|

市场调查报告书

商品编码

1850068

汽车降雨感应器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Rain Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

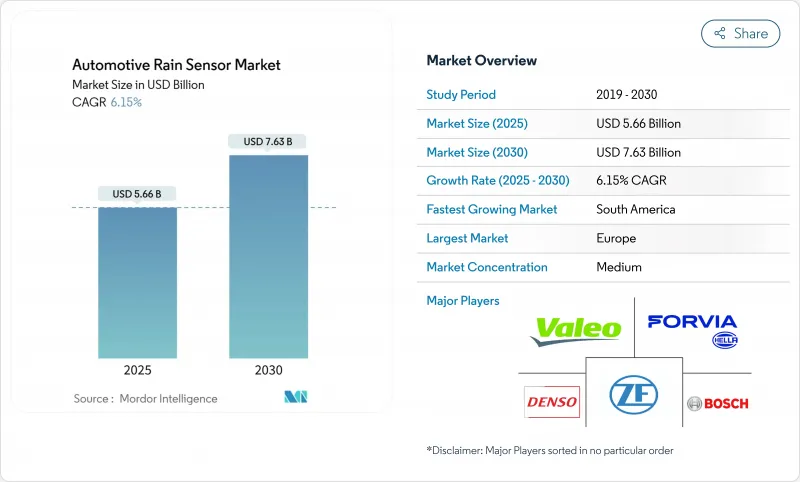

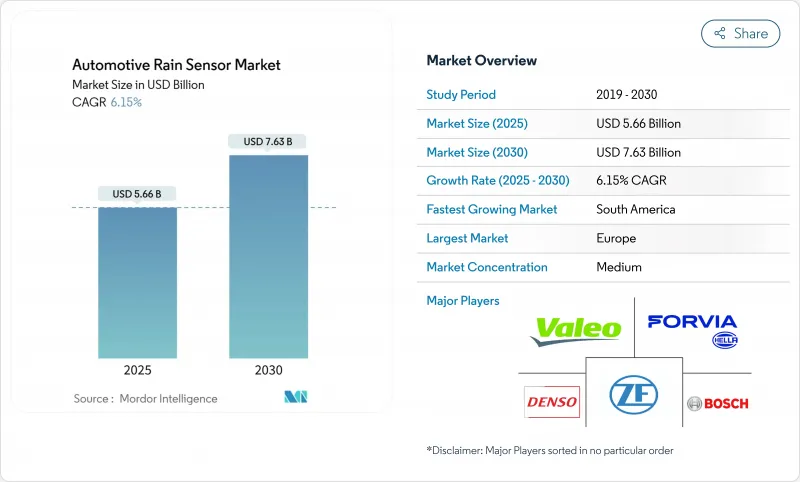

目前预计汽车降雨感应器市场规模将在 2025 年达到 56.6 亿美元,预计到 2030 年将达到约 76.3 亿美元,复合年增长率为 6.15%。

稳步推进的电气化进程、L2+级驾驶援助系统的日益普及以及监管政策的不断完善,正持续推动雨量传感器从舒适性添加物功能向安全关键型感测输入设备转变。 ADAS功能捆绑、半导体小型化以及支援订阅的软体堆迭正在扩大雨量感测器的潜在用户群体,而降低成本的MEMS技术创新则正在扩大其在大众市场的普及度。供应商与晶片製造商之间日益激烈的竞争也压缩了硬体利润空间,但同时也加速了整合光学、电容式和湿度模组的功能升级。综上所述,随着OEM厂商围绕集中式、空中下载(OTA)和可更新的平台重建车辆电气架构,这些因素共同作用,将使汽车降雨感应器市场在未来几年持续处于转型发展阶段。

全球汽车降雨感应器市场趋势及洞察

ADAS普及率的不断提高使得多功能环境感知变得至关重要

L2+ 和 L3 级感知系统需要精确的雨滴、光照和雾气数据,以确保相机镜头和雷射雷达视窗清晰,这使得感测器从可有可无的附加功能转变为核心安全保障。欧洲的原始设备製造商 (OEM) 正在将光学降雨感应器与湿度和光照通道整合到单一 PCB 板上,从而减轻线束重量并实现整合诊断。北美卡车製造商也在将雨量侦测功能整合到前视丛集中,以延长自动紧急煞车的运作。高解析度 CCD 阵列能够提高水滴分类的准确性,并将资料输入到融合软体中,该软体可在单一控制迴路中协调雨刷速度、自我调整头灯和除雾器逻辑。因此,采购团队现在不仅关注雨刷延迟,还关注雷达和摄影机的协同性能指标,这使得多感测器解决方案的成功对于一级供应商的收入成长至关重要。

