|

市场调查报告书

商品编码

1850083

植物生长灯:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Grow Lights - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

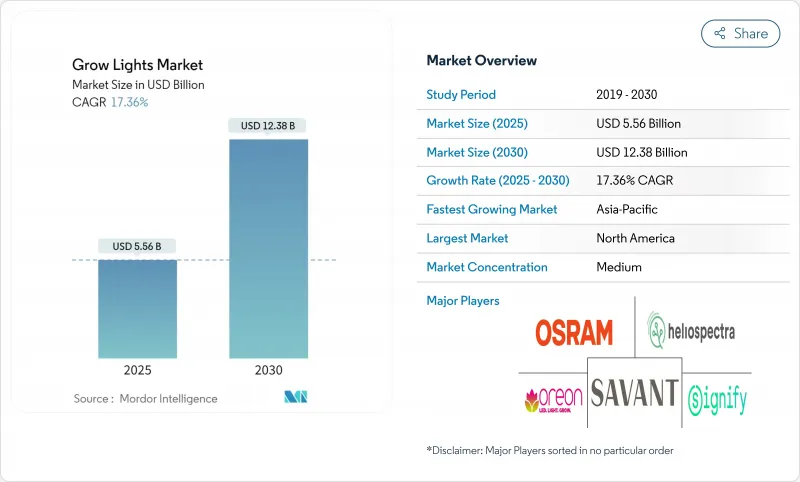

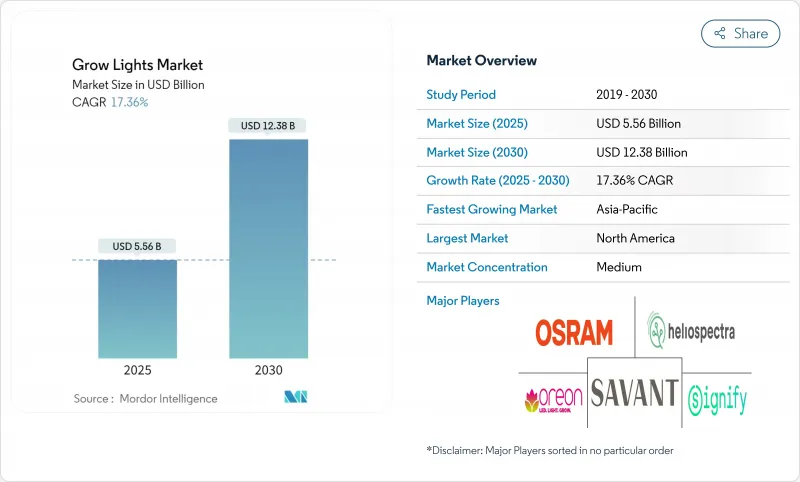

预计到 2025 年,植物生长灯市场规模将达到 55.6 亿美元,到 2030 年将达到 123.8 亿美元,年复合成长率为 17.36%。

LED技术的快速普及、可控环境农业的扩张以及商业温室和垂直堆迭式城市农场日益增长的需求,正在推动植物生长灯市场的成长。儘管硬体仍占据大部分支出,但软体主导的频谱控制技术的快速普及预示着感测器、物联网连接和数据分析的深度整合。随着温室营运商用高效LED灯取代传统的HID灯具,以及公用事业补贴缩短投资回收期,改装活动已超过新建案。北美大麻合法化、欧洲更严格的能源法规以及海湾国家积极的粮食安全计划,进一步刺激了植物生长灯市场在各个应用领域和地区的成长。

全球植物生长灯市场趋势与洞察

北欧垂直农场反季节高价值作物产量激增

透过安装完全由LED运作的高密度垂直农场,北欧的种植者们有效缓解了冬季极度黑暗的挑战,实现了比传统露地种植作物高出350倍的平方公尺产量。操作人员可根据作物的具体频谱调整LED灯,缩短25%的生长週期并提高营养密度。由于电力是主要的营运成本,因此能源效率至关重要。在这一光照条件严苛的地区取得的成功,正使芬兰和瑞典成为技术出口国,当地企业已将承包农场模组授权给欧洲各地。随着市场需求从概念验证转向需要可靠、高功率效率(PE)设备和自适应控制系统的多兆瓦级食品加工厂,这一发展趋势正为植物生长灯市场注入持续动力。

成人用大麻合法化加快了德国和美国的受控环境产能建设。

德国联邦立法允许成人使用大麻,美国各州也陆续批准了相关核准,这些措施释放了资金,用于建造新的、高度管控的种植设施。大麻花需要高达 1500 μmol m² s⁻¹ 的光子密度,这使得种植所需的灯具数量和电力负荷远远超过绿叶蔬菜。种植者倾向于选择优质 LED 灯,以增强大麻素和萜烯的含量,并且愿意为更高级的个人防护装备和频谱灵活性买单。公用事业公司的补贴降低了营运成本,而像加州第 24 号法规这样的能源效率强制性规定则有效地禁止了低效率灯具的使用。这些因素共同推动着植物生长灯市场向性能主导的差异化方向转变。

对中国LED晶片征收关税将推高北美照明成本

美国贸易措施对关键半导体产品加征高达25%的关税,对国内照明设备製造商造成压力。企业要么接受利润率下降,要么提高产品标价,从而延长种植者的投资回报期。同时,许多种植者正考虑升级到LED照明,成本压力加剧了资金筹措难度,并在一定程度上减缓了照明市场的成长。

细分市场分析

到2024年,LED将占据植物生长灯市场65%的份额,并在2030年之前以18.2%的复合年增长率增长。 LED的光合量子效率目前已超过3.1 μmol J⁻¹,比传统高压钠灯(HPS)提高了90%。 LED价格的下降和频谱精度的提高使其成为新建和维修专案的首选,增强了其规模优势,从而支持了研发投入。高强度气体放电灯(HID灯)仍透过辐射热支持作物生理,但其市场份额正逐年萎缩。萤光管由于价格低廉仍然受到业余爱好者的欢迎,但入门级LED价格的下降正在稳步蚕食这一市场。等离子灯和感应灯主要用于研究,对植物生长灯市场的收入贡献甚微。

开发人员目前正在利用多通道二极体,这种二极体可以调节从植物生长到开花阶段的频谱。这项功能减少了不同生长阶段之间更换灯具的需求,并支援光形态发生触发机制的实验。这种多功能性正在推动垂直农场和种植室等场所采用这种技术,并促使植物生长灯市场从通用灯具转向智慧照明解决方案。

到2024年,改造计划将占植物生长灯市场规模的58%,反映出目前仍有数百万平方公尺的温室使用高压钠灯照明。更换这些灯具可降低30%至50%的能源费用,如果灯具符合设计照明联盟(Design Lights Consortium)的规定,许多北美公用事业公司将承担高达一半的硬体成本。在奖励充足的州,投资回收期不到两年,从而确保了维修的稳定需求。

随着待开发区垂直农场和医用大麻种植园区的激增,新建设活动正以20%的复合年增长率成长。这些新设施从一开始就将照明布局与空调、灌溉和资料网路整合在一起。这种系统级设计提高了光子均匀性,简化了未来的升级,从而帮助植物生长灯市场从设备安装、网路闸道和试运行服务中获得额外收入。

区域分析

到2024年,北美将以40%的市占率引领植物生长灯市场。美国和加拿大的温室受益于公用事业公司的激励措施,而大麻种植则推动了对高端灯具的需求。加州第24号法规等州级法规禁止使用低效灯具,从而巩固了LED灯的地位,并鼓励采用控制系统。大学和农业技术培养箱进一步传播最佳实践,加强区域领先地位,并播下出口技术的种子。

亚太地区是成长最快的地区,预计到2030年将以19%的复合年增长率成长。主要城市的土地稀缺推动了室内农业的发展,而从新加坡到首尔等地的政府粮食安全政策也为垂直农业津贴。本地二极体供应缩短了前置作业时间,并在一定程度上抵消了其他地区面临的关税影响。中国的现代化计画旨在发展节能农业,并为LED升级提供津贴。这些因素正在扩大植物生长灯市场在亚太地区多样化气候条件下的覆盖范围。

欧洲凭藉荷兰和西班牙先进的温室产业以及斯堪的纳维亚半岛的尖端垂直农业,保持着强劲的市场地位。严格的生态设计法规正在加速LED灯的普及,而碳定价机制则迫使营运商对每一千瓦的用电量进行严格审查。一项对丹麦和加拿大种植基地的对比研究表明,经济效益取决于当地的能源价格,这促使欧洲种植者转向动态照明系统,该系统仅在光照强度经济运作时才会运作。儘管能源价格波动,但监管与科学之间的这种相互作用,正支撑着植物生长灯市场的稳定成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 北欧垂直农场反季节高价值作物产量激增

- 成人用大麻合法化加速了德国和美国受控环境能力的提升。

- 海湾合作委员会城市农业津贴与室内农场电力补贴

- 亚太地区特大城市仓库改造:解决耕地短缺问题

- 透过实施基于物联网的动态频谱控制来降低光週期能量成本

- 畜牧光生物学计画的拓展推动了对专用设备的需求。

- 市场限制

- 对中国LED晶片征收关税将增加北美地区的照明成本

- 能源价格波动缩短了欧洲温室气体排放的投资回收期

- 东协园艺照明标准不一致

- 小型老式HID温室维修成本高昂

- 产业生态系分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 报价

- 硬体

- 软体

- 服务

- 透过光源技术

- 高强度气体放电灯(HID灯)

- 发光二极体(LED)

- 萤光

- 紧急灯和等离子灯

- 频谱

- 全频谱/广谱

- 部分/窄频频谱(蓝光、红光、远红外线、紫外线)

- 按额定输出

- 300瓦或以下

- 300~1000W

- 1000瓦或以上

- 按安装类型

- 新安装

- 维修工程

- 透过使用

- 室内农业

- 垂直农业

- 商业温室

- 家畜

- 研究和教育机构

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 东南亚

- 亚太其他地区

- 南美洲

- 巴西

- 其他南美洲

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议与发展

- 市占率分析

- 公司简介

- Signify Holding

- OSRAM GmbH(Fluence)

- Savant Systems(GE Current)

- Heliospectra AB

- Lumileds Holding BV

- Bridgelux Inc.

- Cree LED

- Samsung Electronics Co., Ltd.

- Everlight Electronics Co., Ltd.

- Valoya Oy

- California LightWorks

- Gavita International BV(Hawthorne)

- LumiGrow Inc.

- AB Lighting

- Kind LED Grow Lights

- ViparSpectra

- Iwasaki Electric Co., Ltd.

- Lemnis Oreon BV

- Hortilux Schreder

- BML Horticulture

- ProGrowTech

- Illumitex Inc.

第七章 市场机会与未来展望

The grow lights market size is USD 5.56 billion in 2025 and is on track to reach USD 12.38 billion by 2030, advancing at a 17.36% CAGR.

Growth is propelled by rapid LED adoption, expanding controlled-environment agriculture, and rising demand from both commercial greenhouses and vertically stacked urban farms. Hardware still captures most spending, yet the swift uptake of software-driven spectrum controls points to deeper integration of sensors, IoT connectivity, and data analytics. Retrofit activity outpaces new builds as greenhouse operators swap legacy HID fixtures for high-efficacy LEDs, helped by utility rebates that shorten payback periods. Cannabis legalization in North America, tighter energy regulations in Europe, and aggressive food-security programs in the Gulf are further stimulating the grow lights market across applications and regions.

Global Grow Lights Market Trends and Insights

Off-season High-Value Crop Production Surge in Nordic Vertical Farms

Nordic growers mitigate extreme winter darkness by installing dense vertical-farm stacks that run solely on LEDs delivering up to 350-fold higher yield per square meter than field cultivation. Operators tune LEDs to crop-specific spectra, trimming growth cycles by 25% and boosting nutrient density.Energy efficiency is decisive, as electricity is the chief operating cost. Success in this harsh-light region is turning Finland and Sweden into technology exporters, with local firms licensing turnkey farm modules across Europe. This trajectory adds sustained momentum to the grow lights market as demand shifts from proofs of concept toward multi-megawatt food factories that need reliable, high-PPE fixtures and adaptive controls.

Adult-Use Cannabis Legalization Accelerating Controlled-Environment Capacity in Germany & the United States

Germany's federal law permitting adult-use cannabis and additional US state approvals are unlocking capital for new, highly controlled facilities. Cannabis flowers need photon densities up to 1,500 µmol m2 s -1, driving fixture counts and electrical loads far above those for leafy greens. Cultivators favor premium LEDs that enhance cannabinoid and terpene profiles, paying for high PPE and spectrum flexibility. Utility rebates lower operating costs, while efficiency mandates such as California Title 24 effectively prohibit low-efficacy lamps. These factors collectively push the grow lights market toward performance-led differentiation.

Tariffs on China-Origin LED Chips Elevating Fixture Costs in North America

United States trade measures add up to 25% duty on key semiconductors, squeezing domestic lighting manufacturers. Companies must either absorb reduced margins or raise list prices, lengthening ROI for growers. Some firms shift sourcing to countries with friendlier tariffs, but tool requalification and certification slow that pivot.Cost pressure arrives just as many cultivators weigh LED upgrades, making financing more complex and slightly tempering grow lights market momentum.

Other drivers and restraints analyzed in the detailed report include:

- GCC Urban Agriculture Grants and Subsidised Electricity for Indoor Farms

- Mega-city Warehouse Conversions in APAC Addressing Arable-Land Scarcity

- Energy Price Volatility Undermining Payback Periods in European Greenhouses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

LEDs captured 65% of grow lights market share in 2024 and are growing at 18.2% CAGR to 2030. Their photosynthetic photon efficacy now tops 3.1 µmol J-1, a 90% leap over legacy HPS. LEDs' falling price and spectrum accuracy make them the default choice for new installs and retrofits, reinforcing scale advantages that keep R&D flowing. HID lamps still play a role where radiant heat aids crop physiology, but their niche narrows yearly. Fluorescent tubes remain popular with hobbyists because of low purchase costs, yet declining prices for entry-level LEDs steadily erode that segment. Plasma and induction stay research-focused, adding minimal revenue to the grow lights market.

Developers now exploit multi-channel diodes that let growers dial spectra from propagation to flowering. This functionality reduces the need for fixture swaps between growth stages and supports experimentation with photomorphogenic triggers. Such versatility drives adoption in vertical farms and cannabis rooms, pushing the grow lights market toward intelligent lighting packages rather than commodity luminaires.

Retrofit projects accounted for 58% of grow lights market size in 2024, reflecting millions of square meters of greenhouse area still lit by HPS. Swapping these fixtures trims energy bills by 30-50%, and many North American utilities fund up to half the hardware cost when luminaires meet Design Lights Consortium rules. Payback periods in well-incentivized states fall below two years, ensuring steady retrofit demand.

New-build activity is rising at 20% CAGR as greenfield vertical farms and cannabis campuses proliferate. Fresh facilities integrate lighting layouts with HVAC, fertigation, and data networks from day one. This system-level design improves photon uniformity and simplifies future upgrades, helping the grow lights market capture incremental dollars for mounting gear, network gateways, and commissioning services.

The Grow Lights Market Report is Segmented by Offering (Hardware, Software, and Services), Light Source Technology (High-Intensity Discharge Lights, and More), Spectrum (Full/Broad Spectrum, and More), Power Rating (Below 300 W, 300 - 1000 W, and More), Installation Type (New Installations, and Retrofit Installations), Application (Indoor Farming, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the grow lights market with 40% share in 2024. US and Canadian greenhouses benefit from utility incentives, while cannabis cultivation drives premium fixture demand. State rules like California Title 24 lock out low-efficacy lamps, entrenched LEDs, and boost control-system uptake. Universities and ag-tech incubators further spread best practices, reinforcing regional leadership and seeding export know-how.

Asia Pacific is the fastest-growing territory at a 19% CAGR through 2030. Megacity land scarcity pushes indoor farming, and government food-security mandates subsidize vertical farms from Singapore to Seoul. Local diode supply shortens lead times, partially offsetting tariff effects seen elsewhere. China's modernization programs target energy-efficient agriculture, steering grants to LED upgrades. These factors enlarge the grow lights market footprint across APAC's varied climates.

Europe maintains a robust position anchored by sophisticated greenhouse sectors in the Netherlands and Spain and cutting-edge vertical farms in the Nordics. Strict Ecodesign regulations accelerate LED turnover, while carbon pricing forces operators to scrutinize every kilowatt. Research comparing Danish and Canadian sites underlined that financial viability hinges on local energy rates, nudging European growers toward dynamic lighting that only runs when photons are profitable. This regulatory-science interplay sustains steady grow lights market adoption despite energy volatility.

- Signify Holding

- OSRAM GmbH (Fluence)

- Savant Systems (GE Current)

- Heliospectra AB

- Lumileds Holding B.V.

- Bridgelux Inc.

- Cree LED

- Samsung Electronics Co., Ltd.

- Everlight Electronics Co., Ltd.

- Valoya Oy

- California LightWorks

- Gavita International B.V. (Hawthorne)

- LumiGrow Inc.

- AB Lighting

- Kind LED Grow Lights

- ViparSpectra

- Iwasaki Electric Co., Ltd.

- Lemnis Oreon B.V.

- Hortilux Schreder

- BML Horticulture

- ProGrowTech

- Illumitex Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Off-season High-Value Crop Production Surge in Nordic Vertical Farms

- 4.2.2 Adult-Use Cannabis Legalization Accelerating Controlled-Environment capacity in Germany and U.S.

- 4.2.3 Gulf Cooperation Council Countries Urban Agriculture Grants and Subsidised Electricity for Indoor Farms

- 4.2.4 Mega-city Warehouse Conversions in Asia-Pacific Addressing Arable Land Scarcity

- 4.2.5 Adoption of IoT-Enabled Dynamic Spectrum Controls Reducing Photoperiod Energy Cost

- 4.2.6 Expansion of Livestock Photobiology Programs Driving Specialist Fixtures Demand

- 4.3 Market Restraints

- 4.3.1 Tariffs on China-origin LED Chips Elevating Fixture Costs in North America

- 4.3.2 Energy Price Volatility Undermining Payback Periods in European Greenhouses

- 4.3.3 Inconsistent Horticultural Lighting Standards Across ASEAN

- 4.3.4 High Retrofitting Cost for Small-Scale Legacy HID Greenhouses

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Light Source Technology

- 5.2.1 High-Intensity Discharge (HID) Lights

- 5.2.2 Light Emitting Diodes (LED)

- 5.2.3 Fluorescent Lights

- 5.2.4 Induction and Plasma Lights

- 5.3 By Spectrum

- 5.3.1 Full/Broad Spectrum

- 5.3.2 Partial/Narrow Spectrum (Blue, Red, Far-Red, UV)

- 5.4 By Power Rating

- 5.4.1 Below 300 W

- 5.4.2 300 - 1000 W

- 5.4.3 Above 1000 W

- 5.5 By Installation Type

- 5.5.1 New Installations

- 5.5.2 Retrofit Installations

- 5.6 By Application

- 5.6.1 Indoor Farming

- 5.6.2 Vertical Farming

- 5.6.3 Commercial Greenhouse

- 5.6.4 Livestock Farming

- 5.6.5 Research and Educational Institutes

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 South Korea

- 5.7.3.4 India

- 5.7.3.5 South East Asia

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 United Arab Emirates

- 5.7.5.1.2 Saudi Arabia

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Signify Holding

- 6.4.2 OSRAM GmbH (Fluence)

- 6.4.3 Savant Systems (GE Current)

- 6.4.4 Heliospectra AB

- 6.4.5 Lumileds Holding B.V.

- 6.4.6 Bridgelux Inc.

- 6.4.7 Cree LED

- 6.4.8 Samsung Electronics Co., Ltd.

- 6.4.9 Everlight Electronics Co., Ltd.

- 6.4.10 Valoya Oy

- 6.4.11 California LightWorks

- 6.4.12 Gavita International B.V. (Hawthorne)

- 6.4.13 LumiGrow Inc.

- 6.4.14 AB Lighting

- 6.4.15 Kind LED Grow Lights

- 6.4.16 ViparSpectra

- 6.4.17 Iwasaki Electric Co., Ltd.

- 6.4.18 Lemnis Oreon B.V.

- 6.4.19 Hortilux Schreder

- 6.4.20 BML Horticulture

- 6.4.21 ProGrowTech

- 6.4.22 Illumitex Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment