|

市场调查报告书

商品编码

1850071

包装涂料:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Packaging Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

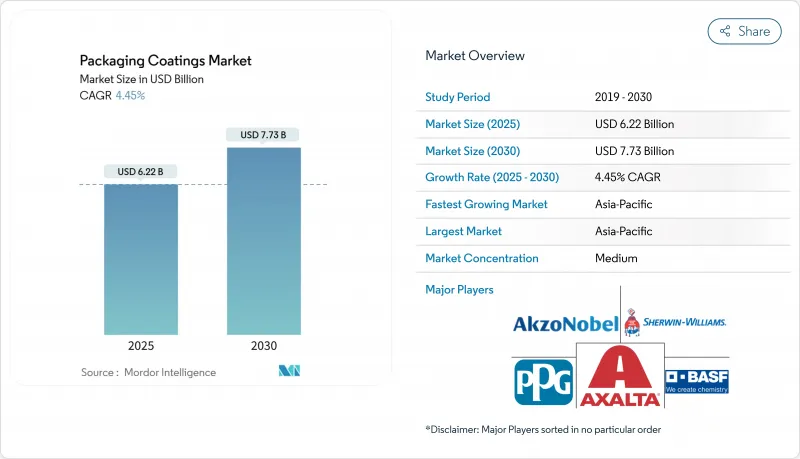

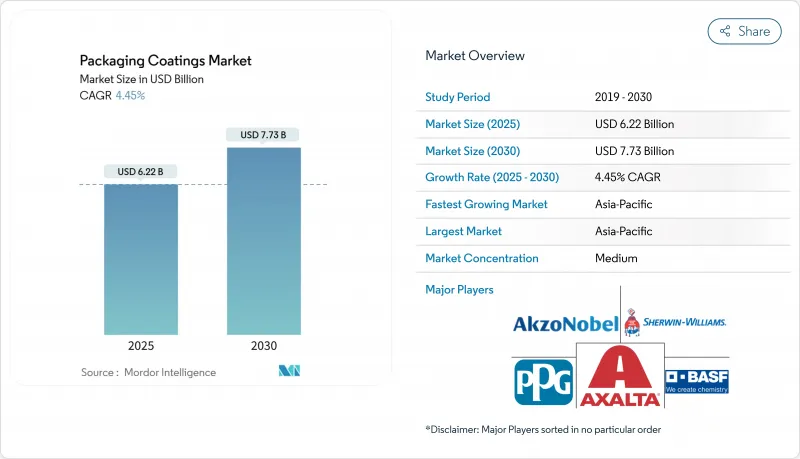

预计到 2025 年,包装涂料市场规模将达到 62.2 亿美元,到 2030 年将达到 77.3 亿美元,预测期(2025-2030 年)复合年增长率为 4.45%。

成长的驱动因素包括全球食品接触法规的收紧、向不含 PFAS 和无BPA 的化学品的快速转变,以及消费者对优质和视觉上独特的包装日益增长的需求。

亚太地区仍是规模最大、成长最快的市场,水性、紫外光固化和不含双酚A的环氧树脂技术市场份额不断扩大,加工商竞相满足不断变化的客户和监管标准。硬质包装仍占据销售量主导地位,但柔性包装技术的创新,加上电子商务和轻量化的发展,正在缩小与硬包装的差距。环氧树脂原料成本的波动以及循环经济物流物流的不足,阻碍了包装涂料市场的稳定发展。

全球包装涂料市场趋势与洞察

无BPAA罐内衬强制令推动环氧树脂替代品的需求

欧盟法规2024/3190将于2025年1月生效,该法规禁止在食品接触材料中使用双酚A(BPA)。北美地区也采取了类似的措施,这促使市场对符合规定的罐体内外涂层的需求日益增长。製造商正积极回应,扩大其不含BPA且性能与环氧树脂相当的树脂产品线,例如剪切机司的valPure V70和阿克苏诺贝尔公司的Accelshield 700。填料供应商和品牌所有者在内衬涂料18个月的过渡期之前就对这些系统进行了认证,从而推动了这些产品在两大洲金属包装生产线上的广泛应用。

亚洲精酿饮品热潮加速了紫外线固化清漆的普及

印度、中国和东南亚的独立啤酒生产商正在寻求色彩鲜艳、表面光滑的包装,以使他们的啤酒罐在琳琅满目的货架上脱颖而出。 UV固化罩光漆具有即时固化、高光泽度和提升生产线效率等优点,推动该技术以约5.01%的复合年增长率成长。 ACTEGA位于马哈拉斯特拉邦的WESSCO UV工厂展示了扩大本地产能如何支援品牌生产计划并缩短前置作业时间。

环氧树脂价格波动对利润率带来压力

供应链中断、能源价格波动和原材料短缺已将环氧树脂成本推至多年来最高的水平。由于环氧树脂占据了包装涂料市场的一半份额,即使价格小幅上涨也会扩大製罐商和灌装商之间的成本转嫁差距。例如,PPG公司正在加快原材料避险和生产效率提升计划,以减轻对公司利润的影响。

细分市场分析

到2024年,环氧树脂体系将占据包装涂料市场51%的份额,充分展现了其卓越的附着力、耐热性和化学阻隔性。随着供应商将符合法规要求和填料性能阈值的无双酚A(BPA)产品商业化,环氧树脂相关包装涂料市场规模预计将以4.7%的复合年增长率成长。宣伟公司的valPure V70和PPG公司的HobaPro 2848便是这种折衷方案的典范,它们既能保持生产线效率,又能消除内分泌干扰物带来的隐患。

丙烯酸树脂和聚氨酯树脂分别适用于对VOC含量要求较低或柔韧性要求较高的应用。聚烯用于热封铝箔盖,而聚酯网路则为冲印饮料罐提供耐溶剂性。生物基树脂虽然仍处于小众市场,但随着品牌商测试纤维素、萜烯和多醣体基质在零食包装和一次性杯子材料方面的应用,其市场正经历两位数的成长。

抑制情境中所描述的环氧树脂价格波动促使采购经理们随时注意替代机会。然而,终端用户很少会完全放弃这类产品,因为生产线改造需要停机和重新测试。因此,混合策略应运而生:使用薄层环氧底漆搭配丙烯酸或聚酯面漆,既能降低双酚的整体暴露量,又能保持其核心优势。在整个预测期内,预计透过渐进式改进而非彻底替换,环氧树脂将继续保持其主导地位,同时避免违反日益严格的迁移限制。

到2024年,水性产品将占销售额的43%,因为加工商追求更低的VOC含量和更简化的授权流程。随着欧洲PFAS政策奖励水性阻隔技术的发展,水性包装涂料的市场规模预计将稳定成长。薄膜稳定性的进步,例如PUD#65215A,缩短了干燥曲线,并可製备更厚的薄膜,从而缩小了与溶剂型涂料相比以往的生产效率差距。

紫外光固化技术以5.01%的复合年增长率位居榜首,这主要得益于其即时固化的经济性和对烘箱基础设施的极简要求。亚太地区的移动罐装生产线采用了紫外光局部清漆装置,为精酿啤酒生产商提供小批量贴标服务,凸显了该平台的通用性。溶剂型硝化纤维素或环氧树脂系统仍然是高温蒸馏食品的主要涂料,这类食品需要极强的耐化学腐蚀性,但加州和欧盟持续实施的空气品质法规限制了其进一步成长。粉末涂料虽然市占率较小,但凭藉零挥发性有机化合物(VOC)和优异的边缘覆盖率,正在焊接气雾罐领域不断扩大市场份额,进一步强化了绿色化学理念,而这正是包装涂料市场竞争格局的关键所在。

技术选择日益多元化,需要在固化速度、能耗、迁移限制、气味、可回收性和总应用成本之间取得平衡。配方师们正在整合人工智慧驱动的实验设计,以优化成分基质,从而减少实验室排放并加快产品上市速度。由此催生了一系列混合化学技术——水性紫外线固化涂料、能量固化粉末涂料和高固态聚酯涂料——这些技术模糊了技术边界,并将整个包装涂料市场推向具有生命週期优势的平台。

区域分析

亚太地区以43%的市占率领先包装涂料市场,预计到2024年将以4.73%的复合年增长率持续成长。中国饮料罐生产的蓬勃发展、印度精酿啤酒的兴起以及东南亚零食出口的蓬勃增长,共同推动了该地区无与伦比的销售成长。区域政府也正在加速推动低VOC(挥发性有机化合物)排放标准,鼓励国内企业引进西方水性涂料技术,同时投资建置本地UV树脂配製能力。像安姆科这样的跨国公司正在扩大其医疗包装工厂,以开拓快速成长的医疗保健细分市场,进一步巩固了亚太地区的市场地位。

北美位居第二,这主要得益于其人均饮料消费量高以及对柔触哑光清漆等高端表面处理的广泛应用。 FDA 与欧盟 PFAS 法规的接轨将加快标籤更新週期,并增加对合规替代方案的需求。除了罐头食品外,北美电子商务的普及也将推动对抗衝击包装袋和防刮封口的需求,从而扩大包装涂料市场的地理范围。

在欧洲,监管变革而非销售激增将成为成长的主要驱动力。将于2025年1月生效的双酚A(BPA)禁令以及即将实施的全氟烷基和多氟烷基物质(PFAS)禁令正在推动技术快速转型,阿克苏诺贝尔投资3200万欧元的西班牙工厂就是一个例证,该工厂计划于2025年中期运作。儘管受经济低迷影响,销量成长有所放缓,但每吨技术附加价值有所提升,部分抵消了罐体销量成长放缓的影响。同时,中东和非洲将受益于可支配收入的成长以及海湾合作委员会(GCC)仓储基础设施的完善,而南美洲将继续为涂料出口商提供选择性的成长空间,饮料业在经济波动中正在復苏。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 北美和欧洲强制要求使用无BPAA的罐内衬,推动了对环氧树脂替代品的需求。

- 亚洲精酿饮品热潮加速了紫外线固化清漆的普及

- 耐刮瓶盖和封口涂层推动了海湾合作委员会地区生鲜电商的成长。

- 欧洲逐步淘汰 PFAS 推动纸板水性阻隔涂料的发展

- 扩大气雾罐包装涂层在个人护理行业的应用

- 市场限制

- 环氧树脂价格的波动给全部区域的利润率带来了压力。

- 回收利用流程薄弱,生物屏障的引入进展缓慢。

- 关于挥发性有机化合物排放的严格法规和环境问题

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 树脂

- 环氧树脂

- 丙烯酸纤维

- 聚氨酯

- 聚烯

- 聚酯纤维

- 其他树脂

- 透过涂层技术

- 水溶液

- 溶剂型

- 粉末

- 紫外线固化

- 按包装类型

- 硬质(罐、瓶盖、封口)

- 柔性包装(袋装、薄膜包装、小袋)

- 透过使用

- 罐头食品

- 饮料罐

- 气雾剂和管

- 瓶盖和封口

- 工业和特殊包装

- 按最终用户行业划分

- 食品/饮料

- 个人护理和化妆品

- 医疗保健和製药

- 工业产品

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 中东和非洲

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Akzo Nobel NV

- ALTANA

- artience Co., Ltd.

- Axalta Coating Systems LLC

- BASF SE

- DIC Corporation

- Dow

- HB Fuller Company

- Hempel A/S

- Henkel AG & Co. KGaA

- Jamestown Coating Technologies

- Jotun

- KANGNAM JEVISCO CO., LTD.

- Kansai Paint Co., Ltd.

- Michelman, Inc.

- PPG Industries Inc.

- RPM International Inc.

- Silgan Holdings Inc.

- The Sherwin-Williams Company

第七章 市场机会与未来展望

The Packaging Coatings Market size is estimated at USD 6.22 billion in 2025, and is expected to reach USD 7.73 billion by 2030, at a CAGR of 4.45% during the forecast period (2025-2030).Growth is being propelled by tighter global food-contact rules, rapid shifts toward PFAS-free and BPA-free chemistries, and rising consumer demand for premium, visually distinctive packages.

Asia-Pacific remains both the largest and fastest-expanding region, while water-based, UV-curable, and non-BPA epoxy technologies capture share as converters race to meet evolving customer and legislative standards. Rigid formats continue to dominate volumes, yet flexible innovations tied to e-commerce and lightweighting are eroding the historical gap. Cost volatility for epoxy feedstocks and infrastructure gaps in circular-economy logistics temper the otherwise steady advance of the packaging coatings market.

Global Packaging Coatings Market Trends and Insights

BPA-free Can-Lining Mandates Fueling Epoxy-Alternative Demand

The EU Regulation 2024/3190 banning bisphenol A in food-contact materials, effective January 2025, coupled with parallel North-American measures, has created an acute need for compliant internal and external can coatings. Manufacturers are responding by scaling non-BPA chemistries that retain epoxy performance, such as Sherwin-Williams' valPure V70 and Akzo Nobel's Accelshield 700. Fillers and brand owners are qualifying these systems well ahead of the 18-month transition window granted for internal linings, driving brisk adoption across metal packaging lines in both continents.

Craft Beverage Boom in Asia Accelerating UV-Curable Varnish Uptake

Independent breweries across India, China, and Southeast Asia seek vibrant graphics and scratch-free finishes that differentiate cans on crowded shelves. UV-curable overprint varnishes deliver instant cure, high gloss, and line-speed productivity benefits, pushing their technology CAGR around 5.01%. ACTEGA's new WESSCO UV facility in Maharashtra illustrates how local capacity expansion supports brand schedules while reducing lead times.

Epoxy Resin Price Volatility Pressuring Margins

Supply-chain disruptions, energy price swings, and feedstock tightness have pushed epoxy costs to multi-year highs. Because epoxies underpin half of the packaging coatings market, even minor price spikes widen cost-pass-through gaps for can-makers and fillers. PPG, for example, has accelerated raw-material hedging and productivity programs to soften earnings exposure.

Other drivers and restraints analyzed in the detailed report include:

- GCC E-Grocery Growth Boosting Scuff-Resistant Cap & Closure Coatings

- Europe PFAS Phase-Out Driving Water-Based Barrier Coatings for Paperboard

- Weak Recycling Streams Slowing Bio-Barrier Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Epoxy systems accounted for 51% of packaging coatings market share in 2024, underlining their unrivaled adhesion, heat resistance and chemical barrier attributes. The packaging coatings market size tied to epoxies is set to grow on a 4.7% CAGR as suppliers commercialize non-BPA variants that satisfy both regulatory scrutiny and filler performance thresholds. Sherwin-Williams' valPure V70 and PPG's HobaPro 2848 exemplify this middle-path approach, preserving line efficiency while eliminating endocrine-disruptor concerns.

Acrylic and polyurethane chemistries now capture applications requiring lower VOC profiles or higher flexibility, respectively. Polyolefins serve heat-seal foil lids, whereas polyester networks bring solvent resistance to D&I beverage cans. Bio-derived resins, although still niche, post double-digit gains as brand owners test cellulose, terpene and polysaccharide matrices for snack flexibles and single-use cup stock.

Epoxy price swings described in the restraints scenario keep purchasing managers alert to substitution opportunities; nonetheless, end-users rarely abandon the class outright because retrofitting lines entails downtime and retesting. Consequently, hybrid strategies emerge: thin epoxy primers topped with acrylic or polyester overcoats reduce overall bisphenol exposure while retaining core advantages. Over the forecast window, incremental reformulation rather than wholesale replacement is expected to preserve epoxy primacy without breaching tightening migration limits.

Water-based products held 43% revenue in 2024 as converters chased lower VOCs and simpler permitting. The packaging coatings market size for water-based lines is forecast to rise steadily, helped by European PFAS policies that incentivize aqueous barrier science. Film stability advances such as PUD #65215A shorten drying curves and allow thicker films, narrowing historical productivity gaps versus solvent routes.

UV-curable technology registers the highest 5.01% CAGR thanks to instant-cure economics and minimal oven infrastructure. Asia-Pacific mobile canning lines now adopt UV spot-varnish units to enable short-run labels for craft brewers, highlighting the versatility of the platform. Solvent-borne nitrocellulose or epoxy systems still dominate retort foods needing extreme chemical resistance, but ongoing air-quality caps in California and the EU limit incremental growth. Powder coatings, although a smaller base, earn share in welded aerosol cans by offering zero VOCs and superb edge coverage, reinforcing the green-chemistry narrative that underscores competition within the packaging coatings market.

Technology selection is increasingly multivariate-balancing cure speed, energy, migration limits, odor, recyclability and total applied cost. Formulators now integrate AI-guided design of experiments to optimize ingredient matrices, accelerating time-to-market while cutting lab emissions. The resulting pipeline of hybrid chemistries-water-based UV, energy-curable powders and high-solid polyesters-suggests that technology lines will blur, yet the overall packaging coatings market will pivot toward platforms with verifiable life-cycle advantages.

The Packaging Coatings Market Report Segments the Industry by Resin (Epoxies, Acrylics, and More), Coating Technology (Water-Based, Solvent-Based, and More), Packaging Type (Rigid and Flexible), Application (Food Cans, Beverage Cans, and More), End-User Industry (Food and Beverage, Industrial Goods, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific led the packaging coatings market with a 43% revenue share in 2024 and the highest 4.73% CAGR outlook. China's beverage can production, India's craft-beer rise and Southeast Asia's snack export boom combine to deliver unrivaled volume growth. Regional authorities also fast-track low-VOC mandates, pushing domestic firms to license Western water-borne know-how while investing in local UV resin synthesis capacity. Multinationals such as Amcor are expanding medical-pack plants to tap the fastest-growing healthcare sub-segment, reinforcing Asia-Pacific's centrality.

North America ranks second, buoyed by high per-capita beverage consumption and widespread adoption of premium finishes such as matte-varnish soft-touch. The FDA's alignment with EU PFAS restrictions accelerates label-change cycles, driving incremental demand for compliant alternatives. Beyond canning, North American e-commerce penetration lifts the need for impact-resistant pouches and scuff-proof lids, extending the regional scope of the packaging coatings market.

Europe experiences regulatory-induced transformation rather than volume surge. The BPA ban effective January 2025 and looming PFAS prohibition are compelling rapid technology swaps, evident in Akzo Nobel's EUR 32 million Spanish plant scheduled for mid-2025 start-up. Although economic sluggishness tempers unit volume growth, technology value-add per ton rises, partially offsetting slower can counts. Meanwhile, the Middle East and Africa benefit from rising disposable incomes and GCC warehousing infrastructure, while South America sees beverage-sector resilience amid economic swings, continuing to offer selective upside for coating exporters.

- Akzo Nobel N.V.

- ALTANA

- artience Co., Ltd.

- Axalta Coating Systems LLC

- BASF SE

- DIC Corporation

- Dow

- H.B. Fuller Company

- Hempel A/S

- Henkel AG & Co. KGaA

- Jamestown Coating Technologies

- Jotun

- KANGNAM JEVISCO CO., LTD.

- Kansai Paint Co., Ltd.

- Michelman, Inc.

- PPG Industries Inc.

- RPM International Inc.

- Silgan Holdings Inc.

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 BPA-free Can Lining Mandates Fueling Epoxy-Alternative Demand in North America and Europe

- 4.2.2 Craft Beverage Boom in Asia Accelerating UV-Curable Varnish Uptake

- 4.2.3 GCC E-grocery Growth Boosting Scuff-Resistant Cap and Closure Coatings

- 4.2.4 Europe PFAS Phase-out Driving Water-based Barrier Coatings for Paperboard

- 4.2.5 Growing Utilization of Packaging Coatings in Aerosol Cans for Personal Care Industry

- 4.3 Market Restraints

- 4.3.1 Epoxy Resin Price Volatility Pressuring Margins Across Regions

- 4.3.2 Weak Recycling Streams Slowing Bio-barrier Adoption

- 4.3.3 Stringent Regulation and Environmental Concern Regarding VOC Emission

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin

- 5.1.1 Epoxies

- 5.1.2 Acrylics

- 5.1.3 Polyurethane

- 5.1.4 Polyolefins

- 5.1.5 Polyester

- 5.1.6 Other Resins

- 5.2 By Coating Technology

- 5.2.1 Water-based

- 5.2.2 Solvent-based

- 5.2.3 Powder

- 5.2.4 UVcurable

- 5.3 By Packaging Type

- 5.3.1 Rigid (Cans, Caps and Closures)

- 5.3.2 Flexible (Pouches, Films, Sachets)

- 5.4 By Application

- 5.4.1 Food Cans

- 5.4.2 Beverage Cans

- 5.4.3 Aerosol and Tubes

- 5.4.4 Caps and Closures

- 5.4.5 Industrial and Specialty Packaging

- 5.5 By End-User Industry

- 5.5.1 Food and Beverage

- 5.5.2 Personal Care and Cosmetics

- 5.5.3 Healthcare and Pharmaceutical

- 5.5.4 Industrial Goods

- 5.6 By Geography

- 5.6.1 Asia-Pacific

- 5.6.1.1 China

- 5.6.1.2 India

- 5.6.1.3 Japan

- 5.6.1.4 South Korea

- 5.6.1.5 Indonesia

- 5.6.1.6 Malaysia

- 5.6.1.7 Thailand

- 5.6.1.8 Vietnam

- 5.6.1.9 Rest of Asia-Pacific

- 5.6.2 North America

- 5.6.2.1 United States

- 5.6.2.2 Canada

- 5.6.2.3 Mexico

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics

- 5.6.3.7 Turkey

- 5.6.3.8 Russia

- 5.6.3.9 Rest of Europe

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Qatar

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Nigeria

- 5.6.5.4 Egypt

- 5.6.5.5 South Africa

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 ALTANA

- 6.4.3 artience Co., Ltd.

- 6.4.4 Axalta Coating Systems LLC

- 6.4.5 BASF SE

- 6.4.6 DIC Corporation

- 6.4.7 Dow

- 6.4.8 H.B. Fuller Company

- 6.4.9 Hempel A/S

- 6.4.10 Henkel AG & Co. KGaA

- 6.4.11 Jamestown Coating Technologies

- 6.4.12 Jotun

- 6.4.13 KANGNAM JEVISCO CO., LTD.

- 6.4.14 Kansai Paint Co., Ltd.

- 6.4.15 Michelman, Inc.

- 6.4.16 PPG Industries Inc.

- 6.4.17 RPM International Inc.

- 6.4.18 Silgan Holdings Inc.

- 6.4.19 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Growing Inclination for Eco-Friendly Packaging Coatings