电气化和高压架构将推动其普及应用。

E平台可在400V和800V电压下运行,为讯号处理ASIC和雷射微调VCSEL发射器提供稳定的功率余量,在高湿度瞬变条件下性能优于12V同类产品。中央运算域透过安全的CAN-FD连结将原始水滴向量资料传输至区域控制器,机器学习模型在此优化擦拭巾时机,从而延长刮水片寿命并降低空调负荷。透过空中韧体更新,OEM厂商可以迭代地提高侦测阈值,从而开启计量收费模式,并结合预测性维护警报功能。因此,电池供电品牌不再将降雨感应器作为被动式玻璃配件进行销售,而是将其作为节能资产进行推广,可减少高达6%的窗户除雾次数。

入门A/B级车的价格敏感度较高

在印度、部分东协国家和拉丁美洲,成本主导平台为整个仪錶面板电子组件预留的预算不足75美元,几乎没有空间容纳价格在25-30美元之间的降雨感应器模组。印度的国内含量法规提高了非本地化PCBA的进口关税,挤压了一级供应商的盈利,并减缓了采购速度。在整合MEMS的价格降至15美元以下之前,车长小于4公尺的车辆仍将依赖手动可变间歇式雨刷。与本地玻璃贴合伙伴关係建立合作关係的供应商可以降低运费额外费用,但目前订单量低,此类资本支出难以实现。

细分市场分析

预计到2024年,乘用车降雨感应器市场将占据71.23%的市场份额,并在2030年之前维持6.55%的强劲复合年增长率。轿车车型在各配置等级中保持稳定的安装率,而掀背车的价格则继续向高阶车型倾斜。轻型商用车车队越来越多地指定使用自动雨刷功能,以最大限度地减少驾驶员分心和保险索赔,而中型卡车由于改装的复杂性而进展缓慢。需求调整将使平均係统构成比。

与週转率高的轻型商用车车队相比,乘用车的更新换代週期虽然较慢,但销售成长稳定。研究远端资讯处理技术的车队营运商报告称,启用预测性雨刷分析功能后,挡风玻璃维修索赔减少了7%,这进一步增强了该技术的商业价值。总体而言,SUV的普及推动了汽车降雨感应器市场向功能丰富的套装方向发展,而大规模生产的掀背车利润率较低,这在一定程度上平衡了这一趋势。

2024年,具有高信噪比的光学CCD/CMOS元件将占总收入的81.64%。前五的光学控制器ASIC晶片已达到B版或更高版本,降低了成本曲线,使MEMS参与企业能够获得性价比优势。电容式/MEMS装置的复合年增长率将达到8.83%,因为它们可以避免玻璃键合的公差限制。红外线反射式混合元件虽然单价较高,但将满足-25 度C以下防冰性能的特定应用需求。

根据战略蓝图,MEMS供应商正将环境光感测器和红外线接近感测器整合到共用晶粒空间内,从而将PCB尺寸缩小35%。同时,光学产业的现有企业正透过整合尖端的AI推理核心来确保产量,以实现液滴的自校准识别并保持技术领先地位。光学器件将继续保持其高端和严苛应用领域的市场地位,而MEMS将推动其普及化。

区域分析

欧洲37.84%的市占率反映了联合国欧洲经济委员会(UNECE)严格的可见度标准以及2025年新车撞击测试(NCAP)的评分系统。此系统对雨水、光线和湿度融合功能给予两分安全分,因此B级以上掀背车必须安装感应器。南美洲成熟的高阶车型组合也确保了高利润光学阵列的主导地位。在巴西圣保罗大众市场OEM中心的引领下,南美洲是成长最快的地区,复合年增长率(CAGR)高达10.33%。消费者从入门级车型升级到紧凑型SUV,为自动雨刷的物料清单腾出了空间;此外,联邦政府为促进电子元件本地化而提供的奖励,也推动了马瑙斯附近一家传感器外壳成型企业的成立。

亚太地区是一个复杂的区域。中国的新车评估计画将从2027年起评估自动视觉性管理技术,将刺激其製造地(该基地年产能已达2,500万辆)的出货量。在印度和部分东协国家,进口电子产品的课税推高了成本。儘管如此,随着电动车的普及,降雨感应器再次变得重要起来:出口到泰国和印尼的售价低于1.5万美元的中国製造微型电动汽车配备了基本的电容式感测器,以便于适应右舵驾驶。因此,亚太地区既是成长最快的地区,也是竞争最分散的地区。

北美地区的普及速度较为稳定,而非迅猛,但较高的平均交易价格促使主流皮卡和SUV安装了复杂的感测器融合套件。空中升级的普及催生了预测性挡风玻璃维护的订阅模式,这种模式产生的持续收入缓解了硬体的商品化趋势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 随着ADAS(先进驾驶辅助系统)的普及,多功能环境感测器(雨量、光线、雾)变得至关重要。

- 电气化和高压车载架构将加速固态光学雨量感测器的普及应用。

- 推动自动雨刷系统相关法规的製定

- 消费者对中型车舒适性和便利性功能的需求日益增长

- 挡风玻璃抬头显示器(HUD)模组整合需要清洁度感测(未经充分通报)

- 透过汽车的空中升级,基于订阅的雨刷自动化功能将创造新的收入(未充分报告)。

- 市场限制

- 入门级A/B级车对价格的高度敏感度将限製印度和东协地区的感测器安装率。

- 汽车级光电二极体和垂直腔面发射雷射短缺

- 挡风玻璃设计上的不一致会使光学耦合变得复杂,并增加检验成本(未充分报告)。

- 软体定义的雨量侦测可望与仅使用摄影机的ADAS系统竞争(儘管其覆盖范围较小)。

- 价值链/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按车辆类型

- 搭乘用车

- 掀背车

- 轿车

- SUV 与跨界车

- 商用车辆

- 轻型商用车(LCV)

- 中型和重型商用车辆

- 搭乘用车

- 透过技术

- 光学(CCD/CMOS)

- 红外线反射

- 基于电容/MEMS的

- 按销售管道

- OEM安装

- 售后改装

- 透过使用

- 自动雨刷控制

- 整合式雨量、光照和湿度感测器

- ADAS感测器融合模组

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东和非洲

- 土耳其

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- HELLA GmbH & Co. KGaA

- Valeo SA

- DENSO Corporation

- ZF Friedrichshafen AG

- Robert Bosch GmbH

- STMicroelectronics NV

- Analog Devices Inc.

- ams-OSRAM AG

- onsemi

- Hamamatsu Photonics KK

- Sensata Technologies Inc.

- Melexis NV

- Texas Instruments Inc.

- Panasonic Holdings Corp.

第七章 市场机会与未来展望

The automotive rain sensor market currently stands at USD 5.66 billion in 2025 and is predicted to reach roughly USD 7.63 billion by 2030, reflecting a 6.15% CAGR.

Steady electrification, rising Level 2+ driver-assistance adoption, and regulatory momentum continue to shift rain sensors from comfort add-ons to safety-critical perception inputs. ADAS feature bundling, semiconductor miniaturization, and subscription-ready software stacks are enlarging the addressable base, while cost-down MEMS innovation is broadening access for volume segments. Increased supplier competition from chip makers is also compressing hardware margins but accelerating functional upgrades through integrated optical, capacitive, and humidity modules. Collectively, these forces sustain a multi-year transformation trajectory for the automotive rain sensor market as OEMs reshape vehicle electrical architectures around centralized, over-the-air-update-capable domains.

Global Automotive Rain Sensor Market Trends and Insights

Rising ADAS Penetration Mandates Multi-Function Environmental Sensing

Level 2+ and Level 3 perception stacks require precise raindrop, light, and fog data to keep camera lenses and LiDAR windows clear, recasting the sensor from a comfort extra into a core safety enabler. European OEM programs pair optical rain sensors with humidity and light channels on a single PCB for reduced harness weight and unified diagnostics. Chinese brands replicate the architecture to meet forthcoming NCAP visibility scoring, while North American truck makers embed rain detection in forward-vision clusters to extend automatic emergency braking uptime. High-resolution CCD arrays improve droplet classification, feeding fusion software that modulates wiper speed, adaptive headlights, and defogger logic in one control loop. Consequently, procurement teams now benchmark performance against radar-camera synergy metrics rather than wiper latency alone, making multi-sensor wins pivotal to Tier 1 revenue pipelines.

Electrification & Higher Onboard Voltage Architectures Accelerate Adoption

E-platforms working at 400 V and 800 V offer stable power headroom for signal-processing ASICs and laser-trimmed VCSEL emitters that outperform 12 V counterparts under high-humidity transients. Centralized compute domains pull raw droplet vectors over secure CAN-FD links into zone controllers where machine-learning models refine wipe timing, extending blade life, and trimming HVAC load. Over-the-air firmware releases let OEMs iteratively sharpen detection thresholds, opening pay-per-use revenue tiers tied to predictive maintenance alerts. Battery-electric brands, therefore, market rain sensors as energy-management assets, reducing window-defog cycles by up to 6%, rather than passive glass accessories.

High Price Sensitivity in Entry-Level A/B-Segment Cars

Cost-led platforms in India, parts of ASEAN, and Latin America allocate less than USD 75 for the entire instrument-panel electronics stack, leaving marginal headroom for a USD 25-30 rain-sensing module. Domestic content rules in India amplify import tariffs on unlocalized PCBAs, compressing Tier 1 profitability and slowing take rates. OEMs resort to manual-variable-intermittent wipers in sub-4-m vehicles until integrated MEMS pricing drops below USD 15. Suppliers that secure local glass-bonding partnerships can shave freight surcharges, but low-volume orders currently deter such CAPEX outlays.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for Automatic Wiper Systems

- Rising Consumer Demand for Comfort & Convenience Features

- Shortage of Automotive-Grade Photodiodes & VCSELs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The automotive rain sensor market size for passenger cars captured 71.23% share in 2024, and is expected to lead at a robust 6.55% CAGR through 2030. Sedan programs maintain consistent attach rates across trim lines, yet hatchbacks remain price-gated to upper variants. Fleets of light commercial vans now specify automatic wiping to minimize driver distraction and insurance claims, though medium trucks lag because of retrofit complexities. Demand alignment shows that every 10-point uptick in SUV mix raises system-average BOM ceiling by USD 4, supporting margin retention for Tier 1s. Over the forecast period, SUVs' larger windshield area drives higher droplet-noise in capacitive arrays, sustaining OEM preference for optical architectures that maintain +-2 ml sensitivity accuracy in heavy downpours.

Passenger-car refresh cycles grant slower but steadier volume accrual compared with high-churn small commercial fleets. Fleet operators investigating telematics report 7% lower windshield repair claims once predictive wipe analytics are activated, strengthening business cases. Overall, SUV proliferation ensures the automotive rain sensor market remains skewed toward feature-rich packages, balancing the lower margins of high-volume hatchbacks.

Optical CCD/CMOS devices controlled 81.64% of 2024 revenue owing to proven signal-to-noise fidelity. With the top five optical controller ASICs already at silicon-revision B or later, cost curves flatten, giving MEMS entrants a price-to-performance opening. Capacitive / MEMS-based devices will clock an 8.83% CAGR as they sidestep glass-coupling tolerances, ideal for vehicles using advanced UV-blocking laminated windshields. Infrared-reflective hybrids capture niche programs needing anti-icing credibility below -25 °C, albeit at higher per-unit cost.

Strategy roadmaps show MEMS suppliers bundling ambient-light sensors and IR proximity in shared die space, trimming PCB footprint by 35%. Conversely, optical incumbents shield volumes by embedding AI-edge inference cores, enabling self-calibrating droplet recognition that sustains specification leadership. Coexistence rather than displacement defines the horizon: optical retains premium and severe-duty niches; MEMS drives democratization.

The Automotive Rain Sensors Market Report is Segmented by Vehicle Type (Passenger Cars [Hatchback, Sedan, and More] and Commercial Vehicles (Light Commercial Vehicle (LCV) and More), Technology (Optical (CCD/CMOS) and More), Sales Channel (OEM-Installed and Aftermarket Retrofit), Application (ADAS Sensor Fusion Modules, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Europe's 37.84% share reflects strict UNECE visibility norms and 2025 NCAP scoring that awards two safety points for rain-light-humidity fusion, cementing sensor fitment as an entitlement across B-segment hatchbacks upward. The continent's established premium mix also ensures high-margin optical arrays dominate. South America, led by Brazil's volume OEM hubs in Sao Paulo, is the fastest climber with a 10.33% CAGR. Consumer upgrades from entry to compact SUVs introduce room in the BOM for automated wiping, while federal incentives to localize electronic content spur sensor-housing molding ventures near Manaus.

Asia-Pacific delivers nuanced dynamics. China's New Car Evaluation Program will credit automated visibility management starting in 2027, anchoring stable shipments within a manufacturing base already scaling 25 million vehicles yearly. Hindrances lie in India and parts of ASEAN, where taxation on imported electronics inflates cost. Nonetheless, EV push grants rain sensors renewed relevance: Chinese-built sub-USD 15,000 micro-EVs that export to Thailand and Indonesia include basic capacitive sensors to ease right-hand-drive adaptation. Hence, Asia-Pacific remains both the largest growth reservoir and the most fragmented battlefield.

North America's uptake is steady rather than spectacular, yet high average transaction prices allow complex sensor-fusion packages on mainstream pickups and SUVs. Over-the-air update culture seeds subscription models for predictive windshield maintenance, producing recurring revenues that temper hardware commoditization.

- HELLA GmbH & Co. KGaA

- Valeo SA

- DENSO Corporation

- ZF Friedrichshafen AG

- Robert Bosch GmbH

- STMicroelectronics N.V.

- Analog Devices Inc.

- ams-OSRAM AG

- onsemi

- Hamamatsu Photonics K.K.

- Sensata Technologies Inc.

- Melexis NV

- Texas Instruments Inc.

- Panasonic Holdings Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising ADAS penetration mandates multi-function environmental sensing (rain, light, fog)

- 4.2.2 Electrification & higher onboard voltage architectures accelerate adoption of solid-state optical rain sensors

- 4.2.3 Regulatory push for automatic wiper systems

- 4.2.4 Rising consumer demand for comfort & convenience features across mid-segment vehicles

- 4.2.5 Integration of windshield head-up-display (HUD) modules requires cleanliness sensing (under-reported)

- 4.2.6 Automotive over-the-air updates unlock new revenue via subscription-based wiper automation (under-reported)

- 4.3 Market Restraints

- 4.3.1 High price sensitivity in entry-level A/B-segment cars limits sensor attach-rates in India & ASEAN

- 4.3.2 Shortage of automotive-grade photodiodes & VCSELs

- 4.3.3 Windshield design heterogeneity complicates optical coupling & raises validation cost (under-reported)

- 4.3.4 Competition from camera-only ADAS stacks promising software-defined rain detection (under-reported)

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.1.1 Hatchback

- 5.1.1.2 Sedan

- 5.1.1.3 SUVs and crossovers

- 5.1.2 Commercial Vehicles

- 5.1.2.1 Light Commercial Vehicle (LCV)

- 5.1.2.2 Medium and Heavy Commercial Vehicle

- 5.1.1 Passenger Cars

- 5.2 By Technology

- 5.2.1 Optical (CCD/CMOS)

- 5.2.2 Infra-red Reflective

- 5.2.3 Capacitive / MEMS-based

- 5.3 By Sales Channel

- 5.3.1 OEM-Installed

- 5.3.2 Aftermarket Retrofit

- 5.4 By Application

- 5.4.1 Automatic Wiper Control

- 5.4.2 Integrated Rain-Light-Humidity Sensing

- 5.4.3 ADAS Sensor Fusion Modules

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Turkey

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 South Africa

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 HELLA GmbH & Co. KGaA

- 6.4.2 Valeo SA

- 6.4.3 DENSO Corporation

- 6.4.4 ZF Friedrichshafen AG

- 6.4.5 Robert Bosch GmbH

- 6.4.6 STMicroelectronics N.V.

- 6.4.7 Analog Devices Inc.

- 6.4.8 ams-OSRAM AG

- 6.4.9 onsemi

- 6.4.10 Hamamatsu Photonics K.K.

- 6.4.11 Sensata Technologies Inc.

- 6.4.12 Melexis NV

- 6.4.13 Texas Instruments Inc.

- 6.4.14 Panasonic Holdings Corp.

7 Market Opportunities & Future Outlook

- 7.1 Demand surge for combined rain-fog-light sensor modules to support L3 autonomy

- 7.2 Growth of subscription-based "feature-on-demand" wiper services post-2026

- 7.3 Localisation of sensor assembly in India, Brazil & Indonesia to bypass import duties

- 7.4 Development of hydrophobic nano-coated windshields reducing sensor calibration cycles