|

市场调查报告书

商品编码

1850058

数位签章:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030)Digital Signatures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

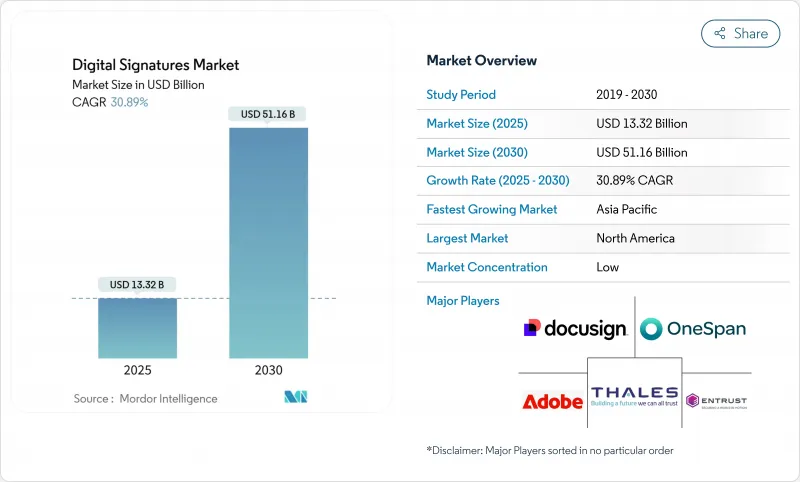

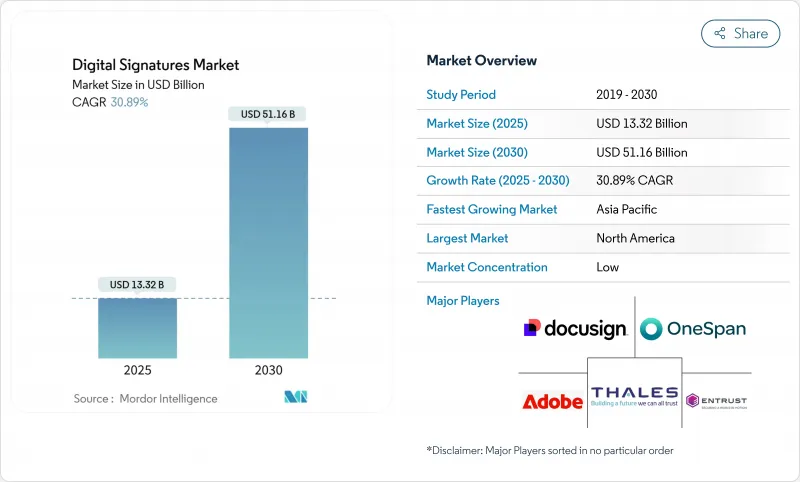

预计到 2025 年数位签章市场规模将达到 133.2 亿美元,到 2030 年将达到 511.6 亿美元,复合年增长率为 30.89%。

持续的势头源于严格的全球合规要求、全面的企业数位化计划以及对量子安全加密技术的迫切需求。云端技术仍然是预设架构,远端办公导致交易量激增,应用程式介面 (API) 整合使签名成为日常业务流程中一个不为人知的环节。如今,供应商的差异化不再仅仅取决于基本的签名功能,而更多地取决于后量子蓝图和跨平台互通性。同时,新兴市场碎片化的资料主权制度和频宽限制正在阻碍先进签章技术在全球的快速部署。

全球数位签章市场趋势与洞察

加速欧盟合格电子签章合格(eIDAS 2.0)

eIDAS 2.0 法规于 2024 年 5 月生效,要求所有成员国在一年内推出至少一个欧洲数位身分钱包,并要求私人服务供应商接受这些钱包进行强用户身份验证。各组织必须在 2025 年 5 月之前从 TLv5 信任列表迁移到 TLv6 信任列表,从而加速签名创建设备和检验服务的升级。合格的电子签章已成为黄金标准,推动了对硬体安全模组 (HSM) 和多因素身份验证的投资。因此,在欧盟各地运营的跨国公司正在将其全球签名堆迭与欧盟指南同步,以避免法律风险。在企业竞相遵守合规性的过程中,提供承包钱包解决方案的供应商将获得先发优势。

亚太地区公共部门工作流程中的大规模数位化项目

中国、印度、日本和越南等国政府正迅速迈向无纸化管治,推动公民入口网站上数位数位签章交易数量的成长。 2024年下半年,越南数位签章的激增清晰地表明,公共部门的强制要求如何激发了私部门的采用。印度的「数位印度」电子签章倡议也展现了类似的网路效应,其中eMudhra占全国证书颁发量的35%。随着数百万政府员工在线上进行交易,标准化的信任框架已成为供应商、银行和保险公司的必然要求。指数级成长的交易量也迫使供应商提供低延迟、行动优先的体验。

特定国家的数据本地化规则阻碍了跨境有效性

40个国家/地区近100项在地化措施要求将敏感资料储存在国家云端中,这导致基础设施碎片化,并推高了合规成本。数位签章提供者必须为每个监管辖区复製金钥储存、审核日誌和时间戳服务,同时维护全球检验链。处理多币种交易单据的金融机构感受到的额外延迟和审核复杂性负担最为沉重。研究表明,资料本地化削弱了ISO 27002 14项安全控制措施中的13项,可能会损害威胁侦测和危机回应。这减缓了技术丰富、高利润地区以外的采用速度。

細項分析

2024年,云端解决方案将创造90.6亿美元的收入,占数位签章市场占有率的68%。云端解决方案将继续以33.5%的复合年增长率加速成长,到2030年,将占总增量收益的一半以上。与身分即服务平台的紧密整合、即时功能部署和弹性扩展,将受到寻求快速回报的企业的青睐。云端供应商正在整合经FIPS 140-3认证的防篡改HSM集群,以缓解过去对密钥託管和多租户的担忧。因此,采购团队通常会选择订阅许可证,而不是资本支出安装。

本地部署将满足国防、核心银行和主权云端的需求,这些领域硬体所有权至关重要。中国、俄罗斯和印度的资料居住法规将使本地资料中心从偏好提升为必需,而本地解决方案仅占收益的 32%。 2025 年至 2030 年间,混合架构将成为一种可行的桥樑,将常规交易转移至 SaaS,同时在本地 HSM 机架中保护「合格」或机密签名。这种双轨模式使受监管的公司能够利用 API 丰富的生态系统,而不会失去主权控制权。因此,在数位签章产业,整合商正专注于在两个环境中统一策略编配。

数位数位签章市场配置(本地部署、云端)、产品类型(软体、硬体、服务)、终端用户产业(金融服务、保险、保险业、政府、医疗保健、石油和天然气、军事和国防、物流和运输、其他)以及地区(北美、南美、欧洲、亚太、中东和非洲)细分。市场预测以美元计算。

区域分析

北美的收益份额将达到34%,到2024年将达到45.3亿美元。这反映了E-SIGN下早期监管的清晰化、成熟的云端运算应用以及密集的ISV和经销商合作伙伴生态系统。按行业垂直划分,金融服务、保险和保险业(BFSI)和技术行业占据了消费的大部分,而州级数位政府专案正在增加新的交易量。案例研究表明,零售银行在将签名功能纳入其行动应用程式后,线上贷款成交量翻了一番。该地区也是领先供应商的所在地,为他们提供了人才和伙伴关係的优势。

亚太地区是成长最快的地区,到2030年的复合年增长率将达到35.5%。印度、中国和日本的大规模政府数位化正在推动需求激增,并将带动私人采购。印度与Aadhaar关联的电子签名将降低每笔交易的身份验证成本,推动基层银行和保险业对数位签章市场的采用。中国的《网路安全法》将促进在地采购,从而形成独特的供应链模式。

随着 eIDAS 2.0 的推出,欧洲的采用速度加快,其中德国、法国和英国在企业支出方面处于领先地位,尤其是在医疗保健、金融和法律服务领域。欧洲数位身分钱包承诺实现无摩擦的跨境身份验证,但传统整合仍然是一个障碍。支援 TLv6 信任清单管理和远端认证签章的供应商在 RFP 中的采用率正在上升。

在海湾合作委员会电子政府的推动下,中东和非洲地区正经历健康的中期成长。阿拉伯联合大公国正在实施一项允许远端签署的国家信託框架,以简化外国投资者的入职流程。儘管电力和网路存在时有时无的限制,南非的金融部门仍在积极采用云端解决方案,利用位于约翰尼斯堡和开普敦的冗余资料中心。

在南美洲,巴西、阿根廷和智利已颁布法律授权的需求。巴西的CertiSign公司正在扩大其跨境贸易文件证书签发范围,并刺激出口企业的采购。该地区的成长仍然受到税收制度和公证法规差异的影响,促使云端供应商为南方共同市场贸易航线预先打包合规模板。在所有地区,数位签章市场都受益于政府持续推动安全数位经济的努力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 欧盟合格电子签章的加速合规义务(eIDAS 2.0)

- 亚太地区公共部门工作流程的大规模数位化项目

- 嵌入企业 SaaS 套件(Microsoft 365、Salesforce)的电子签章API

- 量子安全性证书堆迭的更新周期

- 推动ESG相关无纸化交易及范围3碳减排

- 市场限制

- 特定国家的数据本地化规则阻碍了跨境有效性

- 信任服务认证体系的分散世界

- 低频宽行动网路上生物识别签名的使用者体验差距

- 对于中小型企业来说,基于 HSM 的合格签名成本高昂

- 监理展望

- 技术展望

- 评估宏观经济因素的影响

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章市场规模及成长预测

- 按部署

- 本地部署

- 云

- 按报价

- 软体

- 硬体

- 服务

- 按最终用户产业

- BFSI

- 政府

- 卫生保健

- 石油和天然气

- 军事和国防

- 物流与运输

- 其他(研究/教育、房地产、製造、法律、IT、通讯)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 秘鲁

- 南美洲其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 纽西兰

- 其他亚太地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 非洲

- 南非

- 肯亚

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- Strategic Developments

- 市占率分析

- Vendor Positioning Analysis

- 公司简介

- DocuSign Inc.

- Adobe Inc.(Adobe Sign)

- OneSpan Inc.

- Thales Group(SafeNet)

- Entrust Corporation

- Nitro Software Ltd.

- airSlate Inc.(SignNow)

- Dropbox Inc.(HelloSign)

- Box Inc.(SignRequest)

- SIGNiX Inc.

- Ascertia Limited

- GlobalSign GMO

- Signeasy

- PandaDoc Inc.

- RPost Communications Ltd.

- CertiSign Certificadora Digital

- Kofax Ltd.

- Digicert Inc.

- Signicat AS

- Zoho Corporation(Zoho Sign)

第七章 市场机会与未来展望

The digital signatures market size stands at USD 13.32 billion in 2025 and is forecast to climb to USD 51.16 billion by 2030, advancing at a 30.89% CAGR.

Sustained momentum comes from stringent global compliance mandates, full-scale enterprise digitization projects, and the looming need for quantum-resistant cryptography. Cloud deployment remains the default architecture, remote work drives soaring transaction volumes, and application programming interface (API) integration turns signatures into an invisible step inside everyday business processes. Vendor differentiation now rests on post-quantum roadmaps and cross-platform interoperability rather than on basic signing features. At the same time, fragmented data-sovereignty regimes and bandwidth constraints in emerging markets temper the otherwise rapid global roll-out of advanced signing technologies.

Global Digital Signatures Market Trends and Insights

Accelerated compliance mandates for qualified e-signatures in EU (eIDAS 2.0)

The eIDAS 2.0 regulation, effective May 2024, obliges every Member State to launch at least one European Digital Identity Wallet within a year and compels private service providers to accept those wallets for strong user authentication. Organizations must shift from TLv5 to TLv6 trust lists by May 2025, prompting accelerated upgrades to signature creation devices and validation services. Qualified electronic signatures become the gold standard, driving investment in Hardware Security Modules (HSMs) and multi-factor authentication. Multinationals with pan-EU operations, therefore, synchronize global signing stacks to EU guidelines to avoid legal exposure. Vendors offering turnkey, wallet-ready solutions gain early-mover advantage as enterprises race to comply.

Mega-scale digitisation programmes in APAC public sector workflows

Governments in China, India, Japan, and Vietnam are fast-tracking paperless governance, propelling digital signature transaction counts across citizen-facing portals. Vietnam's late-2024 surge in digital signatures underscored how public-sector mandates ignite private-sector adoption. India's e-Sign initiative under Digital India shows similar network effects, with eMudhra holding 35% of national certificate issuance. As millions of civil servants transact online, standardized trust frameworks become de facto requirements for suppliers, banks, and insurers. The sudden volume also pressures vendors to deliver low-latency, mobile-first experiences.

Country-specific data-localisation rules hindering cross-border validity

Roughly 100 localisation measures across 40 countries require sensitive data to stay in domestic clouds, fragmenting infrastructure and driving up compliance costs. Digital signature providers must replicate key stores, audit logs, and timestamp services in every regulated jurisdiction while preserving global validation chains. Financial institutions handling multi-currency trade documents feel the burden most, incurring extra latency and audit complexity. Studies show data localisation can weaken 13 of 14 ISO 27002 security controls, undermining threat hunting and crisis response. The resulting overhead slows deployment outside technology-rich, high-margin sectors.

Other drivers and restraints analyzed in the detailed report include:

- Embedded e-signature APIs in enterprise SaaS suites (Microsoft 365, Salesforce)

- Renewal cycle toward post-quantum cryptography certificate stacks

- UX gaps for biometric signatures on low-bandwidth mobile networks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud solutions generated USD 9.06 billion in 2024, translating into 68% of the digital signatures market share. Continued acceleration at a 33.5% CAGR positions cloud to exceed half of the total incremental revenue through 2030. Tight integration with identity-as-a-service platforms, instantaneous feature roll-outs, and elastic scaling resonate with enterprises seeking rapid returns. Cloud providers embed tamper-resistant HSM clusters certified to FIPS 140-3, alleviating past fears about key escrow and multi-tenancy. As a result, procurement teams routinely default to subscription licensing rather than capital expenditure installations.

On-premise deployments endure in defense, core banking, and sovereign-cloud mandates where hardware ownership is non-negotiable. Data-residency statutes in China, Russia, and India elevate local data centers from preference to requirement, ensuring a persistent 32% revenue share for on-premise solutions. During 2025-2030, hybrid architecture emerges as a pragmatic bridge, offloading routine transactions to SaaS yet reserving "qualified" or classified signatures for in-house HSM racks. This dual-track model allows regulated enterprises to tap API-rich ecosystems without forfeiting sovereign control. The digital signatures industry, therefore, sees integrators focusing on unified policy orchestration that spans both environments.

Digital Signatures Market is Segmented by Deployment (On-Premise, Cloud), Offering (Software, Hardware, Services), End-User Industry (BFSI, Government, Healthcare, Oil and Gas, Military and Defense, Logistics and Transportation, and More), Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 34% revenue share, worth USD 4.53 billion in 2024, reflects early regulatory clarity under E-SIGN, mature cloud penetration, and a dense ecosystem of ISV and reseller partners. BFSI and technology verticals dominate consumption, but state-level digital-government programs add fresh volume. Case studies show retail banks doubling online loan closures after embedding signing inside mobile apps. The region is also home to leading vendors, securing talent and partnership advantages.

Asia-Pacific is the highest-velocity arena with a 35.5% CAGR to 2030. Mega-government digitisation in India, China, and Japan underpins demand spikes that cascade into private-sector procurement. India's Aadhaar-linked e-Sign lowers identity verification cost per transaction, pushing digital signatures market adoption at grassroots banking and insurance tiers. China's Cybersecurity Law triggers local HSM sourcing, shaping unique supply-chain patterns.

Europe's adoption accelerates following the eIDAS 2.0 rollout. Germany, France, and the United Kingdom head enterprise spending, especially in healthcare, finance, and legal services. The European Digital Identity Wallet promises frictionless cross-border recognition, yet legacy integration remains a hurdle. Vendors equipped with TLv6 trust-list management and remote qualified signature support see growing RFP inclusion.

The Middle East and Africa post healthy mid-teen growth anchored by Gulf Cooperation Council e-government efforts. The United Arab Emirates enforces national trust frameworks that recognize remote signatures, streamlining foreign investor onboarding. South Africa's financial sector adopts cloud solutions despite sporadic power and network constraints, leveraging redundant data centers in Johannesburg and Cape Town.

South America witnesses rising demand, with Brazil, Argentina, and Chile enacting legal recognition statutes. Brazil's CertiSign expands certificate issuance for cross-border trade documents, spurring procurement among exporters. Regional growth still contends with heterogeneous tax and notary regulations, prompting cloud vendors to pre-package compliance templates for Mercosur trade lanes. Across all regions, the digital signatures market benefits from sustained governmental push toward secure digital economies.

- DocuSign Inc.

- Adobe Inc. (Adobe Sign)

- OneSpan Inc.

- Thales Group (SafeNet)

- Entrust Corporation

- Nitro Software Ltd.

- airSlate Inc. (SignNow)

- Dropbox Inc. (HelloSign)

- Box Inc. (SignRequest)

- SIGNiX Inc.

- Ascertia Limited

- GlobalSign GMO

- Signeasy

- PandaDoc Inc.

- RPost Communications Ltd.

- CertiSign Certificadora Digital

- Kofax Ltd.

- Digicert Inc.

- Signicat AS

- Zoho Corporation (Zoho Sign)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated compliance mandates for qualified e-signatures in EU (eIDAS 2.0)

- 4.2.2 Mega-scale digitisation programmes in APAC public sector workflows

- 4.2.3 Embedded e-signature APIs in enterprise SaaS suites (Microsoft 365, Salesforce)

- 4.2.4 Renewal cycle toward post-quantum cryptography certificate stacks

- 4.2.5 ESG-linked push for paperless transactions and Scope-3 carbon reduction

- 4.3 Market Restraints

- 4.3.1 Country-specific data-localisation rules hindering cross-border validity

- 4.3.2 Fragmented global trust-service accreditation regimes

- 4.3.3 UX gaps for biometric signatures on low-bandwidth mobile networks

- 4.3.4 High cost of HSM-backed qualified signatures for SMBs

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Assessment of Macroeconomic Factors Impact

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Offering

- 5.2.1 Software

- 5.2.2 Hardware

- 5.2.3 Services

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Government

- 5.3.3 Healthcare

- 5.3.4 Oil and Gas

- 5.3.5 Military and Defense

- 5.3.6 Logistics and Transportation

- 5.3.7 Others (Research and Education, Real Estate, Manufacturing, Legal, IT and Telecom)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Chile

- 5.4.2.4 Peru

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 South Korea

- 5.4.4.4 India

- 5.4.4.5 Australia

- 5.4.4.6 New Zealand

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 United Arab Emirates

- 5.4.5.1.2 Saudi Arabia

- 5.4.5.1.3 Turkey

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Kenya

- 5.4.5.2.3 Nigeria

- 5.4.5.2.4 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Market Share Analysis

- 6.3 Vendor Positioning Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.4.1 DocuSign Inc.

- 6.4.2 Adobe Inc. (Adobe Sign)

- 6.4.3 OneSpan Inc.

- 6.4.4 Thales Group (SafeNet)

- 6.4.5 Entrust Corporation

- 6.4.6 Nitro Software Ltd.

- 6.4.7 airSlate Inc. (SignNow)

- 6.4.8 Dropbox Inc. (HelloSign)

- 6.4.9 Box Inc. (SignRequest)

- 6.4.10 SIGNiX Inc.

- 6.4.11 Ascertia Limited

- 6.4.12 GlobalSign GMO

- 6.4.13 Signeasy

- 6.4.14 PandaDoc Inc.

- 6.4.15 RPost Communications Ltd.

- 6.4.16 CertiSign Certificadora Digital

- 6.4.17 Kofax Ltd.

- 6.4.18 Digicert Inc.

- 6.4.19 Signicat AS

- 6.4.20 Zoho Corporation (Zoho Sign)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment