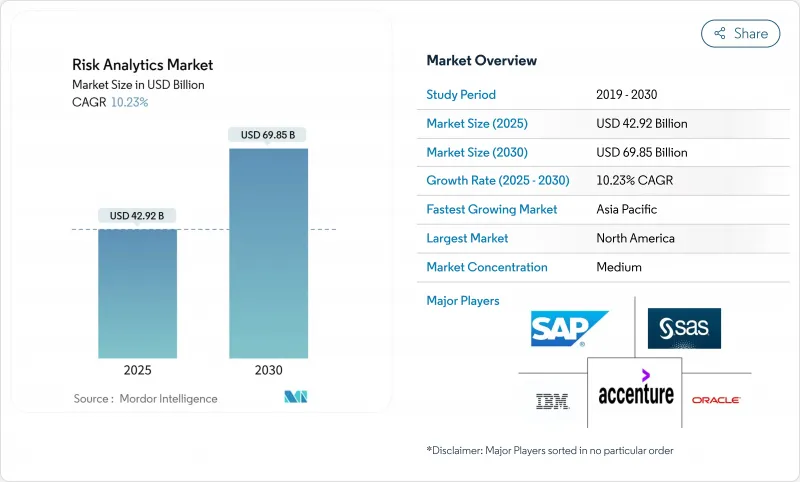

预计全球风险分析市场规模到 2025 年将达到 429.2 亿美元,到 2030 年将达到 698.5 亿美元,复合年增长率为 10.2%。

监管审查力度的加强、即时支付管道的即时诈欺以及强制性的气候风险揭露,使得高级分析成为一项战略必需品,而非一项可自由支配的IT支出。金融机构正在摒弃基于规则的工具,转而采用人工智慧主导的平台,这些平台能够在几毫秒内评估数百万个资料点,并支援资本优化、诈欺预防和气候变迁情境建模。云端原生架构、量子安全演算法和整合资料结构正在降低整体拥有成本,同时支援跨辖区平行合规报告。这些因素的融合正在重塑供应商策略,使其转向融合软体、咨询和託管营运的平台即服务交付模式。

全球风险分析市场趋势与洞察

即时支付领域即时诈欺激增

即时支付环境使银行面临交易级攻击,批量诈骗工具难以应对。预计到2028年,全球即时支付将达到5,750亿美元,迫使金融机构采用结合行为生物辨识、设备智慧和网路分析的毫秒级分析技术,同时将误报率维持在1%以下。在英国,推播支付诈欺赔偿规则正在成为强制规定,这提升了在交易发生时进行评分的人工智慧原生平台的经济价值。能够将串流资料撷取、图形分析和模型管治整合到单一云端原生堆迭中的供应商将拥有至关重要的优势。

巴塞尔协议IV之后加强资本监管

欧盟将于2025年1月实施《巴塞尔协议IV》,而瑞士金融市场监理局(FINMA)的《操作风险增强指令》则要求跨国银行并行执行多项风险加权资产计算。云端基础的蒙特卡罗引擎能够在不同规则集上实现近乎即时的资本优化,同时满足BCBS239资料聚合测试的要求。随着监管机构加强现场资料审核,对统一资料沿袭、审核线索和场景库的需求正在加速向原生整合监管逻辑的服务型平台的转变。

模式风险管治人才短缺

54% 的银行报告称,定量检验技能短缺,导致模型发布速度放缓,合规成本上升。同时具备统计、监管洞察和人工智慧能力的专家薪资涨幅最高。金融机构正在采用自动检验套件,用于重播生产数据并发布治理警报,但监管机构仍然要求人工签核。整合了工作流程、管治和自动化测试功能的供应商可以缓解限制,但无法完全取代稀缺的专业知识。

細項分析

市占率数据预测,到2024年,解决方案将占据65%的市场份额,但服务领域的成长速度更快,复合年增长率高达11.8%。随着银行着手解决人工智慧管治、气候变迁压力测试和量子风险建模问题,风险分析市场将透过咨询、实施和託管营运等方式不断扩张。服务公司帮助将先进的引擎与传统核心系统集成,并将输出结果与管辖模板保持一致。同时,核心软体正朝着低程式码可配置性、自然语言前端和量子安全库的方向发展。

持续的监管变化促使客户依赖外部专家来整理、记录和检验其模型库。涵盖资料品质、场景库和即时监控的託管服务可以降低中型企业的成本。因此,即使持有永久许可证,客户的支出也倾向于购买定期服务合约。将软体升级与基于结果的服务合约相结合的供应商能够确保续约和提升销售的机会。

到2024年,本地部署系统将维持67.6%的份额。然而,12.1%的云端运算复合年增长率表明,风险分析市场正朝着透过SaaS和平台即服务模式提升价值的方向转变。云端运算的采用支援弹性运算突发事件,以实现日内压力测试、即时诈欺评分和高频市场风险重新计算。主权云端区域的供应商可以缓解欧洲、中东和亚洲地区资料居住异议。

混合架构在迁移蓝图中占据主导地位,传统的信贷引擎仍保留在本地,而人工智慧推理层、视觉化仪表板和大量彙报则迁移到云端微服务。客户使用多重云端编排器来避免锁定,并使工作负载与延迟、成本和资料本地化约束相协调。随着金融机构完善其资源配置策略,整合工作负载布局逻辑和跨云端成本分析的解决方案将获得更大的市场份额。

风险分析市场报告按组件(解决方案和服务)、部署(内部部署和云端)、风险类型(信用、营运、其他)、应用程式(诈欺侦测和反洗钱、压力测试和情境分析、其他)、最终用户垂直领域(BFSI、医疗保健和生命科学、其他)、组织规模(大型企业和中小型企业 (SME))和地区进行细分。

区域分析

受严格的监管制度和超大规模云端运算的早期应用推动,北美地区占2024年全球云端运算收入的38.6%。美国联邦的气候指南和巴塞尔协议III最终版规则正在支援资本优化、压力测试和资料处理历程解决方案的支出。在IBM数十亿美元量子蓝图的支援下,美国金融机构也在试行量子安全加密技术,以打造面向未来的支付管道。

欧洲占了很大份额,并正在塑造全球监管模板。 2025年《数位营运韧性法案》将要求银行将ICT风险分析与传统金融风险指标结合。遵守巴塞尔银行监理委员会239号准则正在推动对即时数据聚合的投资。成员国法规的片段化推动了对将多种报告模式映射到一致资料模型的平台的需求。

亚太地区是成长最快的地区,复合年增长率高达11.5%。印度的统一支付介面每月处理数十亿笔汇款,推动了即时诈欺预防的需求。中国正在深化供应链金融分析,并正在筹备数位货币风险框架。东南亚市场正在加速使用另类数据对首次借款人进行信用评分。监管机构正在采用沙盒方法来加快供应商核准,从而促进符合本地资料本地化规范的可扩展云端产品的快速部署。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 即时支付系统中即时诈骗的激增

- 巴塞尔协议IV后加强资本充足率监控

- 强制揭露气候风险

- 为小文件借款人提供人工智慧信用评分

- 多重云端风险资料架构可将 TCO 降低 25% 以上

- 量子运算对传统加密演算法的威胁

- 市场限制

- 模型风险管治人才严重短缺

- 中型企业对 SaaS 订阅的疲劳感日益加重

- 对专有机器学习堆迭的供应商锁定的担忧

- 不同司法管辖区的 ESG 分类不一致

- 价值链分析

- 监管格局

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估宏观经济趋势对市场的影响

第五章市场规模及成长预测

- 按组件

- 解决方案

- 风险计算引擎

- 风险报告和仪表板

- ETL/资料管理中心

- 服务

- 咨询

- 整合与实施

- 託管/BPO服务

- 解决方案

- 按部署

- 本地部署

- 云

- 依风险类型

- 信用

- 手术

- 流动性

- 合规/监理科技

- 气候与 ESG

- 按用途

- 诈骗侦测和反洗钱

- 压力测试和情境分析

- 模型风险管理

- 网路风险分析

- 供应链/第三方风险

- 按最终用户产业

- BFSI

- 医疗保健和生命科学

- 零售与电子商务

- 能源和公共产业

- 资讯科技和通讯

- 其他的

- 按公司规模

- 大公司

- 小型企业

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- SAS Institute Inc.

- IBM Corporation

- Oracle Corporation

- SAP SE

- Moody's Analytics Inc.

- FIS Global

- NICE Actimize

- Fair Isaac Corp(FICO)

- AxiomSL/Adenza Group

- Capgemini SE

- Accenture plc

- OneSpan Inc.

- Risk Edge Solutions

- Provenir Inc.

- Verisk Analytics

- LexisNexis Risk Solutions

- Riskonnect Inc.

- Dun and Bradstreet Holdings

- Nasdaq Risk Platform

- Palantir Technologies

第七章 市场机会与未来展望

The global risk analytics market is valued at USD 42.92 billion in 2025 and is projected to reach USD 69.85 billion by 2030 at a 10.2% CAGR.

Heightened regulatory scrutiny, real-time fraud exposure on instant-payment rails, and mandatory climate-risk disclosure are making advanced analytics a strategic necessity rather than a discretionary IT spend. Financial institutions are phasing out rule-based tools in favor of AI-driven platforms that evaluate millions of data points within milliseconds to support capital optimization, fraud interdiction, and climate scenario modeling. Cloud-native architectures, quantum-resistant algorithms, and unified data fabrics are cutting total cost of ownership while enabling parallel compliance reporting across jurisdictions. The convergence of these forces is reshaping vendor strategies toward platform-as-a-service delivery that merges software, consulting, and managed operations.

Global Risk Analytics Market Trends and Insights

Real-time fraud surge in instant-payment rails

Instant settlement environments expose banks to transaction-level attacks that overwhelm batch fraud tools. Global real-time payment volumes are on track to hit 575 billion transactions by 2028, forcing institutions to deploy millisecond analytics that blend behavioral biometrics, device intelligence, and network analytics while maintaining false-positive rates below 1%. The United Kingdom's mandatory reimbursement rule for authorized push-payment fraud strengthens the economic case for AI-native platforms that score transactions as they occur. Vendors that can combine streaming data ingestion, graph analytics, and model governance within a single cloud-native stack hold a decisive edge.

Heightened post-Basel IV capital-adequacy scrutiny

The EU's January 2025 Basel IV rollout and FINMA's enhanced operational-risk ordinances oblige multinational banks to run several risk-weighted asset calculations in parallel. Cloud-based Monte-Carlo engines allow near real-time capital optimization across diverging rulesets while satisfying BCBS 239 data-aggregation tests. As regulators intensify on-site data audits, demand for unified data lineage, audit trails, and scenario libraries accelerates the migration toward service-rich platforms that embed regulatory logic natively.

Acute talent shortage in model-risk governance

Fifty-four percent of banks report gaps in quantitative validation skills, delaying model releases and inflating compliance costs. Salary inflation is steepest for specialists who combine statistics, regulatory insight, and AI competence. Institutions are adopting automated validation toolkits that replay production data and issue governance alerts, but supervisors still require human sign-off. Vendors that bundle workflow, documentation, and auto-testing capabilities mitigate the constraint yet cannot fully replace scarce expertise.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory climate-risk disclosure

- AI-powered credit scoring for thin-file borrowers

- Rising SaaS subscription fatigue among mid-tiers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Market share data show Solutions at 65% in 2024, yet the Services arm is expanding faster at 11.8% CAGR. The risk analytics market size tied to consulting, implementation, and managed operations grows as banks confront AI governance, climate stress testing, and quantum-risk modeling. Service firms help integrate advanced engines with legacy cores while aligning outputs to jurisdictional templates. In parallel, core software evolves toward low-code configurability, natural language front-ends, and quantum-resistant libraries.

Ongoing regulatory change keeps customers reliant on external specialists for model inventory curation, documentation, and validation. Managed services covering data quality, scenario libraries, and real-time monitoring reduce overhead for mid-tier players. As a result, spending tilts toward recurring service contracts even where perpetual licenses remain in place. Vendors that fuse software upgrades with outcome-based service commitments guard renewals and upsell opportunities.

On-premises systems retain 67.6% share in 2024 as institutions guard sensitive data against extraterritorial access. Yet a 12.1% CAGR for cloud indicates decisive migration momentum, raising the risk analytics market value delivered via SaaS and platform-as-a-service models. Cloud deployments support elastic compute bursts for intraday stress testing, real-time fraud scoring, and high-frequency market-risk recalculations. Providers of sovereign-cloud zones ease data-residency objections in Europe, the Middle East, and Asia.

Hybrid architectures dominate transition roadmaps. Legacy credit engines remain on-premises while AI inference layers, visualization dashboards, and batch reporting shift to cloud micro-services. Clients use multi-cloud orchestrators to avoid lock-in and align workloads with latency, cost, and data-localization constraints. Solutions that embed workload-placement logic and cross-cloud cost analytics capture wallet share as institutions refine resource allocation strategies.

The Risk Analytics Market Report is Segmented by Component (Solution and Services), Deployment (On-Premises and Cloud), Risk Type (Credit, Operational, and More), Application (Fraud Detection and AML, Stress Testing and Scenario-Analysis, and More), End-User Industry (BFSI, Healthcare and Life-Sciences, and More), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), and Geography.

Geography Analysis

North America held 38.6% of revenue in 2024, underpinned by strict supervisory regimes and early hyperscale-cloud adoption. The Federal Reserve's climate guidance and Basel III endgame rules sustain spending on capital optimization, stress testing, and data lineage solutions. U.S. institutions also pilot quantum-resistant encryption to future-proof payment rails, supported by IBM's multi-billion dollar quantum roadmap.

Europe commands significant share and shapes regulatory templates worldwide. Implementation of the Digital Operational Resilience Act in 2025 obliges banks to integrate ICT-risk analytics with traditional financial-risk metrics. The bloc's leadership on ESG rules propels climate-scenario spending, while BCBS 239 compliance pushes real-time data aggregation investments. Fragmented member-state rules raise demand for platforms that map multiple reporting schemas onto consistent data models.

Asia-Pacific is the fastest-growing region at 11.5% CAGR. India's Unified Payments Interface processes billions of monthly transfers, heightening real-time fraud needs. China deepens supply-chain finance analytics and readies digital currency risk frameworks. Southeast Asian markets accelerate credit-scoring for first-time borrowers using alternative data. Regulators adopt sandbox schemes that speed vendor approvals, fuelling rapid deployment of scalable cloud offerings adapted to local data-localization norms.

- SAS Institute Inc.

- IBM Corporation

- Oracle Corporation

- SAP SE

- Moody's Analytics Inc.

- FIS Global

- NICE Actimize

- Fair Isaac Corp (FICO)

- AxiomSL / Adenza Group

- Capgemini SE

- Accenture plc

- OneSpan Inc.

- Risk Edge Solutions

- Provenir Inc.

- Verisk Analytics

- LexisNexis Risk Solutions

- Riskonnect Inc.

- Dun and Bradstreet Holdings

- Nasdaq Risk Platform

- Palantir Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Real-time fraud surge in instant-payment rails

- 4.2.2 Heightened post-Basel IV capital-adequacy scrutiny

- 4.2.3 Mandatory climate-risk disclosure

- 4.2.4 AI-powered credit scoring for thin-file borrowers

- 4.2.5 Multi-cloud risk-data fabrics cut TCO by above 25%

- 4.2.6 Quantum-computing threat to legacy crypto-algos

- 4.3 Market Restraints

- 4.3.1 Acute talent shortage in model-risk governance

- 4.3.2 Rising SaaS subscription fatigue among mid-tiers

- 4.3.3 Vendor-lock-in concerns over proprietary ML stacks

- 4.3.4 Inconsistent ESG taxonomies across jurisdictions

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solution

- 5.1.1.1 Risk-calculation engines

- 5.1.1.2 Risk reporting and dashboards

- 5.1.1.3 ETL / Data-management hubs

- 5.1.2 Services

- 5.1.2.1 Consulting

- 5.1.2.2 Integration and Implementation

- 5.1.2.3 Managed / BPO Services

- 5.1.1 Solution

- 5.2 By Deployment

- 5.2.1 On-premises

- 5.2.2 Cloud

- 5.3 By Risk Type

- 5.3.1 Credit

- 5.3.2 Operational

- 5.3.3 Liquidity

- 5.3.4 Compliance / RegTech

- 5.3.5 Climate and ESG

- 5.4 By Application

- 5.4.1 Fraud Detection and AML

- 5.4.2 Stress Testing and Scenario-Analysis

- 5.4.3 Model-Risk Management

- 5.4.4 Cyber-Risk Analytics

- 5.4.5 Supply-chain / Third-party Risk

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 Healthcare and Life-sciences

- 5.5.3 Retail and E-commerce

- 5.5.4 Energy and Utilities

- 5.5.5 IT and Telecom

- 5.5.6 Others

- 5.6 By Organisation Size

- 5.6.1 Large Enterprises

- 5.6.2 Small and Medium Enterprises (SMEs)

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Russia

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Australia and New Zealand

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SAS Institute Inc.

- 6.4.2 IBM Corporation

- 6.4.3 Oracle Corporation

- 6.4.4 SAP SE

- 6.4.5 Moody's Analytics Inc.

- 6.4.6 FIS Global

- 6.4.7 NICE Actimize

- 6.4.8 Fair Isaac Corp (FICO)

- 6.4.9 AxiomSL / Adenza Group

- 6.4.10 Capgemini SE

- 6.4.11 Accenture plc

- 6.4.12 OneSpan Inc.

- 6.4.13 Risk Edge Solutions

- 6.4.14 Provenir Inc.

- 6.4.15 Verisk Analytics

- 6.4.16 LexisNexis Risk Solutions

- 6.4.17 Riskonnect Inc.

- 6.4.18 Dun and Bradstreet Holdings

- 6.4.19 Nasdaq Risk Platform

- 6.4.20 Palantir Technologies

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment